-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: ECB Clearly Signals December Easing

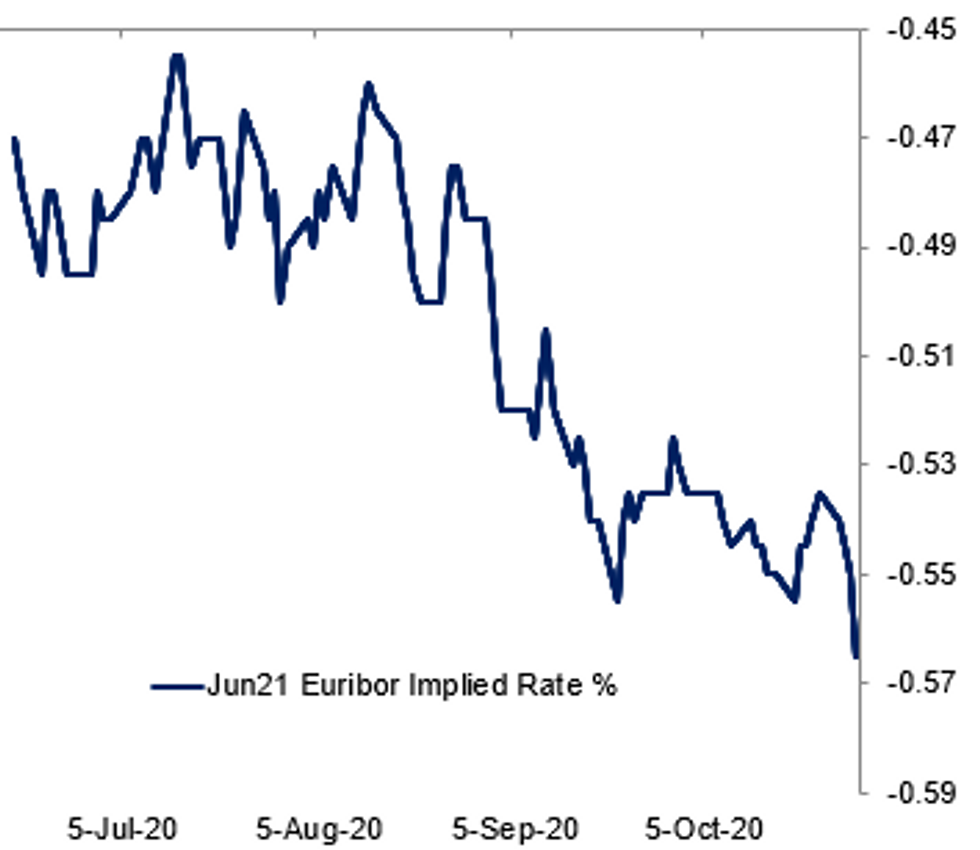

Fig.1: Lagarde Hinting At A Possible Rate Cut?

BBG, MNI

BBG, MNI

EGB SUMMARY: ECB meeting the highlight of the session

The ECB meeting and press conference was the highlight of the day with Lagarde striking a notably more cautious and noting that there was a unanimous decision to "recalibrate" the ECB's toolkit before the December meeting. Lagarde said that this did not rule out or in any measures and policies could be extended, increased or terms changed. The market took the view that this did not merely mean that the PEPP could be extended but that TLTRO terms could be tweaked and there could potentially even be a rate cut in December. Furthermore, Lagarde noted the flexibility of the PEPP and that the ECB had recently moved closer to the capital key than earlier in the crisis with its purchases and that purchases could deviate further from the capital key again during the second wave if needed.

- Peripheral bonds saw a bid, as did European bank stocks, while Bunds also moved higher before being the rally was pulled back by a sharp sell-off in Treasuries as more position squaring ahead of the US election took place.

- Bund futures are up 0.20 today at 176.27 with 10y Bund yields down -0.9bp at -0.636% and Schatz yields down -1.6bp at -0.810%.

- BTP futures are up 0.69 today at 149.70 with 10y yields down -6.3bp at 0.701% and 2y yields down -4.0bp at -0.365%.

- OAT futures are up 0.41 today at 170.18 with 10y yields down -2.1bp at -0.350% and 2y yields down -2.2bp at -0.739%.

GILT SUMMARY: ECB Steals the Show

The morning rally in gilts subsided just after midday with the subsequent selloff pushing yields back to yesterday's close alongside sideways trading in equities.

- Last yields: 2-year -0.068%, 5-year -0.0752%, 10-year 0.2136%, 40-year 0.7556%.

- The Dec-20 gilt future trades at 136.19, in the middle of the day's range (L: 135.98 / H: 136.37) and in line with yesterday's close.

- Short sterling futures are broadly 0.5-1.0 ticks higher on the day.

- Mortgage approvals printed far higher than expected for September (91.5k vs 76.1k) and likely reflects the boost in demand from the stamp duty holiday.

- The ECB struck a dovish tone at today's presser and appeared to set up additional stimulus in December, upping the ante on the BoE which continues to hint at the possibility of a shift to negative rates.

DEBT FUTURES/OPTIONS:

- 0RZ0/3RZ0 100.50 call calendar, sells the 1Y at 4.25-4 in 5k

- 0RZ0 100.625 call sold at 1.5 in 3k

- 3RH1 100.50 puts sold at 7.5 in 15k

- ERH1 / 3RH1 100.50/100.625 call spread, sold the front at 1 in 1.5k

- 0RH1 100.625 call sold at 3.5 in 5k

- 0RH1 100.75 call bought for 1.25 in 3k

- 0RH1 100.50/100.375 put spread sold at 1.25 in 5k

- 3RZ0 100.50/100.625 call spread v ERZ0 100.50/100.625 call spread sold at 0.25 in 4k (-blue, +front)

- 0RZ0 100.50/100.625/100.75 call fly bought for 6 in 3k

- LF1 100.00/100.125 call spread bought for 2.25 in 4k

- DUZ0 112.40/112.30/112.20 put fly bought for 2 in 3k

- RXZ0 176.00/175.00/174.00 put fly bought for 16.5 in 1k

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.