-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Gilts End The Week Under Pressure

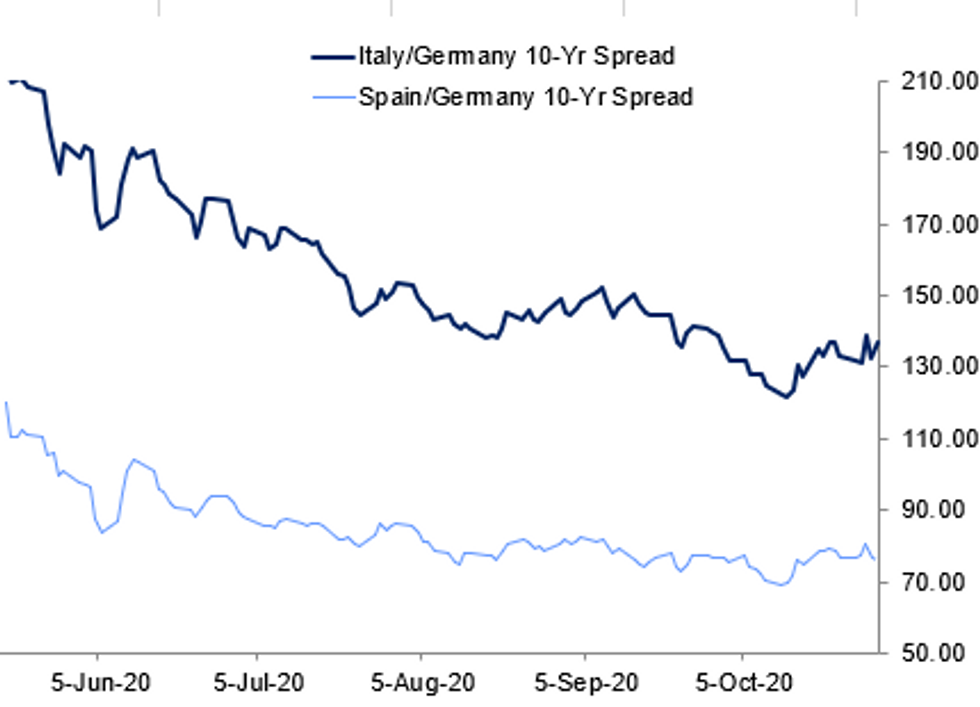

Fig. 1: Periphery Spreads Hold In Despite Risk-Off Week

BBG, MNI

BBG, MNI

EGB SUMMARY: Bunds remain in yesterday's range

Unlike gilts and Treasuries which have taken a leg lower, Bunds have continued to bounce around within yesterday's trading range. Peripheral spreads have been mixed with BTP spreads a bit wider on the day but other spreads generally narrower.

- Bund futures are down -0.18 today at 176.13 with 10y Bund yields up 1.1bp at -0.627% and Schatz yields up 0.9bp at -0.803%.

- BTP futures are down -0.08 today at 149.55 with 10y yields up 2.2bp at 0.746% and 2y yields up 2.2bp at -0.350%.

- OAT futures are down -0.20 today at 170.05 with 10y yields up 1.3bp at -0.341% and 2y yields up 0.7bp at -0.729%.

GILT SUMMARY: Long-End Pressure

The longer end of the gilt curve has come under pressure this afternoon alongside weak trading in equities.

- Cash yields are 2-5bp higher with the 2s30s spread 4bp wider. Last yields: 2-year -0.043%, 5-year -0.0455%, 10-year 0.2612%, 30-year 0.8172%.

- The Dec-20 gilt future trades at 135.64, towards the bottom end of the day's range (L:135.50 / H: 136.08).

- The short sterling futures strip has steepened with greens/blues down 3.0-5.0 ticks on the day.

- Looking ahead, focus next week will be on the BoE and FOMC meetings, particularly in light of speculation that the former could eventually opt for negative policy rates and given that the ECB this week effectively set up a fresh round of stimulus in December.

- The data calendar will be light, with the final PMI prints for October being the main release of note.

DEBT FUTURES/OPTIONS:

- ERH1 100.25 put bought for 0.5 in 3k

- 0RZ0 v 3RZ0 100.625/100.75 call spread, buys the mid for 0.75 in 5k

- 0RH1 100.625/100.75 call spread v 3RH1 100.625/100.75 call spread, pays 1 for the mid in 2k

- 3RG1 100.375/100.125 put spread bought for 2.25-2.5 in 3k

- 0EZ0 135.50/135.25/135.00 put fly sold at 3 in 4k x 6k x 1k

- LH1 99.875/99.75 1x2 put spread, sold the 1 at 0.25 in 3k

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.