-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

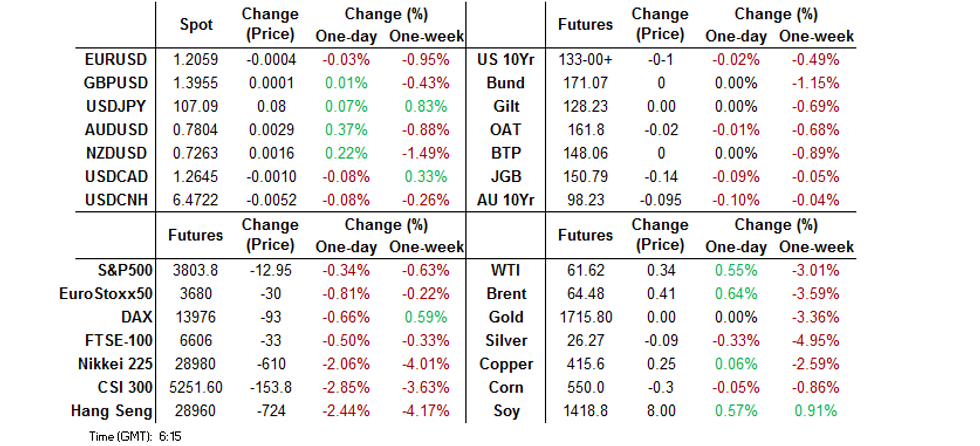

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equities Continue To Struggle, Powell Speech Eyed

- Equities continue to struggle in Asia, tech hit, S&P 500 futures have brief look through last week's lows before recovering from worst levels.

- U.S. Tsys firm a little after yesterday's weakness, growing interest re: apparent short base being built in 10-Year zone of curve.

- Eyes on Fed Chair Powell's language re: Tsy purchases and SLR matters.

BOND SUMMARY: Off Lows On Equity Sell Off

T-Notes held to a narrow 0-05+ range during Asia-Pac hours, last dealing -0-01 at 133-00+, with cash Tsys seeing some light bull flattening as 30s richen by ~2.5bp, benefitting from a downtick in the e-mini space, although those contracts have now corrected from worst levels of the day. Early Asia trade saw the space subjected to some very light pressure on the back of the dynamics witnessed in the Aussie bond space. There was little in the way of tier 1 headline flow to drive broader market dynamics in Asia, although there was growing focus on repo market indications re: a notable short base being built in U.S. 10s. Today's local docket is headlined by the latest address from Fed Chair Powell, his tone re: the future shape of the Fed's Tsy purchases isn't expected to change, even with some observers/participants pointing to the need for the implementation of a fresh operation twist. Comments re: the future of SLR relief will also be eyed. Elsewhere, weekly claims data and the Treasury's mid-month supply announcement will be eyed.

- JGB futures blipped lower in the wake of the latest round of 30-Year JGB supply, extending on the weakness seen during overnight trade, before recovering on the broader round of equity weakness, closing -12 on the day, while 20- & 30-Year paper underperformed in cash trade post-auction as the curve twist steepened. In terms of specifics, the auction drew the lowest cover ratio seen at a round of 30-Year supply since July 2016, with the tail widening substantially vs. the previous round of 30-Year JGB issuance, while the low price was some way shy of broader expectations (100.15 per the BBG dealer poll). This meant that it was a particularly weak auction all around, with the recent stabilisation in the longer end of the curve doing little to entice bidders on the back of last week's vol., as the ongoing BoJ monetary policy review continues to provide another layer of uncertainty to matters. 1-10 Year BoJ Rinban purchases headline locally on Friday.

- YM closed -4.0, with XM -9.5. The market was seemingly disappointed by the lack of RBA purchases to enforce its 3-Year yield target, while its longer dated round of ACGB purchases "only" printed at "normal" sizes after Monday's doubling of purchases covering ACGB's maturing in 2024-2028. The RBA is clearly more at ease with how the market is functioning, at least for now. The broad equity weakness allowed longer dated paper to tick away from worst levels of the session, although bonds never got anywhere near neutral levels. Local data, in the form of the monthly trade balance and retail sales readings, had no impact on the space. Comments from the RBA's head of financial stability didn't add much, if anything, to the broader narrative. A$1.0bn of ACGB 1.50% 21 June 2031 supply and the release pof the AOFM's weekly issuance schedule headline locally on Friday.

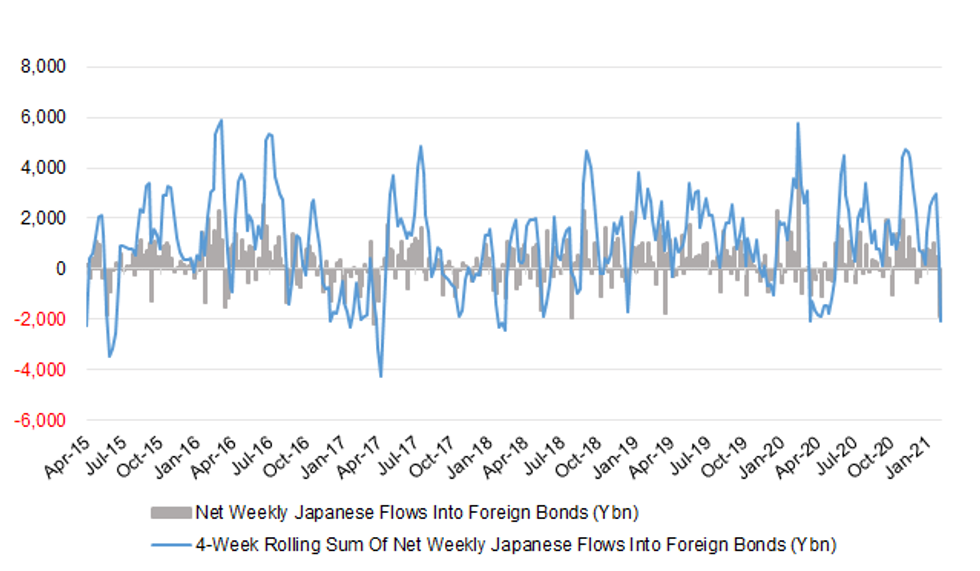

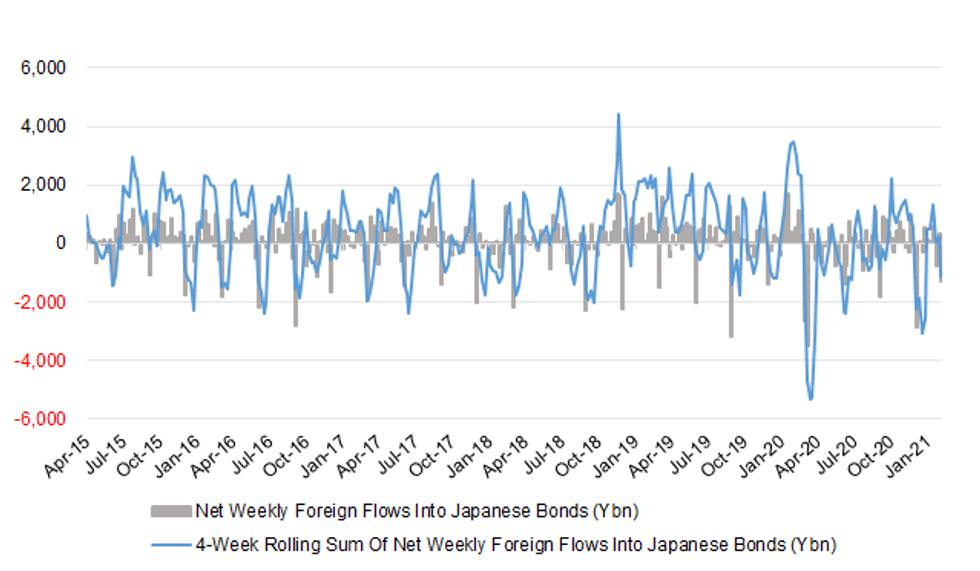

JAPAN: Bonds Dominate Weekly International Security Flow Data

The latest round of weekly Japanese international security flow data revealed net sales across all 4 of the major headline metrics, with bond flows stealing the headlines.

- Japanese net sales of foreign bonds saw a marginal downtick last week, which of course included the period of notable pressure in U.S. Tsys/global core FI, and came on the back of the previous week's multi year highs in terms of net sales.

- Elsewhere, foreign investors shed a notable amount of Japanese bonds. As a reminder, the week also saw JGB futures soften, with suggestions that CTA accounts were a driver of the move.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1719.0 | -1888.7 | -2100.8 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -459.1 | -377.3 | -1369.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -1277.8 | 316.6 | -1120.5 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -454.6 | 93.5 | 441.6 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 1: Net Weekly Japanese Flows Into Foreign Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 2: Net Weekly Foreign Flows Into Japanese Bonds (Ybn)

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

FOREX: AUD Firmer After Solid Trade Report, DXY Extends Gains

AUD has added a handful of pips against all of its G10 peers after Australia's trade surplus widened more than forecast, reaching a record high. Worth noting A$994mn of options with strikes at $0.7800 & A$1.4bn of AUD puts with strikes at $0.7820-25 will expire today. The AFR reported that Australia's Cleanaway is in advanced talks with France's Suez to buy the latter's Australian business for about EUR2bn, but there was little reaction to the news in the FX space.

- The DXY continued to push higher, grinding past yesterday's high, ahead of today's address from Fed Chair Powell.

- GDP came under a modicum of pressure as concerns over the UK's relationship with the EU resurfaced after London suggested that it would unilaterally tweak trade rules regarding Northern Ireland.

- PBOC fixed its USD/CNY mid-point at CNY6.4758, just 4 pips above sell side estimates. China's key annual political meetings begin today, where focus will be on the policy agenda for the next five year plan.

- On the radar today, we have U.S. initial jobless claims, factory orders & final durable goods orders, EZ unemployment & retail sales as well as speeches from Fed's Powell, ECB's Knot & Centeno and Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1890-10(E1.2bln), $1.2000-10(E819mln), $1.2075(E518mln), $1.2085-00(E1.35bln), $1.2150(E554mln), $1.2250(E558mln), $1.2300-05(E900mln)

- USD/JPY: Y105.45-50($582mln), Y105.60-75($1.6bln), Y106.30-50($1.0bln), Y106.90-107.00($535mln)

- GBP/USD: $1.3700-10(Gbp406mln), $1.3900(Gbp550mln), $1.4090-00(Gbp708mln)

- AUD/USD: $0.7700(A$614mln), $0.7750(A$779mln), $0.7775(A$579mln), $0.7800(A$1.0bln), $0.7820-25(A$1.5bln-AUD puts), $0.7900(A$885mln)

- USD/CNY: Cny6.45($745mln)

ASIA FX: Bond Rout Lifts Greenback And Hamstrings Risk Assets

The DXY continued to grind higher, pushing past yesterday's highs ahead of an address from Fed Chair Powell, this coupled with widespread risk aversion saw most Asia EM FX lose ground.

- CNH: PBOC fixed USD/CNY at 6.4758, just 4 pips above sell side estimates. Having peaked into the US close on Wednesday USD/CNH has fallen back slightly, but is holding the majority of its gains from yesterday. A subdued session in a narrow range, the pair last flat at 6.4773.

- SGD: Singapore dollar is weaker, USD/SGD consolidating above the 1.33 handle. Strong resistance awaits at 1.3362, the 100-day moving average, above which the psychological figure of 1.34, which acted as a peak in February, awaits.

- TWD: The Taiwanese dollar strengthened at the open, after central bank smoothing at the close yesterday, the rate has moved in a narrow range after the initial jump lower. The rate came under some pressure today thanks to flows from equity markets, the Taiex dropping sharply.

- KRW: The won is worst performer in Asia today, USD/KRW hitting the highest since November, as the greenback marches higher, despite upward revisions in South Korea GDP and a small beat in CPI figures.

- INR: The rupee opened lower but has quickly regained its footing, USD/INR last at 72.8375 and not far off yesterday's lows at 72.70. INR is expected to come under further pressure today, domestic equity indices are sustaining heavy losses and foreign outflows are expected.

- MYR: Ringitt is weaker, markets await the central bank policy decision due later today.

- IDR: Rupiah is weaker, President Jokowi said there were challenges to hit the 5% growth target this year, while the UK COVID-19 variant has also been found in Indonesia.

- PHP: Peso is weaker, the Dept of Health said they are monitoring the continued increase in daily Covid-19 case counts in Manila and two other areas.

- THB: PM Prayuth said that he expects "only a small change" to the composition of the cabinet at the upcoming reshuffle.

ASIA RATES: Bond Rout Felt In Asia

- INDIA: Yields are higher across the curve in India, but moves are far more sanguine compared to peers with market participants looking ahead to an increased size operation twist later today. The operation size has been increased to INR 150bn from INR 100bn. In the operation the RBI will buy longer bonds and sell shorter bonds, which has resulted in some curve flattening.

- INDONESIA: Yields are higher across the curve in Indonesia, pressured by the global bond rout. Foreigners sold Indonesian bonds for the eighth straight day yesterday. Indonesian President also sounded a note of caution, saying achieving the 5% growth target will be difficult.

- CHINA: The PBOC drained a net CNY 10bn of liquidity from the market via OMOs today, bringing this week's net drain to CNY 20bn. The overnight repo rate rose following the drain, last up 40bps at 1.9087%, while the 7-day repo rate rose 30bps to 2.1596%. Elsewhere, corporate bond spreads are rising, AA rated Chinese corporate debt in the 5-year tenor has seen spreads widen from 20-week lows, with Chinese government debt less susceptible to the global bond sell-off.

- SOUTH KOREA: Futures are lower in South Korea, pressured by the sell off in other markets, upbeat data adding to the downward pressure in the space. GDP was revised higher while CPI saw a small beat against expectations. The BoK sold 2-year debt at a 0.86% yield, but with cover of just 1.37.

EQUITIES: Tech Under Pressure In Asia

A negative day for equities in the Asia-Pac time zone, all markets in the red and sustaining heavy losses. Asian chipmakers have endured heavy losses after the Philadelphia Semiconductor Index declined for a second day to touch a one-month low on Wednesday. The tone was negative from the open with US markets selling off for the second day.

GOLD: Still Struggling, No Meaningful Test Of $1,700/oz, Yet

Gold has struggled over the last 24 hours on the back of the uptick in U.S. real yields and the DXY, while ETF holdings of gold continue to trickle lower. Spot last deals little changed on the day around the $1,715/oz mark, with psychological support at the $1,700/oz yet to be subjected to a significant test. Fed Chair Powell's Thursday address will be key re: setting the tone as we move towards the Fed's blackout period ahead of its March monetary policy decision.

OIL: Rally Rides Again

Crude futures are higher in Asia on Thursday, extending yesterday's rally, though still just below highs hit on Thursday. WTI & Brent print $0.40 & $0.50 above their respective settlement levels at typing.

- Production data yesterday was bullish for crude. gasoline inventories collapsed, dropping the most since 1990 after the Texas deep freeze took out over 5m bpd of refining capacity, distillate inventories also recorded their largest draw since January 2003. Headline crude stocks rose but markets instead focused on the bullish downstream readings.

- There were additional tailwinds for oil from OPEC+ headlines, where no recommendation was made on output. Some member states appear to be pushing for a higher level of easing of the cuts, while others are being more cautious. It was reported that Saudi Arabia are cautious on oil's recovery and wants to limit any rise in production quotas. The talks will continue today.

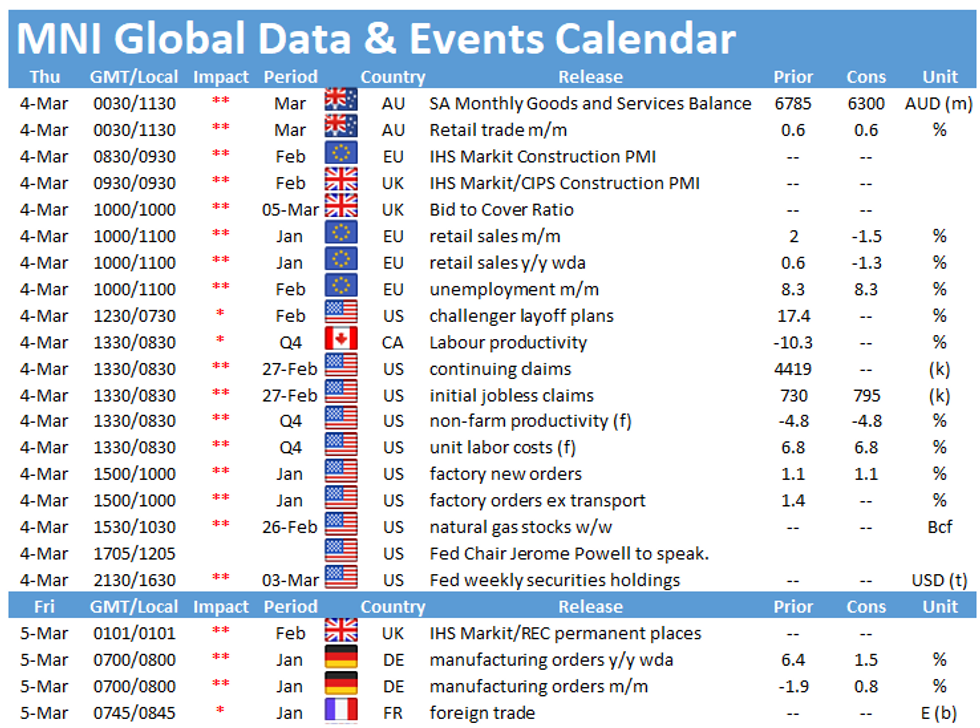

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.