-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Soften On Regulation Chatter

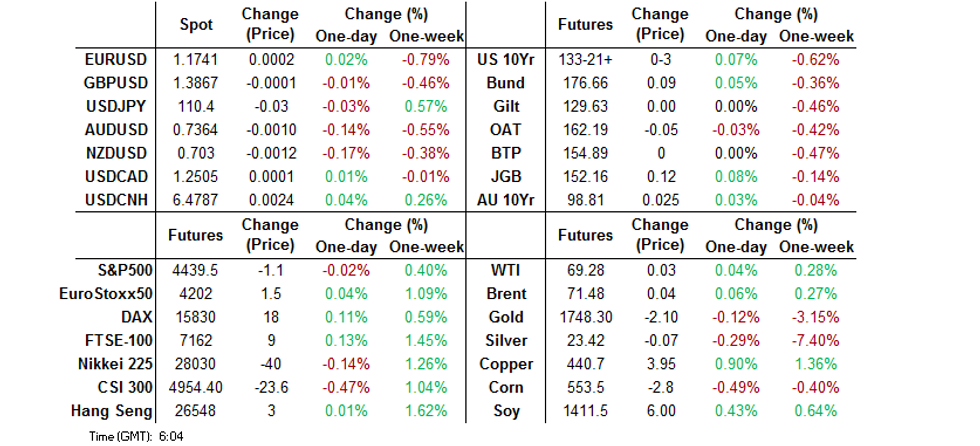

- Core FI edge higher in early Asia-Pac trade as China's continued regulatory crackdown as well as Wednesday's U.S. CPI data & strong 10-Year auction provide support.

- China regulation chatter applies pressure to local equity indices.

- Antipodean currencies offered as Australia struggles to contain Covid-19 outbreak, locks down capital for a week.

BOND SUMMARY: Initial Impetus Carries Core FI Higher And Peters Out

Core FI started the Asia-Pac session on a firmer footing as Asia-Pac participants woke up to a particularly strong 10-Year U.S. Tsy auction and the latest U.S. CPI report. Consumer-price growth slowed in July, pouring some cold water on prospects of sooner asset purchase tapering from the Fed. Continued regulatory crackdown by Chinese authorities, this time targeting insurance tech platforms, lent further support to core FI early on. T-Notes climbed to 133-24 in early trade, but trimmed gains as the initial impetus evaporated. The contract last trades +0-02 at 133-20+. Cash Tsy yields retraced their marginal dips and are virtually unchanged across the curve. Eurodollar futures run unch. to +1.5 tick through the reds. Factory-gate inflation, weekly jobless claims and a 30-Year auction take focus in the U.S. today.

- JGB futures attacked their overnight high of 152.17 in early Tokyo trade but then eased off alongside T-Notes and last trade at 152.14, 10 ticks shy of the previous settlement. Cash JGB yields sit a tad lower across the curve, with the super-long end outperforming. Japanese above-forecast PPI figures came and went, while the latest round of 1-10 Year Rinban operations saw no changes to purchase sizes.

- The RBA also held its bond purchase ops today and offered to buy A$2.0bn worth of ACGBs with maturities of Nov '28 to May '32 today. However, it was the local Covid-19 situation that stole the limelight, with ACT entering a snap seven-day lockdown after detecting the first positive case in more than a year. Cash ACGB curve bull flattened, driven by the impetus which swept across core FI space early on, with 10-Year debt outperforming. Aussie bond futures stabilised after the initial uptick, refusing to ease off alongside their U.S. & Japanese peers; XM sits +3.0 & YM +1.5 as we type. Bills trade -1 to +4 ticks through the reds. Australia/U.S. 10-Year bond yield spread continued to tighten to levels not seen since March 2020.

FOREX: Greenback Holds Post-CPI Decline

Major pairs hugged narrow ranges in Asia with the greenback holding its post-CPI decline.

- AUD/USD is down 8 pips heading into Europe, data earlier showed consumer inflation expectations slipped to 3.3% in August from 3.7% in July. Coronavirus cases remain elevated, there were 345 in NSW today, up from 344 on Wednesday, the lockdown in Sydney was extended this week and looks like it will run until August. Elsewhere there were reports that ACT (Australian Capital Territory) will go into a 7-day lockdown.

- JPY is stronger, USD/JPY down 3 pips after the pair snapped a five day winning streak on Wednesday. Data showed PPI rise above estimates at 5.6% Y/Y and 1.1% M/M. A panel of experts advising the Health Ministry warned that strain on the healthcare system in Tokyo and other localities is reaching a critical phase, as Japan recorded another daily record in new Covid-19 infections.

- Offshore yuan is flat, USD/CNH holding yesterday's losses. There are fears of further regulation with a statement from the State Council yesterday saying it would actively work on legislation in areas including national security, technological innovation as well as anti-monopoly to improve the legal framework and help govern the country.

- Markets look ahead to UK GDP figures and PPI out of the US later today, GBP, EUR and CAD all essentially flat.

FOREX OPTIONS: Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650-60(E2.4bln), $1.1700-05(E1.7bln), $1.1785-00(E2.2bln), $1.1810-15(E1.6bln)

- USD/JPY: Y109.40-50($712mln), Y110.00-10($618mln), Y110.30-50($1.3bln), Y110.95-00($881mln)

- GBP/USD: $1.3840-60(Gbp906mln)

- EUR/GBP: Gbp0.8500(E570mln)

- AUD/USD: $0.7300(A$697mln), $0.7440(A$678mln)

- USD/CAD: C$1.2495-00($1.0bln), C$1.2540($585mln), C$1.2655($555mln)

- USD/CNY: Cny6.4620($960mln)

ASIA FX: Most EM FX Gains, Yuan & Won Buck The Trend

The greenback held most of its post-inflation data decline, risk environment generally supportive which helped most Asia EM currencies gain.

- CNH: Offshore yuan is slightly weaker but has hugged a narrow band again. There are fears of further regulation with a statement from the State Council yesterday saying it would actively work on legislation in areas including national security, technological innovation as well as anti-monopoly to improve the legal framework and help govern the country.

- SGD: Singapore dollar is slightly weaker but has seen sluggish trade throughout the session. On the coronavirus front Singapore reported 61 new locally transmitted COVID-19 infections yesterday, three new COVID-19 clusters were identified.

- TWD: Taiwan dollar is stronger, snapping a four day losing streak. There were reports that Taiwan to get 520,000 doses of AstraZeneca vaccine today.

- KRW: Won is weaker, hitting fresh 2021 lows. On the coronavirus front South Korea reported 1,987 new cases in the past 24 hours, New cases fell back below 2,000, but the peak of the current wave of the pandemic has not yet come say authorities.

- MYR: Ringgit is stronger. The Straits Times reported that Malaysia's King asked PM Muhyiddin to bring forward the confidence vote, with next Wednesday proposed as a possible date.

- IDR: Rupiah is slightly higher, movement was muted as Indonesian participants return from a market holiday yesterday. Markets look ahead to the Central Bank announcement next week.

- PHP: Peso rose, the Monetary Board are expected to leave monetary policy settings unchanged today, after Governor Diokno ruled out RRR cuts anytime soon.

- THB: Baht gained, Thailand declared a record daily increase in new Covid-19 cases today, with 22,782 infections detected. The number of fatalities rose by 147.

ASIA RATES: China Futures Snap Four Day Losing Streak

- INDIA: Yields lower in early trade. Bonds finished the day lower on Wednesday, 10-Year yields rose around 1bps to 6.24%. Markets look ahead to what promises to be a busy session. The RBI's will conduct its next INR 250bn GSAP purchase operation today. Bonds eligible for purchase are the 5.63% 2026, 7.17% 2028, 7.26% 2029, 7.61% 2030, 7.95% 2032. The other focus today is the domestic data docket, CPI is expected to have slowed to 5.72% in July from 6.26%, back within the RBI's target band. Industrial production is also due which is expected to have slowed to 14% in June from 29.3% in May. Trade balance data could be released as soon as today.

- SOUTH KOREA: Futures in South Korea are mixed; the 10-Year contract is up, playing catch up with a move in US tsys, while the 3-Year contract is down slightly. On the coronavirus front South Korea reported 1,987 new cases in the past 24 hours, New cases fell back below 2,000, but the peak of the current wave of the pandemic has not yet come amid calls for tougher measures to bring virus infections under control and slow vaccinations. The pace of vaccinations is still slow with 16% of people now fully vaccinated. Finance Minister Hong was on the wires earlier saying the potential economic fallout of the fourth wave of the pandemic will be "inevitable" starting in August.

- CHINA: The PBOC matched injections with maturities today, repo rates are mixed but within recent ranges. The overnight repo rate is down 17bps at 19288%, while the 7-day repo rate is up 23bps at 2.1312%. Futures are higher, snapping a four day losing streak, 10-year future is up 14.5ticks at 99.955. Equity markets are slightly lower. There are fears of further regulation with a statement from the State Council yesterday saying it would actively work on legislation in areas including national security, technological innovation as well as anti-monopoly to improve the legal framework and help govern the country. The CBIRC has also laid out new guidelines for cracked down on improper marketing and pricing practices in insurance technology platforms

- INDONESIA: Yields higher today, Indonesian markets return from a holiday today. The government sold IDR 11tn of sukuk bonds at auction on Tuesday, slightly lower than the IDR 12tn target, there were IDR 51.6tn of bids received. Markets look ahead to the Central Bank announcement next week.

EQUITIES: China Markets Pressured By Regulation Chatter

Markets in the Asia-Pac region are mixed, despite a positive lead from the US where markets hit another record high. In Japan markets are trading with small gains, data showed PPI rise above estimates at 5.6% Y/Y and 1.1% M/M. A panel of experts advising the Health Ministry warned that strain on the healthcare system in Tokyo and other localities is reaching a critical phase while Fitch affirmed Japan at A with a negative outlook. Markets in China are down, the CSI 300 shedding almost 1%; there are fears of further regulation with a statement from the State Council yesterday saying it would actively work on legislation in areas including national security, technological innovation as well as anti-monopoly to improve the legal framework and help govern the country. The CBIRC has also laid out new guidelines for cracked down on improper marketing and pricing practices in insurance technology platforms. Most EM bourses in minor positive territory amid generally supportive risk sentiment. In the US futures are mixed, e-mini Nasdaq the laggard hovering just beneath neutral while e-mini Dow and S&P slightly higher. Markets look ahead to UK GDP and US PPI data later today.

GOLD: Hovering Around Wednesday's High

After rising from the lowest levels since March during Wednesday's session gold hugged a narrow range during Asia-Pac hours, last down $1.72 at $1,749.98 and just above session lows. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement. Should the tame US inflation print resume downward pressure support is seen at the Aug 8 low of $1690.6.

OIL: Inventory Data Helps Secure Gains

Crude futures are steady, holding gains seen made during the US session yesterday. WTI is up $0.08 from settlement at $69.33/bbl, Brent is up $0.07 at $71.51/bbl. Conflicting factors helped stabilise oil benchmarks into the Wednesday close, with early pressure hitting WTI and Brent futures after the US issued a statement appealing to OPEC+ to open the output taps and relieve oil prices in the face of a slowing post-COVID recovery. This pressured WTI futures to back below $67/bbl before prices bounced on the DoE inventories release. The weekly release saw an unexpected draw of 448k barrels against a forecast of a build, with implied demand data also proving supportive and helping secure a two day advance. To resume any incline in Brent futures, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg. A break and close back above here opens key resistance at $76.80, Jul 6 high.

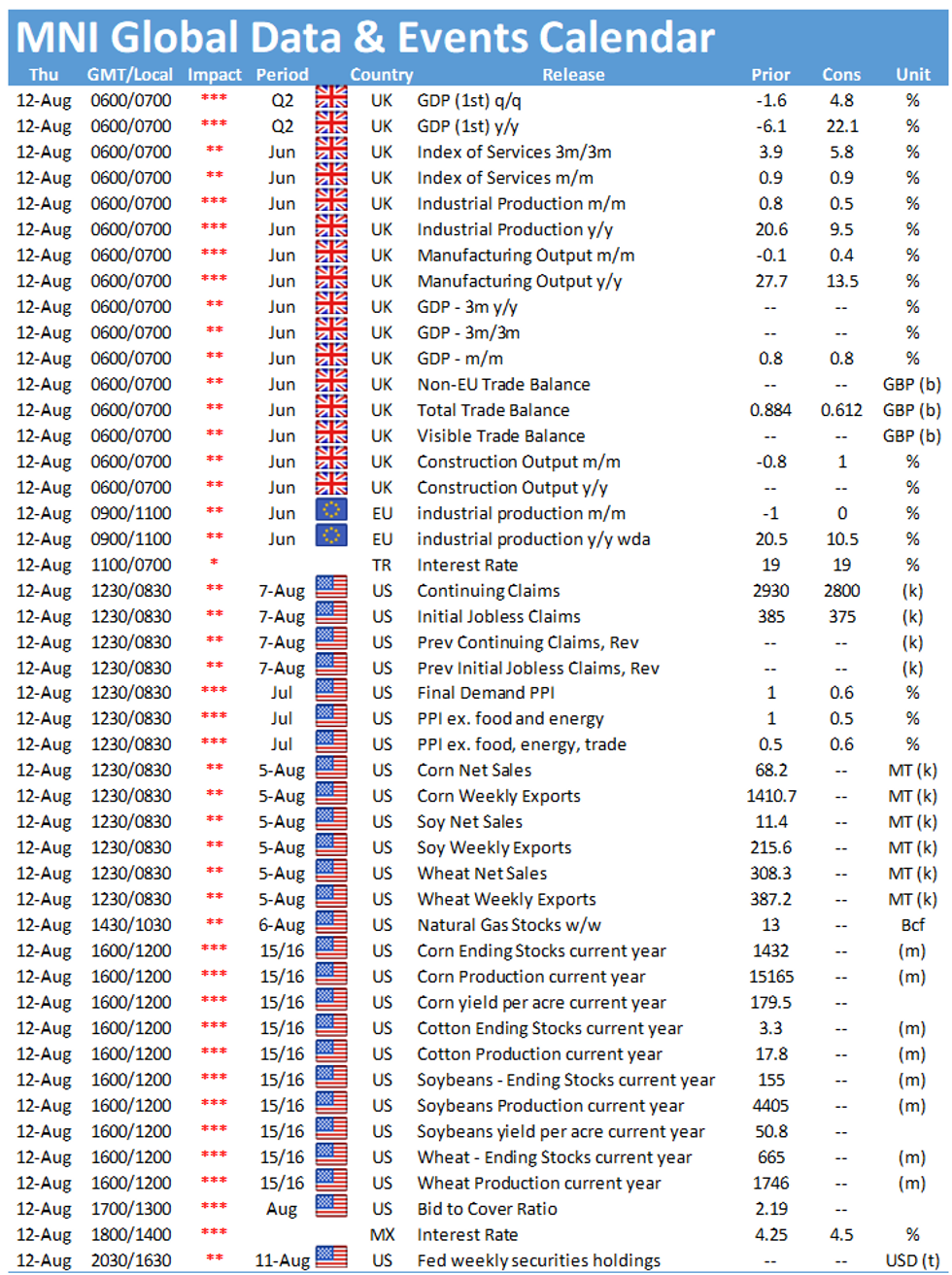

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.