-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD & NZD Pressured On Weaker China Data

- China Q2 GDP was lower than expected in y/y terms, while June activity data hinted at softer retail/property related spending. This has weighed on regional risk appetite, while the USD has generally been on the front foot against higher beta FX. AUD and NZD are notably underperformers against the yen in the G10 space.

- Cash tsys have been closed in Asia due to the observance of a national holiday in Japan and will re-open in the London session. A severe storm has seen HK markets closed as well, which has likely impacted broader liquidity.

- There is a thin docket in Europe today, further out we have Empire Manufacturing. The Fed has entered its policy blackout window which runs until 27 July the day after the next rate announcement.

MARKETS

US TSYS: Narrow Ranges In Asia, Cash Re-Opens In London

TYU3 deals at 112-18+, +0-00+, a 0-06 range has been observed on volume of ~33k.

- Cash tsys have been closed in Asia due to the observance of a national holiday in Japan and will re-open in the London session.

- Tsy futures have observed narrow ranges and are holding marginally richer in Asia. The early move higher came alongside the USD marginally extending gains however there was little follow through and narrow ranges persisted.

- The space looked through a mixed round of Chinese monthly activity data.

- There is a thin docket in Europe today, further out we have Empire Manufacturing. The Fed has entered its policy blackout window which runs until 27 July the day after the next rate announcement.

SITR: $-Bloc STIR Little Changed From Pre-US PPI Levels

$-Bloc STIR is little changed from pre-US PPI levels.

- Year-end rate hike projections firmed on Friday as consumer confidence ticked higher and inflation expectations rose.

- The Fed terminal rate closed at 5.395% for Nov'23. The market continues to price around a near 95% chance of a 25bp hike at the July FOMC. Reminder, the Federal Reserve entered a policy blackout at midnight Friday, running through July 27, the day after the next rate announcement.

- Today RBA-dated OIS pricing is 2-5bp softer across meetings.

- RBNZ dated OIS pricing is 1-3bp firmer for ’24 meetings today.

Figure 1: $-Bloc STIR: Terminal Rate Expectations & Mar’24 Pricing

Source: MNI – Market News / Bloomberg

AUSSIE BONDS: Dealing Mixed, Mid-Range, RBA Minutes Tomorrow

ACGBs are sitting mixed (YM -1.0 & XM +1.0) and in the middle of the Sydney session range. Without domestic data, local participants have likely been on headlines and US tsys watch.

- On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Q2 GDP was as expected at +0.8% q/q, but the y/y number softer at +6.3%, versus +7.1% expected. However, the data didn’t appear to have any lasting impact on ACGBs.

- Cash ACGBs are flat to 1bp richer.

- The 3s10s swap curve has twist flattened with rates 1bp lower to 2bp higher. EFPs are 1bp wider.

- The bills strip is cheaper with pricing -1 to -4.

- RBA-dated OIS pricing is little changed across meetings.

- Tomorrow sees the release of the RBA Minutes for the July meeting. The market will be looking for more details about the July pause.

- The AOFM has selected Structuring Advisors to assist with establishing the Australian Sovereign Green Bond program. The AOFM and the Treasury will be working with National Australia Bank and UBS. The first green bond issuance will occur in mid-2024, with the Australian Government Green Bond Framework to be released well in advance.

AU & NZ RATES: AU-NZ 10-Year Differential Tracking The Short-End Higher

Today, the 10-year yield of NZGB has declined by 6bp. However, NZGBs have still underperformed ACGBs, as evidenced by the 2bp narrowing of the AU-NZ 10-year yield differential. A longer-term perspective, however, reveals a dramatic outperformance by NZGBs since mid-March.

- In mid-March, the AU-NZ 10-year yield differential reached a concerning -100bp, marking its lowest level since the late 1990s. This sharp decline was triggered by a disappointing deterioration in NZ's current account deficit, which caught the attention of S&P bond ratings, leading to consequential comments from them.

- The recent movement in AU-NZ differential can be attributed to the market adjusting its pricing to reflect the anticipation of the RBA catching up to the rate hikes that have already been implemented by the RBNZ. Since mid-March, the AU-NZ 1Y3M swap differential has moved from around -175bp to -85bp.

Figure 1: AU/NZ 10-Year Yield Differential Vs. 1Y3M Swap Differential

NZGBS: Closed On A Strong Note, Q2 CPI On Wednesday

NZGBs closed on a strong note with benchmark yields 4-5bp richer. The local market has played catch-up to global bond market developments following Friday’s public holiday.

- On the domestic data front, NZ’s performance of services index fell to 50.1 in June from 53.3 in May. Three of five sub-indexes printed above 50 with employment dipping to 49.1, and inventories dropping to 47.3. At the margin, this, along with China’s underwhelming economic data, would have supported the strengthening through the session.

- On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Notwithstanding the base effect impact on today's outcomes.

- US tsy futures were little changed in Asia-Pac trade, with cash tsys closed due to a Japanese public holiday.

- Swap rates are 5-7bp lower with the 2s10s curve 2bp flatter.

- RBNZ dated OIS pricing is 1-3bp firmer for ’24 meetings with terminal OCR expectations at 5.63%.

- Tomorrow the local calendar is light ahead of Q2 CPI data on Wednesday. BBG consensus expects headline CPI to print +0.9% q/q in Q2 with the annual rate dropping to 5.9% y/y from 6.7%.

- Tomorrow also sees the release of the RBA Minutes for the July meeting.

FOREX: Antipodeans Pressured After Chinese Data

The AUD and NZD are pressured in Asia on Monday, early pressure extended after a mixed round of Chinese data. Q2 GDP was as expected in q/q terms (+0.8%), but weaker in y/y terms (6.3%, versus 7.1% forecast) Industrial Production was firmer than expected but Retail Sales was a touch softer than forecast in June.

- AUD/USD prints at $0.6805/10, the pair is ~0.4% softer today. Support comes in at $0.6784, the low from July 13, and $0.6713, the 20-Day EMA.

- Kiwi is also pressured, early losses marginally extended after risk sentiment soured post the Chinese data. NZD/USD prints at $0.6345/50, support comes in at the 13 July low ($0.6290).

- Yen is marginally firmer, however ranges remain narrow with little follow through on moves. Japanese markets have been closed for the observance of a national holiday on Monday.

- Elsewhere in G-10 EUR and GBP are a touch lower, BBDXY is up ~0.1%.

- Cross asset wise; US Tsy futures are marginally firmer and e-minis are down ~0.1%. WTI futures are pressured down ~0.8%.

- Empire Mfg from the US is the highlight of an otherwise thin docket on Monday.

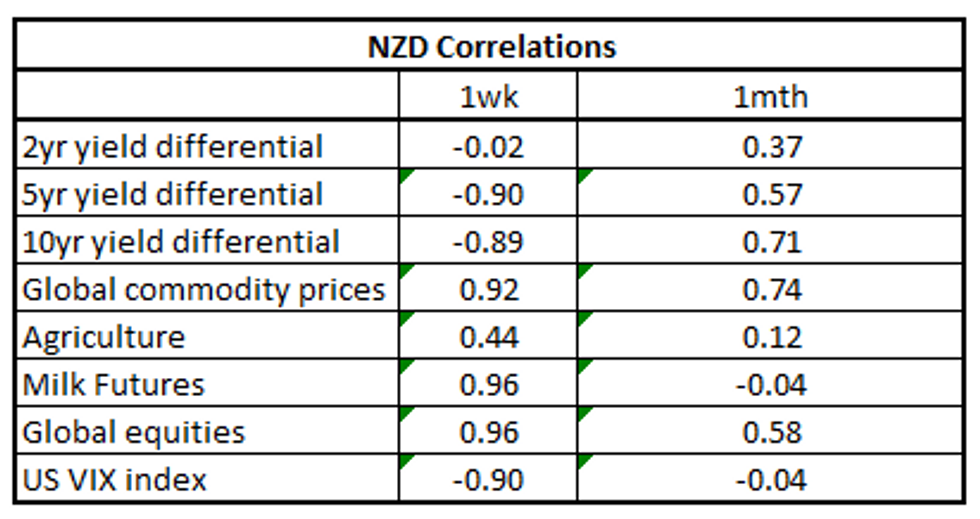

NZD: Global Equities, Milk & Commodities Dominant Drivers Last Week

NZD/USD correlations with global equities, milk futures and commodities have strengthened over the past week, standing out as a key macro driver in recent dealings. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Recent strength in NZD, up ~2.6% last week, looks to be associated with the recent strength in global equities, milk futures and commodities.

- The pair looked through narrowing 5-Year and 10-Year Yields differentials.

- Over the longer time frame rate differentials, commodities and global equities are the dominant macro drivers.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

EQUITIES: China Markets Weaken, Amid Signs Of Softer Activity In Retail/Property

Most regional equity markets are tracking lower in the first part of Asia Pac dealing for Monday. China markets are down over 1%, although Hong Kong markets are out due to a storm, so this is likely impacting liquidity to some extent. Japan markets are also out today for a local holiday. US futures are a touch weaker at this stage, Eminis off by ~0.1% to 4532, Nasdaq futures down by a similar amount.

- China markets were weaker from the open, and faltered further post the Q2 GDP update and June monthly activity prints. These updates showed weaker than expected GDP y/y momentum, while discretionary spending and the housing market lost traction in June.

- At this stage the CSI 300 is off by 1.09% at the break, the Shanghai Composite slightly more. Financial stocks are also under pressure post reports from late last week the PBoC may open the door for mortgage refinancing, which may put pressure on interest margins per J.P. Morgan reports.

- Elsewhere, the Kospi has given back some of last week's gains, down 0.58% at this stage, while the Taiex is outperforming, sitting closer to flat. It's a similar story for the ASX 200.

- In SEA most markets are down, although losses aren't much beyond 0.50%. Indonesia's benchmark is outperforming, +0.40% at this stage.

OIL: Crude Down Again As Supply Disruptions Ease

Oil prices are down around 0.9% during APAC trading today as output at a Libyan oil field resumed and expectations of further Fed tightening firm. Prices were trending lower before the mixed activity data from China but have been moving sideways since then. The USD index is flat.

- WTI is down 0.9% to $74.75/bbl off the intraday low of $74.61. It reached a high of $75.14, but hasn’t been able to hold breaks above $75. Brent is 0.9% lower at $79.16 after a high of $79.56 and low of $79.02. $79 is providing support.

- Annual Q2 China GDP disappointed as well as retail sales but IP was stronger than expected. Also apparent June oil demand was 14% higher on a year ago, according to Bloomberg. China is the world’s largest oil importer.

- Higher crude prices in the last week have meant that the Urals crude price has risen above the $60 price cap, which is likely to complicate the purchase and shipping of Russian oil.

- Today is quiet with no Fed speakers but there is a pre-recorded welcome from ECB’s Lagarde and Panetta and Lane speak. On the data front, there is only the US Empire manufacturing index for July, which is expected to decline.

GOLD: Softer In Asia-Pac After Edging Lower On Friday

Gold is 0.2% lower in the Asia-Pac session, after edging lower on Friday as US tsys reversed cheaper following solid consumer sentiment data. The UofM’s preliminary July consumer sentiment index easily beat expectations rising to 72.6 from 64.4 in June. Additionally, 1Y inflation surprisingly increased to +3.4% (consensus +3.1%) after +3.3%; 5-10Y inflation increased a tenth to +3.1% (consensus +3.0%), back at the top end of the 2.9-3.1% range seen since Aug’21 and one-tenth off the high since 2011.

- Year-end rate hike projections firmed on heavy short-end selling, with the Fed terminal rate holding at 5.395% for Nov'23. The market continues to price around a near 95% chance of a 25bp hike at the July FOMC. Reminder, the Federal Reserve entered a policy blackout at midnight Friday, running through July 27, the day after the next rate announcement.

- Prior to Friday’s data, bullion had been supported by the positive trend in US tsys due to the growing belief in a 'soft-landing' narrative for the US economy. This narrative gained momentum as evidence of cooling inflation emerged, with producer and consumer prices falling more than anticipated in June.

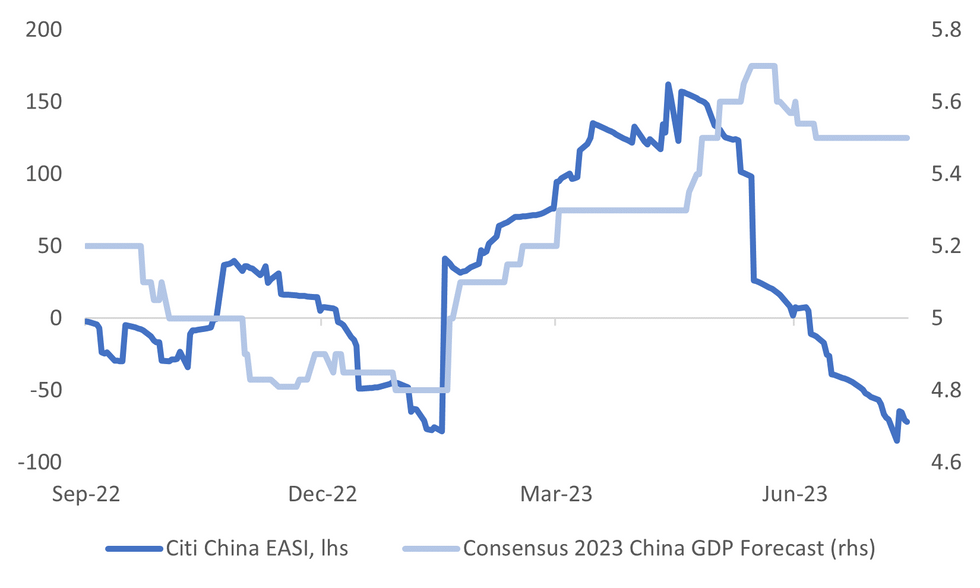

CHINA DATA: Policy Support Calls Likely To Continue

On balance, China's Q2 GDP print, and mixed June activity data, are likely to see calls for policy support continue. Notwithstanding the base effect impact on today's outcomes.

- The data didn't show the same degree of downside surprises we saw in parts of Q2, see the chart below, which overlays the Citi China EASI against 2023 China GDP growth expectations. Still the market may want to see signs of greater policy support to ensure more positive momentum as we progress through H2.

- Q2 GDP was as expected at 0.8% q/q, but the y/y number softer at 6.3%, versus 7.1% expected.

- IP was one of few bright spots, coming in nearly double market expectations in y/y terms. This largely owed to an improved trend in mining related output (back into positive territory +1% from 23.8%.5% y/y, from -1.2%), while agricultural related sectors also improved. Auto manufacturing slowed to 8.8% y/y, from 23.8% y/y.

- Retail sales was slightly weaker than expected, which largely owed to weaker discretionary related spending - restaurants +16.1% y/y from 35.1%, clothing to 6.9% from 17.6%. Household electronics rose 4.5%, from 0.1% prior, but automobiles were weaker at -1.1% (from 24.2%).

- Fixed asset investment showed similar trends to last month. FAI for the private sector easing to -0.2% ytd y/y (from -0.1%), while state owned enterprises were at 8.1%.

- There were little signs of better property related sentiment though at least in ytd y/y terms. Investment to -7.9%, while sales eased to 1.1% from 8.4% on the same basis. Under construction slipped to -6.6%, new construction to -24.3% (from -22.6%) and property sales -5.3% (from -0.9%). The authorities did note trends were stabilizing in the sector in H1.

- The unemployment rate held steady at 5.2% (as expected), although youth unemployment (16-24yrs old) was at 21.3%, a record high.

Fig 1: Citi China EASI Versus 2023 China Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

ASIAN FX: Dollar Firmer Against Most Asian FX

USD/Asia pairs are mostly higher in Monday dealings, as the USD sees further modest support following the consolidation at the end of last week. Signs of weaker China retail and property related activity has weighed, albeit not uniformly, across the region. USD/CNH has recovered further, but found selling interest above 7.1800. The data calendar for tomorrow is very light.

- USD/CNH sits slightly down from session highs (7.1814), last tracking in the 7.1740/50 region. Onshore equities are tracking lower by more than 1% at this stage. HK markets are out due to a storm, which is likely impacting CNH liquidity. Equity weakness, coupled with mixed data earlier is likely weighing. Soft points in terms of retail spending and housing activity are likely to see stimulus calls persisted with. The CNY fixing was set firmer, but at the narrowest level (relative to expectations since late June), which is likely to weighed on CNH as well.

- The Rupee is little changed in early dealing in a muted start to the week's trade. USD/INR prints at 82.10/20, the pair rose ~0.1% on Friday paring some of the week's gain. Equity inflows by foreign investors continued with a $688.10 inflow on Thursday, this morning the total amount in July to ~$2.386bn. The local data docket is empty this week.

- The Ringgit is pressured in early trade on Monday as the greenback trims some of last weeks losses. USD/MYR is up ~0.7% last printing 4.5570/4.5620, the Ringgit is paring some of its post US CPI outperformance. Looking ahead the only data on the docket this week is June Trade Balance which crosses on Thursday. A surplus of MYR18.70bn is expected.

- The SGD NEER (per Goldman Sachs estimates) is little changed, the measure sits a touch off cycle highs and is ~0.3% below the top of the band. USD/SGD printed its lowest level since early February on Friday before marginally paring losses. We sit at $1.3220/30, broad USD trends continue to dominate with the pair falling ~3% from the high on July 6. Singapore Export data cross this morning, Non-Oil Exports grew 5.4 M/M in June beating expectations. In the month exports to China grew 3.7%, which likely contributed to the strong Q2 GDP print on Friday. Looking ahead the local data calendar is empty for the remainder of the week.

- USD/IDR spot has edged back to the 14995/00 level in latest dealings. We have moved off intra-day highs of 15009 to 15000 post a better than expected trade surplus for June. It printed at $3460mn, versus $1162mn expected and $430mn prior. This was largely due to a slump in imports (-18.35% y/y, -4.20% forecast), with export growth also faltering to -21.18% y/y (-17.80% forecast and 0.93% prior).

USD/IDR is back above the 50-day EMA (around 14978), but still sub the 20-day at this stage (~15009). - USD/PHP has backed away from earlier highs around 54.51. The pair last at 54.40. Remittances were weaker than expected at 2.8% y/y, versus 4.5% projected. New BSP Governor Eli Remolona spoke late last week, indicating the central bank is not yet contemplating rate cuts, as inflation remains above the target band still. The central bank maintains a tightening watch and is watching for upside inflation risks from el nino and wage hikes.

INDONESIA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of Indonesian Newspapers and some other major news outlets.

Geopolitics: “ASEAN lauds Indonesia’s engagement with all parties in Myanmar” – Antara News (see link)

Geopolitics: “US, ASEAN work towards an open Indo-Pacific: Antony Blinken” – Jakarta Globe (see link)

FX: “Indonesia obliges natural resource exporters to keep 30% of forex revenues in local banks” – Jakarta Globe (see link)

Trade: “India, Indonesia plan local currency trade, fast payments links” – Bloomberg (see link)

Trade: “Gov’t reimposes export duty after CPO prices rebound” – Jakarta Globe (see link) (CPO = crude palm oil)

Trade: “Trade ministry to protect labor-intensive industries from import hikes” – Antara News (see link)

Economy: “Number of air traffic, passengers grows to near pre-pandemic levels” – Jakarta Globe (see link)

Finance: “Financial sector’s role crucial in improving ASEAN food security: govt” – Antara News (see link)

Politics: “Indonesia names new tech minister as previous faces graft probe” – Bloomberg (see link)

INDONESIA DATA: Weak Exports But Weaker Imports Drives Surplus Widening

Indonesia’s trade surplus for June widened a lot more than expected to $3.46bn from $0.43bn due to a slump in imports but the data details were soft. Exports fell a more-than-expected 21.2% y/y after rising 1% in May due to lower commodity prices, while imports fell 18.4% y/y after rising 14.4%.

- Exports excluding oil & gas fell 21.4% y/y with crude oil down 31.1% and gas 22.4% due to lower prices. Mining exports fell 37.5% y/y and manufacturing -16.4%. H1 2023 exports fell 8.9% y/y. Oil & gas imports were 39.5% y/y lower and consumer goods -6.6% y/y but capital goods rose 4.1% y/y. Imports fell 6.4% y/y in H1.

- Non-oil exports to Indonesia’s three largest destinations were weak in June with China down 4% m/m and -10% y/y, Japan -23.2% y/y and US -20.6% y/y. Indonesia has been talking with India to improve trade ties to diversify away from China, as the Chinese economy has disappointed.

- Non-oil imports from China fell 20.6% y/y, from Japan -4.2% y/y, and US -1.2% y/y.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Period | Flag | Country | Release |

| 17/07/2023 | 0800/1000 | ** | Jun |  | IT | Italy Final HICP m/m |

| 17/07/2023 | 0800/1000 | ** | Jun |  | IT | Italy Final HICP y/y |

| 17/07/2023 | 1230/0830 | * | May |  | CA | Intl Securities Transactions |

| 17/07/2023 | 1230/0830 | ** | May |  | CA | Wholesale Sales |

| 17/07/2023 | 1230/0830 | ** | Jul |  | US | Empire Manufacturing Index |

| 17/07/2023 | 1530/1130 | * | 21-Jul |  | US | Bid to Cover Ratio |

| 17/07/2023 | 1530/1130 | * | 21-Jul |  | US | Bid to Cover Ratio |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.