-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: BOJ - Bond Buying Taper But Close Call On Rate Hike

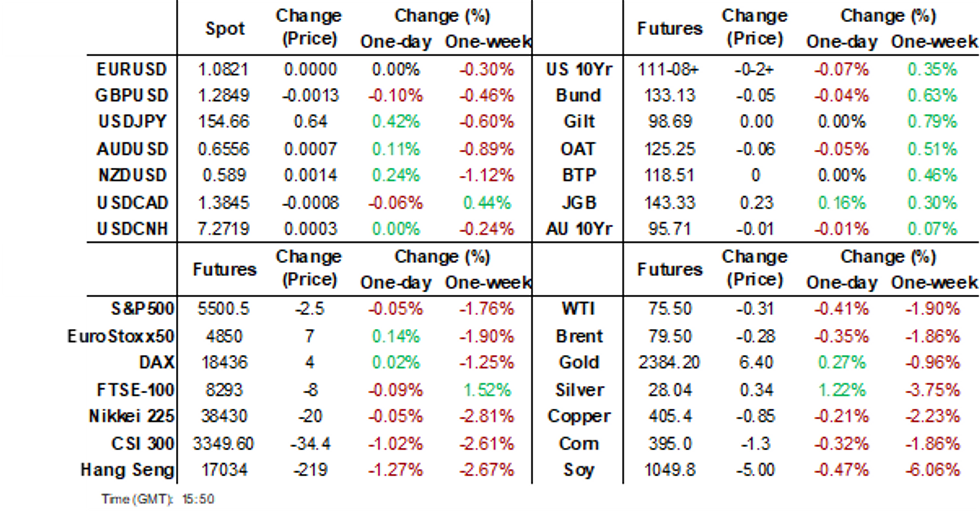

- JGB futures are stronger and near session highs, +19 compared to the settlement levels, ahead of tomorrow’s BoJ Policy Decision. USD/JPY has been supported on dips and is pressing towards Friday highs. NZD and AUD are marginally higher. US equity futures have moved away from earlier lows. Commodity prices are mostly weaker though.

- It has been a subdued trading session for US tsys, ranges have been very tight while volumes are below average.

- Later there are US May housing data, June JOLTS job openings and July consumer confidence and in Europe, euro area Q2 GDP, July economic sentiment and German preliminary July CPI.

MARKETS

US TSYS: Tsys Futures Steady, Volumes Below Average Ahead Of Fed Thursday

- It has been a subdued trading session for US tsys, ranges have been very tight while volumes are below average. TUU4 is currently trading at 102-18⅛, while TYU4 is - 01+ at 111-09+

- Earlier there was a block vol trade - TYU4 109.5/112 strangle bought at 37 x5,000, there has been little else outside of this trade

- The steepener trade has seen some unwinding over the past week after the 2s10s hit -11bps, its least inverted level for the year, while the 10s30s hit the least inverted since May 2023.

- The cash treasury curve is flat to 0.5bps higher today, with the 10y trading +0.4bps at 4.178%.

- The U.S. Treasury Department said Monday it expects to borrow USD740 billion in the third quarter, USD106 billion less than previously announced in April. For the fourth quarter, Treasury expects to borrow USD565 billion, lower than market estimates.

- Thursday, the Fed meets for its July meeting, the market is pricing in a 4% chance of a cut as we look forward to September the market has fully priced in a cut, with a total of 66bps of cuts into year-end

- Today, FHFA House Price Index, while Microsoft will release earnings after market.

JAPAN: MNI BoJ Preview - July 2024: Bond Buying Taper But Close Call On Rate Hike

EXECUTIVE SUMMARY

- The Bank of Japan's (BoJ) Policy Board will convene on July 30-31, with markets keenly observing any steps the central bank may take towards monetary policy normalisation. Governor Kazuo Ueda is expected to hold a press conference following the meeting on July 31.

- At this week’s meeting, the BoJ is anticipated to unveil a detailed plan for reducing the pace of its bond purchases over time. The upcoming plan is expected to outline the specifics of the reductions in terms of magnitude, duration, and flexibility. Market estimates suggest a gradual reduction, potentially cutting monthly purchases by half over two years. This announcement will mark a significant shift in Japanese monetary policy, as the BoJ has been consistently expanding its bond holdings since 2012.

- Regarding policy rate settings, we anticipate the BoJ will maintain its target for the overnight uncollateralized call rate at 0-0.1% this week, consistent with consensus. Those advocating for the BoJ to remain on hold cite an uneven economic expansion and only a modest acceleration in wages and prices.

- Contrastingly, a recent Reuters report suggested the BoJ might consider raising interest rates this week, consistent with market pricing. Proponents of a rate hike argue that a 10-15bp increase represents a minor reduction in policy accommodation rather than tightening.

- Even if the BoJ decides to maintain its policy rate, the Outlook Report and post-MPM press conference might raise the price outlook, sending a clear signal of a potential rate hike at the September MPM provided upcoming data aligned with BoJ expectations.

- Full preview here:

JGBS: Cash Bonds Mostly Richer Ahead Of BoJ Policy Decision Tomorrow

JGB futures are stronger and near session highs, +19 compared to the settlement levels, ahead of tomorrow’s BoJ Policy Decision.

- Outside of the previously outlined mixed labour market data, there hasn't been much in the way of domestic drivers to flag.

- Cash JGBs are mixed across benchmarks, with yields 1-2bps lower out to the 10-year and flat beyond. The benchmark 10-year yield is 1.6bps lower at 1.010% versus the cycle high of 1.108%.

- The swaps curve has twist-steepened, pivoting at the 20s, with rates 2bps lower to 0.5bp higher.

- Tomorrow, the local calendar will see the BoJ Policy Meeting, with markets keenly observing any steps the central bank may take towards monetary policy normalisation.

- The BoJ is anticipated to unveil a detailed plan for reducing the pace of its bond purchases over time.

- Regarding policy rate settings, we anticipate the BoJ will maintain its target for the overnight uncollateralized call rate, consistent with consensus. That said, it appears to be a close call.

- See MNI BoJ Preview here.

- Ahead of the BoJ Decision tomorrow, the local calendar will see Retail Sales and Industrial Production data.

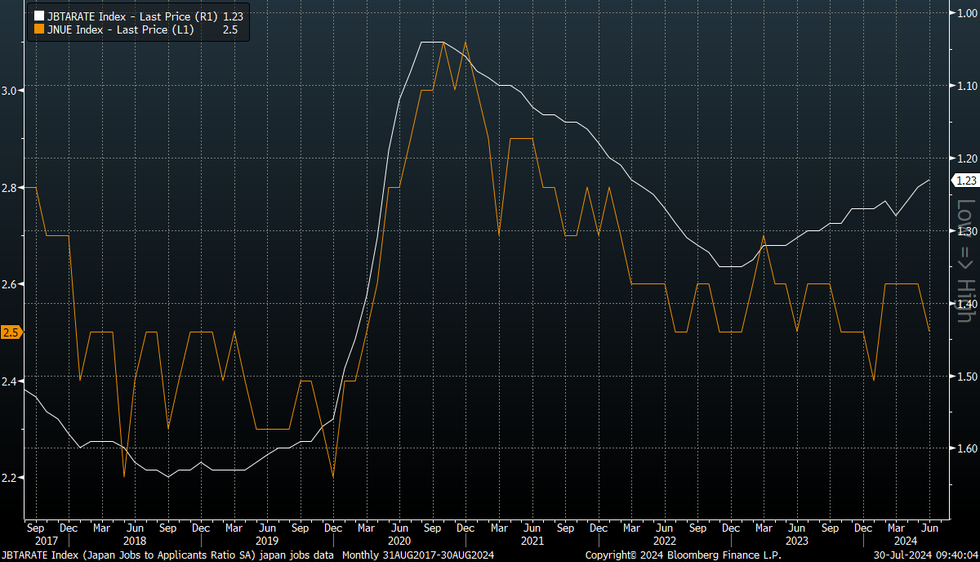

JAPAN DATA: Unemployment Rate Falls, But So Does Job-To-Applicant Ratio

Japan June jobs data showed a slight downtick in the unemployment rate to 2.5%, from 2.6% prior, while the consensus forecast was also 2.6%. The job to applicant ratio was 1.23, versus 1.24 forecast (prior was also 1.24).

- In terms of the detail, the number people employed rose +250k m/m, following last month's 100k rise. This reverses the negative trend seen through March-April.

- The participation rate also firmed to 63.7%, a fresh cycle high.

- Still, the downtick in the new-job-to-applicant ratio was less positive. The chart below shows this index inverted against the unemployment rate.

- This is fresh lows in the job to applicant ratio back to early 2022. It suggests some caution around the better jobless rate data.

- In terms of the detail, total applicants rose 0.6%m/m, but job offers fell 0.1%m/m. These trends were replicated in y/y terms. Job offers were -4.4% y/y.

Fig 1: Japan Unemployment Rate Edges Down, Defying Lower Job To Applicant Ratio (Inverted)

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Cheaper But Narrow Ranges Ahead Of CPI Data, BoJ & FOMC Policy Decisions Tomorrow

ACGBs (YM -2.0 & XM -1.5) are cheaper after dealing in relatively narrow ranges.

- Outside of the previously outlined Building Approvals, there hasn't been much in the way of domestic drivers to flag.

- Tomorrow the local calendar will see Q2/June CPI and June Retail Sales data.

- Headline CPI rose to 4.0% and trimmed mean to 4.4% in May. If the data prints in line with RBA May expectations of 3.8% for headline and trimmed mean, requiring 1.0% q/q and 0.8% quarterly rises, then rates are likely to be unchanged at the August 6 meeting.

- Retail sales for June are forecast to rise for the third straight month. Sales were stronger than expected in May rising 0.6% m/m and consensus is at +0.2% for June.

- Following tomorrow’s domestic data drop, the market faces policy decisions from the BoJ and the FOMC.

- The BoJ Policy Meeting will be keenly watched for any steps towards monetary policy normalisation. See MNI BoJ Preview here.

- Cash US tsys are slightly cheaper in today’s Asia-Pac session.

- Cash ACGBs are 1-2bps cheaper, with the AU-US 10-year yield differential at +11bps.

- Swap rates are 1-2bps higher, with the 3s10s curve flatter.

- Bills strip pricing is -2 to -4.

- RBA-dated OIS pricing is slightly firmer across meetings. Terminal rate expectations sit at 4.43%.

RBA: Higher Inflation Scenarios & Our Policy Reaction Function

Q2 CPI is released tomorrow and given the pickup in inflation in April and May, it will be watched closely for signs of a pickup in inflation pressures, especially domestically-driven ones. If the data print in line with RBA May expectations of 3.8% for headline and trimmed mean, requiring 1.0% q/q and 0.8% quarterly rises, then rates are likely to be unchanged at the August 6 meeting. Our simple policy reaction function implies that if the RBA has to revise up its CPI trajectory, then the outlook is for higher rates.

- Our base case uses the RBA’s May forecasts for the CPI and GDP to calculate the inflation and output gaps. It estimates that economic fundamentals suggest that rates should have been around 10bp higher in Q2 than they were and that they would peak another 10bp above that around mid-2025.

- If we assume that the inflation profile is revised up by 0.2pp each quarter over the forecast horizon resulting in the top of the band being achieved 2 quarters later in Q4 2025, then rates are 12.5bp (half a rate hike) higher than baseline by end 2025. It is worth noting that the inflation gap variable in the equation leads by 2 quarters.

- The reverse is the case if inflation is revised down 0.2pp.

- Our worst case scenario has inflation stuck at 4%, which sees half a rate hike by end 2024, a full 25bp by mid-2025 and another one by end-2025 relative to the base case.

Source: MNI - Market News/Refinitiv

AU STIR: Will Terminal Rate Expectations For RBA Spike Again?

Ahead of tomorrow’s Q2/June CPI data release, terminal rate expectations are at 4.43%, indicating a 44% chance of an additional 25bp hike.

- For context, terminal rate expectations have spiked twice this year—once in late April to 4.48% and again in late June to 4.52%.

- Both spikes were triggered by higher-than-expected CPI figures.

Figure 1: RBA-Dated OIS: Terminal Rate Expectations

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: Non-House Approvals Struggle To Recover

Australia has a housing shortage and the June building approval data signalled that the situation is not improving as scarce labour and material continue to weigh on the sector. The number of dwellings approved fell 6.5% m/m after rising 5.7%, with both private houses and multi-dwelling units contracting but it was the latter, which is very volatile, which drove the disappointment.

- Bright spots were the second straight month of positive 3-month momentum and private homes up 11% y/y. But the ABS notes that FY24 recorded the lowest number of new dwellings approved since FY12.

- Total approvals were down 3.7% y/y in June as private homes fell 0.5% m/m and non-houses 19.7% m/m, which left this sector down 22.1% y/y. Houses are now 4.4% above the pre-Covid level in February 2020 but multi-dwellings are a significant 46.8% lower leaving the total 18.5% below. House approvals are gradually trending higher while non-houses are lower.

- The value of alterations and additions rose to a series high in June, suggesting that it is easier for many to renovate than move or build.

Source: MNI - Market News/ABS

NZGBS: Cheaper, BoJ & FOMC Policy Decisions Tomorrow

NZGBs closed on a weak note, with benchmark yields 2-4bps higher and the 2/10 curve steeper.

- (Bloomberg) New Zealanders are about to keep more of what they earn as the new government follows through on an election promise to cut taxes despite a deepening budget deficit and advice from the OECD that the measures should be delayed. (See link)

- "CoreLogic NZ is introducing a new measure of real estate values that it says will reflect changes in the housing market sooner. The Home Value Index will replace the House Price Index on August 1." (per BBG)

- Cash US tsys are little changed in today’s Asia-Pac session.

- This week will see policy decisions from the BoJ, BoE and Fed alongside top-tier economic releases including the US Non-Farm Payrolls report and Employment Cost Index, Euro Area CPI and GDP, Australian CPI and China PMI.

- Swap rates are 3-5bps higher.

- RBNZ dated OIS pricing is slightly firmer across meetings, with a cumulative 75bps of easing priced by year-end.

- Tomorrow, the local calendar will see Building Permits and ANZ Business Confidence data.

- On Thursday, the NZ Treasury plans to sell NZ$300mn of the 4.50% May-30 bond, NZ$150mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

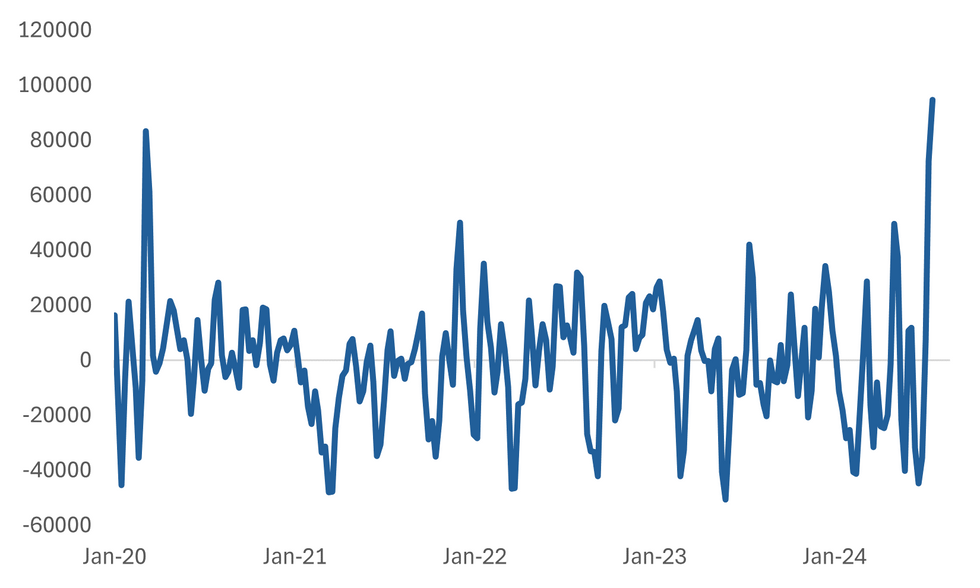

JPY: Position Adjustment May Leave High Bar For BoJ To Boost Yen Tomorrow

We have arguably seen a decent adjustment in terms of market positioning around yen shorts in recent weeks as tomorrow's BOJ outcome approaches. The first chart below plots the rolling 2 week change for leveraged funds and asset managers (per the CFTC report). It shows a very strong squeeze in short yen positions.

- This data is up to last Tuesday (July 23rd). Given yen continued to rally strongly through Wed/Thurs last week, the actual adjustment may have been larger than this.

- At face value it suggests there is a high bar for a hawkish BoJ surprise tomorrow, given how much positions have been adjusted (see our full preview here.)

- Of course, these position adjustments have reflected a number of factors and not necessarily view shifts around the BoJ outlook. Changing Fed views, risk off in the equity space, global growth concerns amid the metal price slump (which was a factor in AUD/JPY's decline last week) have all been in play as well.

- There are some other important caveats to be mindful as well. Firstly, outright positioning is still short and the JPY TWI is very low by historical standards. This may draw some selling interest on USD/JPY on any BOJ disappointment or as expected outcome (no rate change and BoJ bond buy taper as expected).

- We also have the FOMC outcome not long after the BoJ meeting. Here though with markets fully priced for a Fed cut in September, it may be difficult for the Fed to sound more dovish than what is already priced by the market.

- Levels wise for USD/JPY we have the 151.94 July 25 low, while the simple 200-day MA is at 151.57. On the topside, the July 24 high is at 155.99.

- In the FX option expiry space, note the following for NY on July 31 Y154.00 ($1.4bln), Y155.00 ($1.8bn), Y15650-65 ($1.2bln), then on Aug01 Y154.00-05 ($1.3bln), Aug02 Y151.41 ($2.0bln), Y155.00 ($1.7bln).

Fig 1: Rolling 2 Week Change In Leveraged Funds/Asset Management JPY Positioning

Source: CFTC: MNI - Market News/Bloomberg

FOREX: Yen Reverses Earlier Gains Against Higher Beta FX, But Overall Moves Modest

Overall G10 forex moves have been fairly modest in the first part of Tuesday trade. The BBDXY sits little changed, last near 1260.6, close to end Monday levels from NY trade. Early yen strength, particularly against higher beta FX has reversed as the session progressed.

- USD/JPY has seen modest volatility, albeit in the first half of the session. The pair saw an early dip to 153.62 as US equity futures weakened, but there no follow through. We last track in the 154.15/20 region, close to session highs, but only marginally above end Monday levels.

- Earlier data showed mixed labor market trends, with unemployment rate easing to 2.5% in Japan, but the job-to-applicant ratio also falling. The data didn't impact sentiment.

- AUD and NZD are off earlier lows, aided by US equity futures moving away from session levels (although the benchmarks remain in the red). AUD/USD was last 0.6555 against an earlier low of 0.6534).

- Regional equity market sentiment has mostly been in the red, with Hong Kong and tech sensitive markets weaker.

- NZD/USD has outperformed, up nearly 0.30% to 0.5890/95. This has helped bring the AUD/NZD cross away from recent highs, the pair back to 1.1125/30.

- US yields are close to flat at this stage. Commodities are mostly under pressure., with oil, copper and iron ore all down, although this isn't impacting AUD greatly at this stage (outside of some AUD/NZD softness).

- Looking ahead we have US June JOLTS job opening data and July consumer confidence. In the EU, German preliminary July CPI and euro area Q2 GDP.

ASIA STOCKS: Hong Kong Equities Lead Sell-Off As Investors Concerns Grow

Chinese and Hong Kong equity markets are lower today, declining more than 1% as optimism over Chinese government stimulus plans waned, investors also remain cautious ahead of major central bank rate decisions from the BoJ, BOE & the Fed this week. The Chinese Politburo meeting will be closely watched for any potential stimulus measures, but sentiment remains bearish due to the ongoing property downturn and subdued consumer demand. China's bonds have rallied again with 10-year yields hitting record lows, which poses a challenge for the central bank as it tries to balance boosting growth with easing measures and avoiding financial instability.

- Hong Kong equities are lower across the board today, Real Estate Benchmarks are all lower with (Mainland down 1.75%, and HS Property down 1.50%), the HSTech Index is about 1.40% lower today, while the BBG Asia Semiconductor Index is off earlier lows and trades just 0.30% lower, the wider HSI is trading 1.10% largely inline with other major benchmark indices

- China onshore equities are lower although, slightly better than HK listed stocks, small-caps are again the best performers after the PBoC lowered rates last week with the CSI 1000 down 0.30%, while the CSI 2000 is 0.75% The CSI 300 Real Estate Index is down 1% today and 7.70% for the past 5 sessions, major benchmarks such as the CSI 300 are down about 0.90%

- Investors pulled significant amounts of cash from ETFs with heavy exposure to Chinese stocks during the week ending July 26. The Vanguard FTSE Emerging Markets ETF which holds 25% of its assets in China, experienced over $506 million in redemptions, marking its largest weekly outflow in over four years. Additionally, the iShares MSCI China ETF saw its biggest weekly outflow on record, as per BBG. In China, upcoming economic data, particularly on manufacturing activity, will be closely watched for indications of the country’s economic health and potential further support measures from the central bank. Investors have grown cautious around Chinese stocks after a lack of policy updates came from the Third Plenum meeting, while at the same time the China National Team look to have slowed their purchases of benchmark indices post the meeting.

- China will stop publishing daily data on overseas fund flows into and out of its stock market starting August 18, 2024, instead providing such information quarterly. This move follows earlier efforts to limit data on intraday flows with Hong Kong and aims to bolster confidence amid significant outflows of global funds. Real-time data for mainland China to Hong Kong flows will still be available, per BBG.

- Looking ahead China PMI and Hong Kong GDP is expected on Wednesday

ASIA PAC STOCKS: Equities Off Earlier Lows Although Cautious Ahead Of CB Meetings

Asian stocks fell amid speculation that investors are reducing their holdings ahead of major upcoming events, including central bank decisions, key economic data, and earnings from US megacap companies. The MSCI Asia Pacific Index extended July's decline to 0.5%, with shares in Hong Kong leading losses as optimism over Chinese government stimulus waned. The yen held strong before a BoJ policy decision, while the USD edged higher ahead of a Federal on Thursday. Commodities have erased gains for the year, affected by a challenging outlook in China and losses in US natural gas and foodstuffs.

- Japanese stocks fell as investors braced for key central bank decisions from the BOJ and the Fed, while also digesting mixed corporate earnings. The Topix Index is 0.63% lower led by declines in banks and mining stocks, with Mitsubishi UFJ contributing significantly by falling 1.4%, while the Nikkei is 0.50% lower. Investor caution ahead of the BOJ meeting, where potential changes to quantitative easing and interest rates are anticipated, is keeping many on the sidelines. Additionally, machinery maker Komatsu's earnings are under scrutiny, adding to the cautious sentiment in the market.

- South Korean equities opened lower, influenced by mixed performances on Wall Street and investor anticipation of the Federal Reserve's upcoming rate decision. The benchmark KOSPI is down 1.10% with major large-cap stocks seeing declines. Notably, Samsung dropped 0.9%, and SK hynix fell 2.7%, reflecting broader market caution, while the small-cap focused Kosdaq is down 0.70%. The market is also awaiting earnings results from major tech firms like Samsung, adding to the cautious trading environment.

- Taiwan equity opened weaker, however as steady to trade little changed for the session after global tech stocks has seen a bit of a bounce as we head into Microsoft's earnings which are due out post the US session later today.

- In Australia, the ASX 200 index fell as much as 1% early driven by losses in mining and tech shares, we have since pared half those losses to trade down 0.50% as we head into the final hour of trading. Investors are cautious ahead of the country's quarterly inflation report due on Wednesday, which will influence the debate over the need for further interest rate hikes by the RBA. In New Zealand, the NZX 50 index bucked the regional trend, rising 0.85%, as investors remained optimistic about the local economy and corporate earnings, while A2 Milk was the largest contributor to gains after Bell Potter raised their price target on the stock 24%.

- In EM Asia markets are mixed today with Thailand's SET returning for their break to trade 0.40% higher, Singapore's Strait Times is 0.15% higher while elsewhere most other markets are lower with Malaysia's KLCI down 0.10%, Indonesia's JCI is 0.70% lower, Philippine's PSEi is 1% lower while India's Nifty 50 is little changed.

OIL: Crude Continues To Sink But In Oversold Territory Now

After falling over 2% on Friday and then 1.6% yesterday, oil prices are down another 0.5% during APAC trading today a China growth concerns persist and the US dollar strengthened, although it is now off its intraday high to be little changed. WTI is down 0.5% to $75.46/bbl, close to the intraday low, and Brent -0.4% to $79.45, holding just above initial support.

- Pessimism re the outlook for China has been driving crude lower. Citigroup revised its GDP forecasts down and as a result H2 imports are also likely to be soft, according to Bloomberg. This is consistent with US light sweet crude to Asia priced at a discount.

- The 9-day relative strength index is signalling that both benchmarks are now oversold, according to Bloomberg.

- Last week the EIA reported that US crude inventories fell for a fourth consecutive week. Industry data from API is released today and EIA on Wednesday and will be watched to see if the trend continued. The Fed decision on Wednesday and payrolls on Friday will also be key to the outlook.

- OPEC holds it review meeting on Thursday and while market participants are divided over whether there will be changes to production targets, the 6.5% drop in oil prices this month may still prompt some caution. Delegates have said ahead of the meeting though that they are unlikely to recommend any alterations to the current plan to reduce output cuts from Q4, which have made the market nervous.

- Later there are US May housing data, June JOLTS job openings and July consumer confidence and in Europe, euro area Q2 GDP, July economic sentiment and German preliminary July CPI.

GOLD: Steady Ahead Of A Busy Week Of Global Policy Decisions and Data

Gold is steady in today’s Asia-Pac session, after closing slightly lower at $2384.19 on Monday.

- It was a subdued start to a busy week of global central bank policy meetings and key data releases. This week will see policy decisions from the BoJ, BoE and Fed alongside top-tier economic releases including the US Non-Farm Payrolls report and Employment Cost Index, Euro Area CPI and GDP, Australian CPI and China PMI.

- (AFR) Goldman Sachs economist David Mericle wrote "We expect the FOMC to revise its statement to say that the unemployment rate has ‘risen slightly but remains low’, that there has been ‘further progress’ (dropping ‘modest’) toward the 2 per cent inflation goal, that the risks to the two sides of the mandate ‘are in’ (not ‘have moved toward’) better balance, and—most importantly—that it now needs only ‘somewhat’ greater confidence in the inflation outlook to start lowering interest rates.”

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the yellow metal has recently pierced the 50-day EMA at $2,361.8, a clear break of which would signal scope for a deeper retracement towards $2,277.4, the May 3 low. For bulls, a reversal higher would refocus attention on $2,483.7, the Jul 17 high.

ASIA FX: USD/Asia Pairs Mixed, MYR Continues To Outperform

USD/Asia pairs are mixed, albeit mostly sticking to recent ranges. The exception remains continued gains for MYR. CNH and KRW are weaker, although more so the won, as USD/JPY climbs back towards highs from Friday last week. In South East Asia, THB is rallying along MYR, although IDR is softer. Tomorrow the focus will be on China's official PMI prints.

- USD/CNH has been biased higher today, although overall moves are muted. The pair last near 7.2730, little change from end Monday levels in NY. the USD/CNY fixing was set at a fresh high above 7.1300 (levels last seen in Nov 2023). Onshore equity sentiment remains on the backfoot, last down 1% for the CSI 300. Onshore yields are steadier though. Tomorrow's manufacturing is expected to show a contraction.

- Spot USD/KRW has drifted, but at 1384.5 remains comfortably within recent ranges. Onshore equities are off over 1.1%, reversing yesterday's gain. Local yields remain biased lower at the front end.

- USD/MYR continues to track lower, last near 4.6250, around +0.25% stronger in MYR terms and fresh lows in the pair back to the start of this year. USD/THB has also fallen sub 36.00, last 35.95, as onshore markets returned today.

- IDR isn't joining in on the rally though, with USD/IDR spot back to 16320, which is fresh highs back towards the start of July. Regional equity losses haven't helped today, while softer commodity prices may also be weighing on the terms of trade outlook, although arguably the same should be true for MYR.

ASIA FX: SGD & CNH Have Highest Correlations With Yen, INR The Lowest

With tomorrow's BoJ meeting coming into focus, below we look at the correlation between USD/JPY moves and major USD/Asia pairs. The table below reflects correlations since the start of the year based off daily percent changes between USD/JPY and the relevant USD/Asia pair.

- USD/SGD sits the highest, just under 70%, this is followed by USD/CNH at 56%. For SGD FX, largely being a deliverable currency (outside of hitting the MAS policy bands), leaves it reasonably strongly correlated with the yen.

- For USD/CNH there are trade linkages between the two economies. We have also seen both currencies used as funding vehicles for long carry trades. This helped explain USD/CNH's sharp retracement last week, as USD/JPY also dipped sharply.

- Other correlations are mostly lower and between the 15-30% region. KRW's correlation is not that high, despite the other trade competitiveness linkages.

- INR's is the lowest at close to flat. There are clearly less economic links between Japan and India, but the rupee also remains heavily managed by the Indian authorities.

- These correlations are worth being mindful of given tomorrow's BoJ outcome could induce yen volatility.

Fig 1: USD/Asia Correlations With USD/JPY - 2024 To Date

Source: MNI - Market News/Bloomberg

CHINA RATES: 10yr Yield Consolidates Post Recent Fall

- A slow day in China bond space following the strength of recent trading sessions.

- Having moved lower in yield for seven successive trading days, the 10yr government bond took a breather today on light volumes.

- In a day of limited data to move markets, markets paused ahead of tomorrow’s PMI.

- The PMI is expected to continue to show that manufacturing is in a modest contraction.

2yr 1.519% (+0.5bp) 5yr 1.882% 10yr 2.149% 30yr 2.373% (-0.5bp)

CHINA: 2H Liquidity Challenge Points To RRR Cuts

The second half of the year will see challenging liquidity for the Chinese economy.

- The medium term lending facility used by banks has significant maturities in the second half, and a significant redemption schedule in bonds.

- Recent data shows too significant outflows in China related ETF’s with the Vanguard FTSE EM ETF (tk VMO) reporting the largest outflows in 4 years of over US$500 (per BBG).

- Liquidity will remain a key focus for authorities in the second half of the year.

- With greater autonomy given to the regions in the recent plenum, it is expected that issuance could reach as much as CNY1tn in this period.

- To support liquidity Chinese authorities have been pro-active already with multiple policy changes (cut in repo rate and reduction in 1 year policy rate).

- The next policy announcement is likely to be a reduction in the Reserve Requirement Ratio for banks. A cut of 25-30 bps in the RRR could release over CNY1tn of liquidity according to estimates.

- This liquidity would help stabilize financial markets and allow for the issuance schedules to proceed, allowing regions to prioritize the funding for 2025.

- Whilst most commentary on Government Bond yields has been to highlight concerns as to their decline, ironically those concerns could be a support to the regions in 2H 2024.

INDIA: Changes for Bond Market Investors

- A decade after India first entered into discussions with JPMorgan about inclusion in the widely followed EMBI benchmark, mixed signals are now coming out of India.

- Following June’s inclusion, India represents one of the largest weightings in the index

- Discussions on entry were long and enduring given the index provider’s concerns about access for foreign investors

- From June 28, 2024 India was admitted to the EMBI at a time when China’s economy is slowing dramatically and the potential for protectionism on the rise

- The inclusion could represent as much as a USD40bn windfall in liquidity given the funds that are benchmarked against this index

- Yet in less than a month since inclusion, the nation’s Central Bank issued a statement on July 29 that Foreign Investors will no longer be freely able to buy recently issued Indian government bonds with 14 and 30 year tenors.

- This had not been flagged prior and when considered with the recent tax changes for investors do not hold their investments for more than 12 months, creates an element of uncertainty for foreign investors in India

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/07/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/07/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/07/2024 | 0600/0800 | *** |  | DE | GDP (p) |

| 30/07/2024 | - |  | US | FOMC Meeting | |

| 30/07/2024 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/07/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/07/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/07/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/07/2024 | 0800/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 30/07/2024 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/07/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/07/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/07/2024 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/07/2024 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/07/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/07/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/07/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/07/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/07/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/07/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/07/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 30/07/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 30/07/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.