-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI EUROPEAN MARKETS ANALYSIS: China Adds Further Stimulus With 20bp 1yr MLF Cut

- Safe haven gains again dominate the G10 FX space. Yen gains exceeded 1% at one stage before being pared. AUD/JPY is down sharply amid continuing metal price losses. The surprise 20bp cut for the 1yr MLF today, announced by China, hasn't shifted sentiment positively. USD/CNH is tracking lower though in line with yen gains. China 2yr CGB yields are at fresh cycle lows

- US Treasury futures have edged slightly higher throughout with the front-end out-performing again which has been helped by multiple block steepener trades going through. In NZ, year end pricing is for 75bps worth of cuts, which looks stretched.

- Later US Q2 GDP, jobless claims, June durable orders and German July Ifo survey print. Also ECB President Lagarde speaks.

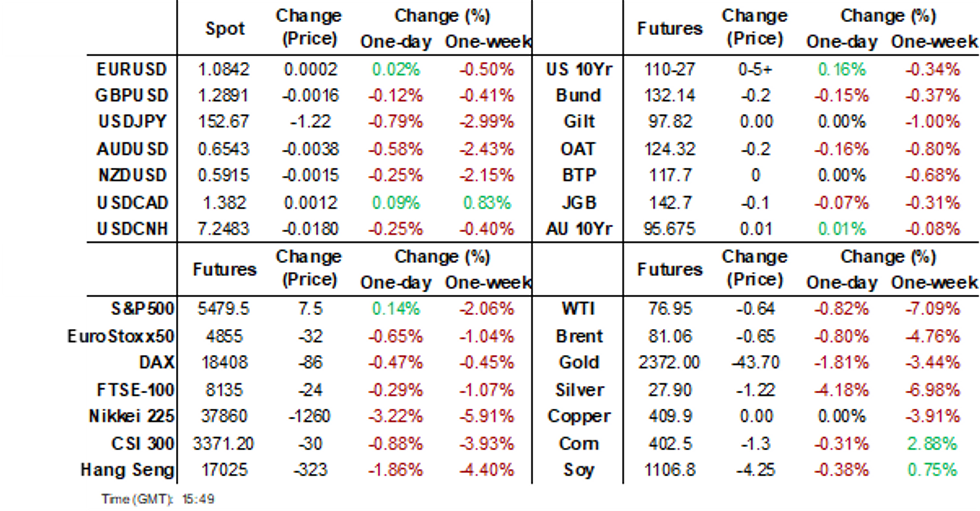

MARKETS

US TSYS: Tsys Futures Higher Ahead Of GDP, Curve Least Inverted This Year

- Treasury futures have edged slightly higher throughout with the front-end out-performing again which has been helped by multiple block steepener trades going through. Futures are trading at session's best with TU + 02⅝ at 102-19⅜, while TY trades + 05 at 110-26+.

- Tsys flows: Sellers of TY 109.5 puts, 0'18 x6000, Buyer TYU4 111/112 Call spread, 0'22 x12,000. Multiple Block Steepener trades 2x FV/TY DV01 330k & FV/US DV01 525k

- The tsy curve has bull-steepened today with yields 1-4.5bps lower. The 2y is -4.1bps at 4.389%, while the 10y is -2.2bps at 4.262%

- The 2s10s continues to trade higher last +2.176 at -12.927, the least inverted this year.

- Projected rate cut pricing into year end are gained vs. this morning's levels (*): July'24 at -5.5% w/ cumulative at -1.4bp at 5.315%, Sep'24 cumulative -27.3bp (-25bp), Nov'24 cumulative -42.8bp (-40.1bp), Dec'24 -65.3bp (-62.8bp).

- looking ahead we have GDP, Core PCE Weekly Claims and 7Y Note Sale

FED Viewpoint: All Eyes On September

How do fixed income investors hedge their risks as we await the FED decision? With market’s largely pricing in a September move, portfolios now must consider how to hedge risks in the event the FED remains on hold, or if the FED cuts but signals that the cut was not the start of a range of broad cuts.

- Overnight comments from Bill Dudley occupied headlines as he stated that he has changed his mind and that the FED should cut at the end July meeting. He points out that whilst wealthy households continue to consume thanks to buoyant asset prices yet the rest of households have generally depleted any one off transfers from the COVID period and are feeling the pinch with higher interest rates. He goes on to say that the household employment survey showed just 195,000 jobs added over the last 12 months and that the three month employment rate at 0.43 is only marginally below the 0.5 threshold. However, he concedes that at 2.6% the CPI is still above the Central Bank’s objective and that the significance of June’s number has increased given what markets have priced in.

- In light of this overnight we assessed comments by voting board members between May to July to understand what obstacles remain in terms of them being open to a cut.

- John Williams: whilst inflation is improving, is not ready to see rate cuts yet

- Thomas Barkin: need more edge off demand, before rate cuts

- Michael Barr: inflation data in the first few months of the year has been disappointing, tight policy needs more time

- Raphael Bostic: not past the point of worry about inflation

- Michelle Bowman: willing to hike if needed, but inflation will fall if rates are held steady

- Lisa Cook: inflation should continue to fall without a significant rise in the unemployment rate

- Mary Daley: inflation data is good, but we are not there yet.

From a fixed income portfolio positioning perspective, with much already priced in, the risks now are skewed towards no change. Inflation has a habit of being sticky and whilst the current trajectory is good, there is still some work to be done to achieve inflation goals and lets not forget in 2023 when a moderation in inflation was reversed and quickly proved to be transitory.

What we could see in September is in lieu of a cut, the FED altering their language such that they are open to the idea. This however may not satisfy markets and those positioned for a cut may need to rethink.

GLOBAL MACRO: US Deficits With NAFTA/EU Wider, China Narrower Since 2016

The US trade deficit has widened close to $350bn since 2016, the first year of the Trump presidency. He has said that he would introduce a 10% tariff on all imports if he is elected again in November. An increase in protectionism will impact the US’ NAFTA partners the most given their high exposure to the US but it will also be a concern across Asia as many have a high exposure to the US or will feel indirect effects if China is targeted.

- Exports to the US would initially increase ahead of the introduction of further trade barriers. There is often a considerable lag between the announcement and enforcement. China’s deficit with the US widened in 2018 but trended lower thereafter, although numerous Chinese firms have set up production in Mexico to avoid restrictions and these may now be targeted.

- A 60% import tariff on all imports from China is proposed. The largest deficit continues to be with China, 2024 annualised deficit is $251.7bn but this is down from 2016’s $346.8bn. The EU is catching up at $222.2bn in 2024, as a result Europe is concerned about a Trump presidency.

Source: MNI - Market News/Refinitiv

- Exports to the US accounted for around 3% of GDP for both China and the euro area in 2023. They are a lot less reliant on US trade than others such as Canada (20.5% of GDP) and Taiwan (10.1%) though.

- There are other Asian nations that will be monitoring developments. Korea, Taiwan and Thailand have high export and GDP exposures to the US,and Japan and India export shares. Indirectly, Australia, Korea and Taiwan would also be significantly impacted by high tariffs against China.

- Trump renegotiated the NAFTA treaty during his first presidency but given US deficits with Mexico and Canada have increased further since the new agreement in 2020, more changes are likely if he wins the election.

Source: MNI - Market News/Refinitiv

JGBS: Cash Bonds Twist-Flatten, Hike Fears Pressure Short-End, Tokyo CPI Tomorrow

JGB futures are slightly weaker, -3 compared to the settlement levels, but at Tokyo session highs.

- Outside of the previously outlined PPI Services and International Investment Flow data, there hasn't been much in the way of domestic data drivers to flag.

- Accordingly, the rally in longer-dated JGBs appears to have been driven by equity and USDJPY weakness. Recent moves have added more evidence to the argument that carry-trade dynamics that dominated much of this year's currency trade are starting to reverse.

- Cash US tsys are 1-4bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s twist-steepening.

- However, JGB yields out the 5-year remain higher following the Reuters report that the BoJ was set to consider a hike at next week’s meeting in addition to providing a plan to taper bond buying. Benchmark yields are 2bps higher to 3bp lower.

- The benchmark 10-year yield is 0.8bp lower at 1.073% versus the cycle high of 1.108%.

- Swaps are dealing mixed across maturities, with 1- and 40-year rates ~1bp higher and 10- to 30-year rates ~2bps lower. Swap spreads are mixed.

- Tomorrow, the local calendar will see Tokyo CPI data, Leading & Coincident Indices and 2-year supply.

JAPAN DATA: Offshore Investors Sell Local Equities & Bonds

In terms of offshore inflows into local equities we saw a pause last week, albeit with a modest -¥49bn in net outflows. This ended a positive run of inflows seen in the prior 3 weeks. Some cracks that have emerged in the tech equity backdrop may see a further retracement in such flows for this week. The Topix is back to late June levels.

- On the bond side, offshore investors returned to net sellers in this space. This has been the general trend in recent months and fits with gradual BoJ tightening, which is improving onshore yields but pushed bond prices lower. Next week's focus at the BoJ meeting will be on the central bank's tapering plans, although a Reuters article from late yesterday indicated the central bank was still weighing up a potential hike.

- In terms of Japan outflows to the rest of the world, local investors were net sellers of offshore bonds, which has been the general theme in recent months. Outbound flows to offshore equities were just in positive territory, but again the trend in this segment has been for net selling flows.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending July 19 | Prior Week |

| Foreign Buying Japan Stocks | -49.0 | 227.8 |

| Foreign Buying Japan Bonds | -352.1 | 774.5 |

| Japan Buying Foreign Bonds | -730.4 | -206 |

| Japan Buying Foreign Stocks | 12.1 | -136.3 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Bull-Steepener As Cash US Tsys Richen On Equity & USDJPY Weakness

ACGBs (YM +6.0 & XM +1.0) are richer and near Sydney session highs. With the domestic data calendar light, today’s local market movements appear to have been driven by offshore factors. First, cash US tsys are 2-4bps richer in today’s Asia-Pac session, with equity and USDJPY weakness as the catalysts.

- Secondly, the PBoC, in an unscheduled operation, announced that the 1-year MLF rate has been lowered to 2.3% from 2.5% prior. This was the first reduction in the rate since August last year. Today’s move was in line with cuts in the 7-day repo rate and the Loan prime rate earlier in the week.

- Cash ACGBs are 1-6bps richer, with the AU-US 10-year yield differential 4bps lower at +5bps. The current level for the differential places it near the middle of the +/- 30bps range it has traded in since November 2022.

- The swap curve has bull-steepened, with rates 2-6bps lower.

- The bills strip has bull-flattened, with pricing +1 to +7.

- RBA-dated OIS pricing is 2-7bps softer across meetings, with 2025 leading. Terminal rate expectations are 2bps lower at 4.40%.

- The local calendar is empty tomorrow, with the next key release being Building Approvals on Tuesday.

NZGBS: Twist-Steepening, 75bps Of Cuts By Year-End

The NZGB curve twist-steepened, with benchmark yields closing 1bp lower to 2bp higher. In the absence of domestic drivers, the move away from the morning’s cheaps appears to have been fueled by a 2-4bp richening in cash US tsys in today’s Asia-Pac session. With news flow light, equity and USDJPY weakness appears to have been in the driving seat.

- The PBoC’s unscheduled lowering of the 1-year MLF rate from 2.5% to 2.3% also likely provided support.

- Today’s weekly supply was adequately absorbed, with cover ratios ranging from 2.16x to 2.59x.

- On a relative basis, the NZ-US and NZ-AU 10-year yield differentials continue to hover around their lowest levels since late 2022 at +16bps and +11bps respectively.

- The 2s10s swaps curve has bull-steepened, with rates flat to 4bps lower.

- RBNZ dated OIS pricing closed relatively stable out to November but showed a 4-11bps softening for 2025 meetings.

- Today’s moves have resulted in a softening across meetings beyond August, ranging from 25 to 71bps compared to pre-RBNZ decision levels.

- A 56% chance of a rate cut in August is currently priced in, with a cumulative 92% chance of a cut by October, before expectations jump sharply to three 25 bps cuts by year-end.

- Tomorrow, the local calendar will see ANZ Consumer Confidence data.

NZ STIR: RBNZ Dated OIS Year-End Easing Expectations Look Stretched

RBNZ dated OIS pricing has remained relatively stable out to November but shows a 2-4bps softening for 2025 meetings today.

- Today’s moves have resulted in a softening across meetings beyond August, ranging from 24 to 65bps compared to pre-RBNZ decision levels.

- A 55% chance of a rate cut in August is currently priced in, with a cumulative 90% chance of a cut by October, before expectations jump sharply to three 25 bps cuts by year-end.

Figure 1: RBNZ Dated OIS Post-RBNZ Versus Pre-RBNZ Levels (%)

Source: MNI – Market News / Bloomberg

FOREX: AUD/JPY Sub 100.00, As Metal Losses Continue, JPY TWI Rebound Continues

Safe haven gains again dominate the G10 FX space. USD/JPY fell to 152.23, but we sit slightly higher in latest dealings, last around 152.65, still around 0.80% strong in yen terms. The CHF is the only other major firmer against the USD, up 0.25% at this stage.

- The BBDXY USD is down slightly to 1256.1, largely owing to yen gains. Broader macro trends continue to support then yen, with negative equity trends weighing heavily on Asia Pac markets today. Fresh policy stimulus in terms of the 20bps MLF cut in China hasn't shifted the sentiment needle.

- Further weakness in metals prices, with copper and iron ore down around 1% each, has weighed on AUD/JPY, which has fallen below 100.00. Current levels are very close to the 200-day MA, around 99.83.

- AUD/USD is tracking to 0.6540, fresh lows back to the start of May and sub key support (0.6576). The continued metals falls have likely weighed on AUD/NZD, which is back to 1.1060. NZD/USD is lower, last near 0.5910/15, off 0.30%, compared with AUD's 0.60% fall.

- The general trend around softer core yields, with US yields weakening further at the front end has been another JPY support point.

- For USD/JPY we are oversold based off RSI (14), while the TWI is up 5% in the past month. However, on-going position adjustments may offset such technical stretch points. Recent CFTC data still suggested market positioning was some distance from neutral (after being aggressive short this year).

- USD/JPY's simple 200-day MA is around 151.5. The 200-day EMA (152.38) was tested earlier, but we haven't sustained the break at this stage.

- Later US Q2 GDP, jobless claims, June durable orders and German July Ifo survey print. Also ECB President Lagarde speaks.

ASIA STOCKS: China & Hong Kong Markets Mixed, Small-Caps Higher, Tech Lower

Chinese and Hong Kong equity markets continue to face pressure despite Beijing’s efforts to bolster the economy. The MSCI China Index fell as much as 1.2%, with major tech companies like Tencent and Meituan dragging the gauge lower. The surprise rate cut by the PBoC looks to have helped the small-cap names although investor confidence remains weak on the lack of any large policy update. The sell-offs have been exacerbated by disappointing earnings reports from global tech giants and ongoing concerns about the economic recovery in China.

- Hong Kong equities are underperforming, property stocks have been the least hit with the Mainland Property Index down just 0.50%, while the HS Property Index is down 0.50%, the HSTech Index has fallen 1.63% while the HSI is down 1.40%.

- China onshore equities are mostly lower today, although small-caps are in positive territory with the CSI 1000 up 0.80% and the CSI 2000 up 1.20% with the wider CSI 300 down 0.60%.

- Macau's gaming sector experienced a notable decline after Las Vegas Sands, reported second-quarter net revenue of $2.76 billion, missing the average analyst estimate of $2.82b. Despite an 8.6% y/y increase, visitation in Macau remains below pre-pandemic levels. The overall recovery continues but investor sentiment is weakened by the missed revenue targets. Additionally, Macau's casino operators are facing challenges with net interest margins, which have been below the critical 1.8% threshold for the past five quarters, hitting a record low of 1.54% at the end of March, as per bbg.

- An increasing number of Chinese companies have canceled their A-share IPO plans due to tighter listing rules and a slowing economy. As of Wednesday 339 companies had terminated their IPO applications. The primary reason for these terminations is more stringent listing criteria. Some firms are now planning to go public through mergers and acquisitions or seeking listings on the Beijing bourse or Hong Kong stock exchange, according to a Shanghai Securities News report.

ASIA PAC STOCKS: Equities Head Lower On Weaker Tech Stocks, Central Bank Moves

Asian stocks fell to a four-week low with technology stocks declining as investors look to pull back on their AI investments. The MSCI Asia Pacific Index dropped over 1.5%, with significant declines in Hitachi, SK Hynix, and Tencent. Japan’s Nikkei 225 fell nearly 3%, while the yen continued to strengthen against the USD. The losses followed a Wall Street selloff triggered by disappointing earnings from Tesla which fell over 10% and Alphabet, cooling an already weakening AI-driven rally. Former NY Fed Pres Dudley said he had changed his mind and rate cuts were warranted now, not later in the year, with some analysts believing such a move would be worrisome as it would indicate officials rushing to avoid a recession. Concerns about Beijing's economic rejuvenation also weighed on Hong Kong and mainland China stocks, while Taiwan's market remained closed due to a typhoon.

- Japanese equities are under pressure today with benchmark indices down 1-3% with some nearing a technical correction, as an AI-driven rally in technology shares reversed and concerns grew over a potential BoJ interest rate hike. The Nikkei is down 2.75% today and has dropped over 10% from its peak two weeks ago, with Renesas Electronics leading the decline after disappointing earnings. The broader Topix index is 2.5% lower, with significant declines in exporters such as Hitachi and Tokyo Electron as the yen continues to trade higher and now is now up 5% over the past two weeks.

- South Korean equities are lower, with tech stocks like SK Hynix tumbled as much as 8.4%, even after solid earnings, contributing to the broader market's decline. The strengthening yen has added to the pressure on South Korean exporters. The Kospi & Kosdaq both trade about 1.50% lower.

- Taiwan equity markets are again closed today due to a Typhoon, Taiex futures continue to trade though and are 2% lower. Philadelphia SE Semiconductor Index fell 5.41% overnight and now trades down almost 14% since the July highs.

- Australian equities are lower today, tech stocks fell inline with global peers but due to the large exposure to resources rather than tech, the ASX 200 is down just 1.10%. New Zealand equities fell 0.90%.

- In EM Asia all markets are lower with Singapore's Straits Times down 0.80%, Malaysia's KLCI down 0.25%, Indonesia's JCI down 0.55%, Philippines PSEi is down 1.10% while India's Nifty 50 fell 0.50%

Asian Equity Flows Muted As Tech Stocks Sell-Off

- South Korea: South Korean equities saw outflows of $216m yesterday, contributing to a net outflow of $657m over the past five trading days. The 5-day average outflow is $131m, compared to the 20-day average inflow of $101m and the 100-day average inflow of $110m. Year-to-date, South Korea has experienced substantial inflows totaling $18.749b.

- Taiwan: The local market was closed on Wednesday due to a Typhoon, expected heavily selling to resume once the market reopens after the Philadelphia SE Semiconductor Index fell 5.41% on Wednesday, with the Index now off 14% from all time highs made on July 7th. The 5-day average outflow is $901m, higher than the 20-day average outflow of $380m and the 100-day average outflow of $77m. Year-to-date, Taiwan has experienced outflows totaling $2.855b.

- India: Indian equities saw outflows of $185m Tuesday, resulting in a net inflow of $1.833b over the past five trading days. The 5-day average inflow is $367m, higher than the 20-day average inflow of $306m and significantly higher than the 100-day average outflow of $50m. Year-to-date, India has experienced inflows totaling $4.877b.

- Indonesia: Indonesian equities recorded outflows of $23m yesterday, leading to a net inflow of $49m over the past five trading days. The 5-day average outflow is $10m, below the 20-day average outflow of $8m and close to the 100-day average outflow of $11m. Year-to-date, Indonesia has experienced outflows totaling $149m.

- Thailand: Thailand saw an inflow of $11m yesterday, resulting in a net inflow of $76m over the past five trading days. The 5-day average inflow is $15m, better than the 20-day average outflow of $10m and the 100-day average outflow of $26m. Year-to-date, Thailand has seen significant outflows amounting to $3.279b.

- Malaysia: Malaysian equities experienced outflows of $8m yesterday, contributing to a 5-day net inflow of $18m. The 5-day average inflow is $4m, higher than the 20-day average inflow of $16m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced inflows totaling $165m.

- Philippines: Were closed on Wednesday due to a Typhoon. The 5-day average inflow is $14m, better than the 20-day average inflow of $4m and the 100-day average outflow of $6m. Year-to-date, the Philippines has seen outflows totaling $446m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -216 | -657 | 18749 |

| Taiwan (USDmn)** | 290 | -4506 | -2855 |

| India (USDmn)* | -185 | 1833 | 4877 |

| Indonesia (USDmn) | -23 | 49 | -149 |

| Thailand (USDmn) | 11 | 76 | -3279 |

| Malaysia (USDmn) | -8 | 18 | 165 |

| Philippines (USDmn)** | 8 | 68 | -446 |

| Total | -123 | -3119 | 17062 |

| * Up to 23nd July | |||

| ** Closed due to Typhoon |

OIL: Crude Lower As Further China Easing Weighs On Commodities

After rising around 0.7% on Wednesday, oil prices have given up these gains during APAC trading today as the general pullback in risk following China’s announcement of further policy support has weighed on equities and commodities too. The fourth consecutive weekly drop in US crude inventories and 0.1% drop in the USD index have failed to support prices.

- WTI fell below $77 to a low of $76.86/bbl. It is currently down 0.9% to $76.93. Brent touched $81 but is now around $81.05. Both are above initial support levels.

- Today’s unexpected China stimulus included a 20bp MLF cut and a 2000bn liquidity injection, which follows Monday’s 10bp reduction in key rates. Markets have been concerned re demand from the world’s largest crude importer for some time and the monetary policy easing this week may be confirming those fears. The China Petroleum Planning and Engineering Institute estimates that gasoline demand will fall 3.2% y/y in H2 and diesel 6.4%, according to Bloomberg.

- The EIA reported a 3.74mn barrel US inventory drawdown for last week, the fourth consecutive decline amounting to a total of 24.21mn barrels. The level is now its lowest since the start of February. But next Wednesday’s FOMC meeting will be key to the oil outlook.

- Later US Q2 GDP, jobless claims, June durable orders and German July Ifo survey print. Also ECB President Lagarde speaks.

GOLD: Yesterday’s Slide Extends Into Today’s Asian Session

Gold is under heavy pressure in today's Asia-Pacific session, down 0.9%, after closing 0.5% lower at $2,397.70 yesterday.

- Bullion’s recent drop comes despite former NY Fed President Dudley suggesting rate cuts were warranted now, not later in the year. Projected US rate cut pricing into year-end strengthened from Tuesday’s levels: Sep'24 cumulative -27bps (-25bps), Nov'24 cumulative -43bps (-40bps) and Dec'24 -65bps (-63bps).

- Lower rates are typically positive for gold, which doesn’t pay interest.

- The market focus now turns to Advance Q2 US GDP later today and Friday’s update on the Fed’s preferred underlying inflation measure. The PCE deflator is expected to have retreated to an annual pace of 2.5% from 2.6% in the year to May.

- According to MNI’s technicals team, the medium-term trend for gold still points higher and the previous breach of key resistance at $2,450.1, the May 20 high, opens the $2,500.00 handle next. Initial support is at $2,393.8, the 20-day EMA.

SOUTH KOREA DATA: Q2 GDP Falls, Softer Domestic Demand Offsets Export Strength, Complicating BoK Outlook

South Korean GDP unexpectedly contracted in the June quarter contracting -0.2%q/q versus expectations of +0.1%.

- Following a strong start to the year and a surge in demand for chip manufacturers this was an unexpected release. Consumption fell 0.2%q/q, while construction investment was also down -1.1%q/q, pointing to a soft domestic demand backdrop for the quarter.

- This puts the BOK in an interesting position on providing support to the economy given surging home prices in Seoul raising concerns from a financial stability standpoint.

- However, with the government forecasts for 2024 remaining robust, the Q2 number could merely be a short term blip on what will be a strong year for the Korean economy. Recall yesterday's consumer confidence print hit fresh multi year highs.

CHINA: Policy Support Picks Up Amid USD Weakness & With Growth Sub 5%

Our updated thoughts post China's surprise policy move: In surprise move the PBOC reduced the rate on it’s medium term loan facility in an out of cycle operation, following on from the other reductions in policies reductions earlier in the week. Whilst it has been well flagged that the focus on a strong currency remains, it appears possible that this opportunistic move follows a period of USD weakness as equity volatility continues.

- The magnitude of the cut is significant as it is the largest cut since COVID times, and policy changes are typically made in 10bps increments.

- The MLF was cut by 20bps and offered CNY200bn to banks via the facility and CNY235bn via reverse repo.

- With the economic growth outlook flagging, the post plenum policy response is in full flight as base effects take GDP growth below 5%.

SINGAPORE: MAS Seen On Hold Tomorrow

The MAS is expected to remain on hold at tomorrow's policy meeting. This is our own bias and the firm consensus per the Bloomberg survey of economists.

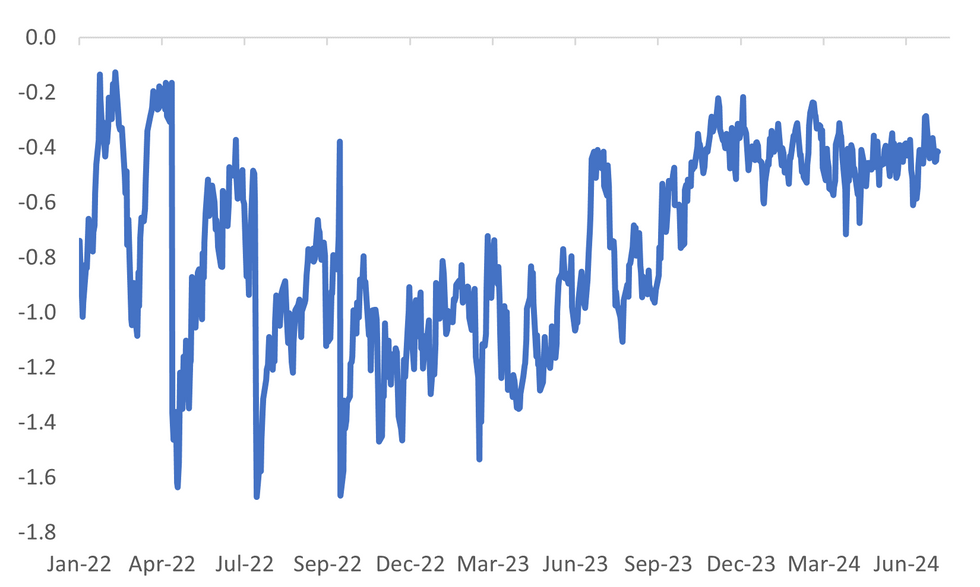

- Market pricing is also relative steady. The first chart below plots the Goldman Sachs SGD NEER estimate, as a deviation from the top end of the policy band. Since late April we have averaged close to -0.44% from the top end of the band.

- Typically, we would expect to see lower levels of the NEER, relative to the band extremes, if market expectations were more heightened in terms of a potential easing.

Fig 1: Goldman Sachs SGD NEER - Deviation From Top End Of MAS Policy Band

Source: Goldman Sachs/MNI - Market News/Bloomberg

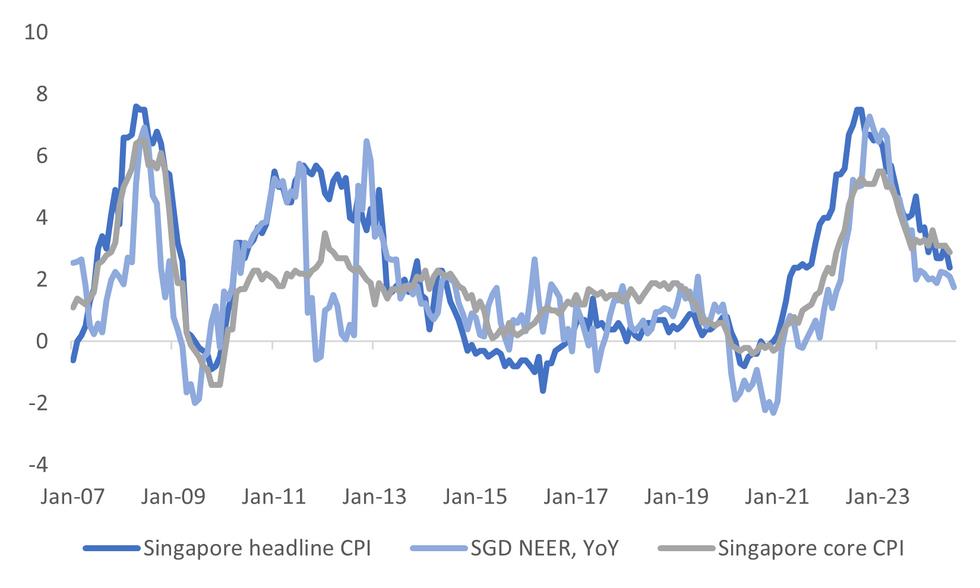

- Earlier this week we had inflation data, which surprised on the downside. Headline CPI printed at 2.4% y/y, back near mid 2021 levels. Core CPI was 2.9%y/y, the first sub 3% print since early 2022.

- The second chart below plots y/y headline and core CPI against the y/y changes in the SGD NEER. At face value the discrepancies between the series don't appear large and hence don't warrant a policy response at this stage.

- The central bank would likely want to see further progress on core inflation towards its medium term objective of around 2% before easing policy.

- The growth backdrop has seen volatile trends from the export side, but overall GDP growth is holding close to 3%y/y. This is running slightly above the mid point of MAS's expectations for this year (2-3%).

- One local sell side bank, DBS, sees an MAS easing risk tomorrow, expecting a slightly reduced pace of SGD NEER appreciation, which most analysts have pegged at around 1.5% per annum at the moment.

Source: MNI - Market News/Bloomberg

ASIA FX: USD/CNH Lower Despite MLF Cut, KRW and IDR Weaker On Equity Losses

USD/Asia pairs are mixed in the first part of Thursday trade, as yen gains in the G10 space continue to dominate sentiment. We have seen weakness in higher beta plays for the likes of KRW and IDR. Steadier trends are evident elsewhere, Note markets for FX onshore in the Philippines and Taiwan have remained shut due to adverse weather conditions. Tomorrow we have the MAS decision in Singapore, although no change is expected. Thailand customs trade data is also out.

- USD/CNH is lower, testing the 7.2550 region at the time of writing (earlier lows came in just ahead of 7.2500). CNH's reasonable beta with respect to yen moves is aiding yuan sentiment. We had the surprise announcement of a 1yr MLF cut today, which was lowered by 20bps (the most since 2020 Covid) and an injection of CNY200bn. This is seen as a further step in terms of policy support. Still, China equity sentiment remains soft, at this stage the CSI 300 is down a further 0.75%, sub 3400. We are testing sub the 100-day EMA (near 7.2580) for the first time since May.

- Spot USD/KRW is around 0.45% higher, last near 1386. This leaves the pair comfortably within recent ranges. Today's Q2 GDP miss has weighed on front end yields, with BoK easing expectations firming. Equity losses have also been a factor, the Kospi sits back at early June levels close to 2700 amid on-going tech pressure. Offshore investors have sold -580mn of local equities so far today. Continued yen gains have provided some offset.

- USD/SGD has been relatively steady, last near 1.3445, holding within recent ranges. We have the MAS July meeting outcome tomorrow. No change is expected, with the SGD NEER holding close to the top end of the band per Goldman Sachs estimates.

- Spot USD/IDR is pushing higher, the pair last near 16270/75, around 0.35% weaker in IDR terms. General weakness in global equity markets will be weighing on rupiah sentiment. For spot, early July highs in the pair came in at 16400.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/07/2024 | 0800/1000 | ** |  | EU | M3 |

| 25/07/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2024 | - |  | EU | ECB's Cipollone at Rio de Janeiro G20 Fin min/central bank meeting | |

| 25/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 25/07/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/07/2024 | 1230/0830 | *** |  | US | GDP |

| 25/07/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 25/07/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 25/07/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/07/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/07/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/07/2024 | 1500/1700 |  | EU | ECB's Lagarde attends Paris Summit | |

| 25/07/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/07/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.