-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Bubble Warnings Weigh On Risk, No Surprises From RBA

- Warnings of local property market and offshore market bubbles from Chinese regulators weighed on broader risk appetite overnight.

- The RBA employed incrementally firmer language surrounding its bond buying scheme, but Aussie bonds faded in the wake of the decision as the release contained nothing in the way of outright surprises.

- DXY firmer in Asia, gold and oil lower.

BOND SUMMARY: Core FI Mixed In Asia As Drivers Diverge

A light bid briefly crept into U.S. Tsys overnight, aided by Chinese regulatory body warnings re: bubbles in domestic property markets and offshore financial markets, while the Hang Seng struggled after Hong Kong's Financial Secretary failed to rule out further stamp duty hikes for equity trading at some point down the line (although he said that no such plans were in the pipeline at present). E-minis have nudged lower as a result. However, the space then pulled back from best levels on cues from Aussie bonds post-RBA. T-Notes last +0-07+ at 133-13+, with cash Tsys trading unchanged to 1.0bp richer across the curve. Overnight flow was headlined by an 1,875 lot block seller of TYJ1 134.00 puts which likely represented profit taking on longs given that the TYJ1 134.00 puts saw a cumulative 9,375 lots lifted via block trades during Asia-Pac hours in the month of February, between prices of 0-13 and 0-18 (all of which were executed in multiples of 1,875). Fedspeak from Brainard & Daly headline locally on Tuesday.

- The cover ratio witnessed in the latest round of 10-Year JGB supply represented the lowest level seen at a 10-Year auction since 2016, which will garner the headlines and detract from the fact that the low price still managed to meet broader dealer exp. (matching the projection from the BBG dealer poll), while the tail only experienced a marginal widening. Futures looked through the auction given the broader breakdown outside of the offer/cover ratio, while there was nothing in the way of underperformance for the 7-10 Year sector of the cash curve post-supply. Futures finished +33, with the bid extending through the afternoon after a previously flagged BBG BoJ sources piece (run late Monday Tokyo time) and soft local Q4 capex data provided an early bid for the space. Late in the day we saw Kyodo News cover comments from Tokyo Governor Koike, as she cautioned that the pace of fall in COVID cases had eased, resulting in concern that the reduction may not prove to be enough to lift a state of emergency in play across the greater Tokyo metropolitan area.

- Aussie bonds traded softer post-RBA as the Bank only expressed slightly more aggressive tones re: support for its 3-Year yield targeting scheme and no worry re: the outright levels that ACGB yields hit at the backend of last week. The language employed wasn't overtly forceful and there was a lack of reference to the ACGB Nov '24 line re: the evolution of the Bank's 3-Year yield target, which would have provided some disappointment to those who attributed a non-negligible chance to the appearance of rhetoric surrounding the matter. Ultimately, the RBA is looking to maintain optionality re: its bond buying scheme and 3-Year yield target. The Bank continued to express some caveated and indeed cautious optimism re: the prospects of a more drawn out economic recovery, while providing nothing in the way of meaningful commentary on the housing market & AUD, although both got a mention. YM -1.0, XM -5.0 at the close, a little off worst levels.

FOREX: Risk Appetite Wanes, AUD Blips Higher Post-RBA

The U.S. dollar led safe haven currencies higher in a tight Asia-Pac session, as most regional bourses saw their benchmark indices lose ground, but resultant FX price swings were somewhat limited. The DXY crept above the prior intraday high and approached its 100-DMA but stopped short of testing that moving average.

- The latest monetary policy decision from the RBA provided the main point of note in the timezone, with AUD slipping in the lead-up to the announcement amid chatter re: the unwinding of longs by short-term funds. The Aussie regained poise as the RBA left its policy settings on hold, as some had expected somewhat more forceful rhetoric surrounding the Reserve Bank's 3-year yield targeting scheme. After the decision, AUD/USD implied volatility eased broadly across a range of tenors.

- The commodity-tied space was weighed on by softer crude oil prices, with NOK lagging all of its G10 peers. NZD ignored comments from RBNZ Asst Gov Hawkesby circulated by BBG early doors, as the official largely reiterated the Reserve Bank's familiar stance.

- USD/JPY extended its winning streak and had a brief look above Monday's best levels, hitting best levels since Aug 28.

- The PBOC fixed its USD/CNY mid-point at 6.4625, 10 pips above sell-side estimates. USD/CNH ground higher, erasing yesterday's losses in the process, after failing to consolidate below its 50-DMA.

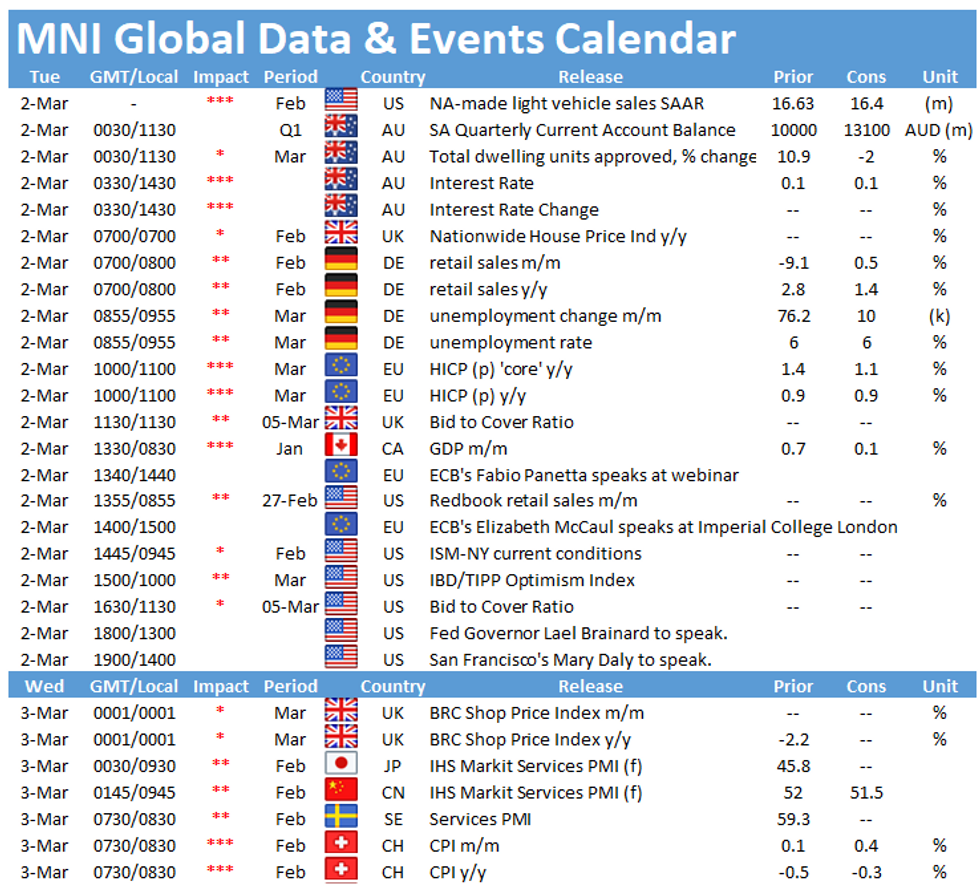

- Today's docket features Canadian GDP, German unemployment & retail sales, flash EZ CPI as well as speeches from Fed's Brainard & Daly, ECB's Panetta & Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Mar 02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-20(E843mln), $1.2045-65(E1.5bln), $1.2085-90(E572mln), $1.2200-06(E595mln)

- USD/JPY: Y105.75-80($1.0bln), Y105.85-90($690mln), Y106.00-10($1.2bln), Y106.30-50($1.5bln), Y107.00($552mln), Y107.50($600mln)

- EUR/GBP: Gbp0.8630-35(E570mln)

- USD/CHF: Chf0.9030($710mln)

- AUD/USD: $0.7875(A$589mln)

- AUD/NZD: N$1.0670(A$722mln)

- NZD/USD: $0.7150(N$685mln)

- USD/CNY: Cny6.4500($588mln), Cny6.4645($833mln)

ASIA FX: Initial Gains Not Sustained

After strong starts most Asia FX weakened as China's CIBRC sounded warnings about asset bubbles.

- CNH: Offshore yuan weakened, the rate initially looked below 6.47 before reversing. The PBOC fixed USD/CNY at 6.4625, 10 pips above sell-side estimates. Markets await policy cues on the broader economy from this week's annual gathering of the National People's Congress.

- SGD: Singapore dollar is weaker, USD/SGD reversing all of its move lower yesterday. Markets look ahead to PMI data at 1300GMT/2100HKT.

- TWD: Taiwan dollar has weakened through the session after strengthening at the open, USD/TWD has still not managed to close below 28.00 with the central bank actively "smoothing" the market on the close. Manufacturing PMI helped support sentiment in the region.

- KRW: The won is broadly flat on the session, having given back all of its opening gains, the fall comes despite strong manufacturing PMI and industrial production data.

- INR: Rupee is weaker, led higher by USD. Bond yields have climbed and gold is lower which has sapped appetite for INR.

- IDR: Rupiah is weaker, FinMin Indrawati said Monday that Indonesia will waive VAT on new home sales and discuss relief measures for the embattled tourism sector, while the MNC Group Investor Forum kicks off today, with Dep FinMin Nazara, FinMin Indrawati & Econ Min Hartarto due to speak

- MYR: Ringgitt is flat, Monday saw PM Muhyiddin deliver a speech marking the first anniversary of his gov't. The head of gov't reiterated that a fresh election will be held as soon as the Covid-19 pandemic abates and pushed back against continued accusations of abusing power during the state of emergency.

- PHP: Peso was fairly resilient, currently flat. CNN Philippines reported that "cinemas and other establishments offering creative, arts, and entertainment activities in areas under general community quarantine would be allowed to reopen starting this Friday

- THB: Baht is weaker, the imprisonment of three ministers last week fuelled speculations about a potential cabinet reshuffle. PM Prayuth reasserted his authority over any personal nominations yesterday, noting that while coalition partners may present their proposals, he will have the final say on any changes.

ASIA RATES: Auctions & Budgets

- INDIA: Yields lower across the curve, extending drop from yesterday as the global bond rout partially reversed. Helping support the space was a report from the finance ministry that goods and services tax collections in February was 7% higher Y/Y at INR 1.13t , which could help assuage worries of financing the budget through extra issuance. Markets await state bond sales to the tune of INR 230bn today.

- INDONESIA: sovereign debt remains in narrow range ahead of IDR 30tn auction, markets will scrutinize the results to ascertain if the governments decision to reduce issuance will support demand.

- CHINA: China's bonds rose for a second day after a CIBRC official sounded a warning on asset bubbles and leverage which sapped risk appetite. The PBOC matched liquidity injections with maturities today, after a net drain of CNY 10bn yesterday. The overnight repo rate jumped at the open but has since receded to trade around unchanged levels, last at 1.7757%, the 7-day repo rate is slightly higher than yesterday's close at 2.0647%.

- SOUTH KOREA: Futures moved higher at the open and moved in a range. It was announced previously that the MOF would issue an extra KRW 9.9tn of government bonds to fund the latest extra budget, in addition to the record KRW 176.4tn issuance already announced, however it is less than the KRW 12tn – KRW 20tn range that was floated, with the ruling democratic party pushing for the larger figure.

EQUITIES: Early Bid Fades

A mixed day for equity markets in the Asia-Pac time zone. A positive open for most markets was cancelled out by mid-session.

- There are a few exceptions, South Korea and Taiwan are in positive territory; both markets were closed yesterday for local holidays, while manufacturing PMI data from both countries earlier today was positive, with the figure supported by robust demand for electronics globally.

- Markets in Hong Kong and China lead the way lower, pressured after warnings from a CIBRC official about leveraging and the possibility for asset bubbles. The comments took the wind out of the sails of risk assets in the region.

- European and US futures are lower, giving back some of the broad based rally seen yesterday. Risk assets have gradually lost favour in the Asia-Pac session, with losses seen across the commodity complex.

GOLD: Multi-Month Lows Lodged In Asia Hours

Bullion moved to the lowest level seen since June during Asia-Pac hours as the USD ticked higher, although it was unclear which was leading which. Spot printed as low as $1,707.2/oz, before recovering from worst levels, last -$7/oz at ~$1,718/oz. U.S. real yields were little changed after fairly flat net trade on Monday, outside of a marginal uptick for 30s during the first trading session of the week. Bears are now looking to force a challenge of round number support at $1,700/oz.

OIL: OPEC Uncertainty

Crude futures are lower in Asia on Tuesday, if the close was negative it would be the third consecutive lower finish; WTI & Brent last trade ~$0.60 below settlement levels.

- Markets are looking ahead to the OPEC+ this week, the group will meet on March 4. Markets expect an increase in production quotas given crude's move higher in 2021, but the groups biggest producer Saudi Arabia are said to be more cautious.

- The coalition has currently taken out 7.2m bpd of crude production, approximately 7% of pre-pandemic supply, and can increase supply by up to 500k bpd each month, as per the agreement struck in December, while there as still questions about Saudi Arabia continuing its voluntary production cuts. The latest report by Goldman Sachs posits that OPEC+ still has a deficit of 2m bpd at present. The pace of draws during the recovery could outstrip the group's ability to ramp up.

- The OPEC joint technical committee (JTC) will meet later on Tuesday, tasked with reviewing conformity to output cuts and market conditions. Meanwhile the weekly inventory reports from the API and the US DOE, are due to be released later March 2 and March 3, respectively.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.