-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN MARKETS ANALYSIS: China Easing Calls Doesn't Lift Equity Mood

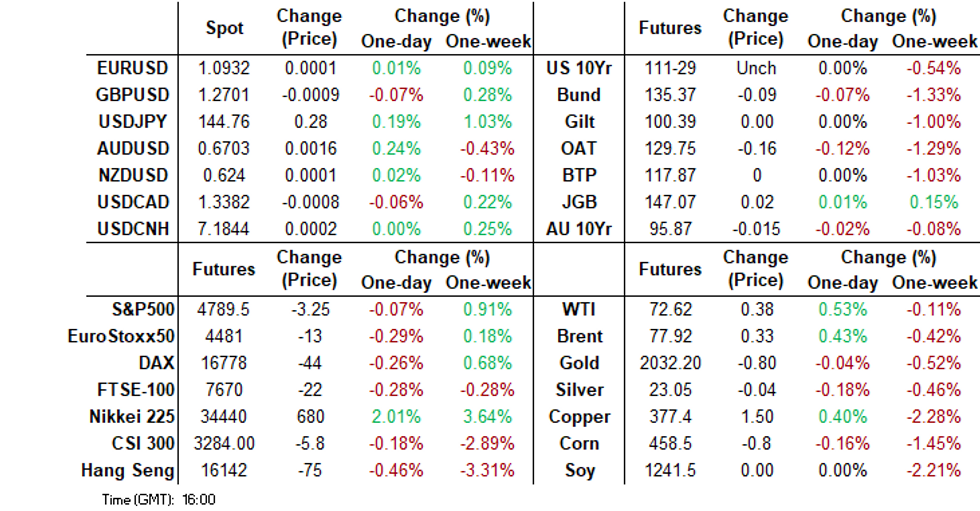

- US Cash US tsys are trading flat to 1bp richer, with a steepening bias, in today’s Asia-Pac session. Recent performance is best seen as a holding pattern ahead of US CPI/PPI data on Thursday/Friday. JGB futures are only slightly richer, +7 compared to the settlement levels, after giving up early gains in post-10-year supply dealings.

- FX trends have been mixed, yen weaker, which has buoyed local equities, the Nikkei to fresh 34 year highs. AUD/USD has edged higher, despite a slightly weaker monthly CPI read.

- Equity sentiment outside of Japan is mostly weaker, helping drag USD/Asia pairs higher. China equities haven't bounced despite calls that policy easing may happen quite soon.

- THB has faltered this afternoon as the BoT announced it will hold a policy briefing next Monday. This follows recent calls by the Thailand PM for lower rates.

MARKETS

US TSYS: Holding Pattern Ahead Of US CPI Data

TYH4 is trading at 111-30, +0-01 from NY closing levels, after giving up early gains.

- Cash US tsys are trading flat to 1bp richer, with a steepening bias, in today’s Asia-Pac session.

- With little in the way of meaningful newsflow, US tsys' recent performance is best seen as a holding pattern ahead of US CPI/PPI data on Thursday/Friday.

- That said, another poor 10-year JGB auction result likely weighed on recent dealings.

JGBS: Bull-Flattening Maintained Despite Poor 10Y Auction Result

JGB futures are only slightly richer, +7 compared to the settlement levels, after giving up early gains in post-10-year supply dealings.

- There wasn't much in the way of domestic drivers to flag, outside of the previously outlined weaker-than-expected November labour and real cash earnings in morning trading. As a result, JGB futures drifted higher, hitting their session high at the lunch break.

- The 10-year auction however showed poor demand metrics once again. The low price failed to meet wider expectations, the tail lengthened, and the cover ratio only improved slightly to 2.904x from 2.823x at December’s auction. It is worth noting that December’s cover was the lowest seen at a 10-year auction since 2021.

- Nevertheless, the cash JGB curve has maintained its bull-flattening, with yields flat to 3bps lower. The benchmark 10-year yield is 0.8bps lower at 0.583% after a morning low of 0.564%.

- Cash US tsys are dealing flat to 1bp lower, with a steepening bias, so far today. In large part, the recent performance of US tsys is best seen as a holding pattern ahead of US CPI/PPI data on Thursday/Friday.

- Swaps curve has also bull-flattened, with swap spreads tighter out to the 5-year and wider beyond.

- Tomorrow, the local calendar is relatively light, with Tokyo Avg Office Vacancies and Leading & Coincident Indices as the highlights.

JGBS: Poor Results Again For 10-Year JGB Supply

The 10-year JGB auction showed poor demand metrics. The low price failed to meet wider expectations (which stood at 100.02, per the BBG dealer poll), the tail lengthened, and the cover ratio only improved slightly to 2.904x from 2.823x at December’s auction. It is worth noting that December’s cover was the lowest seen at a 10-year auction since 2021.

- As highlighted in the auction preview, today’s 10-year auction took place with an outright yield that was approximately 10bps lower than the early December offering. Moreover, the 2/10 yield curve was 5bps flatter and the relative affordability of 10-year JGBs compared to futures, as indicated by the spread between the 7- and 10-year JGBs, was around its lowest point since early October.

- Not even the current bullish sentiment towards long-end global bonds was sufficient to support the bid at today’s auction.

- In early Tokyo afternoon trade, the cash 10-year JGB is around 1.0bp cheaper than lunch levels.

- JGB futures are lower in afternoon dealings, +10 compared to settlement levels, after entering the lunch break at +20.

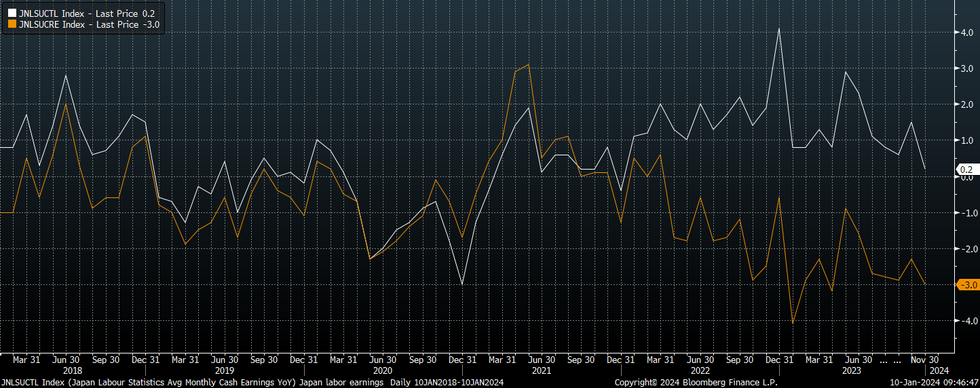

JAPAN DATA: November Wages Well Below Expectations

Japan Nov labor cash earnings data were well below expectations. The nominal outcome printed at 0.2% y/y, versus 1.5% expected. The prior was 1.5%. In real terms, earnings were down -3.0% y/y, against a -2.0% forecast and -2.3% prior.

- The slump in real wages is above earlier 2023 trough points, with a -4.1% y/y drop recorded in January. Still, the trend is not an encouraging one around hopes for a return to positive real wages growth, see the chart below (the white line is nominal earnings).

- The nearly flat y/y nominal outcome, was the softest print since the start of 2022. Bonus payments fell sharply so they may rebound next month as they tend to volatile.

- Positive real wage gains are seen as a key input into the BoJ achieving its inflation target sustainably.

- Today's data is likely to reinforce official calls for stronger nominal wage growth. Several companies and union groups have stated increases this year could be meaningful.

Fig 1: Japan Labor Earnings Y/Y

Source: MNI - Market News/Bloomberg

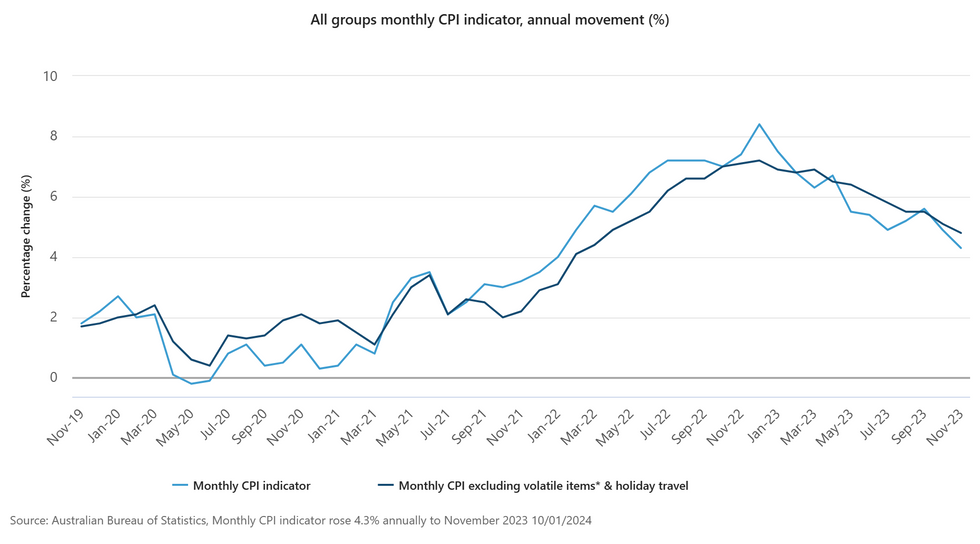

AUSSIE BONDS: Early Gains Lost In Post-CPI Dealings, Poor JGB 10Y Auction

ACGBs (YM flat & XM -1.0) sit little changed having given up early gains. After a slight overnight gain, ACGB futures rallied into the release of November’s CPI Monthly. While the CPI print slightly beat market expectations, the ex-volatile items measure showed a smaller reduction compared to October. The annual rise in November was 4.8% versus 5.1% in October.

- Another poor 10-year JGB auction result also likely weighed on global bonds in afternoon dealings of today’s Asia-Pac session.

- Cash US tsys are dealing flat to 1bp lower, with a steepening bias, so far today. In large part, the recent performance of US tsys is best seen as a holding pattern ahead of US CPI/PPI data on Thursday/Friday.

- Cash ACGBs are flat to 1bp cheaper on the day, with the AU-US 10-year yield differential flat at +9bps.

- Swap rates are unchanged.

- The bills strip is little changed, with price movement bounded by +/- 1.

- RBA-dated OIS pricing is little changed across meetings having given up an early softening. A cumulative easing of 48bps is priced by year-end. It was -53bps earlier in the session.

- Tomorrow, the local calendar will see Trade Balance data for November.

AUSTRALIAN DATA: November CPI Slightly Below Estimates, Continued Lower Y/Y Momentum

The November monthly CPI rose 4.3% y/y, against a 4.4% forecast and 4.9% prior. This continues the trend move down in headline inflation pressures. The monthly measured peaked in Dec 2022 at 8.4% y/y, so base effects are still aiding the pull back.

- The ABS measure which excludes certain volatile items (like fuel, fruit and vegetables) rose 4.8% y/y, against a 5.1% gain in Oct.

- By sub-category, trends were mixed. Housing inflation rose by 6.6%, above October's pace, communication was also firmer, up 2.4% y/y (prior 1.8%). Most other categories saw slower y/y momentum. Recreation eased to 1.2% y/y from 2.7% in Oct.

- Food inflation remains elevated across most categories, while meals out and take away food eased back to 5.7%y/y in Nov, from 6.9% in Oct.

- All in all, the data is unlikely to give any renewed hawkishness for the RBA ahead of Feb policy meeting. Note we get for Q4 CPI on Jan 31.

Fig 1: AU Monthly CPI Y/Y

NZGBS: Cheaper, Underperforms The $-Bloc, Global Bonds Await US CPI Data

NZGBs closed on a weak note, with benchmark yields 4-6bps higher. There hasn’t been much in the way of domestic drivers to flag, with ANZ commodity prices as the calendar highlight. Commodity export prices rose 2.4% m/m in December versus a revised -1.2% in November, according to ANZ Bank.

- For the second day running the NZGB 10-year has underperformed its $-bloc counterparts, with the NZ-US and NZ-AU yield differentials 4bps wider.

- Cash US tsys are dealing flat to 1bp lower, with a steepening bias, in today’s Asia-Pac session. There hasn’t been much in the way of meaningful newsflow, ahead of 10-year JGB supply today. The results will be released after the local market closes.

- Swap rates closed 3bps higher, with the 2s10s curve steeper and implied swap spreads ~2bps tighter.

- RBNZ dated OIS pricing closed flat to 4bps firmer across meetings, with October and November leading. A cumulative easing of 90bps is priced for year-end.

- Tomorrow, the local calendar sees Building Permits for November.

EQUITIES: Japan Outperformance Continues, Negative Trends Elsewhere

Outside of continued Japan equity outperformance, Asia Pac bourses are mostly in the red for Wednesday trade. The Nikkei 225 is +2% higher, fresh multi decade highs back to the early 1990s. US equity futures are close to flat. Eminis last near 4789, while Nasdaq futures sit at 16830.

- The Topix is also up +1.4% at the time of writing. A weaker yen, which has lost ground modestly against the USD today, is seen as aiding local benchmarks, particularly in parts of the machinery space.

- Note the weaker Nov labor earnings data as well, which printed earlier today. This may underpin a more dovish BoJ backdrop in the near term.

- Trends elsewhere are mostly negative. At the break, the HSI sits down 0.42%, while the CSI 300 is off 0.16%. Stimulus calls continue and may be delivered soon, per the latest piece from our China policy team (see this link), but this is yet to aid broader equity sentiment.

- The Kospi is off 0.6%, the Taiex down by 0.25% at this stage.

- In SEA, only the JCI in Indonesia is up, last around +0.70%. The index recouping some of the sharp losses seen in recent sessions.

FOREX: Yen Weakens, A$ Stabilizes, But Broader USD Index Unchanged

Outside of yen weakness and the modest A$ recovery, G10 FX markets have been fairly muted today. The BBDXY sits just above 1226, little changed versus end Tuesday levels.

- In the cross asset space, US yield trends have been broadly steady, while US equity futures sit down a touch. Regional equities are weaker, except for Japan, where the Nikkei is +2%.

- The weaker yen, which got close to 145.00 in early dealings (last 144.80/85), is aiding the local equity backdrop. Earlier data showed Nov real and nominal wages coming in well below expectations, which may keep the BoJ dovish in the near term.

- AUD/USD has recovered some ground, back above 0.6700, after underperforming on Tuesday. Nov monthly CPI data was a touch weaker than expected and suggested limited hawkish developments for the RBA. NZD/USD sits a touch higher at 0.6240/45.

- In the commodity space, iron ore is holding close to recent lows, around $134.75/ton, although copper is a touch higher.

- Looking ahead, potential comments from Bank of England Governor Andrew Bailey and a 10-yr treasury auction the only other notable risk events for the rest of the session.

OIL: Benchmarks Edge Higher, Fresh Attacks In The Red Sea

Oil benchmarks have tracked tight ranges in the first part of Wednesday trade. Brent sits near $77.80/bbl in latest dealings, marginally above Tuesday end levels. WTI was last at $72.50/bbl. Both front end benchmarks saw +2% gains for Tuesday's session.

- Headlines crossed earlier of a Houthi attack, reportedly the largest to date in terms of cruise missiles, drones etc, in the Red Sea on commercial shipping.

- Whilst the US military stated there were no damages from the attack, it does underscore risks around the supply route.

- This news, coupled with API data suggesting lower US oil inventories last week (per BBG), has seen supply side dynamics play a role in oils recent rebound.

- Elsewhere, on Tuesday it was announced global consumption of liquid fuels is expected to be 102.46m b/d in 2024, according to the EIA’s January Short-Term Energy Outlook. This is revised up from 102.34m b/d in December’s report.

GOLD: Holding Pattern Ahead Of US CPI/PPI

Gold is little changed in the Asia-Pac session, after closing 0.1% higher at $2030.20 on Tuesday.

- Bullion’s performance was noteworthy considering the strengthening in the USD index throughout the session.

- Like US Treasuries, Tuesday’s session for gold is best seen as a holding pattern ahead of US CPI/PPI data on Thursday/Friday.

- US Treasuries finished the NY session with yields 1-2bps lower across benchmarks. The 10-year note finishing above 4% for the third straight close.

- From a technical standpoint, the range was narrow, with the low failing to test support at $2012.0 (50-day EMA). Such a test would be seen as part of the trend bear leg extension, according to MNI’s technicals team.

SOUTH KOREA: MNI BoK Preview - January 2024: Steady, Too Early For Rate Cuts

- The BoK is widely expected to hold steady at tomorrow's policy meeting. Focus is likely to be on any dovish hints from the central bank, as rate cuts are projected later this year.

- It is too soon for a dovish pivot though, given still elevated inflation pressures, particularly relative to BoK's target rate. The central bank has time on its hand to assess conditions in early 2024 before turning more dovish.

- The other focus for the central bank is likely to be developments in the financial sector, particularly from a stability standpoint.

- Full preview here.

ASIA FX: Baht Weakens As BoT To Hold Policy Briefing Next Monday

Most USD/Asia pairs sit higher in both spot and 1 month NDF terms, slightly underperforming the steadier trends seen in terms of the USD indices. THB and PHP have been the weakest performers, with baht falling after the BoT stated it will hold a policy briefing next Monday. USD/CNH has been well behaved holding close to end Tuesday levels for much of the session. Tomorrow, we have the BoK decision, no change is expected. Thailand consumer confidence is also due, along with Malaysian industrial production.

- USD/CNH got just above 7.1870 in earlier dealings, but didn't breach Tuesday highs. The pair last tracked at 7.1850 little changed for the session. Easing calls continue, with our China policy team noting we could fresh stimulus action soon (see this link). Such talk hasn't boosted aggregate equity sentiment at this stage.

- 1 month USD/KRW has been relatively steady, not drifting far from end Tuesday levels in NY. The pair was last 1318/19, little changed. Onshore equities are weaker, in line with the regional trend (ex Japan). Earlier data showed a bounce in the unemployment rate, suggesting the best of the labor market conditions may be behind us.

- The Philippine peso has continued to lose ground, USD/PHP last at 56.35, fresh highs back to early Nov last week. We have dropped more than 1% in the past two sessions. Today's wider trade deficit figures weighed, but the price action may also reflect a more hands off approach from the BSP from an intervention standpoint, which was hinted at recently by the Governor.

- USD/THB has pushed to fresh highs this afternoon. The pair is in the 35.15/20 region, 0.6% weaker in baht terms. Fresh weakness has followed headlines that the BOT will hold a 'BOT Policy Briefing' on the 15th of Jan, so next Monday. This comes ahead of a meeting between PM Srettha and BoT Governor, which is scheduled to get underway shortly. Earlier in the week the PM called for rate cuts given Thailand's inflation and growth backdrop.

- USD/IDR spot and the 1 month NDF have both gained around 0.25% to 0.30%. Spot is back in the 15565/70 region. The broader equity backdrop isn't helping, although local shares are higher today. Sticky US real yields will be another headwind.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 10/01/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 10/01/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 10/01/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2024 | 0800/0900 |  | EU | ECB's De Guindos speech at Spain Investor Day | |

| 10/01/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 10/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/01/2024 | - | *** |  | CN | Money Supply |

| 10/01/2024 | - | *** |  | CN | New Loans |

| 10/01/2024 | - | *** |  | CN | Social Financing |

| 10/01/2024 | 1415/1415 |  | UK | Treasury Select Hearing on FSR | |

| 10/01/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/01/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/01/2024 | 2015/1515 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.