-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Crude Still Under Downward Pressure Ahead Of PMIs & Jackson Hole

- Preliminary PMIs for Japan and Australia improved for August, but market sentiment didn't shift. US TSYs opened the session lower, with the 10yr testing pre-BLS levels before risk markets, lead by tech stocks saw some selling pressure. This helped curb USD losses.

- Oil prices are off today’s lows to be little changed as global demand worries continue to weigh on benchmarks. Gold was also weaker.

- Bank of Korea left rates on hold today. The small downward revision for GDP leaves door open for a rate cut.

- Later the Jackson Hole Symposium starts but markets will be waiting for Fed Chair Powell’s speech on Friday. The ECB July meeting account is published today and US/European August flash PMIs as well as US jobless claims and Chicago & Kansas indices are out.

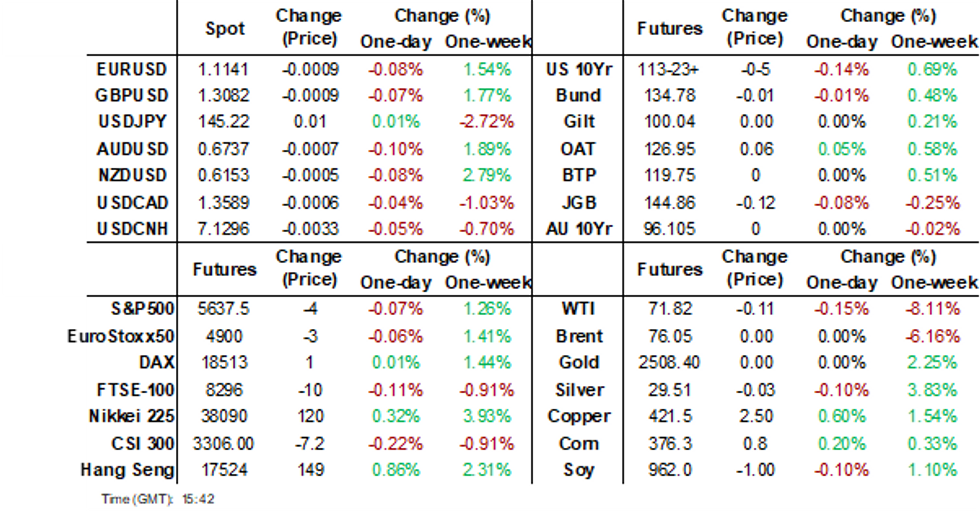

MARKETS

US TSYS: Tsys Futures Steady Ahead Of Jackson Hole & Jobless Claims

- Treasury futures opened the session lower, with the 10yr testing pre-BLS levels before risk markets, lead by tech stocks saw some selling pressure. TYU4 is now back at opening levels at 113-24, while TUU4 is trading at103-11+.

- The market will now turn its focus to US Jobless claims, Jackson Hole Headlines, while BoJ's Ueda is to speak tomorrow with any hawkish comments likely to cause heightened volatility.

- Cash treasuries are trading little changed today with yields flat to 0.5bps lower. The 10yr is trading 3.797% vs overnight & yearly lows of 3.7595%

- Projected rate cuts through year end gained vs. early Wednesday levels (*): Sep'24 cumulative -33.6bp (-33.3bp), Nov'24 cumulative -65.7bp (-64.4bp), Dec'24 -101.3bp (-98.3bp).

JGBS: Steady Ahead Of BoJ Ueda’s Appearance In Parliament & Jackson Hole Symposium

JGB futures are weaker and near session cheaps, -12 compared to the settlement levels.

- Outside of the previously outlined weekly International Investment Flow and Jibun Bank PMIs, there hasn't been much in the way of domestic drivers to flag.

- Machine Tool Orders data are due later alongside an Enhanced Liquidity Auction for 5-15.5-year OTR JGBs.

- Cash US tsys are flat to 1bp cheaper across benchmarks in today’s Asia-Pac session. The market’s focus now turns to advance PMIs and initial jobless claims later today, ahead of the Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell will speak at 1000ET Friday morning.

- Cash JGBs are slightly mixed across benchmarks, with yield swings bounded by +/- 1bp. The benchmark 10-year yield is 0.2bp lower at 0.879% versus the cycle high of 1.108%.

- Swaps are flat to 1bp higher across the curve.

- Tomorrow, the local calendar will see National CPI and Department Sales data.

- BoJ Governor Ueda is scheduled to respond to questions from lawmakers in the lower house of parliament from 0930 JT tomorrow, followed by another session in the upper house starting at 1 p.m. Each session is set to last two and a half hours.

JAPAN DATA: Preliminary August PMIs Improve, But Manufacturing Still Sub 50.0

The preliminary Japan PMIs for August improved, per the Jibun Bank survey measures. Manufacturing rose to 49.5, from 49.1 in July. We are still below recent highs, with the index unable to sustain +50 readings in recent years. The services PMI rose to 54.0 from 53.7 prior. This is close to 2024 highs (although in 2023 the index peaked near 56.0). The composite index is back to 53.0, fresh highs since the first half of 2023.

- The detail showed manufacturing output up to 50.9 from 49.7 prior. New orders for manufacturing also rose.

- On the services side, the detail was less positive, with the employment sub index slipping, while the prices metric also moderated.

- Still this data follows yesterday's July trade figures, which showed generally positive trends. Today's PMI results generally point to a resilient economic picture for Q3 Japan.

JAPAN DATA: Local Investors Purchases Of Offshore Bonds Surge In Recent Weeks

Offshore investors were strong buyers of local bonds for the second straight week, with just over ¥1500bn in net inflows into the space. This was the best two week of inflows since mid March of this year. In contrast, we saw net outflows in terms of equities for offshore investors. We have seen net selling in this segment in 4 out of the last 5 weeks. This comes despite the continued recovery in Japan equity market sentiment post the early August sell-off.

- In terms of Japan domestic outflows, we also saw local investors snapping up offshore bonds. We have seen local investors net purchase just over ¥4trln in offshore bonds in the past 3 weeks.

- Broader trends around the Fed easing cycle likely commencing in September could be playing a role in such flows. Allocations to bonds may also be rising amid lingering recession fears (albeit which have receded in recent weeks).

- Local investors bought offshore equities last week, but this only marginally offset the prior week's net selling.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending August 16 | Prior Week |

| Foreign Buying Japan Stocks | -47.9 | 521.7 |

| Foreign Buying Japan Bonds | 1532.8 | 1433.8 |

| Japan Buying Foreign Bonds | 1854.0 | 1539.7 |

| Japan Buying Foreign Stocks | 353.2 | -322.9 |

Source: MNI - Market News/Bloomberg

AUSTRALIAN DATA: PMI Signals Moderate Growth Improvement

The preliminary Judo Bank composite PMI recovered somewhat in August to 51.4 from 49.9, signalling a pickup in growth. Services rose to 52.2 from 50.4 and in line with the H1 average signalling that we should see some improvement in the quarterly GDP growth rate, as the sector accounts for over 80% of activity. Manufacturing remains lacklustre but the pace of contraction eased. There was good news on inflation with selling price increases moderating.

- Judo Bank reports a positive economic position in August with higher new orders, rising business confidence and an increase in employment growth. If this continues then the RBA’s hold is likely to be extended further.

- The price situation suggested that firms are finding it harder to pass on rising costs to customers with input inflation at its highest in almost 18 months but selling inflation easing to its lowest since January. Costs were driven higher by wages, raw materials and transport, with manufacturers reporting shipping delays and higher costs due to issues in the Red Sea and Southeast Asia.

- Both services and manufacturing export orders rose, while manufacturing continues to see contracting total orders.

- Services drove the increase in new jobs but manufacturing employment stabilised in August.

Source: MNI - Market News/Bloomberg/Refinitiv

AUSSIE BONDS: Subdued Session As Jackson Hole Vigil Continues

ACGBs (YM +1.0 & XM +0.5) are slightly stronger on a data-light session.

- Outside of the previously outlined Judo Bank PMIs, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are little changed across benchmarks in today’s Asia-Pac session. The market’s focus now turns to advance PMIs and initial jobless claims later today, ahead of the Jackson Hole economic symposium, which will be held Aug. 22-24. Fed Chairman Powell will speak at 1000ET Friday morning.

- Cash ACGBs are flat to 2bps richer, with a steeper 3/10 curve and the AU-US 10-year yield differential at +9bps.

- Swap rates are 1-2bps lower, with the 3s10s curve steeper.

- The bills strip shows pricing flat to +3.

- RBA-dated OIS pricing is flat to 2bps softer across meetings. A cumulative 21bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the AOFM’s planned sale of A$700mn of the 2.75% 21 November 2028 bond.

- CPI Monthly data for July will be released next Wednesday.

AUSSIE BONDS: AU-CA 10-Year Yield Differential At Fair Value

The AU-CA official rate differential narrowed to -15bps on July 24 when the BoC delivered the widely expected 25bp cut to 4.50%.

- Looking 12 months ahead using 3-month swap rates 1-year forward (1Y3M), the market expects the RBA’s official rate to be around 75bps higher than the BoC’s.

- A simple regression of the AU-CA cash 10-year yield differential, which at +88bps is currently around its highest level since last December, against the AU-CA 1Y3M spread over the past 24 months suggests that the 10-year yield differential is around fair value.

Figure 1: AU-CA Cash 10-Year Yield Diff. (%) vs. AU-CA 1Y3M Swap Diff. (%)

Source: MNI – Market News / Bloomberg

NZGBS: Cheaper, $-Bloc Underperformance Continues, Q2 Real Retail Sales Tomorrow

NZGBs closed slightly weaker, with benchmark yields rising by 1bp. Despite narrow trading ranges during a data-light session, NZGBs ended the day at their lows.

- Additionally, NZGBs continued to underperform relative to their $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials widening by 2bps.

- Today's performance suggests an ongoing reversal of much of the post-RBNZ rate cut rally. While the 2-year yield remains 12bps lower than pre-RBNZ levels, it has climbed 14bps since Friday’s close. Similarly, the 10-year yield is 4bps lower than pre-RBNZ levels but has risen 6bps since Friday.

- The weekly government bond tender was cancelled today as is standard practice given the bond syndication of the new May-36 earlier in the week.

- Swap rates are little changed.

- RBNZ dated OIS pricing is little changed. A cumulative 72bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q2 Retail Sales Ex Inflation data.

- Before then, the market will be focused on advance PMIs in Europe and the US and US initial jobless claims.

FOREX: Yen Crosses Weighed By Mixed Equity Trends, But Overall Ranges Tight

Overall G10 ranges have been tight in the part of Thursday trade. As has been the case this week the USD was softer in the first part of trade, but follow through hasn't been evident. The USD BBDXY index last near 1230.60, little changed for the session.

- Cross asset signals have lent some USD support, albeit at the margins. US equity futures sit modestly lower, while regional equities have been mixed (despite the positive cash lead from Wednesday offshore trade). US yields are close to flat at this stage, with aggregate swings modest after Wednesday's move lower at the front end.

- USD/JPY has seen some volatility, but has respected recent ranges. Dips sub 145.00 have been supported, while highs were at 145.64. The slight weaker equity tone has likely lent some support to yen on crosses this afternoon.

- AUD/USD and NZD/USD have both ticked lower. The A$ was last 0.6730/35, NZD is back to 0.6150. Commodities are mostly weaker at the margin, likely weighing on commodity FX.

- AUD/JPY has edged down to 97.60/65, with recent highs above 99.00 capping the pair.

- On the data front we had better preliminary PMIs out of Australia and Japan, but more so on the services side. Market sentiment wasn't moved.

- Coming up, US/European August flash PMIs as well as US jobless claims and Chicago & Kansas indices are out. Later the Jackson Hole Symposium starts but markets will be waiting for Fed Chair Powell’s speech on Friday. The ECB July meeting account is also published today.

ASIA STOCKS: Asian Equities Pare Gains As Investors Book Profits Ahead Of CB Speak

Asian equities opened stronger this morning following dovish signals from the FOMC minutes but later gave up most of their gains. The HSTech lost half of its early rally, and mainland China indexes edged lower. South Korea's Kospi slipped as the won weakened, influenced by a the BOK leaving rates unchanged and more dovish stance. Japanese equities remained narrowly mixed, retreating from their best levels. While the broader MSCI Asia Pacific Index initially rose by 0.4%, gains were tempered by declines in markets such as China, Indonesia, and Taiwan with investors booking profits on tech stocks. Traders are now focused on Jackson hole headlines, Jobless Claims while BoJ Ueda is to speak tomorrow.

- Japanese equities have given up most of the session gains, with tech stocks almost erasing all gains, as investors look to book profits, while the yen is trading back at 145.00. Earlier, Jibun Bank PMI rose to 53.0 for August, vs 52.5 prior. The Nikkei is up 0.10%, while the TOPIX is now down 0.25% after the TOPIX Banks Index fell about 1.50%.

- China & Hong Kong equities are swinging between losses and gains while property continues to struggle with major property benchmarks trading at or close to all time lows. Elsewhere China has launched an investigation into EU dairy imports in response to tariffs imposed on China's EV and Pork exports. The HSI is up 0.40%, HSTech is 0.80% higher, while in China the CSI 300 is down 0.13%, property indices are mixed with Mainland Property Index down 2.40% while the CSI 300 Real Estate Index is up 1.10%

- South Korean equities have given all gains made this morning with KOSPI now flat after Samsung dropped -0.40% & SK Hynix fell -0.70%, small-caps are underperforming with the KOSDAQ down 0.80%. Foreign investors have been slightly better sellers this morning, with most of the selling coming from tech names.

- Taiwanese equities have erased all gains with the Taiex now trading 0.50% lower, with banking and property sectors the worst performing following the central bank's request for lenders to reduce their concentration of real estate loans. The central bank's directive, aimed at improving credit resource management, triggered concerns over tighter financial conditions. TSMC is currently trading down 0.85% after initially opening 0.60% higher.

- Australian equities are slightly higher driven primarily by gains in mining and real estate stocks. The ASX200 index is on track for its longest winning streak since February 2015, and trades 0.25% higher today. New Zealand healthcare stocks are underperforming today with the NZX50 down 0.25%.

- Asian EM equities are mixed with Indonesia's JCI down 0.35%, Singapore's Straits Times down 0.35% while Thailand's SET is 0.05% higher, Philippine's PSEi is up 1.10% and Malaysia's KLCI is up 0.13%, India's Nifty 50 is 0.20% higher

ASIA EQUITY FLOWS: Asian Equities See Profit Taking After Strong Rally Post Aug 5th

- South Korea: South Korea saw an outflow of $227m yesterday, resulting in a net inflow of $1.209b over the past five trading days. The 5-day average inflow is $242m, the 20-day average shows an outflow of $52m, and the 100-day average inflow is $66m. Year-to-date, South Korea has accumulated substantial inflows totaling $17.921b.

- Taiwan: Taiwan recorded an outflow of $88m yesterday, contributing to a net inflow of $2.239b over the past five trading days. The 5-day average inflow is $448m, while the 20-day average shows an outflow of $240m, and the 100-day average reflects an outflow of $139m. Year-to-date, Taiwan has experienced outflows totaling $7.947b.

- India: India saw an inflow of $482m Tuesday, leading to a net outflow of $38m over the past five trading days. The 5-day average shows a small outflow of $8m, compared to a 20-day average outflow of $157m and a near breakeven at a 100-day average inflow of $1m. Year-to-date, India has seen inflows totaling $1.925b.

- Indonesia: Indonesian equities recorded an inflow of $116m yesterday, leading to a net inflow of $351m over the past five trading days. The 5-day average inflow is $70m, with a 20-day average inflow of $37m and a 100-day average outflow of $12m. Year-to-date, Indonesia has accumulated inflows totaling $588m.

- Thailand: Thailand experienced an inflow of $22m yesterday, resulting in a net outflow of $235m over the past five trading days. The 5-day average outflow is $47m, while the 20-day average shows an outflow of $13m, and the 100-day average reflects an outflow of $21m. Year-to-date, Thailand has experienced outflows amounting to $3.542b.

- Malaysia: Malaysia saw an inflow of $62m yesterday, contributing to a net inflow of $325m over the past five trading days. The 5-day average inflow is $65m, while the 20-day average shows a modest inflow of $6m, and the 100-day average reflects a small inflow of $4m. Year-to-date, Malaysia has seen inflows totaling $283m.

- Philippines: The Philippines recorded an inflow of $10m yesterday, leading to a net inflow of $83m over the past five trading days. The 5-day average inflow is $17m, aligning with the 20-day average inflow of $2m, but there is a 100-day average outflow of $6m. Year-to-date, the Philippines has experienced outflows totaling $404m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -227 | 1209 | 17921 |

| Taiwan (USDmn) | -88 | 2239 | -7947 |

| India (USDmn)* | 482 | -38 | 1925 |

| Indonesia (USDmn) | 116 | 351 | 588 |

| Thailand (USDmn) | 22 | -235 | -3542 |

| Malaysia (USDmn) | 62 | 325 | 283 |

| Philippines (USDmn) | 10 | 83 | -404 |

| Total | 377 | 3935 | 8825 |

| * Up to Date 20-Aug-24 |

OIL: Crude Still Under Downward Pressure Ahead Of PMIs & Jackson Hole

Oil prices are off today’s lows to be little changed as global demand worries continue to weigh on benchmarks. Brent is little changed at $76.02/bbl after a low of $75.77, key support is at $75.05. WTI is down 0.2% to $71.80 after a low of $71.58, briefly below the bear trigger at $71.67 again. Algorithmic selling has exacerbated downward pressures. If they continue, OPEC may abandon plans to reduce output cuts from October. The USD index is slightly higher.

- There was an 818k downward revision to US payrolls announced Wednesday and the FOMC July minutes signalled that it is looking at cutting rates at its September 18 meeting. These have added to market nerves regarding the strength of the US economy at a time of disappointing growth in China.

- Despite concerns over US demand, EIA data showed another crude drawdown of 4.65mn barrels last week, and gasoline stocks fell 1.61mn and distillate 3.3mn. Crude inventories are down 34.7mn barrels since the start of July to their lowest level since the end of January.

- There is no update on Gaza ceasefire negotiations.

- Later the Jackson Hole Symposium starts but markets will be waiting for Fed Chair Powell’s speech on Friday. The ECB July meeting account is published today and US/European August flash PMIs as well as US jobless claims and Chicago & Kansas indices are out.

GOLD: Weaker Despite Dovish FOMC Minutes

Gold is 0.4% lower in today’s Asia-Pac session, after closing broadly unchanged at $2512.56 on Wednesday.

- Expectations for the FOMC to begin easing policy on September 18 were reinforced by the BLS's downward revisions to nonfarm payrolls and dovish FOMC minutes. Lower rates are typically positive for gold, which doesn’t pay interest.

- The Bureau of Labor Statistics reported that US payroll growth in the year to March was preliminarily revised down by 818k or 68k per month.

- The July FOMC minutes signaled that participants were eyeing a cut in September, with "several" seeing it as "plausible" to cut already in July. There weren't many clues in the minutes on future monetary policy beyond that, with no mention of a potential >25bp cut.

- Focus turns to the KC Fed-hosted Jackson Hole economic symposium will be held Aug. 22-24, with Fed Chairman Powell speaking at 1000ET Friday morning.

- According to MNI’s technicals team, conditions remain bullish for the yellow metal after delivering an all-time high on Tuesday. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend. The focus is on a climb towards $2536.4 next, a Fibonacci projection.

INDIA DATA: PMI Manufacturing moderates.

- Indian PMIs remained firmly in expansion territory in July according to today’s data release, albeit with some signs of moderating in manufacturing.

- HSBC India PMI Manufacturing moderated to 57.9 in August from 58.1 in July.

- HSBC India PMI Services expanded 60.4 in August versus 60.3 in July.

- The HSBC India Aug. Flash Composite PMI 60.5 vs 60.7 prior is the lowest reading since May.

- New orders have declined as have employment.

- The numbers are still in highly expansive territory and the moderating will give little concern at this stage to the RBI.

MALAYSIA DATA: CPI Moderates.

- July CPI rose 2.0% year on year versus 2.0% prior.

- Market expectations were 2.1% year on year.

- Core inflation rose 1.9% year on year.

- Like several of its neighbours in South East Asia, Malaysia now has the enviable situation of better than expected growth and stable inflation.

- BNM’s next meeting on September 5th is just prior to the Federal Reserve’s much anticipated September meeting.

- Today’s data likely gives breathing space for the BNM to stay on hold pending the outcome of the FED.

SOUTH KOREA: Bond Wrap

- Bank of Korea left rates on hold today.

- BOK reduced their 2024 GDP growth forecast to 2.4% vs 2.5% prior.

- CPI forecast maintained at 2.1%

- The small downward revision for GDP leaves door open for a rate cut.

- The bond market liked the news with bond yields 2-4bps lower on the day.

2yr 3.029% (-4bp) 5yr 2.93% (-3bp) 10yr 2.989% (-2bp) 30yr 2.913% (-0.5bp)

CHINA: Bond Wrap

- Quiet day in China with the Shanghai composite flat and bond market activity muted

- PBOC drained CNY218.4 of liquidity via OMO this morning.

- Bond market activity saw intermediate to longer dated maturities outperform.

- No key data out today or tomorrow in China.

2yr 1.615% 5yr 1.868% 10yr 2.146% (-1bp) 30yr 2.352%

Most USD/Asia Pairs Supported On Dips, IDR Weighed By Local Protests

USD/Asia pairs have mostly tracked higher today, albeit to varying degrees. PHP spot gains have bucked this broader trend, while USD/CNH is close to unchanged. USD/IDR has risen around 0.80%, last tracking above 15600. Local protests has weighed on sentiment. The BoK left rates on hold but paved the wave for lower rates. USD/KRW is higher but only marginally.

- USD/CNH is tracking near 7.1300 in latest dealings, little changed for the session. The USD/CNY fixing was set at multi-month lows but also came in above market expectations, so a lean against appreciation pressures for the yuan. Local equities are mostly struggling for positive upside, with property indices marginally higher, but still close to recent lows.

- USD/KRW spot tested near Wednesday intra-session highs close to 1340, as the majority of the BoK board now sees rates potentially coming down in the next 3 months. Still, Governor Rhee stated the BoK easing cycle would not be as aggressive as the US's. A slightly softer tech equity tone in the region has been another won headwind. USD/KRW spot was last near 1336, around 0.15% weaker in won terms for the session. Recent dips sub 1330 have been supported.

- USD/IDR spot has gapped higher today, last in the 15610/15 region, around 0.80% higher. Local protests around proposed electoral rule changes has hurt sentiment. Local equities are off around 0.60% at the stage. Earlier data showed a slightly wider than forecast Q2 current account deficit. USD/IDR spot has been in oversold territory in recent sessions, which may be contributing to the extent of today's bounce.

- USD/MYR sunk at the open, but at 4.3500 found support. The pair was last back close to 4.3800, little changed for the session. Momentum remains skewed to the downside for this pair, a strong outperformer in SEA FX. The July CPI print was 2.0%y/y, slightly below forecasts (2.1%). BNM’s next meeting on September 5th is just prior to the Federal Reserve’s much anticipated September meeting

- USD/PHP sits near 56.35 in recent dealings, around 0.3% stronger in PHP terms. Outside of a modest CNH gain, PHP is the only Asian currency firmer today in spot terms. However, this largely looks to reflect catch up to NDF strength post yesterday's onshore close. Like elsewhere in South East Asia (SEA) FX, USD/PHP is oversold based off RSI (14) but continues to ride the weaker USD wave, as Fed easing expectations remain firm. There doesn't appear much on the charts to 56.00 round figure support. The local data calendar is reasonably quiet until next week when budget balance and bank lending figures are. August CPI prints on Sep 5.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/08/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/08/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/08/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/08/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/08/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2024 | 1130/1330 |  | EU | Account of ECB MonPol meeting in July | |

| 22/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 22/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 22/08/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/08/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/08/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 22/08/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/08/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.