-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Dollar Index & Yields Hold Close To Recent Lows

- France is headed for a hung parliament after the second round of voting as the left New Popular Front (NFP) unexpectedly won the most seats but not enough to have a majority. EUR/USD opened weaker but didn't see much follow through selling. USD trends were fairly steady elsewhere.

- US Tsy futures sit up off earlier lows, while JGB futures are holding weaker, -17 compared to the settlement levels. A majority of Shadow Board members recommended the RBNZ keep the OCR at 5.5% this week according to NZIER. RBNZ dated OIS pricing is slightly mixed across meetings today. A cumulative 35bps of easing is priced by year-end.

- Later there are US May consumer credit and June NY Fed inflation expectations and German May trade data. BoE’s Haskel speaks.

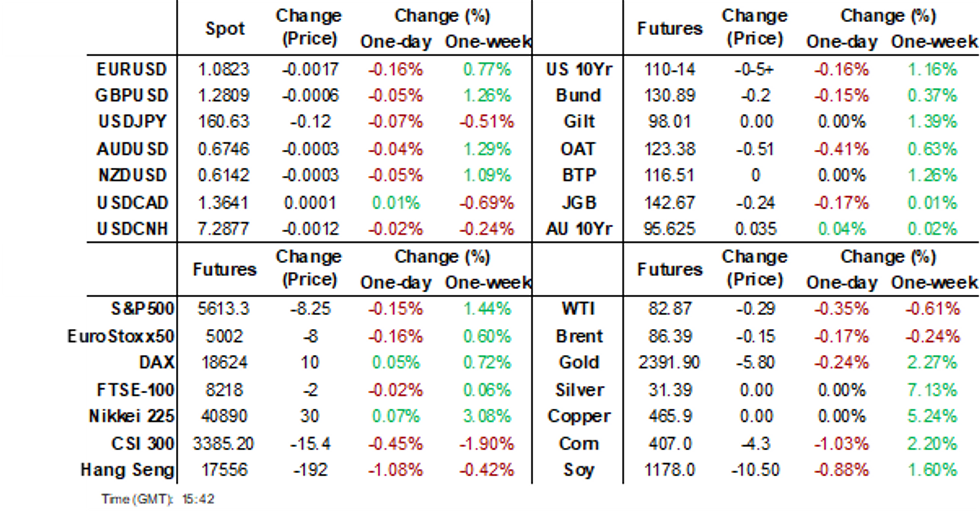

MARKETS

FRENCH POLITICS: Surprise Win By Left, But Political Instability Ahead As Hung Parliament

France is headed for a hung parliament after the second round of voting as the left New Popular Front (NFP) unexpectedly won the most seats but not enough to have a majority. New elections cannot be held for at least a year and so there is significant political uncertainty. Also President Macron has significant flexibility in who he chooses as the next prime minister, especially if no party has a majority.

- The Le Pen’s right wing National Front (RN), who had the highest share of the vote in the first round and was expected to win the second, surprisingly came in third. Many 3rd place candidates from the centre and left had pulled out to concentrate the anti-RN vote. The strategy seems to have had a significant impact.

- NFP is a coalition of the Socialists, Greens, Melenchon’s hard left France Unbowed and Communists. Ipsos polling estimates that the group could gain 171-187 seats, far from the 289 needed for a majority. Melenchon’s party looks like it could be the largest in the group with 94 seats, which could undermine the left’s unity. NFP couldn’t agree on its PM candidate before the election.

- President Macron’s Ensemble is in second place with an estimated 152-163 seats, more than double the projection following the first round. Le Pen’s RN is expected to win 134-152, around half of what was forecast.

- France is not used to negotiating and compromising to form coalitions, like in Germany and the Netherlands. So an alliance is going to be difficult and unstable. With NFP not particularly united, especially if Melenchon takes the helm, the centrist-left Socialists/Greens may split to form a coalition with the centrist Ensemble. This will take time and so incumbent PM Attal may stay in a caretaker capacity.

- NFP campaigned on a 14% minimum wage rise, the reintroduction of the wealth tax and a cap on energy prices, according to The Economist.

US TSYS: Tsys Futures Off Earlier Lows

- Treasury futures have opened lower this morning, some profit taking has occurred along side weakness in the 10y French bond futures after a messy outcome from the second round of voting, OATU4 is trading -0.29 ticks, which equates to about 3.05bps move higher in yields. Tsys futures have since pared some earlier losses to now be trading; TU is - 01⅜ at 102-09¼, while TY is - 05 at 110-14+.

- Volumes are above averages, TU 36k, FV 105k, TY 128k

- Tsys flows: Block Seller belly FV, UXY, WN Fly - DV01 626k. FV/TY Block Steepener DV01 190k

- The Cash treasury curve have widen today, with yields about 1.5bps higher. The 2y is +1.5bps at 4.618%, 7yr +1.6bps at 4.245%, while the 10y +1.4bps at 4.292%.

- Looking ahead, NY Fed 1-Yr Inflation Expectations & Consumer Credit.

JGBS: Cash Bonds Slightly Weaker, Subdued Session, 5Y Supply Tomorrow

JGB futures are holding weaker, -17 compared to the settlement levels.

- Outside of the previously outlined Cash Earnings, Trade Balance and Bank Lending data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 1bp cheaper in today's Asia-Pac session after Friday’s strong post-Payrolls rally. Today’s move may reflect some profit-taking along with a reaction to yesterday’s French election result and news on the PBoC bond purchases. China government bonds are dealing 2-4bps cheaper.

- The PBoC will carry out temporary bond repurchase or reverse repurchase operations depending on the market situation during working days between 16:00 and 16:20.

- Cash JGBs are flat to 1bp cheaper, with the 5-7-year zone underperforming.

- The swaps curve has bear-steepened, with rates 1-2bps higher. Swap spreads are wider.

- Tomorrow, the local calendar will see M2& M3 Money Stock data alongside 5-year supply.

JAPAN DATA: Headline Earning Misses, But Details Stronger

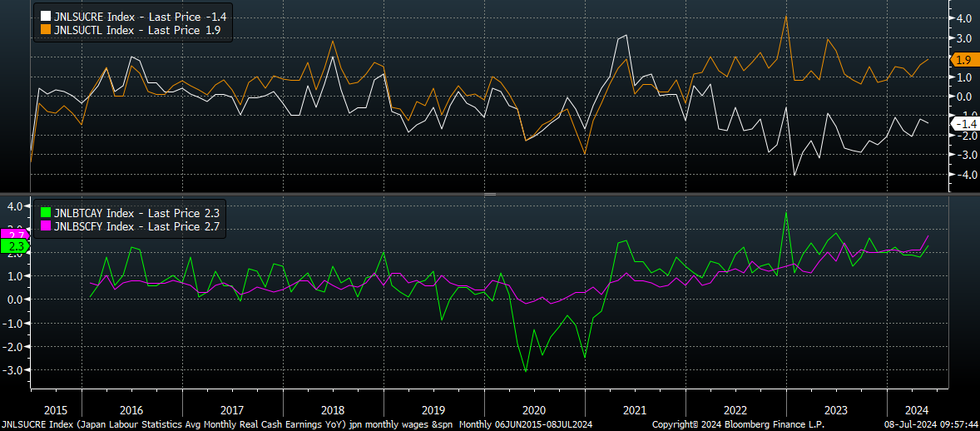

Japan labour cash earnings were a mixed bag. The headline estimates were a touch below market consensus expectations. The nominal headline rose 1.9%y/y, versus 2.1% forecast and 1.6% prior (which was revised down from an initial read of 2.1%). Real earnings remained comfortably negative at -1.4%y/y (forecast was -1.2% y/y and prior -1.2%). See the top panel on the chart below.

- Still, an offset comes from the figures using the same sample base. They were stronger than forecast. Cash earnings rose 2.3%y/y (forecast 2.1%, prior 1.8%). Scheduled full time pay was 2.7% y/y, versus 2.2% forecast and 2.1% prior. This rose a record in y/y terms, these metrics are presented below.

- The detail on the headline results also showed scheduled pay up 2.5%, a firm uptick on the 1.8% rise seen in April. This was the strongest rise since 1993. Bonus payments were down -8.2%y/y, which was a drag on the headline result.

- All in all, this should add to the case for a further unwinding of the BoJ's accommodative stance.

Fig 1: Japan Wage Trends Y/Y

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Subdued Start To The Week, Consumer & Business Confidence Tomorrow

ACGBs (YM +4.0 & XM +3.5) are richer but slightly weaker than session highs.

- Outside of the previously outlined Home Loans data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 1-2bps cheaper in today's Asia-Pac session after Friday’s strong post-Payrolls rally. Today’s move may reflect some profit-taking along with a reaction to yesterday’s French election result and news on PBoC bond purchases. China government bonds are dealing 2-4bps cheaper.

- The PBoC will carry out temporary bond repurchase or reverse repurchase operations depending on the market situation during working days between 16:00 and 16:20.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential at +8bps.

- Swap rates are 3-4bps lower.

- The bills strip has bull-flattened, with pricing flat to +4.

- RBA-dated OIS pricing is 1-3bps softer across meetings. Terminal rate expectations decline by 1bps to 4.48%.

- Tomorrow, the local calendar will see Consumer and Business Confidence data.

- The AOFM plans to sell A$700mn of the 3.75% 21 May 2034 bond on Wednesday and A$800mn of the 2.75% 21 November 2029 bond on Friday.

AU/NZ BONDS: AU-NZ 10Y Yield Differential Is Too Low

The AU-NZ 10-year yield differential closed 1bp higher today at -29bps, its highest level since October 2022.

- However, a simple regression of the AU-NZ 10-year yield differential versus the AU-NZ 3-month swap rate 1-year forward (1y3m) differential over the current tightening cycle suggests the differential is 7bps too low versus fair value (i.e., -29bps versus -22bps).

- The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

Figure 1: AU-NZ Regression: 10-Year Yield Differential Vs. 1Y3M Swap Differential

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: Home Loans Softer But Momentum Strong

May home loan values fell 1.7% m/m after a strong rise of 4.8% the previous month and are still running at 18%y/y. With strong momentum and annual growth rates in double digits, May’s decline looks like payback for previous strength rather than the start of a downtrend. With robust working-age population growth, demand for housing remains strong.

- Owner-occupied loans fell 2% m/m after an upwardly revised +4.5% in April to be up 12.2% y/y and investor loans fell 1.3%, driven by NSW, after rising 5.3% to be +29.5% y/y. Both components are seeing very strong 3-month momentum.

- The value of first homebuyer loans fell 2.9% m/m to still be up 10.1% y/y but down from 18.5% in April. However, 3-month annualized momentum is around 37% signaling the sector remains robust.

- Personal finance loans fell 0.7% m/m but are up 12.7% y/y with vehicle loans up 0.8% m/m.

Source: MNI - Market News/ABS

NZGBS: Richer But Off Best Levels, US Tsys Slightly Weaker

NZGB benchmark yields closed slightly higher than the session’s lowest levels, 3-5bps lower on the day.

- Cash US tsys are 1-2bps cheaper in today's Asia-Pac session after Friday’s strong post-Payrolls rally. It may reflect some profit-taking along with a reaction to yesterday’s French election result and news on PBoC bond purchases.

- The PBoC will carry out temporary bond repurchase or reverse repurchase operations depending on the market situation during working days between 16:00 and 16:20.

- The local calendar is light until the RBNZ’s Policy Decision on Wednesday. Economists surveyed by Bloomberg unanimously expect a no-change decision. Most economists don’t expect the RBNZ to make any major changes to its hawkish commentary, despite signs of downside risks to growth.

- Net migration is also on Wednesday, with its release before the RBNZ decision.

- A majority of Shadow Board members recommended the RBNZ keep the OCR at 5.5% this week according to NZIER.

- RBNZ dated OIS pricing is slightly mixed across meetings today. A cumulative 35bps of easing is priced by year-end.

- Swap rates closed 3-5bps lower, with the 2s10s curve flatter.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 3.0% Apr-29 bond, NZ$225mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

NZ STIR: RBNZ Dated OIS Pricing 35bps of Easing Ahead Of Wednesday’s RBNZ Policy Meeting

RBNZ dated OIS pricing is slightly mixed across meetings today. A cumulative 35bps of easing is priced by year-end.

- The local calendar is light until the RBNZ’s Policy Decision on Wednesday.

- Economists surveyed by Bloomberg unanimously expect a no-change decision. Most economists don’t expect the RBNZ to make any major changes to its hawkish commentary, despite signs of downside risks to growth.

- Net migration is also on Wednesday, with its release before the RBNZ decision.

- A majority of Shadow Board members recommended the RBNZ keep the OCR at 5.5% this week according to NZIER.

Figure 1: RBNZ Dated OIS Pricing (%)

Source: MNI – Market News / Bloomberg

FOREX EUR Recoups Most Early Losses, Broader USD Indices Close To Unchanged

Broader USD indices sit little changed in the first part of Monday dealings. The BBDXY last around 1260.2.

- Early focus was on EUR/USD weakness, following the surprise French legislative election results, with the left New Popular Front (NFP) unexpectedly winning the most seats but not enough to have a majority. A hung parliament is now likely. The pair fell close to 1.0800, but has largely unwound these losses, last near 1.0830, which is close to end Friday levels of 1.0840.

- USD sentiment has been softer during parts of today, but there has been no follow through. USD/JPY got to lows of 160.26, but sits back at 160.55/60 in latest dealings, only down marginally for the session.

- Earlier data showed weaker than expected headline labour earnings data in Japan, with real earnings remaining comfortably negative. Still, the detail, and same sample based data pointed to more positive trends (see this link).

- US yields are higher but away from best levels, last a little up over 1bps for the Tsy benchmarks. This leaves the bulk of Friday's yield losses intact. US-JP yield differentials continue to track lower.

- In the equity space, most regional markets are lower, while US futures are a little over 0.10% off at this stage.

- AUD/USD and NZD/USD both sit a tough higher, with both pairs supported on dips. AUD/USD last near 0.6750/55, NZD near 0.6150.

- Looking ahead, US May consumer credit and June NY Fed inflation expectations and German May trade data are due. Also BoE’s Haskel speaks.

ASIA STOCKS: China & HK Equities Head Lower Ahead Of Third Plenum

Chinese and Hong Kong equity markets are lower today with the Hang Seng China Enterprises Index nearing a technical correction after falling as much as 1.6%. The CSI 300 Index has declined for the fifth straight day, continuing its longest losing streak since early 2012. Investors are cautious ahead of a key meeting of China's top leaders and are not expecting any major stimulus announcements. Geopolitical uncertainties and a patchy economic recovery are further dampening sentiment, with major indices such as the MSCI China Index and Hang Seng Tech Index already in correction territory.

- Hong Kong equities are lower today, the HSTech Index is down 0.25%, Property indices are struggling this morning with the Mainland Property Index off 1.37% today, while the HS Property Index is down 1.34%, the wider HSI is off 1.16%.

- China equity markets are faring slightly better than Hong Kong equities. The CSI 300 is currently down 0.40%, while small-cap indices the CSI 1000 is down 1.30% the CSI 2000 is down 1.80% while the growth focus ChiNext is down 0.56%.

- China's central bank did not buy gold for a second consecutive month in June, maintaining reserves at 72.8 million troy ounces, following an 18-month buying spree that contributed to record-high gold prices. Analysts expect purchases to resume as China diversifies its reserves amid geopolitical and financial risks, despite recent declines in gold prices from its May peak.

- Country Garden delivered 154,500 units from January to June 2023, according to a statement on its website. Chairwoman Yang Huiyan emphasized that the company's primary focus for the second half of the year will remain on ensuring the delivery of homes. Hong Kong developers New World and Far East Consortium are selling apartments in The Pavilia Forest I at the lowest price in eight years for the Kai Tak district, at an average of $2,200 sq foot. This pricing represents nearly a 30% discount compared to other projects in the area. The developers face challenges in quickly selling units amid high inventory and competition, as high borrowing costs have deterred homebuyers despite the removal of extra taxes earlier this year.

- Looking ahead we have China CPI & PPI are expected on Wednesday.

ASIA PAC STOCKS: Asian Equities Mixed, Japan's Real Wages Continue Decline

Asian equities are mixed today, following weaker US employment figures. Investors are also focused on upcoming central bank decisions and key economic data from the US and China later this week. Tech stocks are the top performing sector, especially TSMC which is trading up 3%. The data calendar is light on in the region today, with market largely focus on the French elections.

- Japanese stocks are lower today, with the Topix falling 0.29% while the Nikkei 225 edged up by 0.2% despite a decline in real wages for the 26th consecutive month due to a weaker yen and higher import costs. The drop was influenced by softer US employment figures and profit-taking by ETF managers to secure dividends. Hitachi contributed significantly to the decline, decreasing by 2.3%. Additionally, Nippon Paint and Rakuten Group saw notable declines due to anticipated outflows following the Topix index rebalance. Investors are cautious ahead of key economic data and central bank decisions later this week.

- South Korean equities initially opened higher this morning, however have pared gains. Hopes of a US rate cut has supported markets, tech and autos have been the top performing names while Financials have underperformed. The Kospi is unchanged, while the Kosdaq is up 1.10%.

- Taiwanese equities are higher today, most of the index moves can be attributed to the 3% rise in TSMC. Focus will turn to Trade Balance data due out tomorrow afternoon. The Taiex is currently trading up 1.68%.

- Australian equities are lower this today, the decline is primarily driven by weakness in iron ore miners such as BHP and Rio Tinto, as well as financial shares. A significant slump in iron ore prices has added to the pressure, setting the market further behind global peers ahead of crucial US inflation data later this week. Despite a strong lead from Wall Street, Australian equities continue to underperform due to concerns over Chinese demand and signs of oversupply in the iron ore market. The ASX200 is down 0.70%.

- Elsewhere, New Zealand equities are 0.76% lower, Indonesian equities are unchanged Singapore equities are 0.22% lower, Malaysian equities are down 0.35%, while Philippines equities are up 0.65%.

ASIA EQUITY FLOWS: Asia See Strong Equity Inflows To End The Week

- South Korea: South Korean equities saw inflows of $985m Friday, contributing to a net inflow of $1.305b over the past five trading days. The 5-day average inflow is $261m, higher than the 20-day average of $203m and the 100-day average of $135m. Year-to-date, South Korea has experienced substantial inflows totaling $18.433b.

- Taiwan: Taiwanese equities had inflows of $256m Friday, contributing to a net inflow of $351m over the past five trading days. The 5-day average inflow is $70m, lower than the 20-day average of $101m but higher than the 100-day average of $33m. Year-to-date, Taiwan has accumulated inflows of $4.733b.

- India: Indian equities experienced inflows of $660m Thursday, contributing to a net inflow of $953m over the past five trading days. The 5-day average inflow is $191m, lower than the 20-day average of $255m but significantly higher than the 100-day average outflow of $-28m. Year-to-date, India has seen net inflows of $1.117b.

- Indonesia: Indonesian equities recorded inflows of $34m Friday, with a net inflow of $161m over the past five trading days. The 5-day average outflow is $-32m, close to the 20-day average inflow of $6m and the 100-day average outflow of $-7m. Year-to-date, Indonesia has experienced outflows totaling $-266m.

- Thailand: Thai equities saw inflows of $46m Friday, resulting in a net outflow of $-23m over the past five trading days. The 5-day average outflow is $-5m, close to the 20-day average of $-40m and higher than the 100-day average outflow of $-25m. Year-to-date, Thailand has seen significant outflows amounting to $-3.253b.

- Malaysia: Malaysian equities experienced inflows of $18m Thursday, contributing to a 5-day net inflow of $109m. The 5-day average inflow is $22m, higher than the 20-day average of $1m and the 100-day average outflow of $-3m. Year-to-date, Malaysia has experienced outflows totaling $-91m.

- Philippines: Philippine equities saw a small -$0.19m outflow on Friday, with a 5-day net inflow of $4.3m. The 5-day average is $1m, less than the 20-day average outflow of $-3m and the 100-day average outflow of $-6m. Year-to-date, the Philippines has seen outflows totaling $-523m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 985 | 1305 | 18433 |

| Taiwan (USDmn) | 256 | 351 | 4733 |

| India (USDmn)* | 660 | 953 | 1117 |

| Indonesia (USDmn) | 34 | 161 | -266 |

| Thailand (USDmn) | 46 | -23 | -3253 |

| Malaysia (USDmn) * | 18 | 109 | -91 |

| Philippines (USDmn) | 0 | 4.3 | -523 |

| Total | 2000 | 2862 | 20150 |

| * Up to 4th July |

OIL: Crude Off Intraday Lows, Hurricane Beryl Threat To Texan Refining

Oil prices are down today but off the intraday lows as Hurricane Beryl approaches Texas. WTI is down 0.3% to $82.94/bbl after breaking below $83 earlier today and falling to $82.71. It reached $83.32 early in the session. Brent is 0.1% lower at $86.43 off the low of $86.27 which followed a high of $86.92. The USD index is flat.

- Tropical Storm Beryl has been reclassified as a hurricane again and is forecast to make the Texan coast today, possibly impacting coastal refining and shipping facilities, which would reduce crude demand. Exxon Mobil only sees a small impact on its output from Beryl. Shell’s Perdido platform was in the path of the storm and was shutdown and evacuated by July 4. Shell has 20.9kbd in US offshore waters.

- In the north, fires threaten Alberta’s oil fields again.

- Market indicators continue to signal bullish sentiment with money market net longs up for the fourth consecutive week and the Brent prompt spread in backwardation, according to Bloomberg. Risks from nature and signs of robust US demand from last week’s EIA inventory report have boosted confidence.

- The market will be focusing on this week’s monthly reports from OPEC (Wednesday), EIA (Tuesday) and IEA (Thursday) as well as US June CPI (Thursday).

- Later there are US May consumer credit and June NY Fed inflation expectations and German May trade data. BoE’s Haskel speaks.

GOLD: Sharply Higher Following US Payrolls Data

Gold is 0.4% lower in the Asia-Pac session, after closing 1.5% higher at $2392.16 on Friday following weaker-than-expected US labour market data. Friday’s move took the gain last week to 2.7%.

- US Treasury yields declined following weaker-than-expected labour market data led by the front end. The 10-year yield fell 8bps to 4.28%, ending the week at the yield lows. The 2-year finished 10bps richer at 4.60%, the lowest since late March.

- US Treasury yields briefly gapped higher in response to mildly higher than expected June jobs gain of +206k vs. +190k est but quickly reversed course, extending session lows after prior jobs data was down-revised. Two-month -111k, split evenly over May and April. Private sees surprises lower though, 136k (cons 160k) and a -86k two-month revision skewed slightly to April.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- From a technical perspective, gold continues to trade inside a range for now. A clear break of initial firm resistance at $2,387.8, the Jun 7 high, would be a bullish development. Key resistance is at $2,450.1, the May 20 high.

- Silver was also up by ~3% on Friday, leaving the precious metal 7.7% higher on the week.

ASIA SOVS: INDON/PHILIP Sovs Tighten Through the Front-End

Asian EM Sovs have seen better buying through the belly of their curves today, yields are flat to 5bps lower. Expectations of lower US rates are fueling the moves in EM sovs today.

- The INDON curve has seen better buying in the 7yr tenor, and currently trade about 5bps lower, while the PHILIP curve has seen better buying in the 10-15yr tenors although the curve has underperformed the INDON curve today.

- ID-US & PH-US spread diffs have tighten about 15bps through the front-end over the past week

- Local currencies continue to trade near yearly lows, with the IDR at 16,262, while the PHP is trading at 58.11.

- Indonesia's Consumer Confidence Index dropped to 123.3 in June from 125.2 in May, reflecting decreased consumer optimism. The Current Economic Condition Index fell to 112.9 from 115.4, and the Consumer Expectation Index slipped to 133.8 from 135. The Job Availability Index declined to 106.8 from 113.6, while the Current Income Index rose to 120.8 from 119.9.

- The Philippines' unemployment rate increased slightly to 4.1% in May from 4% in April, according to preliminary data from the Philippine Statistics Authority. This is a decrease from 4.3% in May 2023 and matches the consensus forecast. The number of unemployed persons in May was 2.11 million, down from 2.17 million a year ago. The employment rate was 95.9% in May, slightly lower than April's 96%.

- Today, we have Indonesian Finance Minister & BI Government speaking

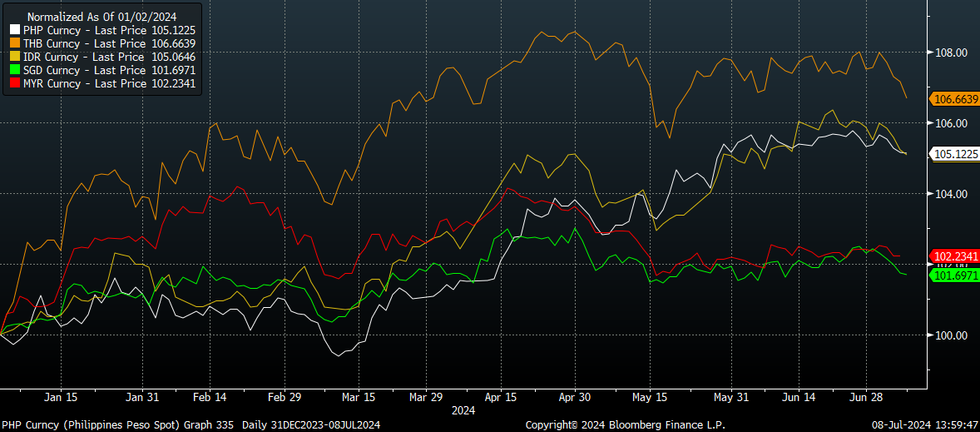

PHP FX: USD/PHP Lagging Other USD/Asia Pairs Today, But Broader Trend In Line With High Yielders

USD/PHP sits in the 58.50/55 region in recent dealings, little changed for the session. This is lagging a modestly softer USD trend seen in terms of other USD/Asia pairs.

- For USD/PHP we are sub the 20-day EMA, (around 58.61), but the 50-day EMA is further south at 58.18. recent highs rest around 58.93.

- Earlier headlines cross from BSP Governor Remolona, which stated an August rate cut was possible and that the central bank can cut ahead of the Fed (per BBG). This follows Friday's slight downside surprise in terms of the June CPI print.

- Sell-side analysts expect cuts from the BSP in H2, with increased risks they are bought forward after Friday's data.

- This has the potential to weigh on PHP all else equal, although softer USD data momentum has risen US easing odds for H2 in recent weeks. This is likely curbing USD gains to a degree.

- More broadly for USD/PHP, the pair is generally in sync with the other high yielder trend in the region in terms of IDR, since the start of this year (the yellow line on the chart). The chart below plots South East Asia currencies since the start of the year (rebased to 100), USD/PHP is the white line.

- On the data calendar this Wednesday we have May trade figures.

Fig 1: South East Asia FX USD/Asia Pairs (Start Of 2024 = 100)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 08/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/07/2024 | 1615/1715 |  | UK | BoE Haskel at ESCoE | |

| 08/07/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.