-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

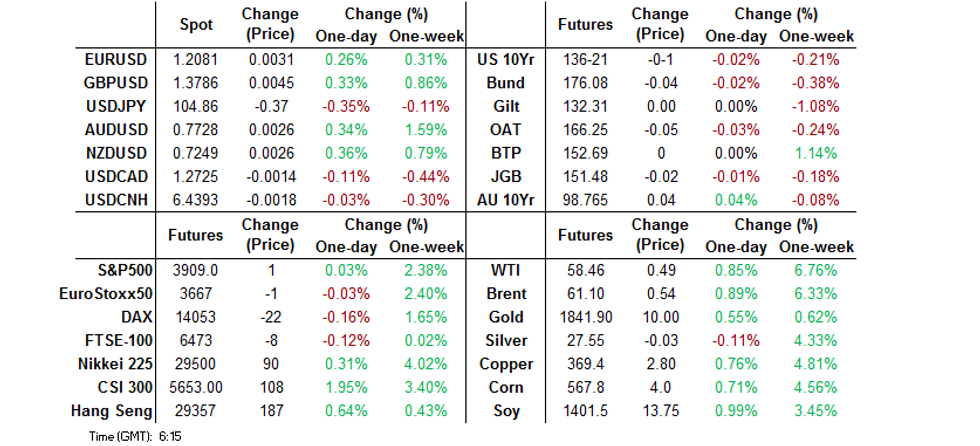

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Adds To Monday's Losses In Asia

- Nothing in the way of notable macro headline flow and a downtick in U.S. Tsy yields allow the DXY to extend on Monday's losses, with crude oil and gold bid in Asia.

- The PBoC continues to implement prudent tweaks to liquidity ahead of the Lunar New Year break.

- U.S. President Trump's impeachment trial gets underway today, although that is expected to be more of a spectacle than a market mover.

BOND SUMMARY: Pre-LNY Feeling, Aussie & U.S. FI Bid

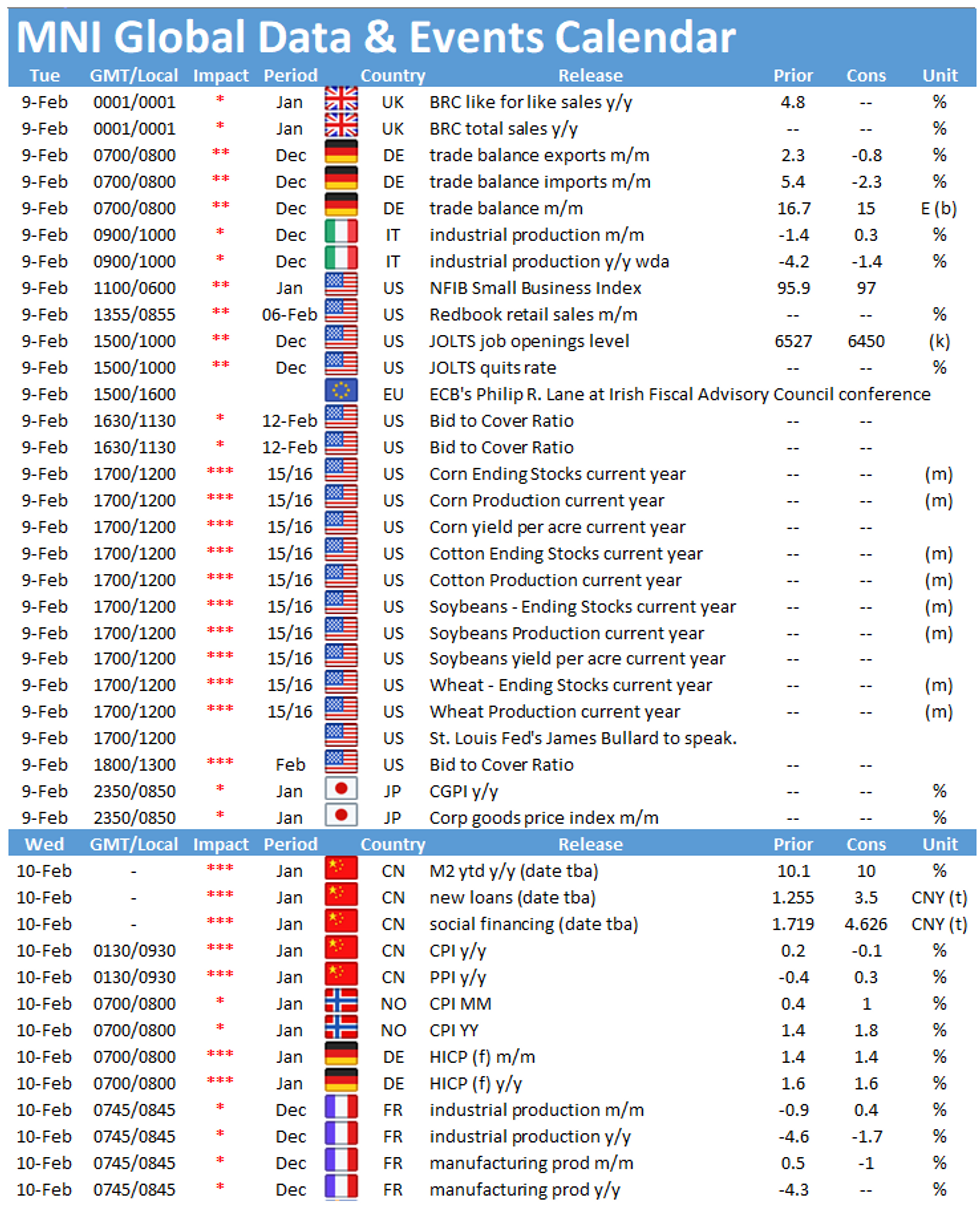

The pre-LNY feel was well and truly in play in the core FI space during Asia-Pac hours, with some light bull flattening witnessed in cash Tsys after 30s failed to make a meaningful break above 2.00% on Monday, with the pullback from intra-day cheaps seemingly resulting in some steepener unwinds after fresh multi-year highs for the 5-/30-Year yield spread. 30s sit ~2.0bp richer on the day at typing, while T-Notes have held to a 0-03 range in overnight trade, last -0-00+ at 136-21+, with limited flow apparent, as that contract operates on <75K of volume ahead of European hours. This week's coupon Tsy supply kicks off today, with 3-Year issuance due. Elsewhere, we will hear from Fed's Bullard, while NFIB small biz optimism and JOLTS job opening data is due.

- JGB futures softened during the Tokyo afternoon, going out 2 ticks softer on the day, after an early, shallow look above the overnight range faded. Cash trade saw some marginal underperformance for the longer end and 5-Year zone for most of the day, although none of the signs of foreign swap payers evident, as the recent LCH/JSCC 30-Year swap spread widening flattened out. The latest round of BoJ Rinban ops saw purchase sizes left as they were, while the offer/cover in the 25+ Year ops moderated. Elsewhere, we learnt that the Japanese cabinet has decided to spend a little over Y1.1tn of its emergency reserves to fund measures to deal with COVID-19.

- Sydney trade has seen some curve flattening, with YM unch and XM +4.0 come the bell, with no outright sign of hedging pressure around the time of pricing SAFA's '34 issuance, which headlined an active day for Semi & SSA issuance. Swaps generally lagged the move in ACGBs, with spreads unchanged to wider across the curve. The latest local NAB business survey saw an uptick in the confidence metric, although the current conditions index moderated, with the survey collator noting that "given conditions remain above average, notwithstanding the fall this month, and lead indicators continue to trend higher, the survey continues to point to an ongoing recovery." Westpac consumer confidence data and A$1.0bn of ACGB 1.00% 21 November 2031 supply headline locally on Wednesday.

FOREX: Regional Data Supports Antipodeans, USD Extends Losses

The Antipodeans firmed up in thin pre-LNY trade, with little of note in the way of fresh headline catalysts. AUD was aided by the improvement in NAB Business Confidence, while NZD caught a bid after the RBNZ released its inflation expectations, which recovered to levels last seen before the onset of the Covid-19 pandemic. NZD/USD rallied to its best levels in a month, looking past the reinstatement of LVR restrictions by the RBNZ & FinMin Roberson's 2021 Budget Policy Statement.

- Commodity FX space drew further support from better crude oil prices, as Brent consolidated above the $60 level. That being said, CAD moved out of sync with its high-beta peers and landed near the bottom of the G10 scoreboard.

- USD underperformed amid continued optimism surrounding U.S. fiscal matters. The DXY approached its 50-DMA but failed to test the level as of yet.

- JPY traded on a slightly firmer footing, even as a contact flagged USD/JPY demand out of Tokyo ahead of the open. USD/JPY extended its recent losses and sank below the Y105.00 mark.

- The PBOC fixed USD/CNY at 6.4533, around 10 pips above sell side estimates, PBOC injected a net CNY 30bn. Offshore yuan has continued to gain in Asia on Tuesday after the PBOC helped reassure markets saying its policies would remain stable yet flexible in its quarterly monetary policy report.

- Focus turns to German trade balance, Italian industrial output as well as comments from ECB's Visco & Lane and Fed's Bullard.

FOREX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-55(E511mln), $1.2000(E853mln), $1.2050(E644mln), $1.2090-1.2100(E544mln), $1.2160-75(E591mln)

- USD/JPY: Y105.00-10($699mln)

- USD/CAD: C$1.2960($1.2bln)

- AUD/CAD: C$0.9860(A$640mln-AUD puts)

- USD/CNY: Cny6.4325-45($812mln), Cny6.45($781mln), Cny6.50($2.1bln), Cny6.55($1.2bln)

ASIA FX: Most Asia EM Currencies Gain On Stimulus Hopes

The greenback extended its losses for a second session, while general risk on tone saw most EM FX gain. Volumes were thin as markets approach the LNY holiday.

- CNH: Yuan gained, the PBOC helped reassure markets saying its policies would remain stable yet flexible in its quarterly mon pol report. The PBOC fixed USD/CNY at 6.4533, around 10 pips above sell side estimates, PBOC injected a net CNY 30bn.

- TWD: Taiwan dollar gained after data yesterday showed exports rose for the seventh consecutive month thanks to bumper electronics demand.

- KRW: Won is higher, boosted by reports that AstraZeneca will start delivering the first batch of its COVID-19 vaccine to South Korea starting from Feb. 24, and the inoculation programme will begin in Feb. 26.

- INR: Rupee gained, supported by a robust bid tone in domestic equity markets.

- IDR: Rupiah inched higher, Indonesia's consumer confidence index issued by BI deteriorated to 84.9 from 96.5, following the re-imposition of social restrictions in Java and Bali. Indonesia also extended its border closure for foreigners by two weeks, through Feb 22.

- MYR: Ringgitt strengthened for a second day, supported by the upside in oil markets.

- PHP: Peso was broadly flat and moved within a tight range amid a lack of catalysts. Markets await details on further bond sales after additional stimulus was all but ruled out yesterday.

- THB: Baht is higher, gov't spokesman said that China informed PM Prayuth that it is ready to begin exports of Sinovac Covid-19 vaccines to Thailand. Dep PM Anutin said that the Thai drug regulator is expected to approve the jabs when the first shipment of 200,000 doses arrives later this month.

ASIA RATES: Issuance Success And Shenanigans

Thin volumes and fairly muted moves are the name of the game heading into LNY. Broad risk on tone was evident in Asia as markets assess hopes for a US stimulus deal.

- CHINA: The PBOC helped reassure markets saying its policies would remain stable yet flexible in its quarterly mon pol report, a net CNY30bn OMO injection also helped assuage some fears. Overnight repo rates fell around 15bps to 1.75%.

- INDONESIA: Cash yields are mostly higher, selling heaviest in the belly. The finance ministry sold sukuk bonds and received bids for IDR 26.1tn against an indicative target of IDR 12tn.

- SOUTH KOREA: MOF conducted its first 2-year auction, the sale was strong and sparked some buying in the short end which helped steepen the curve slightly. Futures are within yesterday's range but higher on the day despite the broad risk on tone in the region.

- INDIA: Sovereign Indian bonds decline after the increase in weekly debt supply overshadowed the RBI's debt-purchase support announcement. There will be two additional auctions held this week on Thursday and Friday.

EQUITIES: Asia Stocks Gain After Another Day Of Record Highs In US Markets

Most indices in the Asia-Pac region are higher, following another positive lead from the US where major indices hit record highs. The mood is broadly positive with risk assets supported as the US inches towards a bumper stimulus plan.

- Equity markets in Australia were the exception, following a sharp move higher yesterday. Volumes across Asia-Pac have been thin as head into LNY holidays; several markets are closed today with others closed or having truncated session's tomorrow.

- Higher oil is helping to support the energy sector across markets in Asia, the rally continues with brent now consolidating above $60/bbl.

- In the US equity futures are hovering around neutral levels, holding yesterday's gains.

GOLD: Adding To Monday's Gains

Bullion has drawn support from the lower USD and flat to softer U.S. real yields witnessed over the last 24 hours or so, last dealing a little over $10/oz firmer vs. Monday's close and ~$25/oz better off week to date. From a technical standpoint bulls now look for a break above some of the shorter- to medium-term EMA's before turning their focus higher.

OIL: Crude Keeps Climbing

Crude futures continue to rally, breaching the highest levels since May 2019. WTI & Brent sit ~$0.50 better off at present.

- The mood is positive in Asia-Pac trade with risk assets supported as the US inches towards a bumper stimulus plan.

- Contrary to yesterday where Vitol and Gunvor sounded a cautious note on oil markets, Trafigura said it sees prices moving even higher as refiners increase processing rates to meet rising demand.

- Meanwhile, market participants are looking for fresh cues on supply dynamics in the upcoming inventory reports from the API, due later today, and the US DOE, due on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.