-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Equity Gains Aid Risk Appetite, NFP Coming Up

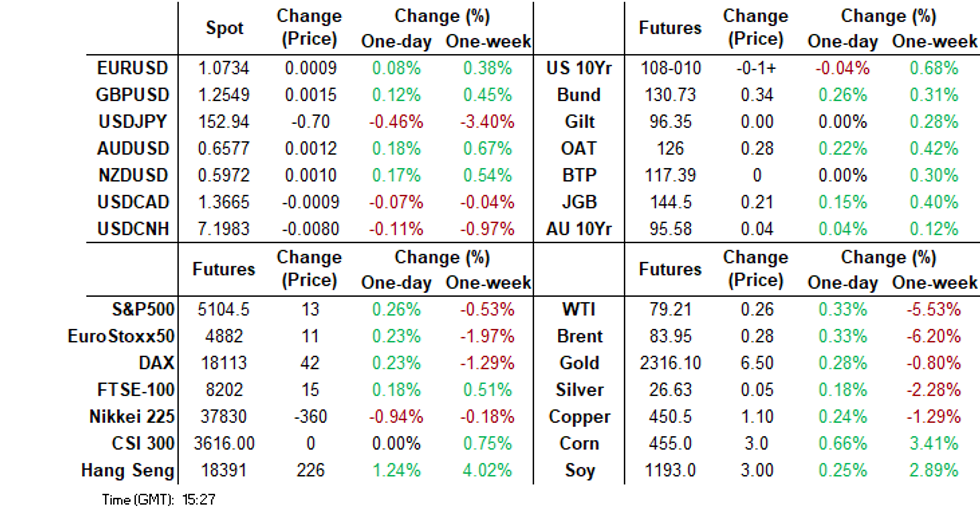

- Japan and China markets have been out today, which has impacted liquidity and seen no cash US Tsy trading. For Tsy futures, TYM4 is trading at 108-10, -0-01+ from NY closing levels, near of the top of today’s relatively narrow Asia-Pac range.

- We have seen further USD weakness, led by the yen. USD/JPY is testing sub 153.00, while USD/CNH is near its 200-day EMA support point.

- A stronger equity backdrop is weighing on the USD more broadly. Hong Kong markets continue to rally.

- Looking ahead, we have the US non-farm payroll print. Before that focus is likely to rest on the Norges rate decision in Norway.

MARKETS

US TSYS: Futures In A Holding Pattern Ahead Of Non-Farm Payrolls

TYM4 is trading at 108-10, -0-01+ from NY closing levels, near of the top of today’s relatively narrow Asia-Pac range. Today’s high remains below Thursday’s intra-session high. News flow has been light.

- There has been no cash trading in Asia today with Japan out for observance of the Constitution Memorial Day holiday.

- After shrugging yesterday’s higher-than-expected Unit Labor Costs and slightly lower than expected Initial Jobless Claims, the market’s focus has turned to Non-Farm Payrolls later today.

- Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. Markets will be mindful of household survey volatility but with continued focus on immigration-driven supply side strength, the u/e rate should help guide on broader labour market balance. At 3.83% in March, it doesn’t take much to move closer to the FOMC’s 4.0% end-2024 forecast.

- AHE growth is seen settling in at 0.3% M/M pace again although a few analysts caution potential downside risks from calendar effects.

- See MNI US Payrolls Preview: Fed Sensitive To An Unexpected, Meaningful Weakening here.

AUSSIE BONDS: A Typical Pre-Payrolls Friday, RBA Policy Decision On Tuesday

ACGBs (YM +2.0 & XM +4.0) are holding richer after dealing in narrow ranges in today’s Sydney session. Today’s data drop was second-tier and offered little in the way of market-moving potential.

- All eyes were on US tsys after they extended their post-FOMC rally yesterday ahead of US Non-Farm Payrolls data later today. Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. There has been no cash trading for US tsys in Asia today due to a holiday in Japan.

- Cash ACGBs are 3-4bps richer with the AU-US 10-year yield differential at -17bps.

- Swap rates are 3-4bps lower.

- The bills strip bull-flattened, with pricing flat to +4.

- The local market’s focus next week will be the RBA Policy Decision on Tuesday. 23 of the 24 economists surveyed by Bloomberg are expecting the cash rate to be left at 4.35%. The more contentious issue is whether the RBA reinstates its explicit tightening bias.

- RBA-dated OIS pricing is little changed across meetings, with the market pricing a 39% chance of a 25bps hike by September.

- (AFR) The RBA might not achieve its inflation target for at least two years without raising rates further unless Treasurer Jim Chalmers uses the coming budget to cool the economy, economists warn. (See link)

NZGBS: Richer But Subdued Trading Ahead Of US Payrolls Later Today

NZGBs closed 4-6bps richer and near the session’s best levels. With the domestic calendar light, today was a typical subdued pre-US payroll session. After the early richening induced by the US tsys’ extension of its post-FOMC rally, ranges were relatively narrow.

- Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. Markets will be mindful of household survey volatility but with continued focus on immigration-driven supply-side strength, the u/e rate should help guide on broader labour market balance. At 3.83% in March, it doesn’t take much to move closer to the FOMC’s 4.0% end-2024 forecast.

- Swap rates are 4-6bps lower.

- RBNZ dated OIS pricing is 3-4bps softer for meetings beyond October. A cumulative 42bps of easing is priced by year-end.

- The local calendar is relatively light next week, with ANZ Commodity Prices on Monday, the Government’s 9-Month Financial Statements on Tuesday and BusinessNZ Manufacturing PMI next Friday.

- Across the Tasman, the RBA delivers its Policy Decision on Tuesday, with 23 of the 24 economists surveyed by Bloomberg expecting the cash rate to be left at 4.35%. The more contentious issue is whether the RBA re-states its explicit tightening bias.

AU STIR: RBA Dated OIS Has Undergone A Significant Reassessment Since Last RBA Meeting

Since the mid-March RBA Policy Meeting, RBA-dated OIS pricing has undergone a significant reassessment.

- Initially, expectations of easing by year-end had been moderated in tandem with a reduction in anticipated Fed easing, a trend that persisted until this week's FOMC meeting.

- However, the most significant catalyst for the shift in the Australian market was the release of the Q1 CPI figures in late April, which surpassed expectations.

- After the Q1 CPI data release, the anticipated year-end cash rate level rose notably, and so did the expected terminal rate. Before Q1 CPI, the expected terminal rate hovered around the existing cash rate of 4.35%. This outlook was reinforced by the removal of the RBA's explicit tightening bias at the March Policy Meeting.

- Presently, the market is pricing approximately 3bps of easing from an anticipated terminal rate of 4.42%.

- While some market analysts anticipate the RBA to resume its tightening cycle in the coming months, former RBA staffers have told MNI that whether the RBA will need to increase rates again to pull inflation back to target without impacting its already generous timeline remains debatable. (See MNI link)

Figure 1: RBA-Dated OIS Expectations: Terminal Rate Versus End-24

Source: MNI – Market News / Bloomberg

FOREX: Dollar Index Drifts Lower Ahead Of US NFP, Yen Up Around 3.5% This Week

The BBDXY USD index sits lower for the first part of Friday trade, last near 1253.00, off around 0.10% versus end Thursday levels in NY.

- All of the G10 bloc is firmer against the USD, albeit away from best levels, as the key US NFP print comes into view.

- USD/JPY got to fresh lows of 153.76, but we now sit back near 153.95, still around 0.45% stronger in yen terms. Japan markets are closed today (and on Monday), but given this week's tendency for intervention to happen during lighter liquidity periods, there is likely to be some degree of caution for the market.

- Key levels to watch on the downside in the near term would be the 50-day EMA near 152.40.

- Yen is up around 3.5% so far this week, its best gain since Nov 2022.

- AUD and NZD are both higher, but gains are less than 0.1% at this stage. AUD/USD was last near 0.570, NZD/USD in the 0.5965/70 region.

- The positive tone to US equity futures and regional equities has likely helped sentiment, but follow through USD selling has been limited against both currencies.

- US Tsy futures have drifted higher, but Thursday late NY session highs remain intact.

- Looking ahead, we have the US non-farm payroll print. Before that focus is likely to rest on the Norges rate decision in Norway.

JPY: Intervention Drives Weekly Gain, Relative Monetary Policy Settings Key Long Term Driver

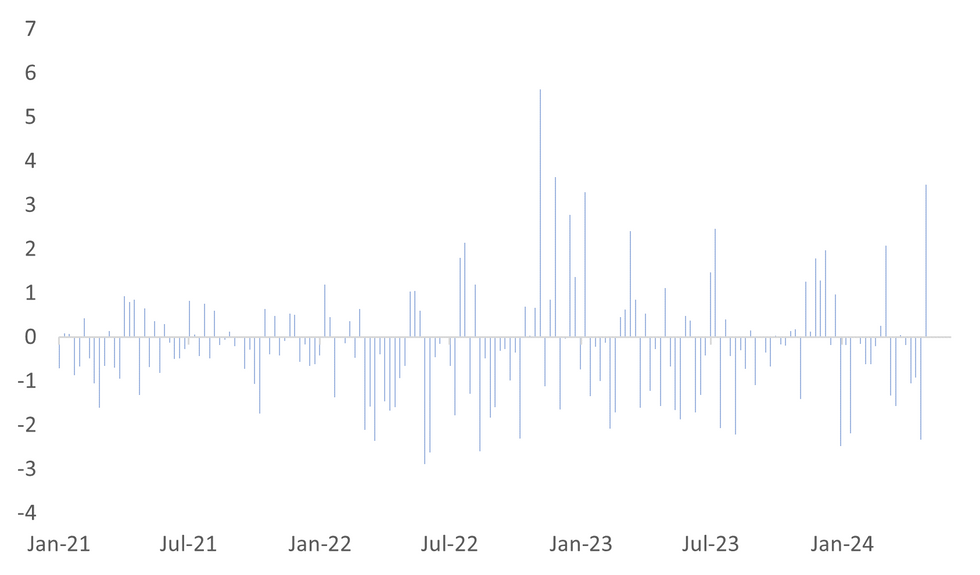

Yen gains for the past week against the USD now stand around 3.5%. This is the best weekly gain since Nov 2022, see the first chart below, as the authorities stepped in to curb yen weakness (post Monday's break above 160.00).

- Short term focus is likely to rest on whether we can see a test of the 50-day EMA at 152.39. We are already comfortably sub the 20-day EMA, at 154.58, which has highlighted the risks of a corrective cycle lower in the pair. Note that trendline support drawn from the Dec 28 low, lies at 151.05.

- Intervention estimates for this week stand at similar to those seen in 2022 (see this link). This is not to say further intervention is unlikely. The authorities have demonstrated a preference to intervene during lighter liquidity periods this past week (see this link). Japan markets are closed today and Monday so a further opportunity may present itself.

Fig 1: Yen Weekly Rate Of Change

Source: MNI - Market News/Bloomberg

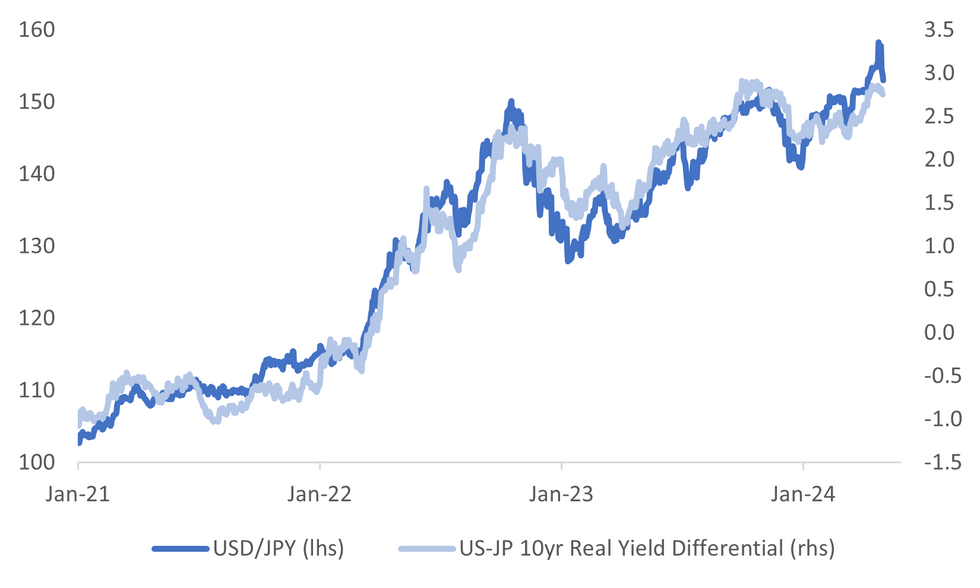

- Longer term trends for USD/JPY are still likely to be dictated by relative monetary price trends between the US and Japan. The second chart below overlays USD/JPY against the real 10yr interest rate differential.

- This week's dovish lean by the Fed has taken US yields off recent highs, although we are only just off cycle highs. The US leg of this spread will continue to dictate the overall direction, given the BoJ's likely moderate tightening cycle.

- The next litmus test will be tonight's US NFP report (see our preview here). The US Citi surprise index has tracked down sharply in the second half of April, suggesting some softening data momentum in the US. We are back close to 2024 lows for this index, although still in positive territory.

Fig 2: USD/JPY & US-JP Real 10yr Yield Differential

Source: MNI - Market News/Bloomberg

EQUITIES: Positive Spillover From US Gains, Hong Kong Rally Continues

The tone for regional equities has been positive as we approach the end of the week. China remains closed until Monday, while Japan markets don't return until next Tuesday. Still, the carry over from a positive US session on Thursday, coupled with higher futures today has been a clear positive. Apple's beat (plus large share buyback) has helped push Nasdaq futures up 0.60%. Eminis were last +0.30% firmer.

- Hong Kong equities continue to rally. The HSI up a further 1.13% to the break. We had very strong gains for the Golden Dragon index in US trade (over 6%) and a closely tracked China related ETF. The HSTECH is up a further 2.0% so far today, tracking up +6% for the week.

- Attractive valuations, particularly in the tech space, is aiding sentiment, while hopes of further policy support in the aftermath of the recent Politburo meeting is another contributor.

- Technically though the HSI is now in overbought territory based off the RSI (14)

- Elsewhere, sentiment has been better in Taiwan markets, aided by the positive tech backdrop. The Taiex up around 0.70% at this stage. The Kospi is posting a more modest 0.2% gain at this stage, unable to retake the 2700 level.

- Australia's ASX 200 is +0.50% firmer. In SEA all markets are firmer today, except for the Philippines, gains are under 0.50% at this stage though.

OIL: Stabilizing But Still Down Sharply For The Week

Brent crude sits just under $84/bbl in recent dealings, slightly higher for the session, but still comfortably lower for the week. At this stage we are tracking down 6.2% for the week for the front month Brent contract. WTI was last near $79.25/bbl, off by around 5.5% so far this week.

- Brent is up from recent lows near $83/bbl, but sub all key EMAs. The 200-day juat above $84.10/bbl is the closest, while the 20-day sits back above $87/bbl.

- The softer USD tone amid dovish Fed leanings has helped stabilize sentiment in the latter stages of this week, but reduced conflict risks in the Middle East have seen some geopolitical risk premium come out of prices. Wires reported on Thursday that Hamas have agreed with Qatar to continue talks on a truce in Gaza.

- There are also signs of less gasoline demand as we approach the US summer driving season (per BBG).

GOLD: Sitting 5% Below Its Recent All-Time High Ahead OF US Payrolls

Gold is slightly lower in the Asia-Pac session, after closing 0.7% lower at $2303.83 on Thursday.

- The price of the yellow metal has declined by approximately 5% since reaching its peak in mid-April.

- Thursday's movement partly counteracted the 1.5% surge triggered by comments from Fed Chair Powell and the FOMC statement, which were perceived as less hawkish than anticipated.

- As US Treasuries extended their post-FOMC rally, the reversal in bullion's price suggests that Wednesday's movement might have been an overreaction.

- The market’s focus now turns to US Non-Farm Payrolls later today. Bloomberg consensus sees nonfarm payrolls growth of 241k in April after another strong 303k in March. See MNI US Payrolls Preview: Fed Sensitive To An Unexpected, Meaningful Weakening here.

- According to MNI’s technicals team, gold again breached initial support at $2291.6, the Apr 23 low. A continuation lower would signal scope for an extension towards $2245.2, the 50-day EMA.

CNH: USD/CNH Can't Sustain 200-day EMA Break, Onshore Mkts Return On Monday

USD/CNH got to lows near 7.1950 in Thursday US trade. We sit slightly higher now, tracking near 7.2050 in the first part of Friday dealing. Intra-session lows from Thursday came under the 200-day EMA (which sits near 7.1990). The pair hasn't sustainable been sub this support point since the earlier part of 2024, see the chart below. On the topside, the 100-day EMA is back near 7.2250.

- The CNH clearly enjoyed the softer dollar backdrop, as US yields fell. The market seemingly putting more weight on the dovish Wednesday FOMC lean rather than Thursday's firmer US data. Further yen gains were also a clear positive. CNH and JPY correlations (in level terms) still sit at 55% for the past 6 months.

- China markets remain closed until Monday. Focus then will rest on the USD/CNY fixing, which should be aided by the lower USD levels in recent sessions (USD BBDXY off nearly 1% since Tuesday).

- The equity backdrop has also been positive since Hong Kong markets returned yesterday, while the Golden Dragon index surged 6% in Thursday US trade. Attractive tech valuations and hopes of further stimulus to boost domestic demand have been positives.

- The data calendar swings back into gear on Monday with the Caixin services PMI. On Thursday we have April trade figures.

Fig 1: USD/CNH & Key EMAs

Source: MNI - Market News/Bloomberg

ASIA FX: Continues To Rally, Aided By Yen Gains, Firmer Equities

USD/Asia pairs are lower across the board, albeit to varying degrees. USD sentiment has remained softer, and the stronger yen has certainly seen positive spillover to parts of the region. At this stage the KRW and IDR are the strongest performers. USD/CNH is down sharply for the week, although is seeing some support sub its 200-day EMA. Onshore markets in China return on Monday.

- USD/CNH got to lows of 7.1854, btu we sit back closer to 7.2000 in recent dealings 9which is right around 200-day EMA levels). For CNH, yen gains were a clear positive. CNH and JPY correlations (in level terms) still sit at 55% for the past 6 months. Focus will rest on the USD/CNY fixing, when onshore markets return on Monday. which should be aided by the lower USD levels in recent sessions (USD BBDXY off nearly 1% since Tuesday). The equity backdrop has also been positive since Hong Kong markets returned yesterday, while the Golden Dragon index surged 6% in Thursday US trade.

- 1 month USD/KRW got near 1360 in earlier dealings, but we sit slightly higher currently, last around 1362, still close to 0.30% firmer in won terms. Outside of the generally positive equity tones, remarks from BoK Governor have helped at the margins as well. Rhee stated that the central bank will have to review rate-cut timing given the Fed policy pivot delay and geopolitical risks. They are also watching won volatility.

- Elsewhere, IDR is around 0.55% stronger, the rupiah showing is higher beta characteristics. USD/IDR spot last under 16100, just up from session lows. The 1 month NDF has rallied a further 0.35%in IDR terms to 16100.

- USD/THB is also lower, last near 36.80, slightly up from session lows (36.76). We had Thailand CPI data cross the wires earlier. It was stronger than expected at 0.85% m/m, versus 0.48% forecast. The y/y headline was back into positive territory, although core was unchanged at 0.37% y/y. May inflation is expected to accelerate further on power and food prices.

- Elsewhere, USD weakness has been more modest. USD/PHP sits near 57.45/50, only down slightly for the session.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2024 | 0645/0845 | * |  | FR | Industrial Production |

| 03/05/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/05/2024 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/05/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/05/2024 | 1230/0830 | *** |  | US | Employment Report |

| 03/05/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/05/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.