-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: EU Model Suggests Low Recession Risk, UK Election/US July 4 Holiday Ahead

- News flow has been light today, with focus remaining on Biden's election prospects and whether he will stay in the race. A group of Democrat Governors backed the President, but a Bloomberg story stated some Democrat Senators have expressed doubts.

- Early USD impetus was to the downside but there has been little follow through. Treasury futures are little changed today, with cash trading closed for the July 4th Holiday. JGB futures are stronger, after today’s 30-year supply.

- Later the ECB’s Lane and Cipollone speak and the minutes from the June 5-6 meeting are published. The UK election is also held. German May factory orders print.

MARKETS

EU: Estimates Suggest Low Risk Of Recession

Q1 euro area GDP rose 0.3% q/q, the strongest quarter since Q3 2022, and the technical recession in H2 2023 was revised away with now only Q4 posting a small negative. We are now past the time that our probability indicator signaled the chance of a recession was above 50%. The June update is suggesting little chance of a prolonged contraction around the turn of the year.

- The 6-month ahead recession probability indicator estimated since 1985 has been at zero since the end of last year. Real rates, REER and real equity prices, whereas real oil prices and economic sentiment have put upward pressure on the probability.

- Our estimation from 1998, and so includes 3 recessions rather than 4, has had the probability of a recession 6-months ahead at around 30% for the last seven months but that is lower than where it was through H2 2023 and remains below the key 50% level. While a recession is currently improbable, growth is likely to remain soft encouraging further ECB easing. Oil prices and economic sentiment have boosted this estimate.

- It is worth noting that econometric calculations are just estimates and not projections.

MNI - Market News/Refinitiv

US POLITICS: Governors United Behind Biden As Democrats’ Presidential Candidate

President Biden has just held talks with Democratic governors following pressure to stand down after his underwhelming debate performance and the subsequent drop in polls. The meeting statement was clear though that they stand behind him as November’s election candidate and they will do everything they can to win. Minnesota’s Governor Walz said that Biden is fit for office. At this stage, it seems very unlikely that he will step aside.

- PredictIt pricing has also shifted sharply since last week with the chance of Biden winning the November election halving to 24% between June 24 and July 3 and down another percentage point today. Vice President Harris’ chances rose sharply following the debate and are up another 15pp to 45%, 22pp ahead of Biden. Both are well behind Trump on 58%, up 6pp since June 24. The Republicans are still set to win with a 58% likelihood compared with the Democrats’ 45% (+1pp).

- Bloomberg is reporting that some Democratic National Committee delegates want more time before making Biden’s nomination official.

- Walz admitted that “Thursday night was a bad performance … but it doesn’t impact what I believe he’s delivering”.

- Those governors seen as most likely to replace Biden, including Newsom and Whitmer, didn’t comment to the press following today’s meeting.

Source: MNI - Market News/PredictIt

US TSYS: Tsys Futures Edge Lower Ahead of July 4th, Employ Data Friday

- Treasury futures are little changed today, with cash trading closed for the July 4th Holiday. TU is trading -0-00⅞ at 102-04, while TY is slightly underperforming the front-end at -0-05+ at 109-28+.

- Volumes in the front-end are half what they were yesterday with TU 16k and FV 30k while is TY inline with yesterday at 54k.

- The 10y yields remains within the recent downward trend at 4.36%, after reaching recent cycle highs of 4.375% in late April. The VIX is trading just off multi year lows at 12.09, while the BBG US Eco Surprise Index sits at the lowest levels 2015.

- Overnight the US treasury sold $85b four-week bills at 5.28%, and $80b eight-week bills at 5.275%, signally investors are uncertain around the fed interest rate path.

- FOMC Meeting Minutes were also out, with Federal Reserve officials needing no additional signs that inflation is heading back toward their 2% target before considering any interest rate cuts.

- The Fed's Goolsbee emphasized the need for more data before the US central bank can confidently cut interest rates, expressing concerns about the labor market cooling more rapidly than desired.

- The US presidential candidate winning odds have been moving around a bit amid speculation Biden may drop out of the race. Kamala Harris surged to be the favored Democratic nominee earlier, however has since dropped back post the governors meeting. According to PredictIt Republicans are now at a 59% chance of winning, while the Democrats are at 44%

- Looking ahead, today we have July 4th Holiday cash trading to remain closed with futures closing early. Focus will turn to employment data on Friday.

JGBS: Subdued Session, 30Y Auction Shows Less Demand

JGB futures are stronger, 18 compared to settlement levels, after today’s 30-year supply.

- Like Tuesday’s 10-year auction, today’s 30-year supply went smoothly although less demand was seen. The low price beat dealer expectations but the cover ratio decreased to 2.972x from 3.591x in June. The auction tail did however narrow slightly.

- Outside of the previously outlined weekly International Investment Flow data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are closed for the 4th of July holiday. The focus is on the US employment report on Friday.

- Cash JGBs are 1bp richer to 1bp cheaper, with the futures-linked 7-year outperforming and the 40-year underperforming. The benchmark 10-year yield is 1.4bps lower at 1.072%.

- The 30-year is little changed in post-auction dealing at 2.278%.

- The swaps curve has bear-steepened, with rates flat to 2bps higher. Swap spreads are wider.

- Tomorrow, the local calendar will see Household Spending data along with the Leading & Coincident Indices.

JAPAN DATA: Offshore & Local Investors Continue To Sell Bonds

Japan offshore investment flows were mixed in the final week of June. Offshore investors continued to sell local bonds, albeit at a reduced pace compared to the prior week, see the table below. The trend remains for outflows form this space. We saw net outflows in 3 out of 4 weeks in June, while Q2 as a whole saw

-¥3233bn in net outflows. Expectations around higher BoJ tapering bond buying plans may be headwinds for flows in this space.

- Offshore investors purchased local equities to the tune of ¥185.3bn. Net flows for the whole of June were still negative though.

- In terms of Japan outbound flows, we saw local investors continue to sell offshore bonds. June as a whole saw firm selling in this segment and this was the general trend through Q2.

- On the equity front, local investors sold offshore equities last week.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending June 28 | Prior Week |

| Foreign Buying Japan Stocks | 185.3 | -85.4 |

| Foreign Buying Japan Bonds | -130.9 | -1606.1 |

| Japan Buying Foreign Bonds | -254.4 | -1062 |

| Japan Buying Foreign Stocks | -488.8 | 119.3 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Little Changed, Cash US Tsys Closed, May-28 Supply Tomorrow

ACGBs (YM -1.0 & XM +1.5) are slightly mixed after a subdued session. Volumes have been low with cash US tsys closed for the 4th of July holiday. The focus is on the US employment report on Friday.

- Outside of the previously outlined trade balance, there hasn't been much in the way of domestic drivers to flag.

- Cash ACGBs are 1bp cheaper to 1bp richer, with the 3/10 curve flatter.

- The bills strip is little changed, with pricing -1 to +1.

- RBA-dated OIS pricing is little changed across meetings today but remains 6-27bps firmer than pre-CPI levels. Terminal rate expectations sit at 4.49%.

- QTC has announced the launch of an increase of QTC 5.25% 21 July 2036 A$ Fixed Rate Benchmark Bond. Initial price guidance is a range of 99-102bps over the 10-year futures contract, [89.7-92.7] bps over the ACGB 3.75% 21 April 2037. This transaction is expected to price tomorrow subject to market conditions.

- (Bloomberg) Australia hopes to issue another green bond in two years as it builds a sovereign green curve, Anna Hughes, chief executive officer of the AOFM. (See link)

- Tomorrow, the local calendar will see Foreign Reserves data alongside the AOFM planned sale of A$900mn of the 2.25% 21 May 2028 bond.

AUSTRALIAN DATA: Trade Surplus Continues Downtrend

The May merchandise trade surplus narrowed more than expected with April also revised lower. It came in at $5.77bn down from $6.03bn, as imports outpaced exports. The surplus has been trending lower for almost two years now with exports performing poorly since mid-2023. Strong consumer goods imports would probably worry the RBA but they have been easing, while strength has been in the intermediate goods component.

Australia merchandise trade surplus $mn

Source: MNI - Market News/ABS

- Exports rose 2.8% m/m after falling 2.2% in April to still be down 7.8% y/y after -7.2%. The pickup was driven by metal ores & minerals driving a 3.7% m/m increase in non-rural goods which are still 7.2% lower on a year ago, while rural fell 1.2% to be down 15.9% y/y.

- Imports rose 3.9% m/m to be up 3.5% y/y after -7.0% m/m and +2.1% y/y in April. May was driven by higher fuel imports and given the trade data are nominal the pickup in oil prices this year would have boosted this.

- Consumer goods imports rose 2.4% m/m but fell 2.3% y/y. The May increase was broad-based across sectors with transport equipment up 2.9% m/m and food & beverages +3.1%. Capital goods rose 0.5% m/m and 1.7% y/y due to the +22.9% m/m rise in ADP equipment but machinery fell 1% and transport 10.2%. Intermediate goods rose 6.6% m/m and 10.5% y/y as fuel increased 10.8% m/m.

Source: MNI - Market News/ABS

NZGBS: Closed On Weak Note After A Poor May-41 Auction

NZGBs closed on a weak note with the long-end pressured by a poor auction of the 1.75% May-41 bond.

- NZ Treasury sold just NZ$94mn May-41 bonds, resulting in the overall proceeds from the weekly supply falling short of the NZ$500mn target (NZ$494mn).

- All the bids were accepted at an average yield of 5.0529%, with a cover ratio of just 0.94x. The sales of the May-31 and May-34 bonds also showed lacklustre demand, with cover ratios of 1.07x and 1.79x respectively.

- The 10-year benchmark closed with its yield 7bps higher than the morning’s low. On a relative basis, the NZ-AU 10-year yield differential closed 6bps wider at +33bps. Cash US tsys are closed today for the 4th of July holiday.

- Outside of the previously outlined Government financial statements and property prices, there hasn't been much in the way of domestic drivers to flag.

- Swap rates closed flat to 1bp lower with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed. A cumulative 36bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

FOREX: USD Downside Limited Ahead Of July 4 Holiday, USD/JPY Dips Supported

The early USD trends were to the downside, although the BBDXY index didn't test sub intra-session lows from Wednesday. The BBDXY last tracked near 1265.25, down slightly for Thursday trade so far.

- There has been no cash Tsy trading with US markets out for the July 4 holiday later. Futures in this space are a touch lower. US equity futures are close to flat, but regional equity markets have been positive, lending a slight risk on trade, although we sit away from best levels.

- AUD/USD was last 0.6710/15, while NZD/USD is around 0.6110. For the A$, higher iron ore prices are also a positive, although recent gains have been dominated by positive yield momentum. Both currencies remain sub Wednesday highs. The Australian May trade surplus was slightly below expectations but didn't impact sentiment.

- USD/JPY was weaker in earlier trade, but remains supported on dips. From lows at 161.14, we last tracked near 161.50/55, only down slightly for the session. FX intervention risks remain, but as we noted earlier, USD/JPY rates of change below April levels, which came prior to intervention.

- News flow has been light today, with focus remaining on Biden's election prospects and whether he will stay in the race. A group of Democrat Governors backed the President, but a Bloomberg story stated some Democrat Senators have expressed doubts.

- Later the ECB’s Lane and Cipollone speak and the minutes from the June 5-6 meeting are published. The UK election is also held. German May factory orders print.

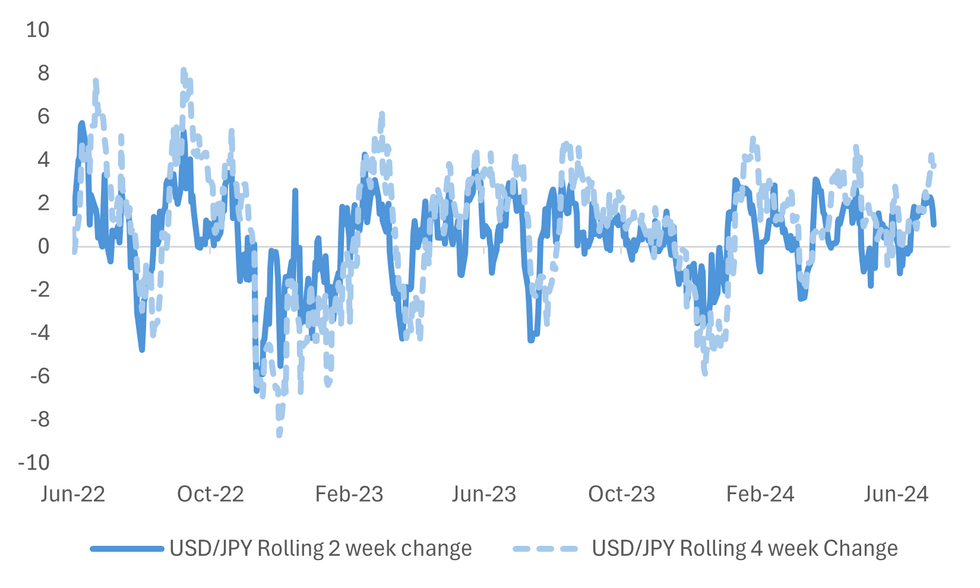

JPY: USD/JPY Recent Rates Of Change Sub Late April Levels (Pre Intervention)

In assessing intervention risks for USD/JPY, the authorities may be able to point to the pair's divergence from US-JP yield differentials, as a shift away from fundamentals for the yen. This has been evident in recent weeks, particularly in terms of 10yr nominal government bond yield differentials (see our bullet from earlier). Still other metrics, like rate of change over a short term period, remain below recent extremes, likewise in terms of implied vol levels.

- USD/JPY is still within striking distance of yesterday's fresh cycle high, only around 50pips off, last 161.50/55 in recent dealings. Earlier lows were at 161.14.

- There has been some speculation the upcoming 4th July holiday could prompt a fresh round of intervention during US hours. Liquidity will be lighter during this period, and we did see the authorities likely intervene early in May late during US trading hours (when liquidity was lighter).

- The chart below though shows USD/JPY's rate of change over a 2 week period is only around +1% though, which is sub late April levels,, which were above 2.6%, and we saw higher levels in 2022 during those intervention episodes.

- The other line on the chart, the 1 month rate of change is closer to recent highs, but only marginally. The run up in USD/JPY compared with early June lows is also below the moves we saw in April both in terms of order of magnitude and time spent to achieve the moves, (I.e. >5.5% rally from mid April lows, see this link, which occurred in less than a month).

- Overnight USD/JPY vols are up around +12.54% currently, comfortably off late April highs, although this metric started moving ahead of the BoJ meeting, which was also around that time.

- Of course, intervention risks can't be completely discounted in the near term, the JPY trade weighted index continues to make fresh lows, as another warning post for markets. The Deutsche Bank JPY TWI is a further 2.6% sub late April levels (which occurred prior to that intervention round).

Fig 1: USD/JPY Rolling 2 week and 4 week Changes

Source: MNI - Market News/Bloomberg

ASIA STOCKS: HK & China Equities Mixed, Property Rally Stalls

Hong Kong and China equity markets are mostly lower today, the top performing sector has been intelligent/electric vehicle names after the government approved 20 pilot cities for testing smart car applications and EU member countries were divided on whether to back additional tariffs on Chinese-built electric vehicles, while after a couple of days of gains in the property sector we have hit a wall. Earlier, Hong Kong S&P Global PMI for June dropped to 48.2 from 49.2 prior, marking the lowest reading for the year and now back at Sept 2023 levels.

- Hong Kong equities are mixed today, property indices have reversed some the the gains made earlier in the week, with the Mainland Property Index down 0.90%, while the HS Property Index is 0.50% lower. Elsewhere the HSTech Index is up 0.50%, tracking gains made overnight in the US market, while the wider HSI is trading 0.05% higher.

- China equity markets are mostly lower today, the CSI300 Real Estate Index is 2.33% lower, small-caps are lower with the CSI 1000 down 1.25% and the CSI 2000 is in bear market territory after falling 24% this year and trade down 1.70% today, while the wider CSI 300 is 0.20% lower

- The latest data from China indicates that the property market's downward spiral is continuing. Despite a slight improvement in new-home sales, this was likely due to price cuts rather than a genuine recovery. The broader housing market remains weak, with falling income, weak spending, and low consumer confidence signaling ongoing trouble. May data showed home prices plunging at the fastest pace in almost a decade, and businesses and households remain pessimistic about the future, suggesting that the downward trend in real estate prices is likely to persist.

- VDA warned that planned EU tariffs on China-made electric vehicles would harm Europe's climate goals and its automotive industry, urging for a negotiated solution with China instead. The VDA emphasized that such tariffs would also negatively impact Western car manufacturers operating in China and hinder the decarbonization and competitiveness of European carmakers.

ASIA PAC STOCKS: Equities Surge Higher, Topix At 34 Year Highs

Asian markets are higher today, driven by favorable economic data from the US that bolstered the case for potential Federal Reserve rate cuts. A regional equities gauge rose for the fifth consecutive session, with Japan’s Topix reaching a record intraday high and gains seen in South Korea and Australia. The USD/JPY gapped lower on the back of US data overnight, although has erased about half the moves to trade back at 161.50, which has help support Japanese export names. The positive sentiment followed the S&P 500 and Nasdaq setting new highs in a shortened trading session before the July 4th Holiday.

- Japanese equities are higher today with the Topix surging to its highest level in over 34, surpassing the peak recorded during the bubble economy in 1989, driven by broad-based buying momentum across almost all industry sub-indexes, with automakers, insurers, and banks leading the gains. The Nikkei 225 Stock Average also climbed above 40,000, with Semiconductor and high-tech stocks leading the gains, following positive trends from the US markets. Overall, Japanese stocks are on a bullish trajectory amid favorable economic conditions and supportive monetary policies. The Topix is currently 0.85% higher, while the Nikkei is trading 0.80% higher.

- South Korean stock market has rallied to its highest levels since early 2022, buoyed by strong gains in tech and automotive sectors. Positive sentiment from US markets, fueled by expectations of Federal Reserve rate cuts, contributed to the rally. Samsung Electronics have surged higher ahead of the company reporting results. The Kospi is up 0.82%, while the Kosdaq is up 0.50%

- Taiwanese equities are higher today, most of the gains can be attributed to TSMC up 2.66% & Hon Hai up 5.40%. The S&P 500 hit new all time highs overnight, while the Philadelphia Semiconductor Index rose 1.92%, the Taiex is currently trading 1.40%.

- Australian equities are higher today, led by gains in mining and energy shares following strong performances in US markets. Key contributors included BHP Group and Arcadium Lithium. Economic data showed a narrowing trade surplus in May, with mixed results in export and import figures. The ASX200 is 1.10% higher.

- Elsewhere, New Zealand equities are 0.18% lower, Singapore equity are 0.50% higher, Indonesian equities are 0.62% higher, Philippines equities are 0.90% higher, India is 0.45% higher and finally Malaysian equities are up 0.15%

ASIA EQUITY FLOWS: Asian Equity Flows Subdued

- South Korea: South Korean equities saw inflows of $207m yesterday, contributing to a net inflow of $469m over the past five trading days. The 5-day average inflow is $94m, lower than the 20-day average of $187m but higher than the 100-day average of $126m. Year-to-date, South Korea has experienced substantial inflows totaling $17.199b.

- Taiwan: Taiwanese equities had inflows of $256m yesterday, contributing to a net outflow of $1.241b over the past five trading days. The recent data suggests a bearish trend with substantial outflows in the short term. The 5-day average outflow is $248m, contrasting with the 20-day average inflow of $59m and the 100-day average inflow of $17m. Year-to-date, Taiwan has accumulated inflows of $3.399b.

- India: Indian equities experienced outflows of $300m Tuesday but saw a total inflow of $937m over the past five trading days. The recent data suggests a strong bullish trend in the short term. The 5-day average inflow is $187m, higher than the 20-day average of $96m. The 100-day average shows a slight outflow of $23m. Year-to-date, India has seen minimal net outflows of $10m.

- Indonesia: Indonesian equities recorded inflows of $38m yesterday, with a net outflow of $355m over the past five trading days. The data shows a predominant negative trend. The 5-day average outflow is $71m, close to the 20-day and 100-day averages of $0m and $8m, respectively. Year-to-date, Indonesia has experienced outflows totaling $348m.

- Thailand: Thai equities saw inflows of $36m yesterday, bringing the 5-day total to a net outflow of $168m. The data shows a predominant negative trend. The 5-day average outflow is $34m, close to the 20-day average of $46m and higher than the 100-day average outflow of $25m. Year-to-date, Thailand has seen significant outflows amounting to $3.262b.

- Malaysia: Malaysian equities experienced inflows of $8m yesterday, contributing to a 5-day net outflow of $17m. The 5-day average outflow is $3m, similar to the 20-day average of $0m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced outflows totaling $165m.

- Philippines: Philippine equities saw no net change yesterday, with a 5-day net inflow of $1.7m. Flows into the region have been mixed recently. The 5-day average is $0m, less than the 20-day average outflow of $5m and the 100-day average outflow of $6m. Year-to-date, the Philippines has seen outflows totaling $531m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 207 | 469 | 17199 |

| Taiwan (USDmn) | 256 | -1241 | 3399 |

| India (USDmn)* | -300 | 937 | -10 |

| Indonesia (USDmn) | 38 | -355 | -348 |

| Thailand (USDmn) | 36 | -168 | -3262 |

| Malaysia (USDmn) * | 8 | -17 | -165 |

| Philippines (USDmn) | 0 | 1.7 | -531 |

| Total | 245 | -373 | 16283 |

| * Up to 2nd July |

OIL: Crude Gives Up Some Gains, US Holiday Likely To Keep Volumes Thin

Oil prices are trending lower and have given up a large share of Wednesday’s gains during APAC trading today. Brent is down 0.6% to $86.85/bbl, close to the intraday low, while WTI is 0.6% lower at $83.34/bbl. The US is closed today and so volumes are likely to be light with the focus then turning to Friday’s US payroll data. The USD index is down slightly.

- Crude reached highs early in the session of $87.12 for Brent and $83.69 for WTI driven by the largest US crude inventory drawdown in almost a year and the partial evacuation of some oil platforms in the path of Hurricane Beryl. But they have trended lower since then possibly due to technical selling and continued demand concerns.

- Hurricane Beryl is currently expected to possibly impact around 73kbd of federal offshore oil output, according to the National Hurricane Center and Ocean Energy Management data.

- Later the ECB’s Lane and Cipollone speak and the minutes from the June 5-6 meeting are published. The UK election is also held. German May factory orders print.

GOLD: Large Gain After Weaker US Economic Data

Gold is slightly stronger in the Asia-Pac session, after closing 1.1% higher at $2356.20 on Wednesday.

- The softer-than-expected US labour market and ISM services survey data allowed gold to break above $2,360/oz briefly as the USD weakened and US Treasuries rallied before gains were pared later in yesterday's session.

- Nonfarm payrolls data due on Friday should also help build a clearer picture of the US labour market and the policy outlook for the Federal Reserve.

- Swaps traders are pricing a 70% chance of a rate cut in September.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- From a technical perspective, gold is in consolidation mode, with initial firm resistance at $2,387.8, the Jun 7 high.

- Meanwhile, silver outperformed, rising ~3% to $30.5/oz. For silver, first resistance to watch is $30.853, the Jun 21 high. A break would be a bullish development.

ASIA FX: USD/Asia Pairs Mostly Up From Earlier Lows, USD/CNY Spot Supported On Dips

USD/Asia pairs are seeing downside momentum in Thursday dealings, albeit we are away from best levels. This is line with majors, with broader USD softness earlier not seeing fresh much follow through. Regional equity markets are mostly up as well, adding to the risk on feel. China markets have weakened though. CNH remains a laggard in terms of broader USD trends. KRW and THB spot have seen the strongest gains so far today.

- USD/CNH has been supported on moves sub 7.3000, lagging the slight softness in the USD indices. USD/CNY spot is relatively steady, with dips under 7.2700 supported so far. As we noted earlier a close to unchanged USD/CNY fixing was unlikely to encourage too much positive yuan momentum. For USD/CNH intra-session lows from Wednesday came in at 7.2920. Equity sentiment continues to be weak for onshore China markets, with the recent property rebound stalling.

- Spot USD/KRW is lower by around 0.35% at this stage. The pair was last near 1382, slightly up from session lows (1380.2). This leaves us sub intra-session lows from Wednesday in the pair. The won was an underperformer through Wednesday's session and with the positive equity tone we may be seeing some catch up unfold today. The pair is testing the 20-day EMA support zone, but the 50-day sits further south near 1373. Focus next week will be on the BoK decision, no change is expected, but dovish leanings may emerge.

- Spot USD/THB is off nearly 0.40% and back to 36.60/65. This leaves within recent ranges, as early June lows came in around 36.325.

- USD/IDR is back to 16350, around 0.10% stronger in IDR terms. Earlier lows came close to the 20-day EMA support zone (around 16330). We haven't been sub this support level since May.

KRW: USD/KRW Uptrend Intact, Any Dovish Shift By The BoK Next Week May Weigh On The Won

Spot USD/KRW has steadied as the Thursday session has progressed. We were last near 1382, still around 0.30% firmer in won terms. This leaves us close to the 20-day EMA, while the broader technical backdrop still remains positive from a dollar standpoint. Since mid May spot USD/KRW has generally printed higher lows. Resistance in the 1390/1400 region is still apparent on the topside.

- Outside of broader risk sentiment shifts, the focus for the won next week will be on the BoK decision. The consensus looks for no change (steady at 3.50%), although onshore there have been more calls for easier policy settings from local politicians.

- Note local media is reporting that BoK Governor Rhee will address parliament on July 9 (next Tuesday), two days before the BOK decision, with Rhee reportedly set to speak about monetary policy (see this link , Yonhap Infomax).

- Market pricing for an easing in H2 has risen post this week's softer CPI print.

- Even without a surprise result next week, a dovish BoK shift next week could weigh on KRW all else equal. We have seen in recent weeks/months PHP weighed by the central bank's language around likelihood of easing (potentially at the August BSP meeting).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/07/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 04/07/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/07/2024 | 0630/0830 | *** |  | CH | CPI |

| 04/07/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 04/07/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 04/07/2024 | 0830/0930 |  | UK | Decision Making Panel Data | |

| 04/07/2024 | 0900/1100 |  | EU | ECB's Lane Lecture at University of Naples | |

| 04/07/2024 | - |  | UK | General Election | |

| 04/07/2024 | 1415/1615 |  | EU | ECB's Cipollone speech at 15th edition of National Statistics conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.