-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN MARKETS ANALYSIS: EUR & EU Equity Futures Higher Post 1st Round Of French Elections

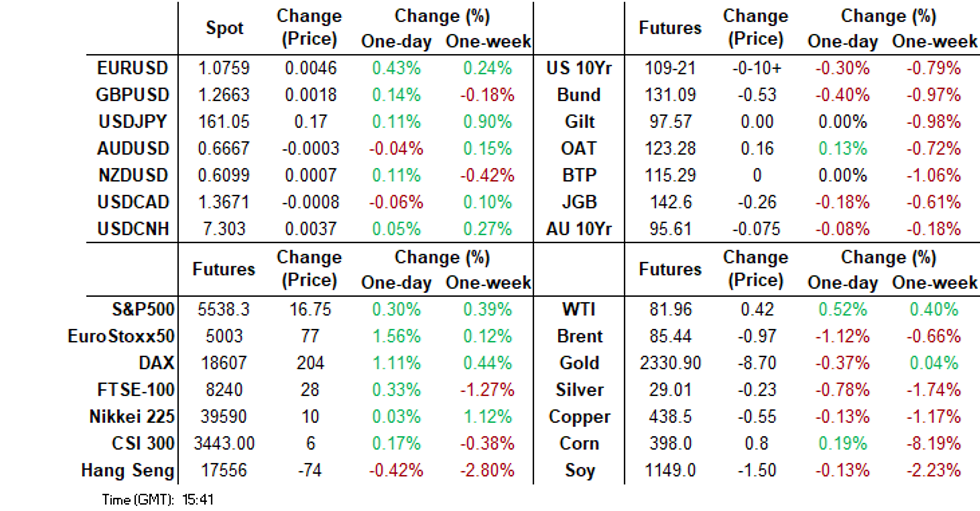

- The first round of voting for France’s National Assembly has produced results broadly in line with surveys, according to exit polls. Marine Le Pen’s right-wing National Rally (RN) won with 33.5% of the vote, less than expected, but as there will be a second round of voting on July 7, it remains unclear if her party will win a majority of seats.

- EUR/USD was higher at the open, while EU stocks futures are also up, likewise for French bond futures.

- Elsewhere the Japan Q2 Tankan survey was mixed but points to an improved large manufacturing sentiment and Capex outlook. Company inflation expectations also remain resilient. Yen has remained an underperformer, while CFTC positioning shows net yen shorts are back close to 2024 lows.

- Later US June manufacturing ISM/PMI, European PMIs and preliminary June German CPIs print. Also ECB President Lagarde speaks.

MARKETS

FRANCE: Right Win Parliamentary Elections, Majority Looks Unlikely

The first round of voting for France’s National Assembly has produced results broadly in line with surveys, according to exit polls. Marine Le Pen’s right-wing National Rally (RN) won with 33.5% of the vote, less than expected, but as there will be a second round of voting on July 7, it remains unclear if her party will win a majority of seats. President Macron has significant flexibility in who he chooses as the next prime minister, especially if RN doesn’t have a majority.

- The group of left-wing parties called the New Popular Front (NFP) ran second with 28.1% of the vote, while Macron’s centrist Ensemble received only 20.7%, but still higher than in recent European elections. The Republicans were fourth with 10.2%.

- Ipsos polling estimates that RN will win between 230 and 280 seats after the second round but they need 289 for a majority. NFP is headed for 125-165 and Ensemble 70-100. Currently it appears that there will be a hung parliament but new elections cannot be held for at least a year.

- Any candidate with more than 12.5% of the vote can stand in the second round. But both the left and Ensemble are calling for its third place candidates to withdraw, to improve the chances of the second place to beat a RN candidate.

- President Macron will choose the next PM and he does not have to pick someone from the party with the most seats but to ignore them would be difficult if it has a parliamentary majority. He also has the option to choose a technocrat as PM, which may be an easier working relationship as Macron’s term doesn’t end until 2027. He will maintain considerable influence over foreign policy.

- Voter turnout was its highest since 1997 at 65.8%.

US TSYS: Tsys Futures Off Earlier Lows, Curve Steepens, ISM Later Today

- Treasury futures are off earlier lows with TUU4 is -0-00¾ at 102-02¾ while TYU4 is down -0-08+ at 109-23+, tsys looks to have followed French bond futures higher throughout the day, with OATU4 up 28 ticks, amid speculation a far-right party may not secure an absolute majority in France’s legislative election, and investors weighing up a Trump Presidency.

- Volumes are above recent averages with TU 56k, FV 118k & TY 180k

- Cash treasuries have erased earlier weakness with yields now lower across the curve. The 2Y -2.5bps at 4.729%, 5Y -1.8bps at 4.359% while the 10Y is -1bps at 4.386%.

- APAC rates: NZGB yields are 1-3bps lower, ACGB yields are 2-9bps higher, while JGBs have seen selling through the belly with yields +/- 2bps.

- The increasing likelihood of a Trump presidential victory has made curve steepeners an attractive bet, as it is expected to slow growth and increase inflation. PredictIt has Trump's odds of winning at 56% although this is down from 64% during the debate, while they have Biden's odds at just 31% chance of winning.

- In-line with the steepening moves, projected rate cut pricing through year end looks steady to mildly higher vs. pre-data levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -18.6bp (-17.5bp), Nov'24 cumulative -27.6bp (-26.6bp), Dec'24 -47.3bp (-45.3bp).

- Looking ahead, S&P Global US Manufacturing PMI, ISM Manufacturing, Construction Spending MoM

JGBS: Belly Of Cash Curve Cheaper, Q1 GDP Revised Lower

JGB futures are weaker but well off session lows, -24 compared to the settlement levels.

- Outside of the previously outlined Tankan Report and Mfg PMI, there hasn't been much in the way of domestic drivers to flag.

- (MNI) Japan's Q1 economy contracted at a faster pace than previously estimated as public investment was revised lower, updated data released by the Cabinet Office showed on Monday. The economy contracted 0.7% q/q, or an annualised -2.9%, compared to previous estimates of -0.5% q/q and an annualized -1.8%.

- Cash JGBs are 1bp richer to 2bps cheaper, with the belly of the curve underperforming. The benchmark 10-year yield is 1.1bps higher at 1.068% versus the cycle high of 1.101%.

- The move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- (Bloomberg) “The BoJ will probably continue to purchase government bonds to some degree long after it kicks off quantitative tightening this summer, according to a former BOJ executive director.” (See link)

- The swaps curve is little changed, apart from the 40-year which is 3bps higher. Swap spreads are mixed.

- Tomorrow, the local calendar will see Monetary Base data alongside 10-year supply.

JAPAN DATA: Tankan Survey Mixed, But Large Manufacturing Outlook Back To Late 2021 Highs

Japan's Tankan data print was mixed. Large manufacturing sentiment was slightly better than forecast For Q2. The headline index rose to +13, versus +11 forecast and +11 prior. The outlook for this segment was also better than forecast (+14, +11 forecast and +10 prior).

- For large non-manufacturing firms, the headline was +33 in line with forecasts, but down a touch from Q1's +34. This headline read is a touch off highs back to the early 1990s. The outlook was +27 for this segment, slightly below forecasts.

- Capex intentions were +11.1%, also below forecasts but up on the Q1 print.

- For smaller manufacturing firms we were in line for manufacturing firms (-1, outlook 0). For non-manufacturing firms we were a touch below expectations (+12, versus +13 forecast).

- The data will be encouraging for the BoJ, albeit at the margins. The outlook for large manufacturers is back to late 2021 highs. The central bank, and the authorities, will be hoping this drives improved growth outcomes.

- Other data showed Q1 GDP growth revised to a -2.9% annualized outcome (-1.8% originally reported).

AU STIR: RBA Dated OIS Remain Sharply Firmer Than Pre-CPI Levels

Although softer than Thursday’s levels, RBA Dated OIS remains 6-23bps firmer than pre-CPI levels.

- The market gives a 25bp hike in August a 43% chance versus 55% last Thursday.

- Terminal rate expectations also remain dramatically firmer than pre-CPI levels at 4.48% versus 4.37% before the CPI data. Thursday’s high was 4.53%.

Figure 1: RBA-Dated OIS – Post-CPI Vs. Pre-CPI

Source: MNI – Market News / Bloomberg

NZGBS: Closed On A Positive Note After Friday’s Holiday

NZGBs closed on a strong note, with benchmark yields 2-3bps lower compared to Thursday’s close. The local market was closed for a holiday on Friday.

- With the local calendar relatively light, the move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- Swap rates closed 1-4bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed flat to 4bps softer across meetings, with 2025 meetings leading. A cumulative 30bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the NZIER Business Opinion Survey results and Building Permits data, ahead of ANZ Commodity Prices on Wednesday.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$100mn of the 1.75% May-41 bond.

AUSSIE BONDS: Cheaper But Off Worst Levels, RBA Minutes For June Tomorrow

ACGBs (YM -5.0 & XM -7.5) are cheaper but well above session cheaps.

- Outside of the previously outlined MI Monthly Inflation Gauge and ANZ Job Ads, there hasn't been much in the way of domestic drivers to flag.

- With the local calendar relatively light, the move away from morning cheaps has been assisted by a bull-steepening in US tsys in today’s Asia-Pac session. Cash benchmarks are currently 1-3bps richer after being as much as 2bps cheaper in early dealings.

- Cash ACGBs are 4-6bps cheaper, with the AU-US 10-year yield differential at -1bp.

- Swap rates are higher, with a steepening bias.

- The bills strip has bear-steepened, with pricing flat to -4.

- Although softer than Thursday’s levels, RBA Dated OIS remains 6-23bps firmer than pre-CPI levels. The market gives a 25bp hike in August a 43% chance versus 55% last Thursday. Terminal rate expectations also remain dramatically firmer at 4.48% versus 4.37% before the CPI data. Thursday’s high was 4.53%.

- Tomorrow, the local calendar will see the RBA Minutes of the June Policy Meeting.

FOREX: EUR/USD Rebounds Post First Election Round, Yen Underperformance Continues

EUR strength has been the main focus point in the first part of Monday trade. This has weighed on the BBDXY USD Index, which is down 0.10% to the low 1268.20/30 region.

- The single currency rallied early doors as Le Pen's far right party didn't poll as strongly as some opinion polls suggested in the first round of French parliamentary elections. Left leaning parties also vowed to bloc Le Pen's majority ambitions. EUR/USD is back to 1.0755, around 0.40% stronger for the session today.

- USD/JPY dips have been supported, the pair last just above 161.00. Friday highs (161.27) remain intact, but the yen remains weaker on crosses. CFTC positioning data showed an extension of yen shorts (we aren't too far away from 2024 lows). The Tankan survey data was mixed, albeit mostly positive for large firms and the Capex outlook, suggesting the BoJ can continue to adjust accommodative settings.

- AUD/USD is near 0.6665, underperforming modestly. Second tier data today hasn't shifted the sentiment needle. NZD/USD is a touch higher, last around 0.6100. Last week trades added to long NZD positions and cut AUD shorts (per CFTC).

- In the cross asset space, US equity futures were last up close to 0.3%. US yields are lower, led by the end of the curve. Iron ore has risen, amid positive China property news but with little benefit for the A$.

- Later US June manufacturing ISM/PMI, European PMIs and preliminary June German CPIs print. Also ECB President Lagarde speaks.

CHINA STOCKS: Equities Mostly Lower, Property Stocks Higher On Promising Sales

Mainland Chinese equities fell after factory activity contracted for the second consecutive month in June, raising doubts about the country's economic recovery, while Hong Kong markets are closed for HKsar Establishment day. Property stocks have rallied on the back of data showing the nations top 100 developers posted a 36% m/m increase in contract sales, although y/y sales were still down 17%.

- China equity markets are mixed today, with the CSI 300 trading 0.22% lower, small-cap indices the CSI 1000 and CSI 2000 are both down about 0.60% while the CSI 300 Real Estate Index has surged 6.05% higher.

- China's factory activity contracted for the second consecutive month in June, with the official manufacturing PMI at 49.5, indicating weak demand and posing a threat to the country's economic growth target of around 5% for the year. Additionally, the non-manufacturing PMI fell to 50.5, reflecting ongoing challenges in the construction and services sectors amid trade tensions and a prolonged real estate crisis.

- In the property space, the downturn in China’s residential real estate sector slowed in June, with new-home sales from the top 100 developers posting a 36% m/m increase although this still equated to a 17% drop y/y, compared to May's 34% decline, following easing measures in major cities. Despite some recovery, the broader market remains weak, with funding challenges for developers and ongoing bearish sentiment among investors.

- Asian regulators have tightened controls on high-frequency and quantitative trading, raising concerns about reduced market liquidity and attractiveness. While intended to stabilize markets, the restrictions have sparked debate over their long-term impact, with some fearing they could stifle innovation and efficient asset pricing.

- Looking to next week, Tuesday we have Hong Kong Retail Sales, Wednesday we have Caixin China PMI composite & Services.

ASIA PAC STOCKS: Asian Equities Rise Led By Gains In Japanese Stocks

Asian markets are mostly higher today, there was been plenty of regional economic data out this morning which has helped support markets, although we have faded in the second half of trading. Japanese stocks are higher as yields rise, yen continues to weaken which continues to support export names, while Japanese department store operators saw significant gains, driven by strong earnings forecasts. South Korean equities are slightly higher today as easing US inflation concerns and rising political uncertainties. Meanwhile, Australian shares declined, led by losses in technology and health-related sectors. Global yields have recovered some of the early morning sell-off, with tsys future volumes well above recent averages.

- Japanese stocks rose for a second day as a jump in US yields and a stronger dollar against the yen lifted banks and exporters. The rise in US rates is expected to positively impact value stocks globally, with Japanese financials and materials stocks showing strength. Exporters, such as automobile makers and machinery producers, firmed as the euro remained stable following the first round of France’s legislative elections. Additionally, shares of department store operators J. Front Retail and Takashimaya surged by at least 11%, driven by raised full-year operating income forecasts and strong quarterly earnings. Earlier, Japan's Tankan data print was mixed. Large manufacturing sentiment was slightly better than forecast For Q2. The headline index rose to +13, versus +11 forecast and +11 prior. The Topix is 0.43% higher, while the Nikkei is 0.10% higher.

- South Korean stocks opened slightly higher amid eased concerns over US inflation and rising political uncertainties. South Korea's exports rose by 5.1% year-on-year to $57 billion in June, leading to a trade surplus of $8 billion as imports fell by 7.5% to $49 billion. This marks the ninth consecutive month of export gains and the 13th consecutive month of a trade surplus. The Kospi is 0.10% higher, while the Kosdaq is up 0.70%.

- Taiwanese equities are higher today with TSMC again contributing the most. AI continued to drive Taiwan's stock market, making it the top-performing market in the Asia-Pacific so far this year, with with TSMC climbing 63% and Hon Hai Precision Industry jumping 105%. Earlier S&P Global PMI Mfg jumped to the highest levels since March 2022 at 53.2 from 50.9, while the Taiex is up 0.20% this morning.

- Australian equities are lower this morning, with Financials and Health care stocks offsetting gains in Materials and Real estate. Earlier this morning, Judo Bank PMI Mfg fell to its lowest levels since 2020m while MI inflation ticks slightly higher to 3.2% y/y from 3.1% and ANZ-Indeed Job Ads fell 2.2% from 1.9% (revised) prior. Eyes will now be on the RBA minutes tomorrow. the ASX200 is down 0.40%

- Elsewhere, New Zealand equities are 0.55% higher, Indonesian equities are 0.70% higher although S&P Global PMI fell to 50.7 from 52.1, the JCI is now up 6.45% from recent lows, Thailand Equities are 0.35% higher, Indian equities are 0.30% higher, Malaysian equities are 0.20% higher, Philippines equities are 0.05% higher while Singapore equities are up 0.15%

Asian Equity Flows Mixed, Taiwan Ends Run Of Outflows

- South Korea: South Korean equities saw inflows of $62m Friday, with a total net inflow of $352m over the past 5 trading days. The 5-day average inflow is $70m, slightly lower than the 20-day and 100-day averages of $152m and $149m, respectively. Year-to-date, South Korea has experienced substantial inflows totaling $17.1b.

- Taiwan: Taiwanese equities had inflows of $432m Friday, ending a run of 5 straight days of selling from foreign investors with the past 5 trading sessions recorded a net outflow of $2.2b. The 5-day average outflow is $439m, contrasting with the 20-day and 100-day average inflows of $35m and $41m. Year-to-date, Taiwan has accumulated inflows of $4.4b.

- India: Indian equities experienced strong inflows of $929m Thursday, contributing to a 5-day total inflow of $1.7b and now marking 14 straight sessions on buying. The 5-day average inflow is $345m, higher than the 20-day average of $153m. The 100-day average shows a slight outflow of $26m. Year-to-date, India has seen inflows of $163m.

- Indonesia: Indonesian equities recorded outflows of $106m Friday, with a modest 5-day net inflow of $30m. On Tuesday, Indonesia saw it's largest inflow in years, however that flow now looks to be largely wiped out. The 5-day average outflow is $6m, similar to the 20-day and 100-day averages of $8m. Year-to-date, Indonesia has experienced outflows totaling $427m.

- Thailand: Thai equities saw outflows of $71m Friday, bringing the 5-day total to a net outflow of $238m and now marking 27 straight sessions of selling from foreign investors. The 5-day average outflow is $48m, close to the 20-day average of $53m and higher than the 100-day average outflow of $24m. Year-to-date, Thailand has seen significant outflows amounting to $3.2b.

- Malaysia: Malaysian equities experienced outflows of $56m Thursday, contributing to a 5-day net outflow of $141m. The 5-day average outflow is $28m, higher than the 20-day average outflow of $11m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced outflows totaling $200m.

- Philippines: Philippine equities saw modest inflows of $7m Friday, with a marginal 5-day net inflow of $0.2m. The 5-day average is flat at $0m, less than the 20-day average outflow of $10m and the 100-day average outflow of $6m. Year-to-date, the Philippines has seen outflows totaling $527m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 62 | 352 | 17128 |

| Taiwan (USDmn) | 432 | -2193 | 4382 |

| India (USDmn)* | 929 | 1724 | 163 |

| Indonesia (USDmn) | -106 | 30 | -427 |

| Thailand (USDmn) | -71 | -238 | -3231 |

| Malaysia (USDmn) | -56 | -141 | -200 |

| Philippines (USDmn)* | 7 | 0.2 | -527 |

| Total | 1197 | -466 | 17288 |

| * Up to 27th June |

OIL: Crude Starts Week Higher On Better China Manufacturing PMI & Geopolitics

After falling moderately on Friday, oil prices are higher during APAC trading today driven by a pickup in China’s Caixin manufacturing PMI and geopolitical uncertainty in the Middle East, US and Europe. WTI is up 0.3% to $81.82/bbl after breaking above $82 briefly. Brent is also 0.3% higher at $85.30/bbl after a high of $85.49. The USD index is down 0.1%.

- China’s Caixin manufacturing PMI for June rose to 51.8 from 51.7, higher than expected and the highest in three years. Uncertainty over the strength of China’s economy has concerned oil markets as the country is the world’s largest crude importer and so this data will be welcomed. However the official manufacturing PMI released Sunday was stable at 49.5, still in contractionary territory.

- In terms of geopolitics, right-wing National Rally’s win in first round elections in France could not only derail French reform but also destabilize the European Union depending on second round results on July 7. Tensions between Israel and Hezbollah in Lebanon have also escalated. In addition, US President Biden’s weak performance in last week’s election has clouded the election outlook.

- The market remains optimistic on oil with prompt spreads suggesting the market is tight and money market net longs increasing, according to Bloomberg.

- Later US June manufacturing ISM/PMI, European PMIs and preliminary June German CPIs print. Also ECB President Lagarde speaks.

GOLD: Steady Despite Benign US Inflation Data

Gold is little changed in the Asia-Pac session, after closing basically unchanged at $2326.75 on Friday. Friday’s move left the yellow metal marginally higher on the week.

- Bullion was steady on Friday despite news that the Fed’s preferred measure of underlying US inflation, the core PCE deflator index, rose 2.6% from a year ago — the slowest pace since March 2021.

- The US short term interest rate market shows traders attach a 58% chance of a rate cut being implemented by September.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, a bear threat in gold remains present and the yellow metal continues to trade closer to its recent lows. A clear break of the 50-day EMA, at $2,318.4, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

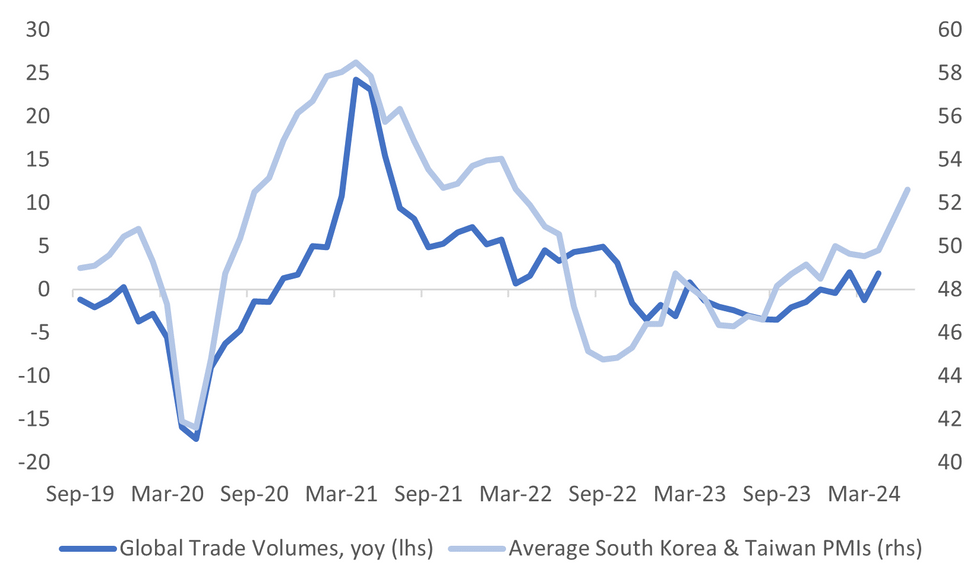

ASIA: South Korea & Taiwan PMIs Point To Further Improvement In Global Trade

The PMI prints for both South Korea and Taiwan continued to improve in June. This, all else equal, points to further improvement in the global trade backdrop. The chart below plots the average PMI prints for both countries against y/y global trade volume growth.

- The South Korean PMI is now at 52.0. This is fresh highs back to the first half of 2022. The output sub index did ease a touch to 53.1 (from 53.3), but new orders rose further and are now back highs since Feb 2022.

- For Taiwan, the headline index is also back to first half 2022 levels. The index has recovered strongly since the start of the year. Output was 54.9 versus 52.6 in May, while new orders rose to their highest level since August 2021.

- Earlier we had South Korean trade figures for June. Headline export growth was just above 5%y/y, but average daily exports for the month were still above a double digit pace for the month.

Fig 1: Average South Korea & Taiwan PMIs Versus Global Trade Volumes

Source: MNI - Market News/Bloomberg

ASEAN DATA: Manufacturing Activity Grows But Foreign Orders Still Negative

June PMIs across ASEAN were mixed but the aggregate was steady in expansion territory at 51.7 driven by orders, but foreign orders continued to contract, and output growth but S&P Global reports that input costs and selling price inflation picked up from May. Business conditions continued to improve and employment returned to growth territory. Vietnam recorded the strongest manufacturing growth in the region.

ASEAN S&P Global manufacturing PMI

Source: MNI - Market News/Bloomberg

- Indonesia’s PMI fell for the third straight month but continues to signal modest growth at 50.7, but the lowest since November 2022. Growth in orders, output and purchases all eased in June, while export orders continued to contract, which is keeping the outlook soft and employment flat. Input cost inflation remains elevated due to the soft currency and higher fuel prices, but eased moderately from May. Selling price inflation remains restrained as demand growth eases but did pick up slightly last month.

- Thailand’s manufacturing activity contracted in the 9 months to April but it grew in May and improved again in June with the S&P Global PMI at 51.7, in line with ASEAN, up from 50.3. This is the highest result since June 2023. New orders are still contracting but now only slightly driving an improvement in the outlook and employment. Costs were steady but output inflation increased but remains below average.

- The manufacturing PMI for the Philippines eased to 51.3 from 51.9 but Q2 still saw a pickup in growth. New orders slowed considerably in June though, including from overseas, and confidence is below the series average. Spare capacity drove a reduction in staffing. Cost inflation rose to its highest since February due to scarce raw materials but remains below average. While output inflation is positive, it moderated in June.

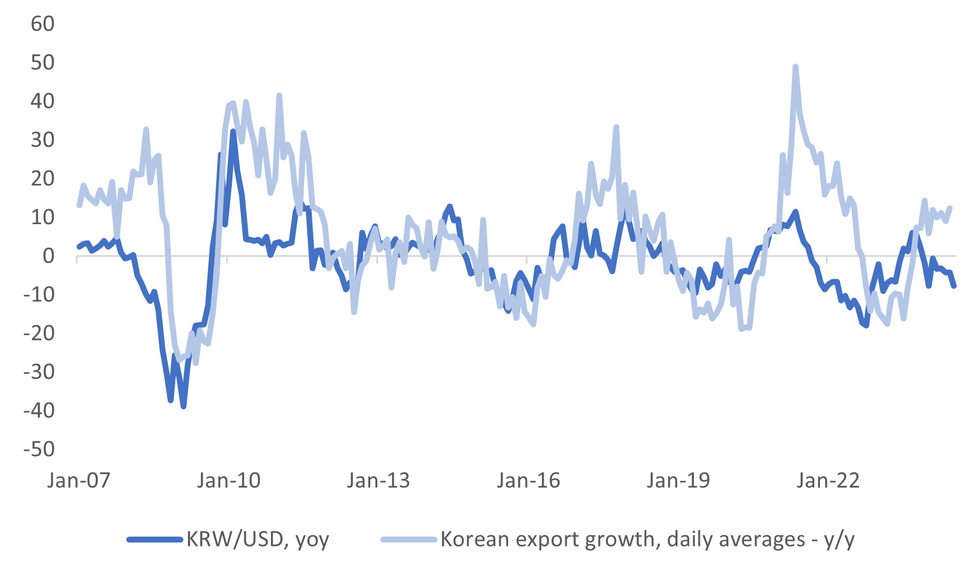

SOUTH KOREA DATA: Daily Average Exports Hold Close To Recent Highs, Trade Surplus Firms

South Korean export growth was a touch above forecasts, up 5.1% y/y, versus 4.4% forecast, although still showed slowing sequential momentum from May (+11.5%). Still, the average daily export print came in at 12.4% y/y, versus 9% in May. Imports were weaker than forecast at -7.5%y/y (-4.7% projected and -2.0% prior). This aided a higher trade surplus, which printed just under $8bn for June ($5.7bn was forecast, prior $4.855bn). This is the highest surplus since Q3 2020.

- The chart below overlays daily average export growth in y/y terms versus KRW/USD y/y changes. A modest divergence persists between the two series.

- Domestic capital outflow pressures, uncertainty around Fed easing and export growth concentrated in the tech/chip space have been highlighted as factors driving this wedge.

- Chips exports remained strong, +50% in y/y terms for June (recent cycle highs rest just above 60%). By country, exports to China were positive albeit just (+1.8% y/y). For the US it was +14.7% y/y.

- The lower import bill helped boost the trade surplus position. The trend on the trade surplus remains firmly positive, although the Citi South Korean terms of trade proxy is off earlier YTD highs.

Fig 1: South Korea Export Growth & KRW/USD Y/Y Changes

Source: MNI - Market News/Bloomberg

INDONESIA DATA: Inflation Well Contained, Too Early To Talk Rates Cuts Though Given IDR

Indonesian June CPI inflation came in below expectations with headline down 0.3pp to 2.5% y/y, lowest since September 2023, and core steady at 1.9%. Both are well within Bank Indonesia’s (BI) 1.5-3.5% target band with underlying inflation at the low end. BI left rates at 6.25% in June despite the weaker rupiah. It is “confident” that inflation will stay in the corridor and that its focus on FX stability will help contain import prices. With USDIDR still elevated at 16362, rate cuts remain some way off and are highly unlikely to occur before the first Fed easing.

- The moderation in June inflation was driven by lower food prices, which BI was expecting as harvests increase supply. Volatile foods price inflation moderated to 6% y/y from 8.1%.

- S&P Global reported that the weak rupiah continued to add to input cost pressures in June but they eased moderately compared to May. Selling price inflation remains restrained though as demand growth eases but they did pick up slightly last month.

- Utilities were stable at 0.5% y/y while transportation picked up to 1.6% y/y after 1.3%. Personal care prices were also higher.

- State administered prices rose 1.7% y/y.

Source: MNI - Market News/Refinitiv

ASIA FX: USD/Asia Pairs Supported On Dips

Most USD/Asia pairs have been supported on dips as the Monday session has unfolded. Overall moves have been modest though. Won spot has given back some of last week's gain, but remains within recent ranges. USD/CNH dips under 7.3000 remain supported. Tomorrow, we have South Korean CPI first up, later on tomorrow evening Singapore PMIs print.

- USD/CNH has tracked narrow ranges. We sit above 7.3000, just under recent highs, but little changed for the session. The Caixin PMI was better than forecast, offsetting to some extent, the softer official read from the weekend, which remained in contraction territory. Signs that the housing sale slump is easing has also aided local property stocks, but there hasn't been any positive follow through to the yuan at this stage.

- 1 Month USD/KRW is a touch higher, last near 1380, while onshore spot is back to 1382, unwinding some of last week's won outperformance. Earlier data showed a resilient export growth backdrop and a wider trade surplus than forecast, but won sentiment didn't shift. PMI data also showed further improvement in the manufacturing backdrop. Local equities are marginally higher. A reminder that spot won's trading extension kicks off today

- Spot USD/TWD has also risen, last above 31.50, but the 1 month NDF is close to unchanged. Spot remains short of late June highs around 31.60.

- USD/IDR was last near 16360/70 little changed for the session. We remain off recent highs near 16480. On the data front, June CPI was a little below expectations, headline 2.51% y/y (versus 2.70% forecast), while the PMI dipped but remained above the 50 expansion/contraction point.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 01/07/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0800/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 01/07/2024 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 01/07/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 01/07/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/07/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 01/07/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (final) |

| 01/07/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2024 | 1400/1000 | * |  | US | Construction Spending |

| 01/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 01/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/07/2024 | 1900/2100 |  | EU | ECB's Lagarde speech at ECB forum on Central Banking |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.