-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Familiar Themes At Work

- Narrow ranges for markets overnight, with little macro flow in Asia.

- Brexit, Sino-U.S. relations & OPEC continue to draw most of the attention.

- API inventory data adds to pressure on crude.

BOND SUMMARY: Asia Happy To Buy The Dip In Tsys, Again

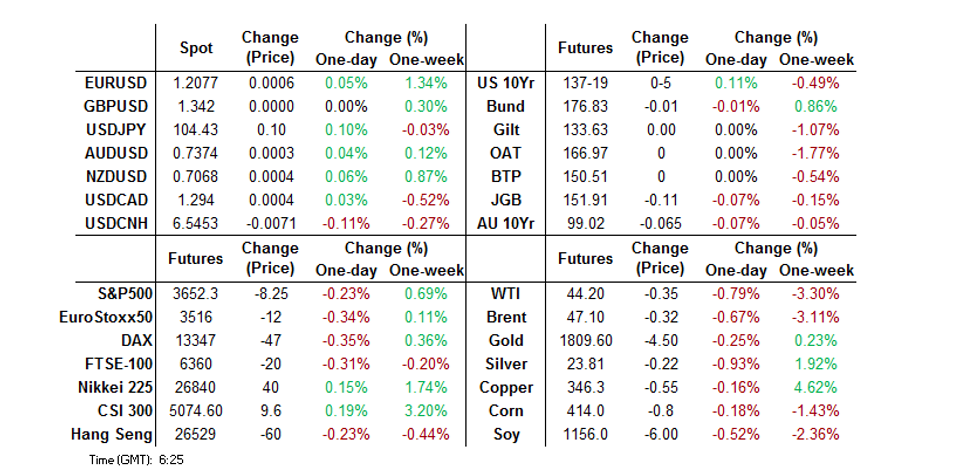

Wednesday's Asia-Pac session was light on news, but that didn't stop regional investors from dipping their toes into long U.S. Tsy positions on the back of Tuesday's dip. Desks cited solid demand from real money a/cs in the 10-Year zone as the curve saw some light bull flattening (cash Tsys trade up to 1.0bp richer at typing), with T-Notes +0-05 at 137-19 on volume of ~120K. Eurodollar futures are unchanged to +1.0K through the reds, with the highlight on the flow side coming in the form of an EDU2/U4 steepener (which saw 5.5K lots trade in 1 clip) although outright and spread flow was generally mixed in nature.

- It was a narrow session for JGB futures, with the contract operating a touch off the overnight lows, closing 11 ticks below Tokyo settlement levels after the overnight cheapening which came about on the back of the dynamic in U.S. Tsys. Cash JGBs were cheaper across most of the curve but generally traded within 1.0bp of settlement levels. Today's BoJ Rinban operations saw the Bank leave the size of its 1-5 Year JGB purchases unchanged, with little in the way of notable movement in the offer/cover ratios. Elsewhere, we heard from BoJ's Amamiya, but he didn't add to the policy debate as he went over old ground.

- Aussie bonds are steeper on the day, although futures finished off their lows with YM -1.0 & XM -6.5, and have given back their early outperformance vs. Tsys (at least as observed by the AU/U.S. 10-Year yield spread). Contacts flagged decent real money interest to receive 10-Year swaps. The Australian Q3 GDP reading was stronger than median expectations. Elsewhere, RBA Governor Lowe & Deputy Governor Debelle made an appearance in front of the Economic Standing Committee in Canberra, which generated little in the way of surprise. The impact of flows vs. stock of QE, relative bond yield dynamics, direction of the AUD (with AUD TWI at the fore), focus on unemployment as opposed to the risk of excessive borrowing levels, housing prices, infrastructure investment and the Bank's economic outlook dominate the lines of questioning. It is worth noting that Lowe pointed to an open mind re: the potential extension of QE beyond the already outlined A$100bn level, with that particular thought process to focus on economic performance, relative central bank stances and the functioning of markets. The latest ACGB '31 offering saw a soft cover ratio, at least by recent standards, perhaps the recent cheapening scared off a chunk of the potential bidders even against the upcoming Christmas break for AOFM issuance. Still, average yields managed to stop ~0.6bp through prevailing mids at the time of auction (per BBG pricing).

FOREX: US Dollar Weakens Again in Mild Risk-On Conditions

FOREX: Another fairly quiet FX session for Asia-Pac, the main driver of price action was again a weaker US dollar as risk on sentiment prevailed and equity indices moved mostly higher. E-Minis were a touch weaker after Wall Street hit record highs on Tuesday, but this did little to dampen broadly positive sentiment.

- Yen crosses were slightly weaker as safe haven currencies fell out of favour. USD/JPY last at 104.37 after touching highs of 104.46 earlier. EUR/JPY charged through the 126 handle with chatter of momentum accounts active around the handle, pair last at 126.06

- AUD has strengthened slightly vs. the US dollar, the pair last at 0.7381. Risk on tone in Australia was supported by a 2% jump in gold prices, and a positive assessment on the domestic economy from the OECD who expect a 3.2% rebound in 2021 GDP figures. Markets shrugged off stronger than expected Q3 GDP figures.

- NZD has seen a similar move higher, currently hovering around the highest level in 30-months. Market participants will look ahead to the speech from RBNZ Governor Orr at 0630GMT/1730AEDT, his recent comments have moved away from speculation that the RBNZ is contemplating negative rates, in a speech last week he said that it would only be used if absolutely necessary.

- The yuan continued to grind higher against the US dollar. The PBOC set the USD/CNY reference rate at 6.5611, higher than the 6.5572 from sell-side model estimates. The 39pip difference was the third-largest miss since the PBOC announced that it was phasing out its counter-cyclical adjustment for the fixing in October. Markets shrugged off this discrepancy, USD/CNH last trades at 6.5451, just off session lows.

FOREX OPTIONS: Expiries for Dec1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.2bln), $1.1850-60(E545mln), $1.1900(E509mln), $1.1950(E642mln), $1.2000-10(E995mln)

- USD/JPY: Y103.00($504mln), Y104.85-00($1.0bln)

- GBP/USD $1.2800(Gbp511mln), $1.3215-30(Gbp545mln)

- EUR/GBP: Gbp0.8900(E630mln)

- USD/CNY: Cny6.6275($574mln-USD puts)

EQUITIES: Asia Little Changed, E-Minis Edge Lower After New Wall St. Records

The major regional indices struggled for any meaningful sense of direction during Wednesday's Asia-Pac session, operating either side of unchanged, while U.S. e-minis edged lower after their cash equivalents backed away from fresh record highs (in the case of the S&P 500 and NASDAQ 100) into the Wall St. close. This came in the wake of a solid rally lining up with the resumption of fiscal stimulus discussions in DC and a decent ISM m'fing print.

- Macro headline flow was generally light during the Asia-Pac session, although Donald Trump continued his battle against "big tech" friendly regulations.

- Nikkei 225 +0.1%, Hang Seng -0.1%, CSI 300 +0.2%, ASX 200 unch.

- S&P 500 futures -10, DJIA futures -125, NASDAQ 100 futures -17.

GOLD: Back Above $1,800

The latest round of USD weakness has supported bullion over the last 24 hours, even with Tsys struggling/stagnant U.S. real yields and ETFs continuing to shed their gold holdings (which still sit just shy of historically elevated levels in the grand scheme of things). Spot last deals around the $1,810/oz mark. From a technical perspective bulls look to force a break above the Nov 26 high at $1,818.3/oz which would allow them to turn their focus higher.

OIL: API Inventories Add Fresh Pressure

WTI & Brent sit $0.30--0.40 below their respective settlement levels, building on yesterday's losses.

- OPEC+ production matters continue to dominate. OPEC delegates continue to err on the optimistic side re: reaching a broad consensus re: future production ahead of the OPEC+ ministerial gathering, although the market is a little more uncertain. There appears to be 3 potential scenarios that are being discussed among some of the major players.

- Extend the current production cut by 3 months, which the Saudis seem to be behind.

- Raise output from Jan, but in a more gradual manner and by less than previously planned 2mn bpd, which seems to be Russia's preference.

- Raise output by 2mn bpd from Jan as previously planned, which Kazakhstan favours.

- Elsewhere, a surprise, sizeable headline crude stock build in the latest round of weekly API inventory data provided a further source of pressure.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.