-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Global Disinflationary Forces Easing

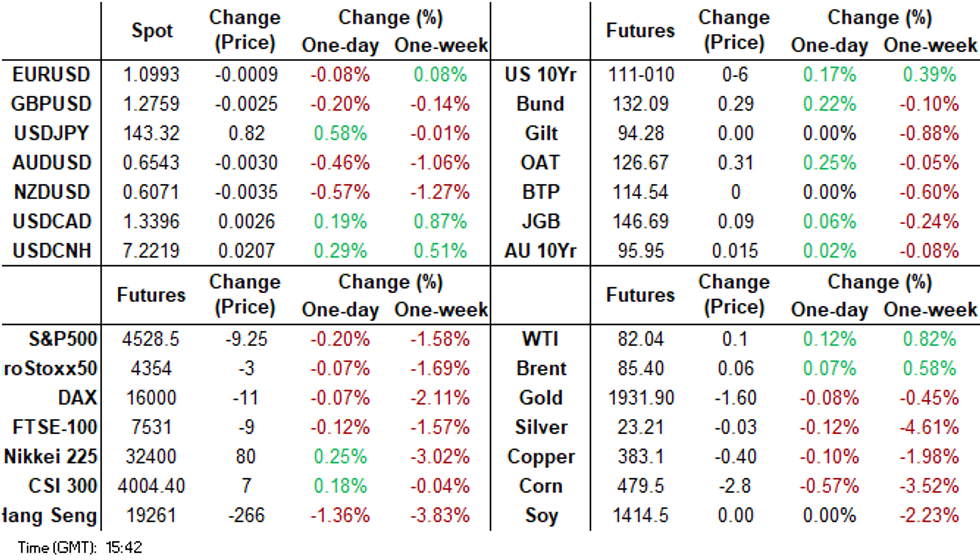

- China trade figures were weaker than expected from an export and import growth standpoint. At face value the data suggests the economic backdrop remains a challenging one. USD/CNH spiked to fresh highs above 7.2300, aided by a higher USD/CNY fixing and weaker equities (the trade figures didn't see meaningful market impact). The onshore equity backdrop has improved this as the session progressed though.

- Elsewhere, US cash tsys sit 1-5bps richer across the major benchmarks, the curve has bull flattened. USD indices continue to track higher though, although remain sub pre-payroll levels from last Friday.

- More broadly, the disinflationary effect from supply chains, food and oil seems to have come to an end but apart from the latter are not yet adding to price pressures. G20 inflation eased to 5.5% y/y in June from 5.9%, the OECD to 5.7% from 6.5% and non-Japan Asia ex China was steady at 3.8%. Data where it is available are showing a further moderation in inflation in July but there is a risk of higher headline before year end, see below for more details.

- Looking ahead, the final print of German CPI headlines in Europe, further out we have trade balance as well as wholesale inventories and trade. Fedspeak from Philadelphia Fed President Harker and Richmond Fed President Barkin is due. We also have the latest 3-Year Supply.

MARKETS

GLOBAL: Disinflationary Forces Easing

The disinflationary effect from supply chains, food and oil seems to have come to an end but apart from the latter are not yet adding to price pressures. G20 inflation eased to 5.5% y/y in June from 5.9%, the OECD to 5.7% from 6.5% and non-Japan Asia ex China was steady at 3.8%. Data where it is available are showing a further moderation in inflation in July but there is a risk of higher headline before year end.

- The NY Fed’s global supply chain pressure index rose in July to -0.9 from -1.14, the highest since February. It is still negative and so supply chain bottlenecks continues to ease but less than earlier this year.

- Brent crude rose to $80.11/bbl on average in July and in August so far is $85.29. While this is still down 12.6% y/y, it is up from -23.9% in July and has risen 13.8% since June. This move is likely to be seen in monthly CPIs soon.

- FAO food prices remained weak in July. It was too early for the impact of Russia pulling out of the Black Sea grain export agreement and India’s restrictions on rice exports to be felt. Food prices fell 11.8% y/y up from -20.9% in June, and seem to have troughed around mid year.

- All components were down in July except for oils. Only sugar is higher on the year at 29.6% y/y and oils have seen the sharpest drop at -23.1% after rising strongly in 2022 due to Russia’s invasion of Ukraine. Cereals are still down 14.5% y/y.

Source: MNI - Market News/Refinitiv

CHINA DATA: Weaker Export & Import Growth Add To Growth Headwinds

China trade figures were weaker than expected from an export and import growth standpoint. Export growth printed at -14.5% y/y, versus -13.2% expected. Imports were -12.4% y/y, versus a -5.6% forecast. Export growth is back to early 2020 levels, while imports are trending back down, although remain above earlier 2023 lows (near -20% y/y). At face value the data suggests the economic backdrop remains a challenging one.

- One positive from a CNH perspective is a largely than expected trade surplus for July, coming in at $80.6bn, versus $70bn forecast.

- The reaction in USD/CNH has been fairly muted so far. We did spike a little higher, but now sit back closer to 7.2200. As we noted earlier, the extent to which the CNY NEER has already fallen in recent months has discounted a weaker export growth backdrop, see the first chart below.

- Processing exports (with imported materials) continued to ease, down -22.1% y/y from -19.5% in June.

Fig 1: China Export Growth & CNY NEER Y/Y

Source: MNI - Market News/Bloomberg

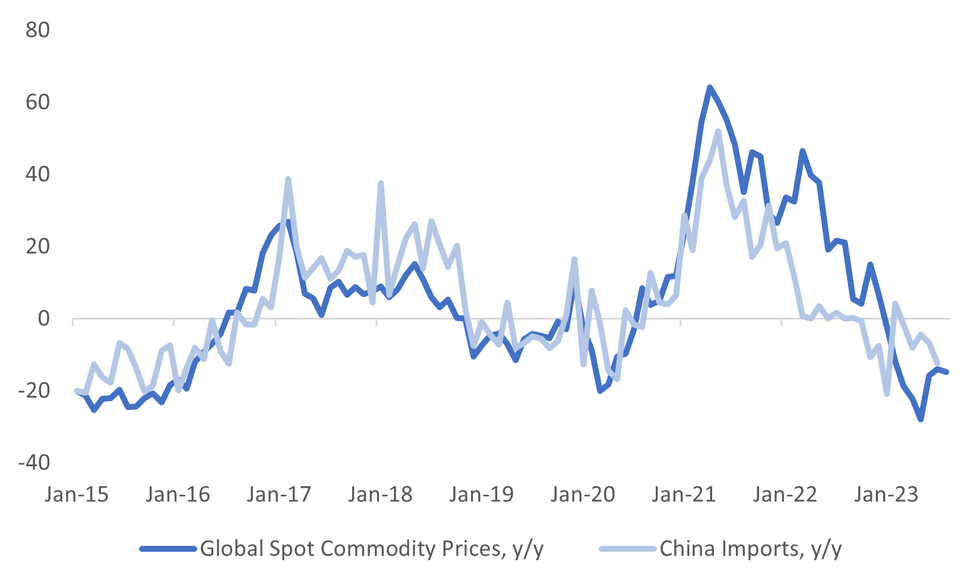

- On the import side, the weaker than expected result shouldn't add to the recovery in aggregate commodity prices in recent months (albeit still negative in y/y terms), see the second chart below.

- Iron ore and oil imports were down in volume terms for July versus June, but still up in y/y terms, more so for oil. Coal import volumes were also down a touch in m/m terms, but like oil up comfortably versus levels from a year ago.

Fig 2: China Imports & Aggregate Commodity Prices Y/Y

Source: MNI - Market News/Bloomberg

US TSYS: Curve Flattens In Asia

TYU3 deals at 111-08+, +0-04+, a touch off the top of the 0-10+ range on volume of ~83k.

- Cash tsys sit 1-5bps richer across the major benchmarks, the curve has bull flattened.

- Tsys were marginally firmer in early dealing as Asia-Pac participants faded yesterday's cheapening, perhaps using the opportunity to enter fresh long positions/close out shorts.

- The long end of the tsy curve has extended gains though the Asian session, perhaps today's slated 3-Year issuance weighed on the short end in Asia. The move came alongside an uptick in the USD and weakness in US Equity Futures and Regional Equities.

- Ranges remained narrow for the most part, and little meaningful macro news flow crossed.

- The final print of German CPI headlines in Europe, further out we have trade balance as well as wholesale inventories and trade. Fedspeak from Philadelphia Fed President Harker and Richmond Fed President Barkin is due. We also have the latest 3-Year Supply.

JGBS: Futures Richer After 30Y Auction, US Tsys Are Also Stronger

In Tokyo's afternoon trading, JGB futures have gained strength, +9 compared to settlement levels, following robust demand witnessed in today's 30-year auction. The auction's lower price surpassed dealer expectations, while the cover ratio reached its highest point seen in a 30-year auction since January 2022. Additionally, the auction tail was notably shorter, marking its briefest length since February 2022.

- There hasn't been a presence of domestic catalysts to highlight, apart from the previously outlined real and nominal labour cash earnings, as well as household spending, all printing lower than estimates.

- US tsys sit 1-5bps richer across the major benchmarks in Asia-Pac trade, the curve has bull flattened.

- The cash JGB curve has bull flattened in afternoon trade with yields 0.3-5.0bp lower. The benchmark 10-year yield is 1.3bp lower at 0.617%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The 30-year JGB is 4.2bp richer on the day after today’s 30-year supply.

- The swaps curve has also bull flattened after twist steepening at lunch. Swap spreads are generally wider across the curve.

- Tomorrow the local calendar sees July M2 & M3 Money Stock along with July Machine Tool Orders data.

- Tomorrow will also see BoJ Rinban operations covering 1- to 25-Year JGBs.

AUSSIE BONDS: Cheaper, Narrow Range, Confidence Data Fails To Move Market

ACGBs (YM +1.0 & XM +1.0) are slightly stronger after trading in a narrow range during the Sydney session. The latest consumer and business confidence data failed to move the market.

- Nonetheless, it is noteworthy that the price and cost measures in the NAB business survey all rose in July which given higher wages, power and fuel prices since July 1 is unsurprising. What they do in the months ahead will be important. It remains unclear whether demand is strong enough for costs to be passed onto consumers fully, partially or not at all.

- Cash ACGBs are 11-14bp richer after being closed yesterday for the NSW bank holiday. The AU-US 10-year yield differential is at +1bp.

- Swap rates are flat to 2bp higher with the 3s10s curve flatter.

- The bills strip is slightly richer with pricing +1 to +2.

- RBA-dated OIS pricing is flat to 2bp softer.

- (AFR) Goldman Sachs is tipping the decline in iron ore prices will extend into the back end of this year as the physical market tips into an imminent surplus, and concerns intensify that China will ramp up cuts to its steel output. (See link)

- Tomorrow the local calendar sees no data releases.

- The AOFM does however plan to sell A$700mn of the 2.75% 21 June 2035 bond.

AUSTRALIAN DATA: NAB Price/Cost Measures Rise But Lower Than July 2022

The price and cost measures in the NAB business survey all rose in July which given higher wages, power and fuel prices since July 1 is unsurprising. They also rose in July 2022 and what they do in the months ahead will be important and should be monitored closely. It remains unclear whether demand is strong enough for costs to be passed onto consumers fully, partially or not at all.

- Labour costs rose to 3.7% in July from 2.3% but were lower than July 2022’s 4% despite the minimum award increase this year being higher. Purchase costs also increased to 2.6% from 2.2% but well below July 2022’s 5.2%.

- There was some pass through of these higher costs to prices with final product prices rising 2% up from 1% but lower than 2.5% the same time last year and retail prices 2.6% from 1.4% but also less than 3.3% in July 2022.

Source: MNI - Market News/Refinitiv

NZGBS: Closed On A Soft Note, NZ-US 10Y Differential Widens

NZGBs closed 4bp cheaper at session cheaps ahead of tomorrow’s important data drop. Tomorrow the local calendar sees July Retail Sales Spending data along with the RBNZ’s Survey of Inflation Expectations. A lift in hospitality spending is expected to offset weakness elsewhere, according to Westpac, while inflation expectations look set to ease now that headline inflation is well past its peak.

- NZGBs have underperformed US tsys today with the NZ-US 10-year differential yield differential 5bp wider at +73bp.

- The long end of the tsy curve has extended gains through the Asia-Pac session. Today's slated 3-year issuance is possibly weighing on the short end. Ranges do remain narrow with little follow through, little meaningful macro news flow has crossed. This leaves cash tsys 1-6bp richer, the curve has bull flattened.

- Swap rates closed 2-3bp higher.

- RBNZ dated OIS closed little changed.

- Bloomberg reports that the NZ Treasury says the downturn in the housing market is nearing an end. Numbers of residential dwelling approvals appear to be stabilising as a surge in net migration helps stem the fall in both consents and house prices and helps lift rents for new tenancies. (See link)

FOREX: Yen Pressured In Asia

The Yen is the weakest performer in the G-10 space at the margins, softer than forecast Labour Cash Earnings pressured the Yen in early dealing. Losses extended after the PBOC Yuan fixing was corrected to 7.1565 from 7.1365 as broad based USD buying was seen.

- USD/JPY prints at ¥134.30/35, the pair is ~0.6% firmer on Tuesday. We remain well below resistance at ¥144.20, the high from July 7. Labour Cash Earnings were softer than expected in June printing at 2.3% Y/Y vs 3.0% exp, Real Cash Earnings fell -1.6% Y/Y.

- AUD/USD is down ~0.4%, last printing at $0.6545/50 sitting at its lowest level since 3 August. Support comes in at $0.6514 (low from Aug 3) and $0.6485 (low from Jun 1).

- Kiwi is also pressured, NZD/USD is down ~0.4% and has breached the $0.61 handle. The pair last prints at $0.6075/80.

- Elsewhere in the G-10 space GBP and EUR are both ~0.2% softer. The scandies are pressured, SEK and NOK are down ~0.3%, however liquidity is generally poor in Asia.

- Cross asset wise; e-minis are down ~0.2% and the Hang Seng is down ~1.3%. BBDXY is up ~0.3% and 10 Year US Tsy Yields are down ~3bps.

- In Europe the final read of German national CPI for July provides the highlight, further out we have US Trade Balance and Wholesale Inventories.

EQUITIES: China Shares Recoup Early Losses, But Generally Weaker Trends Elsewhere

Regional equities are once again mixed. China and HK markets started off weaker, but China onshore sentiment rebounded ahead of the lunch break. US equity futures are lower, with Eminis off by ~0.20%, last near 4529, while Nasdaq futures are down ~0.30% at this stage. These moves have helped offset some of the positive lead from the Monday US session.

- China's CSI 300 is a touch firmer at the lunch time break. We were -0.70% weaker at one stage. In index terms support has been evident around the 3960 level so far in August (latest levels ~3993). Health care stocks have recovered some ground, but the real estate sub index is off a further 0.55%, after dipping -3.36% yesterday. Funding/liquidity concerns at developer Country Garden remain a concern. July trade figures also point to weaker economic conditions for China.

- The HSI is off 1.37% at the break, although we are away from session lows. The HS China Enterprises Index is down 1.65%. The HSI has unwound the late July bounce, but remains comfortably above earlier July lows.

- Japan stocks are edging higher, but without strong conviction. The Topix up ~0.30%, likewise for the Nikkei 225. Yen is tracking weaker, down 0.60% against the USD, but earlier data showed weaker than expected wages and household spending data.

- The Kospi couldn't hold early positive momentum, the index sitting sub 2600, last down -0.10%. The Taiex is off by 0.70% at this stage, despite a bounce in the SOX in US trade on Monday.

- SEA markets are mixed, but mostly lower. Malaysia shares the main outperformers +0.40%.

OIL: Crude Rally Pauses, Market Reports Published This Week

Oil prices are off their lows but have been trading in a narrow range during the APAC session. They are currently around 0.1% higher with WTI at $82.00 and Brent $85.34. The stronger greenback with the USD index up 0.3%, weaker US equity futures and softer Chinese import data have put pressure on crude. Concerns re tensions in the Black Sea have taken a back seat.

- WTI broke through $82 earlier in the session and troughed at $81.90. The level is being tested again. Brent has held above $85 with a low of $85.22.

- The last week of July showed a record decline in US inventories, which was due to some volatility. The API data is released later today. Also, the US’ EIA publishes its monthly “Short-term Energy Outlook”. On the global stage, OPEC+ and the IEA release their reports this week too.

- The Fed’s Harker and Barkin speak later on the economy. On the data front there is US June trade, inventories, July small business optimism and German July CPI. The focus of the week will be US July CPI on Thursday.

GOLD: Slightly Lower In Asia-Pac After Closing Lower On Monday

Gold is slightly lower in the Asia-Pac session, after closing 0.3% lower on Monday. Bullion was weaker after long end US tsys were heavy with yields higher again after short covering on Friday pushed them lower.

- Anticipation of August supply has left US tsys heavy over recent days, especially in the wake of the debt warnings from the Fitch downgrade.

- Overnight, the market's anticipations of the Federal Reserve concluding its tightening measures were challenged by hawkish statements from Fed Governor Bowman. Additionally, Fed Williams maintained the potential for additional rate hikes. Fedspeak from Philadelphia Fed President Harker and Richmond Fed President Barkin is due later today.

- US CPI figures out later this week will be closely monitored.

INDONESIA DATA: Consumer Confidence Pointing To Solid Q3 Spending

July consumer confidence eased for the second consecutive month falling 2.8% m/m to 123.5. Although it is 3.7% off the May high, it remains elevated and continues to signal that retail sales should pick up. June sales are released on August 16 by BI. They were down 4.5% y/y in May. Q2 private consumption rose 5.2% y/y and even if consumer confidence deteriorates moderately over the rest of Q3, consumption growth should remain solid this quarter (see chart).

Indonesia consumption outlook

Source: MNI - Market News/Refinitiv

ASIA FX: Dollar Gains Continue

USD/Asia pairs are higher across the board today, albeit with current levels sub highs for the session. USD/CNH broke higher, getting above 7.2300 before selling interest emerged. Regional equities are mostly lower, while the USD has recovered further ground against the majors, which has also weighed. Still to come today we have Taiwan July trade data. Tomorrow, China July inflation figures are out. South Korea unemployment figures are due, as are Taiwan CPI figures.

- USD/CNH sits off session highs, last tracking around 7.2200. The early impetus for CNH weakness came from a move up in the USD/CNY fixing level (above 7.1500), while onshore and HK equities were also weaker in early trade. The pair got to a high of 7.2321 before retracing. Onshore equities have improved, although are struggling to maintain a positive bias. HK equities remain in the red. July trade data was weaker than expected, particularly in terms of import growth.

- 1 month USD/KRW got to fresh highs near 1314 amid fresh CNH and JPY weakness. We sit slightly lower now, last in the 1312/13 region. Onshore equities are weaker, adding to USD support. Late June highs are the next potential upside target, coming in around 1322.

- The SGD NEER (per Goldman Sachs estimates) has firmed in early dealing this morning, the measure sits a touch off the base of the recent range. We sit ~0.5% below the top of the band. USD/SGD is ~0.2% higher on Tuesday, broader greenback trends are dominating flow on Tuesday, the pair last prints at $1.3430/40. In July Foreign Reserves ticked higher to $340.79bn from $331.19bn in June. The local docket is empty until Friday when the final read of Q2 GDP is due. There is no estimate and the prior read was 0.3% Q/Q.

- The Ringgit is at it's weakest level since July 24, broader greenback trends are dominating flows in Asia on Tuesday. USD/MYR sits at 4.5720/65, the pair is up ~0.3% and has breached the 20-day EMA (4.5652) this morning. On the wires yesterday July31 Foreign Reserves printed at $112.9bn ticking higher from the prior read of $111.8bn.

- The Rupee has trimmed Monday's gains in early dealing today, broader greenback trends are dominating today and USD/INR is up ~0.1%. The pair last prints at 82.80/81, Friday's highs remain intact for now. Technically USD/INR remains in a strong uptrend, bulls look to breach Fridays highs (82.8475) to target the 83 handle. Bears focus on the 20-Day EMA (82.27) to turn the tide. The highlight of the week is the RBIs latest monetary policy decision tomorrow no change to policy is expected. Further out Industrial Production also crosses on Friday, and is expected to tick lower to 5.0% Y/Y from 5.2% Y/Y.

- USD/IDR is testing above its simple 200-day MA (~15220). The pair last at 15225/50, +0.30% higher. We are down slightly from earlier levels. BI stated it will remain in the FX market to ensure stable supply/demand conditions. So, this will be a watch point for markets in the near term. On the data front, July consumer confidence eased for the second consecutive month falling 2.8% m/m to 123.5. Although it is 3.7% off the May high, it remains elevated and continues to signal that retail sales should pick up.

- USD/PHP has backed away from a test of Fresh YTD highs. The pair last at 56.20/25, earlier highs were close to 56.40. The authorities may be mindful of a fresh break through this level. So, we could see verbal jawboning or actual intervention if current trends continue. June trade figures printed a little while ago, coming in slightly better than expected. Exports were +0.8% y/y (forecast -4.8%, prior 2.4%). Imports were -15.2% y/y, versus the -14.4% forecast. Prior was -8.1%. This meant the trade deficit was slightly better than forecast, -$3918mn, versus -4450mn expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/08/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 08/08/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/08/2023 | 1215/0815 |  | US | Philadelphia Fed's Pat Harker | |

| 08/08/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/08/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 08/08/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 08/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/08/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/08/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 08/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 08/08/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.