MNI EUROPEAN MARKETS ANALYSIS: Gold To Fresh Record Highs Amid Weaker USD/Fed Speculation

- US front yields fell today, as speculation continues around whether the Fed will cut by 50bps next week. Former Fed official Bill Dudley advocated such a move, building on press reports from Thursday US trade which stated the 25bps v 50bps move was a close call. Tsy futures are higher, although all the moves came in the first half of the session.

- USD sentiment is mostly softer, with yield sensitive yen outperforming in the G10 space. USD/JPY briefly got to fresh lows back to late last year. Higher beta plays were steady, although some Asian currencies rallied strongly.

- Gold rose to a fresh record high, while oil looks set to post a gain for the week.

- Looking ahead, we have the BoE inflation survey, ECB speak from Lagarde, while in the US we trade prices and the U. Mich. Sentiment reading.

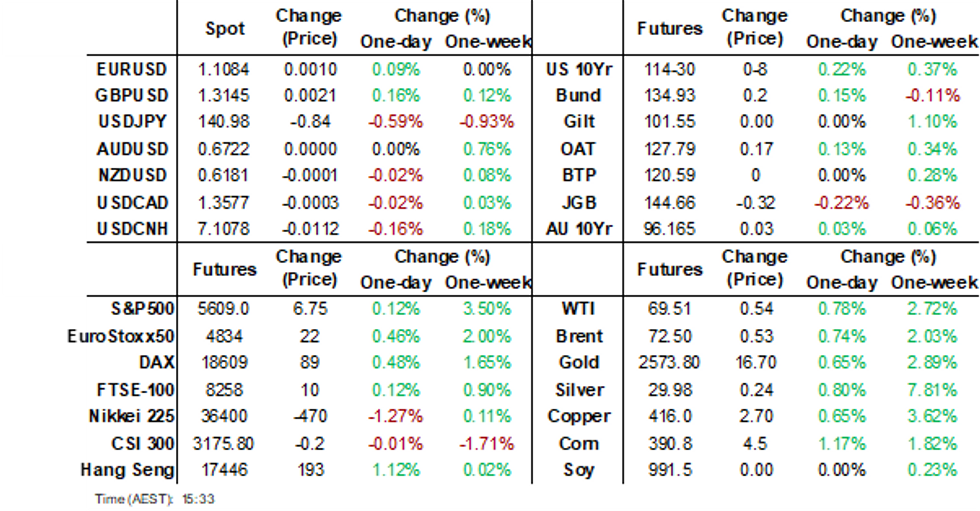

MARKETS

US TSYS: Tsys Futures Edge Higher, Ex-Fed Dudley Sees 50bps Cut Chance

- Tsys futures are higher today, although all the moves came in the first half of the session which looked like a follow on from a large block trade made post the NY close which looked like a bet on a 50bps cut next week. Fed fund futures firmed post the trade with the market pricing moving from a 10% chance of a 50bps cut to about a 45bps chance now.

- Ex-NY Fed Pres Dudley sees a strong case for a half-point rate cut at the FOMC meeting, citing a weakening U.S. labor market and risks to jobs outweighing inflation concerns. While most expect a quarter-point cut, Dudley emphasized Powell's reluctance to allow further labor market weakness, and noted that some Wall Street banks, like Citigroup and JPMorgan, are pushing for more aggressive action.

- There was little reaction in tsys futures to the comments from Dudley, with TUZ4 now +03 ⅜ at 104-12⅞, while TYZ4 is +07+ at 115-13.

- The cash tsys curve has steepened with yield 1-6bps lower. The 2yr is now -5.5bps at 3.584%, while the 10yr is -2.8bps at 3.646% the 2s10s is +2.583 at 5.915

- There was just the one Block traded today, a likely seller of TYZ4 at 115-12+, DV01 $135k, contract little changed since.

- Projected rate hikes have firmed throughout the session vs Thursday open levels (*) : Sep'24 cumulative -37.7bp (-29.4bp), Nov'24 cumulative -76.2bp (-65.2bp), Dec'24 -117.6bp (-106.0bp).

- Later today we have Import/Export Prices and U. of Mich. Sentiment.

STIR: Rate Cut Pricing Firms, ex-Fed's Dudley Sees Case For 50bps Cut

- Tsys futures are reacting little to ex-fed's Dudley's comments around seeing a case for 50bps of cuts at the meeting next week.

- Pricing for a 50bps cut has rallied post the NY close following a block trade in 30-day Fed fund futures, with the market now pricing in about 45% cut of a 50bps cut up from about 20% chance heading into NY close overnight.

- Fed Funds pricing has firmed 5-10bps across meetings out until April 2025.

Chart: Fed Funds Futures Today vs Sep 12 Open Levels

JGBS: Positive Spill Over From US Tsys, But Don't Break Weekly Highs

JGB futures sit just off session highs in latest dealings. JBZ4 is at 144.71, +.17 versus settlement levels. Pre the lunch time break we got as high as 144.79.

- Positive bias has been evident from the move up in US Tsy futures. Ex NY Fed head Bill Dudley was speaking at a forum in Singapore and stated there is a strong case for the Fed to cut 50bps at the September policy meeting.

- For JGB futures, focus is likely to be on whether we can break above recent highs around 144.80. The technical backdrop is supportive of such a move.

- Cash JGB yields are weaker, led by the backend of the curve. The 10yr is off over 2bps and sub 0.845%, not too from its simple 200-day MA in yield terms. The 20yr has seen the largest drop in yield, off 4bps. Swap rates are off around 2bps for key parts of the curve.

- The 3 month debt sale saw a debt to cover ratio of 3.13x, with an average yield just under 0.06%.

- Looking ahead to next week, the main focus will rest on BoJ's Friday policy announcement (before this we have National CPI). No change is expected from the economic consensus.

- On the supply front we have a 1yr debt sale next Wednesday.

AUSSIE BONDS: ACGBs Richer, Curve Steepens Tracking Move In US Tsys

ACGBs (YM +6.6 & XM +3.3) are richer today, tracking moves made in US tsys.

- Australian household spending rose by 1.8% in August, driven by early Father's Day celebrations, according to a survey by the Commonwealth Bank. Spending in hospitality and household goods saw the biggest gains, increasing by 5.2% and 4.4%, respectively. Utilities and transport spending both fell by 0.3%, partly due to government rebates and lower petrol prices. Despite the rise, the annual spending rate still reflects relatively weak consumer activity.

- US Tsys have rallied, with short-end yields falling as investors speculated about a potential 50bps interest rate cut by the Fed next week. The yield on two-year notes dropped 5.5bps to 3.584%, while the 10-year yield fell 2.8bps to 3.646%. There was a decent sized Block trade in Fed Futures post the NY close which saw the market shift from a 20% to a 45% chance of a 50bps cut next week. While comments from ex-NY Fed Pres Dudley who suggested a 50bps cut could be warranted.

- Cash ACGBs are 1-6bps richer, the 2yr yield is -5bps at 3.558%, while the 10yr is -2.7bps at 3.822%. The AU-US 10-year yield differential is little changed today at 17bps.

- Swap rates are 3-6bps lower, with the curve flatter.

- The bills strip is little changed today

- RBA-dated OIS pricing has 5bps into year-end with 22bps of cuts priced now. Pricing has also firmed 2-10bps for meetings through to August 2025.

- Today, the local calendar was empty, with focus now turning to Retail Sales on Thursday, followed by FOMC later in the day.

NZGBS: Trade Richer As US Rate Cut Pricing Firms

NZGBs are richer today curves have steepened over the week although slightly flattened over the day. Earlier today we saw August House prices fall, while BusinessNZ Mfg PMI rose slightly.

- Ex-NY Fed Pres Dudley sees a strong case for a half-point rate cut at the FOMC meeting, citing a weakening U.S. labor market and risks to jobs outweighing inflation concerns. While most expect a quarter-point cut, Dudley emphasized Powell's reluctance to allow further labor market weakness, and noted that some Wall Street banks, like Citigroup and JPMorgan, are pushing for more aggressive action.

- US tsys futures have edged higher and now trade near session's best. The US 10yr yield is trading at yearly lows of 3.644%, while the US 2s10s curve is +2.833 at 5.894, just off recent highs of 7.405.

- NZGBs yields are 4-5bps lower across the curve, with the 2yr -4.1bps at 3.861%, the lowest since Sept 2022, while the 10yr is trading -4.7bps at 4.088% back at may 2023 levels.

- Swap rates are 3-6bps lower

- RBNZ dated OIS continues to fluctuate with pricing firming 2-3bps into year-end, with 37.5bps of cuts priced in for October. Pricing has firmed 5-10bps through to the July meeting.

- NZ Houses are taking longer to sell, with the median time reaching 50 days in August, the highest since April 2023 with house prices flat in August after five months of declines, annual prices dropped 0.7%. While NZ Mfg PMI rose to 45.8 in August from 44.4 in July, marking the 18th consecutive month of contraction, though improving from a low of 41.4 in June.

- The calendar is empty until Thursday when GDP is due out, with consensus expected to show a 0.5% drop for Q2.

FOREX: USD/JPY Testing Weekly Lows, Safe Havens Rally On Fed Easing Expectation

The USD has remained on the backfoot through the first part of Friday trade. The BBDXY index last near session lows sub 1227 9off 0.25%). Focus remains on whether the Fed will cut by 50bps next week, when it is widely expected to commence its easing cycle.

- Market pricing has given greater likelihood to such a move since media articles (WSJ/FT) from US trade Thursday suggested a 25bps versus 50bps cut was a close call. Speaking in Singapore today, ex Fed NY head Bill Dudley stated there was a strong case for a 50bps cut at the September meeting.

- US yields are weaker across the key benchmarks, led by the front end. The US 2yr yield was last at 3.58%, close to recent lows).

- Such a backdrop has benefited the safe havens, with yen outperforming. USD/JPY got to 140.65 in recent dealings, fresh lows back to last Dec last year. We are around 0.70% stronger in yen terms now (140.80/85). CHF is up around 0.25%, USD/CHF last under 0.8500.

- Equity sentiment has been mixed, despite the positive US/EU lead from Thursday trade. Japan equities weighed by the stronger yen. US equity futures are close to flat.

- This has likely helped keep AUD and NZD relatively steady. AUD/USD last in the 0.6725/30, NZD at 0.6185.

- Looking ahead, we have the BoE inflation survey, ECB speak from Lagarde, while in the US we trade prices and the U. Mich. Sentiment reading.

ASIA STOCKS: Asian Equities Saw Strong Inflows Thursday

There were strong inflows into recently heavily sold Asian tech stocks on Thursday with Taiwan seeing the largest inflow since Mid August. We also the largest outflow in a month for Malaysian equities on Wednesday.

- South Korea: Saw $366m of inflows yesterday, with the past 5 sessions totaling -$1.61b, while YTD stands at +$13.38b. The 5-day average is -$323m, below both the 20-day average of -$184m and the 100-day average of - $9m.

- Taiwan: Saw $1.35b of inflows yesterday, with the past 5 sessions reaching -$1.20b, while YTD is -$14.80b. The 5-day average is -$241m, below the 20-day average of -$253m and the 100-day average of -$131m.

- India: Saw inflows of $342m Wednesday, with the past 5 sessions now totaling +$954m, while YTD is +$20.28b. The 5-day average is +$265m, below the 20-day average of +$304m but above the 100-day average of +$64m.

- Indonesia: Saw inflows of $98m yesterday, with the past 5 sessions netting +$226m, while YTD flows are +$2.20b. The 5-day average is +$45m, below the 20-day average of +$96m but above the 100-day average of +$13m.

- Thailand: Saw inflows of $25m yesterday, with the past 5 sessions now totaling +$547m, while YTD flows are -$2.76b. The 5-day average is +$109m, significantly above the 20-day average of +$28m and the 100-day average of -$11m.

- Malaysia: Saw outflows of $22m yesterday, with the past 5 sessions netting +$46m, while YTD flows are +$911m. The 5-day average is +$9m, below the 20-day average of +$47m but above the 100-day average of +$15m.

- Philippines: Saw inflows of $6m yesterday, with the past 5 sessions totaling +$51m, while YTD flows are -$258m. The 5-day average is +$10m, slightly below the 20-day average of +$12m but above the 100-day average of -$3m.

Table 1: EM Asia Equity Flows

OIL: Storm Pushing Oil Higher for weekly gain.

- The outlook for demand for oil is ‘slowing sharply’ as the Chinese economy cools, pushing prices to a 3-year low,” according to a report from the International Energy Agency.

- Global consumption rose by 800,000 barrels year to date for 2024, a fraction of the growth rate for the same period in 2023, reflecting not only China’ s slowing economy, but the impact it has on the global economy.

- Overnight oil was up as markets tracked storm Francine’s movement in the Gulf of Mexico as it headed towards major production areas, disrupting activity.

- The storm appears to be not as significant event as first thought but still has interrupted supply.

- West Texas Intermediate was through $69.50 in early morning trade before settling at $69.28 finishing above last week’s closing price of $67.67

- Brent followed a similar pattern trading up at $72.50 before settling at $72.25, a rise from last week’s closing price of $71.06.

GOLD: Gold Higher for the Week on Rate Cut Speculation.

- Gold surged on Thursday and carried over into Friday on the back of USD weakness ahead of next week’s Federal Reserve Decision.

- Gold touched $2,565 in Asia’s morning trading session, up 0.30% on the day.

- Gold has had a strong week and is set to finish up over 2% on last Friday’s close of $2,557.90.

- This year’s surge in gold prices has been supported by Central Bank’s continuing to buy gold and Geo-Political tensions on the rise in the Middle East.

- This week alone saw data from the Reserve Bank of India confirming that they continue to add to their Gold Reserves adding a further 5 tonnes in July, increasing their total reserves to approximately 850 tonnes.

CNH: Relative Monetary Policy Cycles Pointing To Further CNH/JPY Downside

USD/CNH is benefiting from broader USD softness so far today, as speculation continues around whether the Fed will kick start the easing cycle next week with a 50bps cut. The pair was last 7.1075, around 0.15% stronger in CNH terms. Earlier lows were at 7.1038. We are still some distance from earlier September lows at 7.0735.

- Outside of typically low beta with broader USD shifts, the weaker yield backdrop for local bond yields may be inhibiting CNH upside. The 10yr CGB yield fell to fresh lows back to 2002 earlier, comfortably sub 2.10%. The authorities are attempting to engineer a steeper yield curve. Weak economic fundamentals is still likely pushing flows into bonds though.

- The chart below plots the long run trends of the CNY/JPY cross versus the China-Japan 2yr government bond yield differential. This spread is now back sub +100bps for the first since 2009.

- There are lots of moving parts to the CNY/JPY cross, but respective monetary policy stances have trended strongly favor of the yen in recent months. The BoJ is clearly open to hiking rates further, while policy rates in China remain biased lower.

- For CNH/JPY, we are close to recent lows sub 19.80. A break lower could see the 19.72 region target, lows from late 2023.

- A potential support for CNH and the onshore spot rate is conversion of exporter proceeds back into local currency. This may pick up at the commencement of the Fed easing cycle. Note as well tomorrow's activity updates for August in China.

Fig 1: CNY/JPY & China-Japan 2yr Government Bond Yield Differentials

Source: MNI - Market News/Bloomberg

ASIA FX: THB Surges But BoT Warns On Volatility, PHP & IDR Lag

South East Asia currencies are higher across the board, albeit to varying degrees as Friday's session unfolds. Focus on whether the Fed will cut by 50bps, as it kicks off next week's easing cycle, has weighed on broader USD sentiment. US front end yields are down sharply (2yr off 5.5bps). This has offset a more indifferent regional equity backdrop.

- THB is the clear standout. USD/THB got to lows of 33.25, before BoT commentary on baht volatility steadied sentiment somewhat. Still at 33.30, baht is 1.3% stronger for the session and comfortably sub recent lows at 33.50. This is fresh lows in the pair back to early 2023. A shift sub 33.00 may be on the cards, although the BoT may look to curb baht gains, either through intervention or more fresh verbal jawboning. A continued run higher in the baht may weigh on external related activity. The RSI (14) is not yet in oversold territory for USD/THB.

- USD/MYR is tracking lower as well, around 0.45% firmer in MYR terms. The pair last at 4.3150. this is close to recent lows from the end of August. A clean break sub 4.3100 could see early 2023 lows around 4.2250 come into focus.

- Elsewhere, USD/IDR is a bit of laggard, struggling to make much headway sub the 15400 level. The BI is expected to leave rates on hold next week (per a RTRS survey).

- It has been a similar backdrop for USD/PHP, which has been unable to much headway south of 56.00. The pair was last 56.05/10.

CHINA: Bond Wrap

- China Bond yields down again with the 10-year breaching 2.10% to 2.08% despite evidence of the PBOC selling.

- Central Bank injected liquidity in this morning’s OMO.

- Our MNI Policy team anticipate a cut in the 7-day repo rates by more than 10bps to support efforts to stem the move lower in yields and steepen the curve.

- Shanghai composite down in morning trading with bond activity confined to the 10 year.

2yr 1.34% 5yr 1.703% 10yr 2.08% (-1bp) 30yr 2.246%

INDIA: Data Release Keeps the Rate Doves at Bay.

- Despite expectations for further moderation, India’s inflation surprised to the upside in August, rising more than expected.

- Yesterday’s CPI print saw inflation rise 3.65% following July’s release of 3.54% and survey expectations of 3.47%.

- The Reserve Bank of India forecasts pointed to an expected rise, despite market forecasts.

- The largest contributor to the CPI basket (food prices) rose 5.66%, up from 5.42% in July.

- Core inflation (ex-food) rose also to 3.44% from 3.14% in July.

- Adding to the positive data was an Industrial Production beat.

- Industrial Production rose 4.8% yoy from a revised July of +4.7% and market estimates of +4.6%.

- Whilst some market observers have held concerns about the slowdown in GDP seen from April to June, this data print should provide sufficient comfort to the RBI voting members that they have the opportunity to remain on hold for now and watch how the data evolves for the remainder of 2024.

CHINA DATA PREVIEW: Data Likely to Show Continued Softening in the China Economy.

- Over the weekend will see the release of some prominent data in China, yet the second tier may be of equal interest.

- Tomorrow sees the release of Industrial Production and following July’s increase of 5.1%, surveys suggest a decline to 4.7% marking the fourth successive month of declines.

- Of key interest in the data will be weather related disruption caused throughout August that impacted construction. This has the potential to be one a off event that potentially the market will look beyond.

- A further key release will be the Retail Sales data.

- The Chinese consumer data has been on an ongoing weakening trend given the multiyear housing slump that has impacted all parts of the economy.

- Retail sales survey suggest tomorrow could see a modest decline from 2.7% in July, to 2.5% for August.

- Typically, a second tier data release, New Home price data is also released. Prices are typically tightly controlled by government and with suggestions that some regions have been given some autonomy in determining prices for unsold new homes, the question is when we start to see this turning up in the data.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/09/2024 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/09/2024 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 13/09/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/09/2024 | - | *** |  | CN | Money Supply |

| 13/09/2024 | - | *** |  | CN | New Loans |

| 13/09/2024 | - | *** |  | CN | Social Financing |

| 13/09/2024 | - |  | EU | ECB's Lagarde in Eurogroup meeting | |

| 13/09/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/09/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 13/09/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/09/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |