-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Lack Of Fresh Dovishness From RBA Supports AUD

- G10 FX trades mixed vs. the USD after initial USD weakness become more nuanced. JPY struggled as BoJ Governor Kuroda reaffirmed the need for a steady policy path, while the AUD outperformed as the RBA failed to provide anything in the way of an overt dovish tweak to its guidance paragraph as it delivered the widely expected 25bp rate hike.

- The latest round of moderation in COVID restrictions in the Chinese capital of Beijing got plenty of attention, although failed to generate a meaningful market reaction.

- German factory orders & trade balance data from North America will cross Tuesday. Comments from Riksbank’s Floden are also slated.

US TSYS: Modestly Cheaper In Light Session

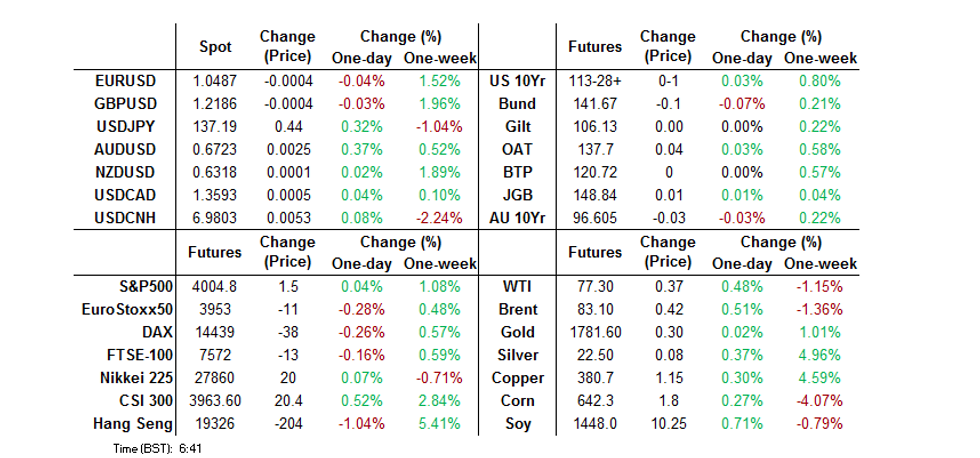

TYH3 deals +0-01 at 113-28+, just off the base of its narrow 0-06+ Asia-Pac range, on volume of ~71k.

- Cash Tsys trade 0.5-1.5bps cheaper across the major benchmarks, with some modest bear steepening in play.

- Spill over from ACGs in post-RBA trade helped apply some light pressure, as did reports of the Philippines seeking proposals for a multi-tranche round of USD-denominated bond issuance.

- Participants looked through Covid headlines from China as Bloomberg reported that Beijing would become the latest city to relax restrictions related to testing requirements for entry into some public spaces.

- Looking ahead, there is a thin docket in Europe today, with German factory orders providing the highlight there. The New York calendar is equally limited and will be headlined by U.S. trade balance data.

JGBS: Curve Twists Flatter, Futures Little Changed

JGB futures hit the bell +1 after wider moves in core global FI markets saw the contract unwind the uptick witnessed in the early part of the Tokyo session. Wider cash JGBs sit 2bp cheaper to 2bp richer as the curve twist flattens, pivoting around 30s.

- The early bid was aided by soft domestic spending and wage data, an uptick in U.S. Tsys and BoJ Governor Kuroda reiterating the need for continued monetary easing, as he once again pointed to the BoJ’s goals and stressed that now is not the time to debate the BoJ’s policy framework/an exit from ultra-loose settings (after BoJ board member Tamura pointed to the need for such discussions “at the right time”).

- Flattening held even against a lukewarm round of 30-Year JGB supply, which saw the cover ratio soften and price tail widen vs. last month’s offering, albeit conducted at lower prevailing yields. Note that the low price also printed below wider dealer expectations. The richness we flagged on the 20-/30-40-Year butterfly pre-auction was probably an impediment for demand. 30s cheapen a touch post-auction, while JGB futures tick lower (albeit with some of those moves representing catch up vs. U.S. Tsy price action in the Tokyo lunch break).

- Looking ahead, the latest round of BoJ Rinban operations and comments from BoJ’s Nakamura headline the Tokyo docket on Wednesday.

AUSSIE BONDS: Holding Cheaper After Lack Of Overt Dovish RBA Pivot

After some early two-way price action it was the lack of an overt dovish pivot in the RBA’s post-meeting statement guidance paragraph that accompanied the widely expected 25bp hike, along with the market adjustment given that 21bp of tightening was priced pre-meeting, that applied some pressure to ACGBs, leaving the space cheaper at the bell.

- YM settled -7.0, while XM was -3.0, with wider cash ACGBs were 2-9bp cheaper, as the curve bear flattened.

- Bills were 6-10bp cheaper through the reds, while RBA terminal rate pricing adjusted 10bp or so higher vs. pre-meeting levels, hovering just above 3.65%, with 12bp or so of tightening priced for the Bank’s Feb ’23 meeting.

- The RBA’s statement reaffirmed the recent messaging in that more tightening is expected, albeit with the Bank in a data-dependent stance and not operating on a pre-set course. The Bank also sounded a little more wary re: the health of the global economy and re: the outlook for household consumption.

- Tomorrow’s local docket will be headlined by Q3 GDP data (after we saw a surprise current account deficit and a smaller than expected detraction for GDP from net exports in today’s releases) and A$900mn of ACGB Nov-33 supply.

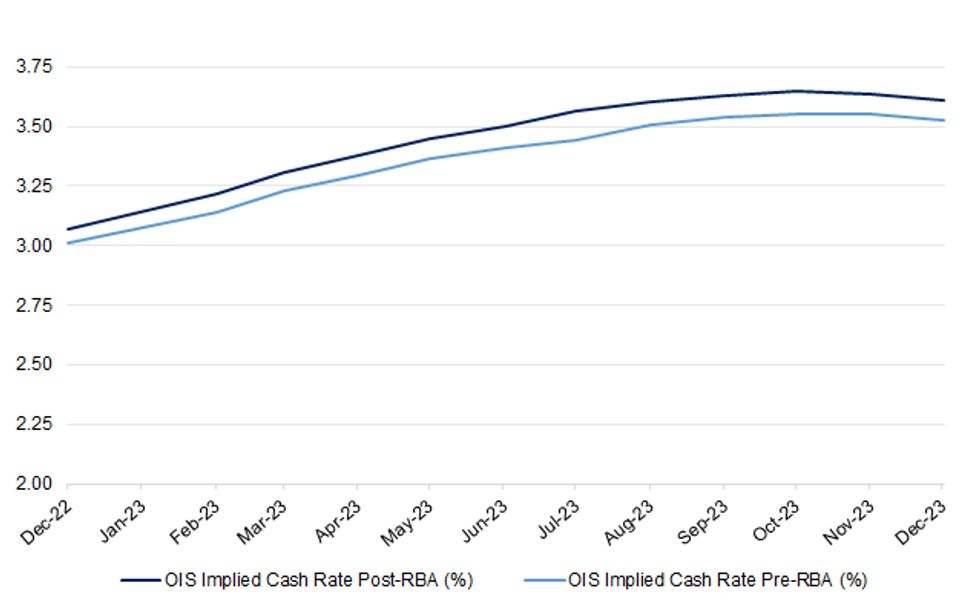

STIR: RBA Dated OIS A Touch Higher On Lack Of Dovish Tweaks To Guidance

| RBA Meeting | OIS Implied Cash Rate Post-RBA (%) | OIS Implied Cash Rate Pre-RBA (%) | Change |

| Dec-22 | 3.07 | 3.01 | +0.05 |

| Feb-23 | 3.22 | 3.14 | +0.08 |

| Mar-23 | 3.31 | 3.23 | +0.08 |

| Apr-23 | 3.38 | 3.30 | +0.08 |

| May-23 | 3.45 | 3.37 | +0.08 |

| Jun-23 | 3.50 | 3.41 | +0.09 |

| Jul-23 | 3.57 | 3.44 | +0.12 |

| Aug-23 | 3.61 | 3.51 | +0.10 |

| Sep-23 | 3.63 | 3.54 | +0.09 |

| Oct-23 | 3.65 | 3.55 | +0.10 |

| Nov-23 | 3.64 | 3.55 | +0.09 |

| Dec-23 | 3.61 | 3.53 | +0.08 |

Source: MNI - Market News/Bloomberg

NZGBS: A Touch Cheaper On The Day On Wider Impetus

Cash NZGBs extended the early cheapening that was derived from the move in U.S. Tsys on Monday, although the move lagged that seen in their U.S. counterpart, which then allowed them to grind cheaper through the day.

- That left the major NZGB benchmarks running 3.5-4.5bp cheaper at the bell, with some light bear steepening in play.

- Meanwhile, swaps rates ran 2-7p higher on the day, with that curve flattening, resulting in mixed swap spread performance across the curve.

- RBNZ dated OIS still prices just over 60bp of tightening for the first RBNZ meeting of ’23, with a terminal cash rate of ~5.35% priced, a touch higher on the day.

- Any post-RBA meeting, trans-Tasman adjustment may kick in early on Wednesday, although the post-meeting cheapening in ACGBs has only been relatively limited.

- The domestic docket is empty on Wednesday.

FOREX: AUD Tops The Pile After No Overt Dovish Pivot From RBA

A round of USD weakness on the latest rollback of COVID testing restrictions re: entry to some public venues in the Chinese capital of Beijing and a degree of fading Monday’s price action provided the impetus in early Asia-Pac dealing.

- JPY then gave back its early gains and more, sitting bottom of the G10 FX pile as we move towards London hours, leaving USD/JPY ~70 pips off its session base, last trading around Y137.00. This came after continued pushback from BoJ Governor Kuroda re: the need to debate an exit from extra loose policy settings, which may have had some extra weight given heightened talk/speculation re: the potential for such a move in recent days/weeks.

- At the other end of the table we saw the AUD, which was initially supported by the aforementioned COVID testing situation re: some Beijing public venues, while a lack of an overt dovish tweak in the guidance paragraph in the latest RBA post-meeting statement (which accompanied the widely expected 25bp hike) allowed the AUD to rally further.

- The remainder of the majors are little changed vs. the USD into London hours.

- USD/CNH struck to a relatively restricted range, operating around session highs, just below CNH6.98, unable to latch onto the previously outlined COVID headline flow and another moderation in China’s daily new COVID case count.

- German factory orders & trade balance data from North America will cross Tuesday. Comments from Riksbank’s Floden are also slated.

FX OPTIONS: Expiries for Dec06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0415-35(E1.6bln), $1.0550(E787mln), $1.0575-00(E746mln)

- USD/JPY: Y140.00($1.7bln), Y143.00($1.5bln)

- GBP/USD: $1.1780-00(Gbp707mln)

- AUD/USD: $0.6800-20(A$1.1bln), $0.6875-00(A$1.7bln)

- NZD/USD: $0.6370(N$587mln)

- USD/CAD: C$1.3380($1.3bln)

- USD/CNY: Cny7.0000($1.3bln)

EQUITIES: Asia Mixed After Negative Lead From Wall St.

Asia-Pac equity indices traded in mixed fashion, initially struggling in the wake of the negative lead from Wall St. on the back of strong U.S. data and a move higher in Fed terminal rate pricing.

- However, some differentiation then crept in, with a round of weakness for the JPY supporting the Nikkei 225, which sits 0.4% higher into the bell.

- Meanwhile, the paring back of COVID test requirements to enter some public venues in the Chinese capital city of Beijing allowed Chinese equities to bounce from worst levels, leaving the CSI 300 sitting marginally higher on the day at typing.

- The Hang Seng was the weakest major regional index, last -1.0%.

- E-minis firmed at the margin, with the aforementioned COVID testing news in Beijing providing some cushion after yesterday’s weakness.

GOLD: China’s Easing Of Covid Restrictions Supports Bullion

MNI (Australia) - Gold prices are slightly higher today after falling 1.6% on Monday. The stronger-than-expected services ISM overnight weighed on gold as the USD strengthened and UST yields rose but it has been supported today by further easing of Covid restrictions in China.

- Bullion is up 0.2% today to around $1772.80/oz, after reaching an intraday high of $1776.34. It has been trading in a $10 range, as the DXY is around its NY close.

- Gold is back below the psychologically important $1800 level. Support is at $1747.40, 20-day EMA ,and key resistance is $1807.90, August 10 high.

- With the Fed in blackout, there is little going on overnight. The only data of note is the US trade balance for October.

OIL: Oil Prices Up Slightly On More Optimistic Chinese Demand Outlook

MNI (Australia) - Oil prices are up 0.5% during the session after two days of weakness, but have been trading in a very narrow range of less than a dollar. The DXY is flat. News of further easing of Covid-related restrictions in China boosted crude on hopes of increased demand.

- WTI is trading around $77.35/bbl after reaching a high of $77.88 and a low of $77.26. It broke support of $78.40 overnight and the next level to watch is $73.38. Brent is around $83.10 after a high of $83.68 and low of $83.08.

- The market is assessing how the oil price cap on Russia will impact supply over the long term. Apart from some ships stranded near Turkey, there has so far been minimal disruption, according to Bloomberg. Currently the price cap of $60/bbl is above where Urals crude prices are and while that continues, the cap is unlikely to have much impact.

- Time spreads suggest that near-term supply is unproblematic.

- With the Fed in blackout, there is little going on overnight. The only data of note is the US trade balance for October and the API inventory data.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/12/2022 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/12/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/12/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 06/12/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 06/12/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 06/12/2022 | 1330/0830 | ** |  | US | Trade Balance |

| 06/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/12/2022 | 1400/1500 |  | EU | ECB Publication of Monthly APP/PEPP update | |

| 06/12/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.