-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Limited Reaction As China Delivers Expected Rollback In COVID restrictions

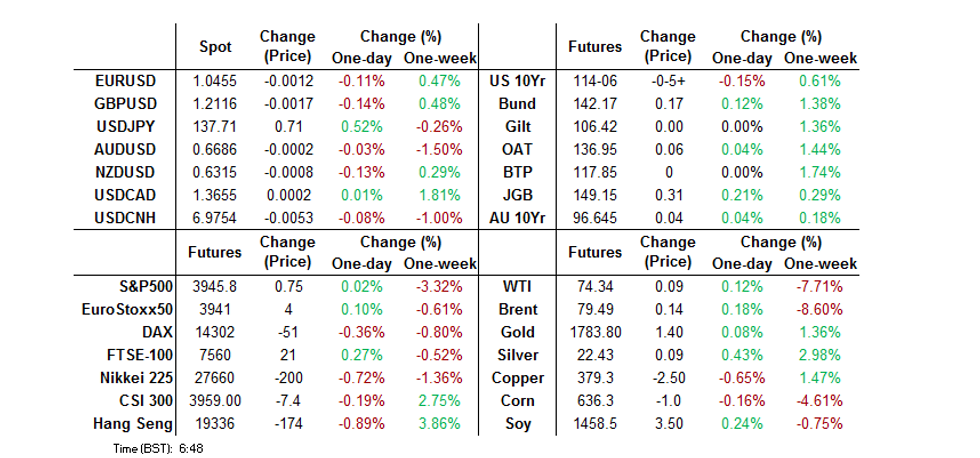

- USD trends have been mixed. The bias has been for slight outperformance from commodity FX against the majors, but only modestly. The BBDXY sits just above 1270.50 currently, slightly down from session highs near 1272.

- Cash Tsys are dealing flat to 2bps cheaper with some light bear steepening apparent, as Asia-Pac participants push back against the richening moves seen in the NY session. 2s10s inversion has eased at the margin, after registering fresh cycle extremes on Tuesday.

- Looking ahead, tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US unit labour costs for Q3 and a number of ECB speakers.

US TSYS: Light Bear Steepening As China Delivers Expected COVID Restriction Rollback

MNI (Australia) - TYH3 deals at 114-05, just off the base of its narrow 0-06 range on a volume of ~73k.

- Cash Tsys are dealing flat to 2bps cheaper with some light bear steepening apparent, as Asia-Pac participants push back against the richening moves seen in the NY session. 2s10s inversion has eased at the margin, after registering fresh cycle extremes on Tuesday.

- Participants looked through COVID headlines from China as daily new case numbers continued to pullback, while the country delivered the widely expected/touted rollback of some of its COVID restrictions (although expectations surrounding that event may have biased the space cheaper overnight, extending the late NY pullback from Tuesday’s richest levels).

- Softer than expected Australian GDP data failed to impact Tsys.

- There is a thin docket in Europe today. Further out we have weekly MBA mortgage applications, while the latest BoC decision will create some interest in events north of the border.

JGBS: Futures Lead The Bid

JGB futures shunted higher in the Tokyo afternoon, with nothing in the way of overt headline flow to trigger the move, leaving the contract +30 ahead of the bell after it extended on overnight gains.

- Cash 7s moved to become the firmest point on the curve on the day as the major cash benchmarks sit 1bp cheaper to 2.5bp richer, with the early twist flattening theme remaining intact.

- The bid in 7s points to a futures-driven bid even after the uptick in the offer/cover ratio that we flagged in BoJ Rinban operations covering the 5- to 10-Year zone of the curve.

- In local news flow, rhetoric from BoJ board member Nakamura failed to move the needle, as he stuck with the central BoJ line re: the need for continued easing, as the Bank looks to foster the conditions for sustainable wage growth and promote demand-pull inflation dynamics.

- Final Q3 DP data, the monthly BoP print, the latest economy watchers survey & 5-Year JGB supply headline the domestic docket on Thursday.

AUSSIE BONDS: Underpinned By Softer Than Expected GDP Data

Slightly softer than expected GDP data allowed the space to firm after what appeared to be payside swap flow-inspired cheapening in futures at the re-open, after an overnight bid linked to the richening in U.S. Tsys.

- While the RBA’s clear focus is on returning inflation to the target band, it has noted that the policy settings required to do so puts it on a narrow path re: keeping the economy on an even-keel. Today’s release wasn’t anywhere near worrying levels re: GDP growth, but the Bank will watch the evolution of economy (with a particular focus on household spending, which rose 1.1% Q/Q in Q3) as the lagged impact of tighter monetary policy takes hold in the coming months.

- YM finished +2.0, with XM +4.0 at the bell, after a tick away from best levels inspired by hope surrounding a further reduction in Chinese COVID restrictions (which was delivered around the Sydney close). Cash ACGBs were flat to 4bp richer across the curve, with the 10- to 12-Year zone outperforming.

- Bills were flat to -1, with little meaningful movement in RBA dated OIS pricing on the session.

- Looking ahead, trade balance data headlines Thursday’s local docket.

RBA: MNI RBA Review - December 2022: 25bp Hike, Time To Assess Data

EXECUTIVE SUMMARY

- The RBA hiked rates 25bp to 3.1%, as was widely expected. This brought the cumulative tightening this cycle to 300bp and the cash rate to just above the mid-point of the central bank's estimated range for neutral.

- Forward guidance was broadly unchanged suggesting that the RBA's tightening bias remains in place. But there were some additions to the statement which give the Board flexibility when it meets again on February 7 after time to assess "incoming data", global developments and its revised forecasts.

- Given the continued tightening bias, that Q4 CPI prints on January 25 and the RBA's inflation forecasts above target, we expect a further 25bp hike in February with another one possible in March given wages print on February 22.

- Click to view full review:

AUSTRALIA: Q3 Consumption Robust, Too Early To See Impact Of RBA Hikes

Q3 GDP rose 0.6% q/q to be up 5.9% y/y, close to expectations. Growth was driven once again by household consumption with a 0.6pp quarterly contribution. While this data is historical, it does give an idea of where we were at coming into the final quarter, and it shows that consumption growth began normalising but is still above pre-Covid rates and that investment remained soft. The end of Q3 was only 4 months after the first RBA hike and given the lags, too early to assess the impact on activity.

- It was a high 0.6% print at 0.647% and so not much more would have brought it to the Bloomberg consensus’ 0.7% q/q.

- Real household consumption rose 1.1% q/q down from Q2’s 2.1% but still well above the 0.3% average of the 2 years before Covid. Spending was supported by a very strong rise in employee compensation up 3.2% q/q, the highest since 2006, to be +10% y/y, and a further drawdown on savings. The savings rate recorded its fourth consecutive fall as it normalises and is now 6.9% from 8.3%, despite the pickup in compensation.

- Private investment was lacklustre for the fourth consecutive quarter and down 0.3% y/y. But there was a rebound in dwelling and non-dwelling construction, as supply and labour constraints eased. Of note was the 4.7% q/q contraction in the private non-financial gross operating surplus reflecting higher costs and lower commodity prices.

- Net exports detracted 0.2pp from growth but exports were still strong rising 2.7% q/q driven by both goods and services. Import volumes were even stronger though rising 3.9% q/q to be up 19.1% y/y driven by travel services (now 56% of pre-pandemic level), fuel and vehicles.

Source: MNI - Market News/ABS

NZGBS: Cheapening A Touch, Swaps More Mixed

MNI (London) - Cash NZGBs cheapened as Wednesday trade wore on, with hope re: another rollback of COVID restrictions in China front and centre. Spill over from some very modest cheapening in U.S. Tsys also aided the trajectory of travel, leaving the major NZGB benchmarks 4-7bp cheaper at the close, with the long end leading the weakness as intermediates lagged the wider move.

- Conversely, the swap curve twist flattened, leaving swap spreads tighter across the curve.

- RBNZ dated OIS inched higher on the day, with ~65bp of tightening now priced for the Bank’s Feb ’23 meeting, while terminal OCR pricing sits just below 5.40%.

- Local headline flow was very subdued.

- Looking ahead, Thursday’s local docket is dominated by the weekly round of NZDM auctions, which consists of NZGB May-28, May-32 & Apr-37.

FOREX: Slight Commodity FX Outperformance, But Muted Trading Overall

USD trends have been mixed. The bias has been for slight outperformance from commodity FX against the majors, but only modestly. The BBDXY sits just above 1270.50 currently, slightly down from session highs near 1272.

- Much of the focus remains on a further easing in China Covid restrictions. The market reaction has been fairly muted though, as moves were telegraphed earlier in the week.

- USD/JPY has generally been supported dips. The pair last at 137.30/35 but finding some resistance ahead of 137.50. US cash Tsy yields are up a touch.

- AUD/USD is holding above 0.6700, +0.20% on NY closing levels. The market shrugged off a slight Q3 GDP miss. Commodities are generally flat at this stage.

- NZD/USD has trailed AUD, but only modestly, the pair last at 0.6325, with the AUD/NZD cross finding selling interest above 1.0600.

- Looking ahead, tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US unit labour costs for Q3 and a number of ECB speakers.

FX OPTIONS: Expiries for Dec07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0370(E725mln), $1.0600(E1.8bln)

- USD/JPY: Y134.00($920mln)

- GBP/USD: $1.1900-15(Gbp665mln)

- EUR/GBP: Gbp0.8520(E700mln)

- EUR/JPY: Y147.00(E684mln)

- NZD/USD: $0.6450(N$811mln)

- USD/CAD: C$1.3540($2.4bln), C$1.3600($1.5bln)

- USD/CNY: Cny6.8900($930mln), Cny6.9690-20($1.8bln), Cny7.1000($1.0bln)

ASIA FX: Follow On Gains Limited

Most of Asia FX has struggled to hold onto gains today, outside of PHP. CNH has benefited from a further reduction in Covid restrictions, but there hasn't been much follow through. Still to come is Taiwan trade figures. Tomorrow the data calendar is light with just South Korean current account figures/goods balance, along with Thailand consumer confidence numbers.

- USD/CNH was firmer in the first part of trade, tracking over 6.9900, but dipped towards 6.9600 on reports of a fresh loosening of Covid restrictions. We last sit near 6.9900 slightly weaker for the session. Poor November trade figures haven't done much to dent sentiment, although may have weighed at the margin.

- USD/KRW 1 month pushed above 1325 in the first part of trading, before falling back to 1312 on positive China covid news. Follow through selling has been limited, the pair is back to 1322, as onshore equities remain in the red.

- The RBI hiked as expected, by 35bps, and gave a somewhat hawkish outlook. Local bonds sold off, but there was limited benefit to the rupee. We last sat at 82.55/60 only slightly down from opening highs of 82.67.

- PHP has been the standout, with USD/PHP slumping back 55.50, fresh lows back to mid August. The unemployment dipped to 4.5%, lows going back to 2019. Onshore equities are weaker, but have given up less than a third of yesterday's gains. Focus may rest on a more aggressive rate hike from the BSP at mid-December meeting, particularly after yesterday's inflation surprise.

- USD/THB is fairly steady, holding above 35.00 (last at 35.045). November inflation figures missed from a headline standpoint (5.55% y/y, 5.80% expected), but core rose to 3.22% y/y, slightly above expectations. The Thai finance minister stated that BoT rate rises should be gradual.

CHINA: Weaker Trade Update, Although Commodity Import Volumes Rebound

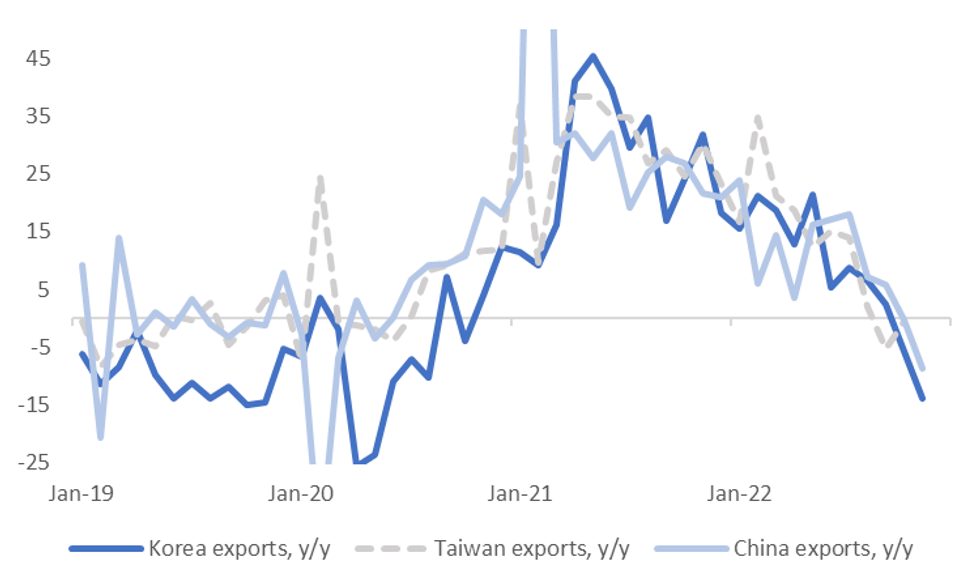

(MIN Australia) China trade figures were softer across the board. In USD terms, export growth was -8.7% y/y, against a -3.9% estimate, while imports fell -10.6%, -7.1% was the forecast. The trade surplus slipped to $69.84bn, against a $78.05bn forecast.

- The slowdown in exports is in line with trends elsewhere in North East Asia, see the chart below. Taiwan's export data for November is due later today and the market looks for a reversal of the improvement last month.

- China export growth is now back to early 2020 lows. Exports to most countries/region continued to moderate in y/y terms. The US is now at -25.4%, the EU -10.6%, while to ASEAN we slowed to 5.2%, from 20.3% in October.

- On the import side, volumes rebounded in November, despite the softer headline result. Coal and iron ore import volumes were up strongly, although this largely reverses weakness seen in October. Oil rose further, as did natural gas. Major commodity import volumes are still down in YTD y/y terms though, except for copper.

- The trade surplus is only back to levels from the first half of the year, although there will be speculation the external balance deteriorates as we progress through 2023 on hopes of a China domestic demand recovery as moving away from CZS takes full effect.

Fig 1: China Export Growth Continues To Slow

Source: MNI - Market News/Bloomberg

RBI: Hikes, But Inflation Battle Not Over Yet

The RBI hiked rates by 35bps as expected. This pushes the policy rate to 6.25%, highs back to early 2019. Das's policy speech has come across as somewhat hawkish. Inflation pressures may have to subside more quickly than expected for the RBI not to take further policy action in 2023.

- The RBI governor noted even after today's policy adjustment real rates are still negative and policy is still accommodative. He also noted core inflation pressures are sticky and that the battle against inflation isn't over.

- The central bank did nudge down its growth expectation for the current financial year (ending March 2023) to 6.8% from 7.00%, but Das still painted a fairly resilient growth picture, outside of external headwinds. Inflation projections were kept basically unchanged at 6.7% for the current financial year.

- Indian bonds have sold off post the speech, with the 5-10yr bucket up by 3-4bps in yield terms. The 10yr yield is back to 7.28%. USD/INR has tracked lower after opening at 82.67. The pair was last at 82.50. Indian equities are flat at this stage.

- Note the next RBI meeting will be held on the 8th of February 2023.

NBP: MNI NBP Preview - December 2022: Rate-Hike Pause To Continue After CPI Miss

EXECUTIVE SUMMARY

- Expected to keep interest rates and dovish guidance unchanged.

- Surprise slowdown in headline inflation to support the dovish-leaning majority faction within the MPC.

- Sell-side analysts unanimously expect the NBP to stand pat, with a growing cohort calling for an end to the tightening cycle.

- Full preview including summary of sell-side views here: MNI NBP Preview - December 22.pdf

BCB: MNI Brazil Central Bank Preview - Dec 2022: Fiscal Risks Cloud The Outlook

EXECUTIVE SUMMARY

- All surveyed analysts expect the Copom to keep the Selic rate unchanged at 13.75%.

- Despite a further easing of inflationary pressures, lingering concerns surrounding the new administration and the fiscal outlook should prompt the BCB board to maintain a hawkish stance, highlighting the committee stand ready “to resume the tightening cycle if the disinflationary process does not proceed as expected”.

- The bulk of sell-side analysts are in agreement that the rising pricing for further hikes across 2023 is more a reflection of fiscal risk premiums, with the next move for the BCB more likely a cut - which some see as soon as March next year.

- Click to view the full preview: MNI Brazil Central Bank Preview - December 2022.pdf

EQUITIES: China/HK Markets Recover After Covid Restrictions Eased Further

(MNI Australia) - Asia Pac equities are away from worst levels, with most focus on a further reduction in Covid related restrictions in China. The moves were expected to some degree, with Reuters stating earlier in the week such an outcome could unfold today. China and HK shares are seeing the main benefit at this stage, while US futures hold in positive territory.

- The easier covid restrictions look to be widening out home quarantine for some Covid patients' nation wide, while scrapping testing requirements for most public places. Testing frequency will also be reduced.

- The HSI is back to 1% after an indifferent first part of the trading session, while the HS China enterprise index is slightly firmer at +1.20%. Casino related stocks have surged, offsetting weakness in the property sub-index. Mainland stocks have recovered from earlier losses, with the CSI 300 now up 0.45%.

- Elsewhere, trends are more mixed though. The Nikkei is down 0.60%, while the Kospi is trying to push into positive territory.

Commodity related indices are lower, with the ASX200 off by 0.85%, while the Indonesian JCI is down by nearly 1%. Indian stocks are also trading with a negative bias after the RBI delivered a hawkish 35bps hike.

GOLD: Bullion Trading Sideways On Unclear Fed

Gold prices are flat on the day in line with a stable DXY and have been trading in a very tight range, as the outcome of the December Fed meeting is unclear. They are currently around $1770.80/oz after reaching a high of $1775.24 and a low of $1768.84 during the session.

- Gold is still below Monday’s recent peak and has been trading broadly sideways since the services ISM. Support is at $1747.40, the 20-day EMA and key resistance at $1807.90, the August 10 high.

- Tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US unit labour cost data for Q3 and a number of ECB speakers.

OIL: Prices Moving Sideways After Recent Sharp Falls

MNI (Australian) - Oil prices have been steady today, in line with a stable USD, after falling for the last 3 days. WTI is trading 0.2% above the NY close at $74.40/bbl and Brent is around $79.60 up 0.3%.

- Crude prices have been trading in a narrow range again of less than a dollar. WTI’s intraday low was $73.93 and its high $74.82. It has remained above its key support of $73.38. Brent has been trading between its low of $79.13 and high of $79.93 and any further downward momentum could test $77.04.

- Demand concerns intensified on continued central bank tightening and warnings from major banks that 2023 is going to be a difficult year, despite recent easing of Covid restrictions in China, the world’s largest oil importer. Traders are also closing positions ahead of year end.

- In retaliation for western countries’ price cap on Russian oil, Russia is looking to set a price floor for its exports either per barrel or a maximum discount.

- API data overnight showed a crude drawdown in the US of 6.426mn barrels after destocking of 7.85mn the previous week.

- Tonight the main event is likely to be the BoC meeting where they are expected to hike another 50bp. There is also US EIA inventory data, US unit labour costs for Q3 and a number of ECB speakers.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/12/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/12/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/12/2022 | 0700/0800 | *** |  | SE | GDP |

| 07/12/2022 | 0700/0800 | ** |  | SE | Private Sector Production |

| 07/12/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/12/2022 | 0710/0810 |  | EU | ECB Lane Speech at China FX Global Perspective | |

| 07/12/2022 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/12/2022 | 0745/0845 | * |  | FR | Current Account |

| 07/12/2022 | 0900/1000 | * |  | IT | Retail Sales |

| 07/12/2022 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 07/12/2022 | 1000/1100 | * |  | EU | Employment |

| 07/12/2022 | 1000/1100 | *** |  | EU | GDP (final) |

| 07/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/12/2022 | - | *** |  | CN | Trade |

| 07/12/2022 | 1300/1400 |  | EU | ECB Panetta Speech at at LBS-AQR Insight Summit | |

| 07/12/2022 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/12/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 07/12/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 08/12/2022 | 2350/0850 | ** |  | JP | GDP (r) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.