-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA Governor Reaffirms View, Chinese Equities More Subdued

- RBA Governor Lowe pushed back against market pricing re: the cash rate, reaffirming the Bank's well-documented view. He didn't discount a suggestion that Australia's NAIRU could be below 4.0% when questioned on the matter.

- Chinese equity markets regained some poise after yesterday's gyrations.

- U.S. CPI data & 10-Year U.S. Tsy supply headline on Wednesday.

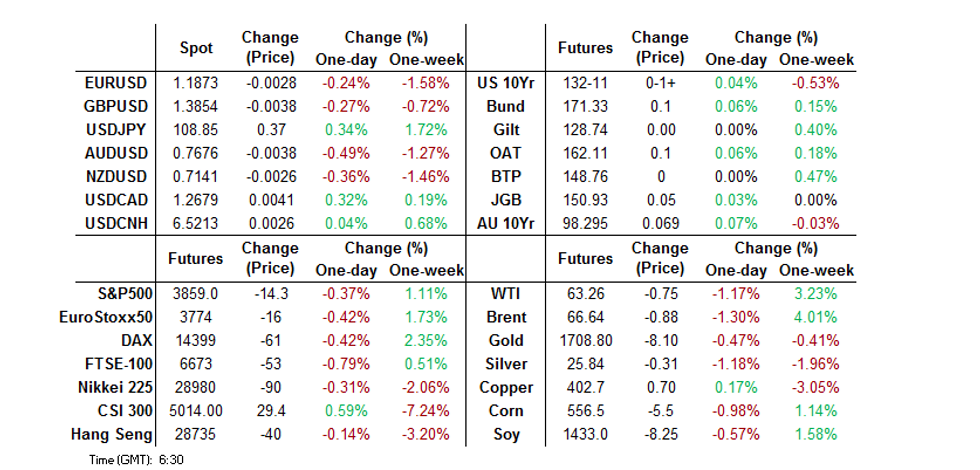

BOND SUMMARY: Another Round Of Mixed Performance

T-Notes held to a narrow 0-06 range overnight, last +0-01+ at 132-11. Cash trade sees some twist steepening of the curve, with 30s cheapening by ~1.5bp on the day. There was nothing in the way of notable headline flow seen overnight, with participants looking ahead to 10-Year Tsy supply and the latest U.S. CPI print, both of which will hit later on Wednesday. A flurry of block trades was seen ahead of European hours. There was a 3,160 lot block buyer of FVM1. Elsewhere, there was a 1,875 lot block seller of TYJ1 134.00 puts (which looks like profit taking). This was followed up by a 9,375 lot block buyer of the TYJ1 130.00 puts. Note that a 5,625 block buyer of the TYJ1 130.00 puts was seen during Tuesday's Asia Pac session. Could the previously flagged long TYJ1 134.00 put profit taking actually be seeing some rolling into lower strikes and greater notional exposure? Eurodollar futures run unchanged to +2.0 through the reds, with a couple of rounds of buying witnessed in the reds during early Asia-Pac dealing as T-Notes traded through Tuesday's high before backing off a touch.

- The Aussie bond space drew support from comments made by RBA Governor Lowe (see earlier bullets for full details), in which he pushed back against market pricing re: the cash rate and didn't discount a suggestion that Australia's NAIRU could be below 4.0% when questioned on the matter. The space operated shy of the knee jerk highs witnessed on the back of Lowe's comments for the remainder of the Sydney session, but futures were comfortably higher on the day, YM +2.4, XM +6.9 at the close, while roll activity dominated. The latest round of ACGB Nov '31 supply didn't see the strongest round of demand, but average yields still managed to stop through prevailing mids by ~0.2bp. The cover ratio softened notably vs. the previous auction of the line, with reduced Japanese demand, futures rolls and the recent bond vol. likely suppressing demand (as flagged pre-auction). Some of the A$ corporate supply flagged yesterday priced today, and was focused on the belly. The local docket is now relatively muted into the end of the week, with the AOFM's weekly supply schedule set to provide the next domestic point of note (due to be published on Friday).

- JGB futures ticked lower during the morning session, unwinding the overnight uptick, before finding a modest bid during the afternoon, closing +6, with little in the way of overt drivers observed, resulting in relatively narrow trade. Cash trade saw some light bull flattening, even ahead of tomorrow's 20-Year JGB supply. Swap spreads generally widened a little across the curve, although the morning uptick in outright swap rates unwound. PPI and the latest round of weekly international security flow data headline locally on Thursday.

FOREX: USD Gets Its Groove Back, While Lowe Dampens AUD

The greenback managed to claw back some of Tuesday's losses, and heads into the European session slightly higher helped by a bump higher in US yields.

- AUD is bottom of the G10 pile, pressured after RBA Governor Lowe said he would prefer a weaker AUD, while iron ore export figures from Port Hedland were revealed to be at a two year low. AUD/USD is down some 29 pips at 0.7685. NZD came under similar pressure.

- JPY pairs are softer, with Goto-bi Day demand conspicuous in its absence. USD/JPY up 39 pips at 108.87. There were some reports in Kyodo that Japan has decided to exclude overseas spectators from attending the Tokyo Olympics, the Olympics Minister Murukawa said a decision would be made in late March.

- The PBOC fixed USD/CNY at 6.5106, 21 pips below sell side estimates, indicating a willingness to let the yuan strengthen. This brings the sum of the misses since the return from LNY to +9 pips. USD/CNH is up 6 pips at 6.5191. The rate moved from negative territory after inflation data from China beat estimates.

- SNB's Zurbruegg was on the wires, he said it is too early to talk of a rate rise, and there are options to ease policy further if needed, USD/CHF 23 pips higher at 1.2664.

- Reports of some tensions between UK and EU officials after a senior EU official wrongly suggested the UK had banned all Covid-19 vaccine exports.

FOREX OPTIONS: Expiries for Mar10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950(E569mln), $1.2000-10(E1.3bln), $1.2050-55(E550mln)

- USD/JPY: Y105.80($1.4bln), Y106.80-90($610mln), Y107.25-30($631mln)

- AUD/USD: $0.7500(A$1.3bln), $0.7600-05(A$798mln), $0.7725(A$643mln), $0.7750-55(A$862mln)

ASIA FX: Greenback Strength Pressures Most Asia EM FX

The greenback regained some poise amid a move higher in US treasury yields, which pressured most Asia FX.

- CNH: Offshore yuan is weaker after a mixed session. The PBOC fixed USD/CNY at 6.5106, 21 pips below sell side estimates, indicating a willingness to let the yuan strengthen. USD/CNH is higher, the rate moved from negative territory after inflation data from China beat estimates.

- SGD: Singapore dollar is weaker after five days of gains, USD/SGD reversing losses from Tuesday and heading towards 1.35

- TWD: Taiwan dollar opened stronger but weakened through the session. Data yesterday showed exports rose 9.7%, while CPI rose above estimates.

- KRW: Won is higher, coming off the back of two-days of losses. The gain came as South Korea's bank lending to households reached KRW 1,000tn for the first time ever, amid warnings from the BoK over possible asset bubbles. This sparked some chatter of rate hikes and saw the won gain while equity markets come off highs.

- INR: Rupee is weaker today, reversing gains sustained yesterday. Indian markets are closed tomorrow for local holiday Mahashivratri. Swaps suggest increased expectations of a rate hike, which helped support INR.

- IDR: Rupiah has eked out some gains after sustained a four day decline.

- MYR: Ringgit is lower, on track for a fifth straight day of losses, palm oil exports fell 5.5% in February.

- PHP: Peso is weaker, data showed that equity market outflows accelerated yesterday and posted the fifteenth straight session of outflows.

- THB: Baht is weaker, oscillating around the 200-day moving average. Markets look ahead to consumer confidence data tomorrow.

ASIA RATES: Mostly Bid After Sell-Off

Most bond markets in the region supported after selling off yesterday.

- INDIA: Indian bonds are bid across the curve as markets await the RBI's operation twist, the central bank have increased the size of long end purchases to INR 200bn, while keeping short end issuance at INR 150bn.

- SOUTH KOREA: South Korean futures are higher today, 10-year future last up 14 ticks at 127.02, but some 13 ticks off session highs. The move reverses the short end sell off yesterday following poor reception of a 3-year auction.

- CHINA: The PBOC matched injections with maturities in today's OMOs, the third straight day of no injections, with CNY 30bn drained last week and no fresh cash injected since Feb 25. The overnight repo rate is around 14.5bps higher today, last at 1.7452%, the 7-day repo rate has come down slightly, last at 2.0173%. In the cash space, some buying seen in the 5-year after a strong auction, the sale was covered 4.15x, at an average yield of 3.03%.

- INDONESIA: Bonds bid across the curve after a sell off sparked by tepid demand at yesterday's auction, the government sold IDR 4.49t against a target of IDR 12tn.

EQUITIES: Mixed Day, China Still Buoyant

A mixed day for equity markets in Asia-Pac, bourses in mainland China have seen decent gains, still riding the wave of China state fund intervention yesterday, while markets in Japan, South Korea and Australia were less bid/lower. South Korean markets initially gained after reports of multiple orders for shipbuilders, but gave back early gains to drop into negative territory. Tech stocks across Asia have seen gains, taking a positive lead from the Nasdaq which saw the biggest one day rise since November.

- Futures in Europe and the US are lower, the Nasdaq the biggest loser at pixel time after its aforementioned rally yesterday.

GOLD: U.S. Yield Dynamics Eyed Around Auctions

Tuesday's pullback in U.S. real yields and the DXY supported bullion allowing spot to reclaim $1,700/oz, although the modest uptick in longer dated U.S. Tsy yields ahead of today's 10-Year Tsy supply alongside a light bid in the USD has applied some light pressure to bullion in Asia-Pac hours, with spot last dealing at $1,712/oz.

OIL: Pressured By Inventories & Production

Crude futures have extended their decline in Asia on Wednesday, WTI sits $0.70 below settlement levels, while Brent is $0.85 weaker on the day.

- Oil fell as the greenback strengthened, while bullishness over OPEC+ rolling production quotas faded and the API reported a large build in US crude stocks. The EIA also revised up its outlook for 2021 production by 100,000 bpd to 11.1m bpd, and for 2022 production by 500,000 bpd to 12m bpd.

- Meanwhile, API data showed a 12.8m bbl build in headline US crude inventories. The markets took solace in the much more bullish product data from the API, which showed 8.5m bbl and 4.8 m bbl draws in US gasoline and distillate inventories, respectively. Markets look ahead to the more comprehensive DOE data later today.

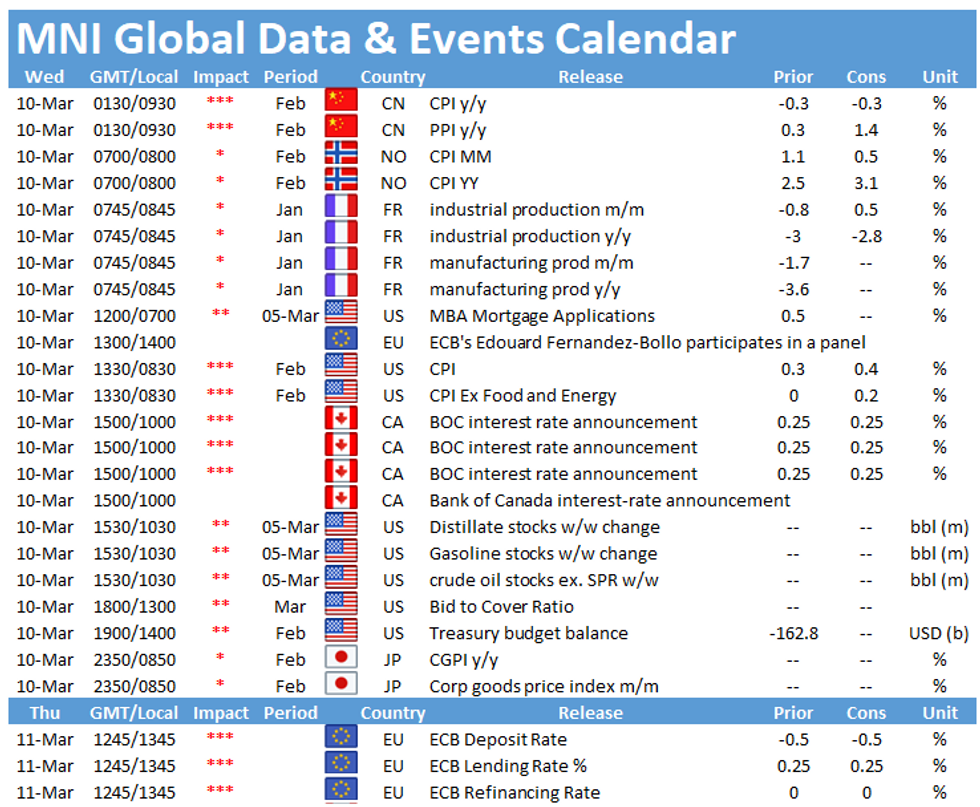

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.