-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Shipping Costs Likely To Post Third Straight Rise In July

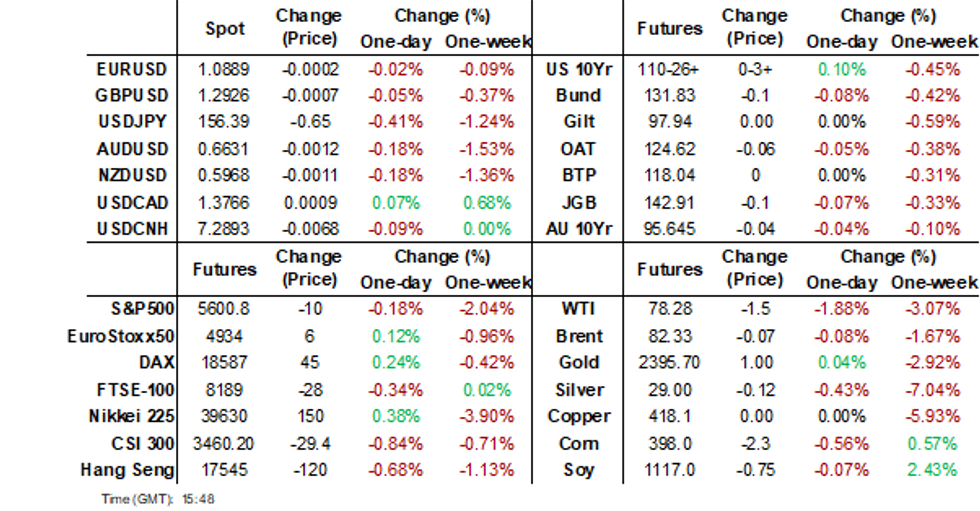

- Today was very quiet data wise. Headlines crossed that Kamala Harris has secured enough delegates to be the Democrat nominee for President.

- The USD was mixed, with JPY continuing to outperform, particularly against higher beta crosses like AUD, where softer commodities have become more of a headwind this past week. US Treasury futures have edged higher throughout the session, with the long-end slightly out-performing. JGB futures are weaker but well off session cheaps, -9 compared to the settlement levels.

- The UN Security Council meets today to discuss the situation in Yemen. Previously, the focus had been on the ongoing civil war but now there is also the problem of rebel Houthi attacks on shipping and now on Israel. A solution seems remote though and in the meantime, shipping costs continue to rise and are no longer disinflationary. It is an issue central banks continue to monitor closely, although they are still well below 2021 highs.

- Looking ahead, another quiet day with only the ECB’s Lane speaking and US July Philly & Richmond Fed indices, and June existing home sales released.

MARKETS

US TSYS: Tsys Futures Edge Higher On Low Volumes, Curve Flattens

- Treasury futures have edged higher throughout the session, with the long-end slightly out-performing after lagging the recovery heading into NY close overnight. Volumes are well down on averages while TU is + 00⅜ at 102-14⅜ and TY is + 03+ at 110-26+.

- Tsys flows: Buyer block 6,061 UXY at 114-11 & Block Steepener DV01 318k TU/UXY

- The treasury curve has bull-flattened throughout the session with the 2yr -0.7bps at 4.510% and the 10yr -1.4bps at 4.239%. The past week has seen the treasury curve move about 9bps wider with the 2s10s little changed at -27bps over the week after rallying from -43bps in July.

- The 1yr USD Inflation Swap is trading near yearly lows at 1.9175, falling 51bps since July 1, futures markets are pricing in just under 2.5 cuts into year-end.

- Projected rate cut pricing into year end has receded vs. early Monday levels (*): July'24 at -2.5% w/ cumulative at -0.6bp at 5.323%, Sep'24 cumulative -24.3bp (-25bp), Nov'24 cumulative -38.5bp (-39.5bp), Dec'24 -60.7bp (-62bp)

- Looking ahead today we have Regional Fed and Existing Home Sales data and $69B 2Y Note auction.

GLOBAL: Shipping Costs Likely To Post Third Straight Rise In July

The UN Security Council meets today to discuss the situation in Yemen. Previously, the focus had been on the ongoing civil war but now there is also the problem of rebel Houthi attacks on shipping and now on Israel. A solution seems remote though and in the meantime, shipping costs continue to rise and are no longer disinflationary. It is an issue central banks continue to monitor closely, although they are still well below 2021 highs.

- Since the Iran-backed Houthis targeted vessels in November last year, global container rates are up 335% and the China to the Mediterranean route is up over 400% as ships take the longer route around southern Africa and insurance and crew costs also rise. The Suez Canal reported traffic down 22% in 2023/2024 financial year.

- FBX global container rates rose sharply at the start of July but eased last week falling 2.9% w/w, but the month average is still up 18.5% m/m to date, likely to be the third straight rise leaving it up 291% y/y after 215% in June. Bulk carrier rates have been more muted with the Baltic Freight Index up 1.6% m/m and 87.8% y/y in July.

Source: MNI - Market News/Refinitiv

- FBX container rates for the China to the east coast of North America rose strongly over the last three months and even though they fell last week are set to post their third consecutive double-digit rise in July bringing them up to 282% y/y from 225% last month. US headline inflation eased 0.5pp over Q2 to 3% in June but rising shipping costs are an area to watch.

- Rates from China to the Mediterranean fell 1.3% last week but are still 7.5% m/m higher this month and up 276% y/y (June 209% y/y). Despite restrictive monetary policy headline euro area inflation has stabilised around 2.5% since February.

Source: MNI - Market News/Refinitiv

STIR: Australia’s Official Rate Set To Be The Highest In The $-Bloc

The RBA’s official rate is currently the lowest among the $-bloc central banks at 4.35%, compared to 5.33% for the FOMC, 4.75% for the BoC, and 5.50% for the RBNZ.

- However, the difference between the RBA’s and the BoC’s policy rates is expected to narrow to +15bps this week, if market pricing is accurate.

- The BoC is widely anticipated to cut its policy rate by another 25bps to 4.50% at this week’s meeting, with the markets now pricing in around a 90% chance of a cut, up from less than 50% two weeks ago.

- Moreover, looking ahead to year-end, the OIS market expects the official rate in Canada to fall below that of Australia. If this occurs, it would be the first time since 2018.

- Even more interestingly, when we look 12 months forward using 3-month swap rates 1-year forward (1Y3M), the market now expects the RBA’s official rate to be the highest in the $-bloc for the first time since 2013.

Figure 1: $-Bloc 1Y3M (%)

Source: MNI – Market News / Bloomberg

JGBS: Cash Bonds Slightly Mixed With A Flattening Bias, 40Y Supply Tomorrow

JGB futures are weaker but well off session cheaps, -9 compared to the settlement levels.

- Machine Tool Orders data is due later today, otherwise the local calendar has been light.

- (Bloomberg) The Bank of Japan should more clearly show its intention to normalize monetary policy, according to ruling party heavyweight Toshimitsu Motegi in remarks a week before the central bank meets to decide whether to raise interest rates. (See link)

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session, ahead of Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- Cash JGBs are 1bp cheaper to 1bp richer across benchmarks. The benchmark 10-year yield is 0.8bp higher at 1.063% versus the cycle high of 1.108%.

- The 40-year yield is 0.2bp lower higher at 2.421%, ahead of tomorrow’s supply and a week ahead of the upcoming BoJ’s policy decision. Although this 40-year sale is set for a higher outright yield than at the May auction (high yield of 2.27%), secondary pricing hasn’t yet reached the 2.5% area which is said to be a target zone for institutional investors.

- Swap rates are flat to 2bps lower, with the curve flatter. Swap spreads are tighter.

- Tomorrow, the local calendar will see Preliminary Jibun Bank PMIs alongside 40-year supply.

AUSSIE BONDS: Light Local Calendar, Subdued Trading, US Tsys Providing Support

ACGBs (YM -4.0 & XM -2.5) are holding weaker after dealing in narrow ranges in today’s Sydney session. With the domestic calendar light today, cash US tsys have been the key influence on the local market. Cash US tsys are 1-2bps richer in today’s Asia-Pac session, ahead of Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- The AOFM sold A$100mn of 2.50% 20 Sep 2030 inflation-linked bond at a weighted average yield of 1.7172%, with a cover ratio of 3.4500x.

- Cash ACGBs are 3bps cheaper, with the AU-US 10-year yield differential at +10bps.

- Swap rates are 2bps higher.

- The bills strip has bear-steepened, with pricing flat to -3.

- RBA-dated OIS pricing is little changed out to May-25 and 1-2bps firmer beyond. Terminal rate expectations sit at 4.43%.

- Tomorrow, the local calendar will see Preliminary Judo Bank PMIs. This will be the data highlight for the week.

- ICYMI, the AOFM announced on Friday that a new Dec-35 bond is planned to be issued via syndication this week (subject to market conditions). The issue size is expected to be around $10bn.

NZGBS: Closed Slightly Richer, Subdued Session, Light Local Calendar Along Week

NZGBs closed near the session’s best levels, with yields down 1bp. Benchmark yields had been 1-2bps higher in early trade following the modest negative lead-in from US tsys overnight.

- Nevertheless, dealings were subdued with the local calendar empty today. Indeed, Friday’s release of ANZ Consumer Confidence data represents the sole release for the week.

- The 1-2bps richening by cash US tsys in today’s Asia-Pac session likely assisted the local market’s move away from session cheaps. Today, the US calendar will see Regional Fed and Existing Home Sales data and a $69bn 2Y Note auction.

- Swap rates closed 1-3bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing is 1-3bps softer for 2025 meetings. The market has a 39% chance of a 25bp cut in August priced. There is an 85% chance of a cut priced by October, with a cumulative 68bps of easing by year-end.

- On Thursday, the NZ Treasury plans to sell NZ$300mn of the 3.0% Apr-29 bond and NZ$200mn of the 4.50% May-35 bond.

FOREX: Dollar Index Down As Yen Rallies On Supportive Cross Asset Backdrop

The USD BBDXY sits lower, largely thanks to a firmer yen backdrop so far in Tuesday trade. The index last under 1254, off 0.10%. Yen gains have been prominent, particularly commodity related FX like NZD and AUD.

- USD/JPY has steadily pushed down through Asia Pac trade, the pair last near 156.25/30, up around 0.50%, and just under intra-session lows from Monday. 155.38, the July 18 low is the next potential downside target.

- Cross asset trends are supporting the yen, with US equity futures lower, while some regional equity markets are struggling as well, most notably China (CSI 300 off 1%), which is likely weighing on higher beta FX against the yen.

- AUD/JPY is back to 103.65, while NZD/JPY is around 93.25/30, with both pairs around session lows. For NZD/JPY we were last near these levels in the first half of May. NZD/USD is back under 0.5970, AUD.USD at 0.6635.

- In the yield space, US Tsy yields have ticked down, 0.7-1.9bps, another support point for the yen. Combined with a slightly firmer JGB yield backdrop has helped push yields differential with the US down a touch.

- Commodity markets are mostly weaker, with focus on the metals space. Cooper (CMX basis) is down modestly while Iron ore is over 2%. China growth concerns/supply are driving sentiment in this space.

- Looking ahead we have another light session data wise, with just the US Richmond Fed index, and existing home sales. The ECB's Lane also speaks.

ASIA STOCKS: China & HK Stocks Struggle As Market Looks For Further Policy Support

Hong Kong and China equity markets are mostly lower today. The subdued performance in these markets contrasts with the broader positive trend in Asian equities, which were bolstered by a tech-led surge in Wall Street. The market still seems a bit concerned around the US election after Biden dropped out with odds showing Trump is well in front, leading to concerns of tougher trade restrictions and tariffs if he does win the Presidential Election. Additionally, the markets are still hoping for more policy announcements to support the struggling Chinese economy following last week's Third Plenum.

- Hong Kong equities are mostly lower today with the Property Indices have given back earlier gains with (Mainland -0.25%, HS Property -0.40%), tech stocks are drifted lower through the day with the HSTech Index now down 1% while the broader HSI is 0.20% lower.

- China onshore markets are underperforming HK stocks, growth/mid cap stocks looks to be the worst performing today with the CSI 500 down 1.70% & ChiNext down 1.55% while small-caps indices are down slightly less with the CSI 1000 1.40% lower & CSI 2000 0.70%, the large-cap CSI 300 is down 0.95%.

- China's government spending fell almost 3% in the first half of the year, with local government expenditures down 4.2%, contributing to a larger deficit of 3.63 trillion yuan and potentially hindering economic growth. Despite central government spending rising 10%, overall economic growth slowed to 5%, prompting fiscal support measures and interest rate cuts to boost the economy, as per BBG.

- The recent Third Plenum and announcements that came from it together with the PBoC cutting LPRs on Monday have done little to spur the market higher, while it is suspected the the China National Team has been involved in supporting the market over the past month, the CSI 300 is up just 0.64% over the same period which suggests there may be further weakness to come without further supportive policies measures.

ASIA PAC STOCKS: Asian Equities Rebound Although Off Earlier Highs

Regional Asian equities have tracked US markets higher today, with the MSCI Asia Pacific Index ending a three-day decline. Taiwanese stocks are the top performers after heavy selling recently by foreign investors looks to have at least temporarily stopped as TSMC surges 3.40%. The market is enjoying a decrease in political uncertainty, with it now widely expected Kamala Harris will lead the Democrat party, while we now just wait for the announcement of her running mate. There is little in the way of economic data today, with focus now turning to US Inflation data and Major Tech earnings later this week.

- Japanese equities are higher today although we are well off the morning highs. The Yen has strengthened and now trades back below 157.00 after LDP Secretary-General Motegi spoke about how the BoJ should articulate its normalization policy more clearly and said “It is clear that an excessively weak yen is negative for the Japanese economy." Japanese banks are the top performing today with the Topix Banks Index up 1.40%, Tech stocks are well off earlier highs with the Nikkei 225 now flat after opening up about 0.80%, while the wider Topix Index is 0.20% higher.

- South Korean equities have rebounded following a four-day sell-off, the Kospi still trades 2% lower over the past week. Foreign investors have continued to sell local tech stocks today, although overall flows are positive with investors buying transport and financial stocks. The Kospi is up 0.60%, while the Kosdaq is 0.50% higher.

- Taiwan equities are the top performers today, tracking gains made overnight in the Philadelphia SE Semiconductor Index which closed 4% higher, TSMC has contributed the most to index gains, up 3.40% while the Taiex is 2.13% higher.

- Australian equities are higher today, although have underperformed global markets. Financials have been the largest contributor to the index gains, while energy stocks are the only sector in the red with Woodside leading the decline after reporting a revenue miss. The ASX 200 is 0.60% higher, while in New Zealand the NZX 50 is trading 0.90% higher.

- In EM Asia, markets are mixed with Singapore's Straits Times up 0.50%, Malaysia's KLCI up 0.50%, while Indonesia's JCI is unchanged, Philippines PSEi is down 0.10%, Thailand's SET is down 1% while India's Nifty 50 is down 0.20%

ASIAN EQUITY FLOWS: Foreign Investors Selling Of Asian Equities Slows

- South Korea: South Korean equities saw outflows of $191m yesterday, contributing to a net outflow of $839m over the past five trading days. Foreign investors have been heavy sellers of tech stocks recently, particularly semiconductor names or any tech firm that sells a lot into China. The 5-day average outflow is $168m, significantly lower than the 20-day average inflow of $115m and the 100-day average inflow of $111m. Year-to-date, South Korea has experienced substantial inflows totaling $18.695b.

- Taiwan: Foreign investors continue to sell Taiwanese equities although at a slower rate with an outflow of $82m yesterday, resulting in a net outflow of $5.062b over the past five trading days. The 5-day average outflow is $1.012b, considerably higher than the 20-day average outflow of $406m and the 100-day average outflow of $84m. Year-to-date, Taiwan has experienced outflows totaling $3.144b.

- India: Indian equities saw inflows of $218m on Friday, contributing to a net inflow of $2.063b over the past five trading days. The 5-day average inflow is $413m, higher than the 20-day average inflow of $281m and significantly higher than the 100-day average outflow of $46m. Year-to-date, India has experienced inflows totaling $4.065b.

- Indonesia: Indonesian equities recorded inflows of $1m yesterday, resulting in a net inflow of $124m over the past five trading days. The 5-day average outflow is $8m, below the 20-day average inflow of $17m and matching the 100-day average outflow of $8m. Year-to-date, Indonesia has experienced outflows totaling $121m.

- Thailand: Thailand was out on Monday for Asarnha Bucha Day. The 5-day average inflow is $10m, better than the 20-day average outflow of $15m and the 100-day average outflow of $25m. Year-to-date, Thailand has seen significant outflows amounting to $3.291b.

- Malaysia: Malaysian equities experienced outflows of $32m yesterday, contributing to a 5-day net inflow of $57m. The 5-day average inflow is $11m, higher than the 20-day average inflow of $12m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced inflows totaling $140m.

- Philippines: Philippine equities saw inflows of $17m yesterday with a 5-day net inflow of $66.1m. The 5-day average inflow is $13m, better than the 20-day average inflow of $4m and the 100-day average outflow of $7m. Year-to-date, the Philippines has seen outflows totaling $453m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -191 | -839 | 18695 |

| Taiwan (USDmn) | -82 | -5062 | -3144 |

| India (USDmn)* | 218 | 2063 | 4065 |

| Indonesia (USDmn) | 1 | 124 | -121 |

| Thailand (USDmn) | 0 | 61 | -3291 |

| Malaysia (USDmn) | -32 | 57 | 140 |

| Philippines (USDmn) | 17 | 66.1 | -453 |

| Total | -68 | -3529 | 15890 |

| * Up to 19th July |

OIL: Crude Holds Onto Losses, US Inventory Data Out Later

Oil prices are little changed today after falling over the last two trading days. Brent is around $82.46/bbl off the intraday high of $82.63, and WTI is $78.40/bbl after rising to $78.59.

- Concerns over the US political situation and demand strength from China in the face of disappointing data and yesterday’s rate cuts have weighed on oil prices. This triggered algorithmic selling, according to Bloomberg. But prompt spreads continue to point to a tight market.

- The last few weeks have seen a sharp crude inventory drawdown in the US and today’s industry data will be monitored to see if that continued last week, especially as there was a rise in both gasoline and distillate stocks.

- Another quiet day with only the ECB’s Lane speaking and US July Philly & Richmond Fed indices, and June existing home sales released.

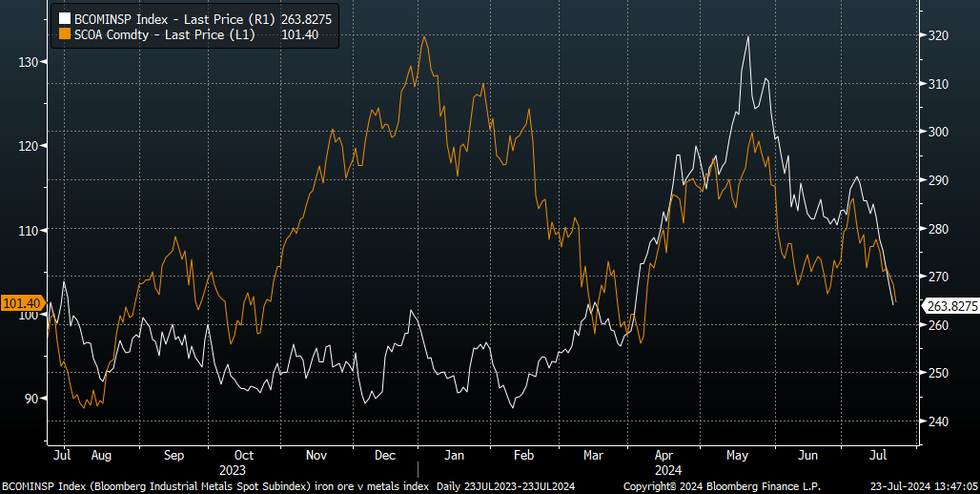

IRON ORE: Iron Ore Testing Multi Month Lows Amid Multiple Headwinds

The active iron ore contract on the SGX is testing multi month lows, last near $101.5/ton. This is just below late June lows. The next logical downside target is a test of the $100/ton level. The 20-day EMA sits back at $107/ton on the topside.

- Iron ore weakness is consistent with softer onshore steel prices. Both hot rolled coil and steel rebar futures are both off more than 1%. Rebar futures are back close to early April lows.

- The CSI 300 is off a little over 1% in the equity space, with equity sub indices tracking down for the third straight session. Yesterday's rate moves not doing much to boost sentiment at this stage.

- Broader metal prices have also been under pressure. The Bloomberg metals sub index off nearly 1.5% in Monday's session the 6th straight loss. The index is back to levels from early April.

- The chart below overlays this index against spot iron ore prices. Over supply (with copper inventories)/China demand concerns are weighing on broader sentiment in the complex.

Fig 1: Iron ore & Bloomberg Metals Sub Index

Source: MNI - Market News/Bloomberg

GOLD: Pullback From Record High Continues

Gold is slightly higher in today’s Asia-Pac session, after closing slightly lower at $2396.59 yesterday. The yellow metal hit an intra-day low of $2384.

- Bullion has now pulled back around 3.5% from its record high set last week.

- US yields ended Monday ~1bp higher after being ~2bps lower during the Asian session on the back of news that President Biden was pulling out of the election race.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- It seems very likely that Kamala Harris will be the Presidential Nominee for the Democrats with the focus now turning to her running mate, betting markets have Josh Shapiro as the favourite with a 32% chance followed by Andy Beshaer at 26% and Roy Cooper at 20%.

- The market is now waiting for Friday’s update on the Fed’s preferred underlying inflation measure, which is expected to show the PCE deflator retreated to an annual pace of 2.5% from 2.6% in the year to May.

- According to MNI’s technicals team, the trend condition in gold remains bullish, despite the fade off last-week highs, with initial resistance at $2,483.8, the July 17 high. Initial support is at $2,390.1, the 20-day EMA.

ASIA FX: USD/Asia Pairs Lower, Led By The Won, Singapore Inflation Below Forecasts

USD/Asia pairs are lower across the board, with Asian currencies outperforming some of the higher beta G10 plays, which are weaker against the dollar. A firmer yen backdrop is helping, particularly for those currencies in North East Asia. USD/CNH is lower, shrugging off a negative equity lead. In South East Asia, FX gains are more muted but still never the less present. USD/SGD is slightly higher post the CPI miss for June, but estimates of the SGD NEER point to little change.

- USD/CNH has slipped back under 7.2900, largely due to lower USD/JPY levels. We also had a steady USD/CNY fixing outcome (despite higher market forecasts), which also provided some marginal support. The equity backdrop remains soft though, with onshore equities struggling despite yesterday's rate cut.

- The won and TWD are seeing benefits from equity market gains, following tech led advances in US trade from Monday. The Taiex is outperforming at the this stage, up around 2.1%, The Kospi is up a more modest 0.60%. Positive spill over from a firmer yen and a steadier yuan backdrop is also aiding both of these currencies. KRW is seeing slightly large gains at this stage. Spot is up around 0.30%, last near 1384. This leaves us comfortably within recent ranges for USD/KRW. Spot USD/TWD is down a little over 0.1%, last near 32.83. Yesterday's fresh multi year highs were close to 32.88.

- USD/SGD is relatively steady, last near 1.3450. Recent highs come in close to 1.3600, back at the start of the month. We are up slightly post a softer than expected June CPI print, with headline back to 2.4% y/y, core under 3.0% y/y. The multiyear lows for both series. It comes ahead of the MAS decision this Friday. The SGD NEER (per Goldman Sachs estimate) is also little changed.

- Trends are biased slightly against the USD elsewhere. USD/MYR is down a touch, last near 4.6730, while USD/PHP and USD/THB are close to unchanged. Philippines Finance Chief Recto stated he was open to a rate cut next month but ultimately it is the board's decision (per BBG).

- USD/IDR opened sub 16200, so off recent highs, but has seen little follow through.

ASIA SOVS: Philippine's FinSec Open To Rate Cuts, Front-End Yields Lower

Asia sov see better buying through the front-end. The Philippines FinSec was speaking earlier where he mentioned the country is on track for monetary easing. Locally there is little data on the calendar this week with focus turning to key US inflation data due out later this week.

- The INDON curve has bull-steepened today with front-end yields 1-3bps lower, while the PHILIP curve twist steepens, with front-end yields 1-2bps lower.

- The Philippine's President Marco delivered his third state of the nation Address to congress on Monday where he pledged measures to support the farm sector and curb inflation, particularly rice prices, which have significantly impacted Filipinos despite overall economic growth. His plans include infrastructure improvements, stricter anti-smuggling rules, and a review of power sector laws to reduce energy costs, aiming to maintain economic momentum and achieve 6-7% growth this year.

- Philippine's Finance Secretary spoke earlier where he mentioned the country was on track for monetary easing and that he is open to a policy rate cut next month. He expects 6% GDP growth in Q2.

- Cross-asset: Asian currencies are higher verses the USD today, with the IDR up 0.14%, while the PHP is 0.11% higher, equity markets are little changed.

- Regionally there is little on the calendars this week.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/07/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/07/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 23/07/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/07/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/07/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 23/07/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/07/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.