-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: T-Notes Edge Higher, Antipodean FX Falter

- Hawkish Fed rhetoric gets weighed against raging Covid-19 outbreak in the Asia-Pacific region and geopolitical tensions.

- Antipodean currencies go offered as lockdowns in Australia dent sentiment among consumers and businesses.

BOND SUMMARY: Raging Delta Variant Supports Core FI Despite Hawkish Fedspeak

The news and data flow seen over the Asia-Pac session failed to offer any notable fresh catalysts, leaving participants to reflect on the latest portion of hawkish Fedspeak. Meanwhile, continued spread of the coronavirus Delta variant continued to provide a lingering source of worry, while Sino-Canadian tensions and combative rhetoric from North Korea were also eyed. T-Notes advanced nonetheless, and last trade +0-00+ at 133-25+, as U.S. e-mini futures slipped. Cash Tsy curve bull flattened, with yields last seen 0.2-1.4bp lower. Eurodollar futures trade unch. to +1.5 tick through the reds. Comments from Fed's Mester on inflation risks and 3-Year Tsy supply headline today's economic docket in the U.S., ahead of Wednesday's much awaited CPI report.

- Japanese markets reopened after the long weekend, with JGB futures wavering within a 10 tick range. The contract last sits at 152.14, 16 ticks below Friday's settlement. Cash JGBs softened across the curve, with 7-20 sector underperforming. 30-Year JGB supply is due to take focus tomorrow. On the fiscal front, Japanese FinMin Aso pushed back against suggestions that the gov't was preparing a new stimulus package and extra budget.

- The initial bear steepening impetus seen at the Australian reopen evaporated and the ACGB yield curve twist flattened at the margin. Yields last sit +0.7bp to -0.4bp across the curve. YM last trades unch, while XM ground higher and now sits +0.5. Bills run unch. to -1 tick through the reds. Participants took note of the deterioration in sentiment among Australian consumers and businesses. The weekly ANZ consumer confidence gauge slipped below the breakeven 100 level for the first time since autumn 2020, while NAB Business Confidence Index returning into negative territory, as regional lockdowns continued to bite. The AOFM sold A$100mn of the 2.50% 20 Sep '30 linker, which attracted bid/cover ratio of 4.27x.

FOREX: NAB Survey Weighs On Antipodean Pairs

Major pairs drifted within fairly tight ranges, there were reports that the Senate had an agreement for final passage on the infrastructure bill. NZD was bottom of the G10 pile, NZD/USD losing 16 pips. Data showed New Zealand July total card spending rose 0.9% M/M. Looking further afield, food price index & inflation expectations hit Thursday, while BusinessNZ M'fing PMI is due Friday.

- AUD/USD is down 6 pips and approaching the worst levels since November 2020. The Australia NAB business confidence index fell to -8 from 11 previously, the business conditions fell to 11 from 25 previously.

- USD/JPY is up 4 pips. as Japanese markets return from a holiday. Data from Japan earlier showed bank landing excluding trusts rose 0.5% in July, the BoP current account surplus widened more than expected to JPY 905.1bn. Elsewhere Sankei reported that PM Suga will ask officials to draft a stimulus package, which would be funded by a Y30tn extra budget. FinMin Aso poured cold water on the reports by saying no new stimulus package or extra budget was currently being prepped and that there were still plenty of unspent COVID-19 funds.

- Offshore yuan is stronger, USD/CNH down 52 pips from yesterday's closing highs. There were 143 new coronavirus cases in mainland China today, the highest case count since January 20.

- Markets look ahead to the passage of the infrastructure bill from the US and later in the week CPI data.

FOREX OPTIONS: Expiries for Aug10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1690-00(E684mln), $1.1800-05(E859mln), $1.1825-40(E1.7bln), $1.1850(E2.4bln)

- AUD/USD: $0.7300(A$949mln), $0.7350(A$539mln), $0.7385-00(A$1.1bln)

- USD/CAD: C$1.2530-50($647mln)

- USD/CNY: Cny6.4730($1bln)

ASIA FX: Won Props Up Returns Table

The greenback pushed slightly higher in Asia on Tuesday, risk sentiment in the region was mixed and catalysts limited.

- CNH: Offshore yuan is slightly stronger, picking up from recent lows. . There were 143 new coronavirus cases in mainland China today, the highest case count since January 20.

- SGD: Singapore dollar is flat, markets await GDP data tomorrow. Ministry of Health has announced that 70% of its population is now fully vaccinated with the target of herd immunity drawing closer.

- TWD: Taiwan dollar is on track for a three-day losing streak after rising for four straight sessions last week. Data late yesterday showed Taiwan posted strong exports again, exports rose 34.7% in July from a year earlier to $37.9bn, the highest for any month in data back to 1981.

- KRW: Won is weaker, on the coronavirus front South Korea recorded 1,540 daily new coronavirus cases on Tuesday, back to above 1,500 as the nationwide resurgence of COVID-19 cases continued amid the summer season

- IDR: Rupiah is weaker, Indonesia announced that it will gradually relax restrictions in several locations including Jakarta and said it's preparing a plan for living with Covid-19 over the next few years.

- PHP: Peso is stronger, Philippine economy expanded 11.8% Y/Y in Q2 after contracting 3.9% in Q1, beating BBG median estimate of +10.9%. The expansion was fastest since 4Q1988

- THB: The Thai Cabinet meets today and is expected to discuss additional economic relief measures for people affected by the outbreak of Covid-19.

ASIA RATES: China Coronavirus Cases Rise

- INDIA: Yields higher in early trade. Bonds were supported yesterday thanks to a sharp drop in oil prices, also supporting the short end is the choice of bonds included in the RBI's next INR 250bn GSAP purchase operation on Aug 12. Bonds eligible for purchase are the 5.63% 2026, 7.17% 2028, 7.26% 2029, 7.61% 2030, 7.95% 2032. Yields fell yesterday for the first time in four sessions, the RBI maintained its dovish tone last week but extension of the VRRR programme indicates the bank is uncomfortable with large amounts of liquidity and is looking to start to normalize liquidity levels.

- SOUTH KOREA: Futures lower at the open as markets played catch up with a move lower in US tsys, overall movement was rangebound through the session and also within Monday's range. On the coronavirus front South Korea recorded 1,540 daily new coronavirus cases on Tuesday, back to above 1,500 as the nationwide resurgence of COVID-19 cases continued amid the summer season. The MOF sold 2-Year debt to decent demand.

- CHINA: The PBOC matched maturities with injections again today; the overnight repo rate is up 36bps at 2.2651%, 7-day repo rate is down 14 bps at 2.3565%. Futures are higher with equity markets struggling for direction. On the coronavirus front there were 143 new coronavirus cases in mainland China today, the highest case count since January 20.

- INDONESIA: Yields are higher across the curve. Indonesia announced that it will gradually relax restrictions in several locations including Jakarta and said it's preparing a plan for living with Covid-19 over the next few years. Officials extended restrictions in Java and Bali through Aug 16 and said that Covid rules for other islands will remain in place through Aug

EQUITIES: Drifting

A mixed session in Asia today as markets drifted between minor gains and minor losses. Markets in Japan were higher after returning from a long weekend. Japanese FinMin Aso was on the wires saying no new stimulus package or extra budget was currently being prepped and that there were still plenty of unspent COVID-19 funds. Markets in mainland China were lower, China hitting the headlines after a court has rejected the death sentence appeal for Canadian. The Hang Seng managed to squeeze out some small gains thanks to a positive lead in the tech sector from the Nasdaq. Indices in Australia and New Zealand also gained, while South Korea and Taiwanese markets fell. In the US futures are lower, markets will look ahead to the vote on the US infrastructure bill.

GOLD: Grinds Higher

After some wild price swings on Monday the yellow metal has held a much narrower range on Tuesday, grinding higher from the open but staying within yesterday's range. Gold is last up $6.73/oz at $1,763.67. Risk sentiment in the region has been mixed, most equity markets managed small gains while the greenback rose slightly. The pull lower yesterday found some support at the 61.8% retracement of the 2020 range, but the recovery off the low will have emboldened bulls. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement. Front-end implied vols for Gold understandably lurched higher, with the 1m contract holding most of the gain.

OIL: Holding Near Recent Lows

After finishing the day slightly lower crude futures have squeezed out small gains in Asia on Tuesday, benchmarks are down almost 10% from last week's highs; WTI is up $0.32 from settlement levels at $66.80, Brent is up $0.13 at $69.17/bbl. Risk sentiment in the region has been mixed, most equity markets managed small gains while the greenback rose slightly. Focus remains on the impact of the delta variant on demand, markets look ahead to monthly IEA and OPEC reports later in the week.

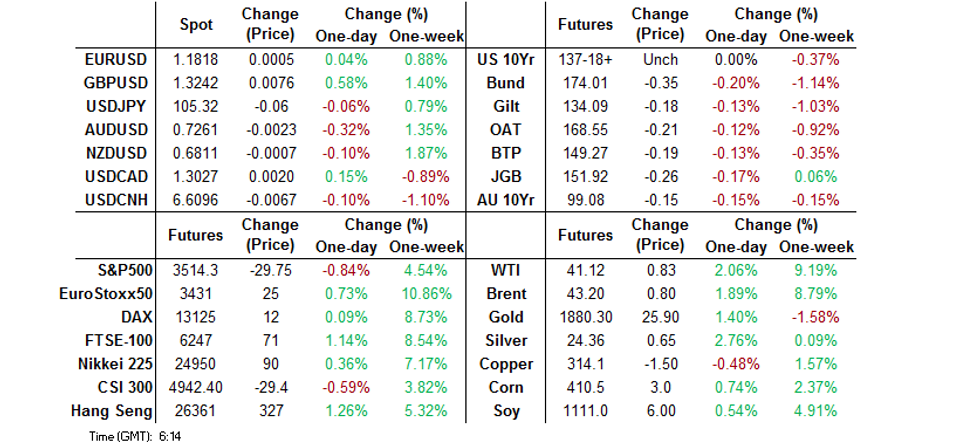

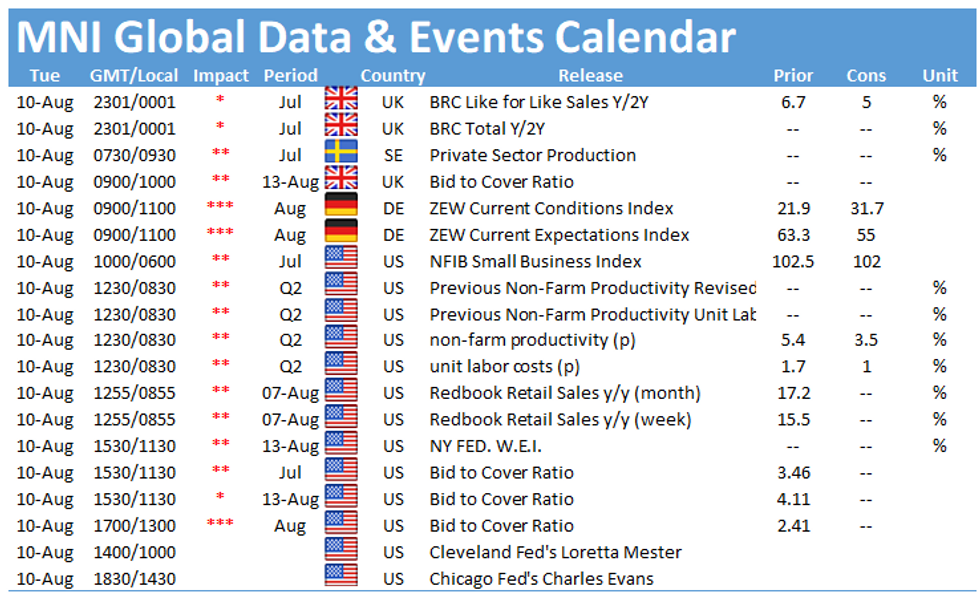

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.