-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Thune Defends Two-Step 2025 Agenda

MNI US MARKETS ANALYSIS - EUR Steadies Ahead of ECB

MNI EUROPEAN MARKETS ANALYSIS: Tsys & USD Cling To Tight Ranges Ahead Of CPI

- The proximity to U.S. CPI left Tsys in a narrow range.

- The BBDXY hasn't drifted too far away from the 1266 level in a range bound session (last at 1265.70). The AUD and NOK have seen some outperformance, while dips in USD/JPY have been supported. The market though appears to be waiting for cues from the US CPI report before deciding on fresh direction.

- U.S. CPI data headlines on Tuesday, with UK job/wage figures also set to print, along with the BoE financial stability report. In Germany, final CPI is out, along with the ZEW survey.

MNI US CPI Preview: Consensus Eyes Moderation Confirmation

EXECUTIVE SUMMARY

- Released Dec 13, core CPI inflation is seen broadly stabilising at a ‘softer’ 0.3% M/M in November after the surprise 0.27% in October, although analyst surveys suggest some upside risk.

- OER and rents of primary residence could see a modest renewed uptick whilst we also watch for the ongoing core goods disinflation/deflation trend and notably core services excluding shelter after particular emphasis from Chair Powell.

- Landing on day one of the two-day FOMC meeting, the report would have to be wildly different to consensus to see something other than the 50bp hike viewed as locked in for Wed but with two-way risk to the Fed rate path further out.

- Whilst a beat or miss compared to expectations might be a logistical challenge to change SEP forecasts and dots, it could however shape the language of the statement and perhaps notably Powell’s presser.

- PLEASE FIND THE FULL REPORT HERE:USCPIPrevDec2022.pdf

Fig. 1: Three key themes to watch: core goods, shelter and core services excluding shelter

US TSYS: Light Richening Holds, CPI In Focus

TYH3 deals at 113-29, +0-02+, just shy of the top of its 0-06 Asia-Pac range on light volume of ~51K.

- Cash Tsys are running 0.5-1.5bp richer across the major benchmarks with the short end of the curve leading the bid, resulting in some very light bull steepening.

- With little in the way of headline drivers, mild USD weakness points to cross-asset derived flows as a driver of the light richening.

- The U.S. CPI release headlines today, which provides the final key input ahead of Wednesday's FOMC decision (see our full preview of the CPI release here). The proximity to that data release limited activity in Asia, with Chinese & HK COVID-related headline flow failing to entice traders into a more active posture.

- Elsewhere, on the supply front, we will see the latest 30-Year Tsy auction.

JGBS: Twist Flattening As Long End Goes Bid In The Afternoon, Futures Hold Lower

JGBs futures looked through, but failed to make a meaningful break below, their overnight base, before retracing from worst levels to finish -13, consolidating their overnight weakness.

- Broader cash JGB trade saw the major benchmarks run 1bp cheaper to 4bp richer, pivoting around 10s as the curve twist flattened, with 7s leading the weakness on the downtick in futures.

- Finance Minister Suzuki reiterated that debt isn’t considered a sustainable funding source, while stressing that no definite decisions on funding matters surrounding increased defence spending had been made in lieu of reports re: the potential deployment of construction bonds to fund some of the spending. Suzuki also noted that an extension of the redemption period for JGBs would alter the market credibility of the instruments, pushing back against calls for a review on the matter from a senior politician.

- A slight firming of U.S. Tsys and the above mixture of headline flow seemed to support long end JGBs in the Tokyo afternoon.

- Looking ahead, the latest BoJ Tankan survey headlines the domestic docket on Wednesday, with BoJ Rinban operations also slated.

AUSSIE BONDS: Meandering Pre-U.S. CPI Session

Aussie bonds wound through the pre-U.S. CPI Sydney session after an early extension lower on the back of overnight weakness in futures, which was tied to U.S. Tsys cheapening on Monday.

- A move away from lows in Tsys and local data likely helped the space find a base, with the monthly NAB business & Westpac consumer confidence data giving further credence to the RBA’s assessment re: the narrow path that the economy is on at present. Some fresh pressure was seen into the close, as YM registered a fresh session low.

- YM finished -4.8, with XM -1.7, as the wider cash ACGB curve saw a similar degree of bear flattening.

- EFPs were narrower on the day, suggesting the cheapening move was bond, not swap, driven.

- Quarterly bond futures roll activity continued to support volumes ahead of Thursday’s Z2 contract expiry, with the YM roll biased to selling and XM roll fairly evenly split in terms of direction of trade.

- Bills were flat to -3 through the reds, with RBA dated OIS little changed on the day.

- Looking ahead, U.S. CPI data will shape matters overnight, with RBA Governor Lowe’s latest address due early Wednesday morning local time.

AUSTRALIA: Business Confidence Pointing To Slowdown Ahead, Costs Elevated

The November NAB business survey showed that the economy remains robust in Q4 but that it is not only expected to weaken but the trend in orders is suggesting that it is imminent. Business conditions remained elevated but fell 2 points to 20. Business confidence, a leading indicator, deteriorated into negative territory at -4 for the first time since December 2021 as monetary tightening and the deteriorating global growth outlook weigh on sentiment.

- Forward orders fell a further 3 points to 5, the lowest since September 2021, and well off the peak of 15 in May. This series suggests that demand is beginning to slow.

- Cost measures in the survey were fairly stable but at elevated rates, which is likely to concern the RBA. Retail prices rose to their highest in three months at 2.9%. Labour costs were 3.0% (Oct 2.8%) and purchase costs 3.9% (Oct 4.1%). The price of final products is also high but off its peak.

- Employment conditions fell 1 point and point to normalising but still robust job growth.

- The fall in confidence was driven by manufacturing, construction and retail. It was also down across the states, except in SA.

- See NAB report here.

Source: MNI - Market News/Refinitiv/NAB

Fig. 2: Australia NAB price of final products vs CPI y/y%

Source: MNI - Market News/Refinitiv/NAB

AUSTRALIA: Consumers More Confident, Unemployment Expectations Rise Again

The Westpac measure of consumer confidence for December rose 3% m/m, despite surveying during an RBA meeting week, but didn’t fully unwind the 6.9% drop in November. The index remains depressed and is down 23% y/y but may have stabilised as rate hike expectations eased further.

- Inflation remained a key concern for households with 58% of households recalling news related to inflation compared to 23% for interest rates. Those surveyed perceived the news on inflation and the state of the economy as the most negative.

- 50% of respondents expect rates to rise at least a further 100bp over 2023 but that has moderated from 60% in the last survey and a peak of 73% in July. Westpac notes that this may have driven the unexpected increase in the outlook for house prices which soared 27.6% and was broad based across states.

- Unemployment expectations rose a further 0.5% m/m after +17% over Oct/Nov to the highest since April 2021 (see chart).

- The forward looking components drove the index higher this month with expectations +4%, family finances a year ahead +6.9% and the economy in 5 years +5.2% but again these increases were still smaller than the declines in November.

- Family finances compared to a year ago fell for the second consecutive month. With the full extent of monetary tightening yet to be felt and increase in the cost of living, this component is likely to remain depressed or even deteriorate further early in 2023. Any relief from the government’s energy plan is not likely to be felt until at least mid-2023.

- See press release here.

Source: MNI - Market News/Refinitiv/ABS/Westpac

AUSTRALIA: Seasonally Adjusted CBA Spending Intentions Flat In November

CBA household spending intentions rose 1.9% m/m in November to be up 3.2% y/y but the seasonally adjusted data was flat on the month. November was driven by an increase in spending on transport due to higher fuel prices, retail because of the sales and health & fitness. Once the festive season is past, the impact of higher rates and cost of living is likely to change consumer behaviour and weaker spending is likely early in 2023.

- Household spending is moderating in annual terms with November down to 3.2% y/y from 7.5% y/y and the peak of 15.2% in August. But the annual series is now facing strong negative base effects from a surge in post-lockdown sales in October/November 2021.

- Home buying intentions index rose 3.9% m/m but is down 24.8% y/y. The increase in November was driven by an increase in listings and inspections but the number of home loan applications was down. This index is likely to fall further in the new year given that there is still a lot of tightening that is yet to be felt by households as there is around a 3-month lag and a lot of mortgages will be refinanced in H1 2023.

- See press release here.

Source: MNI - Market News/CBA/Bloomberg

NZGBS: Flatter Curve, Steeper Swaps, HYEFU In View

The early cheapening across the NZGB curve saw an extension, with some weight in the Aussie bond space and perhaps some fiscal/issuance-related caution ahead of the HYEFU applying pressure. Participants also had to adjust to Monday’s cheapening in U.S. Tsys, with one eye on the impending U.S. CPI print, which nullified any potential spill over from a modest bid in the Tsy space during Asia-Pac hours.

- That left the major benchmarks running 2.5-5.5bp cheaper at the close, as the curve bear flattened.

- Meanwhile, swap rates were 4-7bp higher as that curve steepened, resulting in mixed swap spread performance on the session, with tightening seen in the very front end and some widening further out.

- RBNZ dated OIS was little changed, pricing ~68bp of tightening for the Feb ’23 meeting and a terminal OCR of ~5.45%.

- Local data saw a flat print for food prices (M/M) and another M/M fall in the REINZ house price index as the property market adjusts to ever-tighter monetary policy.

- The HYEFU, current account data and a parliamentary address from RBNZ Governor Orr (opening remarks at the Finance and Expenditure Committee (FEC) annual review) are due Wednesday.

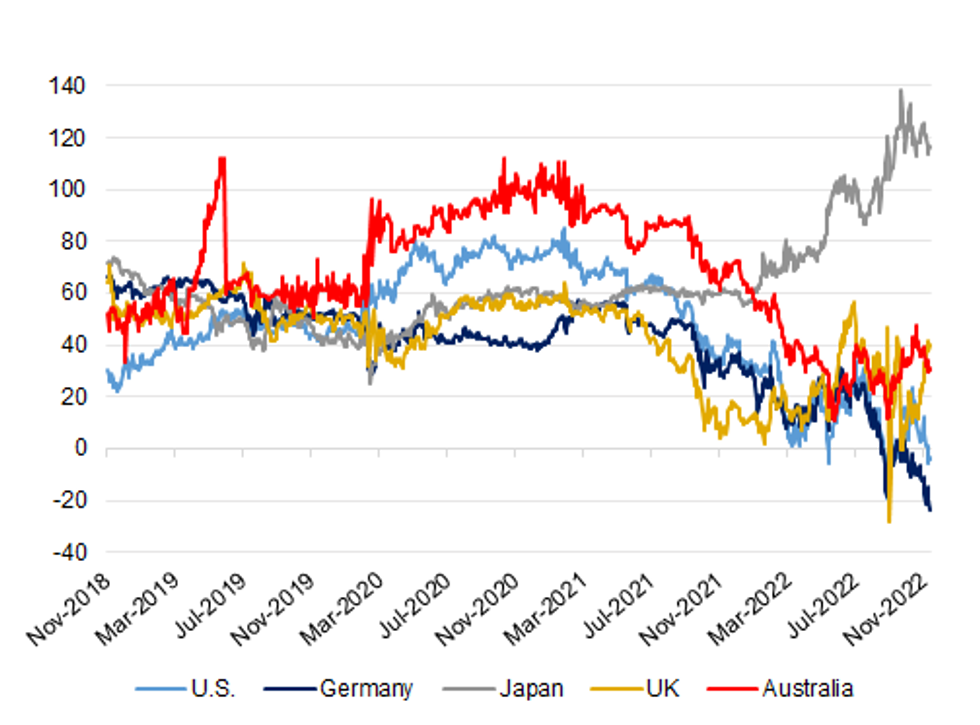

BONDS: Japanese Home Bias Maintained On Steep JGB Curve, Vol. & FX-Hedge Costs

While it is a topic we have flagged on many occasions in recent months, it is worth remembering that the steepness of the 10-/30-Year JGB curve (albeit owing to the BoJ’s YCC policy, which some are speculating will be altered in ’23, although that is a topic for another time), alongside ongoing market vol. and elevated FX hedging costs, have facilitated a home bias for the Japanese life insurer and pension fund cohort.

- This has resulted in several rounds of record monthly net foreign bond sales on the part of Japanese insurers during ’22, most recently in November, when they recorded a net sale of ~Y1.93tn of offshore bonds (this represented the ninth consecutive month of net sales).

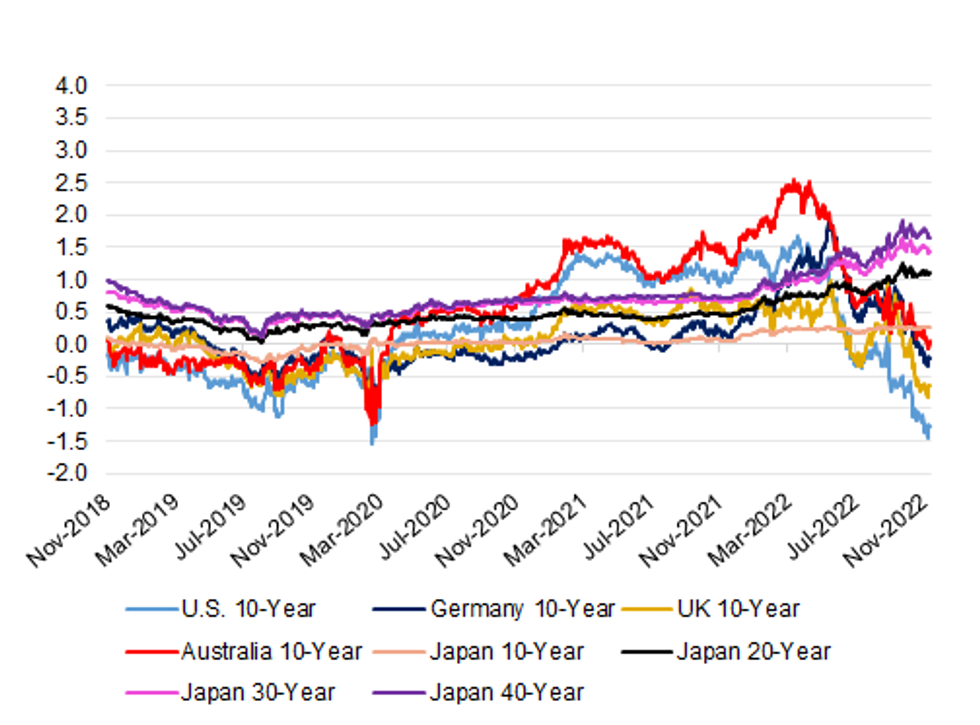

- The second figure highlights the yield pickup that 10- to 40-Year JGBs provides vs. the major 10-Year core global FI alternatives (adjusted for rolling 3-month FX hedging costs from the perspective of a Japanese investor).

- There will be a point whereby offshore paper becomes a little more attractive for this investor cohort, but we haven’t reached that point yet. This week’s central bank decisions are (of course) keenly awaited.

Fig. 1: 10-/30-Year JGB Yield Spread Vs. Major Global Counterparts (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Fig. 2: 10- To 40-Year JGB Yields Vs. The Major 10-Year Core Global FI Alternatives, FX-Hedged From The Perspective Of A Japanese Investor (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: Commodity FX Maintains A Positive Bias

The BBDXY hasn't drifted too far away from the 1266 level in a range bound session (last at 1265.70). The AUD and NOK have seen some outperformance, while dips in USD/JPY have been supported. The market though appears to be waiting for cues from the US CPI report before deciding on fresh direction.

- AUD/USD saw support off 0.6740, but is only back to the 0.6760 region, which is +0.25% higher for the session. Consumer and business sentiment results didn't shift the sentiment needle earlier today. NOK is around 0.2% firmer, with USD/NOK back sub 9.9800.

- NZD/USD is back to 0.6385/90, slightly off session highs. Food prices were flat for November, while the AUD/NZD cross has seen some demand emerge sub 1.0570.

- USD/JPY is holding close to 137.70, flat for the session. Early moves below 137.50 were supported, but the move towards 138.00 faltered.

- Ahead of the US CPI report tonight, UK job/wage figures print, along with the BoE financial stability report. In Germany, CPI is out, along with ZEW.

FX OPTIONS: Expiries for Dec13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E752mln), $1.0500(E717mln), $1.0550-55(E1.3bln), $1.0600-15(E1.3bln)

- AUD/USD: $0.6750(A$613mln), $0.6800(A$708mln)

- USD/CAD: C$1.3700($674mln)

ASIA FX: North East Asia Outperforms South East Asia Ahead Of US CPI Print

(MNI Australia) USD/Asia pairs have been mixed today. Currencies more sensitive to real UST yield shifts have generally underperformed, while those in North East Asia have seen greater resilience, despite equity headwinds. Tomorrow, Indian wholesale prices are due, along with South Korean trade prices.

- USD/CNH has tracked familiar ranges, last just above 6.9800. The China currency is slightly firmer on mixed Covid developments. Easier restrictions in HK, including quarantine free travel with China in the new year is welcomed, but the current covid wave remains a source of concern in China.

- 1 month USD/KRW has broken back sub 1300 this afternoon, despite an indifferent equity market lead. The won is around 0.50% stronger for the session to date. Higher beta FX is doing better in the G10 space, so some spill over is likely evident.

- USD/INR is tracking higher, in line with other UST yield sensitive currencies today. The pair was last at 82.68, with December highs just a touch higher around 82.77. A break above these levels would have the market targeting the high 82.00/low 83.00 region, although this could draw RBI intervention risks. The last RBI policy meeting suggested the central bank was comfortable with the current state of FX markets and signalled a less interventionalist stance. Still, we would be surprised if the RBI stood aside completely and let USD/INR trade to fresh cyclical highs.

- USD/IDR has pushed back into the upper end of recent ranges. We currently sit at 15668, +0.26% higher for the session. Highs in the pair from November came in around the 15750 level. Support still appears evident sub 15400, while the simple 50-day MA is just under 15570.Cross asset signals have been a headwind for IDR over recent sessions, with palm oil falling over 6% yesterday, although we have recouped around half these losses so far today. Still, the Citi Indonesia terms of trade proxy is off its recent highs.

- USD/PHP is tracking higher again today, the pair up a further 0.30% to be last above 55.80. The pair dipped briefly below 55.20 during the start of last Friday's session, so this is somewhat of a turnaround. Resistance may be evident between 56.00 and 56.50 if seen, while on the downside note the simple 200-day MA comes in at 55.00. Better than expected trade figures did little to improve earlier.

EQUITIES: Covid Concerns Crimp China Rally

(MNI Australia) Asia Pac equities have been mixed ahead of key event risk in US markets tonight with CPI due. US futures are down slightly (-0.10/-0.20% at this stage), while regional markets that are higher are mostly away from best levels.

- The positive lead from US markets overnight, hasn't inspired uniformed gains throughout the region. The Kospi (-0.1%) and Taiex (-0.40%) are both weaker, despite some tech outperformance during US trading. Some South East Asian markets have performed better.

- The Nikkei 225 is +0.45% at this stage. Japan is reportedly in talks with the US to tighten chip export restrictions to China. The corporate tax rate could also be raised by 5ppt.

- Mainland China stocks are lower, the CSI 300 off by 0.20% at this stage. Easier Covid restrictions are reportedly planned but some of the focus is shifting to dealing with the current outbreak, amid soaring cases and strains on the local health system.

- The HSI is slightly higher, +0.55% at this stage. China/HK will start quarantine free travel in January, while US auditors of HK companies (that also have US listings) will reportedly present their findings by year end.

GOLD: Gold Prices Range Bound As Waiting For US CPI And FOMC

Gold prices trended up during today’s session on a slightly weaker USD but have almost given up the gains to be almost flat to the NY close. It is now trading around $1782.30/oz. Gold prices fell overnight after UST yields rose.

- Bullion reached a low today of $1777.64 before rising to a high of $1796.39. Resistance remains at $1807.90, August 10 high, which could be tested again if US CPI undershoots expectations. Support is at $1761.80, the 20-day EMA.

- Tonight’s US CPI report for November will be important for gold prices given the inverse relationship with the USD. Headline CPI is expected to moderate to 7.3% y/y from 7.7% and core to 6.1% y/y from 6.3%. The FOMC announcement is Wednesday and a 50bp hike is expected.

OIL: Oil Prices Recovering On China Reopening, Pipeline Closure & European Cold

MNI (Australia) - Oil prices rose further during today’s session after increasing strongly overnight on the back of the closure of the Keystone pipeline in North America. Further easing of Covid restrictions in China have also supported crude. WTI and Brent are up just over a percent to $73.95/bbl and $78.85 respectively, close to intraday highs.

- WTI oil prices have been reversing after clearing support at $71.00. Despite the rally, resistance is still some way from current prices at $78.23, the 20-day EMA. Brent came close to testing support at $78.11, resistance is at $80.81. There is currently limited liquidity in the market coming into year end.

- The Keystone pipeline, which connects oil fields in Canada to US refiners, has now leaked more oil than any other pipeline in the US in the last 12 years. A plan to restart it is yet to be submitted.

- China is the world’s largest oil importer and so recent measures to reopen from Covid are projected to boost oil demand. There are also expectations that there will be fiscal and monetary stimulus to boost growth.

- A cold snap in Europe is also increasing demand for heating fuels.

- Tonight’s US CPI report for November will be important and headline is forecast to moderate to 7.3% y/y from 7.7% and core to 6.1% y/y from 6.3%. The FOMC announcement is Wednesday and a 50bp hike is expected. There is also US API inventory data tonight.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/12/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 13/12/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 13/12/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 13/12/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 13/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/12/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/12/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/12/2022 | 1330/0830 | *** |  | US | CPI |

| 13/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/12/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 13/12/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.