-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Preview - November 2024

MNI POLITICAL RISK - Trump Initiates Tariff Negotiations

MNI EUROPEAN MARKETS ANALYSIS: U.S. Fiscal Matters Support Reflationist Theme In Asia

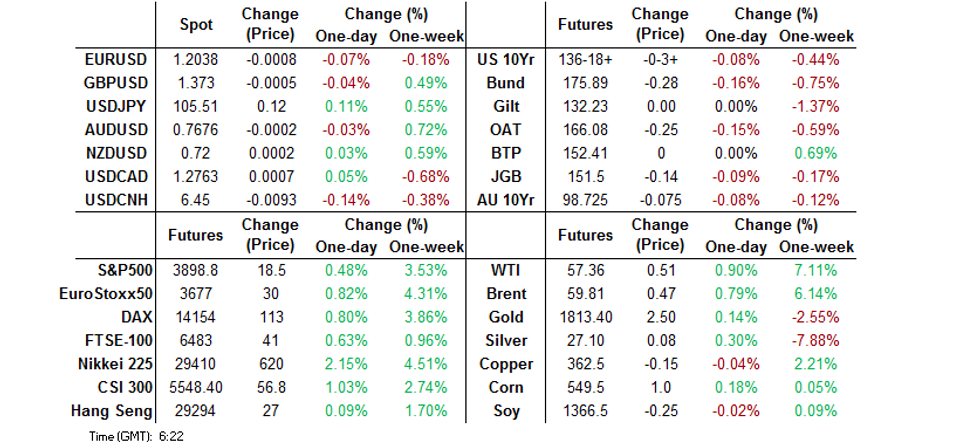

- Reflationist trade theme centred on the U.S. fiscal dynamic supports equities and weighs on core FI in Asia-Pac hours.

- U.S. 30-Year yields threaten to break through 2.00%.

- DXY struggles to make ground after Friday's sell off, latest CFTC CoT report reveals some net USD short covering, dominated by unwind of EUR longs.

BOND SUMMARY: U.S. Fiscal Matters Dominate Sources Of Risk

The start of the week has been dominated by broader focus on the prospects of a sizeable fiscal support package in the U.S., with Treasury Secretary Yellen and President Biden continuing to push home the need for notable assistance for the economy (although it looks like minimum wage hikes will have to wait, at least for now). The continued moderation in U.S. COVID cases is also helping risk-positive flows, although worry re: the spread of the UK strain of the virus around the U.S., in addition to issues pertaining to the efficacy of the Oxford/AstraZeneca vaccine in combatting the South African strain of the virus may be limiting broader follow through. Elsewhere, Sino-U.S. tensions are not expected to ease any time soon, especially on the back of the rhetoric provided by U.S. President Biden & Secretary of State Blinken over the weekend, although they will likely be on a more predictable and less spontaneous trajectory than what was seen during Donald Trump's term. Ultimately, the U.S. Tsy curve has been subjected to some bear steepening on the aforementioned fiscal matters, with 30-Year yields threatening to break above 2.00%, cheapening by ~2.0bp on the day, while S&P 500 e-minis had a very brief, and very limited look above the 3,900 mark, tagging a fresh all-time high in the process. T-Notes last -0-03+ at 136-18+, hovering just off worst levels of the day, but sticking within Friday's range. 10-Year breakevens hit fresh cycle highs in Asia, aided by another uptick in crude oil futures. Fedspeak from Mester headlines a slim local docket on Monday, with focus already turning to this week's 3-, 10- & 30-Year Tsy supply.

- JGB futures also fell afoul of the broader dynamic witnessed in core FI markets, with fresh cycle highs for 10-Year Japanese breakevens (at a not so lofty ~15bp) and super-long swap paying adding some local sources of pressure as the curve twist steepened. JGB futures finished the day 14 ticks worse off. There was little in the way of notable idiosyncratic market moving headlines, with local press reports pointing to a potential early unwind of some of the regional states of emergency in play in Japan, while a minister suggested that the government's go-to travel scheme may see a partial revival as COVID risks subside. We also saw Fitch affirm Japan's sovereign credit rating at A; Outlook Negative. Local focus on Tuesday turns to the latest round of BoJ Rinban ops, covering 1-10 and 25+ Year JGBs.

- Monday's Sydney dealing added to the downside impetus that remerged during the final overnight session of last week, after the lack of an imminent AOFM syndication gave bulls some respite during Friday's Sydney session. Aussie bond futures were pressured by the broader dynamic witnessed in core FI (outlined elsewhere), as well as some local semi issuance in the form of a SAFA '34 tap (for up to A$1.0bn, set to price tomorrow), and reports from BBG which pointed to China allowing some stranded Australian coal cargoes onshore (although the broader import ban is set to remain in place). This left YM unchanged, with XM -7.5 at the bell, as the latter extended on its recent move lower. Other sources of long-standing Sino-Aussie tension saw more negative news flow, although didn't see much in the way of market reaction, given their speculative and/or long dated nature. A quick look to tomorrow's local docket sees the release of the latest NAB business confidence survey, while Wednesday will bring the monthly Westpac consumer confidence print.

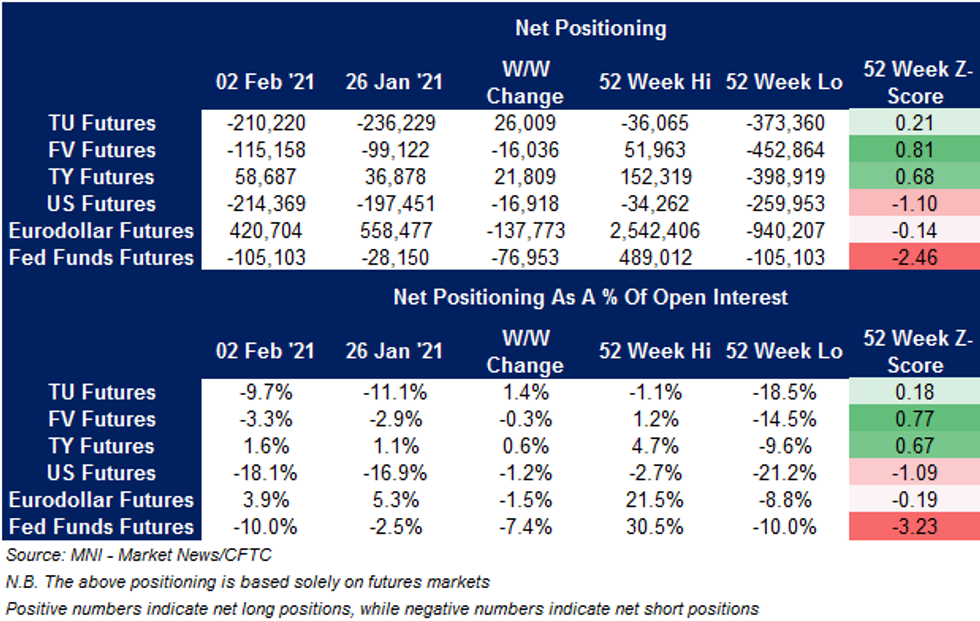

STIR Positioning Stands Out In Latest CFTC CoT

There was little in the way of generic direction in the net positioning among non-commercial U.S. Tsy market players in the week to 02 Feb, with the details outlined below.

- STIR futures saw net length cut in the Eurodollar futures space, while 3-month $ LIBOR went on to fix at fresh all-time lows at the backend of the week i.e. after the survey cut off.

- Fed fund futures net positioning hit the shortest seen since Aug '19, perhaps on the back of some speculation that the Fed may be forced into an IOER hike in the coming months, owing to liquidity dynamics.

FOREX: U.S. Stimulus Optimism Dominates Quiet Asia-Pac Session

Cautious optimism took hold in early trade this week as participants scrutinised weekend comments from U.S. Tsy Sec Yellen, who kept pushing for a sizeable Covid-19 stimulus package. The Antipodeans caught a light bid, even though a lack of major headlines kept G10 crosses rangebound. New Zealand observed a public holiday. AUD/JPY topped Y81.00 for the first time since 2018. Meanwhile, AUD/USD trades at $0.7674 at typing, ahead of the expiry of $1.0bn worth of options with strikes at $0.7650.

- USD/JPY resumed gains after snapping its seven-day winning streak on Friday, but failed to test the nearby 200-DMA. Japanese news flow revolved around potential for the early lifting of the state of emergency introduced in 10 prefectures. BBG reported that the UK's Dialog Semiconductor is in talks to sell the company to Japan's Renesas Electronics for ~EUR4.9bn.

- The DXY edged higher, moving away from Friday's lows.

- The PBoC fix fell roughly in line with expectations. The bank injected CNY 10bn, a still small injection by historical standards but the PBOC seem to be comfortable with liquidity in the system heading into LNY.

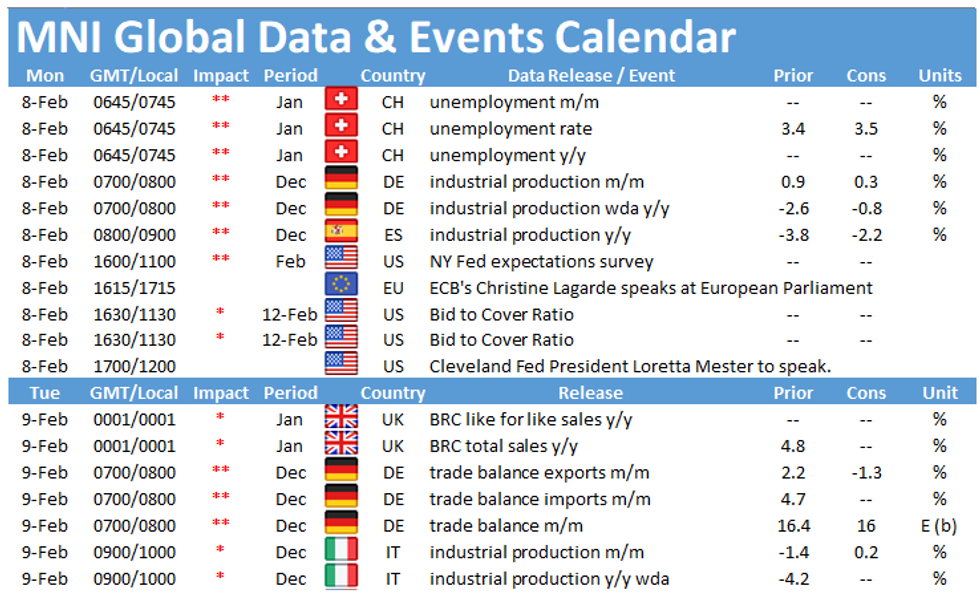

- German industrial output as well as comments from BoE Gov Bailey, Fed's Mester and ECB's Lagarde & Villeroy headline today's economic docket.

FOREX OPTIONS: Expiries for Jan08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E793mln), $1.2175-80(E897mln-EUR puts), $1.2240-60(E870mln-EUR puts), $1.2300(E922mln)

- USD/JPY: Y103.90($790mln-USD puts)

- EUR/GBP: Gbp0.8850-55(E610mln)

- USD/MXN: Mxn19.70($500mln-USD calls), Mxn19.90($515mln)USD/ZAR: Zar15.65($606mln-USD puts)

ASIA FX: Most Asia Currencies Gain, US Stimulus Plans Eyed

A mixed session for Asia FX, the greenback held most of its losses from Friday while positive comments surrounding US stimulus efforts helped engender a broad risk on tone. Volumes have been reduced as market participants prepare for the LNY holiday, with several market closures in the region.

- CNH: Offshore yuan is holding gains from Friday, USD/CNH last down 67 pips at 6.4526. Data over the weekend showed China's forex reserves declined in January after touching a four-year high the previous month. A spokesman for China's SAFE said the decline in reserves was due to a decrease in the value of non-USD currencies and asset price changes, as the dollar index strengthened.

- TWD: Taiwan dollar has weakened through the session, USD/TWD last at 27.992. Markets await trade balance data after market where exports are expected to post double digit growth for the fourth consecutive month. Thin volumes with no stock and bond trading until after LNY.

- KRW: Won has strengthened, posting the first gain in three days. South Korea announced the easing of social distancing rules over the weekend. Restaurants, coffee shops and gyms outside Seoul will now be allowed to stay open until 10pm. Daily coronavirus cases fell below 300 on Monday, marking the lowest number since last November, when a third wave of outbreaks began.

- INR: After dropping to the lowest level since March 2020 post-RBI on Friday INR rebounded and has posted gains in early trade on Monday, supported by gains in the Nifty and Sensex.

- IDR: Rupiah gained, Indonesia's FinMin said GDP was estimated at 4.5% -5.5%. Bloomberg reported that Indonesia will extend its Covid-19 curbs through Feb 22, focusing on specific areas.

- MYR: The ringgit is higher, data showed Malaysian industrial production rose 1.7% Y/Y in December against a 1% decline expected. Manufacturing sales rose 4.5%.

- PHP: Peso gained but failed to consolidate below 48.00. House Speaker Velasco said he had submitted a PHP 420bn pandemic relief bill.

- THB: Baht squeezed out some gains. The Thai gov't said in a statement that it won't procure Covid-19 vaccines through the WHO's Covax programme for now, because of the strict conditions associated with the scheme.

ASIA RATES: Broad Risk On Tone Pressures Most Bonds In The Region

The start of the week has been dominated by broader focus on the prospects of a sizeable fiscal support package in the U.S., with Treasury Secretary Yellen and President Biden continuing to push home the need for notable assistance for the economy. This has spurred risk sentiment and weighed on bonds worldwide.

- China: Bond futures were lower as equity markets posted decent gains. The cash space saw yields rise with some bear flattening evident. The PBOC injected CNY 10bn via OMOs, a still small injection by historical standards but the PBOC seem to be comfortable with liquidity in the system heading into LNY. The O/N repo rate did rise, amid speculation that liquidity could begin to dry up heading into LNY. The rate last 1.9047%, up just shy of 40bps, but way below highs of January.

- South Korea: Fixed income space in South Korea was under some pressure amid robust risk appetite in Asia. The uncertainty around additional issuance to finance an additional budget which features cash handouts also continues to weigh, this concern was evident at the 3-year auction. The yield offered a small yield concession but saw a smaller coverage ratio and less aggressive bids.

- India: India bonds gained to start the week and bucked the regional trend in doing so, recovering from the sharp sell off on Friday. The RBI announced it would increase bond purchases by INR 500bn, the bank also announced twist purchase operations to flatten the yield curve.

- Indonesia: Yields rose across the curve in Indonesia, the sell off exacerbated after deputy FinMin Nazara outlined increased spending plans to support the economy and said the economy is expected to expand between 4.5% and 5.5%. Sales were slowed as the government announced extension of pandemic containment measures until Feb 22.

EQUITIES: Positive Sentiment Spills Over From US

Asia-Pac equities are in positive territory to start the week, most major indices are in the green led by indices in Japan where the Nikkei 225 has gained over 2%.

- Markets took a positive lead from the US on Friday where the S&P 500 hit fresh record highs. Markets are also digesting comments from US Treasury Secretary Yellen who advocated for an accelerated stimulus package, saying the US could reach full employment next year if stimulus is passed. Also providing oil with tailwinds are expectations of stimulus from the US. The senate approved a fast track budget measure on Friday that could facilitate the passing of the stimulus package even without Republican support.

- Bourses in South Korea are the exception, currently trading with minor losses. South Korea's Hyundai Motor said on its talks with Apple over autonomous electric cars ended without a deal, just a month after it confirmed early-stage talks with the tech giant. Kia, an affiliate of Hyundai and the firm touted to actually carry out the work, also dropped.

- Futures in the US are higher, gaining around 0.5% at the time of writing.

GOLD: Holding Back Above $1,800/oz

A softer USD (as measured by the broader DXY) has supported bullion since the final Asia-Pac session of last week, even with longer dated U.S. real yields ticking higher, although the stabilisation/marginal uptick for the DXY during the early rounds of a new week of trade have kept a lid on bullion over the last few hours. Spot last deals little changed, just above $1,810/oz.

OIL: Rally Extends

The rally continues, crude futures are higher in Asia to kick off the week; WTI and Brent both added ~$0.60, with the latter having a brief foray above the $60.00 mark.

- Crude markets are supported by strong demand from China. The number of vessels sailing toward China hit a six-month high of 127 on Friday, equating to approximately 250m/bbls.

- Also providing oil with tailwinds are expectations of stimulus from the US. The senate approved a fast track budget measure on Friday that could facilitate the passing of the stimulus package even without Republican support. US Tsy Sec Yellen weighed in saying that US could reach full employment next year if stimulus is passed.

- Elsewhere Vitol, the world's largest independent oil trader, echoed sentiments of its rival Gunvor and said the market is getting ahead of itself.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.