-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Early Geopol Risk Roils, Focus Turns To Fed

MNI ASIA MARKETS ANALYSIS: South Korea Rescinds Martial Law

MNI EUROPEAN MARKETS ANALYSIS: Upside Risks To Inflation Forecast Likely Needed For Another RBA Hike

- The RBA left rates at 4.1% at its August meeting but retained its tightening bias, in line with our expectations. Its reasons for pausing for a second consecutive month were unchanged from July –significant uncertainty, already material tightening which is working, and it will “provide further time to assess the impact” of hikes to date. Importantly it appears that its forecasts are broadly unchanged from May, suggesting that there will need to be an increase in upside inflation risks from here for rates to rise further.

- RBA-dated OIS pricing shunts 9-11 softer across meetings after today’s policy decision to keep the cash rate at 4.1%. AUD/USD is down ~0.7% sitting just above session lows, last printing at $0.6665/70. The pair remains above support at $0.6619, low from Jul 7, and $0.6596 low from Jun 29 and key support.

- Elsewhere, the Caixin PMI miss in China, coupled with renewed property equity market weakness has curbed regional risk appetite to a degree. USD/CNH is back above 7.1700, while China sensitive commodities are lower. Broader USD sentiment has been positive, although the Japan authorities warned they were watching FX markets closely.

- Looking ahead, a slew of data from the US including JOLTS Job Openings and ISM Mfg provide the highlight on Tuesday.

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 111-14+, +0-01+, a range of 0-04+ has been observed on volume of ~57k.

- Cash tsys sit flat to 2bps richer across the major benchmarks, light bull steepening is apparent.

- Tsys have firmed to session highs in recent dealing, a rally in ACGB's lieu of the RBA maintaining the cash rate at 4.10% has spilled over into the wider space. Ranges do remain narrow and the move has had little follow through thus far.

- Earlier in the session tsys were muted, little meaningful macro news flow crossed and moves were limited.

- FOMC dated OIS remain stable, a terminal rate of ~5.40% is seen in November. There are ~55bps of cuts priced to June 2024.

- The docket is thin in Europe today. Further out we have a slew of US data including JOLTS Job openings and ISM Mfg Survey. Fedspeak from Chicago Fed President Goolsbee crosses.

JGBS: Futures Richer, At Session Highs, Despite A Relatively Poor 10Y Auction

JGB futures are sitting at session highs, +23 compared to settlement levels, after initially cheapening in early afternoon trade on the back of a relatively poor showing for 10-year supply. The low price failed to meet wider expectations, the cover ratio declined to the lowest level observed at a 10-year auction since May and the tail increased to its longest also since May.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined unemployment rate that undershot expectations.

- Cash JGBs are mixed across the curve with yields +1.8bp (30-year) to -2.4bp (7-year). The benchmark 10-year yield is 1.4bp lower at 0.598%, above the BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- ICYMI, after yesterday’s unscheduled Y300bn purchase of 5- to 10-year JGBs at market, the BoJ only announced today the intention to buy an unlimited amount of 5- to 10-Year JGBs at a fixed rate of 1.0%.

- Swap rates are trading mixed with swap spreads wider.

- Tomorrow the local calendar sees the release of BoJ Minutes for the June meeting and Monetary Base data for July along with BoJ Rinban operations covering 1- to 25-Year+ JGBs.

RBA: Rates On Hold, Upside Risks To Inflation Forecast Likely Needed For A Hike

The RBA left rates at 4.1% at its August meeting but retained its tightening bias, in line with our expectations. Its reasons for pausing for a second consecutive month were unchanged from July –significant uncertainty, already material tightening which is working and it will “provide further time to assess the impact” of hikes to date. Importantly it appears that its forecasts are broadly unchanged from May, suggesting that there will need to be an increase in upside inflation risks from here for rates to rise further. The details will be published on Friday including Q4 2025.

- While “some further tightening of monetary policy may be required” it will now depend upon the “data and the evolving assessment of risks”, thus RBA decisions have become even more data dependent (with key areas unchanged) and contingent on risks to its forecasts.

- Inflation is projected to continue moderating reaching around 3.75% by end 2024 and the 2-3% target by late 2025. The phrase that inflation would remain high for “some time yet” was removed from the meeting statement and the warnings regarding the damage it can do was moved down.

- Below-trend growth is “expected to continue for a while”. The Board was more definite on the weakness in consumption and added dwelling investment. It expects GDP growth to be around 1.75% “over 2024” and “a little above” 2% over 2025.

- The assessment of the labour market was marginally stronger with it remaining “very tight” and the easing now only being “a little”. The end 2024 4.5% unemployment rate forecast is unchanged but end-2023 may still be revised down given recent data.

- Inflation remains “too high”, services prices a risk, productivity needs to improve for wages to stay consistent with target, returning inflation to target remains a “priority”, house prices are rising and there are still significant uncertainties.

- See statement here.

STIR: RBA Dated OIS Pricing Shunts Softer After RBA Decision

RBA-dated OIS pricing shunts 9-11 softer across meetings after today’s policy decision to keep the cash rate at 4.1%.

- The market had attached a 35% chance of a 25bp hike at today’s meeting.

Figure 1: RBA-Dated OIS – Post-RBA Vs. Pre-RBA

Source: Bloomberg / MNI - Market News

AUSSIE BONDS: Richer After RBA Keeps Cash Rate Unchanged

ACGBs (YM +8.0 & XM +8.0) sit at session highs after the RBA leaves the cash rate unchanged at 4.1% for the second consecutive month. ACGB futures are 6-8bp higher after the announcement.

- In brief, the Decision statement noted that inflation remains high at 6%, with services prices rising while goods inflation eased. The Board's priority is to return inflation to the 2-3% target range. Despite uncertainties, recent data indicate inflation may return to target, but household consumption faces ongoing challenges. Further tightening of monetary policy may be needed, depending on data and risk assessment. The Board will closely monitor global developments, household spending, inflation, and the labour market to achieve its inflation target.

- Cash ACGBs are 5-7bp richer after the decision with the 3/10 curve steeper and the AU-US 10-year yield differential -5bp at +2bp.

- Swap rates are 5-8bp lower after the data with the 3s10s curve also steeper.

- The bills strip has bull flattened with pricing +6 to +13.

- RBA-dated OIS pricing is 10-12bp softer for meetings beyond August after the decision with mid’24 leading. The market had attached a 35% chance of a 25bp hike at today's meeting.

- Tomorrow the local calendar sees no data.

- Tomorrow also sees the AOFM sell A$700mn of 3.75% 21 May 2034.

AUSTRALIAN DATA: Home Lending Recovering, Refis Remain Elevated

Housing finance ex refis was weaker than expected in June falling 1% m/m after rising 5.4%, thus suggesting that the June decline was payback for the very strong May outcome. 3-month momentum strengthened and total loans improved to -18.2% y/y from -20.5%. Despite being down on a year ago, home loans are still robust up 28.1% compared to before the pandemic. The strength has been driven by lending to investors which stands 48.2% above February 2020 levels.

- The large amount of loans due to be refinanced at higher rates this year continues to be a key risk. In June refis were down 3.1% m/m but remained elevated and close to record highs at $20.2bn and up 12.6% y/y, according to the ABS.

- Owner-occupier loans ex refis fell 2.9% m/m but this followed an upwardly revised 5.1% in May. It now stands down 19.9% y/y up from -20.2%. Value of first time home buyer loans rose for the second consecutive month and is now down 8.1% y/y up from -15.1%, but it is still down 12.8% compared with pre-Covid as housing affordability deteriorates.

- Lending to investors ex refis rose 2.6% m/m after 5.9% in May and 3-month momentum rose to 31% saar. It is now down 15% y/y after -21.1%.

- Personal finance fell 6.8% m/m driven by a sharp drop in personal investment and a 2.7% decrease for vehicles but lending for travel rose 6.5%.

Source: MNI - Market News/ABS

NZGBS: Closed On A Soft Note, Cheaper Ahead Of Q2 Employment & Wages Data Tomorrow

NZGBs closed on a low soft note with yields 3bp cheaper across benchmarks ahead of tomorrow’s Q2 employment and wages release.

- Swap rates closed 2-5bp higher with the 2s10s curve steeper and long-end implied swap spreads wider.

- RBNZ dated OIS closed with pricing little changed. Terminal OCR expectations sit at 5.68%.

- Home-building approvals rose 3.5% m/m in June versus a revised -2.3% in May, according to Statistics NZ.

- Tomorrow, the local calendar will feature Q2 employment and Wage data. Indicators point to a promising 0.6% increase in employment during the June quarter, attributed to a surge in migrant arrivals that has enabled employers to fill long-standing vacancies. However, due to the influx of migrants boosting the labor force, the unemployment rate is predicted to slightly rise to 3.5%. This continues a gradual upward trend from last year's historically low rate. Private Wages Including Overtime are expected to print 1.2% q/q versus +0.9% previously. CoreLogic house prices are also due tomorrow.

- As the local market has already closed prior to the RBA policy decision, tomorrow's opening is anticipated to be influenced not only by the overnight movements in global bonds but also by the Australian market's reaction to the announcement.

FOREX: AUD Pressured As RBA Leaves Cash Rate On Hold

The AUD is the weakest performer in the G-10 space at the margins after the RBA left the cash rate on hold at 4.10%.

- AUD/USD is down ~0.8% sitting at session lows, last printing at $0.6660/65. The pair remains above support at $0.6619, low from Jul 7, and $0.6596 low from Jun 29 and key support.

- Kiwi marginally extended session lows after weakness in AUD spilled over. NZD/USD has been pressured through the session, extending losses after weaker than forecast Caixin Mfg PMI print from China.

- USD/JPY has firmed ~0.3%, the pair is through yesterday's highs. Resistance comes in at ¥142.98, top of bull channel drawn from Jan 16 low.

- Elsewhere in G-10, GBP and EUR are down ~0.1%.

- Cross asset wise; BBDXY is up ~0.2% and US Tsy Yields are a touch lower. E-minis are marginally firmer however ranges have been narrow in Asia.

- A slew of data from the US including JOLTS Job Openings and ISM Mfg provide the highlight on Tuesday.

EQUITIES: Weaker China Property Shares & Caixin PMI Miss Weigh On Broader Regional Rally

The early positive regional equity tone has given way to more caution as the Tuesday Asia Pac session has progressed. Hong Kong equities have given up strong earlier gains and now sit back around flat at the break. US equity futures are in positive territory, but down from session highs. Eminis were last around 4617.5, earlier highs printed near 4622. Nasdaq futures have followed a similar trajectory.

- The HSI was +1% higher at one stage, aided by a +2% gain in the tech sub index. Weaker sentiment in the property sector has weighed though, this sub index is down 0.82%, tracking lower for the second straight session. Financing concerns at developer Country Garden have weighed, while Bloomberg noted that China's home sales dropped the most in a year in July.

- The CSI 300 has also given up earlier gains, to sit slightly weaker at the break. The Shanghai Composite is up slightly. Outside of the above headwinds we did see the Caixin Manufacturing PMI print weaker than expected. Still, July was the strongest month for Stock Connect inflows in 6 months, with Hong Kong investors buying just over $6.50bn of mainland shares.

- South Korean shares are higher, albeit away from best levels. The Kospi +1% higher, amid mixed data but a positive lead from major indices in US Monday trade. The Taiex is slightly higher, +0.20%, while Japan shares are +0.50% for the Topix.

- in SEA trends are mixed, with Indonesian and Malaysia shares lower. The Philippines is firmer through by +0.50%. The BSP expects lower inflation pressures in July (data due this Friday) and yesterday saw very large offshore inflows (+$270mn).

OIL: Crude Holding Onto Its Gains, But Possibly Overbought

Oil prices have held onto most of Monday’s gains and are down only around 0.2% but are off their session lows. WTI is at $81.62, off the low of $81.46. Brent is also lower at $85.22, following a low of $85.05. WTI found support at $81.50 and Brent at $85. The USD index is 0.2% higher.

- Bloomberg is reporting that WTI’s 14-day relative strength index may be pointing to the market being overbought again. Also, ETFs saw their largest outflows last week for over a year.

- The OPEC+ Joint Ministerial Monitoring Committee is going to hold a virtual meeting on Friday to assess the impact output cuts are having so far.

- US API crude and product inventory numbers are released later and given low stock levels and signs the market is tightening, this data is likely to be monitored closely. The official EIA data is published Wednesday.

- Later the Fed’s Goolsbee gives welcoming remarks and US manufacturing PMI/ISM for July, June construction spending and JOLTS job openings all print. There are also European manufacturing PMIs and euro area June unemployment.

GOLD: Best Month Since March

Gold is -0.2% in the Asia-Pac session, after closing +0.3% at $1965.09 on Monday. Bullion showed a resilient performance despite coming off earlier highs, considering a net push higher in the USD index and unchanged US Treasury yields.

- According to MNI’s technicals team, resistance remains at the bull trigger of $1987.5 (Jul 20 high).

- However, gold had an impressive performance in July, marking its best month since March. This was largely influenced by the cooling of US inflation, which raised optimism that interest rates might have reached their peak. Despite this positive trend, the precious metal mostly traded within a narrow range during the second half of July, stabilising around its current levels. This stability came after a surge earlier in the month, driven by weaker-than-expected inflation data.

- Bloomberg reports that investors have yet to bite on gold’s rally, with exchange-traded funds shedding 30 tons of the metal over the course of July. Hedge funds trading on the Commodity Exchange Inc also reduced their net bullish position last week, according to data from the Commodity Futures Trading Commission.

BOT: MNI Bank Of Thailand Preview - August 2023: Hiking Towards Expected Inflation Rate

- The Bank of Thailand (BoT) is likely to hike rates 25bp to 2.25% given the inflation risks that BoT still sees as present, despite headline inflation being only 0.2% and core at 1.3% is within the target band. It is the outlook for inflation that matters to BoT and it sees the current very low rates as temporary. . A speech by Governor Sethaput in July made clear that gradual policy normalisation will continue given the outlook.

- Given the focus is on the outlook rather than actual data outcomes, which he says have a lot of noise in them currently, then any changes to BoT’s forecast are likely to be the focus and important to the monetary policy outlook beyond August.

- If the inflation forecast for 2023 remains unchanged at 2.5%, then rates could rise again on September 27 to bring them in line with expected inflation and make real rates slightly positive in 2024.

- See full preview here.

ASIA: South Korea & Taiwan PMIs Present Mixed Backdrops, Global Trade Growth May Have Troughed

The South Korea and Taiwan PMIs presented contrasting pictures for July. The South Korea headline reading rose to 49.4 from 47.8 prior. This is the highest reading since July 2022, albeit while remaining in the contraction zone. The output index rose to 47.2 from 46.5 in June. New orders were also up in the month. It also comes after July trade figures released earlier showed export growth stepping down in July.

- In contrast, the Taiwan PMI eased back to 44.1 from 44.8 in June. We remain above the late 2022 lows for the series, but this is still the weakest print since November last year.

- Output fell to 39.9 versus 42.7 in June, while new orders also weakened.

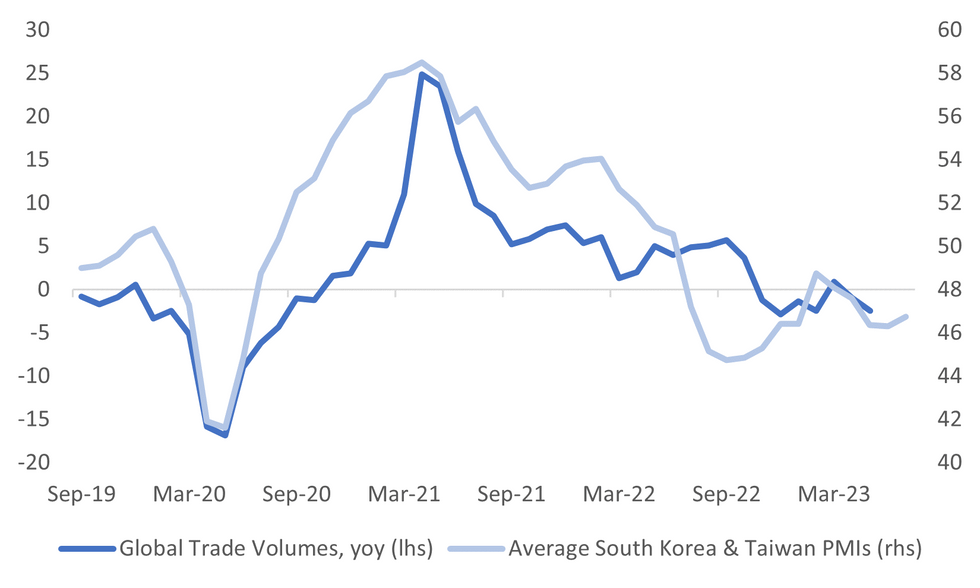

- The average headline South Korea and Taiwan PMIs have a reasonably relationship with global trade volumes, see the chart below. At this stage, the average reading is suggesting that global trade growth may well have troughed, but any upswing is unlikely to be dramatic in the near term.

Fig 1: South Korea & Taiwan PMI Average Versus Global Trade Growth

Source: MNI - Market News/Bloomberg

SOUTH KOREA: Export Growth Back To Recent Lows, Trade Surplus Narrower Than Expected

South Korean July trade figures were slightly weaker than expected. Export growth came in at -16.5%, versus -15.0% projected. This was also a down step from last month's -6% outcome. On the import side we were -25.4% y/y, versus -25.0% forecast and -11.7% prior. This left the trade surplus at $1630mn, versus a $2600mn forecast.

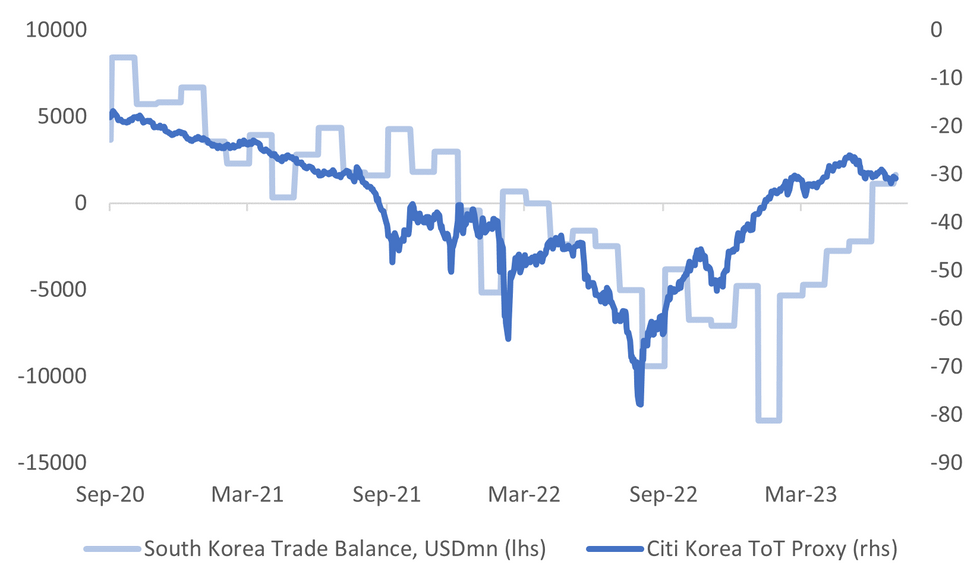

- Further meaningful improvement in the trade position may be difficult to come by. The Citi terms of trade proxy for South Korea hasn't improved further in recent months, which is in line with global energy prices finding a base over this period.

- The first chart below overlays South Korea's trade position against this ToT proxy. Energy imports are down nearly 50% in y/y terms, but if we see further stability/modest upside in global energy prices, this slump is unlikely to continue.

Fig 1: South Korea's Trade Position Versus Citi's South Korea ToT Proxy

Source: Citi/MNI - Market News/Bloomberg

- On the export side, semiconductor shipments remained deeply negative in y/y terms down -34%. Oil related export products also fell sharply, down -42% y/y. Exports to China remained negative.

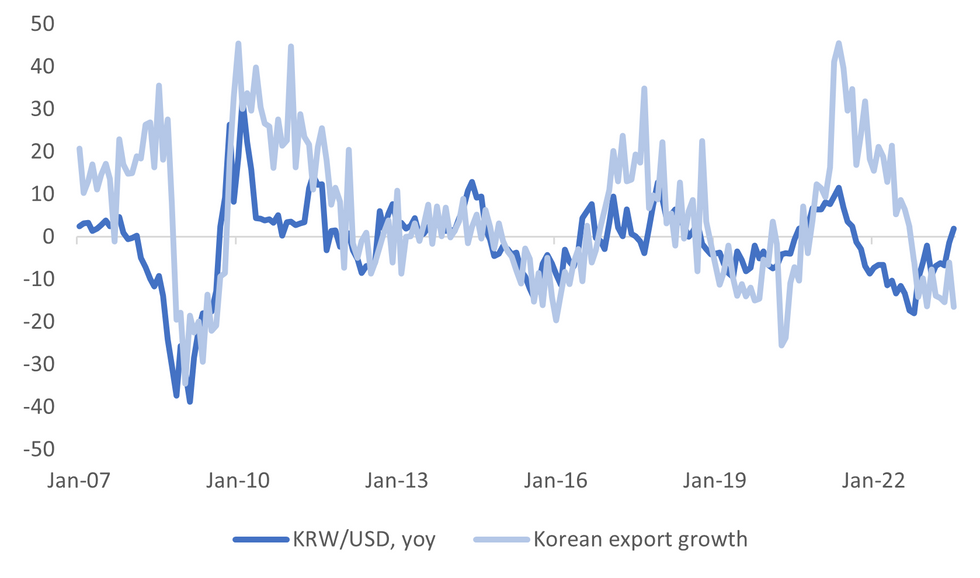

- The won is back into positive territory versus the USD in y/y terms, which is a stronger read than implied by still weak export growth, see the chart below.

Fig 2: KRW/USD Y/Y Versus South Korean Export Growth

Source: MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher, PHP Outperforms

USD/Asia pairs are higher, with a firmer dollar against the majors spilling over. Higher USD/JPY levels have likely biased the USD higher against NEA FX as well. PHP strength was the clear standout in bucking these trends. The Caixin PMI was weaker than expected but didn't have an immediate impact. PMI trends were mixed elsewhere, while South Korean export growth fell. Tomorrow, we get South Korean inflation, the BoT decision (+25bps expected), along with Singapore PMIs.

- USD/CNH spot has maintained a positive bias for much of today's session. We currently sit close to session highs, the pair last near 7.1730. Broader USD gains have weighed on CNH, particularly renewed yen weakness. The Caixin PMI was also notably softer than expected, although the initial market reaction was limited. Local equities are losing ground amid fresh headwinds for the property sub indices. The HSI and mainland indices have given up positive starts to track lower in latest dealings.

- 1 month USD/KRW today has met some resistance around the 1280 level, but we are still around 0.20% weaker in won terms versus NY closing levels on Monday (last near 1279). The 20-day EMA is very close to 1280, so this may be providing some resistance. A break above this level could see a move towards highs on July 21 (~1288.40) targeted. Won weakness is very much in line with softer CNH and JPY levels against the USD. USD/CNH is tracking above 7.1700, while USD/JPY is above 142.70, although this is below earlier highs. Earlier on the data front, we had slightly weaker than expected July export growth and a lower than forecast trade surplus. Some offset was provided by the rise in the manufacturing PMI though. This improvement was driven by export orders rising above the 50.0 point for the first time in 16 months.

- USD/PHP has backed away from late July highs. Spot sits in the 54.70/75 region currently, +0.30% firmer in PHP terms so far today. This is impressive given broadly stronger USD trends elsewhere. Recent highs in spot USD/PHP come in around the 54.90 region, which is also close to the 20-day EMA. Mid July lows in the pair were back near 54.30. One factor potentially boosting the PHP today is carry over from yesterday's chunky +$270.1mn net equity inflow. This was the largest daily inflow going back to late 2021.• Local equities are higher today, the PCOMP +0.50% and tracking higher for the first time in 4 sessions. Late yesterday the BSP stated July inflation likely eased further to between 4.1% to 4.9% (from the June pace of 5.4%). Note this data prints on August 4, this Friday (market consensus is +4.9% y/y).

- USD/IDR continues to track higher, the pair near 15120 currently., right on session highs. This is line with broader USD gains elsewhere in the region and in terms of the majors. Still, the currency was the second worst performer in July (TWD the worst). The pair is now back to mid-July levels. Highs last month were just above 15200. We are above all key EMAs (the nearest being the 200-day at 15042) but the simple 200-day MA sits higher at 15222. July CPI was close to expectations, headline y/y printing at 3.08%, while core eased to 2.43% (forecast 2.52% and 2.58% prior). The continued move lower in headline and core inflation pressures is unlikely to drive a near term easier BI policy backdrop. The central bank is mindful of IDR weakness, particularly with uncertainty hanging over the Fed outlook. It continues to look to manage FX through its policy of keeping export earnings onshore, with the new strategy kicking off today.

- The Rupee is marginally pressured in early dealing on Tuesday as broader greenback trends dominate flows, USD/INR is up ~0.1% consolidating gains above the 82 handle. In July USD/INR observed a narrow ~1.3% range with moves limited for the most part. The pair found support below 81.60, supply was seen above 82.50. India's fiscal deficit widened in June, to INR241,803 Crore from INR76,690 Crore in May. June's Eight Infrastructure Industries grew at 8.2% Y/Y in June, the prior was revised higher to 5.0%.

- The Ringgit had its largest monthly gain since November 2022, USD/MYR fell ~3.4% in July as the Ringgit marginally extended its post US CPI gains late in the month. Today broader USD trends are dominating flows as the greenback is firmer after a weaker than forecast China Caixin Mfg PMI print. USD/MYR is ~0.1%, last printing at 4.5100/40. S&P Global Mfg PMI ticked higher in July, the measure printed at 47.8 rising from 47.7 prior. Despite the uptick this is the twelve consecutive month of contraction. Looking ahead the domestic data docket is empty for the remainder of the week.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing, the measure is holding near cycle highs and sits ~0.3% below the top of the band. USD/SGD is firmer in early dealing as broader USD trends dominate flows. Gains have been capped by the 20-Day EMA in recent dealing, the pair last prints at $1.3310/20. The domestic docket is empty today, tomorrow the July Purchasing Managers Index and the Electronics Sector Index cross. There is no estimate for either print.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/08/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/08/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 01/08/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/08/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/08/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/08/2023 | 1400/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/08/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/08/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.