-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: South Korea Deals With Martial Law Fallout

MNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI EUROPEAN MARKETS ANALYSIS: US Yields Rise Modestly, USD Supported On Dips

- US yields opened higher, recouping a modest proportion or Friday's losses, and we have held these gains for the session. The USD index initially broke down through Friday's lows, but dips were supported, albeit with overall moves quite modest.

- There was a number of data releases today, with the main focus in Japan and Australia. Q4 Japan Capex surged, suggesting upward revisions to Q4 GDP, but JPY and JGB sentiment was unmoved. Likewise in terms of Australian data, which suggests some downside risks for Wednesday's Q4 GDP report.

- Regional equity sentiment has mostly been higher, but HK and China markets have struggled for positive traction. China's NPC will be in focus this week.

- Later the Fed’s Harker speaks but there is no data of note.

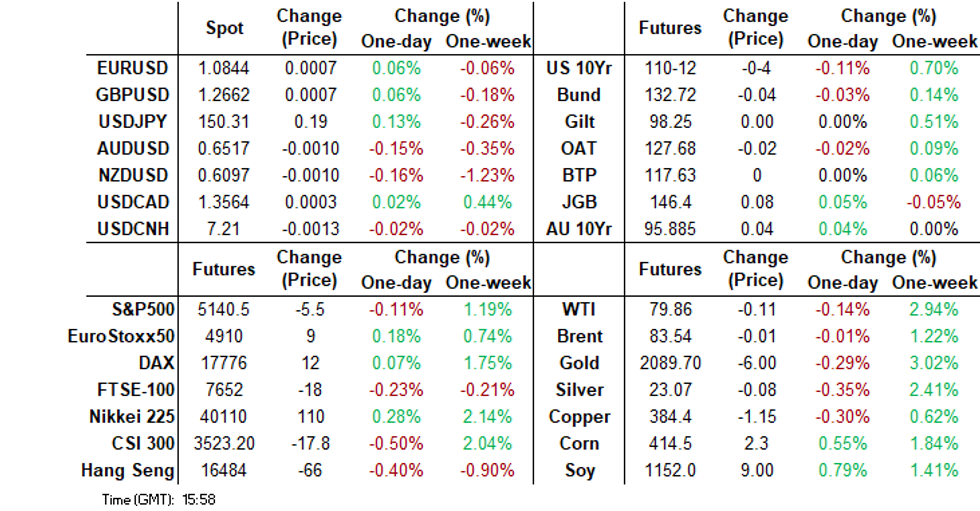

MARKETS

US TSYS: Treasury Futures Off Fridays Highs, Yields 1-2bps Higher

- Jun'24 10Y futures are just off Friday highs trading at 110-29+ down - 03+ from NY closing levels, earlier we made lows of 110-28+ holding above support at 110-26+ (20-day EMA). Initial resistance hold at 111-06 (50-day EMA)

- Treasury yields are giving back some of the moves made on Friday, with yields 1-2bps higher across the curves, the 2Y yield 1.7bps higher to 4.548%, the 10y 1.6bps higher to 4.195%, while the 2y10y -0.304 at -35.456.

- VP Harris is to meet with Israeli War Cabinet Member Gantz at 3pm ET.

- Looking ahead: data resumes Tuesday with S&P Global US Services PMI, ISM Services, Factory and Durable Goods Orders.

JGBS: Futures Stronger, Mid-Range, Tokyo CPI Tomorrow

JGB futures are currently maintaining a mid-range position and are in positive territory, up by 11 points compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Q4 capital spending and company profits data.

- Cash US tsys are 1-2bps cheaper in today's Asia-Pac session. Newsflow has been light so far.

- The cash JGB curve has twist-steepened, pivoting at the 10s, with yields 1.2bps lower (2-year) to 1.0bp higher (20-year). The benchmark 10-year yield is unchanged at 0.717% versus the Nov-Dec rally low of 0.555%.

- Swaps are richer, with rates flat to 2bps lower. Swap spreads are generally tighter.

- (Bloomberg) -- Japan’s government bonds have cheapened relative to swaps amid expectations that an end of the negative-interest-rate policy in the nation is now just a matter of time, Koichi Sugisaki, executive director at Morgan Stanley MUFG Securities in Tokyo, writes in a note. (See link)

- Tomorrow, the local calendar sees Tokyo CPI and Jibun Bank PMI Composite & Services data, along with 10-year supply. BoJ Governor Ueda is also due to give a speech at FIN/SUM 2024.

JAPAN DATA: Y/Y Capex Surges Back To 2006 Levels

Japan Q4 capital spending was stronger than expected. We were up 16.4% y/y for headline spending, versus 2.8% forecast and 3.4% prior. This is the stronger y/y rise since the end of 2006. Excluding software capex also beat expectations (up 11.7%y/y versus 1.5% forecast). This term rose 8.0% q/q, while total capital spending was 10.4% in q/q terms.

- At face value this should help alleviate some of the concerns around second half growth momentum in Japan. Recall the economy was in a technical recession, based off the two consecutive quarters of negative GDP growth, for this period.

- Other data showed company profits at 13.0% y/y, versus 21.3% forecast and 20.1% prior. Company sales were close to expectations at 4.2%y/y (4.5% forecast and 5.0% prior).

- Capex across the manufacturing and non-manufacturing sectors was firm. Up 11.7%q/q for manufacturing and 9.6% q/q for non-manufacturing.

AUSSIE BONDS: Richer, Narrow Ranges, Q4 GDP On Wednesday

ACGBs (YM +3.0 & XM +4.5) sit slightly stronger after dealing with narrow ranges. Today’s local data drop (the Melbourne Institute Inflation Gauge, Q4 Company Profits and Inventories and January Building Approvals) failed to be market-moving.

- (AFR) New house approvals have fallen to their lowest level in nearly 12 years as higher borrowing and building costs put buyers, particularly in NSW and Victoria off committing to new homes, the latest official figures show. (See link)

- Cash US tsys are 1-2bps cheaper in today's Asia-Pac session. Newsflow has been light so far.

- Cash ACGBs are 4bps richer, with the AU-US 10-year yield differential 1bp higher at -10bps.

- Swap rates are 3-4bps lower, with EFPs wider.

- The bills strip has bull-flattened, with pricing flat to +4.

- RBA-dated OIS pricing is flat to 3bps softer across meeting out to Dec-24. A cumulative 39bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Judo Bank PMI Composite & Services, Q4 Net Exports of GDP and BoP Current Account Balance. Q4 GDP is due on Wednesday.

AUSTRALIAN DATA: Stock Drawdown Skews GDP Risks To Downside, More Data Tuesday

Q4 business indicators surprised with profits rising more than expected but inventories lower than forecast. Stocks fell 1.7% q/q after a 1.2% rise in Q3, which is likely to mean that they were a drag on Q4 GDP, which is released on March 6. Bloomberg consensus expected no change in inventories and so the surprise to the downside means that risks to the 0.3% q/q forecast rise are skewed to the downside at the moment. But the net export contribution and government spending data are released tomorrow.

- The drop in inventories was predominantly driven by the mining sector (-5.5% q/q) but retail, wholesale and manufacturing all saw stock drawdowns too.

Source: MNI - Market News/ABS

- Profits rose 7.4% q/q but are still down 5.4% y/y in Q4 after declining the previous two quarters. The pickup was driven by the mining sector which saw profits rise 17.3% q/q.

- The growth in wage costs eased which also supported profits in Q4. Total wages rose 0.9% q/q to be up 8% y/y, the lowest quarterly rise since Q3 2021, after +3% and 9.8% in Q3 respectively boosted by the increase in minimum and award wages. The slowdown in Q4 is likely to reflect lower growth in hours worked.

Source: MNI - Market News/ABS

AUSTRALIAN DATA: MI Inflation Gauge Lowest In Almost Two Years

The Melbourne Institute inflation gauge for February fell 0.1% m/m and the annual rate eased substantially to 4.0% from 4.6% in January, the lowest since April 2022. The trimmed mean measure rose 0.1% m/m to also be 4% y/y down from 4.6%. The 3-month average rates were in line with the average of the last two months. While, the series is running above the monthly CPI, which is not unusual, it is signalling that the moderation in inflation is likely to continue. January CPI was steady at 3.4% y/y and the February data will be released on March 27.

Australia MI inflation gauge vs CPI y/y%

Source: MNI - Market News/Refinitiv

NZGBS: Closed Richer & At Best Levels

NZGBs concluded the session 2-4bps richer, reaching their peak levels for the day, accompanied by a steeper 2/10 curve. This movement marks a cumulative decline in benchmark yields of 15-25bps since the RBNZ decision last Wednesday. Additionally, the 2/10 curve has steepened by 10bps.

- With today’s domestic data calendar relatively light, local participants have been content to extend strength sparked by Friday’s post-ISM rally in US tsys. This came despite US tsys dealing 1-2bps heavier in today’s Asia-Pac session. News flow has been light.

- Today the NZ Government announced that it plans to spend NZ$20bn over three years on transport, including 15 new roads of national significance. It will raise the vehicle licensing fee in 2025 and 2026.

- Swap rates closed flat to 3bps lower, with the 2s10s curve and the swap box flatter.

- RBNZ dated OIS pricing is little changed. A cumulative 52bps of easing is priced by year-end.

- Tomorrow, the local calendar sees NZ Government's 7-Month Financial Statements and ANZ Commodity Prices.

FOREX: USD Recoups Early Losses, But Recent Ranges Hold

G10 FX trading has started the week in a fairly muted fashion. The BBDXY sits a touch below end Friday levels, last near 1241.85. We sit above earlier lows near 1240.8).

- In the cross asset space, US equity futures sit mixed, after posting strong cash gains in Friday trade. US yields opened higher and have generally held gains as the session has progressed. The front end has led, up nearly 2bps, but this is unwinding only a small part of Friday's fall.

- USD/JPY was weaker in the first part of trade, but dips sub 150.00 were supported. We were last near 150.25/30, which is at session highs. We had much stronger than expected Q4 capex data earlier, which should lead to positive GDP revisions for the quarter, but this didn't shift yen sentiment.

- AUD and NZD also sit lower, unable to hold earlier gains. AUD/USD was last near 0.6520. Earlier data was on balance weaker than expected, with potential downside risks for Q4's GDP print (due Wed) after an inventory drag. Iron ore prices unable to find upside traction has likely been another headwind. Still, we sit comfortably above pre US data levels from Friday around 0.6490.

- NZD/USD has tracked a similar range, last near 0.6095, off nearly 0.20% for the session. AUD/NZD touched initial resistance of 1.0700, but has been unable to break back above yet, a break here could open a further move to 1.0740 (Feb 7 highs). In the options space, US$420.5m Puts with a Strike of 1.0700 expire at the NY cut today.

- Later the Fed’s Harker speaks but there is no data of note.

ASIA STOCKS: HK & China Equities Recoup Earlier Losses, Property Underperforms

Hong Kong and China equities have opened mostly lower to start the week, although we are off lows from earlier in the day. The market is eagerly awaiting the National Peoples Congress on Tuesday to hear about further policies that could stimulate the markets. Recent policies have been seen to be supportive but there are still worries about whether or not this has just short-term fixes, as the property market still continues to struggle.

- Hong Kong Equity markets are mostly off lows from earlier today, with the HSI down 0.20% after being down 0.70%, while HSTech turned positive earlier however trades down 0.25% at the moment, while the Mainland Property Index is the worst performer down 2.80% and down 8.22% over the past week. China Mainland Equities are performing better with equities now mostly higher, the CSI 300 is up 0.10% while the CSI1000 is flat, the ChiNext is out-performing the wider market up 0.65 for the day.

- China Northbound flows were -5.333b yuan on Friday, with the 5-day average now 4.70b, while the 20-day is at 3.08b yuan.

- The Hong Kong Budget released last week was seen to be underwhelming for the most part other than for the property market after the government removed all property curbs, and over the weekend the 10 major residential estates booked 27 sales, 3.5 times the previous weekend and the highest sales number in more than a year

- Earlier, China Feb. Vehicle Inventory Alert Rises to 64.1 vs 59.9 prior.

- Looking ahead, Tuesday Premier Li Qiang will deliver the Government Work Report at the Nationals People Congress, while Caixin China PMI data is due out.

ASIA PAC EQUITIES: Asian Equities Mostly Higher, Japan's Nikkei 225 Breaks 40,000

Regional Asian Equities are mostly higher today, following on from the US on Friday. Tech names are the top performing sector in the region, Japan's Nikkei 225 break 40,000 for the first time while South Korea is back from their break on Friday.

- Japan equities continue to push higher after recently breaking all-time highs, markets are largely following the US markets move as there has been little in the way on local market headlines. The Nikkei 225 is now trading at 40,100 up 0.48% and importantly above psychological level of 40,000 level for the first time, while the TOPIX has lagged the move higher and still sits about 6% below it's all-time highs at 2,707 down 0.05%. Earlier Japan had Capital Spending data coming in at 16.4% vs 2.8% expected, while Monetary Base was 2.4% vs 4.8% prior

- South Korean equities are back from their break on Friday and are pushing higher, with the KOSPI up 1.35%. Electrical and electronic equipment stocks led the market higher after Dell surged 32% on Friday after better-than-expected results, fuelled by demand for information technology equipment. Foreign equity inflows are also picking back up, with $355m of inflows today. Earlier SK had industrial production data out coming in at 12.9% vs 10% expected, while S&P Global SK PMI was 50.7 vs 51.2 prior.

- Taiwan Equities are benefitting for higher semiconductor equity prices, after the Philadelphia Stock Exchange Semiconductor Index closed up 4.29% on Friday. the Taiex is currently up 1.93%, looking forward Taiwan has CPI on Thursday.

- Australian equities were up 0.30% during the morning session, however Building approval data at -1.0% vs 4.0% expected pushed the market lower with Mining and Health Care sectors offsetting gains in the Financial and Real Estate sectors. While earlier Melbourne Institute Inflation was out showing inflation had eased substantially to 4.00% vs 4.6% in January the lowest since April 2022. The ASX 200 finished down 0.13%.

- Elsewhere in SEA equities are mixed, with NZ closing down 0.17%, Indonesian equities down 0.16%, Singapore down 0.35% while Malaysian equities up 0.37% and Philippines equities up 1.18% are the top performers.

ASIA EQUITY FLOWS: Foreign Equity Flow Momentum Slows As Markets Hit New Highs

- China equities saw a sharp reversal of flows via northbound connect on Friday as -5.3b yuan left the market, while BofA has reported that China equity funds saw the largest weekly outflow since October. China data has been mixed recently with an unfolding property crisis and stubborn deflation, while factory activity fell for the fifth straight month in February, focus will be on Tuesday's Policy meeting.

- South Korean equity markets were closed on Friday

- Taiwan equities have been dominated by global moves in semiconductor prices, flows have remained positive but have been slowing. 5-day average sits at $197m vs the 20-day at $242m

- Indonesian equities have been trading sideways since mid Feb, while foreign equity flows are quickly turning negative, 6 of the past 7 days have seen outflows with the 5-day average now at -$38m vs 20-day average at +$35m. Indonesia inflation is picking up again largely driven by high rice prices, and with Ramadan coming up inflation is expected to accelerate further.

- Thailand equities saw their largest outflow in a month on Thursday and outflows continued Friday with another $23.2m leaving the market. Equity markets are trading just above technical resistance at the moment at 1,367 vs resistance and multi-year lows of 1,352.

- India equities markets saw their largest inflow for a month on Thursday with $507m. ICICI Securities have reported that foreign ownership of Indian equities is likely the lowest in a decade. The while the 5-day average of $148m sits well above the 20-day average of $24m and comfortably above the 100-day average at $90m, implying that the trend may be changing.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -5.3 | 23.5 | 40.9 |

| South Korea (USDmn) *** | 0 | 756 | 8373 |

| Taiwan (USDmn) | 266 | 987 | 5071 |

| India (USDmn)** | 507 | 743 | -2657 |

| Indonesia (USDmn) | -25 | -193 | 1155 |

| Thailand (USDmn) | -23 | -242 | -811 |

| Malaysia (USDmn) ** | -34 | -28 | 422 |

| Philippines (USDmn) | 12 | 22.4 | 220 |

| Total (Ex China USDmn) | 702 | 2047 | 11773 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Feb 29 | |||

| *** Public Holiday |

OIL: Crude Steady As Waits For China & Gaza Outcomes

Oil prices have held onto Friday’s gains during APAC trading with little reaction to the widely expected extension of OPEC output cuts to the end of June. WTI has been oscillating around the $80 mark and is currently at $79.94 after a high of $80.37. Brent is 0.1% higher at $83.64/bbl after rising to $83.97. The USD index is down only moderately.

- OPEC will extend its 2mbd reductions to the end of June with Russia focusing on cutting production rather than exports. The action is aimed at supporting prices and avoiding excess supply. Higher prices are also needed by many producers to shore up government finances.

- Negotiations continue for a Gaza ceasefire deal before the start of Ramadan next week but the Israelis didn’t send a delegation to yesterday’s talks after Hamas would not name the remaining hostages. The stall in progress towards a truce is providing support to oil prices.

- China’s National People’s Congress is to close on March 11 and the 2024 growth target is to be announced plus any economic policies. Crude sell offs are often driven by market concerns re demand from China, the world’s largest importer.

- Later the Fed’s Harker speaks but there is no data of note.

GOLD: Surges Friday After Weaker Than Expected ISM Data

Gold is little changed in the Asia-Pac session, after closing 1.9% higher at $2082.92 on Friday.

- According to MNI’s technicals team, gold surged beyond a key resistance at $2065.5 (Feb 1 high) and stopped marginally short of $2088.5 (Dec 28 high).

- The move in bullion was driven by lower Treasury yields and a softer USD index following the release of weaker-than-expected ISM Manufacturing data. Continued Red Sea geopolitical tension added to the bid tone.

- Balanced commentary from several Fed speakers and the preview of Chairman Powell's monetary policy report to Congress this week did little to forestall the drop in Treasury yields.

- US data resumes on Tuesday with S&P Global US Services PMI, ISM Services, Factory and Durable Goods Orders.

THAILAND: Economic Weakness Continues, Political Pressure On BoT Unlikely To Wane

Thailand’s economy continues to underperform the region and the February S&P Global manufacturing PMI and business sentiment signal that the undesired situation continued into Q1. The government has been putting pressure on the Bank of Thailand (BoT) to cut rates to stimulate the lacklustre economy but the central bank has responded that structural problems are the cause, which monetary policy cannot impact. But while data continue to disappoint, political pressure on the BoT is likely to continue. The next meeting is on April 10.

- Thailand’s Q4 GDP rose 1.7% y/y compared to Indonesia’s 5.0%, a situation that has been the case for some time and early 2024 data are suggesting that it will continue for now.

- The manufacturing PMI in February fell 1.6points to 45.3, signalling that activity in the sector is falling at its fastest pace since the Covid-impacted June 2020. Indonesia’s was relatively steady at 52.7. The decline was driven by new orders falling at their third fastest pace and the decline in export orders also increased, which has now resulted in job losses.

Source: MNI - Market News/Bloomberg

- February BoT business sentiment rose moderately to 48.8 from 48 and remains below 50, but is more optimistic as it is supported by services in line with more positive consumer confidence due to the recovery in tourism. Orders fell to 47.1 from 47.9 though, which is negative for Thailand’s industrial outlook. The PMI’s business confidence component also deteriorated due to the lacklustre economic and sales outlooks.

- Since, the PMI has been below the breakeven-50 level since August last year, it is unsurprising that manufacturing production remained weak in January declining for the fourth straight month and 3-month momentum is significantly negative at -10.1%.

Source: MNI - Market News/Refinitiv

ASIA FX: Most USD/Asia Pairs Lower, CNH Steady As China's NPC Comes Into Focus

Most USD/Asia pairs are lower, albeit to varying degrees (IDR the main exception). We do sit mostly above earlier lows though. This fits with the majors against the USD, which have lost ground as the session progressed. Equities are firmer, particularly in Taiwan and South Korea, but trends are a little more mixed elsewhere. Looking ahead to tomorrow, China's NPC will be in focus. The China Caixin Services PMI for Feb also prints. South Korea GDP Q4 revisions are also on tap, along with the Thailand and Philippines CPIs. The Indian services PMI is also out.

- USD/CNH hasn't drifted too far away from the 7.2100 handle. The trend from China/HK equities has been relatively muted to start the week, as the market awaits the China NPC. No 'big bang' stimulus is expected, particularly for the property sector. Growth expectations sit close to 5%, but how this achieved via fiscal and monetary stimulus is likely to be a key focus point for markets.

- 1 month USD/KRW tried to go lower in early trade, but there was no follow through. We couldn't test meaningfully sub the 1326 level. The pair last tracked above 1328. Onshore equities have held strong gains for much of the session (+1.3%), but there has been limited spill over to KRW. Data was mixed with IP and the PMI in focus. IP y/y growth looks solid, while the PMI eased, but remains above the 50.0 expansion/contraction point.

- Spot USD/MYR slumped in early trade, hitting fresh lows under 4.7200, but we now sit higher, last near 4.7300. Comments from Malaysia's Financial Markets Committee (FMC), crossed late on Friday local time. The body noted that coordination between the government and central bank had encouraged repatriation inflows, particularly from state-owned firms, in terms of offshore earnings (BBG). Such a backdrop may be lending more support to MYR today.

- Thailand’s economy continues to underperform the region and the February S&P Global manufacturing PMI and business sentiment signal that the undesired situation continued into Q1. The government has been putting pressure on the Bank of Thailand (BoT) to cut rates to stimulate the lacklustre economy but the central bank has responded that structural problems are the cause, which monetary policy cannot impact. USD/THB sits above session lows, last near 35.84, around 0.30% stronger in baht terms. Recent moves above 36.00 have continued to draw selling interest.

- USD/IDR spot has drifted higher, the pair last near 15720. This is only a modest USD gain, but has generally bucked the trend seen elsewhere in the region. We did see firmer offshore buying into local bonds last Thursday but this hasn't shifted sentiment. Modest equity outflows continue.

INDONESIA: Indon Sovereign Debt Curves Bull Flatten As Foreign Investors Buy

Indonesian USD Sovereign Debt curves are bull flattening as trading kicks off for the week, with yields +2 to - 4bps across the curve, out-performing US treasuries.

- The 2Y is 1.8bp higher at 4.800%, 10Y is -3bps lower at 4.961%, while 5yr CDS are down unchanged to 69.25bps

- The spread difference between USD Indon & US Treasury yields has closed over the past month with the 2Y now 33bps, while the 10Y is now 79bps moving 4bps wider over the past month

- Cross market moves, the USD/IDR is 0.13% higher, the JCI is 0.05% lower, whilst US Tsys are 1-2bps higher.

- Foreign Investors bought Indonesian Debt on Thursday with $106m flowing in, the highest Since Mid January, however investors have largely been better sellers of Indonesian bonds over the past month as the 20-day average daily flow currently at -$38m.

- Looking Ahead: It's a quiet Calendar this week, other than on Tuesday when 108D bills to 25Y Sukuk Bonds are sold, while Foreign Reserves are due on Friday.

PHILIPPINES: Philippines Sovereign Debt Yields 2-5bps Lower Ahead of CPI on Tuesday

Philippines USD sovereign debt yields followed US yields lower on Monday, out-performing US Treasuries as curves bull flatten with curves 2-5bps tighter. Markets are awaiting CPI data due out on Tuesday with expectations that food prices will push inflation higher.

- The 2Y yield is 2bps lower at 4.78%, 10Y yield is 3bps lower at 4.97%, while 5yr CDS is unchanged at 60.85bps

- The spread differences between US and PHILIP has remained relatively stable over the past month with the 10y spread difference at 77bps, while the 2Y spread difference has narrow from 36bps to 24bps

- Cross-asset moves, the USD/PHP is 003% lower, PSEi Index is 0.60% higher, Corporate Credit curve is 1-2bps wider, whilst US Tsys are 1-2bps higher.

- Philippines signed a business pact with Australia worth $1.53b spanning diverse sectors such as renewable energy, waste-to-energy technology, organic recycling technology, countryside housing initiatives, establishment of data centers, manufacturing of health technology solutions, and digital health services.

- Coming up Philippines to Sell PHP15b in 91-364day Bills at 1.15pm local, 4:15 aest.

- Looking ahead CPI data is due on Tuesday forecast is for 3%, from 2.8% prior.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/03/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 04/03/2024 | 0730/0830 | *** |  | CH | CPI |

| 04/03/2024 | 1600/1100 |  | US | Philly Fed's Pat Harker | |

| 04/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 04/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/03/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.