-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: USD/CNH To Fresh YTD High, Bucking Softer USD/Lower Yield Backdrop

- This morning Dallas Fed President Logan noted the Fed could well need to tighten monetary policy further in order to bring U.S. inflation sustainably back to the central bank’s 2% target, although policymakers can now afford to proceed more cautiously.

- A move higher in tsys amid volatile early trade was seen alongside pressure on USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. Cash tsys sit ~2bps richer across the major benchmarks. Cash JGBs are flat to richer across the curve, with yields flat to 1.2bp lower. The move lower has helped take the USD off recent highs, although USD/JPY has recouped most of its earlier losses. AUD and NZD are slightly outperforming.

- USD/CNH has bucked the softer USD trend, rallying to fresh YTD highs, as the USD/CNY fix was set at its highest level in 2 months. Onshore equities are weaker, but paring losses in the afternoon session. Note August inflation data prints tomorrow in China.

- Looking ahead, in Europe today we have the final read of German CPI for August. Further out we have VC Barr due to cross and Wholesale Trade.

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 110-06+, +0-07, a 0-11+ range has been observed on volume of ~92k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- A move higher in tsys amid volatile early trade was seen alongside pressure on USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves.

- Gains were marginally pared and tsys dealt narrow ranges for the remainder of the session as little macro news flow crossed.

- This morning Dallas Fed President Logan noted the Fed could well need to tighten monetary policy further in order to bring U.S. inflation sustainably back to the central bank’s 2% target, although policymakers can now afford to proceed more cautiously.

- In Europe today we have the final read of German CPI for August. Further out we have VC Barr due to cross and Wholesale Trade.

JGBS: Futures Stronger But Off Session Bests, FX Intervention Talk Impacts

JGB futures are higher but off session highs, +11 compared to the settlement levels. The move higher in JGB futures was seen alongside pressure on the USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. JBU3 hit a high of 147.03 versus its current level of 149.95.

- US tsy futures also spiked on the comments, although have subsequently pared those gains, with cash US tsys currently sitting 2-3bp richer across the major benchmarks. TYZ3 deals at 110-07, +0-07+.

- The move higher in futures was likely assisted by the previously outlined domestic data drop that was weaker than expected across the board, including labour cash earnings and Q2 (Final) GDP.

- Cash JGBs are flat to richer across the curve, with yields flat to 1.2bp lower. The benchmark 10-year yield is 1.2bp lower at 0.645%.

- Swap rates are lower across the curve, with pricing -0.1bp to -0.8bp. Swap spreads are generally tighter.

- Bloomberg reports that the continued weakness in the yen could put the BoJ under political pressure to trim the amount of its debt-purchase operations, according to Barclays chief yen rates strategist Ebihara. “The BoJ could realistically reduce its JGB purchases at a pace needed to avoid a net increase in its holdings in 2024”. (See link)

- On Monday, the local calendar is light, with M2 & M3 Money Stocks as the only releases.

AUSSIE BONDS: At Session Highs, Tracking Tsys In Asia-Pac But Outperforming

ACGBs (YM +8.0 & XM +8.0) are at Sydney session highs after US tsy futures strengthened during Asia-Pac dealing. TYZ3 moved higher alongside pressure on the USD/JPY as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. However, that gain in US tsy futures was subsequently pared, with cash US tsys currently sitting 2-3bp richer across the major benchmarks.

- Cash ACGBs are 7-8bp richer, with the AU-US 10-year yield differential 2bp lower at -14bp.

- Swap rates are 6-8bp lower.

- The bills strip has seen a bull flattening, with pricing +1 to +6.

- RBA-dated OIS pricing is flat to 1bp softer across meetings.

- Get ready for a world of more volatile inflation, gyrating interest rates and greater economic uncertainty. That was the warning from departing RBA Governor Lowe. Lowe said, “The increased prevalence of supply shocks, deglobalisation, climate change, the energy transition and shifts in demographics means either steeper supply curves or more variable supply curves.” (See link)

- Next week the local calendar is empty on Monday, ahead of Westpac Consumer Confidence and NAB Business Confidence on Tuesday, CBA Household Spending on Wednesday and the August Employment Report on Thursday.

- Next week the AOFM plans to sell A$150mn of 1.25% 21 August 2040 index-linked bond.

AU STIR: RBA Dated OIS Pricing Slightly Firmer Since RBA Decision

Figure 1: RBA-Dated OIS – Today Vs. Pre-RBA Decision

Source: Bloomberg / MNI - Market News

NZGBS: Outperforming $-Bloc Counterparts Ahead Of The Pre-Election Fiscal Update

NZGBs closed the session at their highest levels, with benchmark yields showing a decline of 3-6bp. In the absence of domestic catalysts, local market participants appear to have been influenced by developments in US tsys during the Asia-Pac session. Nevertheless, NZGBs have outperformed their counterparts in the $-bloc, which is noteworthy as it precedes the Pre-Election Economic and Fiscal Update scheduled for Tuesday.

- NZ-US and NZ-AU 10-year yield differentials have narrowed by 5bp and 3bp, respectively. Both differentials had been widening until about a week ago, aligning with speculation that NZ’s fiscal situation was deteriorating beyond what was anticipated in the recent NZ budget. The recent outperformance of NZGBs over the past week appears to be driven by position adjustments or investors capitalising on more favourable entry points.

- Swap rates are 1-8bp lower, with the implied 2s10s swap spread box flatter.

- RBNZ dated OIS pricing is little changed across meetings out to May’24 and 1-3bp softer beyond.

- Next week the local calendar is empty on Monday, ahead of the Pre-Election Economic and Fiscal Update and Retail Card Spending on Tuesday.

- On Thursday 14 September, the NZ Treasury plans to sell NZ$200mn of the 0.5% May-26 bond, NZ$200mn of the 1.50% May-31 bond and NZ$100mn of the 1.75% May-41 bond.

FOREX: USD Marginally Pressured In Asia

The greenback is marginally pressured in Asia as US Tsy Yields tick lower. An early move lower in USD/JPY spilled over into the wider space, however the move didn't follow through and the pair sits unchanged.

- USD/JPY printed an early session low at ¥146.59 in volatile trade as Finance Minister Suzuki reiterated that Japan won't rule out any options to address excessive FX moves. Losses were pared through the session and the pair sits at ¥147.20/25.

- Kiwi is leading the bid in Asia, NZD/USD is up ~0.3%. The pair briefly dealt above the $0.59 handle however the move didn't follow through and gains were marginally pared.

- AUD/USD is ~0.2% firmer benefiting from the general move lower in the greenback. The pair was unable to breach the $0.64 handle and remains well within recent ranges.

- Elsewhere in G-10, EUR and GBP are both up ~0.2%. The Scandies are firmer however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.2% and 2-Year US Tsy Yields are ~2bps lower. E-minis are a touch firmer, and markets in Hong Kong were closed for the morning due to a rainstorm.

- The final read of August CPI from Germany provides the highlight in Europe today.

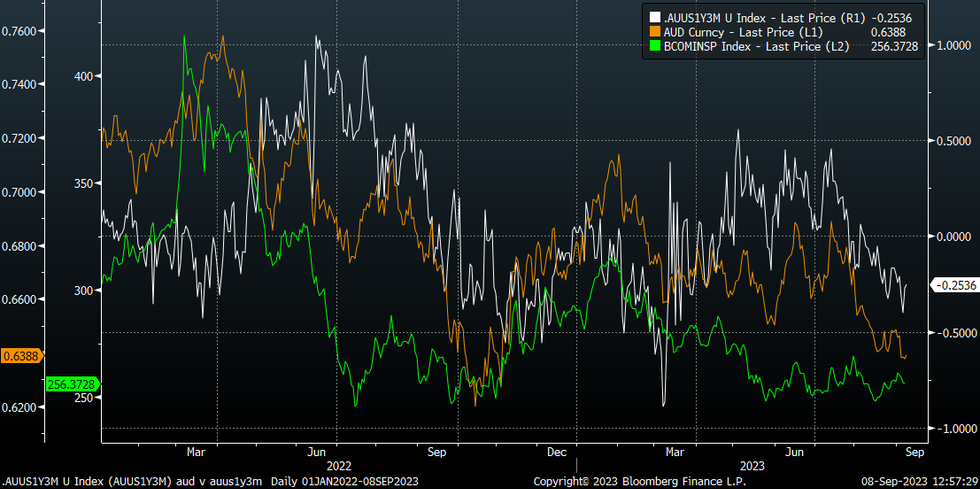

AUD: Relative Policy Expectations A Bigger Driver Than Commodities In Recent Months

AUD/USD continues to see support sub 0.6370, the pair benefiting from a modest USD pull back so far in Friday trade (the BBDXY last down 0.10% to 1256.3, which is up from session lows). The A$ sits near 0.6385 in latest dealings, unable to breach the 0.6400 level yet. The 20-day EMA sits around 0.6450.

- The AUD has seen modest relief from a slightly improvement in forward monetary policy expectations between AU and the US. The chart below plots spot against the AU-US expected 3 month differential in 1 year's time. The correlation with AUD and this differential sits at 88% for the past 3 months.

- In contrast we sit at around 50% for the equivalent correlation between base metals (which is the other line on the chart) and AUD. The correlation between AUD and iron ore is negative over this period.

- China's NDRC noted that the recent spike in iron ore prices had occurred without any change in fundamental demand/supply conditions. Iron ore also sits high relative to China property equity trends.

- If current correlations persist, relative policy expectations may remain a key driver for AUD/USD. in terms of upcoming event risks, next week's US CPI looms large. In Australia next week contains consumer and business sentiment, then August employment data.

Fig 1: AUD/USD Versus AU-US 3m 1y & Base Metals

Source: MNI - Market News/Bloomberg

EQUITIES: Tech Sensitive Bourses Lower, China's CSI 300 Back Tracking Towards August Lows

Regional equities are tracking lower in Asia Pac trade on Friday. Weakness is broad based and follows US and EU losses in Thursday trade. US futures sit around flat in terms of latest levels. Eminis last at 4456.5, lows for the session came in at 4451. Nasdaq futures have followed a similar trajectory, last near 15285 (lows near 15250).

- China shares look set to end the week on a soft note. At the break, the CSI 300 is down 0.80%, near 3728.5 in index terms. August lows just under the 3700 aren't too far away.

- The CSI 300 real estate sub index is down a further 1.05% at this stage, set to end the week down. The MNI Policy team note the authorities could ease housing restrictions further if sales down rebound in coming months. Further easing isn't likely until Q4 though (see this link). China energy stocks are also on the back foot, with higher oil input costs potentially weighing on profitability.

- Note Hong Kong markets have remained closed today due to the rainstorm alert.

- Tech sensitive plays are underperforming in the region, following US losses in Thursday trade (Nasdaq -0.89%, SOX off 2%), as sentiment has been dented by China's iPhone ban for the government sector.

- The Topix is off ~1.00% in Japan, the Kospi -0.60% in South Korea and Taiex -0.20% at this stage.

- In SEA, Thai stocks are trying to move higher, but aren't far away from the 1550 level. Indian stocks are tracking modestly higher at this stage, +0.30%.

OIL: Tracking Down Again, But Still Higher For The Week

The modest downward trajectory evident for Brent crude from Thursday's session has extended in the first part of Friday trade. We now sit back near $89.30/bbl, down a further 0.65%, after Thursday's -0.75% loss. We still sit higher for the week, +0.90% (with last week's Friday's closing levels at $88.55/bbl). WTI is back near $86.20/bbl having followed a similar trajectory so far in Friday trade. This benchmark is tracking firmer for the week as well (+0.80%). Broader risk appetite has been less supportive from the equity space today, although USD indices are tracking modestly lower.

- The modest pullback in the past two sessions looks like a consolidation rather than the start of a sharp pull back, particularly given on-going supply news (larger than expected draw for US crude stocks in the EIA weekly petroleum summary (-6.31m vs -2.35m expected) from Thursday).

- Still, some sell-side banks are cautious around extending the bullish outlook too far. JPMorgan analysts still don’t see oil prices breaching $100 in 2023, absent a major geopolitical event, due in large part to the demand outlook in 4Q despite the OPEC+ cut extension. Separately, RBC have Brent forecast to average 91$/bbl and WTI at $86.50/bbl in 4Q although $100/bbl could be within reach.

- Also note, Saudi Arabia is set to increase crude supplies to China in 2024 to meet demand at new refineries, sources told Platts at the APPEC conference in Singapore.

- For Brent, this week's lows came in close to $88/bbl, while the 20-day EMA is back at ~$86.63/bbl. On the topside, recent highs at $91.15/bbl remain intact.

LNG: Chevron Talk With Unions End Without Deal, Strike Action To Commence Today

Headlines have crossed that talks between Chevron and unions have ended today without an agreement. Chevron stated that it has been advised that industrial action will commence today. The company stated that it and the unions remain apart on key issues, despite recent conciliation sessions.

- Note that Gorgon and Wheatstone plants covered about 7% of LNG supply last year.

- Work stoppages will reportedly be for 1-hour blocks and for periods of 3 hours to 11 hours per day.

- If no agreement is reached by September 14, strike action will reportedly escalate.

GOLD: Extends Thursday’s Gains in Asia-Pac Dealing

Gold is 0.3% higher in the Asia-Pac session, after closing +0.2% at $1919.77 on Thursday. The drag from a modestly stronger US dollar was offset by lower tsy yields.

- A mid-session reversal in US tsys left them 1-7bp richer across the major benchmarks on Thursday. The curve steepened. US tsys were briefly pressured as the latest round of US data continued to show a robust labour market.

- Initial Jobless Claims came out lower than expected (216k, 234k est). Meanwhile, Unit Labor Costs printed higher than expected at +2.2% vs. +1.9% est.

- Nonetheless, the US dollar is headed for its eighth consecutive weekly gain, with a stronger greenback generally negative for gold.

- According to MNI’s technical team, gold is holding above support at $1903.9 (Aug 25 low), with resistance seen at $1931.4 (50-day EMA).

ASIA FX: USD/CNH Makes Fresh YTD Highs, Most Other USD/Asia Pairs Lower

Most USD/Asia pairs are lower in line with USD softness/weakness in yields in the first part of Friday trade. CNH is a clear exception which fell to fresh YTD lows against the USD. A move higher in the USD/CNY fix and weaker equities are weighing. TWD and IDR are also seeing modest underperformance. PHP has outperformed modestly, with 57.00 representing a firm resistance point at this stage. Later on, Taiwan August trade data is out, while tomorrow China August inflation data is due.

- The move higher in the USD/CNY fix (to 7.2150), saw a spike in USD/CNH above 7.3600, fresh highs for 2022. We aren't too far off 2022 highs of 7.3749. USD/CNY also rose, last tracking near 7.3450, fresh highs back to late 2007. USD/CNH settled back into the 7.3500/7.3600 range post the 7.3612 high, but CNH has underperformed the broader USD sell-off. Some onshore commentary noted CNY may find it difficult to strengthen against the USD in the near term, while China equities are tracking lower at this stage, the CSI 300 off ~0.70%.

- USD/TWD looks to be consolidating gains above the 32.00 level. The pair was last near 32.03, with the pair making fresh highs back to early November last year. Highs last year came in close to the 32.35 level. The 20-day EMA sits back near 31.86. Taiwan equities are modestly tracking lower, down 0.20% so far today, with China looking to expand its iPhone ban in the government sector weighing on Apple suppliers, including TSMC. Offshore investors remain net sellers of local equities, with already nearly $1.1bn in outflows in September to date. For the quarter to date, we are running at -$8.63bn in net outflows.

- USD/IDR spot continues to drift higher, last near 15345, not too far from mid August highs at 15358. A move above this level, could see March highs around 15450 targeted. The 20-day EMA trend is rising, last near 15259. Local lawmakers have told BI to take 'bold but measured steps' to ease borrowing costs, while being mindful of Fed rate hikes. BI's next policy announcement is on Sep 21 and it continues to emphasize financial stability and may be reluctant to turn more dovish with Fed rate cuts not yet on the agenda, particularly with USD/IDR trending higher.

- USD/INR printed fresh YTD highs yesterday edging higher as broader USD trends dominated flows. The pair is holding close to record highs in early trade today, last printing at 83.16/17. Equity outflows continued on Wednesday, a net of $340.94 Indian equities were sold by foreign investors bringing the total outflow for September to ~$570mn

- The Ringgit is little changed in early trade on Friday, ranges have been narrow with little follow on moves. USD/MYR continues to hold in narrow ranges a touch off YTD highs, the pair last prints at 4.6760/90. BNM held the Overnight Policy Rate at 3.00% yesterday as expected. The banks statement dropped a phrase from the previous meeting that had characterised core inflation as “elevated”, the latest reading of core CPI was 2.8%. The bank also cited two-way risks to growth.

- The SGD NEER (per Goldman Sachs estimates) printed its lowest level since July 7 yesterday before paring losses. The measure sits ~0.9% below the top of the band. USD/SGD printed a fresh YTD high yesterday as broader greenback trends dominated flows. In early dealing this morning recent gains have been trimmed, the pair is ~0.1% lower at $1.3640/45. Foreign Reserves ticked lower in August and now sit at $337.25bn, the prior read was $340.79bn.

- USD/PHP has tracked lower in the first part of trade today. We were last at 56.65/70, around +0.25% firmer in PHP terms since the open. The BBDXY is down around 0.15% in the first part of Friday trade, which is helping Peso sentiment. Recent highs rest at 57.00, which remains a clear resistance point for the pair. On the downside, early September lows sit at 56.495, which is also close to the 20-day EMA. On the data front today, we had July trade figures. The deficit widened to -$4.2bn, close to market expectations and wider than the prior -$3.9bn outcome.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/09/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/09/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 08/09/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 08/09/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/09/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/09/2023 | 1300/0900 |  | US | Fed Vice Chair Michael Barr | |

| 08/09/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/09/2023 | 1500/1100 |  | US | San Francisco Fed's Mary Daly | |

| 08/09/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.