-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: USD Firms, T-Notes Are Rangebound Ahead Of Inflation Data

- T-Notes hold a tight range ahead of the release of U.S. CPI report later today, while long-dated debt auctions grab attention in Japan and Australia.

- The greenback firms in anticipation of U.S. data, with the DXY testing three-week highs. The AUD falters on the back of the local Covid-19 situation.

BOND SUMMARY: Long-End Supply Headlines In Asia, Tsys Rangebound Ahead Of U.S. CPI

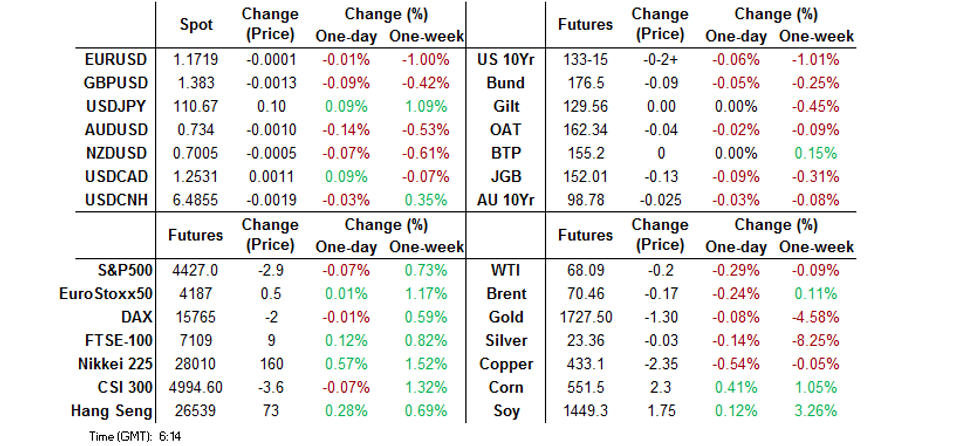

Thin headline flow in Asia-Pac hours allowed participants to focus on today's U.S. CPI data, set to receive additional scrutiny after the latest rounds of Fedspeak fanned taper expectations. Adding to hawkish musings of his colleagues, Chicago Fed Pres Evans said Tuesday that he expects "substantial progress" towards tapering asset purchases later this year. The air of expectancy dominated, keeping T-Notes within a tight 0-02+ range, with the contract sitting -0-02+ at 133-15 as we type. Cash Tsy yields last trade a touch higher across the marginally steepened curve. Eurodollars are unch. to +1.0. There is more Fedspeak coming up today, with Bostic, George and Logan all due to speak. On the supply front, there is a 10-Year Tsy auction coming up today.

- Japanese MoF sold 30-Year JGBs, drawing bid/cover ratio of 3.07x (prev. 3.63x, highest since Nov 2020), with tail widening to 0.11 (prev. 0.03, tightest since May 2019) and low price matching BBG forecast. The offering had no material impact on JGB space and cash yields continued to sit marginally higher, with 10s underperforming. JGB futures were slightly heavy and slid to fresh one-month lows. The contract trades at 152.04, 10 ticks below last settlement.

- The AOFM auctioned A$300mn of the 3.25% 21 Jun '39 Bond, tapping it for the first time since Oct 2020. Cash ACGB curve remained bear-steepened, albeit 10s lagged. Aussie bond futures held narrow ranges, with YM last trading -1.0 & XM -2.5. Bills sit unch. to -1 tick through the reds. The local Covid-19 outbreak continued to provide interest, with a 4.4% monthly decline in Westpac Consumer Confidence reflecting the impact of restrictions on sentiment. Australia-U.S. 10-Year yield spread tightened further, reaching levels not seen since Mar 2020.

FOREX: Early Losses Recovered

AUD and NZD recovered early losses. AUD/USD dropped as low as 0.7335 before bouncing, last trades down 4 pips at 0.7346. Westpac consumer confidence fell 4.4% to 104.1 while Melbourne extended its lockdown by at least 7-days, and in NSW there were 344 new cases.

- NZD/USD is up 3 pips. For New Zealand BNZ said that NZ job ads rose 1.7% M/M in July and now sit 28% above pre-Covid levels. There is little of note left on the local docket today, but New Zealand's REINZ House Sales, food price index & the RBNZ's measure of inflation expectations will all hit the wires tomorrow.

- USD/JPY is 7 pips higher, NHK released a poll showing that support for the cabinet fell 4pp to 29% in another sign of rapidly faltering support for beleaguered PM Suga. Flash machine tool orders are due later today, with PPI coming up tomorrow.

- USD/CNH is down 55 pips, offshore yuan declined for a third straight session yesterday. Markets continues to digest the PBOC's quarterly monetary policy report which many view as confirming the Central Bank's dovish bias.

FOREX OPTIONS: Expiries for Aug11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E669mln), $1.1750(E557mln), $1.1795-00(E744mln)

- USD/JPY: Y108.65-70($715mln), Y109.85-90($1.4bln)

- EUR/GBP: Gbp0.8450(E655mln)

ASIA FX: Won Weakens On Record Coronavirus Cases

The greenback initially rose but gave back the move as the session wore on. Risk sentiment was tepid, moves mixed in EM FX.

- CNH: Offshore yuan declined for a third straight session yesterday. Markets continues to digest the PBOC's quarterly monetary policy report which many view as confirming the Central Bank's dovish bias.

- SGD: Singapore dollar is stronger, retracing early declines. Data earlier showed Singapore Q2 GDP fell 1.8% Q/Q, less then the expected 2.0%. Following the release the MAS increased the 2021 growth estimate to 6%-7% from 4%-6% previously.

- TWD: Taiwan dollar is slightly weaker, but is off session worsts. Markets look ahead to GDP data later in the week, the final Q2 figure will be published on Friday.

- KRW: Won is weaker, on track for its third session of decline. South Korea reported 2,223 new coronavirus cases in the past 24 hours, a fresh all time record high. Elsewhere data earlier showed the adjusted jobless rate fell to 3.3% against estimates of 3.8%.

- MYR: Ringgit is weaker, Intertek reported yesterday that Malaysia's palm oil exports fell 12.82% M/M in the first 10 days of the month.

- PHP: Peso is stronger, BSP said in a written response to questions that its holdings of government bonds swelled almost fourfold during the pandemic. The central bank plans to "carefully unwind some of the government security purchases as part of its exit strategy from extraordinary monetary accommodation" once the economic recovery becomes sustainable.

- THB: Baht gained, the U.S. added Thailand to its list of "very high risk" countries this week advised that even fully vaccinated Americans should avoid visiting the country. The designation delivered yet another blow to Thailand's struggling but systemically important tourism industry.

ASIA RATES: Foreign Selling Of Indian Bonds Accelerates

- INDIA: Yields dipping slightly in early trade. Bond yields stick to a narrow range yesterday as the rupee declined on the back of a gain in the greenback. Markets will watch an INR 170bn bill sale today to gauge demand, especially after the recent spate of cancelled auctions. Elsewhere data has showed that foreign selling of India's bonds accelerated in the past week as the yield on the benchmark 10-year government bond rose. The 5-day moving average of net foreign outflows accelerated to $7.99 million, compared with the 20-day average outflows of $3.36 million. Markets await industrial production and CPI data tomorrow.

- SOUTH KOREA: Futures are hovering around neutral levels in South Korea, 3-Year future is up 3 ticks at 110.33, the 10-Year is down 5 ticks to 127.84. South Korea reported 2,223 new coronavirus cases in the past 24 hours, a fresh all time record high. Elsewhere data earlier showed the adjusted jobless rate fell to 3.3% against estimates of 3.8%. The gain in jobs denotes the fifth straight month, though the pace of growth did slow as employment in face-to-face service segments was hit hard by the fourth wave of the pandemic. Other data showed exports rose 46.4% Y/Y in the first 10 days of August on the back of robust demand for chips and petroleum products. Bond issuance in South Korea fell sharply in July from the previous month despite continued foreign buying, according to figures from the Korea Financial Investment Association. The value of bonds sold fell KRW 21.8 trillion M/M, the fall is a contrast with the increase of KRW 18.2 trillion in June.

- CHINA: The PBOC matched maturities with injections again today, repo ranges are well within their recent ranges. Overnight repo rate is up 18 bps at 2.0342%, 7-day repo rate is down 28bpd at 2.1705%. Futures are lower as equity markets resume their gains. Futures are lower, on track for a fourth day of declines, with equity markets making gains. There was a piece in the China Securities Journal that China may increase the pace of local government bond sales in August and September due to a slow issuance so far in July. On the coronavirus front cases remain elevated, there were 111 new cases in the past 24 hours.

EQUITIES: Moves Muted Ahead Of US CPI

Another mixed day with muted moves in Asia after a mixed lead from US markets where the Nasdaq dipped but other major indices hit fresh record highs. Markets in mainland China are slightly lower, hovering around neutral levels all session. Markets in South Korea are lower after a record high number of coronavirus cases. Markets in Japan, Australia and Hong Kong all saw small gains. In the US futures are mixed, e-mini Nasdaq seeing a marginal gain after dipping yesterday while e-mini Dow and S&P slip slightly. Markets await US CPI figures later in the day.

GOLD: Picks Up But Stays Within Range

The yellow metal picked up in Asia-Pac trade on Tuesday, gaining $4.49/oz to $1,733.42 but sticking inside Tuesday's range. Gold had a relatively more stable session on Tuesday when compared to Monday trade, with the precious metal trading inside a $20/oz range. Monday's pull lower found some support at the 61.8% retracement of the 2020 range, but the recovery off the low will have emboldened bulls. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement. Markets look ahead to US CPI data later today.

OIL: Oil Dips From Closing Highs

After bouncing on Tuesday oil is slightly off highs; WTI last down $0.06 from settlement at $68.21/bbl, Brent is down $0.06 at $70.57/bbl. WTI and Brent crude futures rallied smartly Tuesday, with oil topping the Monday open to touch new weekly highs. Despite the strength in energy products, the move below the 50-day EMA last week looks convincing, with support now exposes at $66.91 for Brent. To resume any incline, bulls need to again take out $74.47, the 76.4% retracement of the Jul 6 - 20 downleg. API inventory data yesterday was bullish, headline crude stocks fell 816k bbls, while downstream inventories of gasoline stocks also fell which is confirmed by official DOE figures would be the fourth straight weekly decline.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.