-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD/JPY Below 130

- Notable swings in the Hang Seng marked the start to ’23 trade, with participants weighing up economic growth headwinds for China (and the degree of policy support required), slumping property sales in both the Chinese mainland & Hong Kong, worries surrounding the restructuring of property giant Evergrande and the PBoC’s drain of year end-related liquidity provisions. The benchmark index shed over 2.0% in early trade, but now sits 1.7% higher on the day

- The JPY sits atop the G10 FX table, with the hawkish speculation surrounding the BoJ’s inflation projections lending support to the JPY, on top of a bid for Tsy futures. USD/JPY hit a multi-month low of Y129.52, with technical support in the form of the Jun 2 ’22 low (Y129.51) holding. A Tokyo holiday thinned out wider liquidity.

- Looking ahead, state and national CPI data out of Germany provide the focal points of the broader macro docket on Tuesday.

MNI Sovereign Rating Review Calendar - 2023

Please use the below link to access the indicative sovereign rating review schedule for 2023. Do note that the schedule is indicative only and ratings can be reviewed on an ad-hoc basis. The schedule may also be adjusted by the rating agencies during the year.

US TSYS: Firmer In Volatile Asian Session

TYH3 deals at 112-19+, +0-10, 0-02 shy of the top of its 0-09 range on volume of ~86K.

- Cash Tsys are closed until the London session today due to the observance of a Japanese holiday.

- Tsys futures have see-sawed higher in the Asian session, gapping higher at the open as softer than expected official Chinese PMI data from the weekend added support, before paring gains as e-minis sharply reversed early gains in the limited liquidity environment..

- In the absence of macro headline drivers cross-asset flows continued to dominate. Early weakness in the Hang Seng reversed, spilling over into wider markets, with e-minis trading higher weighing on the USD and allowing Tsy futures to print fresh daily highs.

- The space looked through a marginally weaker than expected Caixin Mfg PMI print from China as well as news of US$ supply from Hong Kong & Kexim Bank

- In Europe today we have German state and national CPI readings. The U.S. highlights of the week include the NFP report, minutes from the December FOMC meeting & monthly ISM surveys.

AUSSIE BONDS: Firmer & Flatter To Start The New Year On Chinese Economic Growth Worry

Aussie bonds failed to better their early Sydney best levels, which came as a product of the vol. that surrounded the re-open of U.S. futures, with the previously alluded to turnaround in fortunes for Hong Kong’s Hang Seng Index seemingly allowing the space to nudge further away from best levels.

- Still, worries surrounding immediate Chinese economic growth prospects seemed to provide a stickier bid for core global FI markets, with the latest batch of Chinese PMIs fanning those flames.

- That left YM +3.0 and XM +5.0 at the bell, while the major cash ACGB benchmarks are 2.5-6.0bp richer, with the early flattening impulse intact throughout.

- EFPs were little changed to a touch wider on the day.

- Lower tier domestic data crossed in the shape of final Judo Bank manufacturing PMI & CoreLogic house prices, with the former revealing the slowest rate of expansion seen since ’20 and the latter providing an expected extension of the recent pull lower in property prices.

- Looking ahead, Thursday’s final Judo Bank services and composite PMI data headline the limited domestic data docket during the remainder of the week. A reminder that details on AOFM issuance plans for the second half of 22/23 will be provided on Friday.

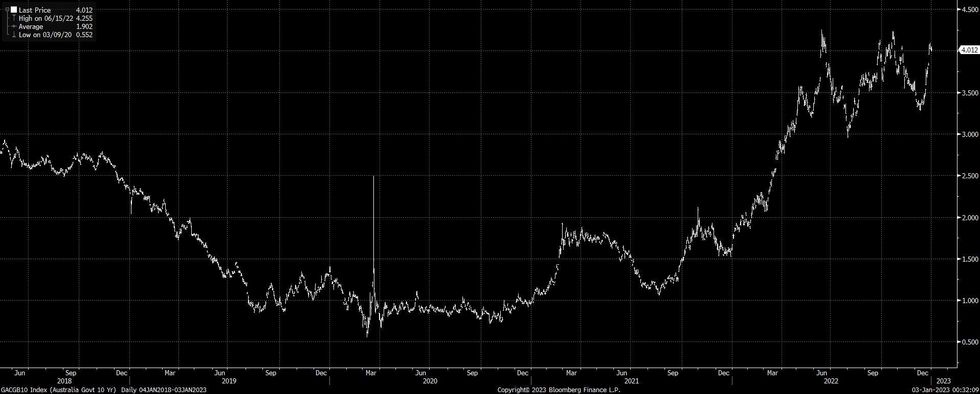

AUSSIE BONDS: 10s Back At 4.00%

10-Year ACGB Yields are trading at ~4.00%, ~25bp shy of the ’22 double top. The ~75bp shift higher in recent weeks is leading many to question what has changed? In short, not much, at least from a headline/economic outlook perspective.

- Cross-market dynamics (most notably vs. the U.S. Tsys, but also vs. NZGBs) point to the exit of long ACGB spread trades vs. their major counterparts.

- Meanwhile, terminal RBA cash rate pricing has moved up to ~4.00% from the ~3.50% seen in early to mid-December, even after the Bank stepped down its pace of tightening during the latter part of ’22 (the return of the RBA being “behind the curve” trade).

- With cross-market trades now less crowded, and Aussie 10s providing a premium vs. their U.S. counterparts, in addition to a more attractive outright yield level, participants may look to deploy some capital in the ACGB space as ’23 gets underway.

- Early staging posts for global FI markets in ’23 include the minutes from the latest Fed meeting, the monthly NFP report from the U.S. & Eurozone CPI data, all of which cross this week.

Fig. 1: Australian 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUSTRALIA: CoreLogic House Prices Down Again But Further To Go

The CoreLogic house price index fell 1.2% m/m in December to be down 7.1% y/y (November -1.1% m/m & 5.4% y/y). This was the eighth consecutive fall and it now stands 8.7% below its peak, so far one of the largest corrections globally, but still 9.6% above its linear trend. Many expect house prices to fall around 20% from their April 2022 peak. This data is unlikely to result in the RBA pausing in February.

- The housing market is an area that the RBA is watching closely as it can have significant knock on effects to the rest of the economy. While dwelling prices continue to fall, they continue to do so in an orderly manner and haven’t yet reached the expected trough. The RBA expects defaults to be contained due to high savings buffers and advance mortgage payments. With a large number of mortgages refinancing in the first half of 2023 and previous rate hikes still feeding through, the housing correction has further to go.

- Sydney is seeing the worst of the correction with prices down a further 1.4% to be down 12.1% y/y and 12.2% off the 2022 peak. Melbourne fell 1.2% and is 8.1% below its peak.

- House prices turn following housing affordability. If we assume that disposable income rose in line with the 2022 quarterly average in Q4, then there was a further deterioration in housing affordability in the last quarter of the year to its lowest since Q2 2011. Our index is now 26.5% below its trend on the back of higher rates and lower house prices.

Source: MNI - Market News/Refinitiv/CoreLogic

Fig. 2: Housing Affordability

Source: MNI - Market News/Refinitiv *Q4:22 estimate

FOREX: Cross-Asset Flows In Focus As USD Softens, JPY Tops G10 On BoJ Inflation F’cast Talk

Participants returned from the festive break and assessed softer than expected official PMI data out of China, continued hawkish ECB speak, speculation surrounding a hawkish inflation forecast shift from the BoJ and the continued fallout from the rollback of China’s ZCS.

- FX trade was volatile around the re-open of U.S. FI & equity futures.

- We then saw a soft start for Hong Kong’s benchmark Hang Seng Index lend support to the traditional safe havens (JPY, CHF & USD), although a reversal in the fortune for that index, which allowed the S&P 500 to reverse losses after early, two-way gyrations, changed the tone of the session. This combination supported U.S. Tsy futures, after an early push higher faded a little, applying further weight to the USD.

- Slightly softer than expected Caixin m’fing PMI data did little for markets.

- The JPY sits atop the G10 FX table, with the aforementioned hawkish speculation surrounding the BoJ’s inflation projections lending further support to the JPY. USD/JPY hit a multi-month low of Y129.52, with technical support in the form of the Jun 2 ’22 low (Y129.51) holding. A Tokyo holiday thinned out wider liquidity.

- USD/CNH probed CNH6.8800, as it registered its own multi-month low, with the next level of meaningful technical support in the pair located at the 200-DMA

- Looking ahead, state and national CPI data out of Germany provide the focal points of the broader macro docket on Tuesday.

EQUITIES: Sharp Reversal In Hang Seng Noted After Soft Start

Notable swings in the Hang Seng marked the start to ’23 trade, with participants weighing up economic growth headwinds for China (and the degree of policy support required), slumping property sales in both the Chinese mainland & Hong Kong, worries surrounding the restructuring of property giant Evergrande and the PBoC’s drain of year end-related liquidity provisions. The benchmark index shed over 2.0% in early trade, but now sits 1.7% higher on the day.

- Elsewhere, gains for the CSI 300 were much more marginal, last printing +0.2% in afternoon trade.

- Speculation surrounding the need for greater policy support in China seemed to provide the impetus for a recovery at a macro level. Meanwhile, casino names provided a pocket of micro strength.

- Australia’s ASX 200 suffered from worry re: China, shedding more than 1%.

- E-minis were subjected to notable two-way flows, initially more than unwinding early gains, before bouncing alongside the Hang Seng. The major e-mini contracts are ~0.2% higher as we head into London hours.

GOLD: Bullion Reaches Multi-Month High

Gold prices are up 1% from their NY close on Friday to $1841.25/oz after reaching a high of $1843.18 earlier. This was the strongest since late June. The intraday low was $1826.95. Today’s move is consistent with the technical bullish trend. The USD is flat on the day.

- Gold has been supported by the IMF’s warning that a third of the global economy could be in recession this year. It noted that America, the EU and China are “slowing simultaneously”.

- Later today the final December US manufacturing PMI prints. There is further PMI/ISM data over the week but the focus is on Wednesday’s FOMC minutes and Friday’s payroll data for December, which is expected to post a 200k gain (bbg). Any signals of a less hawkish Fed should be good for gold prices.

OIL: Oil Prices Lower As Growth Concerns Back In The Forefront

MNI (Australia) - Oil prices are slightly lower today with WTI down 0.4% on Friday’s NY close to just under $80/bbl, slightly below its 50-day simple moving average. It reached an intraday high of $80.78 and a low of $79.32. Brent is down 0.5% to about $85.50 after a high of $85.96.

- The IMF’s warning that a third of the global economy could go into recession this year fuelled the oil market’s growth fears. It noted that America, the EU and China are “slowing simultaneously”. Demand expectations are also being impacted by the spread of Covid through China and the introduction of some travel restrictions in other countries.

- On the supply-side analysts are watching to see the extent of the impact of sanctions on Russian crude and its reaction. There is also concern that OPEC+ will cut output further as the global economy slows.

- Later today the final December US manufacturing PMI prints. There is further PMI/ISM data over the week but the focus is on Wednesday’s FOMC minutes and Friday’s payroll data for December, which is expected to post a 200k gain (bbg).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2023 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/01/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 03/01/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 03/01/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/01/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 03/01/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 03/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/01/2023 | 1500/1000 | * |  | US | Construction Spending |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.