-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: USD & US Yields Close To YTD Lows Ahead Of Jackson Hole

- BoJ Governor Ueda noted that the current policy rate is far below likely neutral rates. If the outlook unfolds as expected, more policy adjustments are likely. Yen regained some ground on the comments, while JGB futures are holding weaker, -23 compared to the settlement levels.

- Earlier data showed Japan National CPI for July close to expectations. NZ Q2 retail sales volumes fell more than forecast but hasn't impacted sentiment. The slower NZ growth backdrop is well known.

- USD/IDR is sharply lower, as political risk premium fell.

- US Treasury futures have been rangebound today, we initially opened stronger although have largely pared those gains.

- Today the focus will be on J Powell speech at Jackson Hole at 10:00 ET.

MARKETS

US TSYS: Tsys Futures Pare Earlier Gains, Ueda Speaks Before Parliament, Powell Later

- Treasury futures have been rangebound today, we initially opened stronger although have largely pared those gains. Trading have been largely just tsys roll activity today, although there were some block steepeners earlier, marking the first block trades during Asia this week from memory.

- TUU4 is +00⅜ at 103-07⅛ vs highs of 103-08¼ while TYU4 is + 02 at 113-11+ vs highs of 113-15+

- looking at the technical levels for TYU4, the bull theme remains intact as we remain above all key moving averages the recent breach of 111-01 (Jun 14 high) confirmed a resumption of the uptrend. Initial resistance is 114-03 (Aug 6 high), while support is 112-29+ (20-day EMA)

- Cash treasury yields have given back earlier gains and now trade about 1bps lower, the curve slightly steeper. The 2yr is back under 4% at 3.989%, while the 10yr is -0.8bps at 3.846%

- BoJ's Ueda stated earlier that there has been no change in the CB's outlook, and that as rates are still low if the economy remains in good shape they may raise rates to neutral levels, he has been slightly less dovish than Deputy Gov Uchida.

- Projected rate cuts through year-end have firm 1bps for Nov & Dec vs. Thursday closing levels (*): Sep'24 cumulative -31.6bp (-32.7bp), Nov'24 cumulative -64.2bp (-67.2bp), Dec'24 -97.9bp (-100.4bp).

- Today the focus will be on J Powell speech at Jackson Hole at 10:00 ET, we also have New home sales.

STIR: Small Net Movements Across $-Bloc Over Past Week

STIR markets within the $-bloc have seen small net movements over the past week, with the market awaiting the upcoming Jackson Hole Symposium.

- Year-end official rate expectations firmed by 7bps in New Zealand over the past week as the euphoria following the August 14 rate cut by the RBNZ was pared. A cumulative 71bps of easing is priced by year-end.

- By contrast, the US, Canadian and Australian markets have seen year-end official rate expectations soften by 1-4bps over the past week.

- The December 2024 expectations and the cumulative easing across the $-bloc are as follows: 4.40%, -93bps (FOMC); 3.75%, -75bps (BoC); 4.08%, -24bps (RBA); and 4.54%, -71bps (RBNZ).

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

BOJ: Ueda States Current Policy Rate Far Below Likely Neutral Rate

BoJ Governor Ueda hasn't sounded as dovish as Deputy Governor Uchida (relative to remarks from early August), as Ueda's appearance before both houses of parliament continues.

- The Governor stated early in his appearance that market shifts need to be watched closely. Such developments can also impact the economic outlook. He also noted that the central bank needs to communicate its thinking/outlook carefully.

- These points were a likely nod from the Governor to the early August market rout, of which the late July BoJ rate rise, was partially attributed to (weaker US NFP the other big driver).

- Still, Ueda noted that there had been no change to the central bank's outlook that further policy adjustments can be made if certainty (likely around sustainably achieving its inflation target) rises.

- Ueda noted that current rates are still quite low and if the economy remains in good shape, the central bank can raise rates up to neutral levels (RTRS).

- Ueda didn't state what the neutral level was, but noted there is high uncertainty (one board member indicated it was around 1% at the last board meeting). He added current rates are still far below the likely neutral rate (RTRS).

- The weaker yen also played into upside inflation risks (somewhat) at the July policy meeting.

- On a slightly more dovish note, Ueda stated that by keeping the current policy stance it will move closer to its inflation target.

- Overall though Ueda's remarks so far today clearly point to room for further policy adjustments.

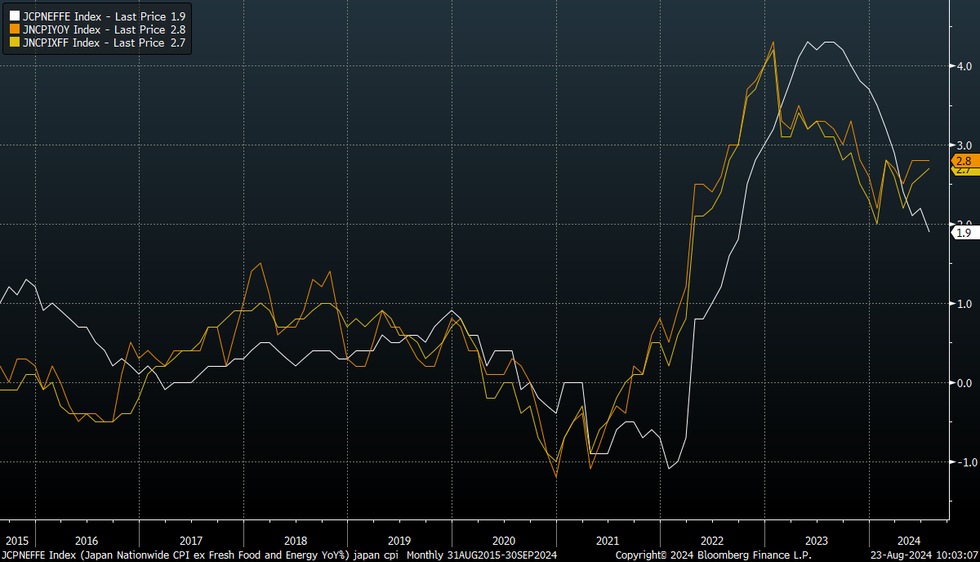

JAPAN DATA: CPI Close To Expectations, Core-Core Sub 2%Y/Y But Some Resilient Details

Japan national July CPI was close to expectations. Headline rose 2.8%, against a 2.7% forecast. (June's print was 2.8%). Ex fresh food was 2.7% in line with market expectations, 2.6%y/y was the June outcome. Core, ex fresh food and energy, printed in line with market forecasts at 1.9%y/y but this was a step down from the June 2.2% pace.

- In m/m seasonally adjusted terms momentum was still reasonable. Headline CPI rose 0.2%, slightly down from June, while core ex fresh food was 0.3%, ex fresh food and energy 0.1%. Good prices rose 0.5%, while services were up 0.1%, although this is at risk of being revised away if history is a guide.

- The ex all food and energy measure rose 0.2% m/m terms (not seasonally adjusted).

- In terms of the sub-categories, fresh food (-1.8%m/m) and -1.2%m/m for clothing were the main drags. Entertainment rebound +1.0%, after falling in the previous two months. Other segments didn't display significant shifts relative to June outcomes.

- The data is unlikely to shift BoJ thinking materially. The watch point will be on core ex fresh food, energy y/y momentum being sub 2%, see the chart below (the white line).

- Base effects may bias y/y momentum lower through the remainder of Q3/early Q4. Still, the other inflation metrics remain comfortably above the BoJ's 2% target.

Fig 1: Japan National CPI Trends

Source: MNI - Market News/Bloomberg

JGBS: Cash Bonds Cheaper As BoJ Ueda’s Remarks Point To More Tightening

JGB futures are holding weaker, -23 compared to the settlement levels.

- Outside of the previously outlined National CPI, there hasn't been much in the way of domestic drivers to flag.

- BoJ Governor Ueda hasn't sounded as dovish as Deputy Governor Uchida in early August, in his appearance before both houses of parliament.

- Ueda noted that current rates are still quite low and if the economy remains in good shape, the central bank can raise rates up to neutral levels (RTRS).

- Ueda didn't state what the neutral level was, but noted there is high uncertainty. He added current rates are still far below the likely neutral rate (RTRS).

- Overall though Ueda's remarks so far today point to room for further policy adjustments.

- Cash US tsys are flat to 1bp richer, with a slight steepening bias, ahead of Fed Chair Powell’s address at the Jackson Hole Symposium later today.

- The cash JGB curve has shifted cheaper, with yields flat to 2.5bps higher. The benchmark 10-year yield is 2.3bps higher at 0.900% versus the cycle high of 1.108%.

- Swap rates are higher, with the 20-40-year zone leading (1-5bps higher). Swap spreads are tighter apart from the 20-40-year zone.

- Next week, the local calendar will see Coincident & Leading Indices on Monday, ahead of PPI Services on Tuesday.

AUSSIE BONDS: Cheaper As Jackson Hole Vigil Comes To An End

ACGBs (YM -6.0 & XM -5.0) are cheaper after dealing in narrow ranges in today’s Sydney session. With the domestic calendar light today, local participants appear to have been happy to sit on the sidelines ahead of Fed Chair Powell’s address at the Jackson Hole Symposium later today.

- The latest round of ACGB Nov-28 supply showed strong demand metrics, extending the trend of firm pricing at ACGB auctions.

- Cash US tsys are flat to 1bp richer, with a slight steepening bias, in today’s Asia-Pac session after yesterday’s sell-off.

- Cash ACGBs are 4-5bps cheaper, with the AU-US 10-year yield differential at +8bps.

- Swap rates are 4bps higher.

- The bills strip has bear-steepened, with pricing flat to -6.

- RBA-dated OIS pricing is flat to 6bps firmer. A cumulative 21bps of easing is priced by year-end.

- Next week, the local calendar is light until Q2 Construction Work Done and July CPI Monthly data on Wednesday.

- Next week, the AOFM plans to sell A$800mn of the 3.50% 21 December 2034 bond on Wednesday and A$700mn of the 2.75% 21 November 2029 bond on Friday. There is also a planned sale of A$100mn of the 0.25% 21 November 2032 index-linked bond on Tuesday.

NEW ZEALAND DATA: Q2 Retail Volumes Fall Amid Consumer Headwinds

New Zealand Q2 retail sales (in volume terms) were weaker than forecast. They fell -1.2% q/q, against a market forecast of -0.9%. The Q1 rise was revised down to +0.4% (originally reported as +0.5% gain).

- This fits with the generally bearish economic backdrop both the RBNZ and NZ Treasury have painted in recent months.

- Card spending trends have been generally painting a downbeat picture for NZ consumer spending trends.

- In terms of the detail, there was a big swing against discretionary spending. Accommodation spending fell -4.4% q/q (+3.9% in Q1), while recreational goods was also down sharply, likewise for electrical goods (-6.0%. Food spending held up (+2.1%), while fuel spending edged down (-0.5%).

- DJ noted that "Retail sales per person are as weak as they were during the global financial crisis".

NZGBS: Cheaper Ahead Of Fed Chair Powell’s Speech At Jackson Hole

NZGBs closed cheaper, with benchmark yields 1-2bps higher.

- This came despite retail spending volumes falling 1.2% q/q in Q2, slightly weaker than the 0.9% decline expected from the market consensus. The Q1 climb in retail volumes was also revised down to 0.4% q/q.

- Trading volumes were light, and ranges were narrow today, however, ahead of Fed Chair Powell’s address at the Jackson Hole Symposium later today.

- Nevertheless, today's performance continues the ongoing reversal of much of the post-RBNZ rate cut rally. While the 2-year yield remains 11bps lower than pre-RBNZ levels, it has climbed 15bps since last Friday’s close. Interestingly, the 10-year yield is only 2bps lower than pre-RBNZ levels and 8bps higher than last Friday.

- Swap rates closed flat to 3bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed flat to 3bps firmer across meetings. A cumulative 71bps of easing is priced by year-end.

- Next week, the local calendar is empty on Monday and Tuesday, ahead of Filled Jobs data on Wednesday, ANZ Business Confidence on Thursday and Building Permits on Friday.

FOREX: Dollar Index Tracking Down For 4th Straight Week, Yen Up On Ueda Remarks

The USD has spent the first part of Asia Pac Friday trade giving back some of Thursday's gains. The USD BBDXY index is back under 1333, off around 0.20%. This week's lows for the index rest near the 1228 level, we are tracking 0.45% lower for the week for this this index (the fourth straight weekly loss).

- Yen gains have been the standout at this stage. USD/JPY got to lows of 145.30, but sits higher in latest dealings, near 145.65/70, still a gain in yen terms of around 0.45% (we opened near 146.30).

- Yen has received support from remarks by BoJ Governor Ueda who is before Japan's lower and upper house today. Ueda struck a slightly more hawkish tone relative to remarks made by Deputy Governor Uchida (back in early August, - if the market is volatile the BoJ won't hike). The Governor noted that the BoJ outlook hasn't changed and that the current policy rate is far below the likely neutral rate.

- If the economy evolves as expected further policy adjustments can be made Ueda stated.

- Earlier data showed Japan national CPI for July close to expectations. The core measure which excludes fresh food and energy was sub 2.0% y/y, but base effects played a role. There were also some signs of firmer services related inflation.

- In the cross asset space, US equity futures have rebounded, up 0.30% for Eminis and 0.50% for the Nasdaq. US yields are tracking lower, albeit only unwinding part of Thursday's gains. These moves are likely weighing on the USD at the margin.

- AUD/USD has ticked higher, last up 0.2% to 0.6720. NZD/USD is up by a similar amount to 0.6150/55. The Kiwi largely ignored a softer Q2 retail sales volume print earlier, but the market is well aware of NZ's current growth headwinds.

- Looking ahead, the main focus will be on Fed Chair Powell's speech at Jackson Hole. Despite the focus on Powell and the proximity to the September Fed meeting, relatively little clarity is expected from the Fed Chair on Friday - he's unlikely to deviate from the script too much - emphasizing data dependence and a meeting-by-meeting approach - however any reference to the envisaged tempo of cuts or the eventual destination for rates would be market-moving. Our full Jackson Hole preview found here: https://roar-assets-auto.rbl.ms/files/66056/Aug202...

ASIA STOCKS: Asian Equities Mixed, Ueda Before Parliament, Corp Earnings Mixed

Asian equities are mixed today, with markets showing caution ahead of Jerome Powell's upcoming speech at Jackson Hole. The yen strengthened as investors reacted to remarks from BOJ's Ueda as he speaks before parliament, contributing to mixed performance in Japanese stocks. Meanwhile, disappointing earnings from key Chinese tech firms added to the pressure, leading to declines in Hong Kong, while onshore equities are higher. Broader market sentiment was also weighed down by lingering concerns over global monetary policy direction, following hawkish rhetoric from central banks earlier in the month.

- Japanese equities traded mixed on Friday as investors remained cautious ahead of Jerome Powell's speech. The yen strengthened, supported by comments from BoJ's Ueda which added to market uncertainty. Earlier, Japanese inflation data exceeded expectations, further fueling speculation about the BoJ's policy direction. While some sectors, such as oil-related stocks, saw gains due to rising crude prices, overall market sentiment was subdued as traders awaited clearer signals on global monetary policy. The TOPIX is down 0.20%, banks are holding up ok at the moment with the Banks Index flat, while the Nikkei 225 is down 0.30%

- Hong Kong and Mainland China markets are mixed today with tech firms leading the losses, echoing the declines seen in their U.S. counterparts. In Hong Kong, significant sell-offs in major Chinese tech stocks like Baidu and NetEase weighed heavily on the market, despite Alibaba's announcement of upgrading its shares to primary status in the city. This move is expected to allow Alibaba to join a connect scheme with the mainland, potentially opening up access to more than 200 million Chinese investors and generating up to $19.5 billion, according to estimates. The HSI is down 0.40%, while CSI 300 is up by 0.57%.

- South Korean equities have pared losses to trade unchanged for the session, the weakness came on the back of soft US tech stocks as investors booked profits ahead of Jackson Hole tonight. The local currency also weakened against the USD, adding to the cautious sentiment in the market, currently the KOSPI & KOSDAQ are both unchanged.

- Taiwanese equities faced pressure as investors adopted a risk-off approach with tech stocks leading the decline. The market sentiment was further dampened by concerns over the global tech sector's outlook, particularly as key Taiwanese firms are closely linked to global supply chains. The Taiex is currently trading 0.30% lower, with TSMC down 0.40%

- Australian equities are trading lower, mirroring the negative sentiment from Wall Street's selloff on Thursday, with the ASX200 trading 0.10% lower. The Australian market saw a pullback after a strong rally, as investors braced for potential volatility ahead of Jerome Powell’s speech. In contrast, New Zealand's market managed to edge higher with the NZX50 up 0.80%, driven by an almost 10% jump from Fisher & Paykel after they raised earnings guidance.

- Elsewhere in Asia EM equities, Indonesia's JCI is 0.75% higher, Singapore's Strait Times is 0.15% higher, India's Nifty 50 is flat and Malaysia's KLCI is down 0.35%

ASIA EQUITY FLOWS: Asian Equity Flows Mixed, Tech Focus Inflows Slow

- South Korea: South Korea saw an outflow of $12m yesterday, local equities have still recorded a net inflow of $849m over the past five trading days, although the inflows were linked to just a single day with the last 4 sessions have seeing outflows in a sign momentum could be about to turn after equities prices have rebounded sharply recently. The 5-day average inflow is $170m, the 20-day average shows an outflow of $42m, and the 100-day average inflow is $64m. Year-to-date, South Korea has accumulated substantial inflows totaling $17.91b.

- Taiwan: Taiwan recorded an inflow of $95m yesterday, contributing to a net inflow of $1.888b over the past five trading days, although the market has erased the sell-off from Aug 2nd & 5th we still have a net outflow since then of $1.5b, similar to South Korea flows over the past four sessions have seen a slight change in momentum. The 5-day average inflow is $378m, while the 20-day average shows an outflow of $250m, and the 100-day average reflects an outflow of $136m. Year-to-date, Taiwan has experienced outflows totaling $7.852b.

- India: India saw an outflow of $51m yesterday, leading to a net inflow of $80m over the past five trading days, flows recently have been negative with the past 20 days only seeing 5 days of inflows. The 5-day average shows a small inflow of $16m, compared to a 20-day average outflow of $150m and a near breakeven at a 100-day average inflow of $2m. Year-to-date, India has seen inflows totaling $1.874b.

- Indonesia: Indonesian equities recorded an inflow of $80m yesterday, this has led to a net inflow of $392m over the past five trading days and now marked 12 straight session of inflows. The 5-day average inflow is $78m, with a 20-day average inflow of $40m and a 100-day average outflow of $10m. Year-to-date, Indonesia has accumulated inflows totaling $668m.

- Thailand: Thailand experienced an outflow of $25m yesterday, resulting in a net outflow of $245m over the past five trading days. Monday saw the largest outflow since March, investors look to be benefitting from the strong rally in the THB after it traded to it's strongest level for the year, foreign investors have also been heavily selling Thai bonds. The 5-day average outflow is $49m, while the 20-day average shows an outflow of $14m, and the 100-day average reflects an outflow of $16m. Year-to-date, Thailand has experienced outflows amounting to $3.566b.

- Malaysia: Malaysia saw an inflow of $67m yesterday, contributing to a net inflow of $386m over the past five trading days, Aug 19th saw the largest inflow in seven years. The 5-day average inflow is $77m, while the 20-day average shows a modest inflow of $13m, and the 100-day average reflects a small inflow of $4m. Year-to-date, Malaysia has seen inflows totaling $350m.

- Philippines: The Philippines recorded an inflow of $41m yesterday, leading to a net inflow of $124m over the past five trading days. The region has now marked 11 straight days of inflows, and has seen the third and forth largest inflow days for the year the past week. The 5-day average inflow is $25m, aligning with the 20-day average inflow of $4m, but there is a 100-day average outflow of $6m. Year-to-date, the Philippines has experienced outflows totaling $362m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -12 | 849 | 17910 |

| Taiwan (USDmn) | 95 | 1888 | -7852 |

| India (USDmn)* | -51 | 80 | 1874 |

| Indonesia (USDmn) | 80 | 392 | 668 |

| Thailand (USDmn) | -25 | -245 | -3566 |

| Malaysia (USDmn) | 67 | 386 | 350 |

| Philippines (USDmn) | 41 | 124 | -362 |

| Total | 196 | 3474 | 9020 |

| * Up to Date 21-Aug-24 |

OIL: Oil Markets Looking At Fundamentals At Week’s End

- Oil bounced back 1.5% to $77.18 overnight from four straight day of declines but will still end down for the week, trading at $77.33 in the afternoon session (last Friday’s close $79.68).

- West Texas Intermediate rebounded 1.5% also to settle at $73.12 (last Friday’s close $76.65).

- Oil prices have been dominated by concerns for Middle East tensions in the weeks prior.

- This week prices appear to pivot more towards fundamentals with the dual forces of a slowing US economy and serious challenges for the China economic outlook.

- Israeli negotiators are in Cairo this weekend to negotiate with Hamas in an attempt to find common ground.

- Any agreement reached could take back some of the Middle East tensions priced into oil currently.

GOLD: Weaker As Dollar & Yields Push Higher Ahead Of Jackson Hole

Gold is 0.4% higher in today’s Asia-Pac session, after closing 1.1% lower at $2484.75 on Thursday.

- Bullion reflected dollar strength, which gained the most in over a month due to concerns traders had overplayed prospects for aggressive easing before the end of the year. A stronger greenback is usually a negative for gold as it is priced in the US currency.

- Additionally, US Treasury yields finished higher following steady data and cautious comments from Fed’s Schmid ahead of the Jackson Hole Symposium.

- The Fed could be approaching the time to reduce interest rates, but it must make sure inflation is coming down sustainably to its 2% target, Kansas City Fed President Jeffrey Schmid said Thursday. “We’ve got some data sets to come in before September, I want to be thoughtful about it,” Schmid told CNBC in an interview.

- US initial jobless claims were in line at 232k, with the four-week moving average looking like a plateau rather than suggesting any further deterioration in the labour market.

- According to MNI’s technicals team, gold remains in a bull-mode condition and this week’s fresh cycle high reinforces current conditions. The recent breach of resistance at $2483.7, the Jul 17 high, confirmed a resumption of the primary uptrend. Note that moving average studies remain in a bull-mode set-up and this continues to highlight a dominant uptrend.

ASIA FX: USD/Asia Pairs Mostly Lower, IDR Rebounds As Political Concerns Ease

USD/Asia pairs are mostly tracking lower in the first part of Friday dealings, unwinding some of Thursday's gains. This fits with the majors where USD/JPY is lower (aided by Ueda remarks). Other supports have been lower US yields and mostly positive regional equity tones. IDR is the strongest performer, as the currency recovers from yesterday's political induced sell-off. USD/THB is off earlier highs, with local equities rallying close to 1%. The Thailand King reportedly endorsed the government's budget bill, which provides an additional 122bn THB for the 2024 fiscal year (per RTRS).

- USD/CNH sits back under 7.1400, around 0.10% stronger in CNH terms. The USD/CNY fixing was set higher, but not as much as the market consensus expected, seeing a re-widening in the fixing error. USD/JPY is lower, which is imparting some positive bias for the yuan, although the beta remains quite low as has been the case this year. Local equities are higher today, but a meaningful uptrend remains illusive for local bourses.

- Spot USD/KRW is back under 1340, off 0.35% for the session (Thursday highs rest near 1344). This is close to higher beta FX moves, while local equities are back near flat after opening weaker. Firmer US equity futures, led by the tech side, are another positive.

- The 1 month USD/IDR has slumped more than 1%, as political risk premium gets unwound. The pair fell as far as 15522, but sits at 15560 in latest dealings. Onshore spot is back close to 15540. The government adjourned a meeting which was to vote for electoral changes that would effectively favour the alliance between President Widodo and incoming President Subianto. The protests gained global attention resulting in at first the halting of the meeting and now the cancelling of the vote. Recent lows in the 1 month NDF rest at 15422. Thursday intra-session highs were 15769.

- USD/THB moved above 34.50 in the first part of trade but now sits back near 34.30, slightly firmed in baht terms for the session. Reuters noted earlier that Thailand's King has endorsed the government's budget bill, which provides an additional 122bn THB for the 2024 fiscal year. Local equities are up nearly 1% and generally outperforming the rest of the region.

- MYR sold off this morning, touching 4.3930 against the US dollar at the open compared to Thursday’s close of 4.3780. We have stabilized since though, back near 4.3800, little changed for the session.

- Trends elsewhere are relatively muted.

SOUTH KOREA: Fiscal Stimulus Coming

- The Head of the ruling People Power Party’s policy committee on Friday stated that the ‘South Korean Government is to announce measures next week to boost domestic consumption.’

- This week’s data release saw the overall consumer sentiment index edge down by 2.8 points to 100.8 in August, according to the BOK. The threshold dividing optimism and pessimism is 100.

- An index measuring the outlook for home prices climbed to 118 in August from 115 last month, marking a third straight rise; dominated by housing in Seoul.

- Concerns about Seoul house prices have been mentioned explicitly by the Bank of Korea Governor.

- Several government spokesmen have indicated their dissatisfaction at the Central Bank not cutting rates this week.

- Any policy announcement will be watched closely by the bond market for the potential impact on issuance of new government bonds and any likely impact on monetary policy going forward.

- The KTB 10yr bond ticked up 1bp in yield in the morning session.

SINGAPORE DATA: Core Inflation Moderates in July.

- Core inflation slowed in July, more than expected.

- The decline opens the door for monetary adjustments after the Federal Reserve meeting in September.

- Core prices (ex transport and accommodation) was up 2.5% year-on-year.

- Market expectations were for a rise of 2.9% following 2.9% in June.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2024 | 1500/1700 |  | EU | ECB's Cipollone in panel at the Rimini Meeting | |

| 26/08/2024 | 0700/0900 | ** |  | ES | PPI |

| 26/08/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/08/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/08/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/08/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.