-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI EUROPEAN MARKETS ANALYSIS: Weaker China Inflation Helps USD Recoup Some Of Friday's Losses

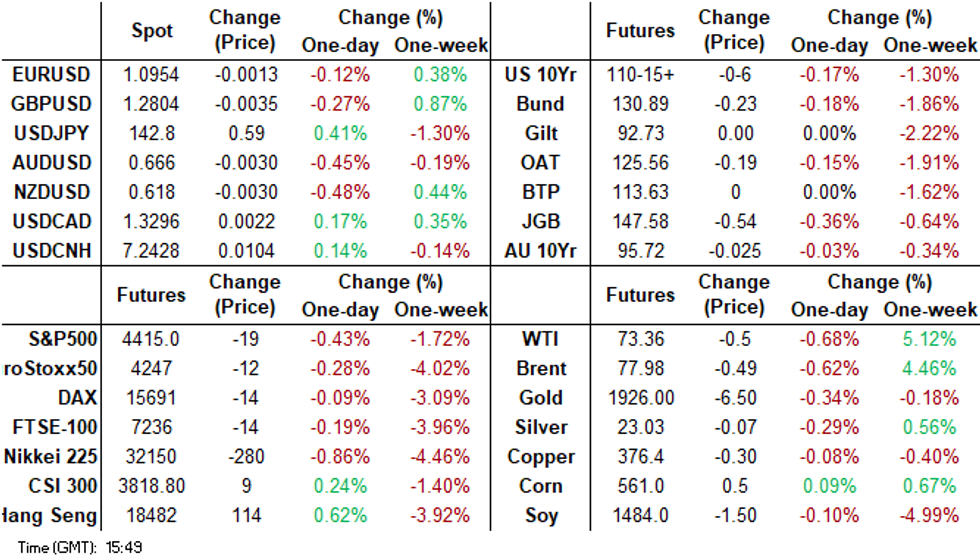

- China June inflation data was weaker than expected, with calls for further policy stimulus likely to continue after today's print. USD/CNH rebounded from fresh lows from around 7.2200 to 7.2430/40 this afternoon. Other USD/Asia pairs are mostly higher, while AUD and NZD are down around 0.50%.

- HK/China equities rallied strongly at the open on hopes the worst of the regulatory burden on the tech sector is now behind us. However, gains have been pared post the break.

- Cash tsys sit 1bp richer to 1bp cheaper, the curve has twist flattened pivoting on 7s. Tsys were pressured in early dealing, there was no overt headline driver as participants perhaps focused on the stronger than expected AHE from Friday's NFP report.

- In Europe the docket is thin, further out the final print of May Wholesale Inventories crosses. Fedspeak from VC Barr, SF Fed President Daly, Cleveland Fed President Mester and Atlanta Fed President Bostic is also due.

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 110-15+, -0-06, a narrow 0-06 range has persisted on volume of ~65k.

- Cash tsys sit 1bp richer to 1bp cheaper, the curve has twist flattened pivoting on 7s.

- Tsys were pressured in early dealing, there was no overt headline driver as participants perhaps focused on the stronger than expected AHE from Friday's NFP report.

- Losses marginally extended as Chinese inflation was weaker than forecast which weighed on risk sentiment and saw the USD firm off session lows.

- There was little follow through and narrow ranges persisted for the remainder for the session.

- In Europe the docket is thin, further out the final print of May Wholesale Inventories crosses. Fedspeak from VC Barr, SF Fed President Daly, Cleveland Fed President Mester and Atlanta Fed President Bostic is also due.

JGBS: Futures Weaker, At Session Cheaps, 5-Year Supply Tomorrow

In the Tokyo afternoon session, JGB futures are trading on a negative note, -49 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined balance of payments and bank lending data.

- Accordingly, local participants have been on headlines and US tsys watch.

- Tsys have been pressured in recent dealing and sit a touch-off session lows despite weaker-than-expected China CPI data.

- The bear steepening of cash JGBs curve extends in Tokyo afternoon trade in line with the higher and positive spreads seen at today’s BoJ Rinban operations. Yields are 0.4bp lower to 6.4bp higher with the 20-year zone as the underperformer ahead of Thursday's supply. The benchmark 10-year yield is 4.0bp higher at 0.468%, below the BoJ's YCC limit of 0.50%. The benchmark 5-year is 2.0bp cheaper at 0.122%, outperforming on the curve, ahead of tomorrow’s supply.

- Swap rates are higher across the curve with rates 0.2bp to 5.7bp higher. Swap spreads are mixed.

- Tomorrow the local calendar sees M2 & M3 Money Supply (Jun) and Machine Tool Orders (Jun P) along with 5-year supply.

- The global calendar is relatively light today with US Wholesale Inventories and US Consumer Credit as the highlights.

AUSSIE BONDS: Narrow Range, Twist Steepening, Confidence Data Highlights Tomorrow

ACGBs remain mixed (YM +1.0 & XM -2.5) after trading in a relatively narrow range in the Sydney session. In the absence of domestic data, local participants have been on headlines and US tsys watch.

- Tsys have been pressured in Asia-Pac dealing and sit a touch-off session lows. There has been no obvious headline driver for the move.

- Cash ACGBs are 2bp richer to 3bp cheaper with the AU-US 10-year yield differential +1bp at +21bp.

- The swap curve has twist steepened with rates -3bp to +4bp.

- Bills are richer across the strip with pricing +3 to +6, early reds leading.

- RBA dated OIS are 4-8bp softer across meetings beyond October with early to mid'24 leading.

- (AFR) Westpac’s Bill Evans will move on from his role of chief economist from January next year, to be replaced by RBA assistant governor Luci Ellis.

- Tomorrow the local calendar sees CBA Household Spending data for June, Westpac Consumer Sentiment for July, and NAB Business Confidence for June. Additionally, on Wednesday, market attention will be focused on Governor Lowe's speech, as investors hope to gain insights into the central bank's level of concern regarding inflation.

- The global calendar is relatively light today with US Wholesale Inventories and US Consumer Credit as the highlights.

NZGBS: Twist Steepening, 10Y Performs In Line With US Tsys & ACGBs

NZGBs closed with benchmark yields 2bp richer to 4bp cheaper. After opening the local session with a material outperformance versus US Tsys and ACGBs, NZGBs closed with the NZ/US and NZ/AU 10-year yield differentials unchanged.

- The swap curve closed with the rates -2bp to +4bp and the 2s10s curve 6bp steeper.

- The local calendar is light again tomorrow, ahead of the RBNZ policy decision on Wednesday. BBG consensus is unanimous in expecting a no-change outcome after the RBNZ steered the market in its May Monetary Policy Statement that it expected that no further increases in the OCR would be required and that now is the time to “watch, worry and wait”. (See link)

- RBNZ dated OIS pricing closed little changed across meetings. A 14% chance of a 25bp hike is priced for this week’s policy meeting. Terminal OCR expectations are sitting at 5.79%.

- A majority of nine members of the RBNZ Shadow Board recommend no change in the OCR at the July 12 decision given slowing demand, the NZIER says in a statement. One member recommends a 25bp increase to 5.75%. Looking ahead a year, the Shadow Board views centre on an unchanged 5.5% but with a range from 4.5% to 6%. (See link)

NZ RATES: RBNZ Dated OIS – Terminal OCR Expectations Follow Global STIR Higher

Today RBNZ dated OIS pricing is little changed across meetings ahead of the RBNZ policy decision meeting on Wednesday.

- BBG consensus is unanimous in expecting a no-change outcome after the RBNZ steered the market in its May Monetary Policy Statement that it expected that no further increases in the OCR would be required and that now is the time to “watch, worry and wait”.

- A 14% chance of a 25bp hike is priced for Wednesday’s policy meeting.

- Terminal OCR expectations are holding at 5.80% after shunting 14bp firmer on Friday.

Figure 1: RBNZ Dated OIS Terminal Rate Pricing (%)

Source: MNI – Market News / Bloomberg

FOREX: USD Firms In Asia

The greenback is firmer in Asia, paring some of Friday's post NFP losses. Inflation data from China was weaker than forecast which weighed on risk sentiment in the Asian session, seeing the USD firm from session lows and US equity futures fall from session highs alongside regional equities.

- Kiwi is the weakest performer in the G-10 space, NZD/USD is down ~0.5%. The pair has broken below the $0.62 handle and last prints at $0.6180/85. Bears look to sustain a break of $0.62 to target the 20-Day EMA ($0.6163).

- AUD/USD is also pressured, the pair is down ~0.4% and last prints at $0.6660/65. The pair remains well above support at $0.6596 the low from June 29.

- Yen has also fallen, giving back some of Friday's outperformance. USD/JPY is up ~0.4%, we remain under the ¥143 handle for now, last printing at ¥142.75/85. Resistance comes in at ¥145.07, June 30 high and bull trigger. Support is at ¥142.11, the 20-Day EMA.

- Elsewhere in G-10, EUR is down ~0.1% as the broad based US strength weighs. GBP is down ~0.2%.

- Cross asset wise; e-minis are down ~0.3% and the Hang Seng is up ~0.8% having been up over 2% in early dealing. BBDXY is ~0.2% firmer, and the US Tsy curve is marginally steeper.

- There is a thin docket on Monday, the next macro risk event is on Wednesday when the latest US CPI figures cross.

NZD: Commodity Prices Main Macro Driver Last Week

NZD/USD correlations with global commodities have strengthened over the past week, standing out as a key macro driver in recent dealings. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Recent strength in the NZD, the pair rose ~1.8% last week, looks to be associated with rising global commodity prices. Widening 2 Year Yield Differentials also added a layer of support. The pair looked through weakness in global equities and milk futures last week.

- Over the longer term there is no stand out macro driver for NZD, however global commodities and global equities have the strongest correlation over the last month.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

EQUITIES: Most Regional Markets Tracking Higher, HK/China Shares Down From Early Highs

Regional equities are mixed. The early focus was on HK and China market gains, which were led by the tech sector, on hopes that worst of the tech regulatory crackdown is now behind us. However, gains have been pared as the session progressed. Other markets are mostly higher, with Japan and Australia, NZ, the exceptions. US equity futures are in the red, Eminis last down ~0.15% to be around 4428.

- Eminis bottomed out around the 4422 level in earlier trade, not too far from lows last Thursday around 4420.

- The HS Tech index was up 3.2% at one stage, but now sits up 1.2% at the break, still tracking higher for the first time since last Tuesday. The HSI is +0.78%. Fines for Ant and Tencent are giving hope that the regulatory crackdown on the tech sector is now behind us.

- The CSI 300 was up strongly in early trade, but now sits +0.52% firmer at the break. June inflation data was weaker than expected, underscoring a still soft economic backdrop but raising hopes of fresh stimulus.

- Japan shares are tracking weaker, the Topix -0.50% at this stage, while the Nikkei has lost around 0.70%. The ASX 200 is also weaker, down by 0.25% at this stage.

- SEA stocks are mostly higher, although gains are generally sub 0.50%. Malaysian stocks are slightly outperforming, up 0.60%.

OIL: Edging Down From Recent Highs

Brent crude has edged away from recent highs as Monday's Asia Pac session has progressed. We were last just under $78.00/bbl. Against highs just above $78.50/bbl from late in NY dealing on Friday. This puts Brent 0.64% lower for the session so far. However, this is unwinding only a modest proportion of Friday's +2.55% gain. WTI was last around $73.35/bbl off by a similar amount for the session so far (-0.69%).

- Weaker oil levels are in line with a firmer USD during the course of the session so far, whilst risk aversion has also been evident in terms of weaker US equity futures.

- Lower than expected China inflation outcomes have also likely weighed at the margin, in terms of painting a less supportive China outlook.

- Still, we are only modestly off recent highs, and Brent remains comfortably above the 20 and 50-day EMAs at this stage. The 100-day EMA (around $78.40/bbl) remains a resistance point on the topside.

GOLD: Higher As Attention Turns To Wednesday's US CPI Data

Gold is slightly weaker in the Asia-Pac session, after closing +0.7% at $1926.05 on Friday, boosted by a weaker USD following the US payrolls report.

- Non-farm payrolls increased 209k which was marginally less than the 225k expected but there were large downward revisions of 110k to previous months. US tsys gapped higher initially after the data dropped but reversed support as attention turned to the unemployment rate falling back to 3.6%, from 3.7% in May, and wage growth printing stronger than expected, rising 4.4% on an annual basis.

- Traders are currently anticipating the release of inflation data scheduled for Wednesday, which will greatly influence expectations regarding the next actions of the Federal Reserve.

- According to forecasts, the inflation report is expected to reveal a 3.1% increase in the CPI compared to the previous year, marking the smallest rise since March 2021. This is primarily attributed to the decrease in gasoline prices. Core CPI, excluding volatile items, is predicted to show a year-on-year increase of 5.0%, slightly lower than the previous reading of 5.3%.

- Despite these figures, the majority of traders still anticipate another interest rate hike by the Fed later this month, which could reduce the attractiveness of non-interest-bearing gold.

CHINA DATA: June Inflation Prints Below Expectations, With Soft Details

China June inflation data was weaker than expected. Headline CPI was flat y/y, versus +0.2% forecast. In the month, the CPI fell -0.2%, the same as May. M/M outcomes have been negative for the past 5 months. Non-food inflation fell -0.6% y/y, while food inflation rose 2.3% y/y. The core ex food and energy measure rose 0.4% y/y (May was 0.6%), a fresh low back to early 2021. The chart below overlays the core CPI print against the 10yr government bond yield.

- Looking at the details of the CPI print, food and housing saw a pick up in y/y momentum, although housing is only back to flat after a long run of negative prints. The other 6 categories saw either the same y/y outcome or softer y/y momentum.

Fig 1: China Core CPI & 10yr Government Bond Yield

Source: MNI - Market News/Bloomberg

- The PPI was also weaker than expected at -5.4% y/y, versus a -5.0% forecast. Weaker momentum was evident across all the sub components. Manufacturing eased to -4.7% y/y (from -4.6%), with consumer goods -0.5% y/y, with durables off by -1.5%.

- Raw material prices fell -9.5% y/y, although we may see stability soon on this front given some basing in global commodity prices in recent months, see the second chart below.

- All in all though, the data still point to a challenging macro backdrop for China. Calls for further policy stimulus are likely to persist post today's prints.

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Rebound, INR Outperforms Modestly

Most USD/Asia pairs are above lows for the session, with the USD supported on dips. The weaker China inflation data has aided the turnaround, whilst all of the G10 bloc is weaker against the dollar as well. The Rupee is seeing some outperformance. Tomorrow delivers May trade data for the Philippines, while China June aggregate credit data should also be out this week.

- USD/CNH is around session highs, last in the 7.2430/40 region. This is 0.15% weaker in CNH terms versus NY closing levels from Friday. Weaker inflation data has weighed and offset a better equity tone amid optimism that tech regulatory headwinds are now behind us. The pair did get to a low of 7.2200 before support emerged. The CNY fixing was again on the strong side.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing, the measure remains well within recent ranges. We now sit ~0.7% below the upper end of the band. Broader greenback trends dominated flows for USD/SGD on Friday, the pair was pressured as broad based USD weakness weighed. Support came in ahead of $1.3450. Losses have been pared this morning, as weaker than expected Chinese CPI boosts the greenback, and the pair sits a touch under the 20-Day EMA ($1.3487). The Advance read of Q2 GDP headlines this weeks docket, a fall of 0.2% Q/Q is expected.

- The ringgit is little changed from Friday's closing levels in a muted start to the week's dealing. USD/MYR prints at 4.6640/70. On Friday the pair was marginally firmer rising ~0.1% however ranges were narrow with little follow through on moves. The local docket is thin this week, the only data of note is May Industrial Production which crosses on Wednesday. A rise of 1.5% Y/Y is expected, the prior read was -3.3%.

- The Rupee is a touch firmer in early dealing, USD/INR has retreated from its highest level since late May and is down ~0.1% today. The pair is trimming some of Friday's ~0.3% gain, as the Rupee suffered its largest one week fall since early December 2022. The highlight of the week's data docket is the June CPI print which crosses on Wednesday, an uptick in CPI to 4.58% Y/Y from 4.25% is expected. Also due this week is May Industrial Production, an increase of 5.0% Y/Y is expected, which crosses on Wednesday. On Friday June Trade Balance is due, a deficit of -$20.05bn is expected.

- USD/IDR is tracking higher in the first part of Monday trade, the pair last just under the 15200 level. Earlier highs were at 15210. The 1 month NDF is also climbing, last around the 15250/55 level, slightly down from session highs (15275). Both pairs are comfortably above all key EMAs. Note for spot USD/IDR, the simple 200-day MA comes in around 15222. On the data front we had June consumer confidence edged down to 127.1 from 128.3 prior. This is not typically a market mover though.

- Like elsewhere in the region, USD/THB has seen support emerge after tracking lower in the first part of trade. From lows close to 35.05 we now sit back at 35.20, close to unchanged for the session. July highs in the pair come in just above the 35.30 level, while recent lows rest near 34.84. We are above all key EMAs, with the 20-day, near 35.05, the closest. The local data calendar is quiet this week, with only June consumer confidence out on the 13th (this Thursday). Thursday should also see the National Assembly gather, where it is expected to vote for a new PM. Challenger Pita Limjaroenrat may face opposition in the Senate, but held a rally on Sunday to galvanize support.

- Spot USD/PHP sits just below session highs, last near 55.62. This is down slightly from Friday closing levels, but only modestly, with little follow to early USD weakness sub the 55.40 level. There has been some selling interest evident above 55.60 in recent sessions. Key EMAs remain clustered nearby, while the 200-day is slightly lower, just under 55.40. The 1 month NDF was last around 55.67, slightly above NY closing levels from Friday. Tomorrow, we get May trade data, with the market expecting the deficit to remain wide at -$4629mn.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/07/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/07/2023 | - | *** |  | CN | Money Supply |

| 10/07/2023 | - | *** |  | CN | New Loans |

| 10/07/2023 | - | *** |  | CN | Social Financing |

| 10/07/2023 | 1230/0830 | * |  | CA | Building Permits |

| 10/07/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/07/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 10/07/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/07/2023 | 1500/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/07/2023 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/07/2023 | 1900/1500 | * |  | US | Consumer Credit |

| 10/07/2023 | 1900/2000 |  | UK | BOE Bailey Speech at Financial & Professional Services Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.