-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Market Unwinds RBNZ -ve OCR Pricing For '21

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* FED'S ROSENGREN FAVORS LONGER QE DURATION (MNI)

* ECB SOURCES: COVID VACCINE COULD SMOOTH RECOVERY (MNI)

* RBNZ INCREASES STIMULUS AS DOUBTS EMERGE OVER NEGATIVE RATES (BBG)

* MCCONNELL PUSHING FOR 'HIGHLY TARGETED' COVID-19 RELIEF DEAL (THE HILL)

* BYTEDANCE ASKS U.S. COURT TO INTERVENE IN TIKTOK FORCED SALE (BBG)

* HONG KONG OUSTS FOUR OPPOSITION LAWMAKERS ON CHINA RULES (BBG)

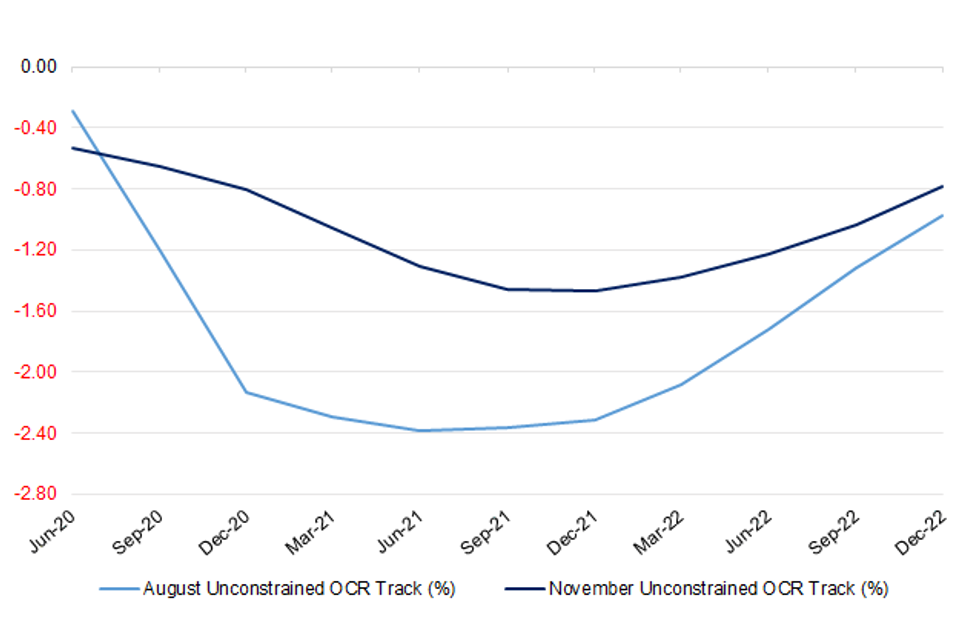

Fig. 1: RBNZ November vs. August Unconstrained OCR Track (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: A breakthrough in COVID-19 vaccinations means there is a "70-80%" chance the UK will be returning to normality by Easter - as long as authorities do not "screw up" distribution of the jab, a top a scientific adviser has said. Sir John Bell, Regius Professor of medicine at University of Oxford, told MPs the announcement by Pfizer and BioNTech suggested there could be two or three coronavirus vaccines by the new year. He said he was "quite optimistic" that most of the country's vulnerable people could have jabs administered by spring - heralding a resumption of normal life. (Sky)

CORONAVIRUS: The tier system of Covid-19 restrictions will be changed before it is reintroduced because of concerns over compliance, it has emerged. Ministers are considering carving England up into large regions, that will then be placed into the tiers in order to simplify the system brought in last month. A fourth tier also remains under considerationif the current lockdown fails to bring down the infection rate far enough, Government sources said. Matt Hancock, the Health Secretary (seen below, speaking in late October), said that regions would not necessarily emerge from the current lockdown into the same tier they were in last month. But Government sources said the tiers may not be "exactly the same". (Telegraph)

CORONAVIRUS: Conservative MPs who voted against the current lockdown in England have formed a new group aimed at preventing further blanket national restrictions. The Covid Recovery Group will argue for a different approach when the current curbs end on 2 December to enable the country to "live with the virus". Its 30-plus members want more analysis of the economic damage being done and to challenge the scientific advice. (BBC)

BREXIT: The Government has delayed a vote over legislation that threatens to tear up the Brexit divorce deal and poison relations with US President-elect Joe Biden. Boris Johnson pushed back a Commons vote on the Internal Market Bill , which overrides parts of the Withdrawal Agreement relating to Northern Ireland, until the end of the month at the earliest. (Telegraph)

BREXIT: Brussels has warned that it will only grant the City of London market-access rights that are "in the EU's interests" even after Britain adopted regulatory decisions designed to smooth future ties. Britain's chancellor Rishi Sunak announced on Monday that the government was taking regulatory decisions intended to ensure that EU-based exchanges, clearing houses and financial benchmarks could continue to be used by UK customers. The moves, known as equivalence decisions, effectively endorse EU regulations and financial supervision as being as good as the UK's. (FT)

BREXIT: Joe Biden, US president-elect, has delivered a warning to Boris Johnson not to let Brexit destabilise the Northern Ireland peace process, in a call that suggested the "special relationship" is about to become more complicated. Mr Biden surprised Downing Street by including Mr Johnson among the first world leaders to receive a post-election phone call, but the diplomatic niceties were accompanied by a firm message on Brexit. "They talked about the importance of implementing Brexit in such a way that upholds the Good Friday Agreement," said one British official, referring to the peace accord that ended decades of violence in Northern Ireland. "The PM assured the president-elect that would be the case." (FT)

BREXIT: Liz Truss's Department for International Trade (DIT) is scrambling to meet a Wednesday deadline for tabling £80bn of trade agreements before parliament, in time for them to come into force in January under standard procedures. Truss's department has signed a string of "continuity agreements" to ensure the UK can go on trading with non-EU countries on similar terms, when the Brexit transition period comes to an end on 31 December. (Guardian)

EUROPE

ECB: MNI EXCLUSIVE: Covid Vaccine Could Smooth Recovery - ECB Sources

- News that a Covid-19 vaccine was 90% effective in Phase 3 trials boosts confidence and could herald a smoother eurozone recovery in 2021, but will have little effect on European Central Bank preparations for additional December easing, ECB sources told MNI.

ECB: European Central Bank must introduce additional monetary policy stimulus in December to stave off the risk of deflation in the euro zone, the Bank of Spain's chief economist said. "We know that in order to ensure such a risk doesn't materialize, we must act swiftly and forcefully," Oscar Arce, the Spanish central bank's director general of economics, said in an interview in Madrid on Tuesday. The prospect of an entrenched decline in prices stalks the entire currency bloc and not just Spain, he said. (BBG)

FRANCE: Deaths in France from the coronavirus rose 1,220 to 42,207, the biggest increase since April 15. The European nation also reported 22,180 new s cases in the past 24 hours. The seven-day average, which smooths out fluctuation in the data, dropped to 46,699 cases. (BBG)

ITALY: Italy reported 35,098 new coronavirus cases Tuesday, bringing the total to 995,463. Covid-19 related daily deaths jumped to 580, the most since mid-April. Silvio Brusaferro, head of the ISS public health institute, said at a press conference that the pressure on hospitals is close to critical levels. Covid-19 patients occupied 36% of all intensive therapy units and 51% of hospital beds across the country. (BBG)

ITALY: Italy may need to spend as much as 10 billion euros ($11.8 billion) a month to aid businesses and workers hit by coronavirus restrictions, according to people familiar with the matter. Authorities are working on plans that would help the country navigate through a surge in infections that's derailed the rebound from one of Europe's worst recessions. Lockdown measures similar to the ones imposed earlier this year are estimated to cost the government between 40 billion to 50 billion euros, or about 3% of Italy's output, if they last until March, said the people, who declined to be identified because the discussions are confidential. Under softer curbs, the aid bill would be at least 6 billion euros a month, they said. (BBG)

U.S.

FED: MNI INTERVIEW: Fed's Rosengren Favors Longer QE Duration

- Boston Federal Reserve President Eric Rosengren told MNI Tuesday he would prefer to see the Fed lengthen the average duration of its Treasuries purchases rather than increase buying, adding that more QE overall may be "advantageous" if longer rates rise amid a challenging next six months - on MNI Main Wire and email now - for more details please contact sales@marketnews.com - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: Despite potentially groundbreaking news about a coronavirus vaccine, the economy is still in danger and needs help, San Francisco Federal Reserve President Mary Daly said Tuesday. Fed officials continue to discuss what they can do to help, and those talks have included stepping up the asset purchase program if necessary, the central bank official told CNBC. (CNBC)

FED: Dallas Federal Reserve President Robert Kaplan said on Tuesday he was "cautious and concerned" about downside economic risks in the short run because of the resurgence of the coronavirus, but more optimistic in the longer term. "The next two quarters are going to be very challenging, very difficult," Kaplan told Bloomberg's Future of Finance virtual conference. "Downside risks are growing with this resurgence." (RTRS)

FED: Kansas City Federal Reserve Bank President Esther George said Tuesday she was encouraged and surprised by the strength of the third-quarter bounceback from the coronavirus downturn, but said she expects growth to moderate, and believes Fed monetary policy is where it should be. "The calibration right now is appropriate," George said of the Fed's near-zero interest rates and current pace of bond buys. The key risk to growth, she said in a virtual event put on by Monmouth University, is the coronavirus, which has put women and people of color out of work at higher rates than others, and continues to weigh on some sectors more than others. (RTRS)

ECONOMY: MNI EXCLUSIVE:US Hiring Dimmed by Skills Mismatch, Covid Worry

- Companies are having a harder time hiring as laid-off service workers lack the skills needed in the more stable goods-producing sector, while fear of contracting Covid-19 deters people from searching for work, recruiters and industry experts told MNI. Employers through October struggled to fill available positions or attract applicants, even with a lot of people still out of work, said Mike Brady, who owns a staffing company in Jacksonville, Florida. "For us, there's definitely more job openings than there are people to fill them," he said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: Senate Majority Leader Mitch McConnell (R-Ky.) said Tuesday he believes Congress needs to pass a "highly targeted" coronavirus relief deal, similar to the roughly $500 billion GOP bill that was blocked earlier this year. McConnell's comments underscore that the price tag remains the biggest hurdle for any potential deal, with a dispute regarding the size of a package looming over any hopes of clinching a deal before the end of the year. "I don't think the current situation demands a multitrillion-dollar package. So I think it should be highly targeted, very similar to what I put on the floor both in October and September," McConnell told reporters. (The Hill)

FISCAL: GOP Senator Kennedy says he's doubtful of stimulus deal. (BBG)

CORONAVIRUS: Sacramento, San Diego and Stanislaus counties in California have been moved to the state's "widespread" reopening tier, which places the heaviest set of restrictions on businesses and schools for in-person learning. The widespread level of California's four-tiered reopening system means those counties are reporting a weekly average of more than 7 Covid-19 cases per 100,000 people every day, adjusted for number of tests performed, or a positivity rate greater than 8%, according to the state's website. (CNBC)

CORONAVIRUS: Newark, New Jersey's most populous city, immediately will enforce a curfew in three sections where positivity rates are highest, save for emergencies and those going to and from work. "No one should be on the street after 9 p.m. on weekdays and 10 p.m. on weekends," according to a statement issued by the office of Mayor Ras Baraka. Newark's positivity is 19% while New Jersey's is 7.7%, Baraka said. He also ordered the suspension of "all sports of any kind," capped indoor and outdoor gatherings at 10 people, banned visits to long-term health-care facilities and limited religious services to 25% capacity. The city is averaging 230 new cases per day, higher than some county-wide numbers. (BBG)

POLITICS: A Pennsylvania postal worker whose claims have been cited by top Republicans as potential evidence of widespread voting irregularities admitted to U.S. Postal Service investigators that he fabricated the allegations, according to three officials briefed on the investigation and a statement from a House congressional committee. (Washington Post)

POLITICS: President-elect Joe Biden said Tuesday that the Trump administration's refusal to authorize the start of the official transition process "does not in any way change the dynamic of what we're able to do." "We have already started the transition, we are well under way," Biden said at a press conference in Wilmington, Delaware. Asked what he thought of President Donald Trump's refusal so far to concede, Biden said: "I just think it's an embarrassment, quite frankly." (CNBC)

POLITICS: Secretary of State Mike Pompeo on Tuesday did not acknowledge President-elect Joe Biden's victory in the election when he was asked whether he would cooperate with the Biden administration's transition team. "There will be a smooth transition to a second Trump administration," Pompeo said during a State Department news conference. (CNBC)

POLITICS: Pennsylvania's secretary of state will ask a federal judge to dismiss a new lawsuit by the Trump campaign, which seeks to bar the state from certifying the results of its election between President Donald Trump and President-elect Joe Biden. "The Secretary disputes that Plaintiffs have stated a claim," lawyers for Secretary of State Kathy Boockvar wrote in a court filing Tuesday, which also asked the judge to move the case to Harrisburg, the state's capital. (CNBC)

POLITICS: Most of the Affordable Care Act appeared likely to survive Tuesday as the Supreme Court heard oral arguments over the law's individual mandate. Two members of the court's conservative majority — Chief Justice John Roberts and Justice Brett Kavanaugh — suggested they're unlikely to throw out the entire health care law, as Republican attorneys general and the Trump administration have urged. Their votes would be enough to save it. (axios)

MARKETS: President-elect Joe Biden on Tuesday tapped a number of fierce advocates for Wall Street regulation to his agency review teams, a sign that he could be quickly preparing to take stock of the deregulatory push President Trump has led for almost four years. (Washington Post)

MONEY MARKETS: The drumbeat for change to rules surrounding money-market mutual funds may be growing, with U.S. central bank official Eric Rosengren on Tuesday once again taking aim on the subject. Money funds "failed again" during the coronavirus-related market upheaval that took place earlier in the year, and there needs to be a focus on reforming the rules that govern them, the Federal Reserve Bank of Boston president said Tuesday. He said it was prime funds -- those which are able to invest in non- government-backed instruments -- "that were the problem" and that the situation surrounding money funds is "quite disturbing." (BBG)

EQUITIES: Apple held a product launch event Tuesday, where it announced its first homemade chip for the Mac, the M1. The company also introduced three new Macs powered by the chip: A new MacBook Air laptop, a new 13-inch MacBook Pro laptop and Mac Mini desktop computer. The designs look nearly identical to the current generation of each computer. Apple made several claims about the M1′s performance and how it'll contribute to better battery life in the new Macs. (CNBC)

EQUITIES: U.S. aviation authorities are considering new safety-related penalties or other enforcement action against Boeing Co., according to a person briefed on the details, even as they prepare to allow the plane maker's beleaguered 737 MAX fleet back in the air as soon as the middle of next week. (WSJ)

EXCHANGE NEWS: A Fox reporter tweeted the following on Tuesday: "Officials at major exchanges meeting w @GregAbbott_TX about moving to Texas as NY NJ weigh various tax schemes but they say chances of moving are low, and the meetings are meant to send a message to lawmakers to back off taxes." (MNI)

OTHER

U.S./CHINA: ByteDance Ltd., the Chinese owner of TikTok, asked the federal appeals court in Washington to intervene to prevent the U.S. government from requiring it to sell the popular video-sharing app or face a ban in America. The Beijing-based company is seeking to block an order forcing it to sell by Thursday its most important international business, a viral video service with upwards of 100 million users in the U.S. The Trump administration issued an executive order banning TikTok in the U.S. on national security grounds, and demanded the Chinese company cede control of TikTok to American investors. (BBG)

CORONAVIRUS: Anthony Fauci, the top U.S. infectious-disease expert, said Americans less at risk for contracting Covid-19 could have access to a vaccine by April. "I would say by April you'll be able to be vaccinated," he said on CNN, indicating the time frame was an estimate. The Centers for Disease Control and Prevention is in charge of prioritizing who will get a shot first. Health-care providers and high-risk groups such as the elderly would likely be at the front of the line, Fauci said. He said in a CNN interview yesterday that some of the first vaccinations could come at the end of the month or December. Fauci acknowledged logistical challenges related to distributing doses, but said the Trump administration's Operation Warp Speed program was meant to help overcome those hurdles. (BBG)

CORONAVIRUS: Health and Human Services Secretary Alex Azar told reporters the government will begin distributing Eli Lilly's coronavirus antibody treatment to state health departments this week, Reuters reported Tuesday, a day after the company received an emergency use authorization from the Food and Drug Administration and the number of confirmed coronavirus cases in the U.S. soared past 10 million. (BBG)

CORONAVIRUS: States and local health-care systems should expect to face some early challenges administering Eli Lilly's coronavirus antibody drug, senior administration officials warned Tuesday, after the FDA authorized the drug to treat patients with Covid-19. (CNBC)

CORONAVIRUS: Brazil's health regulator suspended a clinical trial of China's Sinovac coronavirus vaccine due to a severe adverse event, delighting President Jair Bolsonaro, who has repeatedly criticized the vaccine's credibility and said it would not be purchased by his government. Brazil's health regulator, Anvisa, suspended the trials late on Monday saying the event occurred on Oct. 29. The state government of Sao Paulo, where the trial is being run, said the death of a trial volunteer had been registered as a suicide and was being investigated. A police report of the incident was seen by Reuters. (RTRS)

CORONAVIRUS: China will actively consider the COVID-19 vaccine needs of countries within the Shanghai Cooperation Organization and support the creation of hotlines among their centers for disease control and prevention, Chinese President Xi Jinping said at an SCO summit. Xinhua News Agency reported comments from Xi, who said that China would strive to preserve multilateral frameworks, support global governance and strengthen cooperation and communication. He said China welcomed participation in the the opening up of its economy and co-operation in the digital economy, e-commerce and other innovation projects. (MNI)

HONG KONG: Hong Kong government immediately disqualifies four opposition lawmakers after Xinhua says China will disqualify lawmakers in the city that support independence of the city or seek foreign interference in its affairs. The four are Alvin Yeung, Dennis Kwok, Kwok Ka-ki and Kenneth Leung. Chief Executive Carrie Lam to meet the media at 2:30pm local time Wednesday. (BBG)

JAPAN: Japan to extend large event capacity cap until end-Feb. (Yomiuri)

RBNZ: New Zealand's central bank delivered a fresh round of monetary stimulus while also projecting a more upbeat view of the economic recovery, prompting investors to remove bets that interest rates will go negative next year. Policy makers agreed to begin a new Funding for Lending Program in December aimed at reducing banks' funding costs and lowering interest rates, the Reserve Bank said in a statement Wednesday in Wellington. In its economic projections, the RBNZ was less pessimistic about future economic growth and inflation, and sees a lower peak in the jobless rate. New Zealand's currency climbed and bond yields surged as traders priced out the chance of the official cash rate being taken negative in 2021. (BBG)

RBNZ: New Zealand's Central Bank said on Wednesday that it would consult next month on whether to reintroduce limits on the amount of "high-risk lending" banks can make, amid growing concerns of a housing bubble in the country. The Reserve Bank of New Zealand removed the loan-to-value ratio (LVR) restrictions on mortgage lending until May earlier this year to spur credit flow and boost the economy hit by the coronavirus pandemic. But historically low interest rates, no LVR restriction, and chronic shortages have pushed up prices in an already booming housing market. (RTRS)

TAIWAN: Undersecretary of State Keith Krach will lead the U.S. delegation in the Economic Prosperity Partnership Dialogue with Taiwan, Secretary of State Michael Pompeo told reporters on Tuesday. (BBG)

ASIA: The long-awaited travel bubble between Hong Kong and Singapore will launch on November 22, with the number of people allowed to move quarantine-free in each direction initially limited to 200 per day. (SCMP)

OIL: Saudi Arabia and Iraq agreed on Tuesday on coordinating positions in the oil sector within the scope of work of OPEC and OPEC+ and to fully commit to all decisions that have been agreed upon in a manner that guarantees reaching fair and appropriate oil prices for exporters and consumers, Saudi state news agency said, citing a joint statement. The statement came after a virtual meeting between Saudi Crown Prince Mohammed bin Salman and Prime Minister Mustafa al-Kadhimi. (RTRS)

OIL: The U.S. Energy Information Administration on Tuesday cut its 2021 world oil demand growth forecast by 360,000 barrels per day to 5.89 million bpd. In its monthly forecast, the agency raised its oil demand growth estimate for 2020 by 10,000 bpd to -8.61 million bpd. (RTRS)

CHINA

YUAN: Chinese foreign trade firms are buying more foreign currency on concerns that the yuan may weaken following a five-month rally, the 21st Business Herald reported citing market participants. As the U.S. election result becomes clearer, traders believe that the Yuan has peaked, the newspaper said. The companies interviewed said they may gain on exchange rates even given the extremely low interest rates on forex deposits. (MNI)

ECONOMY: China is not entering a prolonged period of deflation despite the CPI index sliding to decade-low 0.5% y/y in October, the Economic Daily commented. The low CPI resulted from a low base of comparison and declining pork prices, the Daily said. Core CPI excluding food and energy prices still rose 0.5% y/y, maintaining the pace of the previous month, the report said. (MNI)

FINTECH: China's top banking watchdog doubled down on a renewed push to rein in financial technology companies such as Ant Group Co., promising to eliminate monopolistic practices and strengthen risk controls in the industry. Liang Tao, a vice chairman of the China Banking and Insurance Regulatory Commission, said at a conference in Beijing on Wednesday that fintech companies don't change the nature of the financial industry and regulators should be attentive to the risks and challenges of digitization. Firms should be subject to the same supervision and risk management requirements as banks, he said. (BBG)

OVERNIGHT DATA

JAPAN OCT, P MACHINE TOOL ORDERS -5.9% Y/Y; SEP -15.0%

JAPAN OCT MONEY STOCK M2 +9.0% Y/Y; MEDIAN +9.1%; SEP +9.0%

JAPAN OCT MONEY STOCK M3 +7.5% Y/Y; MEDIAN +7.6%; SEP +7.4%

AUSTRALIA NOV WESTPAC CONSUMER CONFIDENCE INDEX 107.7; OCT 105.0

AUSTRALIA NOV WESTPAC CONSUMER CONFIDENCE +2.5% M/M; OCT +11.9%

This is another strong result. It follows the 11.9% increase in October with the Index now 35.3% above its level in August. The Index is also now 13% above the average over the six months prior to the economy wide shut-down in March and has reached its highest level since November 2013 – a seven year high! The most important developments since last month have been the significant unwinding of restrictions across Victoria and the reopening of the Victoria-NSW border. The survey was conducted over the period of November 2–6 before the second round of easing restrictions had been announced for Melbourne although with Victoria's stunning recent success in containing the virus, expectations for this second round were buoyant. It also preceded the recent encouraging developments around Pfizer's Coronavirus vaccine. During the survey week the Reserve Bank announced further interest rate cuts. While relatively modest, the cuts came with a commitment to keep rates on hold for at least three years. Subsequently, banks have further reduced the rates on fixed rate mortgages – some going below the psychologically uplifting rate of 2%. (Westpac)

SOUTH KOREA OCT UNEMPLOYMENT 4.2%; MEDIAN 3.8%; SEP 3.9%

SOUTH KOREA NOV 1-10 EXPORTS +20.1% Y/Y; OCT -28.8%

SOUTH KOREA NOV 1-10 IMPORTS +7.8% Y/Y; OCT -19.5%

SOUTH KOREA OCT BANK LENDING TO HOUSEHOLD TOTAL KRW968.5TN; SEP KRW957.9TN

CHINA MARKETS

PBOC NET INJECTED CNY30BN VIA OMOS WED

The People's Bank of China (PBOC) injected CNY150 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This resulted in a net injection of CNY30 billion given the maturity of CNY120 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) declined to 2.2000% at 09:27 am local time from the close of 2.3549% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Tuesday vs 42 on Monday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.6070 WEDS VS 6.5897

MARKETS

SNAPSHOT: Market Unwinds RBNZ -ve OCR Pricing For '21

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 443.11 points at 25347.83

- ASX 200 up 109.166 points at 6449.7

- Shanghai Comp. up 1.241 points at 3361.459

- JGB 10-Yr future down 7 ticks at 151.86, yield down 0.9bp at 0.035%

- Aussie 10-Yr future down 7.0 ticks at 99.010, yield up 7.1bp at 0.991%

- U.S. 10-Yr future -0-03 at 137-11, cash Tsys are closed

- WTI crude up $0.43 at $41.78, Gold up $5.17 at $1882.41

- USD/JPY down 11 pips at Y105.19

- FED'S ROSENGREN FAVORS LONGER QE DURATION (MNI)

- ECB SOURCES: COVID VACCINE COULD SMOOTH RECOVERY (MNI)

- RBNZ INCREASES STIMULUS AS DOUBTS EMERGE OVER NEGATIVE RATES (BBG)

- MCCONNELL PUSHING FOR 'HIGHLY TARGETED' COVID-19 RELIEF DEAL (THE HILL)

- BYTEDANCE ASKS U.S. COURT TO INTERVENE IN TIKTOK FORCED SALE (BBG)

- HONG KONG OUSTS FOUR OPPOSITION LAWMAKERS ON CHINA RULES (BBG)

BOND SUMMARY: Core FI Softens In Asia

Antipodean matters dominated headline flow during the Asia-Pac session, with the weakness in that region's FI space perhaps leaning on T-Notes during a thinner liquidity session, with cash Tsys closed (on the back of the Veterans Day holiday), as the contract traded below the lows seen in recent sessions, last -0-03 at 137-11.

- JGB futures have held shy of Tuesday's settlement levels, trading either side of the overnight close thus far, last -7, and have been a little more insulated than the broader core FI space. Cash trade sees 20s outperform, with modest richening seen across the curve. The BoJ left the size of its 1-10 Year Rinban purchases unchanged, with little in the way of meaningful movement in offer to cover ratios.

- Trans-Tasman matters, namely the RBNZ decision and communique, has added fresh weight to the Aussie bond space, squeezing already long positioning. YM -2.5 and XM -6.5, after the latter threatened to break through the 1.00% implied yield level after a brief look through. A reminder that XM traders have used this zone to build longs in recent times, but the already long positioning may limit such a dynamic this time around.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$2.5bn of the 1.00% 21 Nov '31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$2.5bn of the 1.00% 21 November 2031 Bond, issue #TB163:- Average Yield: 1.0211% (prev. 0.8975%)

- High Yield: 1.0225% (prev. 0.9000%)

- Bid/Cover: 4.2628x (prev. 3.8560x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 74.5% (prev. 31.2%)

- bidders 54 (prev. 56), successful 21 (prev. 27), allocated in full 11 (prev. 18)

EQUITIES: Mixed Overnight

The Nikkei 225 continued to run higher on the back of its recent technical breakout (which we flagged earlier this week), while the ASX 200 saw the energy sector outperform as oil continued to push higher.

- The underperformance of the tech sector witnessed in recent sessions continued to hinder the Hang Seng & the CSI 300, with yesterday's report of "China releasing a draft antitrust guideline to rein in internet-based monopolies, signalling policymakers' heightened concerns over the growing power, influence and risks of digital platforms and their market practices in the economy," per the SCMP, adding further weight.

- E-minis traded either side of unchanged.

- Nikkei 225 +1.8%, Hang Seng -0.1%, CSI -0.1%, ASX 200 +1.6%.

- S&P 500 futures +5, DJIA futures +76, NSDAQ 100 futures +35.

OIL: Supported By API Inventory Data

WTI & Brent sit ~+$0.50 vs. their respective settlement levels, building on the gains evident this week. Post settlement trade has seen crude benefit from larger than expected drawdowns in headline crude, distillate and gasoline stocks, per the latest weekly API crude inventory estimates, in addition to a drawdown at the Cushing hub, although both benchmarks sit off of their post settlement high. This came after the benchmarks added over $1.00 on Tuesday.

- Tuesday also saw the Russian Energy Minister try to deploy his poker face, as he noted that it is too early to talk about possible changes to the OPEC+ production pact.

- Elsewhere, the EIA slashed its 2021 world oil demand growth forecast by 360K bpd, while it lifted its 2020 world oil demand forecast by 10K bpd.

- The Veterans Day holiday will limit liquidity in the space on Wednesday, while the weekly DoE inventory report will not hit until Thursday owing to the holiday.

GOLD: Off Monday's Lows

Spot continues to hold away from Monday's lows, last dealing little changed around the $1,880/oz mark, after bears failed to test key support at $1,848.8/oz. The U.S. holiday and resulting closure of cash Tsy markets will limit liquidity today. From a technical perspective, bulls need to regain the 50-EMA.

FOREX: Unwinding RBNZ Easing Bets Fuels Kiwi's Surge

The RBNZ's MPS & subsequent press conference put a strong bid into the kiwi. New Zealand's central bank left its OCR & asset-purchase scheme settings unchanged, while delivering on its promise to unveil the design of a Funding for Lending Programme (FLP), to be rolled out within weeks. RBNZ easing bets were pared as policymakers tipped hat to the relative resilience of domestic economy (with caveats, stressing downside risks and lingering uncertainty) and moved the trough of their "unconstrained OCR track" 90bp higher. In addition, RBNZ Gov Orr used his presser to call the inevitability of negative interest rates into question, noting that "it's too early to tell" if we will see a sub-zero OCR. Numerous sell-side desks backpedalled on their expectations of a negative OCR, while local money markets no longer price such a scenario during 2021.

- The kiwi easily topped the G10 pile and NZD/USD surged to a 19-month high, briefly showing above the $0.6900 mark. AUD/NZD dipped through its 200-DMA and tested key support from Oct 30 low, but rejected that level for now. A spill-over from NZD strength bolstered AUD against other G10 currencies.

- USD struggled, lagging behind all of its G10 peers save for sterling. GBP partially corrected yesterday's rally, amid possible profit taking.

- Greenback sales allowed USD/CNH to grind lower still, as the rate hovers near cycle lows. USD/KRW printed worst levels since Jan 31, 2019, defying pressure from a bleak labour market report released out of South Korea. On the plus side, early South Korean trade figures pointed to a continued recovery in exports.

- Today's data-light calendar features a speech from ECB's Lagarde and Riksbank's Financial Stability Report. The U.S. observes the Veterans' Day holiday.

FOREX OPTIONS: Expiries for Nov11 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1650-55(E1.1bln), $1.1770-80(E820mln), $1.1800-10(E982mln), $1.1830-35(E1.1bln)

- USD/JPY: Y104.00($550mln), Y105.25-37($668mln)

- GBP/USD: $1.3150(Gbp479mln-GBP calls), $1.3275(Gbp428mln-GBP calls)

- USD/CNY: Cny6.5877($500mln), Cny6.63($830mln), Cny6.65($965mln-USD puts), Cny6.70($625mln)

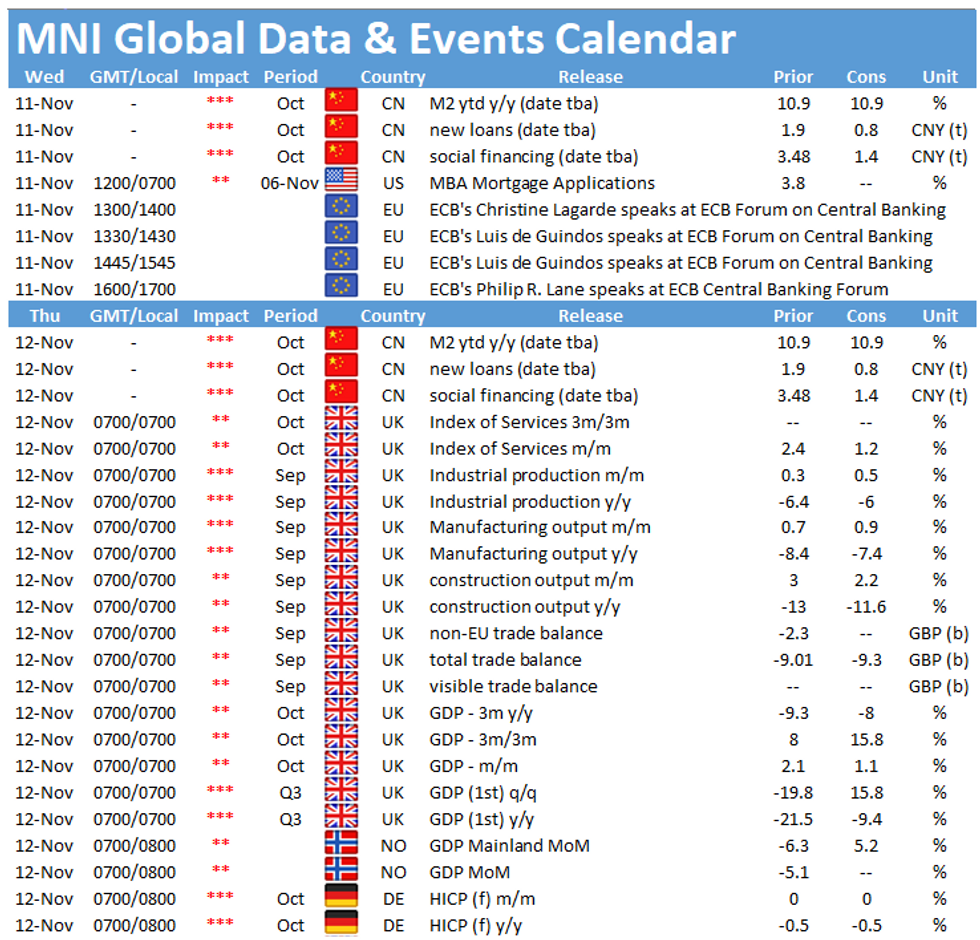

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.