-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Announces QE Extension Ahead Of Most Exp.

EXECUTIVE SUMMARY

- FED'S BOSTIC: ECONOMY COULD RECOVER MORE QUICKLY THAN EXPECTED (CNBC)

- CHINA ECONOMY'S IMPROVING TREND WON'T CHANGE (PEOPLE'S DAILY)

- TOP CHINESE DIPLOMAT CALLS FOR CHINA & U.S. TO RESTORE RELATIONSHIP (RTRS)

- RBA LEAVES RATES ON HOLD, EXTENDS QE (MNI)

- BIONTECH/PFIZER CONFIRMS PLANS FOR 2 BILLION DOSES IN 2021 (BBG)

- SILVER SLIDES ON CME MARGIN HIKE AND CFTC FLAGGING INTEREST IN MATTERS

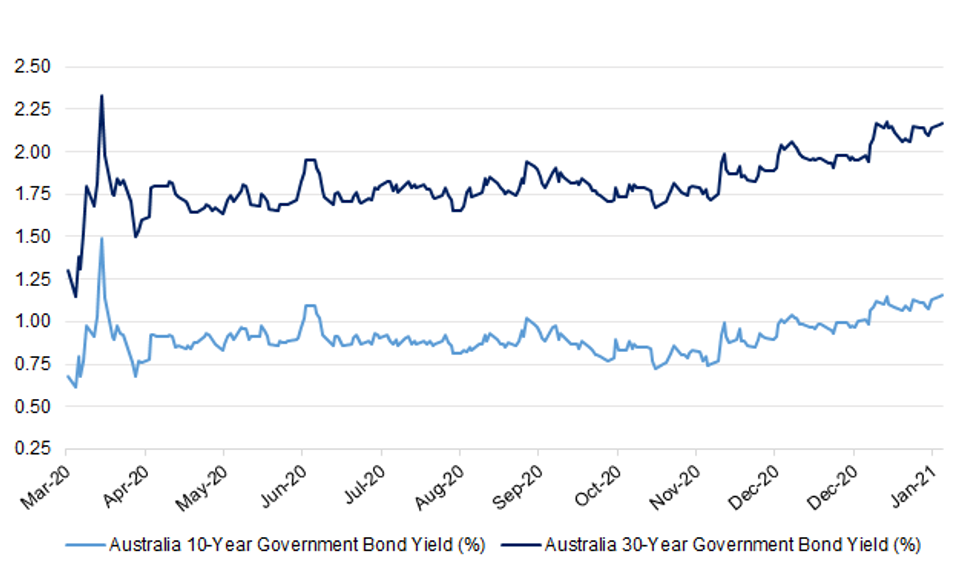

Fig. 1: Australia 10- & 30-Year Government Bond Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: It is "absolutely vital" that people in areas of England where the South African variant of coronavirus has been identified minimise all social contact, the health secretary has said. Speaking at the Downing Street news conference after it was revealed that 105 cases of the COVID-19 variant have been identified in the UK, Matt Hancock said there "may be further cases we don't know about yet". (Sky)

CORONAVIRUS: England may not return to regional coronavirus restrictions when the current lockdown is eased, the prime minister has suggested. "It may be that a national approach, going down the tiers in a national way, might be better this time round, given that the disease is behaving much more nationally," Boris Johnson said. (Sky)

CORONAVIRUS: Boris Johnson has ordered ministers to ramp up preparations for reopening schools after being told the UK is now past the peak of the current wave of coronavirus. The Prime Minister has made it clear that the Government's immediate focus must be on education and is expected to announce further measures to help children catch up after almost a year of disruption. (Telegraph)

CORONAVIRUS: Government scientists had warned that only mandatory hotel quarantine for all travellers would prevent new coronavirus strains from arriving in the country before it emerged that the South African variant was spreading in Britain. Boris Johnson announced limited hotel quarantine measures last week for travellers from 30 "high-risk" countries in an attempt to stop them from spreading potentially "vaccine-busting" new strains. The Times can disclose, however, that Downing Street had been advised by the Scientific Advisory Group for Emergencies (Sage) a week earlier that "geographically targeted travel bans" would not be enough to stop the arrival of new strains. (The Times)

FISCAL: Chancellor Rishi Sunak has agreed to tie his own hands at next month's Budget by sticking with the Conservatives' "triple tax lock", which stops him raising the rates of income tax, national insurance or value added tax. Treasury officials had hoped that Mr Sunak would ditch the Tories' 2019 election manifesto commitment, which stops him using the three biggest tax levers to start curbing a deficit that is expected to top £400bn in 2020-21 because of the coronavirus crisis. (FT)

EUROPE

GERMANY: Angela Merkel has reiterated that every German should receive a Covid-19 vaccination by the end of the summer, despite the current shortage in supply of shots and uncertainty about future deliveries. She told reporters that the authorities could fulfil this promise on the basis of the current commitments made by vaccine suppliers such as BioNTech/Pfizer. (FT)

ITALY: Talks aimed at reviving Italy's collapsed ruling coalition were blocked on Monday over policy issues even before any discussion on who the prime minister should be, political sources said. (RTRS)

ITALY: Italy budget deficit at EUR3.90bn in Jan. (BBG)

PORTUGAL: Portugal, which is facing one of world's worst coronavirus outbreaks, now has an occupancy rate of about 94% at its intensive-care units, Secretary of State for Health Antonio Lacerda Sales said. (BBG)

PORTUGAL: Spain, Germany and Austria have offered medical assistance to Portugal as the country's hospitals struggle to cope with one of the world's worst outbreaks of Covid-19. (FT)

AUSTRIA: Austrian retail opens for business from Feb. 8, albeit under strict Covid measures. Consumers need an FFP2 mask and 20 square meters space in order to shop. Schools will partially reopen two days a week for kids who test negative. Those seeking a haircut need a negative test within 48 hours before booking an appointment. Hotels, bars and cafes? Out of luck. The next review is scheduled for Feb. 15. (BBG)

SNB: Swiss National Bank President Thomas Jordan said U.S. censure won't stop his institution's purchases of foreign exchange to fend off deflation, according to an interview with broadcaster SRF. The central bank governor said he hasn't yet spoken to Treasury Secretary Janet Yellen about getting Switzerland taken off the U.S. list of currency manipulators. But talks with officials in Washington both at a technical and a political level are planned after the U.S. added the country to the list last year. (BBG)

U.S.

FED: Atlanta Federal Reserve President Raphael Bostic said Monday that he's not worried about the U.S. economy overheating, though he does think growth could happen faster than many expect. In an estimate well ahead of most of his colleagues, Bostic, a voting member of the policymaking Federal Open Market Committee, recently drew attention for saying that he thinks the Fed may have to raise interest rates as soon as mid-2022. He based that on his anticipation that the economy could recover from the Coivd-19 recession rapidly once vaccinations become more widespread and the stimulus being pumped begins to go to more people in need. (CNBC)

FED: Dallas Federal Reserve Bank President Robert Kaplan on Monday said the U.S. economy still needs help from both the central bank and from Congress to get the economy back to a more healthy footing as quickly as possible. "We are still in the teeth of this pandemic - and we are not out of the woods yet," Kaplan told the Chicago Council on Global Affairs in an online event. "We need to be aggressive in our fiscal and monetary policy actions, and I am hopeful that by doing that we will ultimately get beyond this pandemic and can then get to a more normalized environment in the months and years ahead." (RTRS)

FED: MNI BRIEF: Fed's Rosengren: Still 'In Depth' of Covid Recession

- Boston Fed President Eric Rosengren said Monday the U.S. economy is still "in the depth of it" when it comes to the Covid-19 slump, and that a hoped-for recovery later this year is highly dependent on the path of the virus and the pace of vaccine rollouts - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: The U.S. central bank and Congress have responded more to the COVID-19 crisis than they did in the last crisis, Minneapolis Federal Reserve Bank President Neel Kashkari said, and they need to do still more to return the economy faster to its pre-crisis footing. "Right now I'm not concerned about it - this is like wartime spending," Kashkari said at an online seminar held by Montana's Bureau of Business and Economic Research, in response to a question about the risks of government borrowing too much in the face of the pandemic. "We have the capacity to do what we need to do." (RTRS)

FED: Federal Reserve Bank of Minneapolis President Neel Kashkari on Monday became the latest central bank official to push back against the idea that the trading frenzy in GameStop Corp. and other hot stocks calls for a monetary policy response. "GameStop has gotten a lot of attention. If one group of speculators wants to have a battle of wills with another group of speculators over an individual stock, God bless them," Kashkari said while answering questions during a virtual town hall event. (BBG)

FED: A federal watchdog is looking into former Treasury Secretary Steven Mnuchin's decision to roll back the U.S. Federal Reserve's emergency lending programs at the end of 2020, an issue that has become a point of partisan tension in Congress. The Special Inspector General for Pandemic Recovery is also inquiring into Texas Republican Senator Ted Cruz's role in persuading the central bank to expand the eligibility rules for the Main Street Lending Program to make it easier for oil and gas companies to apply for the low interest rate loans. (BBG)

ECONOMY: MNI INTERVIEW: US Factory Prices May Rise Past 10Y High- ISM

- U.S. manufacturers could see further price gains after the ISM index showed the biggest increase since 2011, survey chair Tim Fiore told MNI Monday. January's price gains reflected stronger demand, supply chain bottlenecks and a weak U.S. dollar, he said. Manufacturers were also bidding up orders in December as expectations grew that price increases would continue into early 2021 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: The nonpartisan Congressional Budget Office on Monday issued an improved economic outlook and said the labor market will return to full strength quicker than expected thanks to the vaccine rollout and a barrage of legislation enacted in 2020. Gross domestic product, or GDP, is expected to reach its previous peak in mid-2021 and the labor force is forecast to return to its pre-pandemic level in 2022, according to the office. (CNBC)

FISCAL: President Joe Biden intends to continue pushing for a large pandemic relief bill, even if he has to bypass Senate Republicans, his press secretary said, hours after what one Republican senator called a "very productive" meeting Monday on stimulus options. White House Press Secretary Jen Psaki said that "while there were areas of agreement" between Biden and the 10 GOP senators in the White House meeting, "the president also reiterated his view that Congress must respond boldly and urgently, and noted many areas which the Republican senators' proposal does not address." (BBG)

FISCAL: Republican Sen. Bill Cassidy of Louisiana suggested that the Covid relief figure should not be "foreordained" and should be based on data, moments after his meeting with President Joe Biden. "If we're driven by data, we'll come to the right figure," said Cassidy to CNBC's "The News with Shepard Smith" during a Monday evening interview. "That figure should not be foreordained." Biden had a face-to-face meeting with 10 Republican senators Monday, including Cassidy. GOP senators have introduced a $618 billion relief bill that is less than one-third of the price of Biden's $1.9 trillion rescue package. (CNBC)

FISCAL: Treasury Sec. Janet Yellen will meet virtually with the Senate Democratic Caucus on Tuesday to discuss President Biden's stimulus proposals, Treasury Dept says in statement. (BBG)

FISCAL: U.S. Senate Majority Leader Chuck Schumer said on Monday that congressional Democrats would file a $1.9 trillion budget resolution later in the day, as a first step toward eventual passage of sweeping COVID-19 relief legislation. (RTRS)

FISCAL: The U.S. Treasury said on Monday it plans to borrow $274 billion in the first quarter, significantly lower than the November estimate of $1.127 trillion, with the decline due to the department's higher cash balance at the beginning of January. The Treasury last year increased its borrowing projections to account for an estimated $1 trillion in fiscal spending to address the economic devastation from COVID-19-related business shutdowns. A $900 billion stimulus bill was not signed into law until Dec. 27, however, leaving the Treasury with a larger than anticipated cash balance of $1.729 trillion at the end of 2020. (RTRS)

CORONAVIRUS: The US on Monday reported its smallest daily increase in coronavirus deaths in a fortnight, as figures showed January was the deadliest month of the pandemic. Authorities attributed 1,562 fatalities to coronavirus, according to Covid Tracking Project, down from 2,059 on Sunday. That was the smallest daily increase in deaths since January 18, which was a public holiday. (FT)

CORONAVIRUS: More Americans have received at least one dose of a Covid-19 vaccine than have tested positive for the virus, an early but hopeful milestone in the race to end the pandemic. As of Monday afternoon, 26.5 million Americans had received one or both doses of the current vaccines, according to data gathered by the Bloomberg Vaccine Tracker. Since the first U.S. patient tested positive outside of Seattle a year ago, 26.2 million people in the country have tested positive for the disease, and 441,000 have died. (BBG)

CORONAVIRUS: Both FedEx and UPS are keeping a close eye on their shipments of Covid-19 vaccines to the New York City-area, and are armed with contingency plans in case they're delayed as a winter storm dumps heavy snow in the region, the companies said. UPS is using its package-tracking system to monitor the temperature and location of the vials, spokesperson Matthew O'Connor said. The company is utilizing its "healthcare command center," which tracks the movement of each package to its destination and "can step in with contingency plans should it appear that a package may be delayed," he said. (CNBC)

CORONAVIRUS: Some health-care providers have been regularly holding back Covid-19 vaccine doses to ensure there will be supply when people come back to get their second shots, an official on President Joe Biden's coronavirus response team said Monday. Andy Slavitt, a senior advisor to Biden's Covid response team, who previously worked in the Obama administration, said health-care providers should not be holding back vaccine doses. He said the practice is actually causing some providers to cancel appointments and preventing some Americans from getting their first shots. (CNBC)

POLITICS: Senate Minority Leader Mitch McConnell (R-Ky.) on Monday said freshman Rep. Marjorie Taylor Greene's (R-Ga.) controversial comments promoting conspiracy theories and condoning violence against Democrats are "cancer" for the Republican Party. (Axios)

EQUITIES: Robinhood continued to ease trading restrictions on Monday, raising its trading limit on GameStop to 20 shares. Robinhood's changes are slight. Clients who already own more than 20 shares of GameStop cannot buy any new shares. Earlier on Monday, Robinhood eased the restrictions for one share at the open to four shares around midday. (CNBC)

EQUITIES: Robinhood Markets Inc. raised another $2.4 billion from shareholders, days after investors agreed to pump $1 billion into the online brokerage to help it ride out a trading frenzy in popular stocks including GameStop Inc. (WSJ)

EQUITIES: Robinhood, the U.S. online broker that has emerged as a gateway for amateur traders challenging Wall Street hedge funds, has held talks with banks about raising US$1 billion in debt so it can continue to fulfill orders for heavily shorted stocks, according to people familiar with the matter. (RTRS)

EQUITIES: A FOX reporter tweeted the following on Monday: "Ppl inside @RobinhoodApp tell @FoxBusiness plans for an IPO are on hold to focus on surviving the current drama over trading of stocks and settlement issues. Execs say they have access to even more capital than additional amounts raised today." (MNI)

EQUITIES: The frenzied trading of GameStop Corp. points to policy questions that lawmakers should examine, said White House Press Secretary Jen Psaki. "There is an important set of policy issues that have been raised as a result of market volatility in recent days, and we think congressional attention to these issues is appropriate and would welcome working with Congress," Psaki told reporters at the White House on Monday. (BBG)

EQUITIES: The Securities and Exchange Commission could consider a wide range of new regulations to help prevent future volatility and eye-popping short squeezes like those in GameStop and AMC Entertainment that enthralled Wall Street last week. The agency that oversees U.S. markets could pursue a litany of rules, ranging from a cap on the level of short interest on a specific security to aggressive taxes on short-term trading, according to Bank of America Merrill Lynch. (CNBC)

EQUITIES: The recent GameStop trading frenzy has prodded legendary trader Steve Cohen to once again open his hedge fund, Point 72 Asset Management, to new investors, FOX Business has learned. The reason? Well, it depends on who you ask. (FOX Business)

OTHER

U.S./CHINA: Top Chinese diplomat Yang Jiechi called on Tuesday for China and the United States to restore their relationship to a predictable and constructive track of development. Yang, the highest ranking Chinese leader to speak on China-U.S. relations since the Biden administration took office, spoke at an online forum organised by the National Committee on U.S.-China Relations on Tuesday morning Beijing time, Monday night Eastern Standard Time. (RTRS)

U.S./CHINA: China should not yield on contentious issues such as Taiwan despite sending positive signals of cooperation on issues including pandemic containment, policy coordination and climate policy, the Global Times reported citing Lv Xiang, an expert in US studies with the Chinese Academy of Social Sciences in Beijing. China's cooperation with the Biden administration will only be possible if the new administration focuses on fixing bilateral ties, wrote the newspaper. Biden should avoid the influence of domestic conservative forces and seize opportunities to stop the country from declining further, the newspaper wrote citing Chinese experts. (MNI)

GLOBAL TRADE: The European Union stepped up a call on the U.S. for a suspension of each side's tariffs over transatlantic trade in metals and aircraft. EU Trade Commissioner Valdis Dombrovskis urged President Joe Biden's administration to remove U.S. duties on European steel and aluminum based on controversial national-security grounds, signaling the bloc would end its retaliatory levies in return. (BBG)

GLOBAL TRADE: Government is in working-level talks and consultations with member nations of CPTPP, Ministry of Foreign Affairs says in text message. All member nations have clearly understood Taiwan's willingness, determination, and preparation for joining CPTPP; members are showing positive attitude for Taiwan. Taiwan will officially apply to join CPTPP when timing and conditions are right. (BBG)

CORONAVIRUS: BioNTech and Pfizer will boost Covid-19 vaccine manufacturing capacity to produce 2 billion doses this year, up from the prior guidance of 1.3 billion doses, the companies said in a statement that gave more details on the plans to increase manufacturing. (BBG)

CORONAVIRUS: Johnson & Johnson will ship some Covid-19 vaccines ordered by the European Union to the U.S. for the last stage of production, raising concern among some member states that the bloc's inoculation program could be hampered by further delays, according to a diplomatic note seen by Bloomberg. (BBG)

CORONAVIRUS: The team of international scientists investigating the origins of the coronavirus is focusing on early cases and is having "very good discussions around that," World Health Organization officials said Monday. "They're having very productive discussions with their Chinese counterparts, they're visiting hospitals and had a good visit to the market, seeing first-hand the stalls and walking through," said Maria van Kerkhove, the group's technical lead officer on Covid-19. (BBG)

HONG KONG: Four "ambush"-style lockdowns in Hong Kong on Monday night yielded no new coronavirus cases after the government announced tougher measures to reach zero daily infections. More than 1,700 people were tested after authorities prevented residents and workers from leaving their homes and businesses in four parts of the city. (FT)

JAPAN: Japan's government is seeking an extension of the country's state of emergency for 10 prefectures until March 7, Economy Minister Yasutoshi Nishimura said on Tuesday. Nishimura told a meeting on fighting the coronavirus that the situation was improving but that the medical system was still under pressure. (RTRS)

RBA: MNI BRIEF: RBA LEAVES RATES ON HOLD, EXTENDS QE

- The Reserve Bank of Australia left official interest rates on hold at the record low 0.10% at its first board meeting of 2021 today, but decided to extend the AUD100 billion QE program. In an unexpected move, the central bank said it would purchase an additional AUD100 billion in government bonds at the rate of AUD$5 billion per week when the current QE program runs out in April. The central bank made no change to its yield curve control program targeting three year Government bonds - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA: The ABS notes that "payroll jobs rose 1.3% nationally over the fortnight to 16 January 2021. All states and territories reported an increase in payroll jobs, ranging from 2.8% in Queensland to 0.5% in the Northern Territory. With the start of a second year of data we can see payroll jobs were 1.0% lower in the week ending 16 January 2021 than they were in the week ending 18 January 2020. The challenge with new data is to be able to distinguish between changes in the economy and regular seasonal changes. Annual comparisons are a useful way of accounting for seasonality, until we have enough data to produce seasonally adjusted figures." (MNI)

SOUTH KOREA: South Korea's Democratic Party chief Lee Nak-yon says the ruling party will prepare fourth round of cash handouts. To seek to draw up "sufficient" extra budget to provide aid to all citizens as well as additional support for small merchants and others deeply affected by the pandemic. (BBG)

SOUTH KOREA: Financial market volatility could increase depending on talks on U.S. stimulus package, hedge funds investments and concerns over delay in vaccine rollout in Europe, South Korea's Vice Finance Minister Kim Yongbeom says in meeting. To closely monitor impact of GameStop trading as herd behavior in digital trading environment could happen frequently. (BBG)

BOC: MNI INTERVIEW: BOC May End QE Purchases by Midyear-Ex Official

- The Bank of Canada will probably taper QE again in April and could stop making purchases altogether by mid-year as the economic rebound firms up, former central bank and finance department economist Charles St-Arnaud told MNI - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: Prime Minister Justin Trudeau spoke with U.S. Vice-President Kamala Harris on Monday about a series of cross-border issues, including the Democrats' "Buy American" policy, according to his office. In a readout from the bilateral call, the PMO says the pair talked about Harris' years spent in Montreal, which she "recalled fondly," and the two leaders dug into some pressing policy matters. Trudeau's office said on the call the prime minister discussed "avoiding the unintended consequences of Buy American policies," and raised climate change, the "centrality of democratic principles" and the need to promote diversity. (CTV News)

TURKEY: President Tayyip Erdogan said on Monday he believed it was impossible for Turkey to attain its inflation targets with high interest rates, days after the central bank committed to tight monetary policy. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan said his party may start working on a new constitution with its ally Nationalist Movement Party. "Maybe it's time Turkey discusses a new constitution. If we reach an understanding with our partner in Republic Alliance, we may start working on new constitution in the upcoming period," Erdogan says in speech in Ankara after cabinet meeting. Erdogan rules out working on constitution together with those "who lost ties of affection with their country". (BBG)

TURKEY: Turkish police detained 159 people over protests against appointment of a new rector to Bogazici University, according to Governorship of Istanbul statement. (BBG)

MEXICO: Passing legislation that obliges the central bank to buy dollars from local lenders could affect investors' risk perception and impact Mexico's credit rating, pushing up borrowing costs, bank Governor Alejandro Diaz de Leon told lawmakers. (BBG)

BRAZIL: President Jair Bolsonaro breathed new life into the second half of his mandate as candidates he supported will preside over both houses of Brazil's congress, potentially helping to push forward his reform agenda while blocking impeachment attempts. Arthur Lira, leader of a pragmatic group of centrist lawmakers who usually trade their support for jobs and power in the administration, was elected speaker of the lower house with 302 of the potential 513 votes. Rodrigo Pacheco, from the right-wing Democrats party, became the new senate head. Both had Bolsonaro's support. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa said his administration has secured millions of additional coronavirus vaccines to help bring the disease under control and eased a ban on alcohol sales after a two-month spike in cases abated. The country will remain on virus alert level 3, but liquor stores will be allowed to resume trading between Mondays and Thursdays and bars and restaurants can sell alcohol again throughout the week. Beaches, parks, dams and lakes that were closed in Covid-19 hotspots late last year will be reopened, a night-time curfew will be shortened by three hours and religious gatherings will be permitted. (BBG)

IRAN: Iranian Foreign Minister Mohammad Javad Zarif sketched out a path on Monday to overcome the U.S.-Iranian impasse over who goes first in returning to the 2015 Iran nuclear deal, saying the EU foreign policy chief could "choreograph" the moves. "There can be a mechanism to basically either synchronize it or coordinate what can be done," Zarif told CNN when asked in an interview how to bridge the gap between Washington and Tehran. Each government wants the other to resume compliance first. (RTRS)

METALS: Commodity Futures Trading Commission Acting Chairman Rostin Behnam released the following statement regarding recent trading in the silver markets: "The CFTC is closely monitoring recent activity in the silver markets," said Acting Chairman Behnam. "The Commission is communicating with fellow regulators, the exchanges, and stakeholders to address any potential threats to the integrity of the derivatives markets for silver, and remains vigilant in surveilling these markets for fraud and manipulation." (CFTC)

METALS: The CME Group is raising margins on Comex silver futures by 18% after futures surged to an eight-year high, the exchange said in a statement. Margins will rise to $16,500 per contract from $14,000, effective Feb. 2, according to the exchange. The decision is based on "the normal review of market volatility to ensure adequate collateral coverage," it said in a statement. The increase means those who want to trade silver futures will need to put up more collateral to ensure they can meet their obligations. While the exchange routinely raises margins when a contract is soaring or extremely volatile, Monday's move could edge out smaller players who don't have enough cash to make the necessary deposits. (BBG)

OIL: OPEC boosted crude production as planned last month, but the increase was tempered by disruptions at long-troubled member nations., The Organization of Petroleum Exporting Countries raised output by 190,000 barrels a day in January, according to a Bloomberg survey. That fits with an agreement between the group and its allies to revive some of the supplies halted during the pandemic. (BBG)

CHINA

ECONOMY: Manufacturing sector's contribution to China's GDP fell to about 27% in 2019 from 32% in 2006, People's Daily reports, citing an interview with Zhang Yuxian, a researcher with the State Information Center. The improving momentum in China's economy won't change but challenges remain to keep growth at reasonable range. Challenges include uncertainty in global economic recovery, slow recovery in domestic demand and arduous tasks to prevent systemic risks. (BBG)

PBOC: The PBOC should increase liquidity injections to help meet shortages of around CNY1.85 trillion before the mid-February Chinese New Year, the China Securities Journal reported citing Ming Ming from CITIC Securities. The PBOC's CNY98 billion injection on Monday lowered interbank funding rates and rallied both the stock and bond markets, wrote the newspaper. Liquidity is not excessive despite easing measures, the newspaper reported citing Zhao Wei from KaiYuan Securities. (MNI)

PBOC: The PBOC conducted the highest monthly SLF injections in a year in January, totaling CNY37.67 billion, according to official data released on Monday. The SLFs included CNY11 billion overnight, CNY21.5 billion 7-day and CNY5.17 billion 1-month injections. The SLF rates gauge the upper limit of the interest rate corridor, and are conducive to smoothing the money market interest rates, the PBOC said in a statement on its website. Borrowing costs on overnight, 7-day and 1-month loans are 3.05%, 3.2% and 3.55%, respectively, it said. The PBOC has denied market rumors about a potential SLF rate hike and notified law enforcement of the rumors last week, MNI noted. (MNI)

OVERNIGHT DATA

JAPAN JAN MONETARY BASE +18.9% Y/Y; DEC +18.3%

JAPAN JAN MONETARY BASE END OF PERIOD Y616.5TN; DEC Y617.6TN

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 112.1; PREV. 111.2

The second week of gains in consumer confidence reflects the improved assessment of personal financial conditions, consistent with the improving labour market. The pullback in 'economic conditions' is somewhat of a rebalancing following its sharp surge the previous week. The headline confidence level is close to its long-term average, for the first time since late 2019. This suggests momentum in the economy remains positive. Weekly inflation expectations rose 0.1ppt to 3.8% and has now effectively reversed all of fall in expectations seen during the early months of the pandemic. News of the lockdown of Perth and southwest Western Australia came too late to impact the survey. (ANZ)

NEW ZEALAND JAN CORELOGIC HOUSE PRICE INDEX +12.8% Y/Y; DEC +11.1%

SOUTH KOREA JAN CPI +0.6% Y/Y; MEDIAN +0.5%; DEC +0.5%

SOUTH KOREA JAN CPI +0.8% M/M; MEDIAN +0.3%; DEC +0.2%

SOUTH KOREA JAN CORE CPI +0.9% Y/Y; MEDIAN +0.8%; DEC +0.9%

CHINA MARKETS

PBOC NET INJECTS CNY78BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY80 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net injection of CNY78 billion after the maturity of CNY2 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:22 am local time from 3.1656% at Monday's close.

- The CFETS-NEX money-market sentiment index closed at 36 on Monday vs 68 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4736 TUES VS 6.4623

People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4736 on Tuesday. This compares with the 6.4623 set on Monday.

MARKETS

SNAPSHOT: RBA Announces QE Extension Ahead Of Most Exp.

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 224.91 points at 28316.61

- ASX 200 up 104.935 points at 6767.9

- Shanghai Comp. up 19.139 points at 3524.423

- JGB 10-Yr future up 2 ticks at 151.78, yield down 0.8bp at 0.051%

- Aussie 10-Yr future up 1.5 ticks at 98.860, yield down 1.7bp at 1.133%

- U.S. 10-Yr future -0-01 at 137-05, yield up 0.17bp at 1.081%

- WTI crude up $0.54 at $54.09, Gold down $6.83 at $1853.92

- USD/JPY up 5 pips at Y104.98

- FED'S BOSTIC: ECONOMY COULD RECOVER MORE QUICKLY THAN EXPECTED (CNBC)

- CHINA ECONOMY'S IMPROVING TREND WON'T CHANGE (PEOPLE'S DAILY)

- TOP CHINESE DIPLOMAT CALLS FOR CHINA & U.S. TO RESTORE RELATIONSHIP (RTRS)

- RBA LEAVES RATES ON HOLD, EXTENDS QE (MNI)

- BIONTECH/PFIZER CONFIRMS PLANS FOR 2 BILLION DOSES IN 2021 (BBG)

- SILVER SLIDES ON CME MARGIN HIKE AND CFTC FLAGGING INTEREST IN MATTERS

BOND SUMMARY: RBA Pre-Announces QE Extension, Supports Core FI

U.S. Tsys traded unchanged to lower during the bulk of Asia-Pac hours, with the PBoC's latest round of liquidity injections and a message from China's chief diplomat, Yang Jiechi, pointing to the potential for a more constructive Sino-U.S. relationship, albeit with the usual caveats surrounding well defined flash points, seemingly supporting broader risk appetite. Elsewhere, some took solace from after-hours losses for U.S. retail favourite equity name GME. T-Notes trading -0-00+ at 137-05+ last, with the spillover from the latest RBA decision seeing the contract away from lows, although the contract has stuck to a 0-03+ range. Cash little changed across the curve, with a very marginal degree of twist steepening seen.

- JGBs were unchanged to higher for the bulk of Tokyo trade, with futures last +3, a touch shy of best levels, which came on the back of the RBA decision and in the wake of a 10-Year JGB auction which was a little firmer than exp./prev., but was still relatively soft in the grand scheme of things. Cash JGBs were a touch firmer across the curve, with swap spreads generally a little wider on the day.

- Aussie bonds were softer into the first RBA decision of '21, but the RBA's pre-announcement of A$100bn worth of bond purchases, which will run at the same rate as the current scheme when it runs dry in mid-April, caught markets off guard owing to its timing (the size of the new scheme was in line with broader exp.). The rhetoric surrounding the Bank's economic projections was a little more upbeat (as expected), but wasn't a gamechanger.

JGBS AUCTION: Japanese MOF sells Y2.1221tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1221tn 10-Year JGBs:- Average Yield 0.053% (prev. 0.019%)

- Average Price 100.46 (prev. 100.80)

- High Yield: 0.054% (prev. 0.022%)

- Low Price 100.45 (prev. 100.77)

- % Allotted At High Yield: 62.9236% (prev. 32.9842%)

- Bid/Cover: 3.419x (prev. 3.404x)

EQUITIES: Green In Asia After US Indices Rally

Asia-Pac equities took a positive lead from the US, all major indices are in the green. Risk on tone has been supported by a number of developments overnight. The PBOC injected funds to help alleviate the liquidity crunch, a senior Chinese diplomat said the relationship between the US and China should be put back on a more constructive track and in the US officials are said to have made progress towards a coronavirus relief bill.

- Equity markets in South Korea and Taiwan lead the way higher, in the former foreigners are on track for the second day of inflows, after four consecutive sessions of outflows. The tech heavy Taiex in Taiwan also saw strong gains ahead of earnings from Amazon and Alphabet today.

- US futures are higher, e-mini S&P up around 0.6% at the time of writing after adding 1.65% by the close yesterday in the biggest rally for 10-weeks. Nasdaq futures outperforming ahead of the aforementioned earnings.

OIL: Risk On & Supportive Demand Picture Sees Crude Gain

Oil has moved higher in Asia on Tuesday, shaking off a negative tone at the start of the session to build on yesterday's gains. WTI it up $0.62 at $54.17, brent is up $0.58 at $56.93.

- Crude futures were boosted on demand optimism as the US moved towards a coronavirus relief bill, the news saw the greenback come off best levels which spurred the bid in oil. Saudi Aramco were also positive on demand, the oil giant said it saw demand returning to pre-pandemic levels later in 2021, while Japan said it would look to reinstate a travel incentive programme from March.

- As a note the Joint Technical Committee will meet today to discuss compliance to output levels (said to be 99%), while the JMMC (Joint Ministerial Monitoring Committee, meeting of ministers) will meet on Wednesday. The next full OPEC+ meeting is on March 4.

METALS: Tighter Oversight And Margin Hikes For Silver Weigh

Gold sits $5/oz or so lower on the day, stuck in familiar territory, last printing $1,855/oz, although more focus has once again been given to silver.

- The latter has shed $0.70/oz on the session, to last deal around $28.35/oz, a little off worst levels of the day, and comfortably shy of Monday's peak located at $30.10/oz.

- Regulatory oversight has been noted on the back of the recent developments surrounding U.S. retail trading accounts, with the CFTC issuing a statement during the NY-Asia crossover, in which it noted that it "is closely monitoring recent activity in the silver markets. The Commission is communicating with fellow regulators, the exchanges, and stakeholders to address any potential threats to the integrity of the derivatives markets for silver, and remains vigilant in surveilling these markets for fraud and manipulation."

- Elsewhere, CME hiked margin requirements for its silver futures by 18%.

FOREX: Risk-On Flows Evident, AUD Takes Hit From RBA Announcement

AUD crept higher in the lead-up to the RBA's monetary policy decision, but reversed course after the Reserve Bank announced a A$100mn 6-month extension of its bond buying scheme from mid-April. AUD/USD trimmed the bulk of its earlier gains, but remained in positive territory amid broader greenback sales. Worth noting that A$1.2bn worth of AUD puts with strikes at $0.7600 roll off at the NY cut today, with the spot currently trading around $0.7625. AUD/NZD swung to a loss in the wake of the RBA's announcement and seems poised to extend its losing streak to three consecutive days.

- Safe haven currencies faced some headwinds as regional equity benchmarks flashed green, while e-minis climbed through the session. The likes of USD, JPY & CHF landed towards the bottom end of the G10 scoreboard. The DXY pulled back from three-week highs.

- NOK outperformed in the G10 basked, drawing support from firmer crude oil prices.

- EUR/USD edged higher on the back of a softer U.S. dollar, despite continued political uncertainty in Italy, where talks between former ruling coalition partiers have seemingly stalled. Lower house speaker responsible for mediating the negotiations reports back to Pres Mattarella today.

- The PBoC injected funds to help alleviate the liquidity crunch and a senior Chinese diplomat called for a more constructive relationship with the U.S., lending further support to broader risk appetite. Spot USD/CNH slipped even as the PBoC fixed USD/CNY at CNY6.4736, another fix above sell-side estimates, bringing total misses in Feb to +33 pips (Jan +284 pips, Dec +133 pips).

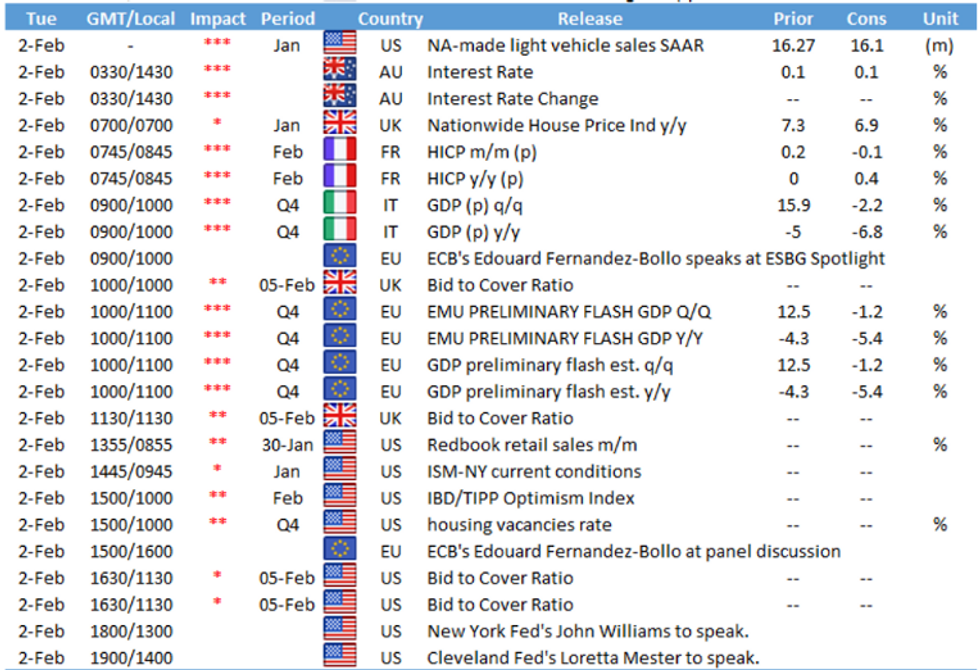

- The economic docket is fairly thin today, focus turns to advance GDP data from the EZ & Italy, flash French CPI and comments from Riksbank's Ingves, ECB's de Cos as well as Fed's Kaplan & Mester.

FOREX OPTIONS: Expiries for Feb02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-65(E653mln), $1.2050(E603mln), $1.2150(E1.4bln-EUR puts), $1.2200(E536mln), $1.2220(E563mln),$1.2290-1.2300(E1.1bln)

- USD/JPY: Y106.00($530mln)

- AUD/USD: $0.7600(A$1.4bln, A$1.29bln of AUD puts), $0.7650(A$624mln-AUD puts), $0.7685(A$1.1bln-AUD puts), $0.7735(A$592mln-AUD puts), $0.7845-50(A$604mln-AUD puts)

- AUD/NZD: N$1.0665-90(A$850mln-AUD puts)

- USD/CNY: Cny6.55($1.1bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.