-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Sets Yuan Parity Higher At 7.1055 Tues; -6.03% Y/Y

MNI China Press Digest Jan 30: PBOC, He Lifeng, Evergrande

MNI EUROPEAN OPEN: Little To Alter The Course In Asia, DXY Trades Lower

EXECUTIVE SUMMARY

- FED'S BARKIN SHRUGS OFF INFLATION RISKS FROM STIMULUS PLAN (FT)

- MESTER WARNS RECOVERY SLOW EVEN AFTER VACCINATION (MNI)

- DRAGHI TELLS ITALIAN BACKERS COMMON EU BUDGET IS A PRIORITY (BBG)

- BRUSSELS POISED TO REJECT UK'S CALLS FOR TWO-YEAR EXTENSION TO NORTHERN IRELAND GRACE PERIOD (TELEGRAPH)

- PBOC CONTINUES NIMBLE LIQUIDITY TWEAKS AHEAD OF LNY

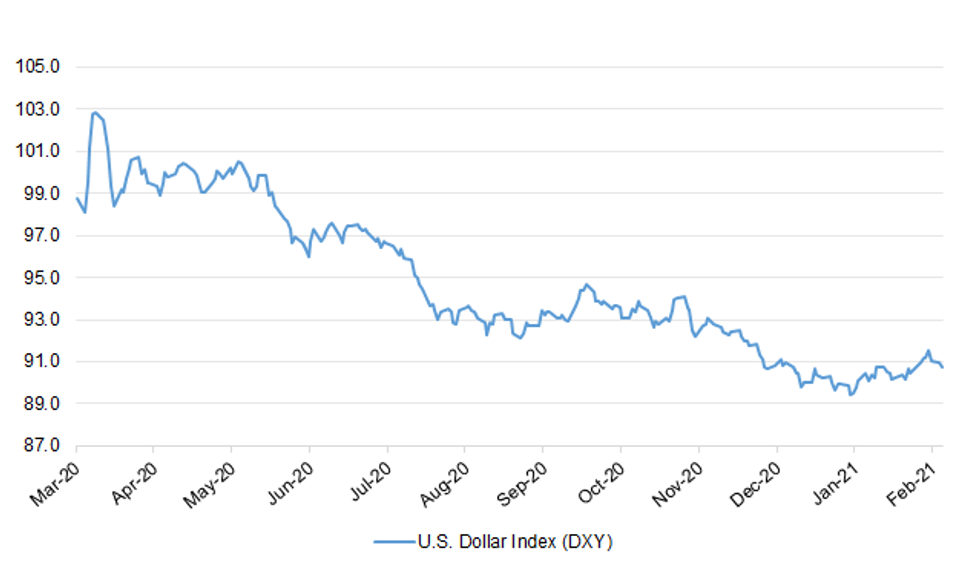

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson says he is "very confident" in the Covid vaccines being used in the UK, amid concerns about the Oxford-AstraZeneca jab's effectiveness against the South Africa variant. The vaccines are effective in delivering a high degree of protection against serious illness, the PM said. A small study found the Oxford jab gave "minimal protection" against mild disease from the South Africa variant. But scientists are confident it will protect against serious disease. Some 147 cases of the South Africa variant have been found in the UK. However, the Oxford vaccine has shown to provide good protection against the so-called Kent variant, which remains the dominant strain in the UK. (BBC)

CORONAVIRUS: Professor Jonathan Van-Tam, the U.K.'s deputy chief medical officer, played down the chances of a coronavirus variant from South Africa becoming widespread across the country in the coming months. His comments, delivered at a news conference Monday evening, follow concerns that the AstraZeneca-University of Oxford jab shows limited effectiveness against that particular strain, known formally as the B.1.351 mutation. "There is no reason to think the South African variant will catch up or overtake our current virus in the next few months," Van-Tam said referring to the U.K.'s mutation which was first found in southeast England. (CNBC)

CORONAVIRUS: The U.K.'s plan for "surge testing" to detect and suppress new variants of coronavirus is unlikely to work unless it is done on a larger scale, a scientific adviser to the government said. Mike Tildesley, an academic at the University of Warwick who advises Boris Johnson's government on pandemic modeling, said authorities should "cast their net slightly wider" to pick up cases and make sure people with the virus are staying home. (BBG)

CORONAVIRUS: ITV News understands the government is set to announce all passengers arriving into the UK must undergo a Covid test on the second and the eighth day of self-isolation after they arrive. The new rules, expected to come into force from 15 February, will not just apply to those arriving from "red zone" countries heading into hotel quarantine, but those self-isolating at home too. All travellers - whether isolating at home or in a hotel - will be required to pay for their own tests. ITV News understands that travellers arriving from "red zone" countries will need to book their quarantine hotel, transfer and test as a package through an online booking system. (ITV)

BREXIT: Brussels appears poised to reject the UK's calls for a two-year extension of the grace periods for post-Brexit trade in Northern Ireland. Multiple Whitehall and EU sources have told The Telegraph that the European Commission is likely to agree to only a three to six-month extension of the arrangements in place for traders moving goods between Britain and the province. Ahead of a crunch meeting in London on Thursday, EU figures also accused the UK of exploiting an international backlash against Brussels over its aborted move to erect a hard vaccine border on the island of Ireland. (Telegraph)

BREXIT: The backlash against the Gove letter has coincided with mounting concerns among some member states that the Commission will come under pressure from the UK to grant concessions on the operation of the Protocol, ones that the Irish government may be tempted to support. "There's a concern that the Commission's interests, those of the UK and those of Ireland might be fairly aligned in this case," says one diplomat, "and that that would lead to compromises which might then be very difficult to swallow for member states." The Irish Government is in a delicate position, given its expressed desire for a pragmatic approach to the implementation to the Protocol, one that does not amount to wholesale renegotiation. "Our view is that some additional flexibility is going to be needed, not least because Covid has made it difficult to address the issues, to find alternative suppliers and routes and so on," says one Irish source. "But we'll just have to see." (RTE)

FISCAL: Boris Johnson is expected to side with Rishi Sunak in a cabinet split over universal credit by extending the £20-a-week uplift for six months rather than a year. The chancellor is locked in a battle with Thérèse Coffey, the work and pensions secretary, over when to remove the extra payment, which was introduced at the start of the pandemic. (The Times)

FISCAL: The £20 weekly increase in Universal Credit must be extended for at least a year to avoid impoverishing hundreds of thousands of people, MPs have warned. The measure, which has been called a lifeline for struggling families, is in place until the end of March. The government has signalled it is looking at a range of options for support ahead of next month's Budget. The Commons Work and Pensions Committee said keeping the higher rate until April 2022 must be the "bare minimum". About six million families have benefited from the top-up, worth more than £1,000 a year, since it was introduced at the start of the pandemic. (BBC)

ECONOMY: Spending by British consumers plunged in January at the fastest rate in seven months as the country went back into a tight COVID-19 lockdown, payment card firm Barclaycard said on Tuesday. A 73% annual increase in online retail spending and record demand for takeaway food - which jumped by a third from a year ago - failed to compensate for the closure of many businesses. Overall consumer spending shrank by 16.3% in year-on-year terms last month, Barclaycard said, the biggest drop since May when the country was starting to emerge from its first lockdown. (RTRS)

BOE: The governor of the Bank of England has angrily rejected criticism that he was slow to make changes in his previous role overseeing City regulation. Andrew Bailey was head of the Financial Conduct Authority when a high-risk bond scheme collapsed two years ago. Nearly 12,000 people invested £236m in London Capital & Finance before it went under. A report last year said the regulator had failed to effectively supervise the firm. (BBC)

EUROPE

ECB: European Central Bank President Christine Lagarde pledged monetary support for the economy amid extended coronavirus lockdowns and said governments must do the same. "The renewed surge in Covid-19 cases, the mutations in the virus and the strict containment measures are a significant downside risk to euro-area economic activity," she told European Parliament lawmakers on Monday. "It remains crucial that monetary and fiscal policy continue to work hand in hand. Fiscal policy -– both at the national and at the European level -– remains crucial to bolster the recovery." While the outlook is highly uncertain, the ECB chief noted that the start of vaccination campaigns across the euro area "provides the eagerly awaited light at the end of the tunnel." (BBG)

ECB: Bank of France Governor Francois Villeroy de Galhau says the European Central Bank's negative deposit rates will not apply to households. Villeroy speaks at Bank of France listening event as part of ECB's strategic review. "There are no negative rates on deposits of retail clients or small and medium enterprises, except for some very wealthy clients". "This situation will continue and the Bank of France will make sure of it. Negative rates apply to big companies and states, but not you and me." (BBG)

ECONOMY: Europe's economy is likely to rally in the second quarter as an acceleration in COVID-19 vaccine roll-out allows governments to gradually lift lockdown restrictions, the European Commission's vice president for the economy Valdis Dombrovskis said Monday. (RTRS)

CORONAVIRUS: The European Union has finalised a deal with Pfizer and BioNTech for the supply of an additional 300 million doses of their COVID-19 vaccine, a European Commission spokesman told Reuters on Monday. The EU secured 300 million Pfizer doses in November last year and announced a preliminary deal for 300 million more shots on Jan. 8, subject to talks about the terms of the new contract. (RTRS)

GERMANY: German Chancellor Angela Merkel criticized Economy Minister Peter Altmaier over delays in the payment of aid to help companies weather the pandemic, Bild-Zeitung reported. Citing people close to the Christian Democratic Union party, the newspaper reported that Merkel told a meeting of party leaders that she couldn't understand why the Finance Ministry and the Economy Ministry haven't managed to provide the support the government promised. (BBG)

ITALY: Mario Draghi told lawmakers he'll make a common euro-area budget a policy priority for Italy if he becomes prime minister this month, in a sign of his ambitions for the incoming administration. Carlo Calenda, head of the Azione party, and Manfred Schullian, head of the group of unaffiliated lawmakers in the lower house, both told Bloomberg that Draghi had emphasized the push for a common budget in separate meetings in Rome Monday. (BBG)

ITALY/BTPS: Italy plans to sell up to 3 billion euros of 0 percent bonds due Jan 15, 2024 in an auction on Feb 11. Italy plans to sell up to 4 billion euros of 0.25 percent bonds due Mar 15, 2028 in an auction on Feb 11. Italy plans to sell up to 2 billion euros of 1.8 percent bonds due Mar 1, 2041 in an auction on Feb 11. (BBG)

SPAIN: Spain's government aims to outline in the coming weeks a set of measures to bolster corporate solvency, possibly including haircuts on state-backed loans as well as direct state aid to help smaller firms weather the COVID-19 pandemic, sources said. "We have to build a bridge to sustain the economy until the vaccination plan is completed and the arrival of the European funds," said a government source present at the discussions. Treasury head Pablo de Ramón-Laca also told state broadcaster RTVE on Monday the state was working on transforming part of the state-backed credit, known as ICO loans, extended so far into an as yet unspecified type of solvency support. (RTRS)

NETHERLANDS: The Dutch government announced Monday it is extending the country's curfew until March 3, declaring that was necessary to slow the spread of the more infectious coronavirus variant first detected in Britain. The curfew was to have expired Wednesday. (AP)

U.S.

FED: A senior Federal Reserve official has shrugged off concerns that further fiscal stimulus might generate an unhealthy jump in inflation this year, saying the US economic recovery still needs support. Tom Barkin, the president of the Richmond Fed, told the Financial Times he expected "short-term price volatility" but stressed that he saw deflationary as well as inflationary risks on the horizon. "I'm keeping my focus on medium-term [inflation] expectations," Barkin said. "I still think there are a lot of people out of work who need a bridge to the other side, and I am supportive of what we can do to help them". (FT)

FED: MNI BRIEF: Mester Warns Recovery Slow Even After Vaccination

- Federal Reserve Bank of Cleveland Loretta Mester on Monday warned that the U.S. economic recovery will take time even after the population is vaccinated and monetary policy will support the recovery throughout - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: US Retail Imports Seen On Record Streak Thru June

- U.S. retail imports are expected to set monthly records through the summertime, the National Retail Federation said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

ECONOMY: Start-up applications in the US surged last year as the economy began its uneven recovery from the coronavirus pandemic in contrast to the Great Recession. Americans filed nearly 4.5m new business applications last year — up 24.3 per cent from 2019 and the highest on records dating back to 2005 — according to the Economic Innovation Group's calculations of Census data. That was also 51 per cent higher than average over the last decade following the financial crisis. (FT)

FISCAL: The White House expects the House of Representatives to track closely to President Joe Biden's coronavirus relief plan as it marks up its latest round of legislation to blunt the effects of the COVID-19 pandemic, but expects lawmakers will tweak some elements, Press Secretary Jen Psaki said on Monday. Psaki added that conversations continue on the formula for determining who receives individual cash relief, and that the final determination is up to Congress. (RTRS)

FISCAL: U.S. President Joe Biden's plan to raise the minimum wage to $15 per hour by 2025 would cut employment by 1.4 million jobs that year and increase the budget deficit by $54 billion over the next 10 years, the Congressional Budget Office said on Monday. (RTRS)

FISCAL: Yellen to join Biden meeting with business leaders Tuesday. (BBG)

FISCAL: House Democrats on Monday released the first draft text for key pieces of legislation that will comprise President Joe Biden's Covid-19 relief bill. The legislative language from the Ways and Means, Financial Services and Education and Labor Committees show Democrats are forging ahead with plans to bump the federal minimum wage to $15 an hour by 2025 and make another round of stimulus payments. Billions of dollars are planned for airline staff, airports and trains. In all, 12 committees are meeting in the coming days to assemble the stimulus bill for a House floor vote during the week of Feb. 22. Once the bill goes to the Senate, it is designed to be passed with just 50 members plus the tie-breaking vote of Vice President Kamala Harris using a special budget fast-track procedure. (BBG)

CORONAVIRUS: The US on Monday reported the lowest number of new coronavirus infections since October and the smallest daily increase in deaths in two months. States reported an additional 77,737 new infections, according to Covid Tracking Project data, marking the smallest daily increase in cases since October 27. That was down from the 95,994 new infections reported on Sunday, which was the first time since November 2 that daily cases in the US were below 100,000. Monday data tend to be lower than other days of the week due to weekend delays in reporting, but the latest figures reflect encouraging signs for the pandemic in the US, where hospitalisations have been on a sustained downward trend and daily death rates appear to be plateauing. (FT)

CORONAVIRUS: More than 32 million people in the U.S. have received at least one dose of a coronavirus vaccine, according to vaccination data published by the Centers for Disease Control and Prevention on Monday. That's roughly 10% of the U.S. population. The updated data, which the CDC says is current as of 6 a.m. Monday, also shows that 9.5 million people have received both doses of either the Pfizer or Moderna vaccines, which is roughly 3% of the population including U.S. territories. (CNBC)

CORONAVIRUS: New, highly contagious variants of the coronavirus are a "threat" to the United States and could reverse the recent drop in Covid-19 cases and hospitalizations, the head of the Centers for Disease Control and Prevention warned Monday. (CNBC)

CORONAVIRUS: The director of the Centers of Disease Control and Prevention suggested that testing people for the coronavirus before U.S. domestic flights could help reduce transmission, as she urged state and local leaders to maintain steps to limit Covid-19's spread. (BBG)

CORONAVIRUS: New York City restaurants will be allowed to reopen their indoor dining sections at 25% capacity beginning Feb. 12, a few days earlier than originally planned, Gov. Andrew Cuomo said. (CNBC)

CORONAVIRUS: New York is hoping to bring back its entertainment venues, which have remained shuttered amid the pandemic, through extensive Covid-19 testing and capacity limitations, Gov. Andrew Cuomo said. (CNBC)

CORONAVIRUS: Iowa Gov. Kim Reynolds lifted the state's mask mandate without consulting the health officials in her administration, The Associated Press reported Monday. (CNBC)

OTHER

U.S./CHINA: A Fox reporter tweeted thew following on Monday: "People w knowledge of new @WhiteHouse thinking on @tiktok_us - @Oracle deal say it's now being slow walked by @JoeBiden team. Future of deal -- poised for approval by Trump White House -- is "unclear," according to person w knowledge." (MNI)

U.S./CHINA: The Biden administration should abandon the "rude manners" of its predecessor and create new space for the two countries to engage in benign rules-based competition, the Global Times said in an editorial. Responding to President Biden's "extreme competition" remark regarding dealing with China. the editorial said Biden had set a bottom line of avoiding a major power conflict by replacing Trump's approach with international rules. China is not afraid of this approach, the newspaper added. (MNI)

U.S./CHINA/TAIWAN: The cooperation and interaction remains unaffected by transition of power in the U.S., Taiwan President Tsai Ing-wen says at a briefing in Taipei. (BBG)

GEOPOLITICS: President Biden spoke with Indian Prime Minister Narendra Modi on Monday, discussing regional security issues that revolve around China and the upheaval in Myanmar, the White House said. The two leaders agreed to promote a free and open Indo-Pacific, "including support for freedom of navigation, territorial integrity, and a stronger regional architecture through the Quad," the White House said in a statement about the call, referring to the four-nation group that also includes Japan and Australia. (WSJ)

GEOPOLITICS: The United States was concerned about an order by Myanmar's military restricting public gatherings following three days of large demonstrations against a Feb. 1 military coup, U.S. State Department spokesman Ned Price said on Monday. (RTRS)

GEOPOLITICS: Iran and North Korea cooperated on long-range missile development projects last year, according to a confidential United Nations report that may pressure the Biden administration to respond to one of its first major geopolitical crises. "This resumed cooperation is said to have included the transfer of critical parts, with the most recent shipment associated with this relationship taking place in 2020," an independent panel of experts monitoring sanctions on North Korea said in the report, citing a member state. (BBG)

GLOBAL TRADE: The British and EU ambassadors to Washington said on Monday they were encouraged by signs the Biden administration will re-engage in talks on reforming global tax rules for digital companies after discussions stalled under former President Donald Trump. European Union Ambassador Stavros Lambrinidis told a trade conference he felt "great optimism" that Treasury Secretary Janet Yellen had shown a willingness to return to talks led by the Organization for Economic Cooperation and Development, adding it was "obvious that digital companies have to pay more tax. It's just the fair ... thing to do." (RTRS)

GLOBAL TRADE: Envoys from Britain and the European Union on Monday underscored their willingness to negotiate with the new U.S. government to quickly resolve a 16-year dispute over aircraft subsidies that has triggered tariffs on both sides. (RTRS)

GLOBAL TRADE: EU lawmakers overseeing new digital regulation in Europe want to force Big Tech companies to pay for news, echoing a similar move in Australia and strengthening the hand of publishers against Google and Facebook. The initiative from members of the European parliament would be a serious blow to Google, which has threatened to leave Australia in protest at a planned new law that would compel it to pay for news. Facebook has also warned it will stop users in Australia from sharing news if the legislation is passed in its current form. (FT)

GLOBAL TRADE: Europe's antitrust chief, Margrethe Vestager, has warned Apple Inc to give equal treatment to all apps on its platform amid the iPhone maker's privacy changes that have drawn charges of anti-competitive practices from rival Facebook Inc. (RTRS)

GLOBAL TRADE: The U.K. wants to prioritize depth rather than speed in completing work on a free-trade agreement with the U.S., the nation's ambassador said. Britain anticipates that the Biden administration may want to add issues like labor and the environment to the agreement that the two nations began to negotiate under the Trump administration, Karen Pierce, the U.K. ambassador in Washington, said in an online event Monday. The nation also sees room to expand services trade, she said. "We don't want to get it done just for the sake of getting it done. We want a comprehensive deal rather than a quick one," Pierce said at a virtual conference hosted by the Washington International Trade Association. (BBG)

G7: The Group of Seven (G7) financial leaders would kick off debate on Friday on emerging market debt problems, implementation of digital taxation and central bank digital currency, Japanese Finance Minister Taro Aso said on Tuesday. Britain will chair a meeting of G7 finance ministers and central bank governors on Feb. 12 to try to map a way out of the global economic crisis inflicted by COVID-19 and find a solution to an international tax wrangle. (RTRS)

CORONAVIRUS: A team of scientists part of a World Health Organization- sponsored mission probing the origins of the coronavirus are due to hold a press conference at 4 p.m. HK in the Chinese city of Wuhan to talk about their findings. Investigators wanted to know how the SARS-CoV-2 virus -- whose closest known relative came from bats 1,000 miles away -- spread explosively in Wuhan before causing the worst contagion in more than a century. On Sunday, Peter Daszak, a New York-based zoologist assisting the WHO mission, said the investigation heralds a turning point in pandemic mitigation. (BBG)

HONG KONG: Hong Kong Chief Executive Carrie Lam said there were indications the city's Covid-19 wave was subsiding, while urging caution ahead of the Lunar New Year holiday. "The situation has been quite turbulent but we have seen signs the outbreak is subsiding," Lam told reporters, citing indicators including a lower number of new cases. She said if the situation continued improving the city could resume daily activities after the holiday, without elaborating. Hong Kong reported 28 new local coronavirus infections on Monday amid a winter wave. Lam appealed to Hong Kongers to not let their guards down over the holiday, during which people traditionally visit loved ones: "Reduce your activities outside, reduce the number of family gatherings." (BBG)

HONG KONG: Hong Kong's highest court has kept Jimmy Lai in jail, while approving the government's appeal against a lower court's decision to release him on bail. The Court of Final Appeal ruled on Tuesday that Lai be remanded in custody. The top court had already sent the Next Digital Ltd. founder back to jail on Dec. 31 to give judges time consider the case after the government challenged a lower court's decision to release him into house arrest. (BBG)

JAPAN: Aso says the cabinet approved use of 1.1 trillion yen of reserve funds for virus response measures. (BBG)

BOJ: MNI POLICY: Repayment of Debt, Credit Costs In FY21 BOJ Worry

- Bank of Japan officials are vigilant against the the risk that liquidity problems will become solvency problems and credit costs will rise over the fiscal year beginning on April 1, MNI understands. Despite the second state of emergency, credit costs haven't increased so far and liquidity concerns have not yet become solvency issues this fiscal year, as businesses have pre-emptively ensured liquidity - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

RBNZ: New Zealand is clamping down on property investors in an attempt to rein in spiraling house prices. The central bank said Tuesday it will reinstate mortgage lending restrictions on March 1 and tighten them further for investors from May 1. Finance Minister Grant Robertson also said today the government will unveil measures soon to curb housing demand, "particularly from those who are speculating." (BBG)

RBNZ: The Reserve Bank of New Zealand – Te Pūtea Matua is making solid progress in responding to a recent malicious data breach, and ensuring affected stakeholders are well supported. Governor Adrian Orr says the Bank has completed its assessment of the files illegally downloaded during the breach and is notifying organisations involved. External legal advisers are also providing assurance checks and advice on any personal information which was included in the downloaded files. "We had no warning to avoid the attack which began in mid-December. Accellion failed to notify the Bank for five days that an attack was occurring against its customers around the world, and that a patch was available that would have prevented this breach." (RBNZ)

NEW ZEALAND: New Zealand's debt level by the year 2034 is forecasted to be about NZ$60 billion ($43.3 billion) less than previously expected on the back of a strong recovery from the COVID-19 pandemic, the finance minister said on Tuesday. New projections using the treasury's fiscal strategy model show net debt now at 36.5% of GDP in 2034/35, Grant Robertson said in his 2021 Budget Policy Statement speech to business leaders in the capital Wellington. "That represents about $60 billion less debt at the end of the projection period than at the pre-election update," he said. (RTRS)

TURKEY: Turkish President Recep Tayyip Erdogan spoke with German Chancellor Angela Merkel via video conference, Turkish Presidency says in statement. Turkish government is determined to continue talks with EU on a positive agenda ahead of March summit, Erdogan told Merkel. Leaders also discussed improving cooperation between two countries. (BBG)

MEXICO: Mexico's central bank will lend money to local banks that can't sell bulk dollars to the U.S., a move meant to satisfy lawmakers who wanted to force the nation's monetary authority to purchase the greenbacks. The pledge to help Mexican banks was unveiled Monday as part of new measures to help migrants access banking services and get better exchange rates for dollars they bring home. Banxico, as the central bank is known, will work with local lenders with "justified difficulties" in getting rid of bulk cash as well as try to improve relations with U.S. banks, Governor Alejandro Diaz de Leon said. (BBG)

BRAZIL: Brazil is preparing a fresh round of emergency cash transfers to millions of poor and vulnerable people, President Jair Bolsonaro said on Monday, adding that any package will also take into account investor concerns over the government's fragile finances. (RTRS)

BRAZIL: Central Bank's autonomy bill is expected to be voted by next Wednesday, the new rapporteur Silvio Costa Filho told reporters in Brasilia. Economy Ministry, Central Bank president agree on the project, said Costa Filho. Economy Minister Paulo Guedes said that central bank autonomy helps to contain inflationary pressure and maintain monetary stability. (BBG)

RUSSIA: Blinken: U.S. in contact with allies over Russia-Navalny issue. (BBG)

RUSSIA: Germany, Sweden and Poland each expelled a member of Russian embassy staff on Monday in retaliation for the Kremlin's expulsion of their own diplomats, which came after they were accused of attending "unlawful" rallies in support of jailed opposition leader Alexei Navalny. (Axios)

IRAN: President Biden's position that Iran must come back into compliance with the nuclear deal before the United States returns to it is unchanged, the White House said Monday after the president appeared to suggest a shift in an interview over the weekend with a head nod. (The Hill)

OIL: A tanker has been forced to divert from Libya's Marsa el-Hariga terminal, where strike action among guards has prevented crude from being exported for two weeks. (Argus Media)

CHINA

CORONAVIRUS: Health authorities in China reported no new locally transmitted cases of Covid-19 for a second day as the country prepared to celebrate the lunar new year. Strict lockdowns, multiple rounds of mass testing and travel restrictions appeared to have controlled a series of outbreaks in the north of the country that represented the largest surge in infections since early 2020. (FT)

PBOC: The PBOC should ensure interbank liquidity after the holiday period as a slew of business debts, monetary instruments and bonds mature in March and April, the Shanghai Securities News reported. The PBOC has reduced the size of injections due to lower demand for cash and increased fiscal spending before the Lunar New Year holiday, pumping in CNY10 billion on Monday following CNY50 billion on Sunday, the newspaper said. (MNI)

ECONOMY: China's credit lending in January may have increased to CNY3.5 trillion, an increase of CNY160 billion from a year ago as corporate demand surged, the China Securities Journal reported citing Wang Jingwen, a senior analyst from China Minsheng Bank. Commercial banks were likely to have boosted lending last month as many loans last year were carried over and executed in January, the newspaper wrote citing Li Chao, chief economist from Zheshang Securities. Regulators may have applied marginal tightening to prevent a further rise in macro leverage ratios, so the growth rate of total social financing may have dropped by 0.2 percentage points from the previous month to 13.1%, Li said. (MNI)

OVERNIGHT DATA

JAPAN DEC LABOUR CASH EARNINGS -3.2% Y/Y; MEDIAN -4.8%; NOV -1.8%

JAPAN DEC REAL CASH EARNINGS -1.9% Y/Y; MEDIAN -3.4%; NOV -0.7%

MNI DATA IMPACT: Japan Dec Wages Down; Real Pay Negative

- Average Japanese wages fell 3.2% y/y in December, recording a ninth straight drop following a 1.8% decline in November. Real wages also remained in negative territory, according to preliminary data released Tuesday by the Ministry of Health, Labour and Welfare - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

JAPAN JAN, P MACHINE TOOL ORDERS +9.7% Y/Y; DEC +9.9%

JAPAN JAN MONEY STOCK M2 +9.4% Y/Y; MEDIAN +9.2%; DEC +9.1%

JAPAN JAN MONEY STOCK M3 +7.8% Y/Y; MEDIAN +7.6%; DEC +7.6%

AUSTRALIA JAN NAB BUSINESS CONFIDENCE 10; DEC 5

AUSTRALIA JAN NAB BUSINESS CONDITIONS 7; DEC 16

Business confidence rose in January to be well above long-run average, while business conditions fell, after reaching multi-year highs in December. Driving the fall in conditions, businesses reported trading conditions had pulled back to around long-run average levels after a very strong November and December. Profitability and employment also pulled back, though both are above their historic averages. The divergence in conditions across industries continues to track as expected, with retail and wholesale still strong, but recreation and personal services continuing to lag. This is also consistent with confidence that is slightly higher in services pointing to expectations of further recovery there. Elsewhere, key indicators of the level of activity recovered – capacity utilisation and capex – made modest gains, where both are just a little below pre-virus levels. Capacity utilisation also generally reflects the outcomes observed in other economic data, where retail has been operating at a higher level than it has in recent years while some sectors of personal services continue to be impacted by restrictions. As such, given conditions remain above average, notwithstanding the fall this month, and lead indicators continue to trend higher, the survey continues to point to an ongoing recovery. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 111.4; PREV. 112.1

Consumer confidence is consolidating close to its long-run average. This solidifies the recovery from 2020. Any meaningful breakout from here on will have to be on back of strong news/developments. The vaccine rollout in Australia could be the next big trigger, with a successful program possibly propelling sentiment much higher. Of course, difficulties in providing vaccine coverage could have the opposite effect. (ANZ)

NEW ZEALAND Q1 2-YEAR INFLATION EXPECTATION +1.89%; Q4 +1.59%

NEW ZEALAND JAN ANZ TRUCKOMETER HEAVY -3.8% M/M; DEC +1.3%

In broad terms, heavy traffic (trucks but also buses) primarily reflects the movement of goods, while light traffic is all about the movement of people. In normal times, light traffic provides a six-month lead on momentum in the economy, but at times of abrupt events such as seen in 2020, the Light Traffic Index will of course not see them coming, temporarily breaking the correlation. The Heavy Traffic Index is a real-time indicator of goods production. In January, the Light Traffic Index was flat, while the Heavy Traffic fell 3.8%. The Heavy Traffic Index was still 1.5% higher than a year earlier (3-month average), but the overshoot is fading as catch-up dynamics wane. Figure 1 tells the same story in level terms – it's back to trend. Similarly, the Light Traffic Index (figure 2) was still 5.3% higher than a year ago in the final three months of the year, but the overshoot was as large as 8.8% back in November. (ANZ)

UK JAN BRC SALES LIKE-FOR-LIKE +7.1% Y/Y; DEC +4.8%

CHINA MARKETS

PBOC NET DRAINS CNY30BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged on Tuesday. This resulted in a net drain of CNY30billion given the maturity of CNY80 billion of reverse repos today, according to Wind Information.

- The operation aims to maintain stable liquidity before the Chinese New Year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.3542% at 09:33 am local time from 2.3461% at Monday's close.

- The CFETS-NEX money-market sentiment index closed at 36 on Monday vs 32 on Sunday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4533 TUES VS 6.4678

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4533 on Tuesday. This compares with the 6.4678 set on Monday.

MARKETS

SNAPSHOT: Little To Alter The Course In Asia, DXY Trades Lower

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 100.92 points at 29489.42

- ASX 200 down 59.478 points at 6821.2

- Shanghai Comp. up 54.235 points at 3586.682

- JGB 10-Yr future down 1 tick at 151.49, yield down 0.1bp at 0.07%

- Aussie 10-Yr future up 4.0 ticks at 98.765, yield down 4bp at 1.23%

- U.S. 10-Yr future -0-00+ at 136-21+, yield down 1.21bp at 1.158%

- WTI crude up $0.46 at $58.43, Gold up $9.06 at $1839.87

- USD/JPY down 34 pips at Y104.89

- FED'S BARKIN SHRUGS OFF INFLATION RISKS FROM STIMULUS PLAN (FT)

- MESTER WARNS RECOVERY SLOW EVEN AFTER VACCINATION (MNI)

- DRAGHI TELLS ITALIAN BACKERS COMMON EU BUDGET IS A PRIORITY (BBG)

- BRUSSELS POISED TO REJECT UK'S CALLS FOR TWO-YEAR EXTENSION TO NORTHERN IRELAND GRACE PERIOD (TELEGRAPH)

- PBOC CONTINUES NIMBLE LIQUIDITY TWEAKS AHEAD OF LNY

BOND SUMMARY: Pre-LNY Feeling, Aussie & U.S. FI Bid

The pre-LNY feel was well and truly in play in the core FI space during Asia-Pac hours, with some light bull flattening witnessed in cash Tsys after 30s failed to make a meaningful break above 2.00% on Monday, with the pullback from intra-day cheaps seemingly resulting in some steepener unwinds after fresh multi-year highs for the 5-/30-Year yield spread. 30s sit ~1.5bp richer at typing, while T-Notes have held to a 0-03 range in overnight trade, last -0-00+ at 136-21+, with limited flow apparent.

- JGB futures have held to a tight range during Tokyo hours, with the contract last +2 vs. settlement after an early, shallow look above the overnight range. Cash trade has seen some underperformance for the longer end and 5-Year zone, although longer dated swaps are tighter on the day, with none of the signs of foreign swap payers evident, as the recent LCH/JSCC 30-Year swap spread widening flattens out. The latest round of BoJ Rinban ops saw purchase sizes left as they were, while the offer/cover in the 25+ Year ops moderated. Elsewhere, we learnt that the Japanese cabinet has decided to spend a little over Y1.1tn of its emergency reserves to fund measures to deal with COVID-19.

- Sydney trade has seen some curve flattening, YM unch and XM +4.0, although there is no outright sign of hedging pressure around SAFA's '34 issuance as of yet. The latest local NAB business survey saw an uptick in the confidence metric, although the current conditions index moderated, with the survey collator noting that "given conditions remain above average, notwithstanding the fall this month, and lead indicators continue to trend higher, the survey continues to point to an ongoing recovery."

JGBS AUCTION: Japanese MOF sells Y2.7717tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7717tn 6-Month Bills:- Average Yield -0.1048% (prev. -0.0982%)

- Average Price 100.052 (prev. 100.049)

- High Yield: -0.1027% (prev. -0.0962%)

- Low Price 100.051 (prev. 100.048)

- % Allotted At High Yield: 22.9064% (prev. 76.2882%)

- Bid/Cover: 4.560x (prev. 4.032x)

BOJ: Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.22tn of JGB's from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y370bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

AUSSIE BONDS: The AOFM sells A$100mn of the 2.00% 21 Aug '35 I/L Bond, issue #CAIN410:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 2.00% 21 August 2035 I/L Bond, issue #CAIN410:- Average Yield: -0.3895% (prev. -0.1934%)

- High Yield: -0.3875% (prev. -0.1875%)

- Bid/Cover: 5.0000x (prev. 3.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 35.0% (prev. 28.3%)

- bidders 42 (prev. 51), successful 5 (prev. 18), allocated in full 3 (prev. 14)

EQUITIES: Asia Stocks Gain After Another Day Of Record Highs In US Markets

Most indices in the Asia-Pac region are higher, following another positive lead from the US where major indices hit record highs. The mood is broadly positive with risk assets supported as the US inches towards a bumper stimulus plan.

- Equity markets in Japan and Australia were the exception, both in minor negative territory at the time of writing following a sharp move higher yesterday. Volumes across Asia-Pac have been thin as head into LNY holidays; several markets are closed today with others closed or having truncated session's tomorrow.

- Higher oil is helping to support the energy sector across markets in Asia, the rally continues with brent now consolidating above $60/bbl.

- In the US equity futures are hovering around neutral levels, holding yesterday's gains.

OIL: Crude Keeps Climbing

Crude futures continue to rally, breaching the highest levels since May 2019. Futures are up around $0.40 with WTI changing hands at $58.40/bbl and brent consolidating gains above $60/bbl at $61.03/bbl.

- The mood is positive in Asia-Pac trade with risk assets supported as the US inches towards a bumper stimulus plan.

- Contrary to yesterday where Vitol and Gunvor sounded a cautious note on oil markets, Trafigura said it sees prices moving even higher as refiners increase processing rates to meet rising demand.

- Meanwhile, market participants are looking for fresh cues on supply dynamics in the upcoming inventory reports from the API, due later today, and the US DOE, due on Wednesday.

GOLD: Adding To Monday's Gains

Bullion has drawn support from the lower USD and flat to softer U.S. real yields witnessed over the last 24 hours or so, last dealing a little over $10/oz firmer vs. Monday's close and ~$25/oz better off week to date. From a technical standpoint bulls now look for a break above some of the shorter- to medium-term EMA's before turning their focus higher.

FOREX: Regional Data Supports Antipodeans, USD Extends Losses

The Antipodeans firmed up in thin pre-LNY trade, with little of note in the way of fresh headline catalysts. AUD was aided by the improvement in NAB Business Confidence, while NZD caught a bid after the RBNZ released its inflation expectations, which recovered to levels last seen before the onset of the Covid-19 pandemic. NZD/USD rallied to its best levels in a month, looking past the reinstatement of LVR restrictions by the RBNZ & FinMin Roberson's 2021 Budget Policy Statement.

- Commodity FX space drew further support from better crude oil prices, as Brent consolidated above the $60 level. That being said, CAD moved out of sync with its high-beta peers and landed near the bottom of the G10 scoreboard.

- USD underperformed amid continued optimism surrounding U.S. fiscal matters. The DXY approached its 50-DMA but failed to test the level as of yet.

- JPY traded on a slightly firmer footing, even as a contact flagged USD/JPY demand out of Tokyo ahead of the open. USD/JPY extended its recent losses and sank below the Y105.00 mark.

- The PBOC fixed USD/CNY at 6.4533, around 10 pips above sell side estimates, PBOC injected a net CNY 30bn. Offshore yuan has continued to gain in Asia on Tuesday after the PBOC helped reassure markets saying its policies would remain stable yet flexible in its quarterly monetary policy report.

- Focus turns to German trade balance, Italian industrial output as well as comments from ECB's Visco & Lane and Fed's Bullard.

FOREX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1850-55(E511mln), $1.2000(E853mln), $1.2050(E644mln), $1.2090-1.2100(E544mln), $1.2160-75(E591mln)

- USD/JPY: Y105.00-10($699mln)

- USD/CAD: C$1.2960($1.2bln)

- AUD/CAD: C$0.9860(A$640mln-AUD puts)

- USD/CNY: Cny6.4325-45($812mln), Cny6.45($781mln), Cny6.50($2.1bln), Cny6.55($1.2bln)

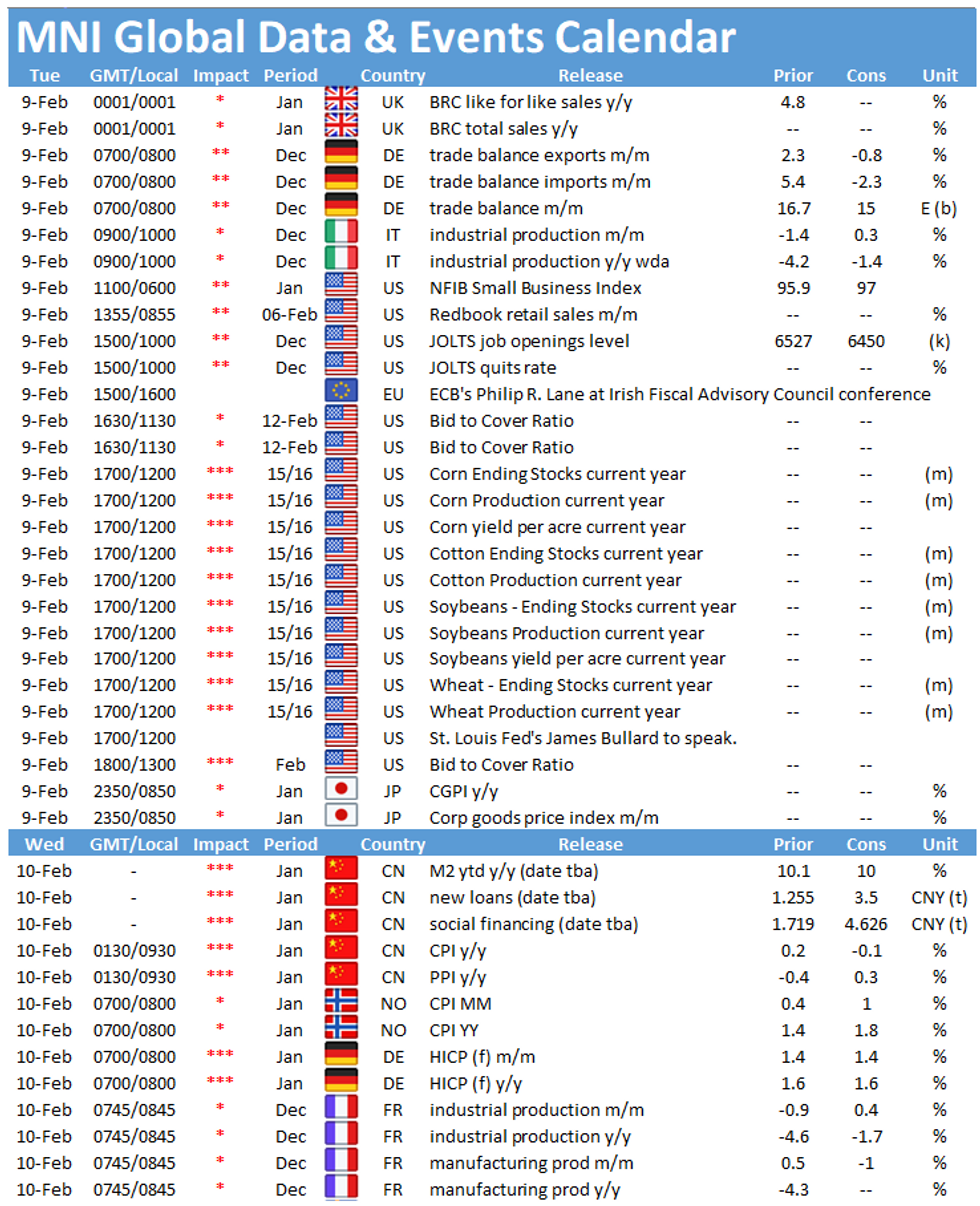

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.