-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Unch., QE Optionality Seen, Chinese Stocks Lower On Bubble Warning

EXECUTIVE SUMMARY

- CHINA SAYS CONCERNED ABOUT BUBBLES IN OVERSEAS FINANCIAL MARKETS (BBG)

- HONG KONG STOCK BENCHMARK FALLS ON STAMP DUTY, BUBBLE WORRIES (BBG)

- RATES ON HOLD AT RBA, MORE QE POSSIBLE (MNI)

- FED'S DALY: K-SHAPED ECONOMIC RECOVERY NOT ACCEPTABLE (BBG)

- SANDERS PUSHES TO HAVE $15 MIN. WAGE INCL. IN COVID RELIEF BILL (AXIOS)

- J&J WAITING ON NEW PLANT APPROVAL TO SHIP HIGH VOLUMES OF VACCINE (CNBC)

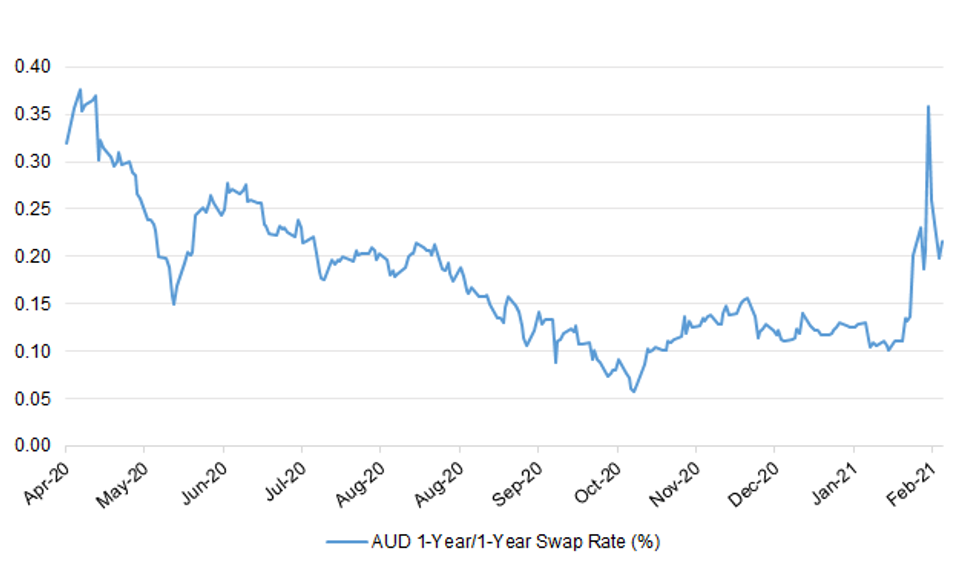

Fig. 1: AUD 1-Year/1-Year Swap Rate (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

FISCAL: Some business and personal taxes "have to go up", Lord Hague, the former Conservative leader and close ally of Rishi Sunak, the Chancellor, has warned. (Telegraph)

FISCAL: Boris Johnson has vowed his green agenda will not lead to any new tax rises for hardworking Brits. Speaking exclusively to The Sun the Prime Minister said this year's Cop26 summit will not hit readers' wallets with new levies on meat or carbon - but instead "generate high quality, high skill, high wage jobs." (The Sun)

FISCAL: Labour would back a gradual increase in corporation tax across this parliament, the shadow chancellor has indicated after a week of criticism over the party's assertion that tax rises should be off the table. Writing for the Guardian, Anneliese Dodds says Labour would not back an immediate hike in taxes on company profits in Wednesday's budget but was open-minded about future increases. Rishi Sunak, the chancellor, is believed to be preparing to increase corporation tax from 19% to up to 25% by the end of the parliament in 2024. Dodds also said the party would back reforms to tighten corporation tax loopholes. But she accused the chancellor of playing politics with early tax hikes, which he reportedly bragged he would cut later in the parliament as a pre-election sweetener. The Guardian also understands that Labour would not automatically oppose the freezing of the income tax threshold, which Sunak is said to be planning to freeze at £12,500 for basic rate taxpayers and £50,000 for the higher rate for at least three years. "When the Conservatives have raised the personal allowance in the past, it has helped the best-off more than others," a Labour source said. (Guardian)

ECONOMY: Boris Johnson has predicted a "strong, jobs-led recovery" that would defy the pessimists, as ministers become increasingly bullish that a predicted Covid-19 jobs catastrophe can be averted. Chancellor Rishi Sunak will present his "Budget for jobs" on Wednesday but there are signs that the UK's effective vaccine rollout could help the economy bounce back without a big new surge in unemployment. Ministers and officials expect that new unemployment forecasts by the independent Office for Budget Responsibility will be improved. Last July the fiscal watchdog predicted a peak in Covid-related joblessness of 12 per cent — worse than the highest total in the 1980s downturn. (FT)

BREXIT: City firms revealed in the final months of 2020 that they planned to shift nearly £100bn in assets to the EU, taking the total value of assets lost to the bloc since the Brexit vote to £1.3 trillion, according to a new survey. The data from consulting group EY pointed to a last-minute push by firms before 31 December after the UK-EU trade deal did not offer concessions for the UK's dominant financial services sector. It forced companies to move staff and assets to the continent in order to continue serving EU customers. According to EY's latest Brexit tracker, which covered the period from October 2020 to February, firms have shifted or declared plans to move approximately £500bn worth of those assets in the last two years alone. (Guardian)

EQUITIES: Rishi Sunak will use his Budget to launch a post-Brexit fightback by the City of London, setting in train new rules to help it compete with centres such as New York, Amsterdam and Frankfurt in attracting fast-growth companies. The chancellor and Boris Johnson, prime minister, want to create a new stock market listings regime as part of their efforts to build an "agile" new economy after Brexit and the pandemic, focused on innovation and technology. Alongside his Budget, Sunak will publish a review by Lord Jonathan Hill, former EU financial services commissioner, which is expected to propose changes to make Britain a more attractive place for entrepreneurs to take companies public. (FT)

EUROPE

CORONAVIRUS: Brussels is to propose a personal electronic coronavirus vaccination certificate in an effort to boost travel around the EU once the bloc's sluggish immunisation drive gathers pace. Ursula von der Leyen, European Commission president, said on Monday the planned "Digital Green Pass" would provide proof of inoculation, test results of those not yet jabbed, and information on the holder's recovery if they had previously had the disease. (FT)

GERMANY: Chancellor Angela Merkel faces further pressure to lay out a path to ease Germany's coronavirus lockdown after Finance Minister Olaf Scholz became the latest senior official to call for a quicker reopening of Europe's largest economy. Scholz -- the vice chancellor and the Social Democratic candidate to succeed Merkel in September's election -- threw his weight behind proposals to move away from a reliance on using the seven-day incidence rate to manage Germany's pandemic and focus on ramping up testing. (BBG)

GERMANY: German Economics Minister Peter Altmaier wants to allow regional governments to open some shops this month, adding pressure on Chancellor Angela Merkel to ease the lockdown. "Nobody wants to see a third wave of Covid infections," he told a business conference late Monday. "But the longer the lockdown lasts, the bigger the risk that Germany's economy will suffer long-lasting damage." (BBG)

FRANCE: France expanded its guidelines for AstraZeneca Plc's coronavirus vaccine, saying it can now be used to immunize the elderly. All three vaccines currently in use, including Astra's, show "remarkable efficacy," Health Minister Olivier Veran said in an interview on France 2 television late Monday. (BBG)

FRANCE: France will retain its current measures aimed at curbing the COVID-19 pandemic, including a nighttime curfew, as a bare minimum for the next four to six weeks, its health minister said on Monday. Other measures now in force include the closure of bars, restaurants and museums, and Olivier Veran said he hoped France would not have to go beyond those measures to rein in the disease. (RTRS)

AUSTRIA: Austria extended lockdown measures for the majority of the country on Monday following government meetings with scientists, opposition parties and provincial governors in Vienna. Chancellor Sebastian Kurz ruled out even outdoor dining until Easter as incidence rates in eastern regions of the country doubled to about 200 over the past month. Only restaurants and cafes in the far-western province of Vorarlberg got the go-ahead to reopen from March 15 after infections fell. (BBG)

U.S.

FED: Federal Reserve Bank of Richmond President Thomas Barkin played down recent Treasury market volatility, in remarks that reinforce the message that the U.S. central bank is not yet troubled by the increase in yields. "I'm mostly concerned about the labor market," Barkin said Monday in a Bloomberg Television interview with Michael McKee in answer to a question about turbulence in the bond market. "At these levels of interest rates, when I talk to businesses in my district, I do not hear any sense that people are dialing back their investment." (BBG)

FED: "I really want a world where we don't have to eat at a local restaurant, get served by individuals, and then wonder if they made a trip to the food bank on the way home," says Federal Reserve Bank of San Francisco President Mary Daly. "An inclusive recovery -- one that we can be proud of -- would be one were everybody has a place. Where we go back and get all of those workers who were displaced. We bring them back into the labor market. And we rethink what 'back in the labor market' looks like." (BBG)

ECONOMY: MNI INTERVIEW: Highest US Factory Prices in Decade May Persist

- U.S. manufacturers could see price gains remain around the fastest in more than a decade over the next few months as the ISM index rebounds, survey chair Tim Fiore told MNI Monday. "All indications are that prices are going to continue to stay high through Q1 and into Q2, which would indicate you're going to have a really strong economic expansion here for this year," said Fiore - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The U.S. Senate will begin debating President Joe Biden's $1.9 trillion coronavirus relief bill this week, Senate Majority Leader Chuck Schumer said on Monday. In remarks on the Senate floor, Schumer, a Democrat, did not say when the chamber might vote on the bill. (RTRS)

FISCAL: Sen. Bernie Sanders (I-Vt.) announced Monday he plans to offer an amendment to the COVID relief bill this week that aims to see the minimum wage raised to $15 an hour. Sanders said in a Twitter post he thinks the Senate should ignore the parliamentarian's advice, which he said was "wrong in a number of respects," but conceded that he wasn't sure that his view "is the majority view in the Democratic Caucus." (Axios)

FISCAL: Senate Democrats are discussing potential changes to a $1.9 trillion coronavirus relief package, saying they want to further target the House-passed legislation. A group of Democrats met with President Biden on Monday to talk about the path forward on the legislation, which is expected to come to a vote on the Senate floor in a matter of days. "We talked about the package and we talked about some ... targeting, targeting dollars," said Sen. Jon Tester (D-Mont.). (The Hill)

FISCAL: A slew of Democrats on Capitol Hill — including progressives Sen. Elizabeth Warren, D-Mass., and Sen. Bernie Sanders, I-Vt. — on Monday proposed a 3% total annual tax on wealth exceeding $1 billion. They also called for a lesser, 2% annual wealth tax on the net worth of households and trusts ranging from $50 million to $1 billion. The Ultra-Millionaire Tax Act aims at reining in a widening U.S. wealth gap, which has been exacerbated by the Covid pandemic. (CNBC)

CORONAVIRUS: The US reported fewer than 50,000 new coronavirus infections for the first time since mid-October, continuing a downward trend in cases and hospitalisations after an autumn surge. There were 48,092 cases confirmed in the last 24 hours, compared with 54,249 a day earlier, the Covid Tracking Project said on Monday. Hospitalisations also declined to hit their lowest level since late October. The US had 46,738 people with Covid-19 in hospital, down from 47,352. Hospitalisations have dropped every day since January 13, according to a Financial Times analysis of Covid Tracking Project data. (FT)

CORONAVIRUS: Covid-19 infections in the U.S. had the biggest monthly decline in February, plunging 61% to about 2.42 million, data compiled by Johns Hopkins University and Bloomberg show. That helped lower the death count from January by 25% to 71,772. Overall, almost 514,000 Americans have succumbed to Covid-19 and about 28.7 million residents -- or 8.7% of the population -- have been infected by it. (BBG)

CORONAVIRUS: More than 50m Americans have received their first coronavirus shot, another milestone for the US vaccine rollout just as Johnson & Johnson prepares to ship out its single-dose jabs. The US has administered at least one dose to 50.7m people, up from 49.8m one day earlier, the Centers for Disease Control and Prevention said on Monday. That equates to 15.3 per cent of the total population, or 19.9 per cent of residents who are over the age of 18. (FT)

CORONAVIRUS: The head of the Centers for Disease Control and Prevention said Monday that she is "really worried" about some states rolling back public health measures intended to contain the coronavirus pandemic as U.S. cases appear to be leveling off at a "very high number." The declines in Covid-19 cases seen since early January now appear to be stalling at around 70,000 new cases per day, CDC Director Dr. Rochelle Walensky said during a White House news briefing. "With these statistics, I am really worried about more states rolling back the exact public health measures we have recommended to protect people from Covid-19." (CNBC)

CORONAVIRUS: The Biden administration is taking the emergence of a new coronavirus strain in New York "very seriously," White House Chief Medical Advisor Dr. Anthony Fauci said Monday. (CNBC)

CORONAVIRUS: Johnson & Johnson's Covid-19 vaccine can be used as a substitute for a second jab of Pfizer's or Moderna's shots for those who have an allergic reaction to the first round of either company's vaccine, a scientist for the Centers for Disease Control and Prevention said Monday. Pfizer's and Moderna's vaccines both use mRNA technology and require two shots to achieve full protection. Patients who suffer an allergic reaction to either should wait at least 28 days before getting the J&J one-dose vaccine, said Jessica MacNeil, an epidemiologist at the CDC's National Center for Immunization and Respiratory Diseases. (CNBC)

CORONAVIRUS: California Governor Gavin Newsom and legislative leaders said they've struck a deal that would push school districts in the most-populous U.S. state to begin reopening by April. The state would hand out more than $6 billion for related costs including personal protective equipment, ventilation upgrades and Covid testing. To make up for lost learning, the school year might extend into summer. (BBG)

CORONAVIRUS: Pennsylvania Governor Tom Wolf said he was easing restrictions, including revising maximum occupancy limits for indoor and outdoor events, as well as ending out-of-state travel restrictions. "There is light at the end of the tunnel." Wolf said in a tweet. "COVID-19 cases are on the decline, and more are being vaccinated." Outdoor events are now allowed a maximum of 20% occupancy, regardless of venue size, the governor said. Attendees and workers must keep six feet (1.8 meters) apart. Indoor venues can have 15% occupancy. (BBG)

OTHER

U.S./CHINA: President Joe Biden's U.S. trade representative nominee, Katherine Tai, said on Monday she would work to fight a range of "unfair" Chinese trade and economic practices and would seek to treat Chinese censorship as a trade barrier. In written answers to senators' questions following her confirmation hearing last week, Tai said she would seek to use the enforcement consultation process in former President Donald Trump's "Phase 1" trade deal with China to ensure the protection of American intellectual property. (RTRS)

U.S./CHINA: China and the United States should remove all barriers to travel between the two countries if the United States achieves herd immunity for COVID-19 with 90% of its population vaccinated, potentially by August, a Chinese epidemiologist has said. The United States is the worst-hit nation in the world by case count, with nearly 30 million infections so far, though new cases have been declining. As of Sunday, 15% of the U.S. population has received at least one dose of a vaccine. "By August it could be reach 90% to reach herd immunity, so if that's the case, if we could remove all political barriers, just based on the science, the two countries could possibly be the first two countries to remove all barriers for free travel," Wu Zunyou, chief epidemiologist of China's Center for Diseases Prevention and Control, said on Monday. (RTRS)

GLOBAL TRADE: President Joe Biden's trade policy priorities include climate change, social impact and global cooperation, a stark contrast with Donald Trump's "America First" mantra and focus on negotiating new bilateral deals. Biden's trade strategy will look to incorporate sustainable environment goals, advance racial equity and partner with friends and allies, according to an annual report released by the office of the U.S. Trade Representative on Monday. It makes no mention of whether Biden will continue to pursue negotiations for new deals with the U.K., the European Union and Kenya, all of which were mentioned in Trump's final annual report a year ago. (BBG)

CORONAVIRUS: Global cases rose for the first time in almost two months in the past week, mainly in the Americas, Europe and Southeast Asia, the World Health Organization said. Part of the reason is that countries are easing restrictions, people are letting their guard down and variants are spreading, WHO officials said at a media briefing Monday. People should continue to limit contacts, avoid crowds and practice hygiene measures as vaccines are being rolled out. (BBG)

CORONAVIRUS: A senior World Health Organization official said Monday it was "premature" and "unrealistic" to think the COVID-19 pandemic will be over by the end of the year, but that the recent arrival of effective vaccines could at least help dramatically reduce hospitalizations and death. The world's singular focus right now should be on efforts to keep coronavirus transmission as low as possible, said Dr. Michael Ryan, director of WHO's emergencies program. "If we're smart, we can finish with the hospitalizations and the deaths and the tragedy associated with this pandemic" by the end of the year, he said at a media briefing. (Los Angeles Times)

CORONAVIRUS: The P. 1 Covid-19 variant that originated in Brazil and has spread to more than 25 countries is around twice as transmissible as some other strains and is more likely to evade the natural immunity people usually develop from prior infection, according to a new international study. The research, conducted by a UK-Brazilian team of researchers from institutions including Oxford university, Imperial College London, São Paulo University, found that the P. 1 variant was between 1.4 and 2.2 times more transmissible than other variants circulating in Brazil. (FT)

CORONAVIRUS: Johnson & Johnson is waiting on regulatory approval of a new, larger plant operated by contract manufacturer Catalent Inc to begin large-scale U.S. deliveries of its just-authorized COVID-19 vaccine following initial shipments this week, a top J&J executive said on Monday. J&J will ship nearly 4 million doses of the one-shot vaccine around the United States this week and expects to deliver another 16 million doses later this month. But none is expected to go out next week. (RTRS)

CORONAVIRUS: The Food and Drug Administration could authorize Novavax's Covid-19 vaccine for emergency use as early as May, the company's CEO, Stanley Erck, told CNBC on Monday. Novavax's phase three trial in the U.S. is still ongoing, with 30,000 participants, Erck said. The company hopes the FDA will allow it to use data from its clinical trial conducted in the U.K. when it files its emergency use application later this year, he added. U.K. health regulators will likely review the vaccine in April, followed by the FDA "probably a month after that," he told CNBC's "Closing Bell" in an interview. (CNBC)

CORONAVIRUS: A single shot of either Pfizer Inc. or AstraZeneca Plc's coronavirus vaccines can cut hospitalizations among older people by around 80%, according to a study, in a further boost for the U.K.'s immunization program. The report from Public Health England, published Monday, also found that one vaccine shot reduces the chance of people aged over-70 becoming ill by some 60%. U.K. Health Secretary Matt Hancock told a press conference in London the "exciting" data was a "sign that the vaccine is working". But he urged people to "keep sticking to the rules" of the country's third national lockdown, adding: "Let's not blow it now." (BBG)

RBA: MNI STATE OF PLAY: RBA Holds Rates But More QE Possible

- The Reserve Bank of Australia said it is prepared to "adjust" its bond purchases in response to market conditions as it reaffirmed its policy settings and left its yield curve target unchanged and focused on three-year government bonds, signalling continued support for the economy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's retirement savings pool exceeded A$3 trillion ($2.3 trillion) as of Dec. 31, the Australian Prudential Regulation Authority says in statement. Total contributions in year to Dec. 31 rose 1.9% to A$120.7 billion. Net contributions fell 81% y/y to A$7.7 billion. (BBG)

RBNZ: New Zealand's central bank said it's watching financial markets closely for signs of dysfunction and warned it has the ability to increase its weekly bond purchases to put more downward pressure on yields. The Reserve Bank "observed pockets of dysfunction" last week and has the operational flexibility to adjust its Large Scale Asset Purchase program up or down, Assistant Governor Christian Hawkesby said in an interview Tuesday in Wellington. Under the NZ$100 billion ($73 billion) program, the bank is currently buying NZ$570 million of government bonds a week. "We are watching markets very closely, we're very aware of what's going on and we do have that ability to adjust the size of our LSAP operations from week to week," Hawkesby said. "We absolutely have the flexibility to adjust those purchases down or up." (BBG)

RBNZ: New Zealand's central bank is in no rush to tighten monetary policy, assistant governor Christian Hawkesby said on Tuesday, as he sought to temper market expectations about sudden changes in interest rates. "Markets are keen to get ahead of central banks but there will inevitably be false starts and that is why we are seeing some of the volatility in bond markets at the moment," Hawkesby told Reuters in an interview. "Our approach is to continually remind markets that we are going to be patient, and we are in no hurry to remove stimulus," he said.

SOUTH KOREA: South Korea is drafting an extra budget of 15 trillion won ($13.38 billion), it said on Tuesday, to boost support for small businesses and safeguard jobs as the resurgent coronavirus forces the government to retain social distancing curbs. The finance ministry said total government spending would increase to a record 573.0 trillion won this year, up 11.9% from last year, while expected tax revenue is seen growing just 0.3%. That is set to worsen the debt-to-GDP ratio by 8.4 percentage points to a record 48.2% in 2021, versus 43.9% last year. "We want to make sure there are no blind spots left when it comes to using support funds (for small businesses), compared to how we spent them before," Ahn Do Geol, the deputy finance minister for the budget, told a news conference. (RTRS)

CANADA: MNI REALITY CHECK: Canada Recovery Seen Overcoming Slip in Q1

- Canadian companies told MNI they see a continued economic recovery following a first-quarter slowdown, with consumers adjusting to health restrictions and the rollout of vaccines while longer-term growth is aided by the return of immigration flows. Statistics Canada on Tuesday is expected by economists to show a 7.5% annualized gain in the fourth quarter, slowing from the significant gain of 41% in third quarter after the spring lockdown lifted. Strong investment in housing will be slowed by a second round of major lockdowns at the end of the year, something the BOC says will cause a small output contraction in the first quarter before solid growth in the second half of the year as vaccines roll out - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: MNI INTERVIEW: Jobless Dip Masks Lasting Damage - Canada Adviser

- Falling unemployment rates are masking a protracted economic recovery that will be dominated by discouraged low-wage workers who will find it hard to re-enter the labor market, Canadian government adviser Mikal Skuterud told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Canada's National Advisory Committee on Immunization (NACI) is not recommending the use of AstraZeneca's COVID-19 vaccine in individuals aged 65 years and older, due to "the insufficiency of evidence of efficacy in this age group at this time." (CTV News)

TURKEY: Turkey will lift weekend lockdowns in low and medium-risk cities and limit the restrictions to just Sundays in high and very high-risk cities as it starts a "controlled normalisation" of coronavirus measures, President Tayyip Erdogan said on Monday. Turkey's biggest city, Istanbul, was categorised as high risk, while the capital Ankara was in the medium-risk category. (RTRS)

TURKEY: Sait Erdal Dincer, a professor at the Faculty of Economics at Istanbul's Marmara University, is named as the new head of Turkey's state statistics institute, according to a decree by President Recep Tayyip Erdogan. (BBG)

MEXICO: President Joe Biden and Andres Manuel Lopez Obrador held a video meeting on Monday where the U.S. leader said they would discuss the Mexican president's request for American coronavirus vaccines. The White House said earlier in the day that it's focused on vaccinating people in the U.S. and has no immediate plans to provide shots to Mexico. The two leaders also planned to talk about immigration, recovery from the pandemic and climate change, White House Press Secretary Jen Psaki said earlier. "There is a long and complicated history between our nations," Biden told his counterpart. He said the two countries "haven't always been perfect neighbors with one another. But we have seen, over and over again, the power and the purpose when we cooperate. And we're safer when we work together." (BBG)

MEXICO: President Joe Biden told his Mexican counterpart, Andres Manuel Lopez Obrador, during their virtual meeting on Monday that he agreed on the need to increase legal paths to immigration, two Mexican officials said. Biden was also open to a proposal on sharing vaccines with Mexico, although details must be ironed out, said one of the officials, who asked not to be named to discuss private talks. (BBG)

MEXICO: Banxico will offer $1.5b from its swap line with the Federal Reserve in two auctions of $750m each on March 3 and 8, according to a statement posted on the central bank's website. Both operations to have terms of 84 days. (BBG)

BRAZIL: Brazil will remove a federal tax on diesel and gas used by families for cooking as President Jair Bolsonaro seeks to soften the impact of high energy prices that's hurting his supporters. The Brazilian government will halt the so-called PIS/Cofins tax on diesel fuel for March and April while permanently eliminating the same tax on gas used by households, according to a statement sent late Monday. The cuts will be offset by higher taxes on financial institutions and the chemical industry to comply with the country's fiscal rules, according to the government statement. While tax increases need to be approved by congress, reductions are automatic and can take effect immediately. The measure will reduce tax revenue by 3.67 billion reais ($651 million) this year, 922 million reais ($164 million) in 2022 and 945 million reais ($168 million) in 2023, according to the Presidency. (BBG)

RUSSIA: The United States is expected to impose sanctions as early as this week on Russians connected to the poisoning of Kremlin critic Alexei Navalny, three sources familiar with the matter said on Monday. The sources declined to identify the targets or the legal authorities Washington would use to penalize them as it seeks to impose consequences for the poisoning of Navalny. He fell ill on a flight in Siberia last August and was airlifted to Germany, where doctors concluded he had been poisoned with a nerve agent. The State Department did not immediately respond to a request for comment on the possibility of sanctions. (RTRS)

RUSSIA: The Pentagon has announced $125 million dollars in military aide for Ukraine to help it combat Russian aggression. Pentagon Spokesman John Kirby said the aid includes training, equipment and advisory efforts "to help Ukraine's forces preserve the country's territorial integrity, secure its borders and improve interoperability with NATO." Kirby said the assistance would not include Javelin anti-tank missiles, but would include two armed Mark IV patrol boats to help Ukraine defend its territorial waters. (PBS)

SOUTH AFRICA: South African President Cyril Ramaphosa sought to identify a backup option in case Finance Minister Tito Mboweni left his post, but abandoned the search because he couldn't find a suitable alternative, according to four people familiar with the situation. While some of the nation's most prominent policymakers and business executives were informally canvassed as potential replacements over the past few months, the two most favored candidates -- Reserve Bank Governor Lesetja Kganyago and former Deputy Finance Minister Mcebisi Jonas -- didn't want the job. The people asked not to be identified because the process was private and senior ruling party members weren't informed. (BBG)

IRAN: Wally Adeyemo, President Joe Biden's nominee as deputy Treasury secretary, underscored his commitment to rigorous enforcement of U.S. sanctions against Iran, Russia and other countries. In written responses to queries from members of the Senate Finance Committee, Adeyemo said Iran should only enjoy sanctions relief if it took the appropriate steps to resume compliance with its commitments under the 2015 nuclear accord. He said Treasury would look carefully at "any Iranian efforts to evade sanctions and abuse the international banking system" to fund terrorist activities, and would use all available tools to disrupt that support. (RTRS)

SAUDI ARABIA: The United States reserves the right to sanction Saudi Crown Prince Mohammed bin Salman in the future if necessary, White House spokeswoman Jen Psaki said on Monday. (RTRS)

MIDDLE EAST: Five people were injured when a missile launched by Yemen's Houthi militia fell in the Jazan region of southwestern Saudi Arabia, state news agency SPA reported early on Tuesday. The media spokesman for the Directorate of Civil Defense in Jazan, Col. Mohammed bin Yahya Al-Ghamdi, said the authority received a report about a missile launched from Yemen toward one of the border villages in Jazan. (Gulf News)

EQUITIES: Hong Kong's Hang Seng Index falls by as much as 0.8% on concerns about further hikes to the city's stamp duty on stock trades as well as comments from China's government about possible bubbles in overseas markets. (BBG)

EQUITIES: They were just days away from a multi-billion-dollar windfall. But now employees of Jack Ma's Ant Group Co. are stuck holding shares so difficult to value that even the company itself is struggling to determine a fair price. It has shelved a share buyback program for current and departing staff, in part because of uncertainty over how to value the company, according to Ant executives familiar with the matter. The move underscores two intertwined challenges facing Ant, four months after Chinese authorities abruptly torpedoed its $35 billion initial public offering: The fintech giant's future is still shrouded in doubt due to an ongoing lack of regulatory clarity, and employee morale is increasingly under threat. Ant is bracing for departures after it pays bonuses in April, the executives said, asking not to be named discussing private information. (BBG)

COPPER: Peruvian copper production has recovered from last year's pandemic disruptions and is poised to increase 21% this year, according to the country's mining and energy society SNMPE. Output, which fell 12% last year after the industry endured a two-month hard lockdown, will also benefit from the start of a new mine, SNMPE President Raul Jacob said in an interview. Some mines are still operating with reduced on-site workforces but are largely free of pandemic restrictions and are managing to maintain production. "In Peru, production is back to normal." (BBG)

OIL: Oil company executives at CERAWeek by IHS Markit were adamant on Monday that crude demand will rise over the coming decade and that the fossil fuel will remain a crucial part of the energy mix even as renewables draw increasing attention. Climate change and renewable fuels are taking center stage at this year's gathering of energy leaders, investors and politicians from around the globe, with oil companies trying to reorient their portfolios after the coronavirus pandemic eroded demand and caused the loss of thousands of jobs. (RTRS)

CHINA

CORONAVIRUS: China has only vaccinated 3.5% of its population and the Chinese Center for Disease Control and Prevention aims to bring that level up to 40% by end of June, Zhong Nanshan, who advises the government on Covid-19, said at an online forum. The country had vaccinated 52.5 million people as of the end of February, Zhong said. Gao Fu, head of the China CDC, suggested in the forum that China ease up on virus suppression to allow small local outbreaks to keep its economy strong and active. China reported 11 new virus cases on Monday, all of which it said were imported. (BBG)

POLICY: China's macroeconomic policies must be stable to help achieve the goal of normal growth after last year's measures to counter the pandemic, Huang Yiping, a former member of the PBOC Monetary Policy Committee, said in a blogpost. China should maintain positive fiscal and prudent monetary policies, support SMEs and account for financial risks, Huang said. China should let the market allocate and price resources, and avoid overexerting the government's role after the pandemic ends, he said. (MNI)

FISCAL: China is likely to cut taxes and fees by CNY1 trillion this year, further reducing VAT rates, individual income taxes, and social security fees, Xinhua News Agency reported citing Shi Zhengwen, a professor at the China University of Political Science and Law. The scale of the cuts will be lower than last year, which totaled about CNY2.5 trillion. China will continue with proactive fiscal policies with spending on people's wellbeing and with direct transfer to local governments amounting to over CNY3 trillion this year, Xinhua said. Monetary policy will remain prudent, emphasizing precision, flexibility, and moderation in line with current economic growth, inflation, and employment, Xinhua reported citing Wen Bin, the chief researcher at China Minsheng Bank. (MNI)

REGULATION: China's top banking regulator said he's "very worried" about risks emerging from bubbles in global financial markets and the nation's property sector, sparking fresh concerns about further tightening in the world's second-biggest economy. Stocks dropped across Asia. Bubbles in U.S. and European markets could burst because their rallies are heading in the opposite direction of their underlying economies and will have to face corrections "sooner or later," Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission and Party secretary of the central bank said at a briefing in Beijing on Tuesday. China's financial regulators are walking a fine line of trying to curb risks at home while limiting disruptions from abroad as the economy opens wider to foreign capital. (BBG)

REGULATION: China will strengthen anti-monopoly work and curb reckless capital expansion this year, China Banking and Insurance Regulatory Commission Chairman Guo Shuqing says in prepared remarks distributed ahead of a briefing. The regulator will keep focusing on preventing financial risks Guo also vows to push forward financing opening, without giving details. (BBG)

OVERNIGHT DATA

JAPAN Q4 CAPEX -4.8% Y/Y; MEDIAN -2.0%; Q3 -10.6%

JAPAN Q4 CAPEX EX SOFTWARE -6.1% Y/Y; MEDIAN -3.0%; Q3 -11.6%

JAPAN Q4 COMPANY PROFITS -0.7% Y/Y; Q3 -28.4%

JAPAN Q4 COMPANY SALES -4.5% Y/Y; Q3 -11.5%

MNI DATA IMPACT: Japan Q4 Capex Down; GDP Seen Revised Lower

- Combined capital investment by non-financial Japanese companies excluding software fell 1.4% q/q in the fourth quarter of 2020, widening from -0.8% in Q3, according to a quarterly revised survey released by the Ministry of Finance on Tuesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN JAN UNEMPLOYMENT 2.9%; MEDIAN 3.0%; DEC 3.0%

JAPAN JAN JOB-TO-APPLICANT 1.10; MEDIAN 1.06; 1.05

JAPAN FEB MONETARY BASE +19.6% Y/Y; JAN +18.9%

JAPAN FEB MONETARY BASE END OF PERIOD Y614.7TN; JAN Y616.5TN

AUSTRALIA Q4 BOP CURRENT ACCOUNT BALANCE +A$14.5BN; MEDIAN +A$13.0BN; Q3 +A$10.7BN

AUSTRALIA Q4 NET EXPORTS OF GDP -0.1; MEDIAN -0.3; Q3 -2.0

AUSTRALIA JAN BUILDING APPROVALS -19.4% M/M; MEDIAN -2.0%; DEC +12.0%

AUSTRALIA JAN PRIVATE SECTOR HOUSES -12.2% M/M; DEC +17.1%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 110.3; PREV. 109.2

Consumer Confidence reversed its three-week losing streak as the nationwide inoculation program began a week ago. Headline confidence is around its long-run average. What stands out is the jump in weekly inflation expectations to 3.9% (from 3.6% a week ago), its highest level since early April. Higher global fuel prices pushed up the average domestic retail petrol price by 1.6 cents/litre last week. This, coupled with a strong housing market and faster than expected recovery in the labour market, could be fuelling inflationary concerns. Inflation expectations are still below pre-pandemic levels, so could rise further without causing undue alarm for the RBA. (ANZ)

NEW ZEALAND Q4 TERMS OF TRADE +1.3% Q/Q; MEDIAN +1.0%; Q3 -4.7%

SOUTH KOREA JAN INDUSTRIAL OUTPUT +7.5% Y/Y; MEDIAN +5.9%; DEC +2.5%

SOUTH KOREA JAN INDUSTRIAL OUTPUT -1.6% M/M; MEDIAN +0.7%; DEC +2.7%

SOUTH KOREA JAN CYCLICAL LEADING INDEX CHANGE +0.3; DEC +0.4

SOUTH KOREA FEB MARKIT M'FING PMI 55.3; JAN 53.2

February data provided a further signal that the South Korean manufacturing sector continued its sustained recovery following COVID-19 disruption last year. The latest Manufacturing PMI reading was the highest since April 2010 and indicated that operating conditions have improved solidly thus far in the first quarter of 2021. Both output and new orders expanded at the fastest pace in close to 11 years in the latest survey period as manufacturers reported increasing demand and new product development had boosted the overall health of the sector. There was also a further rise in international demand, particularly in South East Asian economies. Amid pressure on capacity, South Korean manufacturing businesses signalled a stabilisation in employment levels in February, following a decline in the previous survey period. South Korean manufacturers reported a significantly optimistic outlook for production over the coming 12 months. IHS Markit currently estimates industrial production to grow 1.4% in 2021, with expectations for it to be a key contributor to economic growth in South Korea. (IHS Markit)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUE; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Tuesday. This leaves liquidity unchanged given the maturity of CNY10 billion in reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:24 AM local time from the close of 2.1886% on Monday.

- The CFETS-NEX money-market sentiment index closed at 35 on Monday vs 55 on last Friday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4625 TUES VS 6.4754

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4625 on Tuesday. This compares with the 6.4754 set on Monday.

MARKETS

SNAPSHOT: RBA Unch., QE Optionality Seen, Chinese Stocks Lower On Bubble Warning

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 258.76 points at 29406.01

- ASX 200 down 27.251 points at 6762.3

- Shanghai Comp. down 35.109 points at 3516.291

- JGB 10-Yr future up 33 ticks at 151.14, yield down 3.0bp at 0.125%

- Aussie 10-Yr future down 7.0 ticks at 98.265, yield up 6.6bp at 1.736%

- U.S. 10-Yr future +0-08 at 133-14, yield down 0.52bp at 1.412%

- WTI crude down $0.78 at $59.85, Gold down $9.75 at $1715.29

- USD/JPY up 9 pips at Y106.85

- CHINA SAYS CONCERNED ABOUT BUBBLES IN OVERSEAS FINANCIAL MARKETS (BBG)

- HONG KONG STOCK BENCHMARK FALLS ON STAMP DUTY, BUBBLE WORRIES (BBG)

- RATES ON HOLD AT RBA, MORE QE POSSIBLE (MNI)

- FED'S DALY: K-SHAPED ECONOMIC RECOVERY NOT ACCEPTABLE (BBG)

- SANDERS PUSHES TO HAVE $15 MIN. WAGE INCL. IN COVID RELIEF BILL (AXIOS)

- J&J WAITING ON NEW PLANT APPROVAL TO SHIP HIGH VOLUMES OF VACCINE (CNBC)

BOND SUMMARY: Core FI Mixed In Asia As Drivers Diverge

A light bid briefly crept into U.S. Tsys overnight, aided by Chinese regulatory body warnings re: bubbles in domestic property markets and offshore financial markets, while the Hang Seng struggled after Hong Kong's Financial Secretary failed to rule out further stamp duty hikes for equity trading at some point down the line (although he said that no such plans were in the pipeline at present). E-minis have nudged lower as a result. However, the space then pulled back from best levels on cues from the Aussie bond space post-RBA. T-Notes last +0-07 at 133-13, with cash Tsys marginally mixed.

- The cover ratio witnessed in the latest round of 10-Year JGB supply represented the lowest level seen at a 10-Year auction since 2016, which will garner the headlines and detract from the fact that the low price still managed to meet broader dealer exp. (matching the projection from the BBG dealer poll), while the tail only experienced a marginal widening. Futures looked through the auction given the broader breakdown outside of the offer/cover ratio, while there has been nothing in the way of notable underperformance for the 7-10 Year sector of the cash curve post-supply). Futures last +32, with the bid extending through the afternoon after a previously flagged BBG BoJ sources piece (run late Monday Tokyo time) and soft local Q4 capex data provided a bid for the space.

- Aussie bonds traded softer post-RBA as the Bank only expressed slightly more aggressive tones re: support for its 3-Year yield targeting scheme. The language employed wasn't overtly forceful and there was a lack of reference to the ACGB Nov '24 line, which would have provided some disappointment to those who attributed a non-negligible chance to the appearance of rhetoric surrounding the matter. The Bank continued to express some caveated and indeed cautious optimism re: the prospects of a more drawn out economic recovery, while providing nothing in the way of meaningful commentary on the housing market & AUD, although both got a mention. YM -2.0, XM -7.0.

JGBS AUCTION: Japanese MOF sells Y2.1221tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1221tn 10-Year JGBs:- Average Yield 0.131% (prev. 0.053%)

- Average 99.70 (prev. 100.46)

- High Yield: 0.134% (prev. 0.054%)

- Low Price 99.67 (prev. 100.45)

- % Allotted At High Yield: 30.8194% (prev. 62.9236%)

- Bid/Cover: 3.140x (prev. 3.419x)

EQUITIES: Early Bid Fades

A mixed day for equity markets in the Asia-Pac time zone. A positive open for most markets was cancelled out by mid-session, most major bourses are down 0.5% - 1.0%.

- There are a few exceptions, South Korea and Taiwan are in positive territory; both markets were closed yesterday for local holidays, while manufacturing PMI data from both countries earlier today was positive, with the figure supported by robust demand for electronics globally.

- Markets in Hong Kong and China lead the way lower, pressured after warnings from a CIBRC official about leveraging and the possibility for asset bubbles. The comments took the wind out of the sails of risk assets in the region.

- European and US futures are lower, giving back some of the broad based rally seen yesterday. Risk assets have gradually lost favour in the Asia-Pac session, with losses seen across the commodity complex.

OIL: OPEC Uncertainty

Crude futures are lower in Asia on Tuesday, if the close was negative it would be the third consecutive lower finish; WTI last down $0.65 at $59.99/bbl, brent is down $0.65 at $63.04.

- Markets are looking ahead to the OPEC+ this week, the group will meet on March 4. Markets expect an increase in production quotas given crude's move higher in 2021, but the groups biggest producer Saudi Arabia are said to be more cautious.

- The coalition has currently taken out 7.2m bpd of crude production, approximately 7% of pre-pandemic supply, and can increase supply by up to 500k bpd each month, as per the agreement struck in December, while there as still questions about Saudi Arabia continuing its voluntary production cuts. The latest report by Goldman Sachs posits that OPEC+ still has a deficit of 2m bpd at present. The pace of draws during the recovery could outstrip the group's ability to ramp up.

- The OPEC joint technical committee (JTC) will meet later on Tuesday, tasked with reviewing conformity to output cuts and market conditions. Meanwhile the weekly inventory reports from the API and the US DOE, are due to be released later March 2 and March 3, respectively.

GOLD: Multi-Month Lows Lodged In Asia Hours

Bullion moved to the lowest level seen since June during Asia-Pac hours as the USD ticked higher, although it was unclear which was leading which. Spot printed as low as $1,707.2/oz, before recovering from worst levels, last -$11/oz at ~$1,714/oz. U.S. real yields were little changed after fairly flat net trade on Monday, outside of a marginal uptick for 30s during the first trading session of the week. Bears are now looking to force a challenge of round number support at $1,700/oz.

FOREX: Risk Appetite Wanes, AUD Blips Higher Post-RBA

The U.S. dollar led safe haven currencies higher in a tight Asia-Pac session, as most regional bourses saw their benchmark indices lose ground, but resultant FX price swings were somewhat limited. The DXY crept above the prior intraday high and approached its 100-DMA but stopped short of testing that moving average.

- The latest monetary policy decision from the RBA provided the main point of note in the timezone, with AUD slipping in the lead-up to the announcement amid chatter re: the unwinding of longs by short-term funds. The Aussie regained poise as the RBA left its policy settings on hold, as some had expected somewhat more forceful rhetoric surrounding the Reserve Bank's 3-year yield targeting scheme. After the decision, AUD/USD implied volatility eased broadly across a range of tenors.

- The commodity-tied space was weighed on by softer crude oil prices, with NOK lagging all of its G10 peers. NZD ignored comments from RBNZ Asst Gov Hawkesby circulated by BBG early doors, as the official largely reiterated the Reserve Bank's familiar stance.

- USD/JPY extended its winning streak and had a brief look above Monday's peak, hitting levels not seen since Aug 28.

- The PBOC fixed its USD/CNY mid-point at 6.4625, 10 pips above sell-side estimates. USD/CNH ground higher, erasing yesterday's losses in the process, after failing to consolidate below its 50-DMA.

- Today's docket features Canadian GDP, German unemployment & retail sales, flash EZ CPI as well as speeches from Fed's Brainard & Daly, ECB's Panetta & Norges Bank's Olsen.

FOREX OPTIONS: Expiries for Mar 02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-20(E843mln), $1.2045-65(E1.5bln), $1.2085-90(E572mln), $1.2200-06(E595mln)

- USD/JPY: Y105.75-80($1.0bln), Y105.85-90($690mln), Y106.00-10($1.2bln), Y106.30-50($1.5bln), Y107.00($552mln), Y107.50($600mln)

- EUR/GBP: Gbp0.8630-35(E570mln)

- USD/CHF: Chf0.9030($710mln)

- AUD/USD: $0.7875(A$589mln)

- AUD/NZD: N$1.0670(A$722mln)

- NZD/USD: $0.7150(N$685mln)

- USD/CNY: Cny6.4500($588mln), Cny6.4645($833mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.