-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Yellen Downplays Inflation Risk

EXECUTIVE SUMMARY

- U.S. TSY SEC YELLEN: BIDEN'S COVID RELIEF PACKAGE IS "RIGHT SIZE" (ABC)

- U.S. TSY SEC YELLEN: U.S. INFLATION RISK REMAINS SMALL, "MANAGEABLE" (BBG)

- CHINA'S OUTPUT LEADS RECOVERY; SALES SLACKEN (MNI)

- MORE COUNTRIES SUSPEND VACCINATIONS WITH ASTRAZENECA JAB

- MERKEL'S CDU SUFFERS MAJOR SETBACKS IN REGIONAL ELECTIONS

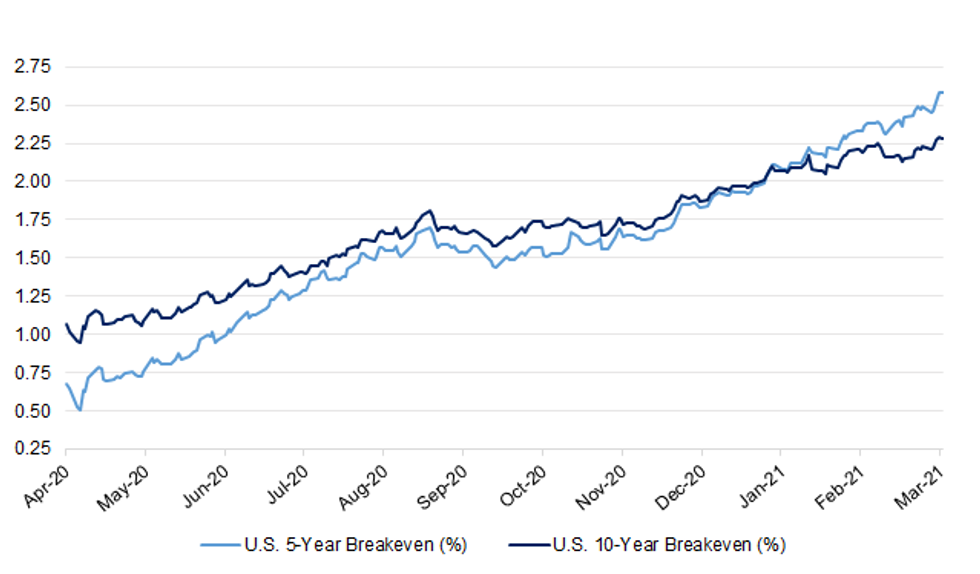

Fig. 1: U.S. 5-Year & 10-Year Breakevens (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The governor of the Bank of England has come under new criticism for failing to declare a potential conflict of interest in a scandal that saw thousands of bank customers mistreated. The Royal Bank of Scotland (RBS) was accused of benefitting as it left some of its customers in financial ruin. Now, it is reported that Andrew Bailey did not reveal his role in the scandal. That is despite being asked about it when he was appointed to his previous job as head of the city watchdog. The Bank of England said there was no interest to declare. (BBC)

CORONAVIRUS: The UK will scale up its coronavirus vaccination programme this week despite continued concerns inside government about supply issues. Vaccination rates have dipped slightly in March to about 2m a week — following a high of 3m a week in February. Ministers are preparing for a significant increase over the next three weeks, although rates may drop again in April. Nadhim Zahawi, vaccines minister, has said "March will be a very big month for us" and predicted jabs would be delivered at "twice the rate over the next 10 weeks as we have done over the past 10 or 11 weeks.' In a letter sent to GPs and clinical commissioning groups on March 2, seen by the FT, the two most senior officials in charge of primary care at NHS England said the government now expected vaccine supply for new first doses "to increase substantially" in the weeks beginning March 15, March 22 and March 29. (FT)

CORONAVIRUS: Boris Johnson accepts it was a mistake to delay the start of the first national lockdown, close allies have said, while insisting the Prime Minister was let down by scientific advisers. Mr Johnson would act "harder, earlier and faster" if he had his time again, supporters say, raising the possibility of a mea culpa moment in a future inquiry into the handling of the pandemic. The Telegraph has learnt that the pivotal moment in imposing lockdown came on March 14 last year – nine days before lockdown started – when Mr Johnson was shown evidence that ministers and scientific advisers had badly miscalculated how quickly the NHS would be overwhelmed. (Telegraph)

CORONAVIRUS: The national statistician has warned of a further wave of Covid-19 infections in autumn despite strong early evidence of vaccine protection. Sir Ian Diamond, head of the Office for National Statistics (ONS), said that although the case rate was the lowest since September it was still much higher than last summer when the first lockdown was lifted. The latest ONS survey found that the infection rate in England was 0.37 per cent, equal to about 6,000 cases a day, compared with 0.04 per cent last summer when it was deemed safe enough to lift the first lockdown. Diamond agreed with Chris Whitty, the chief medical officer for England, that a new wave in autumn was "inevitable". (Times)

CORONAVIRUS: Health officials in Northern Ireland will continue to use the Oxford-AstraZeneca vaccine after its suspension in the Republic of Ireland. The country's National Immunisation Advisory Committee (NIAC) recommended the move after reports of serious blood clotting events in adults in Norway. (BBC)

POLITICS: Prime minister Boris Johnson has hailed the UK's coronavirus vaccination programme as a demonstration of the power of the union ahead of Scottish elections in May that could provide a new platform for independence. Johnson said in a speech to the Scottish Conservatives' online conference on Sunday that the vaccination rollout — one of the most rapid in the world — had "brought our country together". "It shows that the great British spirit that saw us through so much adversity in the past, lives on in us today," he said. Polls suggest the Scottish National party is on course to win elections to the parliament in Edinburgh on May 6 that it hopes will provide a platform to push for a second referendum on independence from the UK. (FT)

POLITICS: Britain's most senior police officer was fighting to save her job last night as she refused to resign over Scotland Yard's policing of the Sarah Everard vigil. Dame Cressida Dick, the Metropolitan police commissioner, was defiant despite calls for her to quit and the announcement of three independent reviews. She insisted that the killing of Everard made her "utterly determined" to remain the force's first female leader. (Times)

POLITICS/ECONOMY: Boris Johnson will launch the biggest shake-up of England's bus network in decades on Monday with a framework for franchising and a pledge to invest £3bn, including on 4,000 new zero-emissions vehicles. The Campaign for Better Transport has stated 3,000 bus services have been cut over the past decade because of a 40 per cent cut in local authority bus funding. The reduction has particularly affected England's smaller towns and rural areas without rail links. (FT)

UK/CHINA: China accused the U.K. of "groundless slanders" after the British government said Beijing's crackdown on dissent in Hong Kong wasn't in compliance with a treaty that paved the way for the city's return to Chinese control. "The U.K. has no sovereignty, jurisdiction or right of 'supervision' over Hong Kong after the handover, and it has no so-called 'obligations' to Hong Kong citizens," China said in a statement posted Sunday on the website of its London embassy. "No foreign country or organization has the right to take the Joint Declaration as an excuse to interfere in Hong Kong affairs, which are China's internal affairs." The statement came after U.K. Foreign Secretary Dominic Raab on Saturday said China is in a "state of ongoing non-compliance" with the 1984 treaty that paved the way for Hong Kong's return to Chinese control. His remarks have gone further than previous comments by the U.K., which had called the changes a breach in the declaration. (BBG)

EUROPE

ECB: The European Central Bank's faster pace of emergency bond buying to rein in bond yields is a temporary strategy that will only last until the economy is stronger, Governing Council member Martins Kazaks said. "If the economy performs better, it could be possible to provide less support," Kazaks said in an interview on Friday. A "rise in yields will need to be accepted. But it should be gradual to avoid premature tightening." The remarks by Latvia's governor highlight the fine line the ECB is walking as it strives to honor its pledge to keep financial conditions "favorable" through the pandemic. Policy makers have differed in their views on how much higher borrowing costs reflect budding economic optimism, and how much is an unwarranted spillover from the stronger U.S. rebound and fiscal stimulus. (BBG)

GERMANY: A collapse in support for Angela Merkel's Christian Democrats in two regional elections on Sunday signaled that a widening corruption scandal and missteps during the pandemic may threaten the party's hold on power in a national election this September. The center-right party suffered its worst-ever results in both Baden-Württemberg, home to much of the country's auto industry, as well as in Rhineland-Palatinate, a small western state bordering France where Helmut Kohl made his name. The Christian Democratic Union (CDU), often described as Germany's last remaining Volkspartei, or big-tent party, lost about 15 percent of its support compared to the previous election in 2016 in both states, a historic decline that party leaders made no effort to sugarcoat. "One has to be honest about it, the CDU recorded a disastrous result," said Susanne Eisenmann, the CDU's lead candidate in Baden-Württemberg, of her loss. As expected, the big winner of the night was the Green Party, which held on to first place in Baden-Württemberg, and nearly doubled its result in Rhineland-Palatinate to finish third. The CDU's lackluster showing could mean Merkel's preferred candidate to succeed her as chancellor — new party leader Armin Laschet — won't even get a chance to run. Laschet, the premier of North Rhine-Westphalia, is vying with Markus Söder, leader of the CDU's Bavarian sister party, the Christian Social Union (CSU), to be the conservative standard-bearer in the upcoming campaign. With Söder well ahead in the polls in terms of favorability, Laschet needed a big boost on Sunday that he didn't get. (Politico)

FRANCE: Officials say the Paris region may be headed toward a new lockdown as new Covid-19 variants fill up hospitals' intensive care wards and limited vaccine supplies drag down inoculation efforts. Special medical planes dispatched patients from the Paris area to less-saturated regions over the weekend. "If we have to lock down, we will do it," the head of the national health agency, Jerome Salomon, said on BFM television Sunday. "The situation is complex, tense and is worsening in the Paris region." Salomon acknowledges that a nationwide 6 p.m. curfew "wasn't enough" in some regions to prevent a spike in cases, notably of the variant first identified in Britain. (France24)

ITALY: Seven years after being ousted as Italy's prime minister, Enrico Letta is back on the political front line as leader of the center-left Democratic Party. Letta, who led a coalition government from 2013 to 2014, was solicited by senior Democrats to run the party after its previous head, Nicola Zingaretti, quit last week, complaining of infighting. Democrats are hoping Letta, viewed as a political heavyweight, can revive the party's diminished popularity to its 2014 peak. On Twitter, Letta said he felt "no lack of emotion" when returning Sunday to the Democratic Party (PD) headquarters in Rome for its national assembly, seven years after he was unceremoniously pushed out as prime minister by then-party leader Matteo Renzi. (Politico)

ITALY: Health Minister Roberto Speranza gave reassurances about the safety of the COVID-19 vaccines being used in Italy during a meeting with the nation's governors on Friday, sources said. (Ansa)

NETHERLANDS: The Netherlands on Sunday joined a fast-growing list of countries suspending use of AstraZeneca's COVID-19 vaccine after reports of unexpected possible side effects from the injection. The vaccine will not be used until at least March 29 as a precaution, the Dutch government said in a statement. (RTRS)

NETHERLANDS: Dutch caretaker Prime Minister Mark Rutte will likely hold onto his job after Wednesday's election, with his Liberal VVD party comfortably ahead in opinion polls. The big question is how long will it take him to form another coalition among the whopping 37 parties contesting the ballot in the 150-seat lower house of Parliament. The process of piecing together a government could take months, and the result will dictate the new administration's priorities, from its pandemic recovery plans to its stance on European Union projects. (BBG)

IRELAND: The rollout of the AstraZeneca Covid vaccine has been suspended in the Republic of Ireland following a recommendation by Irish health officials after reports of blood-clotting incidents elsewhere in Europe. Serious blood-clotting events have been recorded after inoculations in Norway, where the AstraZeneca vaccine programme has been paused. Denmark and Iceland have also suspended the rollout pending an investigation. In an email to The Independent, a spokesperson for the Irish Department of Health said administration of the AstraZeneca jab had been "temporarily deferred" as of Sunday morning. (Independent)

SWITZERLAND: Swiss officials will convene on Friday to reconsider a planned relaxation of some coronavirus-related restrictions from March 22. At its meeting on Friday, the ruling Federal Council decided to begin consultations on a second phase of reopening that would allow people to attend some live events, permit gatherings at home involving up to 10 people and reopen restaurant outdoor seating areas. (FT)

EQUITIES: Danone's board of directors has decided to replace Emmanuel Faber as both chief executive and chairman, according to people familiar with the matter, blowing up a two-week-old compromise designed to have him remain as chairman. The board met on Sunday evening as the crisis deepened at the French consumer group, which since January has been under attack by activist investors that have criticised what they see as its underperformance. The investors have called for Faber's departure. (FT)

US

ECONOMY: President Joe Biden's $1.9 trillion coronavirus relief package is the "right size" to confront the economic effects of the pandemic, Treasury Secretary Janet Yellen said Sunday on ABC's "This Week." "It's the right size to address the very significant problem that we have," she told "This Week" Anchor George Stephanopoulos. "We need to defeat the pandemic. This package really does that." "There's enough support in this package to relieve suffering and to get the economy quickly back on track. I'm hopeful that, if we defeat the pandemic, that we can have the economy back near full employment next year. And I think this is the package we need to do that," Yellen added. Stephanopoulos pressed Yellen about the inflation concerns, amidst recent federal spending. "If we get back to full employment, could we see inflation surge? How big a problem is that?" he asked the treasury secretary. "The most significant risk we face is a workforce that is scarred by a long period of unemployment. People being out of work, not able to find jobs can have a permanent effect on their well-being. I think that's the most significant risk," Yellen said. "Is there a risk of inflation? I think there's a small risk. And I think it's manageable." In order to balance the budget, Stephanopoulos asked Yellen if a wealth tax -- similar to what has been proposed by Sen. Elizabeth Warren, D-Mass. -- could help raise revenue to pay for the Biden administration's programs. "President Biden has put forward a number of proposals. He hasn't proposed a wealth tax, but he has proposed that corporations and wealthy individuals should pay more in order to meet the needs of the economy, the spending we need to do, and over time I expect that we will be putting forth proposals to get deficits under control," Yellen said. When Stephanopoulos challenged Yellen on if that meant the administration would not implement the tax, she responded, "that's something that we haven't decided yet." (ABC)

FISCAL: House Speaker Nancy Pelosi on Sunday pledged swift work by Congress on a job and infrastructure package that will be "fiscally sound," but said she isn't sure whether the next major item on President Joe Biden's agenda will attract Republican backing. (AP)

ECONOMY/CORONAVIRUS: President Joe Biden is eyeing Gene Sperling for a role to oversee the implementation of the administration's coronavirus relief plan, according to two sources with knowledge of the plans. The White House could announce the role for Sperling as early as Monday, the sources said. Sperling, who served on the economic teams in both the Obama and Clinton administrations, was under consideration to serve as Biden's director of the Office of Management and Budget after the president's first pick, Neera Tanden, failed to secure enough support in the Senate. Instead of that post, he is being strongly considered for a position within the White House where he will be tasked with overseeing the enactment of the recently signed $1.9 trillion Covid relief bill. (Politico)

CORONAVIRUS: White House Chief Medical Advisor Dr. Anthony Fauci warned state leaders on Sunday that the nation's battle with the coronavirus is still "not in the end zone," and urged Americans to adhere to public health measures as Europeans experience new infection spikes. "When I hear pulling back completely on public health measures, saying no more masks, no nothing like that, that is risky business," Fauci said during an interview with "Meet the Press." "Don't spike the ball on the five-yard line. Wait until you get into the end zone. We are not in the end zone yet," he said, adding that prematurely pulling away from public health measures could prolong the pandemic. (CNBC)

CORONAVIRUS: NIAID Director Anthony Fauci told "Fox News Sunday" that "it would make all the difference in the world" if former President Trump urged his supporters to take the coronavirus vaccine. (Axios)

POLITICS: Lily Adams, a veteran of Vice President Kamala Harris' presidential bid, is joining the Treasury Department to help promote the $1.9 trillion American Rescue Plan and the administration's broader plans to combat income inequality. Why it matters: Touting Biden's stimulus package will be a government-wide effort, with a coordinated communications strategy. Treasury is taking the lead on implementing it, and Adams will play a key role. (Axios)

POLITICS: President Biden told reporters Sunday he'll wait for the outcome of an investigation into sexual harassment allegations leveled against New York Gov. Andrew Cuomo (D) before commenting on whether the governor should resign. Why it matters: The only Democratic figure who could likely persuade Cuomo to resign is Biden, per Axios' Jonathan Swan. Their friendship and political alliance dates back years. (Axios)

POLITICS: A longtime Gov. Cuomo adviser contacted New York county officials over the past two weeks to gauge loyalty as the governor faced multiple scandals and a sexual harassment investigation, according to reports. Larry Schwartz, known as New York's "vaccine czar," reached out to executives in a move that one Democrat county executive called "inappropriate." (Fox)

POLITICS: Gun control groups are now focusing all of their lobbying efforts on the Senate following House passage of two major bills last week that garnered some GOP support. Senate Majority Leader Charles Schumer (D-N.Y.) is promising quick action on the legislation — to strengthen background checks and to close the so-called Charleston loophole — but advocates face a familiar uphill battle in trying to win over enough Republicans. Still, proponents are optimistic that a Democratic-led Senate, combined with an ally in the Oval Office and a weakened National Rifle Association (NRA), will help get gun control legislation passed for the first time in decades. (Hill)

OTHER

U.S./CHINA: The Biden administration intends to continue the previous presidency's "maximum pressure" strategy by emphasizing the Indo-Pacific concept, said China Daily in an editorial commenting on the summit between the U.S., Japan, Australia and India. China had clearly been the focus of the summit discussions despite not being mentioned in the concluding statement, said the Daily. The four countries have no common foundation or strategic motive to treat China as their common and "imagined" enemy as they all benefit from China's development, and their committed initiatives such as fighting the COVID-19 pandemic and climate issues require co-operation and coordination with China, the Daily said. (MNI)

GEOPOLITICS: Biden, leaders of India, Japan, Australia commit to 'free, open, secure and prosperous' Indo-Pacific in joint op-ed President Biden joined the leaders of India, Japan and Australia in committing to a "free, open, secure and prosperous" Indo-Pacific region in a Washington Post op-ed published Saturday. Indian Prime Minister Narendra Modi, Japanese Prime Minister Yoshihide Suga and Australian Prime Minister Scott Morrison teamed up with Biden in a vow to invest in the "region in need" amid the climate crisis, coronavirus pandemic and other issues confronting the zone. The leaders pointed to the 2004 tsunami that struck the area, prompting the four democratic countries, called "the Quad," to work together for the first time to respond to the disaster. "Now, in this new age of interconnection and opportunity throughout the Indo-Pacific, we are again summoned to act together in support of a region in need," the countries' leaders wrote. (Hill)

CORONAVIRUS: And a fresh statement from AstraZeneca said: "A careful review of all available safety data of more than 17 million people vaccinated in the European Union and UK with COVID-19 Vaccine AstraZeneca has shown no evidence of an increased risk of pulmonary embolism, deep vein thrombosis or thrombocytopenia, in any defined age group, gender, batch or in any particular country." (Sky)

BOC: MNI BOC Review - March 2021: April 21 Meeting Will be Pivotal

- As expected, the Bank of Canada held it's policy rate steady at the lower bound of 0.25% (bank rate at 0.5, deposit rate at 0.25) Wednesday, and kept asset purchases to at least CAD4 billion a week - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

- The Bank of Japan looks set to formalize the trading band currently tolerated for 10-year JGBs and clarify its stance on purchases of Exchange Traded Funds at the March meeting, as it prepares to tweak and not radically overhaul its strategy when policymakers finally lay out the conclusions of the policy review set up in November - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japan plans not to extend the Covid-19 state of emergency in the Tokyo region beyond its March 21 end date, Sankei reported late Saturday, citing unidentified government officials. Improving hospital bed occupancy rates in Tokyo and three surrounding prefectures has allowed the government to plan to lift the emergency on time, even though the number of new virus cases has stopped falling, the newspaper reported. Sankei also cited a cabinet minister as saying the emergency may have lost its effectiveness in improving the situation. Prime Minister Yoshihide Suga had cited the need to prevent a rebound in cases when he extended the capital region's emergency for two weeks at the start of this month. Officials are expected to make a decision as soon as Thursday, Sankei said. (BBG)

JAPAN: Tokyo Olympics organizers will consider a plan to set an upper limit of 50% of capacity in venues at the games this summer, Sankei reported late Saturday night local time, citing unidentified government and organizing officials. The limit for large venues would initially be set at 20,000 spectators, the newspaper said. If the Covid-19 situation improves further, the venues would be allowed to let in more than that, as much as 50% of capacity, it said. (BBG)

RBA: Reserve Bank Governor Philip Lowe said investment in Australia's digital capabilities is crucial to lifting the nation's productive capacity and underpinning future prosperity. "In many ways data is the new oil of the 21st century," Lowe said in prepared remarks to a conference in Melbourne on Monday. "These investments allow better decision making and a faster response to the changes in our economy and society." Australia has opportunities for digital innovation in every sector of the economy, Lowe said, while noting business investment is one piece of the recovery that is "yet to click into gear." The governor also said that jobs have almost returned to the level before the pandemic. Australian economy is experiencing a V-shaped recovery, which has seen sentiment surge and unemployment fall. Lowe said today that looking across the range of indicators, Australia is doing much better than most other advanced economies. "This, however, does not hide the fact that we still have a long way to go," he said, noting the jobless rate of 6.4% in January "is too high and the economy is operating well short of its capacity." (BBG)

AUSTRALIA/NEW ZEALAND: After a muted 2020, renewables investment is heating up again in Australia and New Zealand. New Zealand-based Tilt Renewables Ltd. agreed to sell its Australian business to a venture that includes AGL Energy Ltd. and its New Zealand assets to Mercury NZ Ltd. in a deal that value the company at NZ$2.96 billion ($2.1 billion). The transaction highlights a renewed appetite for renewables infrastructure investment in the region, and is the biggest merger and acquisition agreement in Australia and New Zealand this year after the A$4.5 billion ($3.5 billion) sale of telecommunication business Vocus Group Ltd. to a consortium led by Macquarie Group Ltd. (BBG)

SOUTH KOREA: The defense chiefs of South Korea and the United States will hold their first face-to-face meeting in Seoul this week, and the two sides are working to fix their agendas, the defense ministry said Monday. U.S. Secretary of Defense Lloyd Austin is set to arrive in South Korea on Wednesday for a three-day stay and will hold talks with Defense Minister Suh Wook, according to the ministry. The two ministers will then join Foreign Minister Chung Eui-yong and U.S. Secretary of State Antony Blinken on Thursday for a "two plus two" meeting. It is Austin's first Asia swing, which also includes trips to Hawaii, Japan and India, since taking office in January as the first Pentagon chief of the Joe Biden administration. (Yonhap)

SOUTH KOREA: South Korea has relaxed some of the social distancing rules for first-birthday parties and family gatherings to plan weddings, although the country is still grappling with sporadic clusters of coronavirus infections. Private gatherings of more than four people will still be banned but up to eight people can gather to discuss wedding plans and up to 100 people can participate in birthday banquets for children's first birthdays. (FT)

NORTH KOREA: North Korea has not responded to behind-the-scenes diplomatic outreach since mid-February by President Joe Biden's administration, including to Pyongyang's mission to the United Nations, a senior Biden administration official told Reuters on Saturday. (RTRS)

SINGAPORE/AUSTRALIA: Singapore and Australia are discussing an air travel bubble that would allow travel between the two countries without the need for quarantine, looking to reopen borders that have been mostly shut for nearly a year due to the Covid-19 pandemic. Both countries have largely brought the virus under control, helped by international border closures, lockdowns and strict social-distancing rules. Singapore is also discussing with Australia the mutual recognition of vaccination certificates and resumption of travel with priority for students and business travelers, Singapore's foreign ministry said in a statement. (CNBC)

SINGAPORE: Prime Minister Lee Hsien Loong said in a TV interview he hoped Singapore would start re-opening its borders by the end of the year as more countries ramp up vaccination drives against COVID-19 infections. The Southeast Asian island nation has largely banned leisure travel, but has put in place some business and official travel programs. It is also discussing the mutual recognition of vaccine certificates with other nations. (CNBC)

INDIA: India will propose a law banning cryptocurrencies, fining anyone trading in the country or even holding such digital assets, a senior government official told Reuters in a potential blow to millions of investors piling into the red-hot asset class. (RTRS)

INDONESIA: Indonesia is pursuing another attempt at increasing government influence in the decision-making and operations of its central bank, as well as expanding its ability to fund public debt, according to a draft legislation to be discussed in parliament. A proposed omnibus financial sector reform bill would require Bank Indonesia to take into account the government's broad economic strategy when making monetary policy decisions, according to a copy of the bill reviewed by Bloomberg. The central bank's mandate would also be extended to promoting job creation, supporting sustainable economic growth and keeping stability in the financial system. Bank Indonesia declined to comment. A finance ministry officer, Yustinus Prastowo, said a draft is in the works. (BBG)

PHILIPPINES: Parts of the busy Makati district of Manila have been placed under a lockdown until Monday to control a surge of coronavirus infections. Makati mayor Abby Binay at the weekend declared affected zones of the Pio del Pilar barangay — a village administrative unit — as critical and placed them under three days of "localised enhanced community quarantine". The lockdown comes ahead of a uniform curfew across metropolitan Manila from Monday in response to the surge of Covid-19 infections in the Philippines' capital region. (FT)

MYANMAR: Myanmar's ousted civilian leader Aung San Suu Kyi is to appear in court on Monday (March 15), after one of the country's bloodiest days since the Feb 1 coup. At least 38 people were killed on Sunday as security forces cracked down on anti-coup protesters, taking the total death toll to more than 120, according to the Assistance Association for Political Prisoners (AAPP) monitoring group. (Straits Times)

CHINA

PBOC: The pull-out of high-carbon industries in China would lead to a possible re-evaluation of invested financial resources and might bring systemic financial risks, state-owned Shanghai Securities News said on Monday, citing a central bank official. Authorities should pay close attention to changes in macro-leverage ratios and conduct more comprehensive and accurate risk assessments and stress tests on the financial system, said Wang Xin, head of the research bureau at the People's Bank of China, at a recent event in Shanghai. (RTRS)

ECONOMY: February data showing a 13.3% y/y growth in China's total-social financing and a 12.6% gain in outstanding loans showed that both trends are unsustainable since the central government has said it prefers financial stability over monetary easing, said the 21st Century Business Herald in an editorial. The government should rein in lenders from extending too much credit in a single month, said the newspaper. Companies and residents had scrambled to raise money fearing the government would tighten credit after the March National People's Congress. (MNI)

ECONOMY: China's investment in infrastructure projects this year is likely to rise 5% from last year, reported the China Securities Journal citing Li Xunlei, the chief economist of Zhongtai Securities. Projects funded by the local government special-purpose bonds are likely to be bigger than last year given some of the funds carried over, Li said. Investments this year will concentrate on urbanization, environmental protection, and transportation facilities, the Journal reported citing Liu Xiangdong, a deputy director of the research department of the China Center for International Economic Exchanges. (MNI)

CHINA NEWS: China is experiencing the most severe sandstorm in a decade as 12 provinces in the northern part of the country are blanketed in yellow sand and dust, according to a notice issued by China's National Meteorological Centre on Monday. The range of the sandstorm also covers the widest area seen in the past 10 years, from Xinjiang and Gansu in the northwest to the northern regions of Inner Mongolia and Hebei, the notice said. (SCMP)

OVERNIGHT DATA

CHINA FEB INDUSTRIAL OUTPUT YTD +35.1% Y/Y; MEDIAN +32.2%

CHINA FEB RETAIL SALES YTD +33.8% Y/Y; MEDIAN +32.0%

CHINA FEB FIXED ASSETS EX RURAL YTD +35.0% Y/Y; MEDIAN +40.9%

CHINA FEB PROPERTY INVESTMENT YTD +38.3% Y/Y; MEDIAN +53.4%

CHINA FEB UNEMPLOYMENT 5.5%; MEDIAN 5.2%

MNI DATA IMPACT: China's Output Leads Recovery; Sales Slacken

- The Chinese economy continues to recover with macro indicators significantly rebounding on a lower comparison base last year, when the initial outbreak of the Covid-19 pandemic disrupted production and consumer markets - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA FEB NEW HOME PRICES +0.36% M/M; JAN +0.28%

JAPAN JAN CORE MACHINE ORDERS +1.5% Y/Y; MEDIAN -0.3%; DEC +11.8%

JAPAN JAN CORE MACHINE ORDERS -4.5% M/M; MEDIAN -5.5%; DEC +5.3%

JAPAN JAN TERTIARY INDUSTRY INDEX -1.7% M/M; MEDIAN -0.6%; DEC -0.3%

NEW ZEALAND FEB SERVICES PMI 49.1; JAN 48.0

NEW ZEALAND JAN NET MIGRATION 631; DEC 451

CHINA MARKETS

PBOC NET INJECTS CNY100BN VIA MLF AND REPOS MONDAY

The People's Bank of China (PBOC) injected CNY100 billion via one-year medium-term lending facility (MLF) with the rate unchanged at 2.95% on Monday. This aims to roll over the CNY100 billion of MLFs maturing this month, the PBOC said on its website. The PBOC also injected CNY10 billion via 7-day reverse repos. In total, the central bank net injected CNY100 billion as CNY10 billion repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2385% at 09:27 local time from the close of 2.1111% on last Friday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 32 on last Friday vs 41 on last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5010 MON VS 6.4845

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5010 on Monday, compared with the 6.4845 set on Friday.

MARKETS

SNAPSHOT: Yellen Downplays Inflation Risk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 49.97 points at 29766.9

- ASX 200 up 6.189 points at 6773

- Shanghai Comp. down 27.312 points at 3425.547

- JGB 10-Yr future up 10 ticks at 151.09, yield down 1.3bp at 0.110%

- Aussie 10-Yr future down 8.7 ticks at 98.172, yield up 8.5bp at 1.789%

- U.S. 10-Yr future -0-01+ at 131-23+, yield up 1.07bp at 1.635%

- WTI crude up $0.5 at $66.1, Gold down $2.35 at $1724.78

- USD/JPY up 16 pips at Y109.19

- U.S. TSY SEC YELLEN: BIDEN'S COVID RELIEF PACKAGE IS "RIGHT SIZE" (ABC)

- U.S. TSY SEC YELLEN: U.S. INFLATION RISK REMAINS SMALL, "MANAGEABLE" (BBG)

- CHINA'S OUTPUT LEADS RECOVERY; SALES SLACKEN (MNI)

- MORE COUNTRIES SUSPEND VACCINATIONS WITH ASTRAZENECA JAB

- MERKEL'S CDU SUFFERS MAJOR SETBACKS IN REGIONAL ELECTIONS

BOND SUMMARY: Ebb & Flow

T-Notes (citing the M1 contract) started the Asia-Pac session by partially retracing their Friday downswing, but failed to cling onto those early gains. The contract topped out at 132-00+ and pulled back into negative territory. It last trades -0-01+ at 131-23+, hovering just above session/Friday's low of 131-23. Cash Tsy curve bear steepened, with yields last seen 0.6-1.7bp higher. Eurodollar futures sit up to 1.0 tick lower through the reds. The main focus overnight fell on China's monthly economic activity data, which were a mixed bag (though closely watched industrial output & retail sales topped expectations), distorted by a large base effect & impact of the LNY holidays. In the U.S., an interview with Tsy Sec Yellen grabbed attention, as she downplayed the inflation risk and that there's no decision on whether to pursue a wealth tax yet.

- JGB futures were in demand from the off, smoothly surging past Friday highs in early dealing. The contract edged away from its best levels thereafter and last sits at 151.06, 7 ticks higher on the day. Cash JGB yields are lower, with belly outperforming at the margin. Japan's core machine orders recorded the first monthly drop in four months, but the decline was shallower than expected.

- Cash ACGB curve steepened at the re-open, but yields moved off steeps later in the session and last sit -0.5bp to +7.8bp. Aussie bond futures crept higher before paring some gains, YM last trades unch. & XM -8.6 ticks. Bills trade 1-3 ticks lower through the reds. Little to write home re: RBA Gov Lowe's latest address. Elsewhere, the Reserve Bank offered to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, excluding ACGB Sep '26, as part of its bond-buying scheme.

EQUITIES: Stocks Fluctuate

A mixed day for stocks in Asia-Pac; Japan, Australia, South Korea and Hong Kong are in positive territory. Bourses in South Korea are supported after units of Korea Shipbuilding won orders worth a total KRW 832bn, while the Hang Seng saw gains after Xiaomi surged following a temporary halt to a US ban, while a decline in Tencent tempered gains. Markets in mainland China did manage to get into positive territory after data showed industrial production and retail sales both rose above estimates, but the move was reversed as the session wore on and the CSI 300 is currently down around 1.65%. Futures in the US are higher but off best levels, adding to gains after indices hit all time highs on Friday.

OIL: Crude Rises Despite Lack Of Newsflow

Crude futures have advanced to kick off the week in Asia; WTI last up $0.53 from settlement levels at $66.14/bbl, while Brent is up $0.48 at $69.71/bbl. The demand equation is supported by robust industrial production figures from China, while markets continue to digest the OPEC+ decision to maintain limits on supplies.

GOLD: Bullion Flat

The yellow metal has hovered around neutral levels, last at $1727.20/oz having come off session highs of $1733.99. The increase came after data from China showed industrial production and retail sales both rose above estimates. In general news flow was fairly light with markets awaiting the FOMC meeting later this week for a response to subdued inflation pressures.

FOREX: Antipodean Decoupling

Antipodeans currencies were the big movers at the start to the week, landing at the opposite ends of the G10 scoreboard. The kiwi took flight amid M&A chatter surrounding the planned sale of Tilt Renewables' Australian & NZ sales businesses to Powering Australian Renewables & Mercury NZ, with BBG trader sources flagging demand for NZD/USD from leveraged funds in reaction to the news. AUD went offered against its Antipodean cousin and AUD/NZD tumbled past last Friday's low, despite the recent emergence of a "golden cross" pattern on the intraday chart. RBA Gov Lowe delivered a fairly uninspiring speech, largely sticking to his familiar script.

- USD/CNH crept higher after the release of China's Feb round of economic activity indicators, but the broader market reaction was relatively limited. Industrial output and retail sales rose faster than forecast, but fixed assets and property investment missed expectations, while the unemployment rate was higher than projected. The implications of the data were obscured by the impact of the LNY holidays & a sizeable base effect.

- The DXY moved roughly in tandem with U.S. Tsy yields and managed to recoup its initial slide.

- JPY went offered, which allowed USD/JPY to have a look above Friday's peak, as it topped out just shy of Mar 9 cycle high. The yen's safe haven peer CHF held firm.

- U.S. Empire M'fing, Swedish CPI, Canadian housing starts & m'fing sales as well as ECB speak from Mario Centeno take focus from here.

FOREX OPTIONS: Expiries for Mar15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y108.95-109.00($515mln-USD puts), Y110.00($550mln)

- GBP/USD: $1.3950(Gbp311mln)

- AUD/USD: $0.7650-65(A$751mln), $0.7700-10(A$500mln), $0.7720-35(A$713mln), $0.7780-90(A$655mln), $0.7820-30(A$501mln)

- USD/CNY: Cny6.41($500mln), Cny6.47($1.35bln-USD puts), Cny6.48($823mln), Cny6.50($596mln)

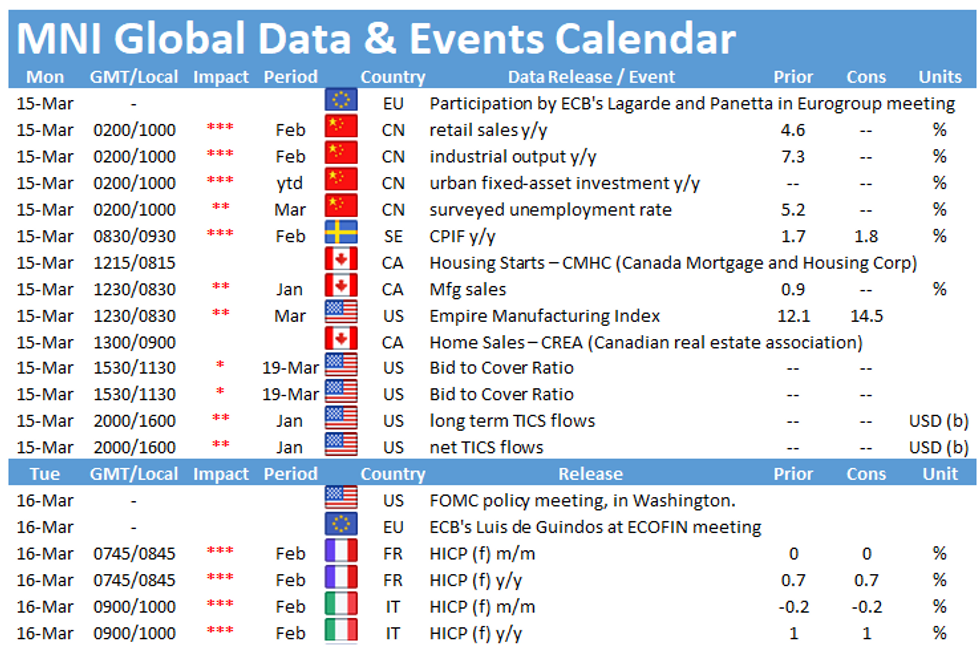

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.