- PolicyPolicy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: - G10 MarketsG10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts - Emerging MarketsEmerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

- CommoditiesCommodities

Real-time insight of oil & gas markets

- CreditCredit

Real time insight of credit markets

- Data

- MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

- About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

- PolicyPolicy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: - G10 MarketsG10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts - Emerging MarketsEmerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

- CommoditiesCommodities

Real-time insight of oil & gas markets

- CreditCredit

Real time insight of credit markets

- Data

- MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

- About Us

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD A Touch Higher Overnight, RBA Speculation Eyed

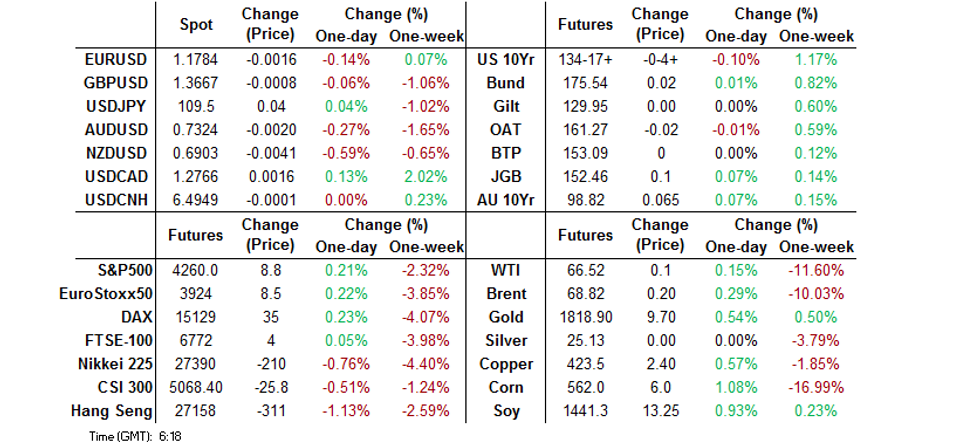

- Bitcoin's first foray below 30K since late June triggered some defensive flows overnight. USD finds itself atop the G10 FX leaderboard.

- Sell-side discussions surrounding the RBA holding off on its already announced tapering move caught the eye in the wake of yesterday's press reports re: the matter. Westpac chief economist Bill Evans went as far as flagging the potential for a temporary lift in bond purchases.

- The broader docket remains thin on Tuesday.

BOND SUMMARY: Core FI Better Bid Into European Hours

It has been a quiet Asia-Pac session in terms of broader news flow. We didn't see much to drive the recent bid in the U.S. Tsy space, but e-minis traded off best levels, with Bitcoin trading back below $30,000 for the first time since late June. We are always cautious when pointing to direct correlations with cryptocurrencies, but that could be at least a partial driver here. Also, the bid in the ACGB space could be providing another (modest) leg of support. T-Notes last -0-03+ at 134-18+, after tagging best levels of 134-21, once again operating on healthy volume of ~135K. The cash curve has twist steepened around the 7-Year point of the curve.

- JGB futures have stuck to the upper half of the overnight range for most of the Tokyo session, and last deal +15. The major cash JGB benchmarks have generally richened by 0.5-1.0bp, given the dynamic in core global FI markets & JGB futures overnight, with 10s moving back to their recent 0.01% low. Still, technical resistance for futures in the form of the July 9 high (152.59) remains untouched. The latest liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs saw a soft cover ratio, although this didn't have much, if any, impact.

- The Aussie bond space has drawn a modest bid from Westpac chief economist Bill Evans flagging the potential for the RBA to temporarily lift its bond purchases to A$6bn/week at its September meeting (and thus reverse its decision to taper to A$4bn/week), please see the earlier bullet for more details on Evans' comments. YM +5.0, XM +8.0. The 10- to 12-Year zone of the cash ACGB curve has outperformed.

JGBS: Foreigners Lodge Notable Net Buying Of JGBs In June

Plenty of commentary out there today re: the second largest round of monthly JGB purchases by foreigners on record during June, totalling a net ~Y4.06tn (per JSDA data). This shouldn't come as any surprise, with the data pointing to most of the demand coming in the 2- to 5-Year zone of the curve. We had previously flagged that foreigners were likely driving the bid in the space at this time, using x-ccy basis swaps to extract positive yields from the space, despite the outright negative yields in play in that zone of the curve.

FOREX: Risk Aversion Lingers In Asia

Asia-Pac equity benchmarks retreated on a negative lead from Wall Street and the PBOC's decision to refrain from cutting its LPRs, which put a bid into the yen, even as U.S. e-mini futures edged higher. JPY gained despite the fact that it is a Gotobi Day in Japan, blipping higher as e-minis trimmed some of their prior advance.

- The Antipodeans traded on a softer footing. AUD/USD re-tested its fresh cycle low of $7322 printed yesterday, but struggled to breach that level. NZD/USD operated within the confines of yesterday's range, while hawkish RBNZ bets got trimmed further, despite the absence of any notable local headline flow.

- USD/CNH moved away from the CNH6.5000 region, which provides a key near-term layer of resistance. The PBOC set the central USD/CNY mid-point just 4 pips above sell-side estimate, but the main focus was on monthly LPR fixing, with rates left unchanged despite some speculation of a cut.

- Activity across the region may have been limited by market closures in Singapore, Indonesia, Malaysia and the Philippines in observance of a major Islamic holiday. Major USD crosses held fairly tight ranges.

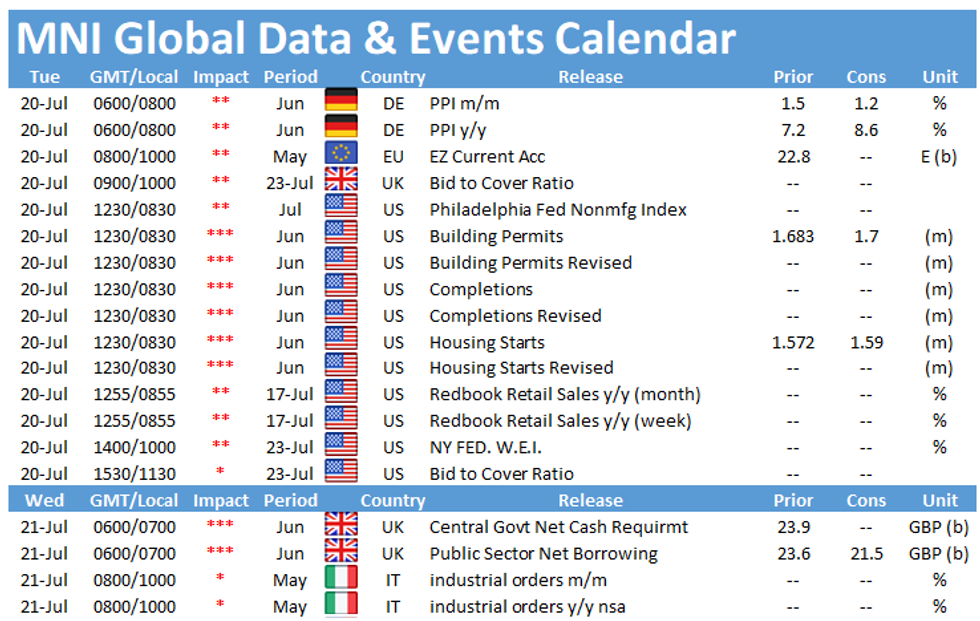

- U.S. housing starts and building permits take focus on the data front today, while ECB's Villeroy headlines the central bank speaker slate.

FOREX OPTIONS: Expiries for Jul20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E765mln), $1.1800-15(E1.6bln), $1.1850-60(E836mln), $1.1880-90(E1.2bln)

- USD/JPY: Y108.70-85($715mln), Y110.00-10($881mln), Y110.50-55($725mln)

- EUR/JPY: Y130.75(E880mln)

- USD/CAD: C$1.2200($832mln)

- USD/CNY: Cny6.4820($1.4bln), Cny6.50($565mln)

ASIA FX: Another Risk Off Day, Liquidity Thinned By Public Holiday

Another risk off session sees most Asia EM currencies under pressure. Several markets closed for public holiday's including Indonesia, Malaysia, Philippines and Singapore.

- CNH: Offshore yuan is stronger, the PBOC kept LPR rates on hold amid some speculation of a cut. Yuan remains under pressure though after the US attributed the Microsoft Exchange hack to China.

- SGD: Singapore dollar is weaker, USD/SGD making fresh session highs as we head into European hours. Liquidity has been thin with markets in Singapore closed for a public holiday.

- TWD: Taiwan dollar is weaker, USD/TWD initially dropped to neutral levels after gapping higher at the open but the move reversed as the session went on. The pair briefly touched the highest since April and remains above 28.00.

- KRW: Won is weaker. Coronavirus concerns continue to suppress risk assets in South Korea, South Korea reported 1,278 new cases in the past 24 hours, in the 1,200s for the second consecutive day.

- MYR: Closed for a public holiday. There were reports that Malaysia will announce plans to ease restrictions for those who have been fully vaccinated, after the Hari Raya Haji celebrations today.

- IDR: Closed for a public holiday. Moody's warned that the surge in new Covid-19 infections observed in Indonesia is credit negative, while GDP growth and the labour market could fall prey to "greater degree of longer-term scarring."

- PHP: Closed for a public holiday. Pres Duterte said Monday that the Philippines "may need to reimpose stricter restrictions to avoid mass gathering and prevent superspreader events."

- THB: Baht is lower, Thailand declared 11,784 new Covid-19 cases on Monday, a new record surge, adding further 11,305 cases today. The national virus task force warned that daily cases could soon hit 30,000 and said that the Delta variant has now become the dominant strain in Thailand. Tighter mobility take effect today.

ASIA RATES: China LPR On Hold As Expected

- INDIA: Yields lower in early trade. Bonds are expected to be supported again today amid broad risk off sentiment and as oil holds the majority of its sharp declines from Monday. In domestic politics India's PM Modi was forced to deny allegations from the Indian National Congress that his government targeted its political rival for surveillance. Participants await the results of an INR 170bn t-bill auction today, ahead of Friday's auction of government bonds.

- SOUTH KOREA: Futures higher in South Korea, tracking an overnight move in US tsys while concern over the fourth wave of COVID-19 also adding pressure, recent comments from the BoK subduing the move the 3-Year contract. South Korea reported 1,278 new cases in the past 24 hours, in the 1,200s for the second consecutive day due to fewer tests amid scorching hot weather, as authorities are tightening their guard against the fast spread of the highly contagious delta variant across the nation. The 20-Year auction was taken down smoothly with the MOF selling KRW 32bn above target, bid/cover rose from the previous auction.

- CHINA: The PBOC kept LPR rates unchanged as expected (1-Year: 3.85%, 5-Year 4.65%), the PBOC matched maturities with injections at its OMOs. Repo rates have inverted, the overnight repo rate is now above the 7-day repo rate as the O/N rate rises for the seventh straight session, the rate remains within recent ranges; overnight repo rate up 28bps at 2.1841%, 7-day repo rate down 2.4bps at 2.1753%. Futures are higher, 10-year future hitting the highest since July 14, with equity markets in the region lower on the session. Elsewhere, corporate bond spreads widened as investor concerns over China Evergrande's ability to raise funds after creditors froze some of its assets.

- INDONESIA: Closed for public holiday. Moody's warned that the surge in new Covid-19 infections observed in Indonesia is credit negative, while GDP growth and the labour market could fall prey to "greater degree of longer-term scarring."

EQUITIES: Another Negative Day In Asia

Another negative day for equities in the Asia-Pac region, though moves are not as dramatic as yesterday there is still a broad risk off tone on concerns over the delta variant. In mainland China indices are lower by around 0.6%, the PBOC opted to keep LPR rates on hold despite some speculation of a cut. In Japan markets are down around 0.9%, CPI rose 0.2%, in line with estimates, though coronavirus concerns weigh. In the US futures are higher, rebounding from a sharp sell off yesterday. US futures are higher by 0.1-0.3%, S&P e-minis need to overcome support turned resistance at 4279.25, the low from July 8.

GOLD: Holding Between The Lines

Gold continues to trade within the well-defined technical parameters, with spot last dealing little changed around the $1,820/oz mark. Monday saw the yellow metal briefly show below $1,800/oz before the DXY pulled back from fresh multi-month highs, allowing gold to recover. Initial lines in the sand come in the form of the Jul 12 low/key near-term support ($1,791.7/oz) and the July 15 high/bull trigger ($1,834.1/oz). U.S. Tsy yield and USD dynamics remain key, as ever.

OIL: Crude Arrests Decline

Crude futures have paused their decline for now after plunging on Monday; with WTI & Brent dealing ~$0.15 above their respective settlement levels at typing. After a failed deal at last month's meeting sent oil markets through an acute spell of strength, OPEC+ finally struck an out-of-cycle agreement to turn on an extra 400,000bpd of extra supply every month from August onwards. This boost to supply met soggy demand for growth proxies as equities globally sank sharply. This manifested in a near-8% slide for WTI crude futures, the sharpest decline since the market-breaking drop into negative territory last year. WTI crude futures now eye support at the $66.02/bbl 100-dma, with the June rally in prices now all but erased. Sentiment has been broadly negative in the Asia time zone over concerns around the delta variant of COVID-19.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.