-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Softer Than Exp. M'fing PMIs Heighten Chinese Growth Angst

EXECUTIVE SUMMARY

- FED BRAINARD EYES SEPTEMBER DATA FOR JOBS PROGRESS (MNI)

- FED'S KASHKARI WARNS DELTA VARIANT COULD SLOW JOBS RECOVERY (BBG)

- CHINESE M'FING PMIS STILL EXPAND, BUT SLOW MORE THAN FORECAST

- CHINA SEEKS MORE COMMUNICATION WITH U.S. ON OVERSEAS IPOS (BBG)

- U.S. SENATE ON PATH FOR VOTE ON INFRASTRUCTURE BILL THIS WEEK (BBG)

- ISRAEL COVID SPREAD AMONGST VACCINATED CAUSES SOME ANGST AROUND VACCINATIONS

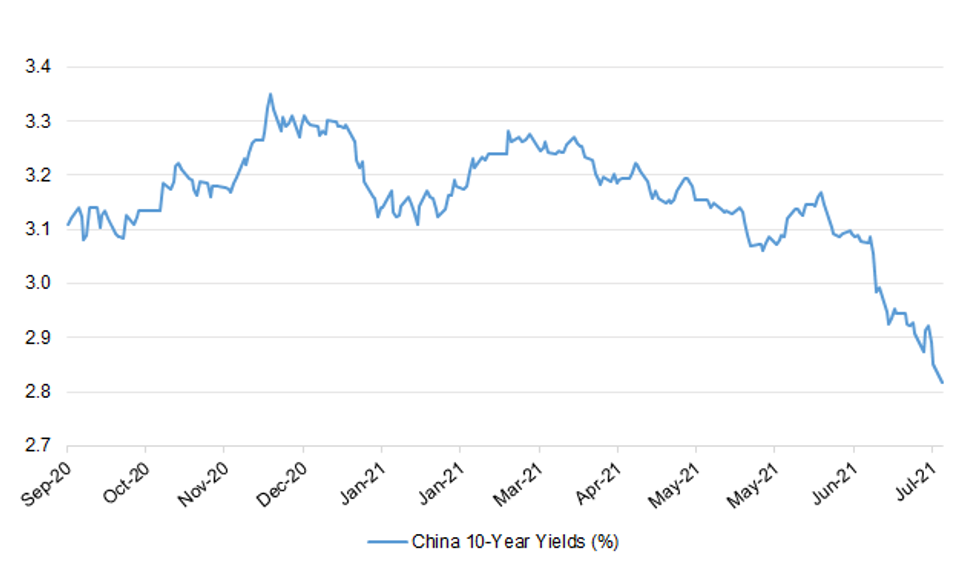

Fig. 1: China 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Young people will be offered discounted takeaways and car travel to get their Covid jabs in a bid to boost vaccine uptake, the government has said. Food delivery and ride-hailing firms including Uber, Bolt and Deliveroo will offer incentives to people to get vaccinated. More than 68% of 18 to 29-year-olds in England have had a first jab, while 88.6% of all UK adults have had one. In total, over 85 million doses have now been administered across the UK. More than 72.5% of UK adults have received two doses so far. Health Secretary Sajid Javid described delivering 85 million doses as a "phenomenal achievement", while vaccines minister Nadhim Zahawi urged people to get both jabs "so we can carry on doing the things we've missed". On Sunday the UK reported 24,470 new Covid cases as well as a further 65 deaths within 28 days of a positive test. (BBC)

CORONAVIRUS: Booster vaccines are to be offered to 32 million Britons starting early next month with up to 2,000 pharmacies set to deliver the programme, The Telegraph can disclose. Amid fears that the efficacy of the vaccines may begin to decline, ministers are planning to deliver an average of almost 2.5million third doses a week starting in the first week of September. Pharmacies will be at the forefront of the vaccine programme so that GPs and other NHS staff can focus on the growing backlog of patients waiting for other treatments. All adults aged 50 and over, as well as the immuno-suppressed, will be offered the booster jabs. (Telegraph)

CORONAVIRUS: British employers have been warned that forcing staff to have the coronavirus vaccination could amount to a criminal offence, amid concerns over "no jab, no job" policies emerging. Only care home staff in England will need to have both vaccine doses to work under current legislation, with a consultation taking place on whether to extend this to NHS employees. But in the US, tech giants Facebook and Google are among those to say their staff will have to show proof they have been fully vaccinated before returning to their workplaces. (Sky)

CORONAVIRUS: The prime minister is facing a renewed backlash against plans to introduce domestic vaccine passports for entry into large-scale events, with demands for parliament to be recalled from its summer recess to allow debate on the issue. The Conservative MP Andrew Bridgen has called for the return if the government is "serious" about its plans. (Guardian)

CORONAVIRUS: Boris Johnson has been accused by cabinet ministers of denying people their fundamental freedoms over plans for vaccine passports. The prime minister has announced plans to make vaccine passports mandatory in indoor venues such as nightclubs and conference centres from September. The move is in response to concerns from government advisers that they are "super-spreading" environments and could fuel a resurgence of coronavirus in the autumn and winter. Cabinet ministers believe that the policy was "railroaded" through at the behest of the prime minister by Michael Gove, the Cabinet Office minister. They have been privately encouraging Tory backbenchers to raise their concerns in an effort to kill the legislation when it comes to the Commons. (The Times)

CORONAVIRUS: Rishi Sunak has written to Boris Johnson calling for the urgent easing of travel restrictions as the holiday hopes of millions hang in the balance this week. The chancellor warned that Britain's border rules were damaging the economy and tourism in particular, ahead of a crucial meeting of ministers on Thursday, which will determine the travel rules for August. The chancellor intervened amid growing concern that the UK is failing to take advantage of its vaccination programme and has saddled travellers with more "draconian" rules than Britain's EU rivals. In the letter, Sunak said that UK border policy was "out of step with our international competitors". (The Times)

CORONAVIRUS: Boris Johnson is under growing Cabinet pressure to ease travel restrictions, amid fears an amber watchlist for European countries could wreck summer holidays. (Telegraph)

CORONAVIRUS: Tory backbenchers and the travel industry have criticised "inexplicably complicated" government plans to warn holidaymakers against visiting popular destinations such as Spain. Ministers are in discussions about creating a new amber watchlist of countries that are at risk of moving to the government's travel red list with little warning. Spain would be put on the new list under the plans. Such a move would be likely to cause an exodus of up to a million British tourists who are on holiday there now. There are fears that Greece and Italy could also be included. Polling for The Times revealed that the public were in favour of greater travel freedoms. (The Times)

CORONAVIRUS: Britain is preparing to open its borders to families and businesses from the Far East, Middle East and Australia by lifting its travel ban on airport hubs. After lifting restrictions on fully-vaccinated EU and US citizens last week, ministers are set to give the go-ahead to quarantine-free travel through vital hubs that link the UK to the rest of the world. (Telegraph)

BREXIT: The UK is "closing in on" striking an agreement in principle with New Zealand, the international trade secretary has said. Liz Truss said "great progress" had been made in the sixth round of discussions between the two sides, which took place from 19 to 30 July. "We're closing in on an agreement in principle, with six more chapters now complete," she said. (Sky)

ECONOMY: One in five firms plan on letting staff go in response to Sunday's furlough policy change, which will see employers contribute more, a survey has found. The British Chamber of Commerce said extra training was needed to deal with thousands of redundancies predicted. From Sunday, government payments reduce to 60% towards salaries, with employers paying 20%. The government said the approach was "right" and meant "we can focus support elsewhere" as the economy recovers. According to the most recent figures up to 30 June, about 1.9m workers were on furlough, down from a peak of 5.1m in January. (BBC)

ECONOMY: Hundreds of thousands of viable jobs will be put at risk when the furlough scheme ends as workers in industries where voluntary restrictions persist lose the support, analysis by the New Economics Foundation suggests. (The Times)

FISCAL: Businessmen who have donated millions of pounds to the Conservatives are urging Boris Johnson not to increase taxes this autumn, warning it would "choke off a recovery when we need it most". Party donors have spoken out after concerns that Mr Johnson and his Chancellor, Rishi Sunak, are willing to sanction tax rises at the Budget, expected in November, to pay the bill from tackling the Covid-19 pandemic and a new strategy to fund social care for the elderly. (Telegraph)

FISCAL: Rishi Sunak is considering a temporary suspension of the Conservatives' "triple lock" election manifesto commitment on state pensions that would save billions by linking this year's rise to inflation instead. The lock commits the Chancellor to lift pay-outs to match the highest out of average earnings, inflation or 2.5pc. However, the impact of the furlough scheme last year is likely to leave wages more than 8pc higher than last year, adding more than £7bn to the state pensions every year if fulfilled. It is understood one option being examined by the Mr Sunak's officials is a "double lock" for one year only, which would raise pensions by the larger of 2.5pc or September's Consumer Prices Index inflation. Consultant Capital Economics predicts CPI of 3.1pc for September, but average earnings growth of 8.5pc for the quarter to July. Using inflation would add £2.6bn to the pension bill, barely a third of the estimated £7.2bn cost of using this year's earnings figures. (Telegraph)

FISCAL/INFRASTRUCTURE: The U.K. plans to invest about GBP5b in rural broadband upgrade, which will benefit ~2.2m homes and businesses, the government says in a statement. (BBG)

POLITICS: Boris Johnson's support has collapsed in Conservative heartlands in the southeast and east of England, according to a poll that suggests the party could lose 17 seats. The Tories' rating is down by eight points from the 2019 general election levels in so-called blue wall areas, a YouGov survey for The Times has found. The findings are based on 53 Tory-held seats that voted to stay in the European Union in the 2016 referendum and had a higher than average share of university degree holders. They have similar voting profiles to Chesham & Amersham, where the Conservatives suffered a surprise by-election defeat to the Liberal Democrats last month. The electorate rejected the Conservatives for the first time, by 8,000 votes. (The Times)

POLITICS: Boris Johnson has fallen nearly 40 points in a survey after what has proved another trying month for the Government. A new cabinet league table by Conservative Home found that the Prime Minister had again lost popularity points and was only just in positive territory for net satisfaction. The survey, which the website aims to be one of Tory party members, for July 2021 found that Mr Johnson's recent U-turn over self-isolating cost him 36 points, whereas Rishi Sunak, the Chancellor, who also tried to avoid self-isolating, was not hugely affected after coming into contact with the Health Secretary who had tested positive for Covid-19. (Telegraph)

POLITICS: The fear in the Cabinet is that it could be 2020 all over again: last year the Government was riding high in the polls after the outbreak of the pandemic, but gradually declined as repeated lockdowns and policy U-turns alienated some of the public. In early 2021 the Conservatives revived, buoyed by the success of the vaccine rollout and Sir Keir Starmer's failure to make an impression on voters. But as other countries have caught up with Britain's jabs programme Boris Johnson has been less able to exploit the rollout for electoral gain. One Cabinet minister said recently: "It's like all psychology, what starts out being extraordinary ends up being seen as ordinary." Another Tory insider suggested the autumn would be a crucial period for the Government as it tries to prove that having led the country through the pandemic, it is now well placed to help rebuild afterwards. They said: "Everyone is expecting the Conservative lead to tighten as memories of the vaccine rollout fade. But it will take a few months to see what the impact is." (The i)

POLITICS: Millions of voters who Labour must win back if it is to regain power have little idea what the party stands for or why it would improve their lives, according to a stark internal analysis by Keir Starmer's new strategist. Former pollster Deborah Mattinson, who has been appointed director of strategy in a shake-up of the leader's inner circle, briefed Starmer, shadow ministers and MPs on sobering internal polling and findings from focus groups days before the summer recess. Her presentation highlighted the huge challenge Labour faces if it is to win back trust in time for a probable 2023 election – and avoid a fifth consecutive loss to the Tories. (Guardian)

SCOTLAND: The UK government will not stand in the way of a second Scottish independence referendum if there is a "settled will" in support of another vote, cabinet office minister Michael Gove has said, as tensions continue between London and Edinburgh over the future of the union. In an interview with the Sunday Mail, Gove said that while now was not the right moment to put the question of independence forward, he argued that under the "right circumstances" the Westminster government would not prevent the Scottish public from expressing their thoughts on the matter. "The principle that the people of Scotland, in the right circumstances, can ask that question again is there", he told the paper. "I just don't think that it is right, and the public don't think it is right, to ask that question at the moment. If it is the case that there is clearly a settled will in favour of a referendum, then one will occur." (FT)

PROPERTY: Britain's banks and building societies are struggling to cope with a highly competitive mortgage market that threatens to hit profits but benefit homeowners. (FT)

EUROPE

CORONAVIRUS: Pfizer raised the price of its Covid-19 vaccine by more than a quarter and Moderna by more than a tenth in the latest EU supply contracts as Europe battled supply disruptions and concerns about side effects from rival products. The groups are set to generate tens of billions of dollars in revenue this year as they sign new deals with countries anxious to secure supplies for potential booster shots in the face of the spread of the highly infectious Delta variant. The terms of the deals, struck this year for a total of up to 2.1bn shots until 2023, were renegotiated after phase 3 trial data showed their messenger ribonucleic acid vaccines had higher efficacy rates than cheaper shots developed by Oxford/AstraZeneca and Johnson & Johnson. The new price for a Pfizer shot was €19.50 against €15.50 previously, according to portions of the contracts seen by the Financial Times. The price of a Moderna jab was $25.50 a dose, the contracts show, up from what people familiar with the matter said was about €19 ($22.60) in the first procurement deal but lower than a previously agreed $28.50 because the order had grown, according to one official close to the negotiations. (FT)

GERMANY: Germany's September election remains up for grabs, with no two-party alliance showing a majority and the presumed successor to Chancellor Angela Merkel deeply unpopular. The latest Insa poll showed approval for conservative leader Armin Laschet at 13%, according to Bild am Sonntag. Combined backing for Merkel's CDU and Bavaria's CSU, its ally at the national level, held steady on the week at 27%. The Green Party at 18% and the SPD at 17% were also unchanged. While the CDU-CSU is poised to win the most votes on Sept. 26, it's likely to need at least one coalition partner to secure a governing majority. Laschet's support fell 2 points on the week and is down 7 points from two weeks ago. (BBG)

FRANCE: Over 200,000 people marched in cities across France on Saturday in the biggest turnout of three consecutive weekends of protests, calling for an end to what they see as draconian rules forcing them to get vaccinated against their will. They marched down the streets of Paris, Lyon, Marseille, and elsewhere, shouting "This is a health dictatorship!" and "No vaccination, no health pass!", in protests that included a wide range of social and political movements. (FT)

FRANCE: Tourism to France is rebounding versus last year, when the pandemic shut borders, though U.S. and Asian visitors remain limited, said Tourism Minister Jean-Baptiste Lemoyne. France expects 50 million foreign tourists this summer, up from 35 million in the comparable period last year but down from 90 million in 2019, Lemoyne said. A so-called health pass -- proof of vaccination or a recent negative Covid-19 test -- is required to enter museums and theme parks, and that will be extended to bars, restaurants and long-distance trains starting Aug. 9. (BBG)

FRANCE: French car sales slumped 35% in July as a semiconductor shortage curbed inventory in one of Europe's biggest markets. (BBG)

ITALY: Italy's government plans to request a vote of support for its justice reform plan, and Prime Minister Mario Draghi's most contentious proposal yet is set to get final parliamentary approval in September. Minister for parliamentary relations Federico D'Inca is expected to formally request the confidence vote on Sunday. It's expected to take place in the Lower House early this week, with results as soon as Monday night or Tuesday before parliamentary holidays, according to Italian media. Earlier on Sunday, Lower House lawmakers agreed that Draghi's justice reform plan is constitutional, a hint that parliamentary support would also be forthcoming. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Ireland at A+; Outlook Stable

- Fitch affirmed Hungary at BBB; Outlook Stable

- DBRS Morningstar confirmed Austria at AAA, Stable Trend

BANKS: Deutsche Bank AG and Societe Generale SA emerged among the weakest of the large European lenders in a stress test that regulators will consult when vetting plans on investor payouts. The German lender's common equity tier 1 ratio, one of the most important measures of financial strength, fell 620 basis points to 7.4% in an adverse scenario that assumes a prolonged period of low interest rates and a steep contraction of the economy over three years. Societe Generale's ratio dropped 562 basis points to 7.5% in the European Banking Authority's assessment, published late Friday. "Deutsche Bank shows its resilience in a potential economic crisis even in a harsher and unfavorable scenario," Chief Financial Officer James von Moltke said in statement. He pointed out that the bank's rising profits in the first half of 2021 weren't factored into the test. (BBG)

U.S.

FED: MNI BRIEF: Fed Brainard Eyes September Data for Jobs Progress

- Federal Reserve Governor Lael Brainard Friday said she will be more confident in assessing the rate of progress in the economy once data is in hand for September, adding that the labor market has some distance to go. "The determination of when to begin to slow asset purchases will depend importantly on the accumulation of evidence that substantial further progress on employment has been achieved," she said. "As of today, employment has some distance to go," Brainard said, citing a 9.1 million jobs hole relative to the pre-pandemic trend. "Importantly, I expect to be more confident in assessing the rate of progress once we have data in hand for September, when consumption, school, and work patterns should be settling into a post pandemic normal," she said in prepared remarks for a speech to the Aspen Institute - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Minneapolis Fed President Neel Kashkari said the spread of the delta variant of Covid-19 could keep some Americans from looking for work, potentially harming the U.S. recovery. (BBG)

FED: The Trimmed Mean PCE inflation rate over the 12 months ending in June was 2.0 percent. According to the BEA, the overall PCE inflation rate was 4.0 percent on a 12-month basis, and the inflation rate for PCE excluding food and energy was 3.5 percent on a 12-month basis. (Dallas Fed)

ECONOMY: MNI BRIEF: St Louis Fed Model Sees Payrolls Slowdown in July

- U.S. employers in July added jobs at just half the pace they did in June, according to a St. Louis Fed analysis of high-frequency data from the scheduling software company Homebase, signaling a slowdown in the labor market recovery. "The index continued its upward trend, albeit at a slower rate," St. Louis Fed economist Max Dvorkin told MNI, and "it's not clear whether the effects of the Delta variant are noticeable in the data." The Homebase model predicts up to 880,000 jobs added this month, far lower than the 1.5 million job gain forecast by the index last month. "The index has been overpredicting changes in the last few months, so this figure may be an upper bound in the forecast," Dvorkin added. Actual nonfarm payrolls came in at 850,000 last month - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: The senators negotiating a $550 billion infrastructure package finished the text of their legislation Sunday, moving the Senate a crucial step closer to likely passage this week. Senate Majority Leader Chuck Schumer said the chamber would be ready to vote on the bipartisan bill "in a matter of days." The bipartisan group that negotiated the plan spent much of Sunday combing through the 2,701-page bill before it was presented to the full Senate. "Neither side got everything they wanted," Utah Senator Mitt Romney, a Republican member of the group, said of the negotiations. (BBG)

FISCAL: The U.S. debt ceiling officially became operative again on Sunday after a two-year suspension, with lawmakers in Washington yet to outline how they'll avoid a potential default later this year. The debt limit -- the total amount that the federal government is authorized to borrow -- was set at $22 trillion in 2019. It will adjust to the current level of debt -- which had risen to $28.5 trillion as of the end of June -- when the suspension ends, putting pressure on Congress to find a solution that will allow the government to keep borrowing. (BBG)

CORONAVIRUS: President Joe Biden's chief medical adviser has warned "things will get worse" as the Delta variant of coronavirus sweeps through the US, although he added a return to the lockdowns of last year was unlikely. "If you look at the acceleration of the number of cases, the seven-day average has gone up substantially," said Anthony Fauci, who warned that the country was witnessing "an outbreak of the unvaccinated". "We have 100 million people in this country who are eligible to be vaccinated who are not vaccinated," Fauci said on CBS. "We've really got to get those people to change their minds, make it easy for them, convince them, do something to get them to be vaccinated because they are the ones that are propagating this outbreak." (FT)

CORONAVIRUS: Growing numbers of people are getting vaccinated in areas hit hard by the Delta variant, offering a glimmer of hope but still falling far short of what is needed to fight Covid-19, public-health officials say. Several factors are driving the increase in vaccinations, including worries about the infectiousness and severity of the Delta variant, growing confidence in the safety of vaccines and the influence of family and friends, health officials and residents say. More employers are implementing vaccine mandates, including a Walmart Inc. requirement for corporate staff announced Friday. (WSJ)

CORONAVIRUS: The U.S. agency leading the fight against Covid-19 gave up a crucial surveillance tool tracking the effectiveness of vaccines just as a troublesome new variant of the virus was emerging. While the CDC stopped comprehensively tracking what are known as vaccine breakthrough cases in May, the consequences of that choice are only now beginning to show. While the CDC has stopped tracking such cases, many states have not. Bloomberg gathered data from 35 states and identified 111,748 vaccine breakthrough cases through the end of July, more than 10 times the CDC's end-of-April tally. Breakthrough cases are expected, and the number and proportion of them should rise as more people are vaccinated. The CDC said at the time that it would continue to collect data on breakthrough cases only if the infections resulted in hospitalization or death — rare because vaccines provide significant protection. (BBG)

CORONAVIRUS: New Orleans will mandate masks indoors in public places -- regardless of vaccination status -- and require all city workers to be inoculated, Mayor LaToya Cantrell announced Friday. (BBG)

CORONAVIRUS: Chicago now recommends everyone over two years old to wear masks in public indoor settings, following the CDC guidance. (BBG)

CORONAVIRUS: Chicago Mayor Lori Lightfoot said the Lollapalooza music festival, which attracts as many as 100,000 fans a night, is a model for gatherings despite rising infections in the city. "Ninety percent of people at Lolla have been vaccinated, and hundreds of people who either haven't been vaccinated or haven't shown a negative test within 72 hours have been turned away," Lightfoot told reporters Sunday. Organizers of the four- day festival "have done a an incredible job," she said. Lightfoot said she has no plans to mandate masks or impose tighter lockdown on Chicago, although last week the city recommended that people wear masks in public indoors, regardless of vaccination status. (BBG)

CORONAVIRUS: The Food and Drug Administration plans to speed up its review of Pfizer Inc.'s Covid-19 vaccine so it can secure full approval formally soon, STAT reported, citing a senior agency official. An FDA spokesperson told the publication that the agency is taking "an all-hands-on-deck approach." President Joe Biden has said he expects full approval for Covid shots in early fall. (BBG)

CORONAVIRUS: Walmart Inc., the largest private employer in the U.S., is requiring its headquarters and regional staff to be vaccinated by Oct. 4, joining Alphabet Inc.'s Google in instituting a policy that other big companies may soon follow as the delta variant continues to spread. (BBG)

CORONAVIRUS: Governor Ron DeSantis of Florida said he would sign an executive order to reverse a decision by Broward County, the state's second-largest, to require masks indoors in schools for students, staff and visitors. (BBG)

CORONAVIRUS: Broadway theaters in New York City will require vaccinations for audience members, performers and other staff, who will also need to wear masks indoors. (BBG)

POLITICS: A federal judge is giving former President Donald Trump time to challenge a Department of Justice order that said the IRS must surrender his income tax returns to Congress. U.S. District Court Judge for the District of Columbia Trevor McFadden said that Trump and his lawyers have until Wednesday to issue a response. (CNBC)

PROPERTY: Three U.S. agencies have extended federal foreclosure-related eviction moratoria in an effort to protect renters after the House failed to pass legislation that would extend the ban. House Democratic leaders did not secure enough votes to pass the legislation on Friday, adjourning the chamber for a six-week recess the day before the ban is set to expire. As many as 15 million people could face evictions, per estimates from the Aspen Institute. Democrats were split on how far ahead the ban should be extended, with progressive members accusing more moderate colleagues of prioritizing vacation over evictees. (Axios)

PROPERTY: U.S. House Speaker Pelosi tweeted the following on Sunday: "The CDC has the power to extend the eviction moratorium. As they double down on masks, why wouldn't they extend the moratorium in light of delta variant? It is a moral imperative to keep people from being put out in the street which also contributes to the public health emergency. The virus is still a threat, the moratorium must be extended and the funds Congress allocated to assist renters and landlords must be spent." (MNI)

OTHER

GLOBAL TRADE: Two small U.S. solar companies plan to petition the government to extend tariffs on solar cell and panel imports, reigniting a fight that has split the industry—and one that could force the White House to choose sides. Auxin Solar Inc., a San Jose, Calif., solar panel manufacturer, and Suniva Inc., which owns an idled solar cell factory in Norcross, Ga., plan to ask the U.S. International Trade Commission on Monday to extend the solar tariffs for four years, said Mamun Rashid, Auxin's chief executive officer. The 18% tariffs were imposed in 2018, and are set to expire next year. They largely affect imports from Chinese-owned companies. China is the world's largest producer of solar cells and panels used to generate electricity, although it has moved some of its production to elsewhere in Asia to avoid U.S. tariffs. (WSJ)

U.S./CHINA: The China Securities Regulatory Commission (CSRC) supports companies' choosing listings between domestic and international markets, the official Securities Times reported citing a statement by the regulator in response to the U.S. SEC requiring Chinese companies to fully explain their legal structures and disclose the risk of Beijing interfering in their businesses. At the same time, China's capital market has had healthy and sustainable growth and offered increased quality investment targets, the regulator said in the statement. The CSRC said the two authorities should find "appropriate solutions" by increased communications on the basis of "mutual respect," according to the newspaper. MNI notes that the Chinese regulator downplayed the impact of the tougher requirement by the SEC and highlighted its domestic capital market can meet companies' capital needs. (MNI)

CORONAVIRUS: Half of the infections in Israel now are among the fully vaccinated, and public health officials are beginning to see signs of more serious disease among them, said Sharon Alroy- Preis, the nation's Director of Public Health Services. She said that infections for people vaccinated in January are double those vaccinated in March, an apparent decrease in effectiveness over time that has led Israel to begin booster shots. She said infections were particularly problematic for people 60 and older. (BBG)

CORONAVIRUS: About three-fourths of people infected in a Massachusetts Covid-19 outbreak were fully vaccinated against the coronavirus with four of them ending up in the hospital, according to new data published Friday by the Centers for Disease Control and Prevention. The new data, published in the U.S. agency's Morbidity and Mortality Weekly Report, also found that fully vaccinated people who get infected carry as much of the virus in their nose as unvaccinated people, and could spread it to other individuals. (CNBC)

GEOPOLITICS: Police in China said they have detained a 30-year-old Canadian man surnamed Wu on suspicion of committing rape, with state media identifying him as Chinese-born pop singer Kris Wu. Wu was being investigated over accusations made online of "tricking young girls into having sex with him," according to a statement by police in the Chaoyang district of the Chinese capital Beijing late on Saturday. (RTRS)

JAPAN: The Tokyo summer Olympic Games have reported over 250 cases among athletes and related personnel, but experts say the bubble system created to separate the sporting event from the Japanese capital appears to be working -- so far. (BBG)

JAPAN: The Japanese government on Sunday started administering COVID-19 vaccine shots at Narita and Haneda airports to citizens who are returning from abroad temporarily to be inoculated. Those subject to the inoculations include people living in places that use vaccines not approved by Japan as well as residents of some developing countries where the progress of vaccinations has been slow. (Kyodo)

JAPAN: Pfizer is in talks with Japanese authorities to start a trial of its orally taken Covid-19 drug in the nation, Nikkei reports, without attribution. (BBG)

JAPAN: The Japanese government is considering urging those fully vaccinated against Covid-19 to receive a third booster shot next year as concerns emerge over variants that are more contagious than previous ones, Nikkei reports without attribution. Japan may start charging patients for the vaccines if their efficacies are maintained to certain levels against new variants. Japanese minister in charge of vaccine rollout, Taro Kono, said in a television program aired Sunday that a third dose would be recommended next year, according to the Yomiuri newspaper. (BBG)

BOJ: MNI: BOJ Faces Homework On Climate Change Lending And CPI

- Climate change lending supported by the Bank of Japan has thrown up questions on how to measure the impact on consumer prices as new spending likely boosts costs, but is also expected to bring offsetting productivity gains, MNI understands. Bank economists are working on modeling information and data of climate change impacts on the macroeconomy and inflation for the board - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Brisbane will remain in lockdown until at least Sunday as Australia's third-largest city struggles to contain an outbreak of the delta variant of the coronavirus, which has also seen stay-at-home orders enforced in Sydney. The lockdown in Brisbane and surrounding regions in the southeast of Queensland state, announced on Saturday, was due to end on Tuesday. It will be extended after authorities detected 13 new cases in the local community on Monday from the day before, Deputy Premier Steven Miles told reporters. (BBG)

AUSTRALIA: Treasurer Josh Frydenberg has failed to act on "imperative" Treasury advice to set up an independent review of the $90 billion JobKeeper program, despite Parliament's budget watchdog exposing an estimated $25 billion was paid to firms that did not record the forecast revenue falls. (Australian Financial Review)

NEW ZEALAND: Support for New Zealand Prime Minister Jacinda Ardern's Labour Party has slipped by almost 10 percentage points amid increasing scrutiny of the government's response to the coronavirus, according to a poll by Newshub-Reid Research. Labour's support fell to 43% compared with a May survey, while New Zealand National Party's backing rose to almost 29% and ACT Party's increased to about 11%, Newshub-Reid found. Ardern was still preferred Prime Minister by a large margin. The research was conducted July 22 to 29 and had a margin of error of 3.3%, according to Newshub-Reid. (BBG)

NORTH KOREA: The powerful sister of North Korean leader Kim Jong Un warned Sunday that next month's annual military drills between South Korean and U.S. troops will undermine prospects for better ties between the Koreas, just days after the rivals reopened their long-dormant communication channels. Kim Yo Jong's statement carried by state media targets only South Korea, and this could add credence to a theory that North Korea's decision to restore the communication lines is mainly aimed at pushing Seoul to convince Washington to make concessions while nuclear diplomacy remains deadlocked. "For some days I have been hearing an unpleasant story that joint military exercises between the South Korean army and the U.S. forces could go ahead as scheduled," Kim Yo Jong said. (AP)

NORTH KOREA: The U.S. Justice Department (DoJ) on Friday announced the seizure of a 2,734-ton tanker it said was owned and operated by a Singaporean national and used to make shipments of petroleum products to North Korea in violation of international sanctions. (Nikkei)

MEXICO: A nationwide referendum spearheaded by Mexico's President Andres Manuel Lopez Obrador to investigate his five predecessors came up far short of the turnout needed to make it legally binding, signaling a lack of urgency or interest in the leader's key anti-corruption campaign. Only 7% to 8% of eligible voters cast ballots on Sunday, shy of the 40% needed for the referendum to force authorities to take action, the nation's electoral agency estimated hours after the vote concluded Sunday. Of those who did show up, between 89% and 96% agreed former leaders needed to come under scrutiny. (BBG)

BRAZIL: Brazil President Jair Bolsonaro lashed out against the country's electronic voting system on Sunday, rousing supporters who took to the streets in major cities over fears of cheating in next year's election. The 2022 presidential contest should use paper ballots and have a public vote count to assure fraud doesn't occur, Bolsonaro said in an address to backers that was posted on his Facebook page. Electoral officials have said there's been no proven case of tampering since electronic voting was introduced. (BBG)

RUSSIA: Russia's central bank governor has warned that inflation is set to be a long- term phenomenon in her country, signalling that the bank is likely to continue with its tough monetary policy stance. Elvira Nabiullina told the Financial Times in an interview that public fears over soaring prices lay behind the central bank's concerns. Sharp rises in food prices had "de-anchored" ordinary Russians' inflation expectations, she said, with polling showing consumers predicting an increase of more than double the central bank's projected annual figure. (FT)

RUSSIA: Germany has little intention of shutting off Nord Stream 2 if Vladimir Putin tries to use the controversial pipeline as a geopolitical weapon, whatever the U.S. might say, according to Berlin officials familiar with the plans. Instead of targeting the direct gas link with Russia, the government would focus on broader sanctions at the European Union level, a more difficult path for retaliating against the Kremlin, said the officials, who asked not to be identified because the discussions are private. (BBG)

IRAN: Days before a new hard-line president is set to be inaugurated in Iran, Biden administration officials have turned sharply pessimistic about their chances of quickly restoring the nuclear deal that President Donald J. Trump dismantled, fearing that the new government in Tehran is speeding ahead on nuclear research and production and preparing new demands for the United States. The concerns are a reversal from just a month ago, when American negotiators, based in part on assurances from the departing Iranian government, believed they were on the cusp of reaching a deal before Ebrahim Raisi, 60, a deeply conservative former head of the judiciary, takes office on Thursday. In June, they were so confident that another round of talks was imminent that a leading American negotiator left his clothes in storage at a hotel in Vienna, where the talks took place through European intermediaries for the past four months. (New York Times)

IRAN: Germany's foreign minister is signaling growing impatience with Iran, saying that a revival of the country's frayed nuclear accord with world powers won't be possible "forever," a German magazine reported Friday. (RFI)

IRAN: The U.S. formally blamed Iran for a deadly attack on an Israel-linked oil tanker off Oman, warning of an "appropriate response." "There is no justification for this attack, which follows a pattern of attacks and other belligerent behavior," Secretary of State Antony Blinken said in a statement Sunday. "We are working with our partners to consider our next steps and consulting with governments inside the region and beyond on an appropriate response, which will be forthcoming." Blinken's condemnation came after Israeli Prime Minister Naftali Bennett said Iran was "unequivocally" responsible for the attack on Thursday. The U.K. foreign secretary issued a similar condemnation. None of the statements offered direct evidence. (BBG)

IRAN: Iran denied Sunday it launched the drone attack on an oil tanker off the coast of Oman that killed two people, even as Israel alleges Tehran carried out the assault amid heightened tensions in the region. The comment by Iranian Foreign Ministry spokesman Saeed Khatibzadeh marked the first official comments on the attack from Tehran, which will see a new president inaugurated Thursday. (Independent)

MIDDLE EAST: A military coalition led by Saudi Arabia said on Friday it had intercepted a drone attack on a Saudi commercial vessel, Saudi state media reported. The coalition said the attack was part of a continued threat posed by Yemen's Houthi militia. (RTRS)

MIDDLE EAST: The main UN compound in Herat, Afghanistan was attacked by "anti-government elements" on Friday and at least one security guard was killed, according to the UN Assistance Mission in Afghanistan, or UNAMA. Rocket-propelled grenades and gunfire were used to target the entrances of the provincial compound, which was clearly marked as a UN facility, according to UNAMA. Heavy fighting between the Taliban and Afghan security forces was also seen near the compound. (CNBC)

US TSYS: Japan's Government Pension Investment Fund made a record cut to the weighting of Treasuries in its portfolio last fiscal year as the world's safest asset led a global debt sell-off. GPIF, as the world's biggest pension fund is known, slashed US government bonds and bills to 35 per cent of its foreign debt holdings in the 12 months through March 30, from 47 per cent previously, according to an analysis by Bloomberg of the latest data. (BBG)

EQUITIES: China should properly handle the relationship between opening up and ensuring security in supervising Chinese companies' overseas listing, state media Xinhua News Agency says in a commentary. Improving oversight is the necessary step to help prevent and resolve risks related to Chinese firms' overseas IPOs. Financial regulators globally should enhance supervision cooperation and policy communication to provide good policy expectations and environment for the market. China supports enterprises to use both domestic and overseas markets for financing in accordance with laws and regulations. (BBG)

COMMODITIES: Hedge funds plowed money into bets that the commodities rally of 2021 still has further to run, snapping three straight weeks of reductions. Net-long positions on a basket of 20 commodities rose by 8.3% in the week ended Tuesday, according to U.S. Commodity Futures Trade Commission data compiled by Bloomberg. Investors added wagers on further price gains for raw materials including crude oil, natural gas, corn and copper, while cutting those for platinum and soybeans. (BBG)

COPPER: The union of workers at BHP Group Ltd's Escondida copper mine in Chile, the world's largest, said on Saturday it had voted to reject the company's final labor contract offer, prompting BHP to request government-mediated talks in a last-ditch effort to stave off a strike. The talks, once confirmed by authorities, will last for 5 to 10 days, according to Chilean labor law. If no agreement is reached, a strike would begin. (RTRS)

OIL: Russia will be able to boost oil output by 100k b/d next month, Deputy Prime Minsiter Alexander Novak told reporters in Moscow. Russia's compliance with its OPEC+ quota in July will be about 100%, Novak says. (BBG)

OIL: Iraq's federal oil exports, excluding flows from the semi-autonomous Kurdistan region, rose 0.9% in July from a month earlier, the oil ministry said Aug. 1, as OPEC's second biggest producer enjoyed a higher quota level. (Platts)

CHINA

PBOC: China's economy has staged a strong rebound from the impact of the COVID-19 pandemic, but recent data has suggested that gains are fading. Factory activity in July grew at the slowest pace in 17 months since February 2020 when the impact of lockdowns to control the coronavirus pandemic was first felt. New export orders contracted for three straight months. China's months-long regulatory crackdown on a range of private companies has also left tech upstarts and decades-old firms operating in a new, uncertain environment. (RTRS)

PBOC: China may implement one or two rounds of cuts to banks' reserve requirement ratios in H2 to meet increasing maturing MLFs and its goals of supporting green finance and innovation, judging by the statement following a Politburo meeting on the economy chaired by President Xi Jinping on Friday, the Economic Information Daily said on its front page citing Dong Ximiao, the chief researcher at Merchants Union Consumer Finance. The Ministry of Finance is also expected to accelerate local government special bond sales to help boost investment so to stabilize the growth, said Wen Bin, chief researcher of China Minsheng Bank. Analysts noted that the Politburo meeting left out the saying of "a window of opportunity with less growth pressure" compared with the wording of the previous meeting, suggesting that stabilizing growth will be emphasized again in the short-term, the newspaper said. (MNI)

POLICY: China should increase policy supports to expand domestic demand and help SMEs recover to consolidate the growth momentum, the Shanghai Securities News said on its front page after the July PMI slowed partly due to abnormal rains and flooding. China should let government investment drive the expansion of domestic demand as well as boost consumption in H2, the newspaper cited analysts as saying. In the short term, service consumption may still be impacted by the outbreaks of Covid-19 cases though the overall impact on the economy will be limited. MNI noted that the Delta variant of Covid-19 spread to more than 10 cities in the past few days which may dampen an expected rebound in summer spending. (MNI)

SOE: China and its regional governments have created funds to help state-owned companies guard against defaults, readying 210 billion yuan ($32.5 billion) to alleviate financing constraints. Tianjin established a 20 billion yuan fund in June, saying it aims to raise the market's confidence in the city's state-owned enterprises. The Guangxi Zhuang Autonomous Region invited experts to a meeting in April to discuss setting up a similar fund. The details of such assistance have not been disclosed in either case, but the regions apparently look to bolster the financial footing of state-owned businesses through steps such as helping to turn high-interest short-term loans into low-interest long-term financing. Local lenders are participating as well, defraying the burden of struggling regional governments. (Nikkei)

CORONAVIRUS: China is studying if it's necessary to give booster vaccine shots to vulnerable groups such as the elderly, people with underlying diseases and those who work in high-risk areas. There isn't yet enough evidence to suggest that a third shot is needed for everyone, Wang Huaqing, an expert with Chinese Center for Disease Control and Prevention, said at a press briefing Saturday. (BBG)

CORONAVIRUS: A new surge of COVID-19 cases starting from an airport of Nanjing, capital city of East China's Jiangsu Province, has spread to five other provinces and Beijing municipality, the most extensive domestic contagion after Wuhan. Since the first confirmed case of the latest outbreak was detected on July 20 at Nanjing Lukou International Airport, nearly 200 infections have been reported as of Thursday morning. Compared to previous rounds of domestic virus resurgences that were usually limited to one city or a few nearby cities, the Nanjing epidemic occurred at a busy international airport, and trans-regional passengers traveling for long distance soon brought the virus across the country to places including Southwest China's Sichuan and Northeast China's Liaoning, experts noted. (Global Times)

CORONAVIRUS: Yangzhou, a city neighboring Nanjing where there's been an outbreak of delta-variant cases, suspended all passenger flights in and out of the local airport starting Saturday. It also stopped bus, cab and ride-hailing services in the city from Sunday. (BBG)

CORONAVIRUS: In the tourist city of Zhangjiajie, officials on Sunday announced stay-at-home orders, calling on people not to go to work unless absolutely necessary. State-backed media reported the city had closed all roads for non-emergency transport as of 3 p.m. on Sunday. (RTRS)

CORONAVIRUS: The Chinese capital (Beijing) will step up efforts to prevent the spread of the virus, including suspension of flights, trains and buses from regions with Covid cases, according to a post on the city's WeChat account. (BBG)

EQUITIES: Beijing's market regulator has fined three private tutoring firms for acts such as false advertising, running unlicensed schools and illegal pricing, state media reported on Monday. The three schools - Xueda Education, ABC Foreign Language School and 51talk - were fined a total of 1.92 million yuan ($297,000), the Beijing Youth Daily newspaper reported. 51talk is also known as China Online Education Group. Xueda, ABC Foreign Language School and 51talk did not immediately respond to requests for comment. (RTRS)

EQUITIES: China's central bank has urged further "rectification" of the country's fintech sector, adding more pressure to tech groups besieged by intensifying regulatory scrutiny. The latest warning from Beijing, which did not name any companies, comes against a backdrop of strengthening headwinds for Chinese tech groups, equities markets and foreign investors in the world's second-biggest economy. (FT)

MACAO: The court of final appeal of the Macao Special Administrative Region (SAR) on Saturday ruled against the appeals by trustees of three candidate lists for the upcoming Legislative Assembly election after the Electoral Affairs Commission refused to accept the lists for failing to include a minimum of four qualified candidates each as required by the election law. The ruling safeguarded the constitutional order of the Macao SAR as stipulated in the Constitution of the People's Republic of China (PRC) and the Basic Law of the Macao SAR, manifesting justice and authority in the SAR. (Xinhua)

OVERNIGHT DATA

CHINA JUL M'FING PMI 50.4; MEDIAN 50.8; JUN 50.9

CHINA JUL NON-M'FING PMI 53.3; MEDIAN 53.3; JUN 53.5

CHINA JUL COMPOSITE PMI 52.4; JUN 52.9

CHINA JUL CAIXIN M'FING PMI 50.3; MEDIAN 51.0; JUN 51.3

The Caixin China General Manufacturing PMI came in at 50.3 in July, down from 51.3 the previous month. The July reading was the lowest in 15 months, though it marked the 15th consecutive month of expansion. That meant while the manufacturing industry continued to grow, the rate of expansion slowed further. Supply in the manufacturing sector continued to expand, while demand contracted for the first time in more than a year. External demand remained stable. The gauge for output in July was the lowest in 16 months, while the gauge for new orders was the lowest in 15 months. Surveyed manufacturing enterprises said market demand was weak. High product prices supressed demand, especially for consumer goods and intermediate goods. The gauge for new export orders came in just above 50 in July. The epidemic situation varied in different regions overseas, which made exports remain stable as a whole. The employment market stayed stable. Some enterprises hired more staff to expand production capacity, while some kept a cautious stance on increasing hiring. The measure for employment was just above 50 in July, marking the fourth straight month of expansion. Outstanding workloads increased slightly. Inflationary pressure eased slightly. Both the gauges for input prices and output prices fell in July, with the latter dropping at a steeper pace. Still, the gauge for input prices was well above 50, as surveyed enterprises said raw material prices remained high, especially for industrial metals. Notably, the gauge for input prices remained above 55 for the eighth consecutive month in July. By comparison, the gauge for output prices was just above 50 in July, the lowest since September. As mentioned earlier, market demand was sensitive to product prices, which limited enterprises' pricing power. Logistics delivery times continued to lengthen. Impacted by the resurgence of the Covid epidemic in some regions in China and the shortage of materials including chips, the measure for suppliers' delivery times remained in contractionary territory. Prices of raw materials remained high. Manufacturing enterprises' quantity of purchases increased marginally, while the stock of purchases fell slightly. Overall, the rate of expansion in the manufacturing sector slowed in July. Market supply continued to expand, while demand began to come under pressure. The job market remained stable, as did the quantity and stock of purchases. Enterprises were cautious about increasing staff and purchasing raw materials. Inflationary pressure was partly eased, but input prices and output prices of manufacturing enterprises continued to rise, especially raw materials such as industrial metals. Entrepreneurs stayed positive about the business outlook, but the measure for future output expectations in July was lower than its long-term average and was the lowest in 15 months. China's official second-quarter economic figures were in line with expectations, but the Caixin China manufacturing PMI in July and relevant data suggested the recovery of the economy is not yet solid. The economy is still facing huge downward pressure, and we need to ensure entrepreneurs' confidence. (Caixin)

JAPAN JUL, F JIBUN BANK M'FING PMI 53.0; FLASH 52.2

The Japanese manufacturing sector continued to see an improvement in operating conditions at the start of the third quarter of 2021, as July PMI data pointed to a quicker improvement in the health of the sector. Moreover, the pace of expansion quickened as firms recorded stronger growth in both output and new orders. That said, supply chain disruption continued to impact activity within the sector, with firms recording the second greatest deterioration in lead times in over a decade. Material shortages and logistical disruption contributed to a rapid rise in average cost burdens, as input prices rose at the fastest pace since September 2008. Beyond the immediate future, Japanese manufacturers remained confident that output would rise over the coming 12 months, although sentiment was at its lowest for three months. Firms were hopeful that a successful vaccine programme would help to end the pandemic and reduce pressure on supply chains, boosting demand across the manufacturing sector. (IHS Markit)

JAPAN JUL CONSUMER CONFIDENCE 37.5; MEDIAN 36.9; JUN 37.4

JAPAN JUL VEHICLE SALES +3.3% Y/Y; JUN +9.2%

AUSTRALIA JUL, F MARKIT M'FING PMI 56.9; FLASH 56.8

Australia's manufacturing sector sustained in growth despite the renewed lockdowns affecting a larger proportion of the population in July. Meanwhile, the average Australian manufacturing firm also appear to be facing issues of supply constraints and price pressures to a greater extent in July as lead times lengthened and price inflation heightened. These constraints may well worsen in the event movement restrictions are prolonged. While hiring conditions remained positive in the manufacturing sector, some firms continued to report difficulties in recruiting staff to meet production requirements. Firms remained generally optimistic in July, though notably less so compared to June given the COVID-19 uncertainties. IHS Markit forecasts the Australian economy to grow 3.4% in 2021. (IHS Markit)

AUSTRALIA JUL MELBOURNE INSTITUTE INFLATION +2.6% Y/Y; JUN +3.0%

AUSTRALIA JUL MELBOURNE INSTITUTE INFLATION +0.5% M/M; JUN +0.4%

AUSTRALIA JUL ANZ JOB ADVERTISEMENTS -0.5% M/M; JUN +1.5%

There was only a slight decline in ANZ Job Ads in July, the first full month of NSW's lockdown. Weekly numbers did not fall steeply in the second half of the month either, when NSW tightened restrictions (on construction, retail and more broadly) and Victoria and SA also went into lockdown. There were certainly no signs of a repeat of last year, when ANZ Job Ads dropped 12.9% in March and a further 53.1% in April 2020.This reinforces our expectation that the impact of NSW's extended lockdown on employment and the unemployment rate will be limited; hours worked and underemployment will again bear the brunt. We think two key factors will mitigate state and national effects on employment and unemployment. First, policy support, including for JobSaver, which requires businesses to maintain their headcount. Second, many businesses are "hoarding" labour to avoid the costs and delays of rehiring once restrictions ease, particularly given reported difficulty finding labour and the record high job vacancy rate. We maintain our positive longer-term labour market outlook and forecast unemployment to fall to 4.5% by Q42021 and 4.2% by end-2022. A longer NSW lockdown and outbreaks elsewhere are significant risks though. (ANZ)

AUSTRALIA JUL CORELOGIC HOUSE PRICE INDEX +1.6% M/M; JUN +1.9%

SOUTH KOREA JUL TRADE BALANCE +$1.764BN; MEDIAN +$108MN; JUN +$4.451BN

SOUTH KOREA JUL EXPORTS +29.6% Y/Y; MEDIAN +30.9%; JUN +39.8%

SOUTH KOREA JUL IMPORTS +38.2% Y/Y; MEDIAN +44.0%; JUN +40.7%

SOUTH KOREA JUL MARKIT M'FING PMI 53.0; JUN 53.9

South Korean manufacturers continued to report a sustained improvement in operating conditions at the start of the second half of the year as production levels continued to expand. However, the latest Manufacturing PMI signalled the softest improvement in the health of the sector for seven months, amid a softer upturn in new orders. Anecdotal evidence suggested a resurgence in COVID-19 cases across Asia and ongoing supply chain disruption had led to demand easing in domestic and external markets. Moreover, sustained shortages of raw materials and delivery delays had placed additional strain on manufacturers' costs. The second-fastest rise in cost burdens in the survey's history contributed to a third consecutive record increase in output charges, as South Korean manufacturers sought to pass higher prices to clients in an effort to protect margins. Ongoing supply chain disruption and the resurgence of the virus also contributed to a softening in business sentiment. The degree of optimism was the lowest since December 2020, yet was strong overall. Confidence was underpinned by hopes that global demand and supply chains would recover at a strong pace, which is in line with the IHS Markit estimate for industrial production to expand by 5.8% in 2021. (IHS Markit)

UK JUL LLOYDS BUSINESS BAROMETER 30; JUN 33

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.1092% at 09:33 am local time from the close of 2.2980% on Friday.

- The CFETS-NEX money-market sentiment index closed at 39 on Friday vs 42 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4660 MON VS 6.4602

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4660 on Monday, compared with the 6.4602 set on Friday.

MARKETS

SNAPSHOT: Softer Than Exp. M'fing PMIs Heighten Chinese Growth Angst

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 531.63 points at 27814.94

- ASX 200 up 99.075 points at 7491.4

- Shanghai Comp. up 50.952 points at 3448.309

- JGB 10-Yr future down 1 tick at 152.29, yield down 0.6bp at 0.016%

- Aussie 10-Yr future +0.5 tick at 98.830, cash ACGBs closed

- U.S. 10-Yr future +0-05 at 134-19+, yield unch. at 1.222%

- WTI crude down $0.67 at $73.28, Gold down $3.54 at $1810.65

- USD/JPY down 2 pips at Y109.70

- FED BRAINARD EYES SEPTEMBER DATA FOR JOBS PROGRESS (MNI)

- FED'S KASHKARI WARNS DELTA VARIANT COULD SLOW JOBS RECOVERY (BBG)

- CHINESE M'FING PMIS STILL EXPAND, BUT SLOW MORE THAN FORECAST

- CHINA SEEKS MORE COMMUNICATION WITH U.S. ON OVERSEAS IPOS (BBG)

- U.S. SENATE ON PATH FOR VOTE ON INFRASTRUCTURE BILL THIS WEEK (BBG)

- ISRAEL COVID SPREAD AMONGST VACCINATED CAUSES SOME ANGST AROUND VACCINATIONS

BOND SUMMARY: U.S. Tsys Turn Bid On Chinese Growth Angst, ACGBs & JGBs Limited

After a limited start T-Notes managed to extend to fresh session highs, presumably on some worry surrounding the Chinese growth trajectory in the wake of softer than expected Chinese m'fing PMI releases (and subsequent expectations for the prospect of further policy easing), with softer oil prices also lending a helping hand. The contract last prints +0-05+ at 134-20, 0-01 shy of best levels on volume of ~92K. Technical resistance is located at the 20 July high/bull trigger (135-07). Light twist steepening of the curve is evident, with 5s leading the richening (last ~1.0bp firmer), while 20s and 30s now print a little off of their intraday cheaps (~0.5bp cheaper on the day last). There hasn't been much in the way of notable market flow to comment on. The latest ISM m'fing survey print will headline during NY hours.

- JGB futures have stuck to a narrow range, after showing below the late overnight lows in early Tokyo trade, before edging away from worst levels to last trade unch. on the day. The major cash JGB benchmarks are little changed out to 7s, with 10+-Year JGBs richening by 0.5-1.0bp as of typing. Idiosyncratic headline flow remains light, with most of the focus falling on the Japanese vaccine scheme. 10-Year JGB supply & Tokyo CPI data headline Tuesday's local docket.

- Thinner market conditions owing to the NSW holiday (cash ACGBs closed) continue to limit broader Aussie bond futures activity, and therefore the willingness/ability of futures to generate a meaningful/lasting bid, even as U.S. Tsys firm. That leaves YM unch. & XM +0.5 at typing. A reminder that NSW COVID cases ticked back from yesterday's joint-record levels, but still printed above the 200 mark. Elsewhere, SE Queensland will see the lockdown in play there extended until 16:00 Sunday. Local lower tier data releases had no impact on the space. Looking ahead, tomorrow's RBA monetary policy decision dominates the local docket, with most looking for the central bank to renege on its tapering move (which wasn't scheduled to get underway until September).

EQUITIES: China Recovers Early Losses

Most equity markets in Asia higher, mainland China markets recovering early losses and post gains of around 1.5%. The rise comes despite the latest reports of a crackdown on the tech sector with regulators demanding large tech companies fix a range of issues in the internet industry. Japanese markets were higher from the open, recovering most of Friday's loss, the rise was attributed in part to a decline in US yields with sentiment also boosted by the approach of the US infrastructure package. Other regional equity markets also gained with PMI data showing that while activity mostly slowed it remained expansionary. US futures are higher, coming off the back of a slightly negative close last week. Still, the S&P 50 finished July with gains for the sixth month in a row. Markets will watch another week of earnings as well as the US infrastructure bill.

OIL: Commodities Under Pressure

Crude futures are lower in Asia; WTI is down $1.10 from settlement at $72.85/bbl, Brent is down $1.21 at $74.20/bbl. There is still some way to go to support for WTI at $69.86 the 50-day EMA and $71.62 the 50-day EMA in Brent. Though most equity markets in Asia are in positive territory PMI data has generally showed slowing activity including Caixin manufacturing PMI from China while concerns linger about a pickup in the number of coronavirus cases across the region. A slightly stronger USD could also be keeping a lid on oil. Elsewhere there are tensions between the US and Iran after the US formally blamed Iran for an attack on an oil tanker linked to Israel, warning an appropriate response would be forthcoming.

GOLD: A Touch Weaker In Asia

A slightly firmer USD and uptick in e-minis has kept a lid on gold during Asia-Pac hours, allowing the space to consolidate after spot pulled away from well-defined resistance levels on Friday, unwinding 2/3 of the weekly gains lodged through Thursday in the process. That leaves spot dealing a handful of dollars softer at $1,810/oz at typing, within a now familiar technical layover. Note that known ETF holdings of bullion nudged higher last week. Our weighted U.S. real yield measure hovers just above the all-time lows that were printed in the middle of last week. ISM m'fing data headlines the broader risk docket on Monday, with Friday's NFP print and Wednesday's address from Fed Vice Chair Clarida providing some notable points of reference for participants this week.

FOREX: Chinese Data Tip Balance Against Riskier FX

Major crosses hugged tight ranges in Asia, with riskier currencies facing some downward pressure. The yuan took a mild hit in reaction to a miss in China's Caixin M'fing PMI, which is skewed towards smaller firms and exporters. The underwhelming print came on the heels of a miss in the official counterpart released over the weekend. The data suggested that recovery in China's manufacturing sector is plateauing, which weighed on riskier currencies, even as most Asia-Pac equity benchmarks advanced.

- High-beta G10 FX went offered as regional participants digested Chinese data, while the raging Covid-19 outbreak in Southeast Asia helped further dent sentiment. NOK was the worst performer as crude oil turned its tail.

- Softer oil and disappointing Chinese data pressured the Antipodeans, with liquidity limited by a bank holiday in Australia. Domestic risks were eyed on both sides of the Tasman, with RBA monetary policy decision coming up tomorrow, ahead of New Zealand's jobs data due the following day.

- PMI data deluge steals the limelight today, while G20 central bank speaker slate is virtually empty.

FOREX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-15(E1.1bln), $1.1900(E1.3bln), $1.2000-20(E901mln)

- AUD/USD: $0.7360(A$524mln), $0.7400(A$1.1bln)

- USD/CAD: C$1.2550($514mln)

- USD/CNY: Cny6.50($650mln), Cny6.5300($1bln)

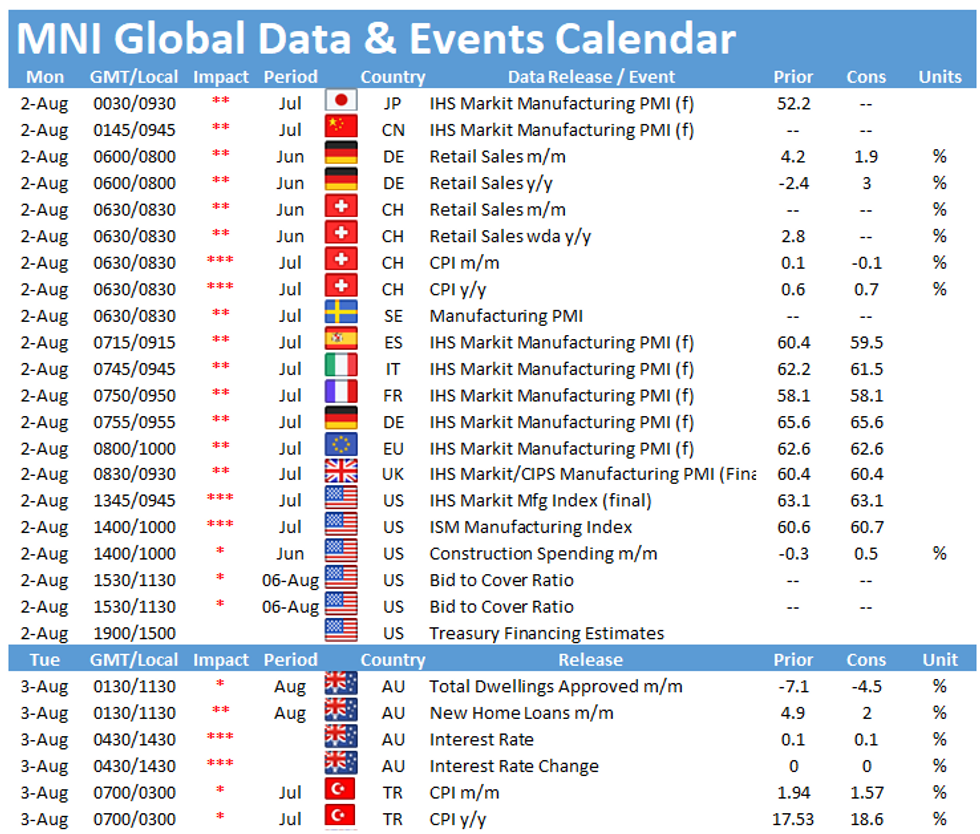

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.