-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Fedspeak & Covid Matters Under Scrutiny

EXECUTIVE SUMMARY

- FED'S BOSTIC URGES FASTER BOND TAPER AS ECONOMY STRENGTHENS

- FED'S ROSENGREN SAYS CENTRAL BANK SHOULD BEGIN SLOWING STIMULUS EFFORTS BY FALL (AP)

- FED'S BARKIN: INFLATION LIKELY TO REMAIN AT FED'S 2% TARGET (RTRS)

- U.S. SENATE SET TO PASS INFRASTRUCTURE BILL TUESDAY (Hill)

- CHINA'S CENTRAL BANK OUTLOOK FUELS CALLS FOR POLICY EASING (BBG)

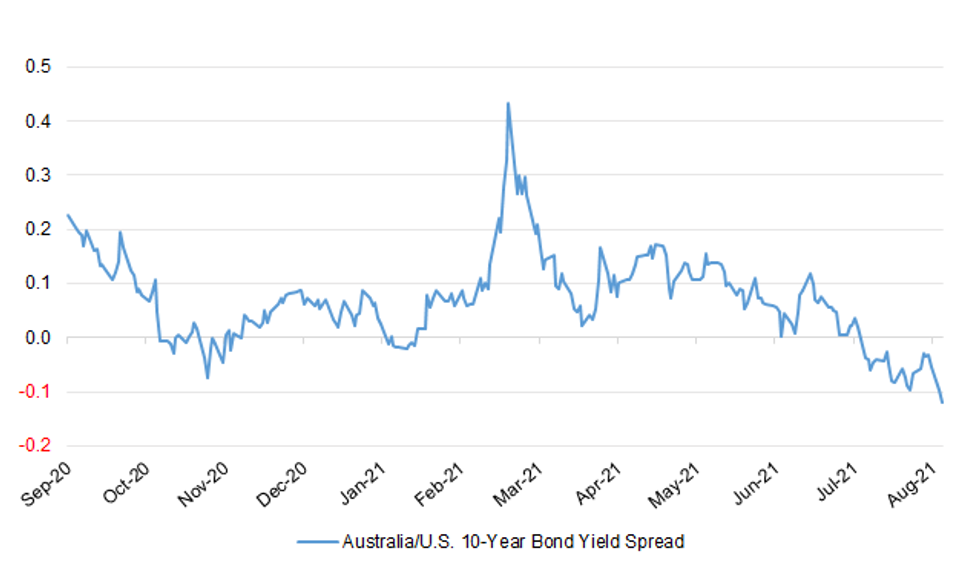

Fig. 1: Australia/U.S. 10-Year Bond Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Time is running out to avoid failure at the crucial climate summit the UK will host in November after a UN report found the world stands at "code red", Boris Johnson has been told. A senior Conservative warned the prime minister had yet to make his "promises a reality", while a respected think tank told Mr Johnson he must make the landmark gathering a personal priority to deliver success. As Tory MPs launched a group to fight climate action they claim will cost too much, the environment minister, Zac Goldsmith, appeared to reveal fears of an active campaign to sabotage Cop26 in Glasgow. But, despite calls for Mr Johnson to "do the heavy lifting" – by using his clout to pressurise other world leaders into stronger commitments – there are no plans for him to meet any before November, The Independent was told. (Independent)

POLITICS: Conservative MPs representing constituencies in northern England have joined local Labour leaders in a last-ditch campaign to save the eastern route of the planned HS2 railway line to Leeds, which they fear Boris Johnson is set to cancel. Several Tory MPs in so-called red wall seats seized from the Labour party at the 2019 election have told the UK prime minister he would break his pledge to "level up" former industrial areas of the north and midlands if he did not build the project in full. (FT)

CORONAVIRUS: Holidaymakers in France are being turned away from events as well as bars and restaurants because their NHS codes are not being accepted. France extended its health pass to cover bars and cafes on Monday, as well as museums and other crowded settings. Although Britons can load digital QR codes provided by the NHS on to the Tous Anti Covid app – also known as the health pass – some venues are unable to read them. (Telegraph)

CORONAVIRUS: The U.K. government will ease travel restrictions to allow tens of thousands of government officials, climate advocates and journalists from around the world to attend a major summit in Scotland that starts in October. (BBG)

EUROPE

GERMANY: Armin Laschet is pushing measures to slow a renewed spread of the coronavirus in Germany and bolster his image as a crisis manager as the front-runner to succeed Angela Merkel falters. With less than seven weeks before the national election and his poll numbers slipping, Laschet will call for more obligatory tests for unvaccinated people at a meeting between Merkel and state leaders on Tuesday, according to a person familiar with the matter. The plan -- presented Monday at a closed-door meeting of the Christian Democratic party -- is aimed at protecting privileges for people who have been immunized against Covid-19, while providing greater incentives to get the shots, said the person, who asked not to be identified because the deliberations were confidential. (BBG)

GERMANY: Germany's federal and regional governments will allocate about 30 billion euros ($35 billion) to help pay for reconstruction in western areas hit by severe flooding last month, according to a person familiar with the plan. Premiers of Germany's 16 states and Chancellor Angela Merkel are expected to discuss the cost of the flood damage when they hold talks via video conference on Tuesday afternoon, according to the person, who asked not to be identified discussing confidential information. (BBG)

HUNGARY: Hungarian central bank Governor Gyorgy Matolcsy renewed his assault on the government's economic policies, worsening the standoff among the adherents of Prime Minister Viktor Orban. Matolcsy used his weekly column in daily Magyar Nemzet on Monday to fault the premier for merging the Economy Ministry, his former turf, into the Finance Ministry, which is run by his rival Mihaly Varga, among a long list of other objections. The attacks by Matolcsy, which stand out in the normally obedient ruling party circles, have also centered on the budget, which he sees at risk of overheating. (BBG)

BELARUS: The US, UK and Canada have tightened sanctions against the regime of Alexander Lukashenko in Belarus, exactly one year after he won re-election in a presidential ballot that he has been accused of rigging. Also on Monday, Latvia said it was poised to declare a state of emergency on its frontier with Belarus and build a fence there to stem a flow of migrants, which it has described as "hybrid warfare". (FT)

US

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said the central bank should move to taper its asset purchases after another strong month or two of employment gains, and proceed with that scaling back process faster than in past episodes. "We are well on the road to substantial progress toward our goal," Bostic told reporters after a webinar speech on Monday, calling the addition of 943,000 jobs last month "definitely quite encouraging in that regard. My sense is if we are able to continue this for the next month or two I think we would have made the 'substantial progress' toward the goal and should be thinking about what our new policy position should be." Bostic is a rotating member on the Fed's policy-setting committee through year-end. He's staked out a more hawkish position than some of his colleagues. For interest rates, he said that he anticipates the first increase "very late" in 2022. At a separate event Monday, Richmond Fed President Thomas Barkin also said he sees progress in the economy toward the central bank's goals. (BBG)

FED: The president of the Federal Reserve Bank of Boston added his voice Monday to a growing number of people, inside and outside the Fed, who say the central bank should soon begin to dial back its extraordinary aid for an economy that is strongly recovering from the pandemic recession. Eric Rosengren said in an interview with The Associated Press that the central bank should announce in September that it will begin reducing its $120 billion in purchases of Treasury and mortgage bonds "this fall." The bond buying, which the Fed initiated after the coronavirus erupted in March of last year, has been intended to lower longer-term interest rates and encourage borrowing and spending. Rosengren also echoed some of the Fed's recent critics by arguing that the bond purchases are no longer helping to create jobs but are instead mostly helping drive up the prices of interest-rate sensitive goods such as homes and cars. (AP)

FED: High inflation this year may have satisfied one of the Fed's benchmarks for raising interest rates, though there is still room for the job market to heal before rates should rise, Richmond Federal Reserve President Tom Barkin said Monday. Under the Fed's current policy guidance, rates will rise "when inflation hits 2%, which I think you can argue it already has, and it looks like it is going to sustain there," Barkin said at the Roanoke Regional Chamber of Commerce in Virginia. But "there is still room to run in the labor market." (RTRS)

FISCAL: The Senate is poised to pass a roughly $1 trillion bipartisan infrastructure bill on Tuesday, capping off a lengthy, days-long debate. Majority Leader Charles Schumer (D-N.Y.), wrapping up the chamber's work for the day, said it had "come to an agreement" and that the Senate will vote on passing the bill at 11 a.m. on Tuesday. "It has taken quite a long time, and there have been detours and everything else, but this will do a whole lot of good for America, and the Senate can be proud it has passed this," Schumer said about the bipartisan bill. ADVERTISEMENT Technically, the clock on the bipartisan bill runs out early Tuesday morning, but cutting the deal on timing allows senators to bypass having to come back for a middle-of-the-night vote. (Hill)

FISCAL: Senate Democrats on Monday unveiled a budget blueprint that paves the way for a massive spending plan they want to pass without GOP support later this year. The budget resolution, which includes instructions for how to draft the $3.5 trillion bill, does not include an increase to the debt ceiling. Democrats can pass the budget resolution and the spending plan on their own if all 50 of their members stay unified, under a process known as reconciliation. Republicans, bristling at the spending package, have warned that they won't put up the 10 GOP votes needed to raise the debt ceiling outside of the budget process. Though the budget resolution can still be changed, the Democratic plan to leave it out paves the way for a massive fight this fall over the nation's borrowing limit. Democrats want to pass the budget resolution this week, after the Senate wraps up its work on a roughly $1 trillion bipartisan infrastructure package. Senate committees will then have until mid-September to write their parts of the $3.5 trillion bill, in what is expected to be a weeks-long haggling session to try to lock down support from all 50 Democrats. (Hill)

FISCAL: Senator Elizabeth Warren of Massachusetts and her allies will propose a minimum tax on the profits of the nation's richest companies, regardless of what they say they owe the government, as part of Democrats' $3.5 trillion economic and social-policy package. Ms. Warren's so-called "real corporate profits tax" was a key part of her presidential campaign, and she has enlisted Senator Angus King, the Maine independent, to help press her case that profitable companies should be taxed, regardless of loopholes and maneuvers that have allowed many of them to avoid federal corporate income taxes altogether. The measure would require the most profitable companies to pay a 7 percent tax on the earnings they report to investors — known as their annual book value — above $100 million. By taxing the earnings reported to investors, not to the Internal Revenue Service, Democrats would be hitting earnings that companies like to maximize, not the earnings they try hard to diminish for tax purposes. (NYT)

POLITICS: The White House is vetting acting Solicitor General Elizabeth Prelogar to be nominated for thejob on a permanent basis, according to two former SG's office attorneys. (BBG)

CORONAVIRUS: A U.S. Centers for Disease Control and Prevention (CDC) advisory panel will meet on Friday to discuss considerations for booster doses of COVID-19 vaccines, as the United States deals with increasing cases from the Delta variant of the coronavirus. (RTRS)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention (CDC) warned on Monday against travel to Israel, France, Thailand, Iceland and several other countries because of a rising number of COVID-19 cases in those nations. (RTRS)

CORONAVIRUS: The Pentagon will require all military personnel to get the COVID-19 vaccine by Sept. 15, according to a new memo from Defense Secretary Lloyd Austin, released Monday. (Hill)

CRYPTOCURRENCIES: A bipartisan amendment to redefine who would be subject to new cryptocurrency regulation requirements under the Senate infrastructure bill was blocked Monday after Sen. Richard Shelby (R-Ala.) tried to attach his untreated proposal to boost military spending by $50 billion. (Hill)

OTHER

CLIMATE CHANGE: The world is likely to temporarily reach 1.5C of warming within 20 years even in a best-case scenario of deep cuts in greenhouse gas emissions, a landmark report on climate change signed off by 234 scientists from more than 60 countries has concluded. Even with rapid emissions cuts, temperatures would continue to rise until "at least" 2050, the scientists said, and lead to further extreme weather events. Without "immediate, rapid and large-scale reductions" in emissions, curbing global warming to either 1.5C or even 2C above pre-industrial levels by 2100 would be "beyond reach", they said. The latest analysis of the science of global warming from the UN's Intergovernmental Panel on Climate Change is the sixth such report and the first since 2013. Its summary was reviewed by representatives from 195 countries and will form a basis for negotiations at the global summit in November. The starkly worded report said the evidence for human-induced warming was "unequivocal" and that its impact was being felt around the world. (FT)

CANADA/CHINA: Canadian Robert Schellenberg has lost his appeal to have his death penalty overturned, while a Chinese court will soon deliver its verdict for Michael Spavor, who is charged with espionage. The Higher People's Court of Liaoning Province said early Tuesday that Mr. Schellenberg's appeal was unsuccessful, and it upheld the lower court's sentence. The ruling was approved by the Supreme People's Court, it said in a statement. Mr. Spavor, a businessman who was charged with espionage is expected to learn his verdict in Dandong later this week, according to two sources. (Globe & Mail)

JAPAN: Finance Minister Taro Aso says the Japanese government isn't preparing any new stimulus package or extra budget now. Says there are a lot of unspent funds left in already adopted Covid-19 measures. (BBG)

SINGAPORE: Singapore said 70% of its population has been fully vaccinated, and 79% have received at least one dose, giving the city-state one of the best vaccination rates in the world as today it starts to ease social distancing restrictions and restart parts of the economy. In an effort to vaccinate the rest, the island trade hub said citizens and long-term residents will no longer need to make an appointment to get the Pfizer-BioNTech vaccine, and can instead walk in to any of the more than two dozen clinics offering it to get a jab. The country earlier this month also made the Moderna vaccine available on a walk-in basis. (BBG)

TAIWAN: Taiwan's navy is scrapping an NT$31.6 billion (US$1.1 billion) project to build 60 mini missile assault boats originally aimed to boost the island's asymmetric warfare ability against the mainland, a reversal that is expected to cost NT$200 million. In a statement on Monday, the navy said the project, proposed by former chief of the general staff admiral Lee Hsi-ming, was cancelled because the boat design could not meet its needs against an enemy. (SCMP)

NORTH KOREA: The sister of North Korean leader Kim Jong-un on Tuesday slammed South Korea and the United States for going ahead with joint military exercises, denouncing the drills as the "most vivid expression" of Washington's hostile policy toward Pyongyang. Kim Yo-jong expressed "deep regret" to South Korea for what she called "perfidious behavior" as the South kicked off a preliminary training with the U.S. in the run-up to next week's main exercise, after her earlier warning that the maneuvers will cloud inter-Korean relations. (Yonhap)

BRAZIL: Brazilian President Jair Bolsonaro sent Congress on Monday a proposal for a constitutional amendment to help handle the payment of the government's court-ordered debts through a fund financed by the privatization of state companies. Bolsonaro earlier visited Congress to hand in a bill to restructure Brazil's welfare program, which would also be partly financed by the same fund, the government said. Officials said the largest debts would be parceled over time to avoid a dramatic impact on the budget deficit. (RTRS)

PERU: Peruvian central bank President Julio Velarde has agreed to stay on for an extra term, a source familiar with his decision said on Monday, which should calm markets that have been rattled by the election of a new left-wing president. The source declined to be identified because the decision has not been made public yet. Newly inaugurated President Pedro Castillo had asked Velarde to stay in the role. (RTRS)

PERU: Peru's finance minister, Pedro Francke, told Reuters on Monday that the new leftist government can increase mining taxes to fund public spending without affecting private-sector competitiveness, all while reducing the fiscal deficit. (RTRS)

CHILE: Workers and management at Escondida agreed to extend mediated talks for another day in a effortto avert a strike at the world's biggest copper mine. (BBG)

MIDDLE EAST: CIA director Bill Burns will visit Israel on Tuesday for the first time since assuming office for talks that are expected to focus on Iran, Israeli officials tell me. He's also expected to meet Palestinian Authority officials in Ramallah. (Axios)

AFGHANISTAN: The United States said it was up to Afghan security forces to defend the country after Taliban militants captured a sixth provincial capital on Monday, along with border towns and trade routes. (RTRS)

AFRICA: Health officials confirmed a case of Marburg virus in Guinea, the first time the severe, often deadly infectious disease has been seen in West Africa. The case occurred in a patient from southwestern Guinea who died in early August, according to the World Health Organization. The report comes just months after an outbreak of Ebola virus was declared over in June. Marburg, part of the same virus family as Ebola, causes a severe hemorrhagic fever and can kill from 24% to 88% of those infected. (BBG)

CHINA

PBOC: China may need to fine-tune its macro policy to lend more support for economic growth, as downside risks have risen amid the recent local COVID-19 resurgences while mild inflation prospects have offered the room for further easing, experts said on Monday. They commented as the People's Bank of China said on Monday that it will support the real economy with effective measures while refraining from flooding the market with liquidity, supporting the country's high-quality development with moderate growth in money supply. Monetary policy independence will be strengthened, the central bank said in its second-quarter monetary policy report, with policy pace and intensity to be properly handled in accordance with the domestic economic situation and price levels. Experts considered the remarks a signal that further lowering of the reserve requirement ratio and even cutting the policy interest rate could be within the Chinese central bank's policy toolkit in the coming quarters, even as the US Federal Reserve is expected to taper its stimulus package. (China Daily)

INVESTMENT: China should promote investments on major infrastructure projects as well as stimulating private capital participation through tax and fee cuts, so to stabilize the economic growth in the next step, given the resurgence of the epidemic will continue to slow the recovery of consumption and services, wrote Guan Tao, chief economist of BOC International and a former FX regulatory official in an article run by Yicai.com. The sales of local government special bonds should accelerate in the rest of this year, with the average monthly issuance up to about CNY460 billion if to use up the annual quota, said Guan. This is 1.37 times higher than the average monthly issuance in the first seven months, and the central bank is expected to make timely and precise injections to keep liquidity ample, wrote Guan. (MNI)

BONDS: China's financial regulators are asking regional governments to delay some of their special-purpose bonds, often used to fund infrastructure, to December, in order to help boost investments that would show up early next year, the 21st Century Business Herald reported citing unidentified government sources. Regional authorities then must use up the remaining quotas for this year by September, including on urban revivals and roads, the newspaper said. China is expected to issue more special-purpose bonds in the second half than the same time last year. It has sold CNY1 trillion special bonds in H1, which was slower than last year, the newspaper said citing an internal meeting by the authorities. MNI noted that China has signaled growth this year is almost certain to hit the earlier set targets and is leaving the ammunition to deal with the more uncertain next year. (MNI)

YUAN: The Chinese yuan will remain resilient as supported by China's increased economic power, and the value of yuan assets will further increase with the country's foreign exchange reserves and interest spread with the U.S. remaining stable, the China Securities Journal reported citing Ming Ming, deputy research head at CITIC Securities. The currency has become more flexible and informative in reflecting the changes in international markets as well as FX supply and demand, the newspaper cited Ming as saying. The annualized volatility of yuan against the U.S. dollar was 3.5% in the first half of this year, while the monthly change of the central parity of yuan against the dollar was only 0.2% back in 2005 to 2015, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN JUN BOP CURRENT ACCOUNT BALANCE +Y905.1BN; MEDIAN +Y855.0BN; MAY +Y1.9797TN

JAPAN JUN BOP CURRENT ACCOUNT ADJ +Y1.7791TN; MEDIAN +Y1.7129TN; MAY +Y1.8665TN

JAPAN JUN TRADE BALANCE BOP BASIS +Y648.6BN; MEDIAN +Y639.0BN; MAY +Y2.0BN

JAPAN JUL ECO WATCHERS SURVEY CURRENT 48.4; MEDIAN 43.4; JUN 47.6

JAPAN JUL ECO WATCHERS SURVEY OUTLOOK 48.4; MEDIAN 49.2; JUN 52.4

JAPAN JUL BANK LENDING INCL-TRUSTS +1.0% Y/Y; JUN +1.4%

JAPAN JUL BANK LENDING EX-TRUSTS +0.5% Y/Y; JUN +0.7%

JAPAN JUL BANKRUPTCIES -39.67% Y/Y; JUN -30.64%

AUSTRALIA JUL NAB BUSINESS CONFIDENCE -8; JUN 11

AUSTRALIA JUL NAB BUSINESS CONDITIONS 11; JUN 25

The continuing lockdown in NSW and the briefer periods of disruption across a number of other states saw a further deterioration in activity in the business sector in July. Conditions fell 14pts, with trading conditions and profitability sharply lower. In addition, the employment index also recorded a solid fall. Unsurprisingly, conditions fell very sharply in NSW but were generally weaker across states. South Australia, in particular, appears to have taken an outsized hit – down around the same amount as NSW despite only a brief lockdown late in the month. Confidence took a big hit in the month with optimism collapsing on the back of ongoing restrictions. NSW declined by a very large 27pts on the back of ongoing uncertainty about how quickly the outbreak could be contained. That said, confidence was softer everywhere with uncertainty over the spread of the virus in the other states and border closures. Forward looking indicators weakened further and point to ongoing weakness in conditions in the near-term. Forward orders fell sharply and are back in negative territory while capacity utilisation also softened further – both had been at high levels in recent months. The fear is that lower capacity utilisation and a fading pipeline on work may see businesses pull back on hiring and investment intentions. It is now widely expected that we will see a negative print for GDP in Q3. However, we know that once restrictions are removed that the economy has tended to rebound relatively quickly. We will continue to track the survey very closely for an indication of just how quickly that happens – particularly forward orders and capacity utilisation as we assess how the disruption has fed into expansion plans as conditions bounce back. The hope is that the economy again rebounds strongly, and we see little pullback in the very positive investment and hiring intentions we have seen by business in recent months. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 98.6; PREV. 101.8

Consumer confidence dropped by 3.1% last week as fresh lockdowns were announced in parts of Queensland and Victoria. As a result, confidence dropped by 7.5% in Brisbane and 1.6% in Melbourne. Sydney and the rest of NSW, on the other hand, saw an increase in confidence of 3.7% and 2.1% respectively as the vaccination rate picked up and some restrictions on construction work were eased. Sentiment is still above the level reached during Victoria's long second lockdown, but it is now in pessimistic territory for the first time since early November last year. Our research suggests we can't be sure the low in confidence in the current cycle has been reached until COVID case numbers start to trend lower. (ANZ)

NEW ZEALAND JUL CARD SPENDING RETAIL +0.6% M/M; JUN +0.8%

NEW ZEALAND JUL CARD SPENDING TOTAL +0.9% M/M; JUN +1.3%

NEW ZEALAND JUL ANZ TRUCKOMETER HEAVY -1.1% M/M; JUN +2.0%

UK JUL BRC SALES LIKE-FOR-LIKE +4.7% Y/Y; MEDIAN +5.0%; JUN +6.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2071% at 09:25 am local time from the close of 2.1387% on Monday.

- The CFETS-NEX money-market sentiment index closed at 62 on Monday vs 51 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4842 TUES VS 6.4840

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4842 on Tuesday, compared with the 6.4840 set on Monday.

MARKETS

SNAPSHOT: Fedspeak & Covid Matters Under Scrutiny

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 8.68 points at 27827.76

- ASX 200 up 10.984 points at 7549.4

- Shanghai Comp. down 4.895 points at 3489.74

- JGB 10-Yr future down 16 ticks at 152.15, yield up 1.1bp at 0.026%

- Aussie 10-Yr future up 0.5 ticks at 98.805, yield down 0.4bp at 1.201%

- U.S. 10-Yr future unch. at 133-25, yield down 1.01bp at 1.314%

- WTI crude up $0.48 at $66.96, Gold up $6.97 at $1736.89

- USD/JPY up 5 pips at Y110.34

- FED'S BOSTIC URGES FASTER BOND TAPER AS ECONOMY STRENGTHENS

- FED'S ROSENGREN SAYS CENTRAL BANK SHOULD BEGIN SLOWING STIMULUS EFFORTS BY FALL (AP)

- FED'S BARKIN: INFLATION LIKELY TO REMAIN AT FED'S 2% TARGET (RTRS)

- U.S. SENATE SET TO PASS INFRASTRUCTURE BILL TUESDAY (Hill)

- CHINA'S CENTRAL BANK OUTLOOK FUELS CALLS FOR POLICY EASING (BBG)

BOND SUMMARY: Raging Delta Variant Supports Core FI Despite Hawkish Fedspeak

The news and data flow seen over the Asia-Pac session failed to offer any notable fresh catalysts, leaving participants to reflect on the latest portion of hawkish Fedspeak. Meanwhile, continued spread of the coronavirus Delta variant continued to provide a lingering source of worry, while Sino-Canadian tensions and combative rhetoric from North Korea were also eyed. T-Notes advanced nonetheless, and last trade +0-00+ at 133-25+, as U.S. e-mini futures slipped. Cash Tsy curve bull flattened, with yields last seen 0.2-1.4bp lower. Eurodollar futures trade unch. to +1.5 tick through the reds. Comments from Fed's Mester on inflation risks and 3-Year Tsy supply headline today's economic docket in the U.S., ahead of Wednesday's much awaited CPI report.

- Japanese markets reopened after the long weekend, with JGB futures wavering within a 10 tick range. The contract last sits at 152.14, 16 ticks below Friday's settlement. Cash JGBs softened across the curve, with 7-20 sector underperforming. Looking ahead, 30-Year JGB supply is due to take focus tomorrow. On the fiscal front, Japanese FinMin Aso pushed back against suggestions that the gov't was preparing a new stimulus package and extra budget.

- The initial bear steepening impetus seen at the Australian reopen evaporated and the ACGB yield curve twist flattened at the margin. Yields last sit +0.7bp to -0.4bp across the curve. YM last trades unch, while XM ground higher and now sits +0.5. Bills run unch. to -1 tick through the reds. Participants took note of the deterioration in sentiment among Australian consumers and businesses. The weekly ANZ consumer confidence gauge slipped below the breakeven 100 level for the first time since autumn 2020, while NAB Business Confidence Index returning into negative territory, as regional lockdowns continued to bite. The AOFM sold A$100mn of the 2.50% 20 Sep '30 linker, which attracted bid/cover ratio of 4.27x.

AUSSIE BONDS: The AOFM sells A$100mn of the 2.50% 20 Sep ‘30 I/L Bond, issue #CAIN408:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 2.50% 20 September 2030 I/L Bond, issue #CAIN408:

- Average Yield: -0.9102% (prev. -0.5512%)

- High Yield: -0.9050% (prev. -0.5425%)

- Bid/Cover: 4.2700x (prev. 2.5133x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 66.7% (prev. 68.2%)

- Bidders 35 (prev. 31), successful 13 (prev. 17), allocated in full 10 (prev. 13)

EQUITIES: Drifting

A mixed session in Asia today as markets drifted between minor gains and minor losses. Markets in Japan were higher after returning from a long weekend. Japanese FinMin Aso was on the wires saying no new stimulus package or extra budget was currently being prepped and that there were still plenty of unspent COVID-19 funds. Markets in mainland China were lower, China hitting the headlines after a court has rejected the death sentence appeal for Canadian. The Hang Seng managed to squeeze out some small gains thanks to a positive lead in the tech sector from the Nasdaq. Indices in Australia and New Zealand also gained, while South Korea and Taiwanese markets fell. In the US futures are lower, markets will look ahead to the vote on the US infrastructure bill.

OIL: Holding Near Recent Lows

After finishing the day slightly lower crude futures have squeezed out small gains in Asia on Tuesday, benchmarks are down almost 10% from last week's highs; WTI is up $0.32 from settlement levels at $66.80, Brent is up $0.13 at $69.17/bbl. Risk sentiment in the region has been mixed, most equity markets managed small gains while the greenback rose slightly. Focus remains on the impact of the delta variant on demand, markets look ahead to monthly IEA and OPEC reports later in the week.

GOLD: Grinds Higher

After some wild price swings on Monday the yellow metal has held a much narrower range on Tuesday, grinding higher from the open but staying within yesterday's range. Gold is last up $6.73/oz at $1,763.67. Risk sentiment in the region has been mixed, most equity markets managed small gains while the greenback rose slightly. The pull lower yesterday found some support at the 61.8% retracement of the 2020 range, but the recovery off the low will have emboldened bulls. To reinforce any upside argument, bulls need to regain $1834.1, Jul 15 high, ahead of $1853.3, a Fibonacci retracement. Front-end implied vols for Gold understandably lurched higher, with the 1m contract holding most of the gain.

FOREX: NAB Survey Weighs On Antipodean Pairs

Major pairs drifted within fairly tight ranges, there were reports that the Senate had an agreement for final passage on the infrastructure bill. NZD was bottom of the G10 pile, NZD/USD losing 16 pips. Data showed New Zealand July total card spending rose 0.9% M/M. Looking further afield, food price index & inflation expectations hit Thursday, while BusinessNZ M'fing PMI is due Friday.

- AUD/USD is down 6 pips and approaching the worst levels since November 2020. The Australia NAB business confidence index fell to -8 from 11 previously, the business conditions fell to 11 from 25 previously.

- USD/JPY is up 4 pips. as Japanese markets return from a holiday. Data from Japan earlier showed bank landing excluding trusts rose 0.5% in July, the BoP current account surplus widened more than expected to JPY 905.1bn. Elsewhere Sankei reported that PM Suga will ask officials to draft a stimulus package, which would be funded by a Y30tn extra budget. FinMin Aso poured cold water on the reports by saying no new stimulus package or extra budget was currently being prepped and that there were still plenty of unspent COVID-19 funds.

- Offshore yuan is stronger, USD/CNH down 52 pips from yesterday's closing highs. There were 143 new coronavirus cases in mainland China today, the highest case count since January 20.

- Markets look ahead to the passage of the infrastructure bill from the US and later in the week CPI data.

FOREX OPTIONS: Expiries for Aug10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1690-00(E684mln), $1.1800-05(E859mln), $1.1825-40(E1.7bln), $1.1850(E2.4bln)

- AUD/USD: $0.7300(A$949mln), $0.7350(A$539mln), $0.7385-00(A$1.1bln)

- USD/CAD: C$1.2530-50($647mln)

- USD/CNY: Cny6.4730($1bln)

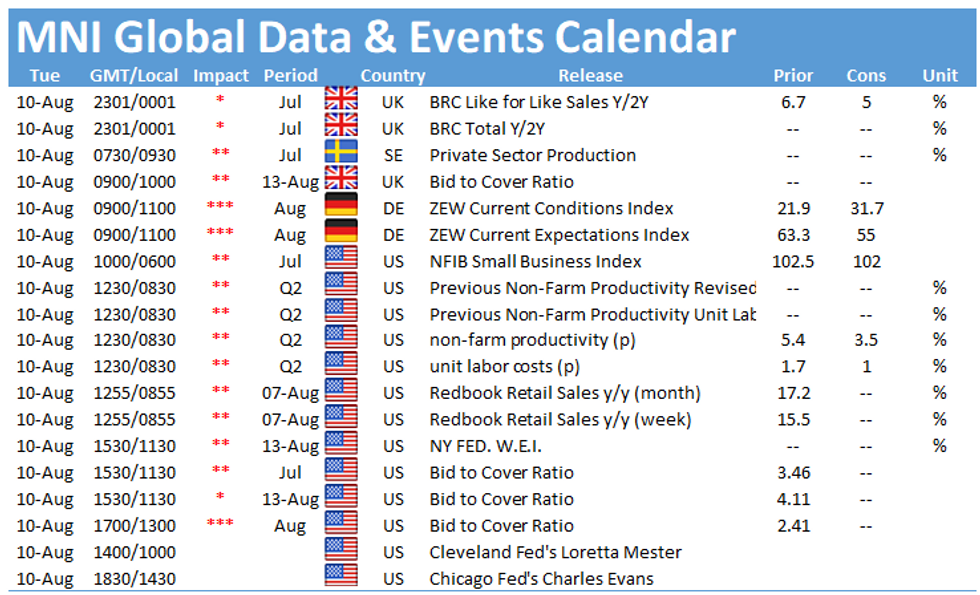

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.