-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Taliban Advance Towards Capital, Coronavirus Spreads In Asia

EXECUTIVE SUMMARY

- U.S. FDA APPROVES BOOSTER COVID JABS FOR IMMUNOCOMPROMISED PATIENTS

- UK AND US SEND TROOPS TO HELP EVACUATE AFGHAN EMBASSIES AS TALIBAN ADVANCE TOWARDS KABUL

- IEA CUTS OIL DEMAND FORECAST, OPEC SEES OIL MARKET TIGHT THROUGH END-2021

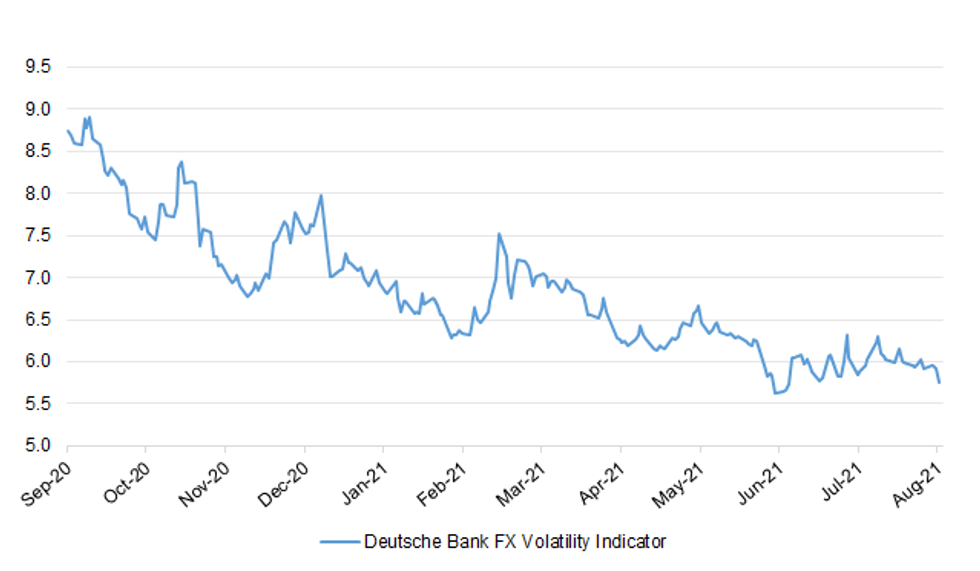

Fig. 1: Deutsche Bank FX Volatility Indicator

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak today declined three times to say whether he had ambitions to be Tory leader as he insisted that "like every cabinet minister I work for the prime minister". (Times)

SCOTLAND: Nicola Sturgeon has asked Boris Johnson to consider halting a controversial North Sea oil project, as Scotland's first minister said the UK fossil fuel industry should not be allowed to continue as if it was "business as usual" given the severity of the climate crisis. In a letter sent to the UK prime minister on Thursday, Sturgeon urged his government to "reassess" oil and gas licences that have already been issued. She also called for a review of proposed projects, including the Cambo scheme, one of the largest undeveloped fields in UK waters. (FT)

BREXIT: Post-Brexit trade frictions have "significantly altered" freight flows between Great Britain and the Republic of Ireland as Irish businesses opt to send goods directly into Europe, according to an official report. The volume of roll-on roll-off cargo transported between Britain and the Ireland fell by nearly a third since the Brexit deal came into force in January as Irish exporters looked to avoid the risk of customs delays at the UK's border with the EU. (FT)

BREXIT: More than half a million EU citizens in the UK are still awaiting decisions over their status six weeks after the June deadline for applying for the settlement scheme. EU nationals and their families were asked to apply to the EU Settlement Scheme (EUSS) by 30 June so they can carry on living and working in Britain after Brexit. (Independent)

EUROPE

GERMANY: A nationwide rail strike is creating turmoil for German travelers at the peak of the holiday travel season — and there are worries the shutdown will extend longer than originally planned. Rail operator Deutsche Bahn said in a statement that it "could not guarantee" all travelers would get to their final destinations and urged people who "do not absolutely have to travel to postpone their trip if possible." In a bid to make maximum use of the few trains that are running, DB said it would scrap its coronavirus measures and allow people to sit closer to each other. The strike was supposed to end at 2 a.m. on Friday, but the pay dispute between the German Train Drivers Union (GDL) and Deutsche Bahn hasn't been resolved. GDL head Claus Weselksy did not rule out further strikes, but said he wanted to "handle the collective bargaining power carefully." (Politico)

GERMANY: Angela Merkel will step in to help fellow conservative Armin Laschet in his bid to succeed her as German chancellor as he sinks in the polls, according to media reports. Merkel will join Laschet at a campaign event in Berlin on August 21 — the day their CDU party and its Bavarian CSU sister party are planning to kick off the final phase of their election campaign, according to a report by Berlin's Tagesspiegel newspaper Thursday. (Politico)

ITALY: Serie A, Italy's top soccer league, is reviving preliminary talks to sell a $2 billion stake to an investor group after failing to act on the deal earlier this year, according to people familiar with the matter. The Serie A board will gather Friday and is expected to informally restart talks that could let Advent International, Italy's FSI fund and CVC Capital Partners buy a 10% stake in a new media arm of the league, said the people, who asked not to be identified since the discussions aren't public. (BBG)

GREECE: Greek Prime Minister Kyriakos Mitsotakis on Thursday described the devastating wildfires that burned across the country for more than a week as the greatest ecological catastrophe Greece had seen in decades. (AP)

POLAND: Discovery Inc. plans to take legal action against the Polish government for potential breach a bilateral investment treaty with the U.S., escalating a standoff over the media giant's television assets in the east European country. A "notice of dispute" for violating the 1990 pact between the two NATO allies was sent to President Andrzej Duda on Thursday, Discovery said in an emailed statement. A day earlier, Poland's lower house of parliament passed legislation that -- if implemented -- will force the U.S. company to sell its TVN unit. (BBG)

BELARUS: Belarus's authoritarian regime, weighed down by sanctions imposed by the U.S. and European Union, is set to get an almost $1 billion lifeline from the International Monetary Fund. That's happening despite calls for the IMF to cut off President Alexander Lukashenko's government following Western accusations of fraud in last year's election and his brutal repression of protests that followed. President Joe Biden also met at the White House last month with exiled opposition leader Sviatlana Tsikhanouskaya, and the U.S. -- the IMF's largest shareholder -- expanded sanctions this week to mark the one-year anniversary of the vote. (BBG)

EQUITIES: Adidas is selling Reebok for up to €2.1bn to US-based celebrity and clothing licensing group Authentic Brands, drawing a line under the German sportswear maker's ill-fated acquisition more than 15 years ago. Net proceeds from the sale will be roughly €325m lower than the original price tag because of stranded costs around the divestment. (FT)

US

CORONAVIRUS: U.S. regulators say transplant recipients and others with severely weakened immune systems can get an extra dose of the Pfizer or Moderna COVID-19 vaccines to better protect them as the delta variant continues to surge. The late-night announcement Thursday by the Food and Drug Administration applies to several million Americans who are especially vulnerable because of organ transplants, certain cancers or other disorders. Several other countries, including France and Israel, have similar recommendations. (AP)

CORONAVIRUS: Rochelle Walensky, director of the Centers for Disease Control and Prevention, warned Thursday that Americans getting unauthorized booster shots of the COVID-19 vaccine undermine the CDC's safety monitoring of recipients. (Axios)

CORONAVIRUS: Anthony Fauci, the nation's top infectious disease expert, said on Thursday that "inevitably" everyone will need booster shots for the COVID-19 vaccine eventually because like any vaccine, its protection won't be "indefinite." NBC News' Craig Melvin asked Fauci on "Today" whether it's "inevitable" that "in the not too distant future everyone is going to need a booster shot," as the debate over the necessity of third shots has ramped up (Hill)

POLITICS: Donald Trump's fundraising committee has hired two political operatives familiar with campaigns in Iowa, the state that typically kicks off the race for the White House, signaling his interest in running in 2024. An aide with Save America, the leadership political action committee that Trump began after losing the 2020 election, told staff and advisers in a memo Thursday that Eric Branstad and Alex Latcham are joining as senior advisers. A Save America spokesman, Taylor Budowich, confirmed the hires and said Latcham and Branstad will help on "many political matters." (BBG)

POLITICS: President Biden on Thursday called on Congress to act to lower the "outrageously" high price of prescription drugs, as lawmakers prepare to press forward on the issue. The presidential backing comes ahead of what is sure to be an intense fight with pharmaceutical companies and Republicans on the issue, as Democrats look to include drug pricing measures in their coming $3.5 trillion budget package. (Hill)

CENSUS: The growth in the American population over the last decade was driven entirely by minority communities, according to new data released Thursday by the U.S. Census Bureau, as the number of white Americans declined for the first time since the nation's founding. Non-Hispanic whites make up just under 58 percent of the American population, the first time since the Census was first conducted that they have fallen under the 60 percent mark. By contrast, the 2000 Census showed non-Hispanic whites made up just over 69 percent of the population, and 63.7 percent in 2010. Hispanic or Latino Americans have grown steadily to 62.1 million, or 18.7 percent of the population, up from 12.6 percent in 2000 and 16.4 percent in the 2010 count. Asian Americans grew faster than any other minority group in the last decade, to 24 million, up about 20 percent since 2010. (Hill)

OTHER

U.S./CHINA: The Central Intelligence Agency is weighing proposals to create an independent "Mission Center for China" in an escalation of its efforts to gain greater insight into the U.S.'s top strategic rival, according to people familiar with the deliberations. The proposal, part of a broader review of the agency's China capabilities by CIA Director William Burns, would elevate the focus on China within the agency, where China has long been part of a broader "Mission Center for East Asia and Pacific." (BBG)

CANADA: Canadian Prime Minister Justin Trudeau is planning a snap election for Sept. 20 to seek voter approval for the government's costly plans to combat COVID-19, four sources familiar with the matter said on Thursday. Trudeau is set to make the announcement on Sunday, said the sources, who requested anonymity given the sensitivity of the situation. Trudeau aides have said for months that the ruling Liberals would push for a vote before end-2021, two years ahead of schedule. (RTRS)

JAPAN: Prime Minister Suga Yoshihide has instructed government officials to make the utmost efforts to respond to the heavy rain that is hitting western Japan. Suga told officials of government ministries and agencies on Friday to provide people with information on evacuation, heavy rain and river conditions in a timely and appropriate manner. (NHK)

RBA: MNI INSIGHT: RBA Baseline Forecasts Still Current In Lockdowns

- An INSIGHT story on the Reserve Bank of Australia gives nuance on the central bank's lockdown read - On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: State premiers will confront the Prime Minister at Friday's national cabinet meeting over Sydney's spreading delta outbreak and NSW Premier Gladys Berejiklian's plan to open up the state even if cases remain high, warning it puts their citizens at risk. The premiers will express concern Ms Berejiklian plans to provide "additional freedoms" once 50 per cent of the adult population is vaccinated, after NSW recorded more than 1000 cases and eight deaths over the past three days. (AFR)

AUSTRALIA: More defence personnel could begin patrolling Sydney from next week to help ensure compliance of lockdown rules as officials on Friday warned of a surge in cases in Australia's largest city after it reported its biggest daily rise in infections yet. (RTRS)

AUSTRALIA/CHINA: China urges Australia to respect its judicial sovereignty and refrain from interfering in China's lawful handling of Cheng Lei case, spokesperson of Chinese embassy in Australia says in a statement. "Chinese judicial authorities handle the case strictly in accordance with law and fully protect the lawful rights of the relevant person," the statement says. (BBG)

NEW ZEALAND: If the Reserve Bank of New Zealand (RBNZ) opts to raise interest rates in response to tightening labour markets and emerging price pressures, the net effect will probably be credit positive for New Zealand banks, says Fitch Ratings. We expect the RBNZ to begin raising interest rates at its meeting on 18 August. Higher rates may be positive for banks' profitability and earnings due to increased returns on bank assets, particularly loans. Rate increases would likely reduce the compression of net interest margins that tends to be seen at ultra-low interest rates.(BBG/Fitch)

SOUTH KOREA: South Korea plans to step up efforts to stabilize prices of agricultural and livestock products before the Chuseok fall harvest holiday in September amid rising inflationary pressure, a senior government official said Friday. First Vice Finance Minister Lee Eog-weon said the government will make efforts to help prices of farm products stay lower than the previous year ahead of the holiday set for Sept. 20-22. Demand for vegetables, eggs and other foodstuffs usually rises in South Korea ahead of the Chuseok holiday as people prepare holiday meals for family gatherings. (Yonhap)

BRAZIL: Brazilian policy makers will do whatever it takes to bring inflation expectations back to target despite a perceived deterioration in the country's fiscal outlook, according to central bank President Roberto Campos Neto. "Keeping inflation anchored is key at this moment, when we are facing consecutive inflationary shocks and it's becoming difficult to model inflation," Campos Neto said on Thursday at an online event organized by the national association of bars and restaurants. (BBG)

BRAZIL: Jair Bolsonaro intensified attacks on Brazil's voting system, as the nation's top court announced it would open a new criminal probe into the president's efforts to cast doubt on security of electronic ballots. Speaking on in his weekly social-media broadcast, Bolsonaro doubled-down on past claims that members of the Electoral Court erased data that suggested a hacking attack during the 2018 presidential vote. (BBG)

MEXICO: Mexico's central bank needs to be cautious on inflation given how unpredictable the Covid-19 crisis has been and will keep a prudent monetary stance going forward, Governor Alejandro Diaz de Leon said in an interview. Banxico, as the central bank is known, anticipates that price shocks are of a transitory nature and largely due to the impact from the virus, said Diaz de Leon, hours after the bank's five-person board hiked interest rates a quarterpoint for the second consecutive meeting. The decision was meant to avoid a deterioration in inflation expectations and price formation, Diaz de Leon said during the telephone interview. "We are mindful of inflation dynamics," Diaz de Leon said. "We know that they are transitory in nature, but Covid has been a crisis like no other, with peculiarities like no other, so we need to be cautious. That's why we want to run a prudent monetary stance." (BBG)

MALAYSIA: Malaysia's Prime Minister Muhyiddin Yassin is resisting demands to bring forward a parliamentary confidence vote from next month, despite the King joining the chorus of calls for the embattled Premier to prove his majority. The Straits Times understands that consecutive meetings were held with party chiefs of his Perikatan Nasional (PN) government on Wednesday evening (Aug 11) - first at the Prime Minister's Office (PMO) and then at his residence - to discuss internal matters, as well as the best plan of action moving forward. Sources with knowledge of the discussions said Mr Muhyiddin's Parti Pribumi Bersatu Malaysia believed bowing to royal pressure would signal weakness and encourage opponents to continue fanning public sentiment for the palace to wade into the ongoing political crisis. Communications and Multimedia Minister Saifuddin Abdullah also said on Thursday that "for now, that is the date, and a notice has been issued by the Dewan Rakyat speaker for it (the vote) to be held on Sept 7". (Straits Times)

MALAYSIA: Malaysia lowered its 2021 economic growth forecast for a second time, as renewed movement restrictions and rising infections hamper the recovery. Gross domestic product is expected to expand 3%-4% this year, Bank Negara Malaysia Governor Nor Shamsiah Yunus said Friday. That compares to an earlier estimate of 6%-7.5% growth. (BBG)

ISRAEL: Foreign Minister Yair Lapid said on Thursday that Israel and Morocco would upgrade their relations to full diplomatic ties and open embassies in each others' countries within two months. Speaking at a press conference in Casablanca, where he met with members of the Jewish community on the second day of his historic trip to Morocco — the first by an Israeli minister since the country's agreed to normalize relations last year — Lapid said that Moroccan Foreign Minister Nasser Bourita is expected to be aboard the first Royal Air Maroc flight from Morocco to Israel in either October or early November, in order to open the Moroccan Embassy in Tel Aviv. (Times of Israel)

AFGHANISTAN: The Taliban captured Afghanistan's third-largest city, Herat, after a day of fierce fighting, as the Islamist militancy continued its rout of provincial capitals while US troops withdraw. Afghanistan's second-biggest city, Kandahar, also appeared on the verge of falling to the Taliban on Thursday. "It does look like . . . ANDSF forces are withdrawing from Kandahar," a US official told the Financial Times, using the initials of the Afghan regular forces. With the fall of Herat, the biggest city captured by the Islamists so far, the militant group has now taken control in 11 provincial capitals, including the city of Ghazni, which is strategically located on the highway from western Afghanistan to Kabul. Afghanistan replaced General Wali Mohammad Ahmadzai, who was appointed army chief in June, with General Hibatullah Alizai on Wednesday. But many analysts were sceptical that leadership changes in the armed forces would bolster Afghan troops, a number of whom appear to have faded away in the face of the insurgents' onslaught. "It's really late in the day for something like this to make a difference," said a senior Pakistani official. (FT)

AFGHANISTAN: Taliban leaders have publicly pledged to be magnanimous in victory, assuring government officials, troops and the people of Afghanistan that they have nothing to fear as ever larger swaths of the country fall under their control. But Afghans pouring into Kabul and those still in Taliban-held areas say they have witnessed unprovoked attacks on civilians and executions of captured soldiers. In addition, they say, Taliban commanders have demanded that communities turn over unmarried women to become wives for their fighters. The U.S. Embassy in Kabul said Thursday that it had received reports of the Taliban executing members of the Afghan military who had surrendered. "Deeply disturbing & could constitute war crimes," the embassy said on Twitter. (DJ)

AFGHANISTAN: The US and UK will send troops to help evacuate staff from their embassies in Kabul as the Taliban continued its rout of provincial capitals in Afghanistan following Joe Biden's decision to withdraw American troops. The Pentagon said it would send 3,000 troops in the next 24-48 hours, including aircraft that could fly personnel out of the Afghan capital, and a back-up brigade of 3,500 soldiers to Kuwait in case the security situation deteriorates further. (FT)

AFGHANISTAN: American negotiators are trying to extract assurances from the Taliban that they will not attack the U.S. Embassy in Kabul if the extremist group takes over the country's government and ever wants to receive foreign aid, three American officials said. The effort, led by Zalmay Khalilzad, the chief American envoy in talks with the Taliban, seeks to stave off a full evacuation of the embassy as they rapidly seize cities across Afghanistan. On Thursday, the State Department announced it was sending home an unspecified number of the 1,400 Americans stationed at the embassy and drawing down to what the agency's spokesman, Ned Price, described as a "core diplomatic presence" in Kabul. (NYT)

OIL: The oil market looks set to remain very tight through the end of 2021, even with OPEC and its allies planning to steadily hike crude production each month, the organization said Aug. 12, as it comes under pressure from the US to cool off rising gasoline prices. In its latest market outlook, the producer bloc kept its global oil demand forecasts for 2021 and 2022 unchanged, while boosting its projections of non-OPEC supply, largely due to Russia's increases under the OPEC+ pact to collectively raise output by 400,000 b/d every month through the end of 2022. Even so, oil demand will likely remain higher than supply over the coming months, the report states, which could maintain upward pressure on near-term prices, with OPEC noting the steepening backwardation in major crude benchmarks. (Platt's)

OIL: The International Energy Agency cut forecasts for global oil demand "sharply" for the rest of this year as the resurgent pandemic hits major consumers, and predicted a new surplus in 2022. It's a marked reversal for the Paris-based agency, which just a month ago was urging the OPEC+ alliance to open the taps or risk a damaging spike in prices. The oil cartel heeded calls to hike supply, which is now arriving just as consumption slackens. (BBG)

CHINA

REGULATORY: China should have "zero tolerance" for vulgar content on the internet which may harm underaged users, People's Daily says in a commentary. Some mechanisms and content of live streaming platforms may guide minors in the wrong way. China's cyberspace watchdog started a campaign in July targeting issues involving minors at live broadcasting and short-video platforms. (BBG)

ECONOMY: China may steer its policies to supporting the economy, including faster issuances of local government bonds and marginally boost liquidity, as the economy faces more headwinds in the second half including slowing exports, Yicai.com reported citing economists. While July's loan data showed less than expected credit growth, it was likely due to seasonal patterns, as historically the first month of a quarter tends to be weak, the newspaper said citing macro strategist Wu Yinzhao of Avic Trust. Monetary policy boost, including a RRR cut or more MLF and OMO operations, may be timed to help the sales of local government special bonds, the news service said. (MNI)

CREDIT: China's new loans and aggregate financing will be supported by accelerated local government bond sales as well as the use of structural monetary tools intended to promote carbon emission cut, support SMEs and high-end manufacturing, the Securities Times said in a front-page commentary, downplaying the weak financial data released this week. Though companies' longer-term loans in July were less than expected and aggregate finance continued to slow, it is too early to say financial demand in the real economy is weakening based on a single month of data, the newspaper said. (MNI)

YUAN: China should maintain the steady strengthening of the yuan in the longer term to help expand domestic demand and serve its new development model with the domestic market as the mainstay, according to a commentary in the Securities Times. A moderate appreciation of the yuan can reduce the cost of imported intermediate products and lower prices of final products sold in China, thereby increasing consumers' purchasing power, the newspaper said. A stronger yuan may also encourage enterprises to produce higher-quality final products and upgrade domestic consumption, the newspaper said. Japan and Germany witnessed such development during which their appreciating currencies helped reduce the dependence on the international markets, eliminate outmoded production capacities and optimize economic structures, the newspaper added. (MNI)

NATURAL CATASTROPHES: Five cities in the central Chinese province of Hubei have declared "red alerts" after torrential rain left 21 people dead and forced the evacuation of nearly 6,000 people, state media reported. (RTRS)

OVERNIGHT DATA

NEW ZEALAND JUL BUSINESSNZ M'FING PMI 62.6; JUN 60.9

The latest Performance of Manufacturing Index (PMI) portrayed an industry champing at the bit. Not content with its very high reading of 60.9 for June it pressed up to 62.6 in July. Only twice before has it been speedier – once in March 2021, when it hit a record high of 63.6, and once back in June 2004 (with 62.8). But if there's a hottest topic of the economy at present it is arguably the labour market. Figures released by Stats NZ last week certainly highlighted a lot of heat, with a drop in the nation's unemployment rate to 4.0% in Q2, from 4.6% in Q1. With this, wage inflation was clearly picking up. Driving the increase in the PMI in July were a few industries that were dragging the chain in June; in a relative rather than absolute sense, that is. While New Zealand's PMI is doing exceptionally well, we are also conscious of the headwinds happening for global manufacturing. This is on account of the resurgence of COVID19 in its delta strain. (BNZ)

NEW ZEALAND JUN NET MIGRATION +897; MAY +881

SOUTH KOREA JUL EXPORT PRICE INDEX +16.9% Y/Y; JUN +13.0%

SOUTH KOREA JUL EXPORT PRICE INDEX +3.5% M/M; JUN +0.9%

SOUTH KOREA JUL IMPORT PRICE INDEX +19.2% Y/Y; JUN +14.4%

SOUTH KOREA JUL IMPORT PRICE INDEX +3.3% M/M; JUN +2.7%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:25 am local time from the close of 2.1196% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 35 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4799 FRI VS 6.44754

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4799 on Friday, compared with the 6.4754 set on Thursday.

MARKETS

SNAPSHOT: Taliban Advance Towards Capital, Coronavirus Spreads In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 17.42 points at 28032.46

- ASX 200 up 35.615 points at 7623.9

- Shanghai Comp. down 8.98 points at 3515.757

- JGB 10-Yr future down 3 ticks at 152.17, yield down 0.1bp at 0.026%

- Aussie 10-Yr future down 2.5 ticks at 98.795, yield up 2.5bp at 1.212%

- U.S. 10-Yr future +0-03+ at 133-18, yield down 1.01bp at 1.349%

- WTI crude down $0.52 at $68.57, Gold up $2.5 at $1755.4

- USD/JPY up 1 pip at Y110.42

- U.S. FDA APPROVES BOOSTER COVID JABS FOR IMMUNOCOMPROMISED PATIENTS

- UK AND US SEND TROOPS TO HELP EVACUATE AFGHAN EMBASSIES AS TALIBAN ADVANCE (FT)

- IEA CUTS OIL DEMAND FORECAST, OPEC SEES OIL MARKET TIGHT THROUGH END-2021

BOND SUMMARY: Steepening Impetus Spills Over Into ACGB Space Early On, Core FI Tread Water

T-Notes established themselves comfortably within yesterday's range and last change hands +0-03+ at 133-18, with overnight headline flow providing little in the way of notable catalysts. Cash Tsy curve bull flattened a tad, with yields last seen unch. to -1.1bp. Eurodollar futures run unch. to +1.0 tick through the reds. Preliminary University of Michigan Sentiment provides the sole point of note on the U.S. economic docket today.

- JGB futures traded sideways after a marginally softer reopen. The contract last deals at 152.17, 3 ticks shy of Thursday's settlement. Cash JGB yield curve runs slightly flatter, with the super-long end outperforming. The MOF held a liquidity enhancement auction for off-the-run JGBs with 5-15.5 Years until maturity, drawing bid/cover ratio of 3.104x.

- The AOGM auctioned A$1.2bn of 4.75% 21 Apr '27 Bond, with bid/cover ratio printing at 3.929x (prev. 2.090x). Cash ACGB curve bear steepened early on, having absorbed Thursday's impetus from U.S. Tsy space. Yields last trade 0.2-3.2bp higher across the curve. Aussie bond futures were rangebound; YM trades -0.5 & XM -2.5 at typing. Bills last seen -1 tick through the reds. The latest MNI INSIGHT piece noted that the RBA could begin to revise its baseline forecasts if the current lockdowns continue into 4Q2021. Meanwhile, NSW declared another record daily Covid-19 case count, while Canberra identified two further infections.

JGBS AUCTION: Japanese MOF sells Y4.0619tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0619tn 3-Month Bills:

- Average Yield -0.1122% (prev. -0.1106%)

- Average Price 100.0280 (prev. 100.0273)

- High Yield: -0.1122% (prev. -0.1074%)

- Low Price 100.0280 (prev. 100.0265)

- % Allotted At High Yield: 60.3417% (prev. 95.5839%)

- Bid/Cover: 5.308x (prev. 4.861x)

JGBS AUCTION: Japanese MOF sells Y498.2bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.2bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.003% (prev. -0.012%)

- High Spread: -0.001% (prev. -0.011%)

- % Allotted At High Spread: 42.2043% (prev. 92.3159%)

- Bid/Cover: 3.104x (prev. 3.188x)

AUSSIE BONDS: The AOFM sells A$1.2bn of the 4.75% 21 Apr '27 Bond, issue #TB136:

The Australian Office of Financial Management (AOFM) sells A$1.2bn of the 4.75% 21 April 2027 Bond, issue #TB136:

- Average Yield: 0.7038% (prev. 0.8948%)

- High Yield: 0.7050% (prev. 0.8975%)

- Bid/Cover: 3.9292x (prev. 2.0900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 34.4% (prev. 65.0%)

- bidders 54 (prev. 34), successful 28 (prev. 15), allocated in full 10 (prev. 9)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 18 August it plans to sell A$800mn of the 1.50% 21 June 2031 Bond.

- On Thursday 19 August it plans to sell A$1.5bn of the 26 November 2021 Note & A$500mn of the 25 February 2022 Note.

- On Friday 20 August it plans to sell A$700mn of the 3.25% 21 April 2025 Bond.

- The AOFM also says that "subject to market conditions, a new 21 November 2032 Treasury Indexed Bond is planned to be issued via syndication in the week beginning 23 August 2021. Further details of the issue will be announced during the week beginning 16 August 2021 including the possibility of a buyback of the 21 February 2022 Treasury Indexed Bond."

COMMODITIES: Oil Extends Losses After IAE Lowers Demand Forecast, Gold Up On Softer USD

Crude oil has extended losses in Asia-Pac hours after the IEA warned of a sharp reduction in demand as the spread of the Delta coronavirus variant resulted in the tightening of restrictions across the globe, particularly in Asia. Separately, OPEC maintained its demand growth forecast for 2021, but raised expectations for supply from non-OPEC producers. WTI last down $0.48 from settlement at $68.61/bbl, Brent is down $0.45 at $70.86bbl.

- Gold has edged higher and last trades up $3.40 at $1,756.30 as the greenback has softened across the board. Bullion is narrowing in on yesterday's high of $1,758.2 and a break here would bring Jul 15 high of $1,834.1 into play.

FOREX: Greenback Slips Amid Subdued Volatility

The greenback slipped in muted Asia-Pac trade, with the absence of market moving headlines leaving participants to reflect on familiar themes and resulting in particularly subdued volatility. Safe haven peers JPY and CHF were also weaker, despite continued spread of the Delta variant of coronavirus across the region. Nonetheless, the DXY seems poised for its second straight weekly gain, following the recent rounds of hawkish Fedspeak.

- AUD rose to the top of G10 scoreboard despite Australia's deepening Covid-19 crisis, which saw NSW log another record increase in new infections (390). Canberra confirmed 2 further positive cases after ACT authorities identified 3,900 contacts linked to the outbreak in the capital.

- Monthly University of Michigan survey provides the only point of note on today's global economic docket.

FOREX OPTIONS: Expiries for Aug13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-60(E562mln), $1.1825-35(E926mln)

- USD/JPY: Y110.00($540mln), Y110.45-50($1.7bln), Y111.25($665mln)

- AUD/USD: $0.7600(A$627mln)

- USD/CAD: C$1.2475($612mln), C$1.2600-10($1.2bln), C$1.2650-60($1.1bln)

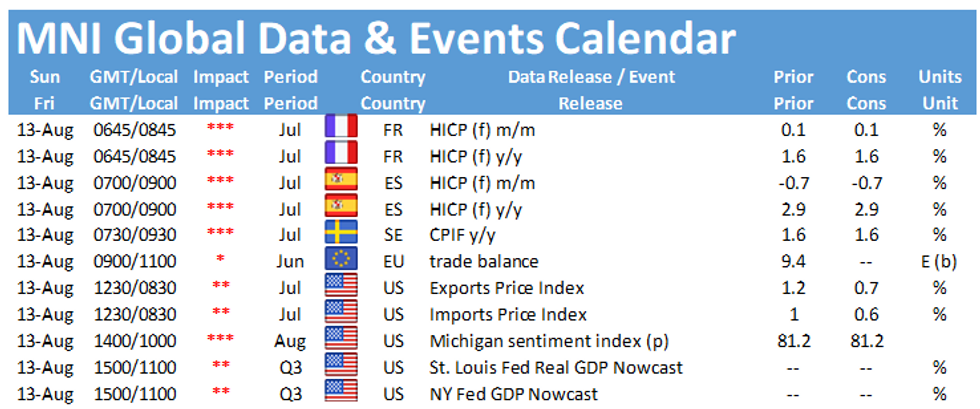

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.