-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead

MNI POLITICAL RISK - Trump Rounds Out Cabinet Nominations

MNI POLITICAL RISK ANALYSIS - Week Ahead 25 Nov-1 Dec

MNI EUROPEAN OPEN: Bullard Reiterates View On Taper Despite NFP Miss

EXECUTIVE SUMMARY

- FED'S BULLARD PUSHES FOR QUICK 'TAPER' DESPITE WEAK U.S. JOBS GROWTH (FT)

- U.S. SENATOR MANCHIN BACKS AS LITTLE AS $1 TRILLION OF BIDEN'S $3.5 TRILLION PLAN (AXIOS)

- XI CRACKDOWN WON'T DERAIL CHINA'S OPENING UP (PEOPLE'S DAILY)

- PBOC: CHINA'S MACRO LEVERAGE RATIO DOWN SLIGHTLY AT END-JUNE (RTRS)

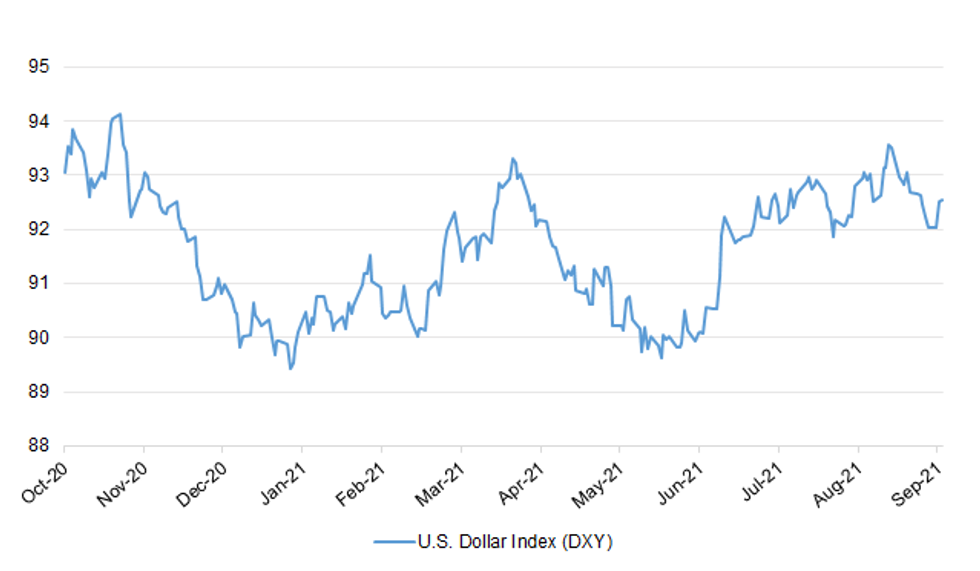

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has refused to rule out further tax rises prior to the next general election as he defended his abandonment of a Conservative manifesto promise not to raise National Insurance contributions. After unveiling his plan for a hike in National Insurance contributions by 1.25% to pay for the social care system in England and to help the NHS recover from the impact of the coronavirus crisis, the prime minister stressed that "COVID was not in the manifesto either". And he insisted he "cannot now shirk the challenge" of putting the health service "back on its feet". (Sky)

FISCAL: Business groups reacted with dismay to the government's national insurance hike and surcharge on dividend income to boost health and social care spending from next April, calling it a tax on jobs and a blow to the economic recovery. The British Chamber of Commerce (BCC) said the extra financial burden from higher tax charges ignored the damage suffered by thousands of small businesses over the last 18 months. In a separate attack on the tax increases, the Institute of Directors accused the government of an opportunistic ambush, "exploiting public sentiment at the expense of some of the most productive and entrepreneurial segments of the economy". (Guardian)

FISCAL/MARKETS: Boris Johnson's £600m tax raid on dividends risks damaging the City of London, deterring investors and punishing entrepreneurs as Britain struggles out of the Covid crisis, economists and business leaders have warned. (Telegraph)

POLITICS: Boris Johnson is considering a cabinet reshuffle this month as Westminster is engulfed by rumours about demotions for some of his most senior ministers. In the middle of a pivotal week for the prime minister, ambitious Tories and career officials are convinced that a shake-up is imminent and could come as soon as tomorrow. Publicly Downing Street has said that there are "no plans" for a reshuffle — stopping short of scotching speculation altogether — while Johnson avoided the question three times at a press conference last night. Some believe that the prospect of a reshuffle has been dangled to dampen opposition to the tax rises that MPs will vote on today. (The Times)

EUROPE

FRANCE: France's economic outlook improved over the summer despite a surge in cases of the delta variant, suggesting an increased vaccination rate may have ended the stop-go disruption of the pandemic. Confidence surveys and high frequency indicators monitored by Insee show activity continued to near pre-pandemic levels in July and August, and should get there by the end of the year. The French statistics agency also revised its 2021 economic growth forecast to 6.25% from 6% in July. (BBG)

U.S.

FED: The Federal Reserve should press ahead with a plan to dial down its massive pandemic stimulus programme despite an abrupt slowdown in US jobs growth last month, according to a top central bank official. James Bullard, president of the St Louis Fed, dismissed concerns the labour market recovery was faltering, even after just 235,000 jobs were created in the month of August, and reiterated his call for the central bank to begin scaling back or "tapering" its massive $120bn-a-month bond-buying programme soon. "There is plenty of demand for workers and there are more job openings than there are unemployed workers," Bullard said in an interview with the Financial Times. "If we can get the workers matched up and bring the pandemic under better control, it certainly looks like we'll have a very strong labour market going into next year." He added: "The big picture is that the taper will get going this year and will end sometime by the first half of next year." (FT)

FED: Federal Reserve Bank of Dallas President Robert Kaplan made multiple million-dollar-plus stock trades in 2020, according to a financial disclosure form provided by his bank, in contrast with other regional Fed leaders who reported more modest financial holdings and smaller transactions. Eleven of the 12 regional Fed banks have provided disclosures of their leaders' 2020 financial profiles since Friday, sharing information that gives insight into the holdings of officials who help set the central bank's monetary policy. The Chicago Fed didn't make immediately available information for their leader. (WSJ)

FISCAL: Sen. Joe Manchin (D-W.V.) has privately warned the White House and congressional leaders that he has specific policy concerns with President Biden's $3.5 trillion social spending dream — and he'll support as little as $1 trillion of it — Axios' Hans Nichols scoops. At most, he's open to supporting $1.5 trillion, sources familiar with the discussions say. (Axios)

FISCAL: The Biden administration on Tuesday proposed a stopgap measure to fund the government as lawmakers haggle over a $1 trillion infrastructure bill and a transformative, Democrat-backed $3.5 trillion budget reconciliation package. With the 2021 fiscal year up at the end of September, the White House encouraged congressional leaders to consider a short-term continuing resolution. (CNBC)

FISCAL: The Office of Management and Budget on Tuesday urged Congress to provide $6.4 billion for Afghan allies and partners and $14 billion for relief for natural disasters that took place prior to Hurricane Ida. OMB is asking Congress to pass a short-term spending bill to provide more time for the full FY 2022 budget process to continue. (Axios)

FISCAL: Congressional Democrats are considering reforms to the 20% pass-through tax deduction as part of a $3.5 trillion federal spending package. Democrats' proposal would phase out the tax break for business owners with taxable income exceeding $400,000, according to a discussion list obtained by CNBC. It would also make the tax cut available to more people below the $400,000 threshold by removing some existing restrictions. A discussion list is a draft of ideas that lawmakers assemble before formally pitching them in the House or Senate. Democrats are weighing changes to the tax code to help raise money for up to $3.5 trillion in spending on climate, education, paid leave and other measures. (CNBC)

FISCAL: The Covid pandemic caused a backlog of nearly 8 million paper-filed business tax returns at the IRS in 2020, according to a report issued Tuesday by a U.S. Department of the Treasury watchdog. That represents a 3,230% increase relative to the end of 2019, when the IRS had about 239,000 paper returns waiting to be processed, according to the report, published by the Treasury Inspector General for Tax Administration. (CNBC)

CORONAVIRUS: The true number of U.S. infections at the end of 2020 was more than 100 million, just under a third of the population and far more than the 20 million previously reported, according to a study cited by the National Institutes of Health. Many cases were undetected because of limited testing and asymptomatic infections early in the pandemic. The study, by researchers at Columbia University, used data from the Centers for Disease Control and Prevention on how many people tested positive for SARS-CoV-2 antibodies, which indicate past infections. The researchers calculated that just 11% of all cases were confirmed by a positive test result in March 2020. (BBG)

CORONAVIRUS: Three-quarters of U.S. adults have received at least one dose of a Covid-19 vaccine. The country hit the 70% threshold in early August, four weeks past President Joe Biden's target. The spread of the delta variant caused another surge of infections in the U.S. over the last month and accelerated vaccinations. But hesitancy among many Americans has left the U.S. well behind many other countries for inoculation. Biden plans on Thursday to address efforts to curb the pandemic. (BBG)

OTHER

U.S./CHINA: U.S. House panel to hold September 14 hearing on South China Sea Dynamic. (BBG)

CORONAVIRUS: The fast-spreading delta variant remains the "most concerning" coronavirus strain despite the emergence of the mu variant, World Health Organization officials said Tuesday. (CNBC)

CORONAVIRUS: Covid-19 is likely "here to stay with us" as the virus continues to mutate in unvaccinated countries across the world and previous hopes of eradicating it diminish, global health officials said Tuesday. "I think this virus is here to stay with us and it will evolve like influenza pandemic viruses, it will evolve to become one of the other viruses that affects us," Dr. Mike Ryan, executive director of the World Health Organization's Health Emergencies Program, said at a press briefing. (CNBC)

CORONAVIRUS: The World Health Organization condemned wealthy nations for stockpiling coronavirus vaccines, treatments and protective equipment, adding their failure to fairly distribute those resources is fueling Covid outbreaks worldwide. (CNBC)

JAPAN: Japanese media outlets suggest that the list of main contenders to replace PM Suga as ruling party chief will include Taro Kono, Fumio Kishida and Sanae Takaichi, after a number of reports noted that Shigeru Ishiba may resign from running, with some members of his faction pushing him to back Kono. The press suggested that Taro Kono considers holding a press conference by the end of this week to declare his candidacy for LDP chief. Deputy Prime Minister and Finance Minister Taro Aso yesterday struck a cautious note about Fumio Kishida's ambitious spending pledges. Meanwhile, Kishida told the WSJ that Japan should consider building a missile-strike capacity to fend off threats from China and North Korea. Sanae Takaichi is expected to announce her bid for LDP leadership as soon as today. The former Internal Affairs Minister has the backing of former Prime Minister Abe and, if elected, would be Japan's first female Premier. Sankei reported yesterday that Seiko Noda told PM Suga that she considered running, but it is unclear if she would be able to gather 20 signatures needed to register her candidacy. Kyodo reported that the government eyes calling a special parliamentary session on October 4 to pick the next Prime Minister. Traditionally, the new Premier would deliver a policy speech in the week of their nomination, before being grilled by opposition leaders the following week. According to Kyodo, under this scenario the general election could be held on November 7. The main opposition Constitutional Democratic Party of Japan (CDPJ) pledged to compile a Y30tn supplementary budget to support individuals and businesses affected by the pandemic if they are voted into power and are set to agree on some joint promises with other opposition parties today. (MNI)

JAPAN: Former Foreign Minister Fumio Kishida said he would aim to defeat deflation as he unveiled the economic policies underpinning his campaign to become the new leader of Japan's ruling Liberal Democratic Party in a vote later this month. Kishida, one of the frontrunners in the race, said Wednesday he would also introduce tens of trillions of yen (hundreds of billions of dollars) to help a Covid-battered economy. To help execute his policies, he would appoint a minister for economic national security. (BBG)

JAPAN: The Japanese government plans to gradually ease Covid-19 restrictions from Oct. in an effort to normalize its economy, the Yomiuri newspaper reports, without attribution. Even in areas that are under state of emergencies, restrictions on restaurants and bars will be eased if they are certified and vaccination certificates and Covid test results are presented before entry. Those vaccinated won't be discouraged from making trips to other prefectures . Caps on large events will also be eased if certain measures are taken. The government is planning to experiment initiatives easing some rules in Oct. and proceed with the plans fully in Nov. Will re-impose restrictions in the event of possible virus resurgences. Japan will seek to approve the plan when it makes decision on extending the state of emergencies that are scheduled to expire Sept. 12. (BBG)

BOJ: MNI INSIGHT: BOJ Turns Focus To Q4 For Economic Rebound Signs

- Downside risks to Japan's economy have heightened in Q3, and the Bank of Japan has turned its focus to rebound signals for Q4 in higher vaccination rates and private consumption, and an easing of semiconductor and auto part shortages, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The Australian state of Victoria will end its lockdown of all regional areas outside Melbourne except for one council zone with high case numbers, Victorian Premier Daniel Andrews told a press conference Wednesday. Lockdown will end for all parts of regional Victoria except for Greater Shepparton. The regions will have movement restrictions eased with venues also allowed to open with numbers caps. Schools will also re-open. (BBG)

RBNZ: Thematic review of banks' compliance with liquidity policy, identifying a range of system, controls and risk management weaknesses as well as areas of good practice that the industry can learn from. Plan to commence a review of liquidity policy in the first half of 2022; Look forward to further constructive engagement with the industry and other interested parties during this process. Review found banks are currently maintaining liquidity ratio levels above the regulatory minimums, and comfortably above their own internal risk tolerance limits. Compliance with the policy varied among banks, but was unrelated to size; Many of the issues identified were due to weak internal controls and inadequate care in policy interpretation. (BBG)

SOUTH KOREA: The chief of the Korea Disease Control and Prevention Agency said the country will be ready by the end of October to shift its strategy from suppressing Covid-19 to managing it while living a normal life, Yonhap reported on Tuesday. KDCA Commissioner Jeong Eun-kyeong told lawmakers during a parliament session that KDCA aims to complete the work of fully inoculating 90% of the elderly and 80% of adults by the end of October. (BBG)

NORTH KOREA: North Korea could hold a military parade this week as it celebrates a national anniversary, Yonhap News Agency reported, an event that would mark the first major public display of its weaponry since U.S. President Joe Biden took office. Given the status of preparation, leader Kim Jong Un's regime may stage the event at night and have it coincide with the Sept. 9 anniversary of the state's founding, Yonhap reported Tuesday citing unidentified military sources. South Korea is closely monitoring North Korea's movements, including preparations for large-scale events like a parade, Kim Jun-rak, a Joint Chiefs of Staff spokesman, said at a briefing. (BBG)

BRAZIL: President Jair Bolsonaro sharpened his criticism of Brazil's top court as massive pro-government rallies were held around the country on Tuesday, the latest escalation of political tensions in Latin America's largest economy. "We will no longer accept that people like Alexandre de Moraes continue to lash out at our democracy and disrespect our constitution," Bolsonaro said in a speech before thousands of supporters in Sao Paulo, referring to the Supreme Court justice who has authorized probes against the president and his allies for alleged attacks against democracy. "I will never be jailed." (BBG)

SOUTH AFRICA: David Masondo, South Africa's deputy finance minister, suggested that investors forgive about 146 billion rand ($10.2 billion) of sovereign debt in exchange for the national power utility meeting climate targets. In order to transition from the use of coal to generate electricity to renewable energy Eskom Holdings SOC Ltd. will need to borrow about 400 billion rand, equal to its current debt, and will need a "complementary transaction" to achieve that, he said in a speech on Tuesday. Under Masondo's proposal, which he termed a debt-for-climate-swap, a portion of national debt, which he suggested could be 146 billion rand, would be transferred forgiven by new or existing creditors. In exchange South Africa would pledge an equivalent amount as an equity injection into Eskom, conditional on it closing down coal-fired plants, and as guarantees for further borrowing, he said. (BBG)

IRAN: Iran is refusing to allow inspectors access to nuclear-related sites and hindering a probe by the United Nations atomic agency while continuing to expand its nuclear activities, the International Atomic Energy Agency said in two confidential reports Tuesday, casting doubt on efforts to revive the 2015 nuclear deal. The reports leave the Biden administration and its European allies facing a choice between pushing for a formal rebuke of Iran—which Tehran's new hard-line government has warned could scuttle the resumption of nuclear talks—or refraining from action, potentially undercutting the authority of the IAEA and its leadership. (WSJ)

IRAN: U.S. Special Envoy for Iran Robert Malley will visit Moscow and Paris this week for talks with Russian and European officials on Iran's nuclear program, the State Department said on Tuesday. (RTRS)

AFGHANISTAN: The status of the Panjshir Valley in the east of Afghanistan remained unclear Tuesday, following Taliban statements that the militants had taken the last holdout province in the country even as anti-Taliban resistance members vowed to keep fighting. If the claims of victory are true, it means that the whole of Afghanistan is now under control of the Taliban, who through a series of stunning battlefield gains and Afghan military surrenders through July and early August took over the country of nearly 40 million as the U.S. withdrew its forces. (CNBC)

OIL: Hurricane Ida's damage to U.S. offshore energy production makes it one of the most costly since back-to-back storms in 2005 cut output for months, according to the latest data and historical records. Ida's 150 mile-per-hour (240 kph) winds cut most offshore oil and gas production for more than a week and damaged platforms and onshore support facilities. About 79% of the region's offshore oil production remains shut and 79 production platforms are unoccupied after the storm made landfall on Aug. 29. Some 17.5 million barrels of oil have been lost to the market to date, with shutdowns expected to continue for weeks. Ida could reduce total U.S. production by as much as 30 million barrels this year, according to energy analysts. (RTRS)

CHINA

PBOC: China's macro leverage ratio, which measures the economy's overall indebtedness, stood at 274.9% at end-June, down 4.5 percentage points from the end of last year, China Finance said on Wednesday. The drop was due to the receding impact of the COVID-19 epidemic on the Chinese economy and a decline in overall debt growth, China Finance, a financial magazine managed by the central bank, said, citing the Financial Survey and Statistics Department at the People's Bank of China. The macro leverage ratio is expected to remain basically stable in H2, it added. (BBG)

POLICY: The mouthpiece of China's ruling Communist Party has run a front-page editorial seeking to ease concern that President Xi Jinping's regulatory crackdown will hurt foreign investors. "Opening to the outside world is China's basic national policy, and it will not waver at any time," the People's Daily said in the editorial, which was published on Wednesday under the headline "Sticking to Regulatory Supervision While Promoting Development." "Unswervingly, the principles and policies of encouraging, supporting and guiding the development of the non-public sector of the economy have not changed!" the newspaper said, adding that the government of the world's second largest economy would protect the rights of foreign investors. (BBG)

POLICY: China is likely to invest more in digital networks to support the growth of a digital technology-based economy, Yicai.com reported interpreting comments by Vice Premier Liu He that urged "promoting infrastructure construction moderately ahead of time." Such infrastructure should include 5G, data center, cloud-based computing, AI and vehicle networking, the newspaper said citing Wei Liurong, an engineer with China Academy of Information and Communications Technology. Direct investments in seven major "new infrastructure" including 5G and UHV will reach about CNY10 trillion by 2025, driving cumulative investment to over CNY17 trillion, the newspaper said.

FX RESERVES: China's foreign exchange reserves will remain at a relatively high level in September as exports show resilience helped by recovering external demand, while the U.S. dollar index and U.S. treasury yield may be little changed, Yicai.com reported citing Zheng Houcheng, research head of Yingda Securities. China's FX reserves stood at USD3.32 trillion by the end of August, down by USD3.8 billion from a month ago. The decrease was mainly due to the depreciation of non-U.S. dollar currencies and the decline in major bond prices, the newspaper said citing Wen Bin, chief researcher of China Minsheng Bank. Trade and cross-border capital flows still supported FX reserves, indicating solid economic conditions and balance of payments, the newspaper cited Wen as saying. (MNI)

WEALTH MANAGEMENT: Chinese commercial banks that have not set up a wealth management subsidiary may not be able to add new wealth management services as authorities try to limit financial risks growing out of the sector, the 21st Century Business Herald reported citing three independent sources. Medium and small-size banks are gradually withdrawing from wealth management business, as local banking regulations in the first half have limited their growth, the newspaper said. This may significantly impact small banks, and may cause unemployment, as the scale of wealth management business generally accounts for 10-30% of the entire bank's assets, the newspaper said citing an industry insider. In the past, small banks carried out much asset management business through outsourcing as they lacked resources and expertise, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN Q2, F GDP +0.5% Q/Q; MEDIAN +0.4%; FLASH +0.3%

JAPAN Q2, F GDP ANNUALISED +1.9% Q/Q; MEDIAN +1.6%; FLASH +1.3%

JAPAN Q2, F GDP NOMINAL -0.1% Q/Q; MEDIAN +0.1%; FLASH +0.1%

JAPAN Q2, F GDP DEFLATOR -1.1% Y/Y; MEDIAN -0.8%; FLASH -0.7%

JAPAN Q2, F GDP PRIVATE CONSUMPTION +0.9% Q/Q; MEDIAN +0.8%; FLASH +0.8%

JAPAN Q2, F GDP BUSINESS SPENDING +2.3% Q/Q; MEDIAN +2.0%; FLASH +1.7%

JAPAN Q2, F INVENTORY CONTRIBUTION % GDP -0.3%; MEDIAN -0.2%; FLASH -0.2%

JAPAN Q2, F NET EXPORTS CONTRIBUTION % GDP -0.3%; MEDIAN -0.3%; FLASH -0.3%

JAPAN JUL BOP CURRENT ACCOUNT BALANCE +Y1.9108TN; MEDIAN +Y2.2882TN; JUN +Y905.1BN

JAPAN JUL BOP CURRENT ACCOUNT BALANCE ADJ +Y1.4134TN; MEDIAN +Y1.8522TN; JUN +Y1.7791TN

JAPAN JUL TRADE BALANCE BOP BASIS +Y622.3BN; MEDIAN +Y634.5BN; JUN +Y648.6BN

JAPAN AUG ECO WATCHERS SURVEY CURRENT 34.7; MEDIAN 45.0; JUL 48.4

JAPAN AUG ECO WATCHERS SURVEY OUTLOOK 43.7; MEDIAN 46.2; JUL 48.4;

JAPAN AUG BANK LENDING INCL-TRUSTS +0.6% Y/Y; JUL +0.9%

JAPAN AUG BANK LENDING EX-TRUSTS +0.3% Y/Y; JUL +0.5%

JAPAN AUG BANKRUPTCIES -30.13% Y/Y; JUL -39.67%

SOUTH KOREA AUG BANK LENDING TO HOUSEHOLD TOTAL KRW1,046.3TN; JUL KRW1,040.1TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1982% at 09:35 am local time from the close of 2.1942% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, flat from the close of Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4674 WEDS VS 6.4533

The People's Bank of China (PBOC) set the dollar-yuan central parity rates lightly higher at 6.4674 on Wednesday, compared with the 6.4533 set on Tuesday.

MARKETS

SNAPSHOT: Bullard Reiterates View On Taper Despite NFP Miss

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 118.13 points at 30031.6

- ASX 200 down 22.839 points at 7507.2

- Shanghai Comp. up 2.594 points at 3679.181

- JGB 10-Yr future down 6 ticks at 151.86, yield up 0.2bp at 0.045%

- Aussie 10-Yr future down 3.0 ticks at 98.730, yield up 3.2bp at 1.290%

- U.S. 10-Yr future +0-02 at 133-02, yield down 1.19bp at 1.361%

- WTI crude up $0.11 at $68.45, Gold up $3.70 at $1798.04

- USD/JPY up 2 pips at Y110.30

- FED'S BULLARD PUSHES FOR QUICK 'TAPER' DESPITE WEAK U.S. JOBS GROWTH (FT)

- U.S. SENATOR MANCHIN BACKS AS LITTLE AS $1 TRILLION OF BIDEN'S $3.5 TRILLION PLAN (AXIOS)

- XI CRACKDOWN WON'T DERAIL CHINA'S OPENING UP (PEOPLE'S DAILY)

- PBOC: CHINA'S MACRO LEVERAGE RATIO DOWN SLIGHTLY AT END-JUNE (RTRS)

BOND SUMMARY: Stabilisation For Core FI In Asia

T-Notes last +0-02 at 133-02, operating in a narrow 0-04 range. Cash Tsys trade little changed to ~1.0bp richer across the curve, regaining some poise in the wake of the cheapening seen since Friday's NFP print. Fed's Bullard ('22 voter) reiterated his view that the central bank should "press ahead with a plan to dial down its massive pandemic stimulus programme despite an abrupt slowdown in U.S. jobs growth last month," via an interview with the FT. Broader macro news flow was on the light side, while the only real market flow of note came in the form of a 4.0K screen lift in TY. The NY session will bring the JOLTS job openings print and the release of the Fed's beige book. Wednesday will also bring 10-Year Tsy supply, while Fedspeak from Williams & Kaplan rounds off the local docket.

- The JGB space looked through local data releases, with futures a touch above their overnight closing levels, last dealing -7 on the day. Yields are little changed across the JGB curve, sitting within -/+0.5bp of Tuesday's closing levels. One of the more notable candidates in the race to become leader of Japan's ruling LDP Party, Fumio Kishida, reiterated his desire to deploy a spending package worth tens of trillion yen, a need to retain bold monetary easing policies and a rethink of tax on financial income. All in all there was no fresh notable information in the address, with the central tenants of Kishida's ideals surrounding these matters already known, and no pressing need for notable tax overhauls observed e.g. consumption tax. The latest round of BoJ Rinban operations revealed the following offer/cover ratios: 1- To 3-Year: 2.30x (prev. 2.60x), 5- To 10-Year: 2.51x (prev. 2.93x).

- Aussie bond futures have stabilised in Sydney dealing, aided by the modest Asia-Pac bid in U.S. Tsys, leaving YM -1.0 and XM -3.0 at typing. The longer end of the cash ACGB curve has cheapened by ~4.0bp. There hasn't been much in the way of local news flow, with focus still on yesterday's RBA decision. The latest round of ACGB Sep '26 supply saw the weighted average yield price 0.45bp through prevailing mids at the time of supply, while the cover ratio ticked higher, moving above 6.00x, even as the auction size lifted. Another smooth takedown for ACGB supply, with well-trodden factors set to support primary demand in the coming months. Corporate and semi-issuance continued to tick over, headlined by the launch of QTC's new green Mar '32 line.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y875bn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.50% 21 Sep '26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.50% 21 September 2026 Bond, issue #TB164:

- Average Yield: 0.6810% (prev. 0.8325%)

- High Yield: 0.6825% (prev. 0.8325%)

- Bid/Cover: 6.0830x (prev. 5.1937x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 20.8% (prev. 97.6%)

- Bidders 57 (prev. 39), successful 23 (prev. 9), allocated in full 8 (prev. 1)

EQUITIES: Japan Rally Continues

A quiet session in the Asia-Pac time zone saw most equity markets sustain minor losses, Japan was the exception where bourses rallied for an eight day. In Japan the LDP leadership race remains in the spotlight, albeit the latest headline flow surrounding the matter included little in the way of market moving updates. In China markets are slightly lower, Evergrande weighed on indices after dropping below its 2009 IPO price after its ratings were cut further. Most EM bourses are in minor negative territory after taking a negative lead from the US and as the greenback held the previous day's gains. In the US futures just about in the green after a lacklustre day on Wall Street, tech gains nudged the Nasdaq marginally higher to another record, while the benchmark S&P 500 and Dow Jones slipped.

OIL: Steadies After Hitting Weekly Lows

Crude futures hovered around neutral levels in Asia after receding the previous day. WTI and Brent crude futures traded lower into the Tuesday close, pressing the oil complex to fresh weekly lows. Price action worked in favour of the WTI-Brent spread, which widened by around $0.50/bbl. USD strength was the primary catalyst behind lower commodities, exposing first support in WTI at $67.12/bbl and $70.42/bbl for Brent crude.

GOLD: Looking Back Above $1,800/oz

Tuesday's uptick in the USD & U.S. real yields kept the pressure on bullion, with a sharp run lower seen on a break below the 100- & 200-DMAs and the recent intraday lows, ultimately resulting in a push below $1,800/oz. Bullion has regained some poise during Asia-Pac hours, trading a handful of dollars higher as it looks back above $1,800/oz.

FOREX: NZD & GBP Land At Opposite Ends Of G10 Scoreboard In Quiet Asia-Pac Trade

Headlines which crossed the wires in Asia-Pac hours failed to provide market-moving signals and catalyse volatility across G10 FX space. Major currency pairs hugged tight ranges, with participants assessing the global Covid-19 outlook.

- NZD was marginally firmer as New Zealand's daily case count continued to ease. The country declared 15 new infections with the coronavirus, all of them detected in Auckland.

- GBP trailed its G10 peers ahead of a House of Commons vote on the government's new tax package, which includes 1.25pp hikes to National Insurance contributions and the dividend tax.

- Focus turns to Bank of Canada monetary policy decision and comments from Fed's Kaplan & Williams, RBA's Debelle and a slew of BoE speakers including Gov Bailey.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.