-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese PPI Rise Tops Exp., Fed's Kaplan Pushes For Taper

EXECUTIVE SUMMARY

- ECB MULLS TWEAK TO PEPP AS MARCH CUTOFF NEARS (MNI SOURCES)

- FED'S KAPLAN EXPECTS TO SUPPORT A TAPER-PLAN ANNOUNCEMENT LATER THIS MONTH (DJ)

- TORY REVOLT OVER HEALTH & CARE LEVY QUELLED BUT WOULD-BE REBELS WARN OF 'MASSIVE DAMAGE' (THE TIMES)

- SEFCOVIC TO BRING FORWARD PROPOSALS TO TRY TO BREAK N. IRELAND PROTOCOL DEADLOCK (RTE)

- JAPAN GOVERNMENT PLANS TO EXTEND VIRUS EMERGENCY TO SEP 30 (BBG)

- CHINA CPI/PPI GAP WIDENS FURTHER

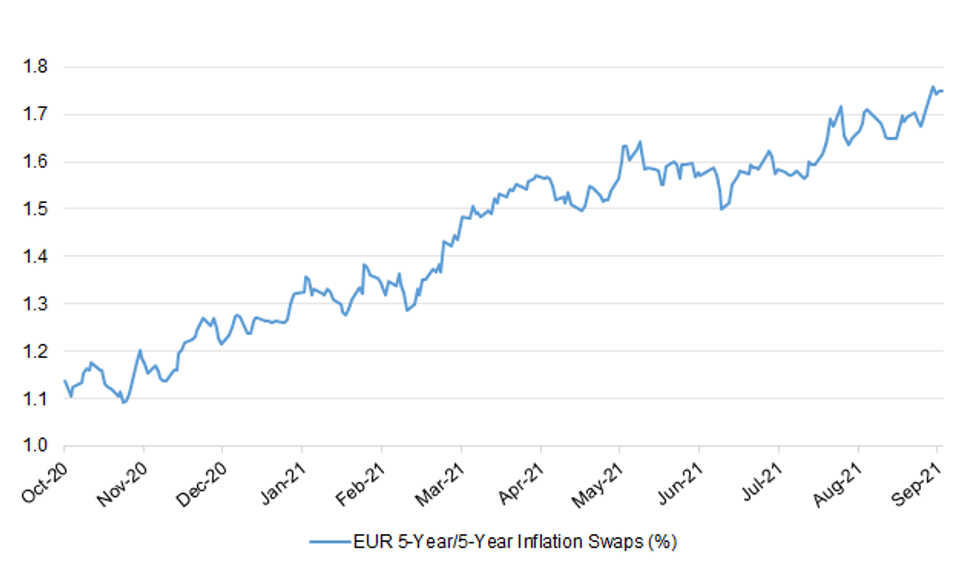

Fig. 1: EUR 5-Year/5-Year Inflation Swaps (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The number of unvaccinated people ending up in hospital with Covid is "concerning", Boris Johnson has said. Three quarters of those hospitalised had not had a Covid jab, with a "higher proportion" of younger people now being affected, he said. He added that while lifting most restrictions in July continued to look right, there was still a risk as infections remained high. The UK has reported more than 30,000 cases for the last nine days in a row. The number of people in hospital with Covid is also rising. It currently stands at 7,907, compared to 5,697 a month ago. (BBC)

CORONAVIRUS: Costly PCR tests for vaccinated travellers could be scrapped as part of a review of the traffic light system. The government is understood to be considering dropping the requirement for double-vaccinated passengers to take a laboratory-based test when arriving in the UK from most countries. The move would bring the UK into line with many European countries. The average traveller pays more than £70 for PCR tests which can double the price of a trip from some regions. The late return of some tests delivered by post and a failure by companies to show the correct price on a government website have been criticised. Ministers are understood to be considering the change as part of plans to simplify the traffic light system. (The Times)

BOE: MNI BRIEF: BOE Policymakers See Transient Supply Bottlenecks

- Bank of England Governor Andrew Bailey said that the supply blockages that are fuelling rising inflation should prove fleeting, telling the Treasury Select Committee that "we expect the supply bottlenecks to sort themselves out" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOE: MNI BRIEF: BOE's Broadben t- Tax Hikes Not Significant Tightening

- Bank of England Deputy Governor Ben Broadbent downplayed the policy significance of increases of 1.25 percentage points in both employees' and employers' national insurance contributions announced by the government Tuesday. Broadbent told the Treasury Select Committee that a key point was that they were being used to fund increases in health and social care spending and not to reduce the deficit - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Ministers saw off a significant Tory rebellion against the creation of a new health and social care tax last night after they were warned that it would do "massive damage" to the Conservative Party's prospects. The House of Commons approved the creation of a new tax to fund a £12 billion-per-year package for social care despite dozens of Tory MPs either voting against or not registering a vote. The levy, which is the biggest personal tax rise in two decades, was approved by 319 votes to 248 with Labour opposing it. Five Conservative MPs, including Esther McVey, Sir Christopher Chope and Sir John Redwood, voted against the proposal and a further 37 did not vote. (The Times)

ECONOMY: Britain's economic recovery is expected to slow over coming months thanks to staff shortages and supply chain disruption, according to a new forecast from a leading business group. Official figures show UK GDP grew by 4.8% in the second quarter but the British Chambers of Commerce (BCC) predicts this will slow to 2.8% in the third quarter and 1.6% in the last three months of 2021. The BCC also warned of the "real danger" that the £12bn National Insurance hike announced this week could further stifle Britain's bounce back. (Sky)

ECONOMY: Businesses are stepping up their recruitment efforts to cope with rising demand, but the supply of workers is dropping at a record pace, according to a report. The Recruitment and Employment Confederation said that permanent job placements had risen at a record pace in August and that the number of new vacancies was down only slightly from July's record high. Although demand for workers is rising sharply now that the country has emerged from lockdown, businesses are struggling to fill key roles. Staff shortages are affecting large parts of the economy and employers are having to increase wages and offer signing-on bonuses to attract workers. The REC/KPMG report pointed to an "unprecedented drop in candidate availability." (The Times)

ECONOMY: The U.K.'s retail and hospitality industry is expecting the government to delay looming new post-Brexit import checks on food as it battles with supply shortages and the impact of the coronavirus pandemic. (BBG)

BREXIT: The EU's chief interlocutor on the Northern Ireland Protocol Maroš Šefčovič has told member states he will bring forward a range of proposals by the end of September or early October in order to try to resolve the ongoing deadlock around the Protocol. Mr Šefčovič is currently holding talks with Taoiseach Micheál Martin at Government Buildings. Earlier, he said he hopes an overall deal can be reached with the UK by the end of the year, although he cautioned that success was not guaranteed. He told EU ambassadors at a meeting in Brussels that the proposals would cover the issues of customs, agrifood, medicines and ways to strengthen the role of the Northern Ireland institutions in overseeing the implementation of the Protocol. (RTE)

BREXIT: Democratic Unionist Party (DUP) leader Sir Jeffrey Donaldson is set to raise the stakes in his party's battle against the Northern Ireland Protocol. In a keynote speech on Thursday, he is expected to issue a warning about the future of Stormont's institutions. He is expected to signal his party's willingness to walk away from government if the DUP's demands on the protocol are not met. Sir Jeffrey is also expected to harden against north-south engagement. The speech comes as the European Commission Vice President Maroš Šefčovič begins a two-day visit to Northern Ireland during which he will hold talks with political and business leaders. (BBC)

EUROPE

ECB: MNI SOURCES: ECB Mulls Tweak To PEPP As March Cutoff Nears

- The European Central Bank's decision on the future pace of its Pandemic Emergency Purchase Programme at its meeting on Thursday will be taken in accordance with a pre-agreed framework, as the Governing Council engages in what could be three months of intense debate on the scale and mechanism for bond purchases once PEPP's active phase concludes in March, Eurosystem sources told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECB: Spain has taken steps to prepare for the gradual tapering of European Central Bank stimulus next year and expects policy makers to avoid a market disruption, the new head of the country's Treasury said. "The biggest risk with these type of measures or withdrawing stimulus would be to do it too quickly," said Carlos Cuerpo, who took over as secretary general at the beginning of the month. "I think in principle we can rule that out." Speaking in an interview in Madrid, Cuerpo said that "given the attitude and the comments from different central banks, what we would expect" are "much more progressive measures." (BBG)

ITALY: Italy's government breached EU state-aid rules when it gave €900m in rescue loans to Alitalia in 2017, according to a verdict set to be announced by Brussels. The decision by EU competition authorities, which two people with direct knowledge of the matter said was set to be made public on Thursday, though that timing may slip, comes after a three-year investigation into whether bridge loans to Alitalia illegally distorted competition in the bloc. EU law prohibits a member state from granting a company financial support that gives it an advantage over its rivals. The current Italian government, which was not in office when the loans were made, declined to comment. (FT)

IRELAND: Ireland will offer mRNA booster shots to people over 65 years old in care homes and to anyone over 80, the health ministry said. Eligibility will be restricted to those who received their initial vaccine at least six months ago. Infection rates are declining across the country, "falling significantly" for adolescents and young adults, the ministry said. (BBG)

U.S.

FED: MNI: Williams Sees Fed QE Taper This Year on Job Progress

- New York Fed President John Williams said Wednesday the central bank could start paring back its monthly USD120 billion QE program this year if there is further good progress on job creation. "Assuming the economy continues to improve as I anticipate, it could be appropriate to start reducing the pace of asset purchases this year," Williams said in prepared remarks. His view is in line with minutes from July's FOMC meeting and Jackson Hole remarks from Chair Jerome Powell - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed Needn't Stick to Past QE Taper Model - Williams

- New York Fed President John Williams said the Federal Reserve does not need to stick to the script from the last time the central bank reduced a QE program in 2013 and 2014. "It's a different set of circumstances this time," Williams told reporters during a press briefing. "We have the ability to set our policy as we see appropriate. We don't have to do exactly what we did before." The Fed is still debating the timing pace and composition of a taper, Williams said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Dallas Fed President Robert Kaplan said Wednesday he expects to advocate that the Fed announce a plan to slow down its $120 billion per month of asset purchases "sooner rather than later," despite the disappointing August jobs report. Kaplan, who has been a leading advocate for the tapering, said he wasn't surprised by the August jobs report. "I will be watching very carefully how the economy is unfolding between now and our Sept. 22 meeting. As I see it now, I don't see see a fundamental change in the outlook. If I get to the meeting, and continue to feel that way, I'd be advocating that we should announce a plan for adjusting these purchases in the September meeting and begin shortly thereafter, maybe in October," Kaplan said during a town hall sponsored by his regional Fed bank. (Dow Jones)

FED: San Francisco Fed President Daly tweeted the following on Wednesday: "Racial inequities cost us nearly $2.6 trillion in economic output in 2019. These inequities leave millions of people on the sidelines and limit our global competitiveness. This isn't a zero-sum game. Increasing our output leaves a bigger economic pie for everyone." (MNI)

FED: MNI BRIEF: Labor and Supply Shortages Temper Beige Book Outlook

- Supply disruptions and widespread labor shortages slowed economic growth in July and August, while consumers also pulled back on dining out, travel and tourism as the Delta variant spread, according to the Fed's Beige Book report on Wednesday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: A senior Democrat on the Senate Banking Committee endorsed Federal Reserve Chairman Jerome Powell for another term, countering pressure from some House progressives for President Joe Biden to pick a nominee more in line with their positions on regulation, inequality and climate risks. "As our economy continues to recover from one of the greatest economic crises in our history, we need a steady hand at the wheel – and Chairman Powell has been just that," Senator Jon Tester of Montana said Wednesday. "He has served as a nonpartisan steward of the economy while skillfully helping guide our economy through this crisis, and he's proven that he won't bow to political pressure from either side of the aisle. That's why I believe he has earned a second term at the Fed," Tester added. (BBG)

ECONOMY: MNI BRIEF: Canceled Trips Put US Hospitality Hiring at Risk

- Leisure travelers in the U.S. are canceling vacation plans amid rising Covid cases, the American Hotel and Lodging Association said Wednesday, causing businesses like hotels and restaurants to cut back on hiring in the near-term. Roughly 69% of the 2,200 adults surveyed by the AHLA between August 11 – 12 said they were planning on taking fewer trips and 65% said they were likely to take shorter trips due to fear of exposure to Covid. About 42% said they would cancel existing trips with no plans to reschedule, and 55% said they would postpone existing travel plans until a later date - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

INFLATION/FISCAL: The Biden administration plans to take a tougher stance toward meatpacking companies it says are causing sticker shock at grocery stores. Four companies control much of the U.S. meat processing market, and top aides to President Joe Biden blamed those companies for rising food prices in a blog on Wednesday. As part of a set of initiatives, the administration will funnel $1.4 billion in COVID-19 pandemic stimulus money to small meat producers and workers, administration aides said in the blog post. They also promised action to "crack down on illegal price fixing." (RTRS)

FISCAL: In the Senate, all roads lead to Joe Manchin. The West Virginia Democrat and his staff have been engaged for weeks in intensive negotiations with the chairs of key Senate committees ahead of his party's release of a sprawling bill to expand the social safety net, laying down his demands on a wide-range of issues: health care, education, child care and taxes, according to multiple sources familiar with the talks. And Manchin is making clear he won't cave on aggressive climate provisions sought by many Democrats, throwing a wrench in his party's efforts to make the bill key to combating global warming. (CNN)

FISCAL: U.S. Labor Secretary Marty Walsh said he doesn't see the need for states to extend emergency unemployment benefits, after a federal emergency program that boosted aid ended this week. "I don't think there's a need right now to extend those benefits unless a state sees fit," Walsh says Wed. in Bloomberg TV interview with David Westin. "We'll see how much of a role it had in labor participation at some point soon" Walsh says, in response to a question about a potential boost in the labor force after the pandemic emergency benefits expired. Walsh says "real opportunity" to organize workers in U.S. and in industries that aren't currently unionized. (BBG)

FISCAL: Treasury Secretary Janet Yellen's team doesn't see prioritizing payments to creditors as an option should the U.S. government exhaust its traditional measures to avoid a default induced by the debt limit, the department said Thursday. The U.S. "pays all its bills on time," said Treasury spokeswoman Lily Adams. "The only way for the government to address the debt ceiling is for Congress to raise or suspend the limit, just as they've done dozens of times before." Treasury's dismissal of the step may put to rest the idea that Yellen would turn to plans devised in 2011 during the Obama administration to prioritize payments on government securities over other obligations. (BBG)

CORONAVIRUS: Florida schools can start requiring masks while Governor Ron DeSantis appeals an earlier decision that struck down his ban on such mandates, Circuit Court Judge John C. Cooper ruled. The decision vacated an automatic stay of Cooper's ruling last month in favor of parents who challenged the governor's ban. (BBG)

BANKS: The U.S. Office of the Comptroller of the Currency on Wednesday proposed rescinding recently updated fair lending rules, as the agency begins work on drafting a new, unified regulation with other bank watchdogs. Under the proposal, the OCC would go back to the previous 1995 regulations for the Community Reinvestment Act (CRA), a 1977 fair lending law. The new proposal would see the OCC officially scrap new rules that were friendlier to banks by the beginning of 2022, setting the stage for the regulator, alongside the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), to move toward putting forward a joint, updated rule. (RTRS)

OTHER

GLOBAL TRADE: U.S. Trade Representative Katherine Tai on Wednesday spoke by phone with the head of the World Trade Organization and acknowledged the "difficult logistical challenges" facing an upcoming WTO ministerial conference, her office said. (RTRS)

CORONAVIRUS: The World Health Organization has extended its call for a moratorium on Covid-19 booster doses until at least the end of the year. The WHO previously urged world leaders to hold off on booster doses until the end of September. "There has been little change in the global situation since then, so today I am calling for an extension of the moratorium until at least the end of the year to enable every country to vaccinate at least 40% of its population," WHO Director-General Tedros Adhanom Ghebreyesus said in a briefing Wednesday. (CNBC)

JAPAN: The Japanese government plans to extend the virus emergency for Tokyo and large parts of the country by more than two weeks beyond the current Sunday expiration as high levels of delta variant-infections strain the medical system. The government is seeking to extend the state of emergency in 19 areas including Tokyo and Osaka until Sept. 30, Economy Minister Yasutoshi Nishimura told an advisory panel Thursday. Prime Minister Yoshihide Suga is set to make the formal announcement of the extension later in the day and will give a news conference at 7 p.m. "If the number of new infections continues to fall at the current rate and we bolster the health care system, the strains on medical care are expected to ease greatly by the end of the month," Nishimura said. (BBG)

JAPAN: Japan looks to shorten quarantine requirements for vaccinated travelers entering the country from two weeks to 10 days as early as this month, opening the door to easier business travel. (Nikkei)

BOJ: MNI BRIEF: BOJ Eyes Lower Phone Costs, Economy, On Price Views

- Bank of Japan officials are watching inflation expectations on the small chance that a recent change in base year and lower mobile phone charges eyed could be a "sectoral shock" and shape the price outlook, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's most-populous state, New South Wales, will lift stay-at-home orders for fully vaccinated adults once 70% of the population has received two shots, the government said Thursday as it unveiled a roadmap to end Sydney's 11-week lockdown. State Premier Gladys Berejiklian said pubs, restaurants, gyms and restaurants would be allowed to reopen to fully-vaccinated people, with social-distancing measures enforced. She said she expected the vaccination target to be met in October. (BBG)

AUSTRALIA: The ABS notes that "payroll jobs fell by 0.7% in the fortnight to 14 August 2021, compared to a fall of 1.8% in the previous fortnight, according to figures released by the Australian Bureau of Statistics (ABS) today. The largest falls in payroll jobs in the first half of August were in New South Wales (down 1.2%), Queensland (down 1.0%), the Australian Capital Territory (down 0.7%) and Victoria (down 0.6%). These four states and territories had lockdowns for either all or part of the first half of August, in addition to existing restrictions and border closures across the country. Payroll jobs in South Australia rose by 1.5% in the first two weeks of August, following the lockdown in late July when payroll jobs fell by 2.0%. New South Wales and Victoria accounted for more than two-thirds (70.0 per cent) of payroll jobs lost in the latest fortnight, which is greater than their pre-pandemic share of payroll jobs (58.4 per cent in mid-March 2020). Impacts from lockdowns continue to be highly visible in payroll jobs data, particularly when the two largest states are both in lockdown. We have also seen how rapid the recovery in payroll jobs can be, when the lockdowns end, such as in South Australia during August 2021 and in the six weeks after the end of Victoria's sixteen week lockdown last year." (MNI)

AUSTRALIA: The latest SEEK Employment Report shows that "national job ad volumes have dropped by 5.3% m/m in August. However, job ads remain 15.2% higher nationally than in the same month in 2019. COVID-19 restrictions continued to have a major impact on the labour market in August 2021. Perhaps unsurprisingly, states and territories under the strictest lockdowns each saw a decline in job ad volumes. New South Wales and Victoria saw the most significant drops in volume down 10.7% and 6.3% month-on-month, respectively. In July, despite a two-week restriction period, Victoria experienced an increase in the number of job ads posted during the month, however with the lockdown extended throughout the whole month of August, job ad numbers have now declined. This demonstrates that short lockdowns don't have too much of an impact on the labour market, but when extended, more businesses start to put hiring plans on hold. Nationally, the industries that have experienced the largest volume drop month-on-month are Hospitality & Tourism (-19.0%), Trades & Services (-7.3%) and Retail & Consumer Products (-8.9%). Last month the decline was driven by the restrictions in New South Wales, this month, Victoria is driving the reduction. Hospitality & Tourism job ads dropped 33.1% month-on-month in Victoria. SEEK.com.au had around 35 million visits last month, though applications per job ad declined slightly by 1.3% month-on-month and remain at low levels. Jobseekers are still not applying at the same rates as they were before COVID-19, with a 1.3% drop in applications per job ad in August. With restrictions and uncertainty continuing across our major job markets, it is timely to remind those considering a move that opportunities are out there in many industries." (MNI)

NEW ZEALAND: Unsurprisingly, August's job ads began to reflect the renewed COVID-19 level 4 restrictions that came into effect mid-month. Note: the 12% reported drop, compared to July, would have included a solid first half to the August numbers, inferring a more material drop occurred over the latter half, as businesses took stock of the abruptly changed situation. (BNZ)

BOK: South Korea's central bank said last month's interest-rate hike will help ease financial imbalances and contribute to a more stable and sustainable pace of growth in the economy. In a quarterly monetary policy report released Thursday, the Bank of Korea said higher rates in the current environment-- where the economy is recovering and households are indebted -- tend to have less impact on economic growth and inflation, and do more to curb debt. "In a recovery phase like now, economic participants tend to increase consumption and investment on the improved outlook, and that can partially offset the tightening impact on the economy," the BOK said. (BBG)

NORTH KOREA: North Korea held a midnight military parade to mark the 73rd anniversary of its founding with leader Kim Jong-un in attendance, but he did not deliver an address and no new strategic weapons were displayed, according to state media and South Korean officials. The parade, which began at midnight Thursday, was watched closely by South Korea and others because the North could show off state-of-the-art weapons systems or leader Kim could make a speech about inter-Korean relations or nuclear talks with the United States. Kim attended the event but did not deliver an address, according to the Korean Central News Agency. The KCNA also said that the parade at Pyongyang's Kim Il-sung Square was mostly led not by regular troops but by the Worker-Peasant Red Guards (WPRG), a civilian defense organization in North Korea composed of around 5.7 million workers and farmers. (Yonhap)

NORTH KOREA: Chinese President Xi Jinping sent a message of congratulations to North Korean leader Kim Jong Un on the 73rd anniversary of the government's founding, China's state TV reports. Xi says he attaches great importance to ties between China and North Korea, willing to work with Kim to push forward bilateral relations. Xi expresses confidence in North Korea's future development under leadership of Kim. (BBG)

CANADA: MNI: Canada Conservative Pledges Cost CAD51.3B Over 5 Years

- Canada's Conservative Party Leader Erin O'Toole said Wednesday his election spending promises will cost CAD51.3 billion over five years, details announced around televised debates that could carry him to a come-from-behind win over Liberal Prime Minister Justin Trudeau in a Sept. 20 vote. The deficit will shrink to CAD24.7 billion in five years, according to party documents, from this year's budgeted CAD155 billion. The costs as given are less than Liberal pledges for CAD78 billion of extra health, housing and childcare programs over five years with a CAD32.1 billion deficit at the end of that timeframe. The costing was released before two nights of debates that could shift control of a campaign where the Liberals' polling lead has faded to a draw with the Conservatives. Trudeau called the snap vote last month hoping to capitalize on vaccination progress, generous relief checks and a job rebound, momentum broken by more recent reports that GDP shrank in the second quarter and a rise in Covid cases linked to the Delta variant - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's finance minister Rogelio Ramirez de la O said on Wednesday that the 2022 budget will focus on the well being of Mexicans, financial stability and prudence and support for regional development, reiterating that no new taxes would be created. (RTRS)

MEXICO: Mexico's plan to use IMF funds to pay debt will take time, Finance Minister Rogelio Ramirez de la O said in an interview.. The Ministry is in informal talks with the central bank on IMF reserves, he said. The higher deficit in the 2022 budget proposal is a pragmatic decision. Inflation gains are temporary. (BBG)

MEXICO: Mexico's government on Wednesday proposed sharply reducing the tax burden for state oil firm Petroleos Mexicanos and forecast economic growth of 4.1% for 2022, as Latin America's second largest economy continues to recover from a COVID-19-induced slump. The finance ministry's 2022 draft budget, which it presented to Congress earlier in the day, laid out a profit sharing rate (DUC) - effectively a tax paid to the government -of 40% for the oil giant known locally as Pemex. (RTRS)

BRAZIL: As it faces successive inflationary shocks both global and domestic, core inflation is spreading and getting higher than what the central bank would want, said its president Roberto Campos Neto in an online event. Inflation expectations for 2022 are also "a bit higher" and it's important to "act fast" to prevent de-anchoring. Next year's election is playing a role in inflation expectations, as it's seen as polarized. "We need to turn the page" on the discussion of how social programs will be funded, said Campos Neto. Central bank is fully independent and will use that independence to achieve its mandate, said policy maker. Growth is above pre-pandemic levels with a good level of formal job creation but there are lags in the informal sector and consumer confidence. (BBG)

RUSSIA: Russia's annual inflation accelerated further in August towards levels last seen in 2016, data showed on Wednesday ahead of the central bank's board meeting where it is widely expected to raise rates for the fifth time this year. Inflation is a sensitive issue in Russia as it overshot the central bank's 4% target in late 2020 and shows no signs of slowing, eating into incomes already dented by the COVID-19 crisis and the weak rouble ahead of a September parliamentary election. Russia's consumer price index (CPI) rose 6.68% in year-on-year terms in August, its sharpest increase since August 2016, after a 6.46% rise a month earlier, data from the federal statistics service Rosstat showed. Analysts polled by Reuters expected annual inflation to be at 6.6%, reflecting the weak rouble that filters into prices by making imports more expensive. (RTRS)

SOUTH AFRICA: South Africa's third wave of coronavirus infections is petering out, with the number of new cases and the positivity rate of those tested dropping, the National Institute for Communicable Diseases said. "The current surge in Covid-19 infections seems to be showing signs of a sustained downward trend," the institute said. Infections are declining in all nine provinces. (BBG)

IRAN: German Chancellor Angela Merkel's top diplomat said waiting two to three months for the new Iranian government to resume talks on reestablishing the 2015 nuclear accord was "too long," as world powers urge President Ebrahim Raisi to commit to a fresh round of negotiations. "We will continue to try to bring these talks to a positive conclusion, but it will depend on Iran whether that can happen. In any case, two or three months is a time frame that is too long for us," German Foreign Minister Heiko Maas told reporters at Ramstein Air Base in Germany, alongside U.S. Secretary of State Tony Blinken. The German envoy was more precise than Blinken, who said the U.S. administration won't "put a date on it" but warned that too much delay would make a direct return to the Joint Comprehensive Plan of Action, as it's known, won't be feasible. (BBG)

AFGHANISTAN: Secretary of State Antony Blinken called on Taliban leaders Wednesday to allow charter flights to leave Afghanistan, saying it would demonstrate the group's "willingness to respect freedom of movement." For days, the Taliban has been preventing the departures of at least four chartered evacuation flights from Mazar-e-Sharif airport, in northern Afghanistan. (Axios)

AFGHANISTAN: China is extending aid to Afghanistan as the new interim government needed external help for stability, the Global Times said after Foreign Minister Wang Yi pledged $31 million worth of food and medical supplies in a meeting with other neighbouring countries on Wednesday. China hopes that its aid can help restore social order and lay a foundation for future friendly interactions, the newspaper said citing Li Haidong, professor at the Institute of International Relations at the China Foreign Affairs University. Wang called for Afghanistan to keep its ports open and maintain security, while China will work on restoring cargo railway services between the two countries, the newspaper said. (MNI)

AFGHANISTAN: The Taliban has moved to tighten its crackdown on escalating protests against its rule, banning any demonstrations that do not have official approval for both the gathering itself and for any slogans that might be used. In the first decree issued by the hardline Islamist group's new interior ministry, which is led by Sirajuddin Haqqani, who is wanted by the United States on terrorism charges, the Taliban warned opponents that they must secure permission before any protests or face "severe legal consequences'". Wednesday's formal ban follows violent and sometimes lethal confrontations between Taliban fighters and demonstrators in several cities since the group swept to power, with women often at the forefront of the protests. (Guardian)

COPPER: Plant workers at Codelco's Andina copper mine in Chile rejected owner's latest wage offer, opting instead to extend a strike now in its fourth week. "We look forward to more dialog and flexibility from Codelco Andina's management," Suplant union leader Clodomiro Vasquez said in a text message. (BBG)

OIL: More than three-quarters of the U.S. Gulf of Mexico's offshore oil and natural gas output remained shut on Wednesday as the fallout from Hurricane Ida continued to hamper production. Some 1.4 million barrels per day (bpd) of crude production and over 1.72 billion cubic feet per day of natural gas output were shut-in. More than 70 platforms of the 288 evacuated ahead of the August storm remain unoccupied, according to the Bureau of Safety and Environmental Enforcement (BSEE). (RTRS)

OIL: U.S. crude oil production is expected to fall by 200,000 barrels per day (bpd) in 2021 to 11.08 million bpd, the U.S. Energy Information Administration (EIA) said on Wednesday, noting that Hurricane Ida should force a bigger decline than its previous forecast for a drop of 160,000 bpd. (RTRS)

OIL: The prolonged shutdown of Gulf of Mexico oil production in the wake of Hurricane Ida is creating an opportunity for Russia to expand its share of the U.S. oil market. Imports of Russian oil Urals to the U.S. are set to increase in September and October as 77% of U.S. Gulf offshore production remains shut 10 days after Ida made landfall on the Louisiana coast, according to people with knowledge of the situation. Gulf coast refineries looking for oil in the absence of supply from the Gulf are supporting higher prices for medium sour Russian oil that is similar to grades produced in the Gulf of Mexico. (BBG)

OIL: Mexico cut its forecast for oil production at Petroleos Mexicanos next year and reduced its tax burden after a string of accidents at offshore platforms signaled the highly indebted state company is struggling. The country's Finance Ministry lowered a preliminary estimate for crude output in 2022 to 1.826 million barrels a day, from a March 31 forecast of 1.867 million, according to a draft of next year's budget proposal. It's also reducing the profit-sharing duty that Pemex has to pay the government to 40% next year, from 54% in 2021. (BBG)

CHINA

POLICY: The Chinese government summoned online gaming firms including Tencent Holdings and NetEase to ensure they implement the new time limit for providing online games to children, Xinhua News Agency reported. Companies are ordered to observe fair competition, prevent excessive concentration or monopoly, and focus on promoting technological innovation, Xinhua said. Beijing last month set limits for those under 18 from playing video games for no more than three hours a week. (MNI)

POLICY: China will set up so-called innovative pilot zones in six cities, including Beijing and Shanghai, that will create a global-standard business-friendly environment through eliminating protectionism and red tapes, lower market barriers and greater openings to outside markets, the State Council said following an executive meeting on Wednesday. China hopes to stabilize market expectations and ensure smooth economic operations through the reform measures, the council said. (MNI)

WEALTH MANAGEMENT CONNECT: Hong Kong will hold launch ceremony for wealth management connect Friday, Sing Tao Daily reports, citing unidentified people. Wealth management connect is expected to start as early as November as it will take time for the authorities to approve banks' applications. (BBG)

OVERNIGHT DATA

CHINA AUG CPI +0.8% Y/Y; MEDIAN +1.0%; JUL +1.0%

CHINA AUG PPI +9.5% Y/Y; MEDIAN +9.0%; JUL +9.0%

JAPAN AUG MONEY STOCK M2 +4.7% Y/Y; MEDIAN +4.6%; JUL +5.3%

JAPAN AUG MONEY STOCK M3 +4.2% Y/Y; MEDIAN +4.1%; JUL +4.6%

JAPAN AUG TOKYO AVG OFFICE VACANCIES 6.31; JUL 6.28

NEW ZEALAND Q2 M'FING ACTIVITY +3.9% Q/Q; Q1 +2.7%

NEW ZEALAND Q2 M'FING ACTIVITY VOLUME -0.1% Q/Q; Q1 +0.6%

NEW ZEALAND AUG ANZ TRUCKOMETER HEAVY -18.1% M/M; JUL -1.0%

UK AUG RICS HOUSE PRICE BALANCE 73%; MEDIAN 75%; JUL 77%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:23 am local time from the close of 2.2008% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 40 on Wednesday vs 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4615 THURS VS 6.4674

The People's Bank of China (PBOC) set the dollar-yuan central parity rates lightly lower at 6.4615 on Thursday, compared with the 6.4674 set on Wednesday.

MARKETS

SNAPSHOT: Chinese PPI Rise Tops Exp., Fed's Kaplan Pushes For Taper

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 237.38 points at 29963.49

- ASX 200 down 140.211 points at 7374.2

- Shanghai Comp. up 3.401 points at 3678.588

- JGB 10-Yr future up 3 ticks at 151.87, yield down 0.5bp at 0.040%

- Aussie 10-Yr future up 3.7 ticks at 98.756, yield down 3.8bp at 1.260%

- U.S. 10-Yr future +0-00+ at 133-08+, yield down 0.85bp at 1.331%

- WTI crude down $0.02 at $69.27, Gold down $1.6 at $1787.56

- USD/JPY down 7 pips at Y110.20

- ECB MULLS TWEAK TO PEPP AS MARCH CUTOFF NEARS (MNI SOURCES)

- FED'S KAPLAN EXPECTS TO SUPPORT A TAPER-PLAN ANNOUNCEMENT LATER THIS MONTH (DJ)

- TORY REVOLT OVER HEALTH & CARE LEVY QUELLED BUT WOULD-BE REBELS WARN OF 'MASSIVE DAMAGE' (THE TIMES)

- SEFCOVIC TO BRING FORWARD PROPOSALS TO TRY TO BREAK N. IRELAND PROTOCOL DEADLOCK (RTE)

- JAPAN GOVERNMENT PLANS TO EXTEND VIRUS EMERGENCY TO SEP 30 (BBG)

- CHINA CPI/PPI GAP WIDENS FURTHER

BOND SUMMARY: Core FI Tight In Asia, 5-Year JGB Supply & Futures Rolls Dominate

T-Notes -0-00+ at 133-07+, sticking to the confines of a 0-02 range in Asia dealing, while cash Tsys sit unchanged to ~0.5bp firmer on the day. There has been little to note on the headline front, outside of hawkish reutterances from Dallas Fed President Kaplan, who pointed to a need to get underway with tapering in October. A 5.0K block buy of TYV1 134.00 calls headlined on the flow side. Thursday will bring weekly initial jobless claims data & 30-Year Tsy supply, while the latest ECB monetary policy decision will garner attention. We will also get plenty of Fedspeak, with Bowman, Williams, Evans & Daly all due to make addresses (although some may not comment on monetary policy).

- JGB futures retraced into the overnight range after a brief look above at the re-open, with a lack of fresh tier 1 headline catalysts observed. Plans to extend the state of emergency in play across 19 prefectures were confirmed by Economy Minister Nishimura after press reports pointed to such a move overnight. Futures +2 vs. settlement last. Cash JGB trade sees the major benchmarks little changed to ~1.0bp richer, with 5s outperforming. Strength in the belly was aided by a well-received round of 5-Year JGB supply. The low price just about topped broader dealer estimates (which stood at 100.50 per the BBG dealer poll), while the cover ratio moved higher (4.42x vs. 6-auction average of 3.70x), likely supported by the relative value appeal and recent cheapening that we flagged ahead of the auction. The price tail remained very tight, showing some incremental narrowing.

- Aussie bond futures were fairly stagnant, clinging onto the bulk of their overnight gains, with roll activity dominating (sellers of the rolls have driven most of the activity thus far). The space continues to look through the local COVID case numbers, with NSW outlining its path out of lockdown, centring on a 70% fully vaccinated ratio. YM +0.7 & XM +3.1 at typing, with the long end of the cash ACGB curve richening by ~3.5bp on the day.

JGBS AUCTION: Japanese MOF sells Y2.0313tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0313tn 5-Year JGBs:

- Average Yield -0.103% (prev. -0.120%)

- Average Price 100.52 (prev. 100.61)

- High Yield: -0.101% (prev. -0.116%)

- Low Price 100.51 (prev. 100.59)

- % Allotted At High Yield: 7.4346% (prev. 3.0486%)

- Bid/Cover: 4.417x (prev. 3.756x)

JGBS AUCTION: Japanese MOF sells Y2.7631tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7631tn 6-Month Bills:

- Average Yield -0.1189% (prev. -0.1308%)

- Average Price 100.059 (prev. 100.066)

- High Yield: -0.1168% (prev. -0.1248%)

- Low Price 100.058 (prev. 100.063)

- % Allotted At High Yield: 78.3200% (prev. 51.5330%)

- Bid/Cover: 3.620x (prev. 5.446x)

JAPAN: Japan Returns To Net Buying Of Foreign Bonds

The weekly international security flow data revealed that Japanese investors put money back into foreign bonds last week, breaking a 2-week run of net sales and lodging the largest round of weekly net purchases seen since April in the process.

- Meanwhile, net flows on the part of foreign investors into Japanese bonds slowed from last week's elevated levels but printed in positive territory for a second straight week.

- The degree of both of the reported rounds of net equity flows widened but printed in the same direction in the previous week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1043.1 | -546.9 | 973.5 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -455.7 | -42.6 | -529.3 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 432.9 | 1480.7 | 1849.9 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 421.6 | 24.1 | 94.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Risk Off Extends To A Second Day

A negative day for equity markets in the Asia-Pac region, taking a lead from the US where bourses extended losses to a third day. Tech shares were hit hardest in Asia, the Hang Seng nursing losses of over 1.5%. Markets mull a warning from Chinese regulators over antitrust issues and a further caution that gaming firms should not be focuses solely on profit. The ASX 200 is on track for its worst day since June as iron ore sells off and weighs on miners. In Japan markets snapped an eight-day winning streak. In the US futures are lower with markets on track for the longest losing streak since July.

OIL: Creeps Higher

Crude futures have crept higher in Asia, building on Wednesday's gains. Both WTI and Brent crude futures finished in positive territory, shrugging off a poor showing from equity markets as well as the rebounding dollar. Buoyant NatGas prices led the way higher, with the active contract printing the highest levels since 2014 as supply concerns feed directly into prices. Forecasts for winter NatGas stockpiles are being downgraded, with solid summer demand pressuring reserves that'll meet Winter heating requirements across the West Coast. The move higher was supported US API stockpile data which showed headline crude stocks fell 2.88m bbls, markets look ahead to official US DOE inventory data which is forecast to show a 4.75m bbl decline in stocks. Markets will also keep an eye on a fresh wave of protests at Libyan oilfields and ports which threatens to impact output.

GOLD: Latest USD Uptick Weighed On Wednesday

Spot gold deals little changed, just shy of $1,790/oz, sticking to a very narrow range in Asia-Pac hours. To recap, Wednesday's modest uptick in the broader USD seemed to keep a lid on bullion, with spot failing to make a notable, sustained push above $1,800/oz, even as our weighted U.S. real yield monitor pulled lower. Initial support is now located at the August 19 low ($1,774.5/oz). Initial resistance remains at the July 15 high and bull trigger ($1,834.1/oz).

FOREX: Risk Aversion Prevails, ECB Decision Eyed

Cautious mood prevailed as participants reassessed economic recovery outlook, with Antipodean currencies bearing the brunt of resultant risk-off flows. That being said, major G10 crosses were happy to hold relatively tight ranges in Asia-Pac hours.

- Traditional safe havens CHF and JPY outperformed at the margin. Japan extended Covid state of emergencies in 19 prefectures including Tokyo and Osaka, as touted in earlier press reports.

- The release of China's inflation data inspired only a limited amount of volatility in USD/CNH, which remained within the confines of yesterday's range. Consumer prices grew slower than forecast, while factory-price inflation proved faster than expected.

- The latest monetary policy decision from the ECB will take focus in European hours, with policymakers likely set to announce a reduction in the PEPP purchase rate.

- U.S. jobless claims and comments from RBA Dep Gov Debelle, BoC Gov Macklem and a number of Fed speakers will also provide some interest.

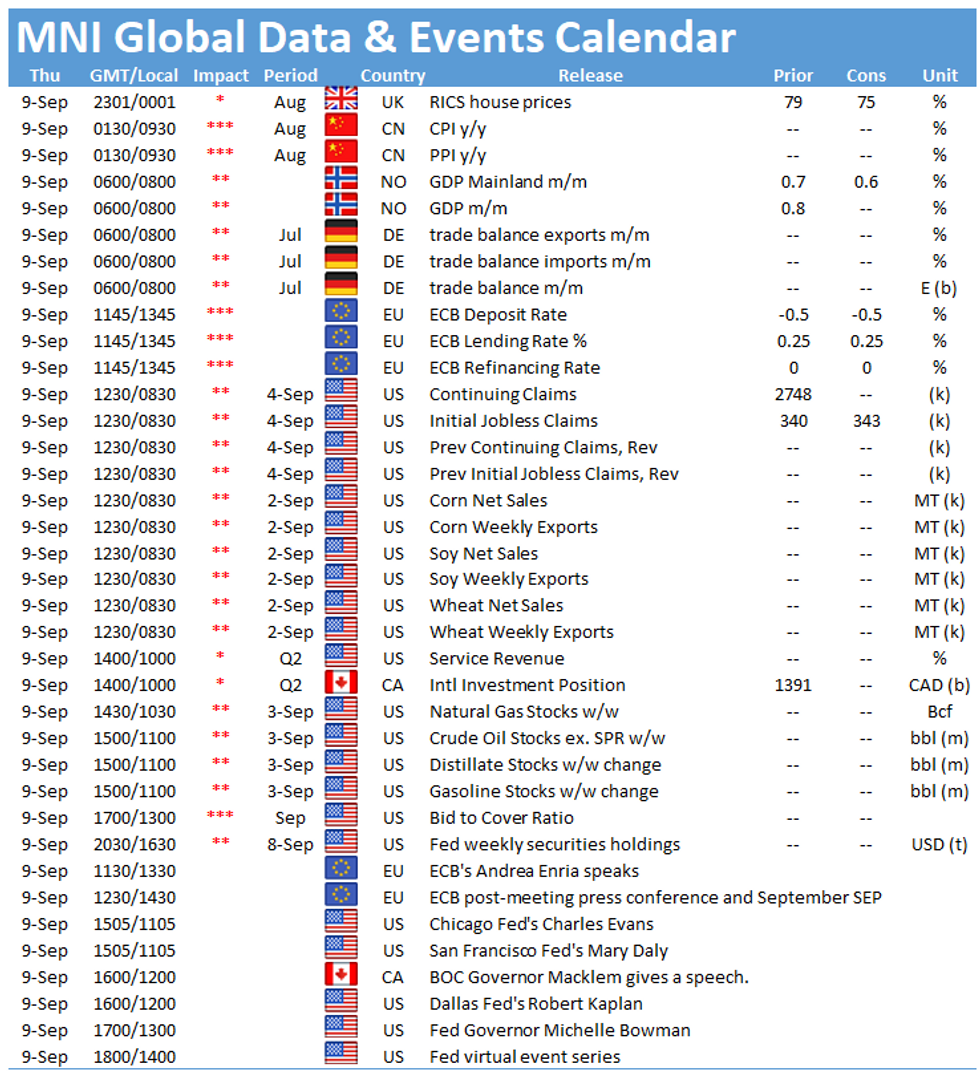

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.