-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Biden & Xi Make Contact

EXECUTIVE SUMMARY

- U.S., CHINA LEADERS HOLD CANDID TALKS ON POLICIES (MNI)

- REPUBLICAN LAWMAKERS RAISE ALARM ABOUT U.S. APPROVAL OF AUTO CHIPS FOR HUAWEI (RTRS)

- FED'S BOWMAN ENCOURAGED STILL BY RECOVERY, TAPER LIKELY THIS YEAR (RTRS)

- FED PRESIDENTS KAPLAN & ROSENGREN TO SELL INDIVIDUAL STOCK HOLDINGS TO ADDRESS ETHICS CONCERNS (CNBC)

- ECB POLICYMAKERS AGREED ON PEPP MONTHLY PURCHASE TARGET OF 60-70BN WITH FLEXIBILITY (RTRS SOURCES)

- TORIES TRAILING LABOUR WITH LOWEST BACKING SINCE ELECTION (TIMES/YOUGOV POLL)

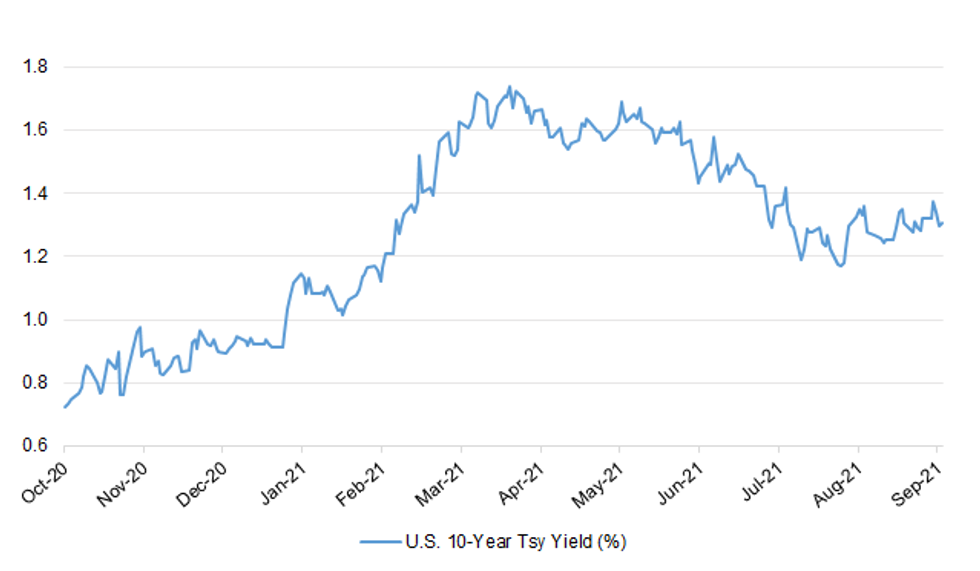

Fig. 1: U.S. 10-Year Tsy Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Ministers have piled pressure on the vaccines watchdog to approve a large-scale programme of Covid booster injections in time for winter, as the number of people in hospital with the virus exceeded 8,000 for the first time since March. On Thursday the UK's medicines regulator granted emergency approval for the Pfizer and AstraZeneca vaccines to be used as third shots to tackle potentially waning immunity, also putting pressure on the Joint Committee on Vaccination and Immunisation (JCVI) to approve a new jab programme. Hours later, the health secretary, Sajid Javid, said he was confident that such injections would begin imminently. "We are heading towards our booster programme," he said. "I'm confident that our booster programme will start later this month, but I'm still awaiting the final advice." (Guardian)

CORONAVIRUS: Booster vaccines are expected to get the go-ahead early next week after data showed that they give a "several-fold increase" in vital antibodies that protect against coronavirus. Millions of older people may have to wait for a third jab until later in the autumn, however, to ensure they are shielded for the winter. The Joint Committee on Vaccination and Immunisation (JCVI) was presented with data yesterday showing that a top-up Pfizer-BioNTech dose months after a second jab greatly boosted the body's immune response to coronavirus. This was seen in those who had previously been given either Pfizer or AstraZeneca, strengthening the case for a mix-and-match booster campaign. (The Times)

CORONAVIRUS: Chris Whitty is expected to recommend next week that children aged 12 and over be vaccinated after expert advisers told him it would benefit their mental health, education and social development. The chief medical officer for England is set to conclude a review of medical evidence early next week, with ministers promising that the first younger teenagers will be jabbed within five working days. In other developments, NHS leaders warned against compulsory vaccination of staff and official data showed that unvaccinated people were up to nine times more likely to die from Covid-19 as adults of the same age who are double-jabbed. (The Times)

CORONAVIRUS: The Scottish Parliament approved plans to introduce vaccine certificates for entry into nightclubs, adult entertainment venues and some live events such as music concerts and soccer matches. The proposal was put forward by the Scottish National Party government, though was opposed by the opposition parties on the grounds that it would ultimately be unworkable. (BBG)

FISCAL/POLITICS: Cabinet ministers are facing a hostile reception from the Tory party's grassroots when they return to their constituencies this weekend after waving through manifesto-busting tax rises in Parliament. (Telegraph)

POLITICS: Tory support has fallen to its lowest level since the election after Boris Johnson's gamble to raise taxes for the NHS and social care reform, a Times poll reveals today. Backing for the Conservatives is down five points to 33 per cent after the government announced plans to increase national insurance. The poll puts Labour in the lead, at 35 per cent, for the first time since January at the height of the Covid-19 pandemic. The YouGov poll also suggests the policy has, at least for now, undermined the Conservatives' reputation as a party of low taxation without giving them the credit for increased investment in the NHS and social care. (The Times)

BREXIT: The Democratic Unionist Party may quit Stormont "within weeks" if its demands over the Northern Ireland Protocol are not met, its leader has suggested. Sir Jeffrey Donaldson also said he feared a return to the loyalist street violence seen earlier in the year unless the issue was resolved. He said his party would also now boycott most north-south ministerial meetings. He said relations could not be "business as usual". Most Stormont parties criticised the speech while the EU's Brexit negotiator called for calm. During his speech in Belfast, Sir Jeffrey said it would be clear "within weeks" if there was a basis for the assembly and executive to continue, or if an election was needed. "I say not as a threat, but as a matter of political reality, that our political institutions will not survive a failure to resolve the problems that the protocol has created," Sir Jeffrey said. "Neither will they survive an indefinite 'stand still' period; urgent action is needed." (BBC)

EUROPE

ECB: With the economy now on a stronger footing, the ECB said that favourable financing conditions could be maintained with a "moderately lower pace" of asset purchases compared to the 80 billion euros it bought per month during the past two quarters. It provided no numerical guidance for the three months ahead, but three sources with knowledge of the discussion said that policymakers set a monthly target of between 60 billion and 70 billion euros, with flexibility to buy more or less, depending on market conditions. Highlighting policymakers' caution, the bank also maintained a longstanding pledge to ramp stimulus back up if markets turn and financing conditions require it. (RTRS)

FISCAL: A group of hawkish EU finance ministers is preparing to take a tough line in talks over post-pandemic changes to the EU's budget rules, insisting any reforms must not jeopardise fiscal sustainability or water down debt reduction targets. A paper supported by finance ministers from eight countries — including Austria, the Netherlands, Denmark and the Czech Republic — declared a willingness to discuss "improvements" to the EU's Stability and Growth Pact. But they warned that member states must recommit to "sound public finances" and cutting public debt, which ballooned during the Covid-19 crisis. In a clear signal to the European Commission, which is set to reopen a consultation on the rules, the eight ministers said "quality is more important than speed" when it comes to any change. (FT)

GERMANY: Germany's Social Democrats and Chancellor Angela Merkel's Christian Democrat-led bloc both gain one point, to 26% and 21% respectively, in latest weekly survey by YouGov. Greens 15% (unchanged); AfD 12% (unchanged); FDP 10% (-3) Left party 6% (-2). (BBG)

FRANCE: France set out a plan to tackle its Covid-19 debt mountain by relying on investment to fuel stronger economic growth, resisting any temptation to raise taxes to repair its public finances. The 2022 budget will deliver on promises to cut corporate tax -- which stood at more than 33% for some companies when Emmanuel Macron took office in 2017 -- to 25% for all firms. It will also continue the phasing out of residency tax, Finance Minister Bruno Le Maire said. Separately, the government is working on the details of a multi-year investment plan worth tens of billions of euros for new industrial sectors, and fresh support for training and employment for young people. "This budget is completely coherent with the three strategic choices we have defended from the start of the presidency: cutting taxes, supporting investment and innovation, and supporting French people to work," Le Maire said. (BBG)

ITALY: The Italian government ruled on Thursday that catering and cleaning staff in schools and nursing homes can only work if they have proof of COVID-19 immunity, extending mandatory vaccination and the use of the so-called "Green Pass" document. The health pass was already required for teachers in Italy, while mandatory vaccination for health workers was introduced in March. The government said on Thursday that under the new rules people working in schools in any capacity must have the health document, and that all nursing home staff will have to be vaccinated. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on Austria (current rating: AA+; Outlook Stable), Luxembourg (current rating: AAA; Outlook Stable), Malta (current rating: A-; Outlook Stable), Norway (current rating: AAA; Outlook Stable) & Portugal (current rating: BBB; Outlook Stable)

U.S.

FED: U.S. Federal Reserve bank Gov. Michelle Bowman added her voice Wednesday to the growing number of policymakers who say the weak August jobs report will not throw off the central bank's developing plan to trim its $120 billion in monthly bond purchases later this year. "Even though some of the recent data may have been less strong than we expected we are still looking at very robust economic growth," Bowman said at an online event organized by the American Bankers Association. "We are very close to our goal on maximum employment...If the data comes in as I expect that it will, it will likely be appropriate for us to begin the process of scaling back our asset purchases this year." Bowman becomes the fifth Fed official in the past two days to signal that the disappointing August jobs report on its own would not stop the Fed from beginning to pare its bond purchases later this year. (RTRS)

FED: MNI BRIEF: Supply Pressures, Labor Mismatches to Last -- Kaplan

- Dallas Fed President Robert Kaplan said Thursday he fears supply chain constrains and labor market mismatches may persist for some time. "My concern based on what I'm seeing is the supply-demand imbalances for materials I think are going to last longer than some people are expecting," Kaplan said. "Price pressures are likely broadening."

FED: Federal Reserve regional presidents Robert Kaplan and Eric Rosengren said Thursday they will sell individual stock holdings amid ethics concerns regarding trading in 2020. The Fed officials will sell all their stocks by Sept. 30 and put the proceeds in passive investments, they said in statements released Thursday. "While my personal saving and investment transactions have complied with the Federal Reserve's ethics rules, I have decided to address even the appearance of any conflict of interest by taking the following steps," Rosengren, president of the Boston Fed, said. (CNBC)

ECONOMY: President Joe Biden cited Thursday's unemployment numbers as a signal his administration is shepherding a "durable economic recovery" following the coronavirus pandemic. The Department of Labor announced earlier that day that the number of people filing new unemployment claims fell to 310,000, the lowest mark since the beginning of the pandemic. Claims spiked in late March 2020 at 6.9 million. White House officials noted that, in total, new unemployment claims have fallen nearly 500,000 since Biden entered office on Jan. 20. (Washington Examiner)

CORONAVIRUS: Covid-19 vaccination rates in the U.S. as cases plateau at a high number, pressuring private employers to immunize their workforce as well as mandating the shots for federal workers, contractors and employees of health-care facilities that receive Medicare or Medicaid funding. The nation is reporting an average of 151,500 new cases per day, according to data compiled by Johns Hopkins University, hovering around levels seen in late January. The country is reporting an average of about 1,500 Covid deaths per day, according to Hopkins' data, in line with numbers seen in March when the U.S. was coming down from its winter surge. Biden, in a speech Thursday evening, discussed a six-part plan intended to get more people vaccinated, allow schools to reopen safely, increase testing, improve care for patients and boost the economic recovery. (CNBC)

CORONAVIRUS: The National Treasury Employees' Union, which represents 150,000 federal workers, said on Thursday the government has the "legal right" to require employees to be immunized for COVID-19, suggesting it will accept the vaccine mandate President Joe Biden is expected to unveil. "The executive order the White House is expected to release later today making vaccination a condition of employment for federal employees is a step the government, as an employer, has the legal right to take," union President Tony Reardon said in a statement. The union, which said it has urged the workers it represents to get vaccinated against the coronavirus, said it will work to ensure government agencies accommodate employees getting immunized in ways such as granting time off to recover from potential side effects. (RTRS)

CORONAVIRUS: Wearing masks and social distancing is an important strategy for preventing the spread of Covid-19 in university settings, a study from the U.S. Centers for Disease Control and Prevention released Thursday found. (BBG)

CORONAVIRUS: The Los Angeles Unified Board of Education approved a measure Thursday mandating eligible students in the nation's second-biggest school district to be vaccinated against the coronavirus. (Axios)

CORONAVIRUS: Kentucky Governor Andy Beshear announced Thursday that an additional 310 Kentucky National Guard members will be deployed to hospitals across the state. Roughly 100 are already aiding four hospitals in particularly hard-hit areas of the state. (BBG)

EQUITIES: One of the top federal agencies overseeing Apple, Facebook, Google and other Silicon Valley tech giants could see a boost to its budget as part of congressional Democrats' sprawling $3.5 trillion economic package. The proposal, unveiled by a panel of House Democrats on Thursday, would set aside $1 billion for the Federal Trade Commission to create a new digital-focused division that would police privacy violations, cybersecurity incidents and other online abuses. The new spending could represent a roughly 30 percent increase in the commission's total projected appropriations over the next decade — money that could add more legal firepower to an agency whose resources are badly outmatched by many of the companies it regulates. (Washington Post)

BANKS: Wells Fargo was hit with a $250 million fine from a banking regulator after it failed to properly execute a mortgage loss mitigation program. The Office of the Comptroller of the Currency said Thursday that the bank engaged in "unsafe or unsound practices" tied to its loan modification program and violated the terms of a 2018 consent order that was critical of its risk management systems. "Wells Fargo has not met the requirements of the OCC's 2018 action against the bank. This is unacceptable," Acting Comptroller of the Currency Michael J. Hsu said in a statement. "In addition to the $250 million civil money penalty that we are assessing against Wells Fargo, today's action puts limits on the bank's future activities until existing problems in mortgage servicing are adequately addressed." (CNBC)

OTHER

U.S./CHINA: MNI BRIEF: U.S., China Leaders Hold Candid Talks On Policies

- Chinese President Xi Jinping and U.S. counterpart Joe Biden spoke on the phone for a candid, in-depth and extensive strategic communication on Sino-U.S. relations and issues of mutual concern, state media Xinhua News Agency reported on Friday. This is the second call between the two leaders after one in February after Biden took the stage. The two sides can continue to engage in dialogue and promote cooperation on climate change, epidemic control, economic recovery and major international and regional issues, based on respecting each other's core concerns and properly managing differences, Xinhua cited Xi as saying.

U.S./CHINA: A group of 13 Republican lawmakers on Thursday raised concerns about U.S. approval for Chinese telecommunications company Huawei to buy chips for its growing auto components business. (RTRS)

U.S./CHINA: American firms in China are hoping for a meeting between Presidents Joe Biden and Xi Jinping this year, according to a new survey, as they look for relief from trade barriers raised during the Trump era. More than 60% of American Chamber of Commerce in China members surveyed cited the need to restore regular visa services for business executives and their families, according to a survey released by the group Friday. Another 47% wanted the removal of tariffs, with more than three-quarters of companies complaining that measures levied during the trade war were impacting their operations. Still, the results suggested companies realized that it was necessary to first improve ties that have remained tense despite Biden's defeat of former President Donald Trump in November. Some 54% of respondents surveyed called for "regularized government-to-government communication" to rebuild relations, while 38% wanted a Biden-Xi summit this year. (BBG)

CORONAVIRUS: Moderna announced Thursday that it is in the process of developing a new vaccine that combines a booster dose of its COVID-19 vaccine with a seasonal flu vaccine. "We believe this is just the beginning of a new age of information-based medicines," CEO Stéphane Bancel said in the press release, which also gave a slew of updates on projects the company is pursuing. "Today we are announcing the first step in our novel respiratory vaccine program with the development of a single dose vaccine that combines a booster against COVID-19 and a booster against flu," Bancel said. (Axios)

JAPAN: With Japan's fourth state of emergency extended yet again, growing numbers of the bars and restaurants that have borne the brunt of curfews say they can no longer afford to comply. Some are simply fed up. Public health experts have pinpointed watering holes as potential hotbeds of infection, leading to the emergency restrictions that ban them from serving alcohol and set 8 p.m. as closing time. (BBG)

AUSTRALIA: The delta surge in Australia's largest state is showing signs of steadying after New South Wales found 1,542 new infections overnight. While Friday's cases are a record, it took six days to reach the new high -- the longest stretch since early July -- according to Bloomberg calculations based off of the state's health department data. Authorities expect the new infections to peak in the next week. Meantime, neighboring Victoria recorded 334 more cases as health authorities struggle to bring delta under control. The state's outbreak has doubled in size to 3,610 cases in seven days, according to Bloomberg calculations of Victorian health data. (BBG)

AUSTRALIA: The Australian Prudential Regulation Authority (APRA) expects locally-incorporated ADIs subject to the Liquidity Coverage Ratio (LCR) to reduce their reliance on the Committed Liquidity Facility (CLF) to zero by the end of 2022 subject to financial market conditions. (APRA)

NEW ZEALAND: The government has announced a second round of the Covid-19 Resurgence Support Payment. It comes as the government's review of Auckland's alert level setting - due on Monday - draws closer. There were 11 new community cases of Covid-19 reported in New Zealand today. Robertson said a second round of the Resurgence Support Payment will open. "This is a new payment as the Resurgence Support Payment was originally seen as a one-off initiative but it is clear that as heightened alert level restrictions are in place for longer it does put more pressure on businesses." (RNZ)

BOC: MNI: BOC Will Reinvest QE Assets At Least Until it Hikes Rates

- The Bank of Canada is looking to eventually scale back QE purchases to a pace of CAD4 billion to CAD5 billion a month to stabilize the size of its balance sheet against maturing assets, Governor Tiff Macklem said Thursday, and remain in a reinvestment mode at least until policy makers decide to raise the record low policy interest rate. The central bank's current weekly pace of CAD2 billion should be scaled back as the economic rebound makes further progress, Macklem said in a speech, without giving a timeframe or a specific target for the balance sheet. Investors have been betting the BOC will taper QE to CAD1 billion a week at the next meeting in October.

MEXICO: The United States and Mexico restarted high-level economic talks Thursday after a four-year pause as top advisers to presidents Joe Biden and Andrés Manuel López Obrador expressed eagerness to make headway on issues important to both nations such as infrastructure, trade and migration. The talks were launched by Biden in 2013 when he was vice president under Barack Obama but were halted under President Donald Trump, whose hard-line immigration policies complicated the United States' relationship with its top trade partner. (AP)

BRAZIL: Brazilian markets jumped before the close of Thursday trading after President Jair Bolsonaro released a statement aimed at easing tensions with the country's Supreme Court. "I never intended to attack" any branch of government, Bolsonaro said in a statement released by his office. "The harmony between them is not a wish of mine, but a constitutional order that all, without exception, have to respect." Stocks reversed losses to climb as much as 2.6%, while the Brazilian real jumped 1.9%, by far leading gains among emerging-market currencies. Brazilian assets had tumbled on Wednesday after Bolsonaro hurled strong criticism at the Supreme Court and electoral authorities in protests the day before, muddying the country's political and economic outlook. (BBG)

BRAZIL: Some members of President Jair Bolsonaro's cabinet and congress leaders have been working in favor of a proposal to remove court-ordered payments from Brazil's spending cap rule, said two people with knowledge of the matter. Removing court-ordered payments, known as precatorios, from the rule that limits spending paves the way for the government's new social program, said the people, who asked for anonymity because the discussions are not public. Excluding precatorios from the cap prevents spending with court-ordered payments from piling up in subsequent years, creating a snowball effect, said one of the people. (BBG)

AFGHANISTAN: The Taliban plans to invite high-level delegations from China and Russia to Afghanistan, and hopes its own delegation can visit Beijing and Moscow, the Global Times reported citing an interview with spokesman Suhail Shaheen. The Taliban's forces will continue to provide security to the Chinese embassy in Kabul around the clock, Shaheen was cited as saying. The group was in contact with Chinese diplomats when its forces first entered Kabul, the newspaper said citing Shaheen. Shaheen dismissed the criticism of the Taliban's interim government that it is seen as not inclusive and does not represent the diverse ethnic groups in the country, according to the newspaper. The appointment of ministers at this time is to fill the vacuum, many vacant positions will be filled and changes and adjustments are possible before the formal government is set up, the newspaper said citing Shaheeen. (MNI)

LIBOR: A U.S. judge signaled he won't immediately terminate Libor, rejecting an effort by a group of borrowers who argued the benchmark is the product of a "price-fixing cartel." The tentative ruling Thursday by U.S. District Judge James Donato in San Francisco is a win for some of the world's biggest banks, including JPMorgan Chase & Co., Credit Suisse Group AG and Deutsche Bank AG. The banks argued abruptly ending the London interbank offered rate would wreak havoc on financial markets and undermine years of work reforming the reference rate. The plaintiffs, which include 27 consumer borrowers and credit card users, argued Libor is an illegal price-fixing agreement. The lawsuit seeks to prohibit the benchmark, or set it at zero with borrowers repaying capital but not interest. (BBG)

COMMODITIES: Brazilian President Jair Bolsonaro said on Thursday that allied truckers protesting on highways across the country had agreed to stand down on Sunday, a move that could bring significant relief to global commodity markets. (RTRS)

OIL: Royal Dutch Shell Plc, the largest oil producer in the Gulf of Mexico, on Thursday canceled some customer shipments due to damages to offshore facilities from Hurricane Ida, signaling energy losses would continue for weeks. About three-quarters of U.S. Gulf of Mexico's offshore oil output remain halted after Ida tore through in late August. Shell and other oil companies warned they could not yet say when full production would resume. The hurricane was one of the most devastating for oil producers since back-to-back storms in 2005 cut energy output for months. (RTRS)

OIL: Chevron Corp on Thursday said there has been "no significant damage" to its Gulf of Mexico platforms as a result of Hurricane Ida, even as crews continue to work to resume production at other locations that were shut due to the storm. "We have redeployed essential personnel to all six of our Chevron-operated facilities and restored partial production at our Jack St. Malo platform," Chevron said in a statement. Fourchon Terminal has backup power and is operational in a reduced capacity, Chevron said, adding that the terminal is ready to receive barrels from connecting pipelines when Gulf of Mexico assets restart. (RTRS)

OIL: Protests have interrupted crude loadings at Libya's Marsa el-Hariga terminal, in the third disruption at the country's eastern ports this week. Shipping and trade sources said protesters at Marsa el-Hariga refused to allow the berthing and loading of the tanker Mikela P earlier this week, after students had started demonstrations at the terminal demanding work opportunities. Libya's state-owned NOC attempted to defuse the situation by launching a graduate training scheme aimed at providing employment. Marsa el-Hariga typically loads Sarir and Mesla crude produced by eastern NOC subsidiary Agoco. (Argus Media)

OIL: The U.S. Energy Department said on Thursday it has approved a second loan of 1.5 million barrels of oil to Exxon Mobil Corp from the Strategic Petroleum Reserve (SPR) after damage from Hurricane Ida devastated offshore oil production. (RTRS)

CHINA

PBOC: The PBOC is still likely to reduce lenders' reserve requirement ratios to add liquidity, though it may not cut interest rates this year, as the economy is at a reasonable growth range, the Securities Times reported citing analysts. The real interest rate excluding inflation is historically low, and the two-year average GDP in Q3 and Q4 is expected to be around 5.5%, which is close to the potential economic growth rate, the newspaper said citing Wu Chaoming, chief economist at Chasing Securities. PPI, which soared to a 13-year-high of 9.5% in August, is likely to decline by year-end as the basis of comparison rise, and monetary policy should focus on stability without overreacting to prices, the newspaper said citing Wang Jingwen, senior researcher at Minsheng Bank. (MNI)

LIQUIDITY: China's new yuan loans in August may rise to CNY1.3-1.4 trillion from CNY1.08 trillion in July as the PBOC promotes reasonable growth in loan scale, while the aggregate financing may rise to CNY2.5-3 trillion from the previous CNY1.06 trillion, the Securities Daily reported citing analysts. M2 may continue to slow to 8.2% y/y from July's 8.3%, considering the low growth rate of aggregate financing, the newspaper said citing Zhang Yu, chief analysts at Huachuang Securities. M1 may also decelerate to around 4.4% y/y, due to the rapid decline in real estate sales and the contraction of off-balance-sheet financing, the newspaper cited Zhang as saying. (MNI)

OVERNIGHT DATA

NEW ZEALAND AUG CARD SPENDING RETAIL -19.8% M/M; JUL +0.7%

NEW ZEALAND AUG CARD SPENDING TOTAL -21.8% M/M; JUL +0.8%

NEW ZEALAND JUL NET MIGRATION +1,139; JUN +527

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2045% at 09:28 am local time from the close of 2.1553% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 40 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4566 FRI VS 6.4615

The People's Bank of China (PBOC) set the dollar-yuan central parity rate slightly lower at 6.4566 on Friday, compared with the 6.4615 set on Thursday.

MARKETS

SNAPSHOT: Biden & Xi Make Contact

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 313.3 points at 30322.82

- ASX 200 up 46.275 points at 7415.8

- Shanghai Comp. up 15.92 points at 3709.05

- JGB 10-Yr future unch. at 151.88, yield down 0.2bp at 0.041%

- Aussie 10-Yr future up 3.5 ticks at 98.783, yield down 3.5bp at 1.235%

- U.S. 10-Yr future -0-02+ at 133-13+, yield up 1.01bp at 1.307%

- WTI crude up $0.31 at $68.45, Gold up $2.99 at $1797.58

- USD/JPY up 14 pips at Y109.86

- U.S., CHINA LEADERS HOLD CANDID TALKS ON POLICIES (MNI)

- REPUBLICAN LAWMAKERS RAISE ALARM ABOUT U.S. APPROVAL OF AUTO CHIPS FOR HUAWEI (RTRS)

- FED'S BOWMAN ENCOURAGED STILL BY RECOVERY, TAPER LIKELY THIS YEAR (RTRS)

- FED PRESIDENTS KAPLAN & ROSENGREN TO SELL INDIVIDUAL STOCK HOLDINGS TO ADDRESS ETHICS CONCERNS (CNBC)

- ECB POLICYMAKERS AGREED ON PEPP MONTHLY PURCHASE TARGET OF 60-70BN WITH FLEXIBILITY (RTRS SOURCES)

- TORIES TRAILING LABOUR WITH LOWEST BACKING SINCE ELECTION (TIMES/YOUGOV POLL)

BOND SUMMARY: Limited Ranges For Core FI In Asia, Minor Reactions To Biden-Xi Call

The U.S. Tsy space is still relatively unmoved given the lack of clear, positive progress in a Biden-Xi phone call, with the readouts from both sides only providing the broad brushstrokes of the dialogue. Still, the space has cheapened a little on the prospect of increased direct dialogue between the two Presidents, but the moves have been very limited. T-Notes have stuck to a 0-03 range during Asia-Pac dealing, last trading -0-02 at 133-14. Cash Tsys run unchanged to ~1.0bp cheaper on the day, with a marginal steepening bias evident. Broader perception surrounding the Biden-Xi call will be eyed in European & U.S. hours. PPI & a couple of addresses from Fed's Mester headline the local docket on Friday.

- A similar pattern to Thursday's Tokyo trade played out this morning, with JGB futures having a brief look above the overnight high early on, before retracing back into the range observed in post-Tokyo trade. That leaves the contract unch. on the day at typing, with domestic equities ticking higher. Cash JGBs run little changed to 1.0bp richer across the curve, aided by Thursday's richening in U.S. Tsys. Headline flow has been light, with the pricing of Softbank's Y450bn round of subordinated debt issuance getting most of the attention.

- In Australia, the AOFM switched its weekly issuance schedule up a little and will only offer one round of conventional ACGB coupon issuance next week. This will be in the form of A$1.5bn of the ACGB April '33, a slightly longer bond than "normal" with a slightly larger notional on offer vs. the norm in a single auction in recent weeks. Still, the negative RBA purchase-adjusted net issuance dynamic remains well and truly in place. Futures roll activity has dominated (sellers continue to drive activity in both YM & XM rolls), with corporate A$ supply continuing to tick over. YM +2.2 & XM +3.5 after both contracts were better bid in the overnight session. Cash ACGB trade sees the longer end of the curve run ~4.5bp richer on the day, with some bull flattening in play, once again aided by Thursday's move in U.S. Tsys.

JGBS AUCTION: Japanese MOF sells Y4.0618tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0618tn 3-Month Bills:

- Average Yield -0.1174% (prev. -0.1194%)

- Average Price 100.0293 (prev. 100.0298)

- High Yield: -0.1122% (prev. -0.1142%)

- Low Price 100.0280 (prev. 100.0285)

- % Allotted At High Yield: 44.1559% (prev. 6.8248%)

- Bid/Cover: 4.147x (prev. 4.496x)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Tuesday 14 September it plans to sell A$100mn of the 2.50% 20 September 2030 Indexed Bond.

- On Thursday 16 September it plans to sell A$1.0bn of the 26 November 2021 Note & A$1.0bn of the 25 March 2022 Note.

- On Friday 17 September it plans to sell A$1.5bn of the 4.50% 21 April 2033 Bond.

EQUITIES: Bourses Bounce

Asian markets bounced back Friday from the previous day's losses, the Hang Seng led gains rising over 1.5%, the upside was attributed to healthy buying into tech firms that were battered Thursday by China's latest clampdown on the gaming industry, while shares in mainland China also ticked higher with reports coming during the session that US President Biden and his Chinese counterpart Xi had spoken on the phone and agreed to a more open dialogue going forward. Markets in Japan resumed their rally, rising over 1% and on track for a third straight weekly advance. In the US futures are higher, rising after equity markets recorded the worst losing streak since June with the S&P 500 dropping for four straight sessions. European industrial production data features in a quiet early calendar on Friday, however US PPI and Canadian August employment may prompt some action, headlining the US session data docket.

OIL: Crude Futures Higher, On Track For Weekly Loss

After dipping on Thursday crude futures have come off closing lows, benchmarks creeping higher through the Asia-Pac session helped by the greenback dropping into negative territory. Despite the bounce so far in Asia oil markets are on track for weekly losses of over 1%. Oil markets traded in a choppy fashion Thursday, with markets eventually settling lower following reports that China had opened the taps on their national crude reserves in the latest move looking to rein in input costs and temper inflation. Given the frequency with which China have moved to temper metals prices using the same technique, a flattening of the WTI crude futures curve reflected the unease. The China-inspired move lower countered any bullish signals from the weekly DoE inventories data, which showed a sharp mark lower for refinery utilisation - with the lingering impact of Hurricane Ida still weighing on output, Shell earlier declared force majeure on several facilities due to the hurricane.

GOLD: Retest Of $1,800/oz

The combination of a downtick in U.S. real yields and the broader USD has supported bullion over the last 24 hours, although spot has stuck within the confines of Wednesday's range over that horizon. Bulls have failed to establish a real footing back above $1,800/z, with that level being tested at present. The technical overlay remains unchanged, with a lack of meaningful headline catalysts scheduled for Friday's session.

FOREX: Antipodeans Edge Higher After Biden Calls Xi

The White House's statement pointing to a phone call between U.S. President Joe Biden and China's President Xi helped breathe some life into risk appetite in the otherwise quiet Asia-Pac session. The leaders held a "broad, strategic discussion" initiated by President Biden after lower-level talks failed to bring any progress. The news prompted USD/CNH to pierce Thursday's low after an in-line PBOC fix catalysed no material volatility.

- The Antipodeans ticked higher amid improvement in risk sentiment, albeit both AUD/USD and NZD/USD remained within the confines of yesterday's ranges. Slightly firmer crude oil prices may have provided another tailwind to commodity-tied FX.

- JPY was the worst G10 performer. USD/JPY crept higher, despite an earlier downtick into the Tokyo fix and broader USD weakness.

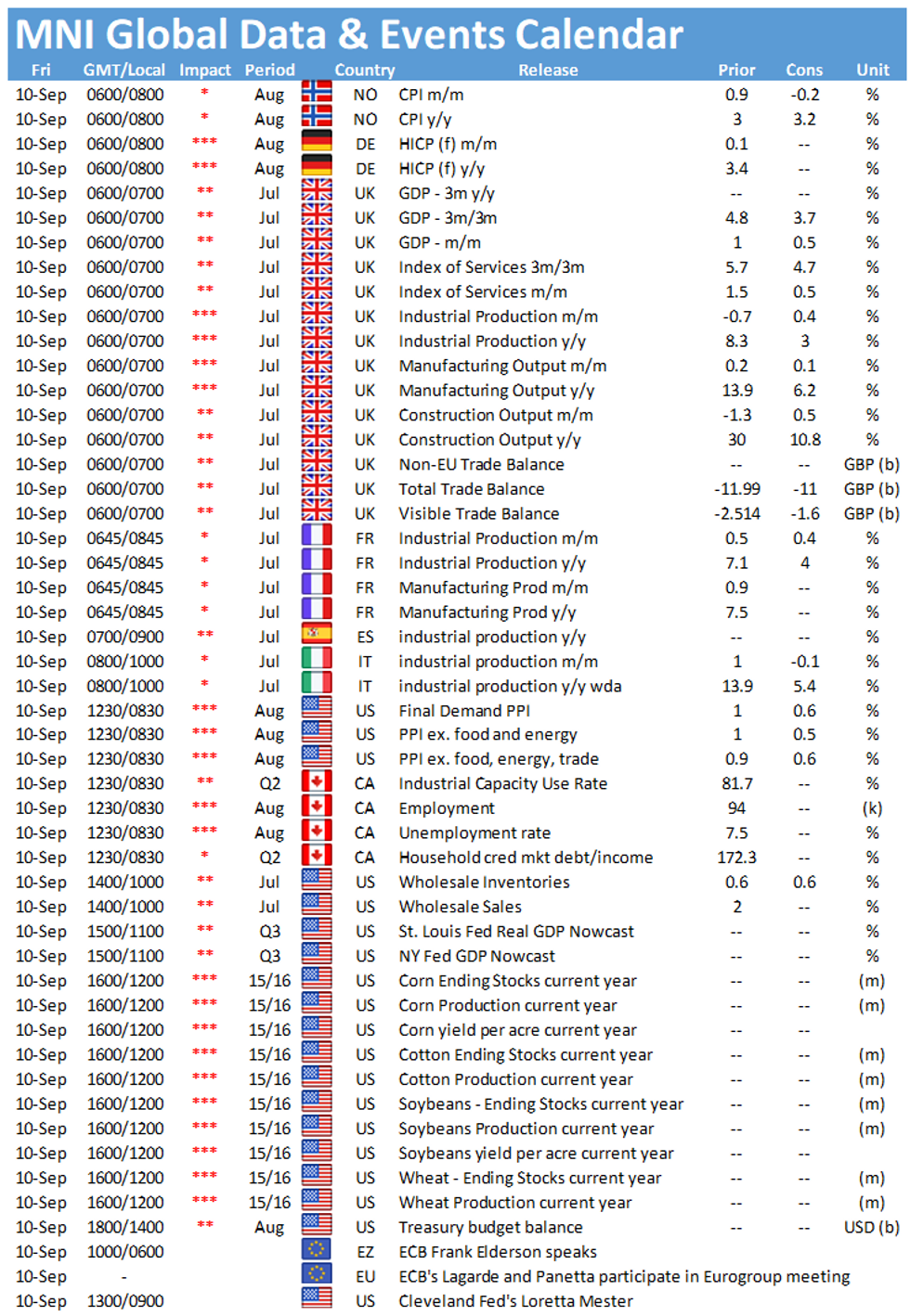

- U.S. PPI and Canadian unemployment take focus on the data front. Central bank speaker slate includes ECB's Lagarde, Villeroy, Elderson & Rehn, the latter of whom will be joined by Fed's Mester.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.