-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: How Will Europe & The U.S. View Biden-Xi Call?

- Limited risk-positive reaction was observed on the back of news re: a Biden-Xi phone call, with the broader European & U.S. digestion of the developments now eyed.

- Regional equities traded on the front foot in Asia-Pac dealing.

- The monthly Canadian labour market report headlines the broader economic docket on Friday, with plenty of ECB speak on the heels of yesterday's meeting and comments from Fed's Mester also due.

BOND SUMMARY: Limited Ranges For Core FI In Asia, Minor Reactions To Biden-Xi Call

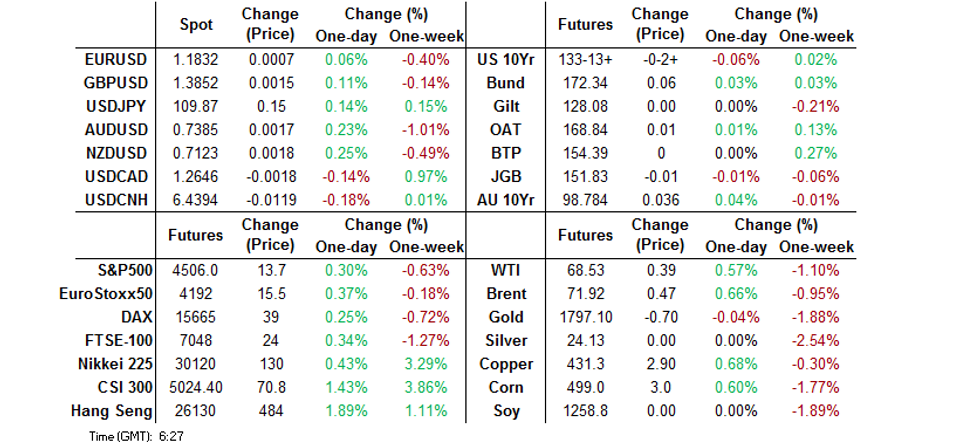

The U.S. Tsy space is still relatively unmoved given the lack of clear, positive progress in a Biden-Xi phone call, with the readouts from both sides only providing the broad brushstrokes of the dialogue. Still, the space has cheapened a little on the prospect of increased direct dialogue between the two Presidents, but the moves have been very limited. T-Notes have stuck to a 0-03 range during Asia-Pac dealing, last trading -0-02 at 133-14. Cash Tsys run unchanged to ~1.0bp cheaper on the day, with a marginal steepening bias evident. Broader perception surrounding the Biden-Xi call will be eyed in European & U.S. hours. PPI & a couple of addresses from Fed's Mester headline the local docket on Friday.

- A similar pattern to Thursday's Tokyo trade played out this morning, with JGB futures having a brief look above the overnight high early on, before retracing back into the range observed in post-Tokyo trade. That leaves the contract unch. on the day at typing, with domestic equities ticking higher. Cash JGBs run little changed to 1.0bp richer across the curve, aided by Thursday's richening in U.S. Tsys. Headline flow has been light, with the pricing of Softbank's Y450bn round of subordinated debt issuance getting most of the attention.

- In Australia, the AOFM switched its weekly issuance schedule up a little and will only offer one round of conventional ACGB coupon issuance next week. This will be in the form of A$1.5bn of the ACGB April '33, a slightly longer bond than "normal" with a slightly larger notional on offer vs. the norm in a single auction in recent weeks. Still, the negative RBA purchase-adjusted net issuance dynamic remains well and truly in place. Futures roll activity has dominated (sellers continue to drive activity in both YM & XM rolls), with corporate A$ supply continuing to tick over. YM +2.2 & XM +3.5 after both contracts were better bid in the overnight session. Cash ACGB trade sees the longer end of the curve run ~4.5bp richer on the day, with some bull flattening in play, once again aided by Thursday's move in U.S. Tsys.

FOREX: Antipodeans Edge Higher After Biden Calls Xi

The White House's statement pointing to a phone call between U.S. President Joe Biden and China's President Xi helped breathe some life into risk appetite in the otherwise quiet Asia-Pac session. The leaders held a "broad, strategic discussion" initiated by President Biden after lower-level talks failed to bring any progress. The news prompted USD/CNH to pierce Thursday's low after an in-line PBOC fix catalysed no material volatility.

- The Antipodeans ticked higher amid improvement in risk sentiment, albeit both AUD/USD and NZD/USD remained within the confines of yesterday's ranges. Slightly firmer crude oil prices may have provided another tailwind to commodity-tied FX.

- JPY was the worst G10 performer. USD/JPY crept higher, despite an earlier downtick into the Tokyo fix and broader USD weakness.

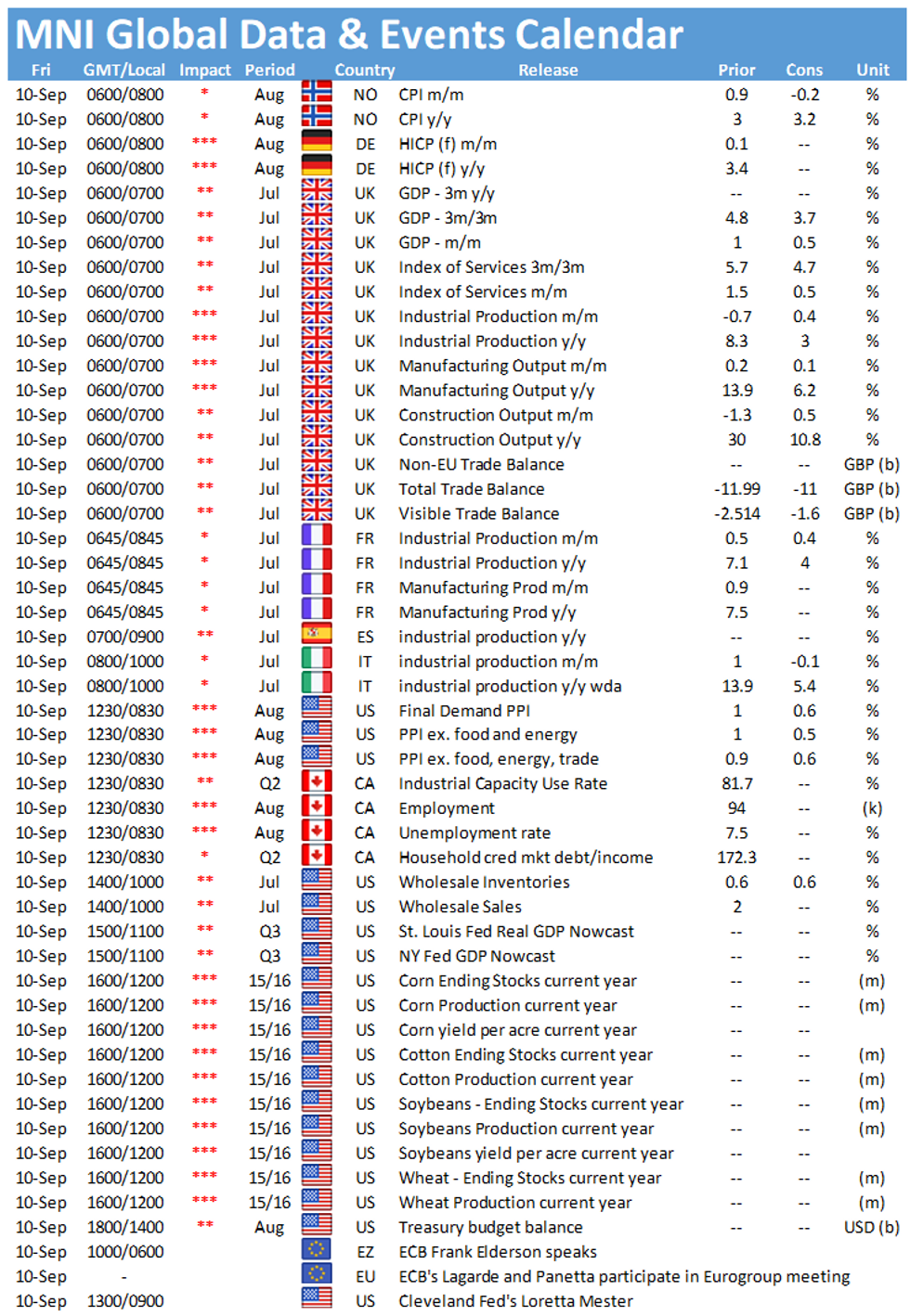

- U.S. PPI and Canadian unemployment take focus on the data front. Central bank speaker slate includes ECB's Lagarde, Villeroy, Elderson & Rehn, the latter of whom will be joined by Fed's Mester.

FOREX OPTIONS: Expiries for Sep10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750-70(E981mln), $1.1800-10(E723mln), $1.1850(E1.4bln), $1.1875-95(E1.5bln)

- USD/JPY: Y110.00-10($1.2bln)

- EUR/JPY: Y130.00(E535mln)

- AUD/USD: $0.7350(A$663mln), $0.7400(A$704mln)

- USD/CAD: C$1.2510-15($886mln), C$1.2690-00($630mln)

ASIA FX: TWD Leads Gains, KRW On Track For Weekly Loss

Risk sentiment was boosted after reports that US President Biden had talked with his Chinese counterpart Xi with a positive outcome, while reports were generic the prospect of increased direct dialogue between the two Presidents supported Asia EM currencies.

- CNH: Offshore yuan is higher, reversing early losses after reports that US President Biden and Chinese President Xi had agreed to a more open dialogue going forward.

- SGD: Singapore dollar gained, despite a rise in coronavirus cases there is an expectation that Singapore will press ahead with its reopening plans.

- TWD: Taiwan dollar rose and was the best performer in Asia. Taiwan received a second shipment of Pfizer-BioNTech Covid-19 vaccines donated by its private sector yesterday. Markets await a sales update from TSMC.

- KRW: Won is slightly stronger, reversing early losses but still on track for a weekly decline. There were 1,892 new cases in the past 24 hours, down from over 2,000 in each of the past two days.

- MYR: Ringgit gained, BNM left the Overnight Policy Rate unchanged at 1.75%, in line with expectations, they were positive on the reopening but noted risks were tilted to the downside. Elsewhere data during the session showed industrial production fell 5.2% in July, a deeper drop than estimated.

- IDR: Rupiah is higher, Indonesia and Australia announced Thursday that they will bolster bilateral cooperation on a number of fronts, including defence ties.

- PHP: Peso rose, Davao Mayor Sara Duterte said that she will no longer seek to succeed her father in 2022 after he announced his vice-presidential bid. Sara Duterte, who was frontrunner in opinion polls, said that they have a family agreement not to run in the same presidential election.

- THB: Baht is slightly higher. PM Prayuth chairs the meeting of Thailand's national Covid-19 task force today. The panel will review the current situation and look into existing control measures

ASIA RATES: China 50-Year Sale Sees Robust Demand

- INDIA: Indian markets closed for Ganesh Chaturthi

- SOUTH KOREA: Futures lower in South Korea, grinding lower from the open as stocks rise while the won has reversed earlier losses. 3-Year future is down 8 ticks at 110.10 while the 10-Year contract is down 41 ticks at 126.66. US/South Korea short end spreads have narrowed after hitting the widest levels since 2015 last week, 2-Year spread last at 116.48bps. There were reports earlier that the MOF has postponed the issuance of the foreign currency-denominated bonds worth up to $1.5 billion to early October from the initially scheduled mid-September. South Korea has record foreign exchange holdings of $463.9bn, while sovereign debt is expected to rise to a record high of KRW 1,068.3tn next year.

- CHINA: The PBOC matched maturities with injections, repo rates within recent ranges. Equity markets rose after reports that US President Biden and Chinese President Xi had agreed to a more open dialogue going forward. Future came off earlier highs and dropped to around neutral levels. The MOF sold 50-Year debt, the sale was well covered despite a ~25bps yield drop from the previous auction. Elsewhere Evergrande's dollar bonds roe as regulators acquiesced to a plan to renegotiate payment deadlines with banks and other creditors.

- INDONESIA: Yields higher, curve flattens in quiet trade. Indonesia and Australia announced Thursday that they will bolster bilateral cooperation on a number of fronts, including defence ties, elsewhere Indonesia's July palm oil stockpiles rose to 4.55m tons from 4.29 million tons in June.

EQUITIES: Bourses Bounce

Asian markets bounced back Friday from the previous day's losses, the Hang Seng led gains rising over 1.5%, the upside was attributed to healthy buying into tech firms that were battered Thursday by China's latest clampdown on the gaming industry, while shares in mainland China also ticked higher with reports coming during the session that US President Biden and his Chinese counterpart Xi had spoken on the phone and agreed to a more open dialogue going forward. Markets in Japan resumed their rally, rising over 1% and on track for a third straight weekly advance. In the US futures are higher, rising after equity markets recorded the worst losing streak since June with the S&P 500 dropping for four straight sessions. European industrial production data features in a quiet early calendar on Friday, however US PPI and Canadian August employment may prompt some action, headlining the US session data docket.

GOLD: Retest Of $1,800/oz

The combination of a downtick in U.S. real yields and the broader USD has supported bullion over the last 24 hours, although spot has stuck within the confines of Wednesday's range over that horizon. Bulls have failed to establish a real footing back above $1,800/z, with that level being tested at present. The technical overlay remains unchanged, with a lack of meaningful headline catalysts scheduled for Friday's session.

OIL: Crude Futures Higher, On Track For Weekly Loss

After dipping on Thursday crude futures have come off closing lows, benchmarks creeping higher through the Asia-Pac session helped by the greenback dropping into negative territory. Despite the bounce so far in Asia oil markets are on track for weekly losses of over 1%. Oil markets traded in a choppy fashion Thursday, with markets eventually settling lower following reports that China had opened the taps on their national crude reserves in the latest move looking to rein in input costs and temper inflation. Given the frequency with which China have moved to temper metals prices using the same technique, a flattening of the WTI crude futures curve reflected the unease. The China-inspired move lower countered any bullish signals from the weekly DoE inventories data, which showed a sharp mark lower for refinery utilisation - with the lingering impact of Hurricane Ida still weighing on output, Shell earlier declared force majeure on several facilities due to the hurricane.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.