-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBA Governor Lowe Pushes Back Against Pricing Of Rate Hikes

EXECUTIVE SUMMARY

- U.S. AUG CPI SEEN ABOVE 5% FOR THIRD MONTH (MNI)

- LORD FROST 'CONCERNED' OVER EU'S NI PROTOCOL COMMENTS (BBC)

- RBA'S LOWE POURS COLD WATER ON SPECULATION OF EARLY RATE INCREASE (DJ)

- EVERGRANDE HIRES RESTRUCTURING ADVISERS AS CRISIS ESCALATES (BBG)

- PBOC MAY ROLL OVER EXPIRING MLF IN SEP, OR INJECT LESS (SEC. DAILY)

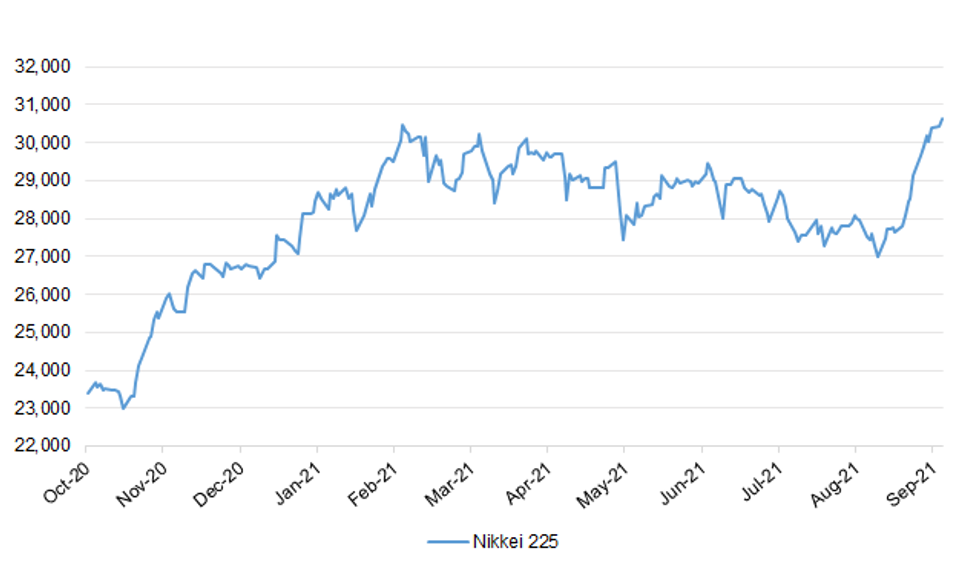

Fig. 1: Nikkei 225

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Six weeks of stalemate between the UK and coronavirus, with little decisive movement in key indicators of infection and disease, are likely soon to end, experts predict. Cases, hospitalisations and deaths are all widely expected to rise following this month's return to school, combined with more social mixing indoors as autumn sets in. Scotland, where schools went back two weeks earlier than in England and Wales, could provide a foretaste of what is to come. According to the Office for National Statistics infection survey, positive tests in Scotland rose to 2.2 per cent of those tested in the week to September 3 — up from just 0.7 per cent a fortnight earlier. However, case numbers suggest that Scottish infections may have peaked. For the past seven weeks the equivalent rate in England has been about 1.5 per cent. (FT)

CORONAVIRUS: Boris Johnson will confirm Tuesday that booster vaccinations against coronavirus will be rolled out to the most vulnerable people this fall, as he sets out the U.K.'s new approach to tackling the virus. The British prime minister will hold a press conference outlining who will be eligible for the booster shot, soon after Health Secretary Sajid Javid gives a statement on the issue to the House of Commons. More details are also expected on which vaccines will be used for the booster program. The government said Monday that 12- to 15-year-olds in England would be offered a single shot of the Pfizer Inc.-BioNTech SE vaccine in schools from next week, in a bid to reduce transmission and keep pupils in classrooms. (BBG)

FISCAL: A tunnel between Scotland and Northern Ireland and a scheme that backs unemployed people to start their own companies have fallen victim to a crackdown as the Treasury grapples with self-imposed public spending limits. Boris Johnson's plan to build "the world's most stupid tunnel" linking Scotland and Northern Ireland — estimated to cost at least £15bn — has been described as "dead" by government officials briefed on spending negotiations ahead of Rishi Sunak's Budget next month. The chancellor gave cabinet colleagues until Monday evening to finalise their bids for public spending and has warned them he wants to "put the public finances on a sustainable path in the medium term". (FT)

BREXIT: Brexit Minister Lord Frost has said he is "concerned" by EU comments which suggests it does not want a "real negotiation" on Northern Ireland. The UK wants fundamental changes to the NI Brexit deal known as the Protocol. European Commission Vice-President Maros Sefcovic has said the EU is looking for further flexibilities but will not renegotiate. Lord Frost said it would be a "significant mistake" to think the UK would not trigger Article 16. That is the part of the Protocol which allows parts of the deal to be temporarily set aside if they are causing "serious economic, societal or environmental difficulties that are liable to persist, or to diversion of trade." Lord Frost said the command paper he published in July sets out that the tests to use Article 16 are met. (BBC)

ECONOMY: Two-thirds of travel sector employers with staff still on the furlough scheme are planning redundancies once the wage support is removed at the end of the month, the travel association ABTA has warned. The body said a survey of its membership showed that 69% of employers planned to let staff go after 30 September. It blamed "overly-cautious" coronavirus restrictions on travel in the UK, saying they had hammered demand during the peak summer season and inflicted huge damage on the industry's chances of recovery as a result. ABTA said that it expected almost 100,000 people in the sector, including airlines, to have either lost their jobs or walked away during the COVID pandemic once the Job Retention Scheme was closed. The figure rose to 226,000 when the employment impact on the supply chain was factored in, its report said. (Sky)

ECONOMY: Nearly 17 per cent of small and medium-sized companies in the UK are at risk of insolvency in the next four years as support from emergency pandemic schemes winds down, research suggests. Euler Hermes, the trade credit insurer, has found that Britain's small businesses are in a more vulnerable position than their counterparts in France and Germany. Only 7 per cent of small and mid-sized businesses in Germany were at risk of failure within four years, and 13 per cent in France. The forecasts were based on three indicators that Euler Hermes said could detect corporate distress up to four years before a bankruptcy is called for: profitability, capitalisation and interest coverage, an indication of how well a business can pay interest due on debts. (The Times)

POLITICS: Sir Keir Starmer will promise a "New Deal for Workers" on Tuesday including a £10 minimum wage, a "right to work flexibly" and a ban on some controversial workplace practices under a future Labour government in the UK. The leader of the main opposition party will use his speech at the annual Trades Union Congress to promise full rights and protections from day one in a job to all workers — including holiday pay, parental leave and protection from unfair dismissal. Starmer will say that the commitment to strengthen employment rights would "reflect changes to the economy and the reality of modern working". The pledges include a ban on "fire and rehire", an end to zero-hours contracts and the right to work flexibly and request shifts that fit around family life. (FT)

EUROPE

FRANCE: France's sooner-than-expected economic recovery from the slump during the Covid-19 pandemic is reviving deep problems in the labor market that have long hobbled growth, the country's central bank said. While activity in the euro area's second largest economy is nearing normal more quickly than the Bank of France forecast in June, with 6.3% growth now expected this year, companies are reporting a sharp rise in hiring difficulties. There are also persistently low employment rates among the oldest and youngest workers. (BBG)

ITALY: Italy's power prices are set to increase by 40% in the third quarter as a global natural gas supply crunch starts to impact the country ahead of the cold season, Ecological Transition Minister Roberto Cingolani said. "These things must be said, we have a duty to face them," Cingolani was reported as saying by Ansa newswire. He noted that the country had already experienced a 20% uptick in electricity prices in the second quarter. The increase is part of a rally across Europe that's set to boost bills for consumers all over the continent. German electricity prices for next year, and the equivalent benchmark in France, have surged to records as European gas inventories aren't rising fast enough for the winter, while global demand increases. (BBG)

SPAIN: Spain will cap gas prices, cut taxes and redirect energy company profits as part of a package to bring down soaring electricity prices, Prime Minister Pedro Sanchez said in an interview on Monday. (RTRS)

NORWAY: Norway's opposition Labor Party is on course to oust the Conservative-led government after two consecutive terms in an election dominated by disputes over the Nordic economy's dependence on fossil fuel. A likely coalition led by Labor, headed by millionaire Jonas Gahr Store, is poised to secure a five-seat majority in the 169-member parliament, according to data on the election authority's website early on Monday, with 98% of votes tallied at least once. (BBG)

U.S.

FED: The architects of the sweeping regulatory legislation adopted after the financial crisis backed Jerome Powell for another term as Federal Reserve chair. Former Democratic Senator Chris Dodd and Representative Barney Frank said Powell's reappointment would provide "strong support" for President Joe Biden's comprehensive program for tackling the underlying social and economic problems facing the U.S. (BBG)

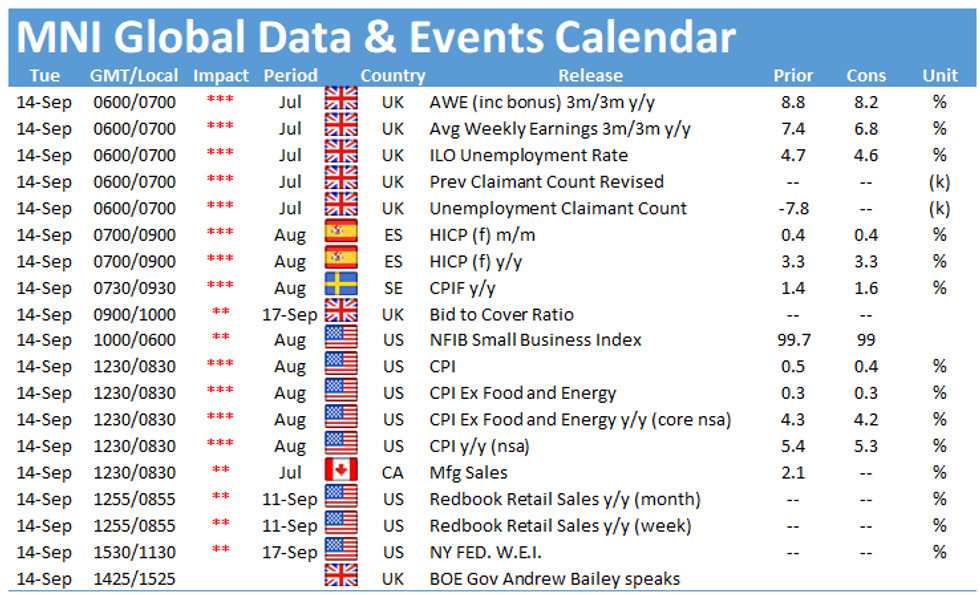

ECONOMY: MNI BRIEF: U.S. Aug Y/Y CPI Seen Above 5% for Third Month

- Annualized CPI growth in August is set to dip just slightly to 5.3% from 5.4% in July, according to Bloomberg, marking the third straight month of year-over-year CPI readings above 5%. Monthly CPI is set to increase 0.4% following a marginally stronger 0.5% gain in July. Analysts say August's increase is likely to be driven by gains in gasoline and food prices, though wage increases earlier in the year and ongoing supply chain disruptions may also push up inflation. Excluding food and energy prices, CPI should increase 0.3%, according to Bloomberg. From a year earlier, core CPI is expected to rise 4.2% compared to 4.3% in July - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: MNI BRIEF: US Budget Deficit Narrows to USD2.71T Thru August

- The U.S. has rung up a USD2.711 trillion budget deficit in the first eleven months of the fiscal year, smaller than the previous period last year, despite another USD171 billion deficit in August, the Treasury Department said Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: House Democrats said they will "undo" the $10,000 cap on the federal deduction for state and local taxes, after the Ways and Means Committee didn't address the tax break in a package of proposals released Monday. Ways and Means Chairman Richard Neal in a joint statement with Representatives Tom Suozzi of New York and Bill Pascrell of New Jersey said the committee's tax plan was not the final step for legislation to enact President Joe Biden's agenda. They called the SALT limit enacted in the Republican's 2017 tax law "short-sighted." (BBG)

CORONAVIRUS: Drugmaker Merck & Co Inc said on Monday it sees potential U.S. emergency use authorization for its experimental COVID-19 antiviral treatment, molnupiravir, before year-end. (RTRS)

POLITICS: Gavin Newsom is the second California governor to ever face a recall election and is likely to be the first to survive one. All eyes are on the Golden State ahead of Tuesday's recall election, a fast-approaching deadline for registered voters in California to vote by mail or in person. The Democratic governor has spent months vigorously campaigning against the recall effort, which he has characterized as a radical GOP power grab that has left his career and California's future hanging in the balance. (CNBC)

POLITICS: Senior Senate Republicans on Monday threatened to indefinitely hold up the nominations of five top U.S. Treasury Department officials if the Biden administration doesn't blacklist the firm managing Russia's Nord Stream 2 pipeline project. Sen. Pat Toomey (R., Pa.) and Ted Cruz (R., Texas) said they are prepared to approve the nominations, including two national security posts that oversee sanctions and counterterror finance, if the Treasury Department blacklists Russia-owned Nord Stream 2 AG. (WSJ)

EQUITIES: Apple Inc. said it patched a security flaw in the Messages app across all of its major devices that security researchers say was actively exploited by Israel-based NSO Group. The flaw, disclosed Monday by Citizen Lab, allowed a hacker using NSO's malware Pegasus to gain access to a device owned by a Saudi activist, according to security researchers. Apple said the flaw could be exploited if a user on a vulnerable device received a "maliciously crafted" PDF file. The malware didn't require victims to engage with the file. Receiving it was enough to infect their devices, according to a report released by Citizen Lab, a cyber-research unit of the University of Toronto. (BBG)

OTHER

U.S./CHINA/TAIWAN: The Global Times tweeted the following on Monday: "The US and Taiwan have continued to increase the mainland's cost of maintaining peace in the Taiwan Straits. The Taiwan question is getting very close to the tipping point." (MNI)

U.S./CHINA/TAIWAN: U.S. and Taiwan will hold first TIFA working group meeting on Sept. 15 to discuss issues relating to agriculture, Taipei-based Central News Agency reports, citing unidentified officials. Taiwan hopes to expand exports of agricultural products to U.S. market. (BBG)

GEOPOLITICS: U.S. President Joe Biden will host a first in-person summit of leaders of the "Quad" countries - Australia, India, Japan and the United States - which have been seeking to enhance cooperation to push back against China's growing assertiveness. (RTRS)

GEOPOLITICS: The European Union will seek new digital partnerships with Japan, South Korea and Singapore, and closer trade and investment relations with Taiwan in an effort to build influence in Asia after the chaotic western military exit from Afghanistan. (Nikkei)

CORONAVIRUS: President Biden plans to call on global leaders to make new commitments to fight the coronavirus pandemic, including fully vaccinating 70 percent of the world's population by next September, according to a list of targets obtained by The Washington Post. The goals were shared with global health leaders ahead of a virtual summit the White House is scheduled to convene next week, positioning the event as an opportunity to set worldwide objectives to end the pandemic. The targets, which draw on similar goals laid out by the World Health Organization and other global health experts, include providing billions of dollars in tests, oxygen and other supplies to developing countries, and setting up a financing system to pay for the global health response by next year. (Washington Post)

CORONAVIRUS: Covid-19 vaccines work so well that most people don't yet need a booster, an all-star panel of scientists from around the world said in a review that's likely to fuel debate over whether to use them. Governments would be better served to focus on immunizing the unvaccinated and to wait for more data on which boosters would be most effective and at what doses, the authors, who included two prominent U.S. Food and Drug Administration experts, argued in the medical journal The Lancet. They based their assessment on a wide range of real-world observational studies as well as data from clinical trials. (BBG)

CORONAVIRUS: France has experienced what its health regulator ANSM called an "important number" of breakthrough cases among those who received Johnson & Johnson's vaccine. France, which has administered about 1 million doses of J&J's Janssen vaccine so far, has seen 32 breakthroughs, 29 of which were severe cases, according to a report from ANSM Monday. Four people died of Covid-19 after getting the vaccine, the regulator said. ANSM is conducting further investigations. (BBG)

JAPAN: Japan looks to provide COVID-19 inoculations to everyone who wants the shots by October or November, reaching a vaccination rate of about 80%. (Nikkei)

JAPAN: Yomiuri reports that former Japanese Defence Minister Shigeru Ishiba will resign from running in the LDP leadership race and is expected to announce his decision at a meeting of his faction tomorrow. The newspaper cited people close to Ishiba as noting that he will back Taro Kono. The recent opinion polls showed that Ishiba was the second most popular candidate for LDP leader and Prime Minister, trailing only Kono. The news that Ishiba won't be throwing his hat in the ring comes as no surprise, as a number of source report circulated over the last week or so suggested as much. Asahi reported that Kono visited Ishiba in his office yesterday to ask for support. Kono left after around 20 minutes, while Ishiba relayed that he did not give a definite answer. Meanwhile, Yomiuri reported that the LDP faction led by Finance Minister Taro Aso remains split on whether to back Kono, although he is a member. Some members of the Aso faction are reportedly inclined to support Kishida's bid. (BBG)

JAPAN: Japanese environment minister Shinjiro Koizumi will back vaccine minister Taro Kono in the ruling Liberal Democratic Party leadership election, the Yomiuri newspaper reports, citing an unidentified party official. Koizumi will announce his support for Kono at a news conference he'll hold Tuesday. (BBG)

JAPAN: Japanese Finance Minister Taro Aso tells reporters that the government should ease restrictions to contain the virus whenever and however it's possible. The economy can't grow unless consumers are able to spend more. Sentiment has to improve so that people feel comfortable spending and don't just sock money away. Corporations also need to give a greater share of income to workers for the economy to grow. Companies should also use their growing pile of retained earnings for investment, he says. (BBG)

BOJ: MNI INSIGHT: BOJ To Explain Lower Phone Cost Impact On CPI

- The Bank of Japan aims to clearly communicate that a drop in consumer prices to near zero because of lower mobile phone costs is temporary and does not reflect the underlying firm forecast trend, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's capital Canberra will extend its lockdown until at least Oct. 15, after recording 22 new cases of Covid-19 Tuesday. The territory entered lockdown in early August after detecting one Covid-19 case, as the delta outbreak that's roiling Sydney spread. Residents of Canberra, Melbourne and Sydney, totaling almost half the Australian population, are all enduring prolonged lockdowns as health authorities scramble to increase the vaccination rate before easing restrictions. New South Wales, the most populous state, recorded an additional 1,127 cases, decreasing the 7-day moving average to its lowest in a week. (BBG)

RBA: Reserve Bank of Australia Gov. Philip Lowe, on Tuesday moved to strongly push back on current market pricing suggesting the central bank could raise interest rates as early as late 2022, saying the bank's desired wages and inflation targets remain a long way off. Mr. Lowe also poured cold water on the idea that the RBA would raise interest rates soon to rein in runaway house-price growth. "These expectations are difficult to reconcile...I find it difficult to understand why rate rises are being priced in next year or early 2023," he said in a speech to market economists. "While policy rates might be increased in other countries over this timeframe, our wage and inflation experience is quite different," Mr. Lowe said. The comments firmly reinforce the RBA's policy guidance that interest rates won't be raised until 2024 at the earliest and cement its intention to be viewed as among the last of the central banks globally to raise interest rates. (Dow Jones)

SOUTH KOREA: President Moon Jae-in said Tuesday South Korea will be able to achieve the goal of offering at least the first COVID-19 vaccine shot to 36 million people ahead of the Chuseok holiday next week. "The first dose of vaccine inoculation for 36 million people in advance of Chuseok will be achieved this week as (the government) has promised," he said during a weekly Cabinet meeting. Vaccinations will further pick up speed, going forward, to get 80 percent of all South Koreans, totaling 52 million, inoculated at least once and reach a 90 percent of inoculation rate for those aged 18 or older, he added. (Yonhap)

NORTH KOREA: The United States remains prepared to engage with North Korea, a White House spokeswoman said on Monday, despite Pyongyang's announcement that it had tested a new long-range cruise missile over the weekend. (RTRS)

BRAZIL: Brazil runs a low risk of an outburst in spending next year if both the spending cap and the fiscal responsibility law are respected, National Treasury Secretary Jeferson Bittencourt told in a virtual event. Treasury sees a law amendment as the best solution for court-ordered payments, known as precatorios. An alignment between the three branches of govt is key to discuss the issue of court-order payments, he added. Brazil seeks to issue more fixed-rate bonds. Goal is not to increase significantly the offer of Selic-linked bonds. (BBG)

BRAZIL: The U.S. Centers for Disease Control and Prevention lowered its Covid-19 travel advisory for Brazil by one notch as the pandemic wanes in Latin America's largest economy. Brazil is now ranked as level 3, or "high," according to an update posted on the agency's website Monday. Travelers are still advised to avoid nonessential trips to the country, and to make sure they are fully vaccinated if they do visit. The CDC had been recommending travelers avoid Brazil since at least May, according to a Bloomberg analysis. (BBG)

SOUTH AFRICA: South African Finance Minister Enoch Godongwana warned leaders of the ruling African National Congress that the party's project wish list could cost 73.5 billion rand ($5.2 billion) and funding it will require difficult trade offs. Big-ticket items that would place pressure on state finances included spending 10 billion rand on a state bank, Godongwana, who also serves as the ANC's head of economic transformation, said in a presentation that was delivered to a Sept. 4-6 party meeting and seen by Bloomberg. The government will also have to come up with 19.6 billion rand for increases for state workers, possibly by cutting jobs, and need 4.6 billion rand to forgive unpaid highway tolls in the central Gauteng province, he said. (BBG)

SOUTH AFRICA: Plans to build a manufacturing facility to produce Russia's Sputnik V Covid-19 vaccine in Cape Town could be scuppered because the country's medicines regulator has not given the shot emergency authorization, Johannesburg-based Business Day reported, citing local backers of the plan. (BBG)

MIDDLE EAST: The United States' chaotic withdrawal from Afghanistan has raised questions for its Arab allies in the Middle East about whether or not they can continue to rely on Washington, a senior Gulf Arab official said on Monday. (RTRS)

RATES: Bank of America has started marketing the first leveraged loan tied to the interest rate that is set to replace Libor, in a milestone for the industry as it transitions away from the disgraced lending benchmark. The US bank has helped tee up a $3.25bn financing package that includes a $750m syndicated loan based on Sofr — the secured overnight financing rate — to fund the $4.5bn takeover of chicken producer Sanderson Farms by Cargill and Continental Grain, according to people involved in the transaction. (FT)

OIL: Over 40% of the U.S. Gulf of Mexico's production of crude and natural gas remained shut on Monday two weeks after Hurricane Ida wreaked havoc in Louisiana, the regulator Bureau of Safety and Environmental Enforcement (BSEE) said. (RTRS)

OIL: Prime Minister Justin Trudeau's promise to reduce Canada's oil sector emissions starting in 2025 looks unlikely to slow the growth of crude production, environmental activists and oil companies say, raising questions about how effectively the pledge will help meet the country's goals to slow climate change. (RTRS)

CHINA

PBOC: PBOC will probably choose to roll over its MLF facility in Sept. at an amount below the value of loans coming due, Securities Daily reports, citing Tao Jin, a researcher at Suning.com's financial research unit. Liquidity is ample after earlier RRR cut so there's no need to increase mid- to long-term liquidity, report Tao as saying, adding he expects no change in MLF rate this month. Liang Si, a researcher at Bank of China's research institute, is cited by Securities Daily as saying PBOC will likely continue using open market operations to inject liquidity and roll over MLF at the same amount as loans coming due. (MNI)

FISCAL: China should ease the market's concerns for slowing credit demand by issuing more local government bonds and loans, the China Securities Journal said citing analysts including Ming Ming of Citic Securities. China's subsequent local debt-raising this year is expected to significantly rise and all the additional quotas this year will be used up, the newspaper said citing Ming. Fiscal policies are expected to actively spur infrastructure building and the real economy's demand for financing, said the newspaper. China's monetary policy is tilting toward targeted reductions in RRRs and rates to lower businesses' financing costs and bridge liquidity shortages due to renewing MLFs, the newspaper said. (MNI)

ECONOMY: China's manufacturing investment is expected to grow about 12% y/y in 2021, with the two-year average growth likely at 5%, the Economic Information Daily said. Manufacturing investment will recovery steadily, as more policy supports help buiding advanced manufacturing and low-carbon transformation and ease the rising costs of raw materials for smaller manufacturers, the newspaper said. Cuts to taxes and fees, as well as financing supports, will be further strengthened, the newspaper said The central bank has made certain that it will provide more credit to support the real economy and strengthen investments in manufacturing and infrastructure, said the daily. Official data reported that manufacturing investment grew 17.3% y/y for the first seven months. (MNI)

LGFVS: More investment entities owned by China's local governments are being downgraded, raising concerns for greater financial risks, as the business environment gets tougher and some regional economies face greater challenges, the 21st Century Business Herald reported. As of Sept. 13, 27 LGFVs this year have been downgraded, more than doubling the number from the same period last year, while the number of entities that got upgrade dropped 87% y/y, the newspaper said. Those that got upgraded ratings received external support including local government's free transfer of assets, capital injection, special funds and financial subsidies, the newspaper said. (MNI)

CREDIT: China Evergrande Group issued a dire assessment of its financial health, saying it faces "tremendous" liquidity strains and has hired advisers for what could be one of the country's largest-ever debt restructurings. The appraisal was Evergrande's most downbeat since market confidence in the developer began deteriorating in May, and followed a spate of protests over the past week by angry homebuyers, retail investors and employees demanding that the company make good on its obligations. (BBG)

CORONAVIRUS: New local COVID-19 infections more than doubled in China's southeastern province of Fujian, health authorities said on Tuesday, prompting officials to quickly roll out measures including travel restrictions to halt the spread of the virus. The National Health Commission said 59 new locally transmitted cases were reported for Sept. 13, up from 22 infections a day earlier. All of them were in Fujian. (RTRS)

OVERNIGHT DATA

JAPAN JUL, F INDUSTRIAL OUTPUT +11.6% Y/Y; FLASH +11.6%

JAPAN JUL, F INDUSTRIAL OUTPUT -1.5% M/M; FLASH -1.5%

JAPAN JUL CAPACITY UTILISATION -3.4% M/M; JUN +6.2%

AUSTRALIA AUG NAB BUSINESS CONFIDENCE -5; JUL -7

AUSTRALIA AUG NAB BUSINESS CONDITIONS 14; JUL 10

Both conditions and confidence saw a small improvement in the month, though the latter remains well into negative territory, reflecting a sharp deterioration in Victoria and more generally, the degree of uncertainty in the economy as lockdowns persist and the timing of a full re-opening remains unknown. That said, business conditions are still elevated – and rebounded in both NSW and SA in the month – and remain well above average in all states. While there has clearly been some deterioration in the survey from early 2021, the deterioration in confidence and conditions, as well as capacity utilisation has not been as severe as early 2020 despite the severity and duration of lockdowns in the two largest states. In addition, forward orders are back to being well above average and capex despite pulling back from the levels seen in early 2021 is around average. The resilience of the survey during the current episode likely reflects the healthy momentum in the economy before the lockdowns, ongoing fiscal and monetary support as well as greater certainty that the lockdowns will end as vaccines roll out. While we expect a large hit to activity in Q3, the survey supports our view that once restrictions are eased, activity will rebound. Beyond the rebound, healthy business investment and hiring will need to be maintained to see ongoing growth in the economy – and for now, investment intentions and job vacancies continue to point to ongoing growth. (NAB)

AUSTRALIA Q2 HOUSE PRICE INDEX +16.8% Y/Y; MEDIAN +14.0%; Q1 +7.5%

AUSTRALIA Q2 HOUSE PRICE INDEX +6.7% Q/Q; MEDIAN +6.1%; Q1 +5.4%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 103.1; PREV. 100.0

Consumer confidence gained 3.1% last week, driven by a huge jump of 10.6% in Sydney as the NSW government released its roadmap out of lockdown. With close to 47% of NSW's adult population already fully vaccinated, this roadmap is expected to take effect by mid-October. That is, once the number reaches 70%. Confidence increased by 6.2% in Victoria, while it fell 3.2% in Queensland as new cases emerged in the state last week. Household inflation expectations have been quite volatile in the past few weeks, rising sharply then dropping back. Our research indicates that expectations tend to follow developments in petrol prices and the headline CPI. With these appearing to have peaked, we may be at a level where expectations stabilise. (ANZ)

NEW ZEALAND AUG REINZ HOUSE SALES -26.5% Y/Y; JUL -11.7%

SOUTH KOREA AUG EXPORT PRICE INDEX +18.6% Y/Y; JUL +17.4%

SOUTH KOREA AUG EXPORT PRICE INDEX +1.0% M/M; JUL +3.9%

SOUTH KOREA AUG IMPORT PRICE INDEX +21.6% Y/Y; JUL +19.5%

SOUTH KOREA AUG IMPORT PRICE INDEX +0.6% M/M; JUL +3.6%

SOUTH KOREA JUL MONEY SUPPLY L +0.9% M/M; JUN +0.9%

SOUTH KOREA JUL MONEY SUPPLY M2 +0.9% M/M; JUN +0.8%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2338% at 09:25 am local time from the close of 2.2195% on Monday.

- The CFETS-NEX money-market sentiment index closed at 54 on Monday vs 40 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4500 TUES VS 6.4497

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4500 on Tuesday, compared with the 6.4497 set on Monday.

MARKETS

SNAPSHOT: RBA Governor Lowe Pushes Back Against Pricing Of Rate Hikes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 157.41 points at 30600.26

- ASX 200 up 6.092 points at 7431.3

- Shanghai Comp. up 1.885 points at 3717.257

- JGB 10-Yr future down 6 ticks at 151.73, yield down 0.3bp at 0.046%

- Aussie 10-Yr future up 0.9 ticks at 98.706, yield down 0.9bp at 1.264%

- U.S. 10-Yr future -0-04 at 133-05+, yield up 1.01bp at 1.336%

- WTI crude up $0.45 at $70.90, Gold down $2.91 at $1790.85

- USD/JPY up 8 pips at Y110.07

- U.S. AUG CPI SEEN ABOVE 5% FOR THIRD MONTH (MNI)

- LORD FROST 'CONCERNED' OVER EU'S NI PROTOCOL COMMENTS (BBC)

- RBA'S LOWE POURS COLD WATER ON SPECULATION OF EARLY RATE INCREASE (DJ)

- EVERGRANDE HIRES RESTRUCTURING ADVISERS AS CRISIS ESCALATES (BBG)

- PBOC MAY ROLL OVER EXPIRING MLF IN SEP, OR INJECT LESS (SEC. DAILY)

BOND SUMMARY: Cross Currents In Asia, Lowe Plays Down Market Pricing Re: Rate Hikes

A fresh multi-decade high for the Nikkei 225 helped apply modest pressure to U.S. Tsys during early Asia-Pac dealing, with some feedthrough from the Aussie bond space also evident. A couple of pockets of TY screen selling added to the downward pressure, although the contract stuck to a 0-05 range, recovering from worst levels as ACGBs turned bid to last trade -0-03 at 133-06+. Meanwhile, cash Tsys trade little changed to ~1.0bp richer on the day, with 5s outperforming. The latest round of U.S. CPI data dominates the NY docket on Tuesday.

- The uptick in the Nikkei 225 applied some light pressure to JGB futures, with the contract last 6 ticks below yesterday's settlement levels. Cash JGB trade sees the major benchmarks trading either side of unchanged out to 20s, within -/+0.5bp boundaries of yesterday's closing levels after initially benefitting from the overnight richening in U.S. Tsys. 30s & 40s print ~0.5bp cheaper on the day. The space seemed to look through a well-received 5- to 15.5-Year liquidity enhancement auction covering off-the run JGBs.

- RBA Governor Lowe's explicit push back against market pricing of rate hikes in '22 & '23 has promoted some outperformance in the front end of the ACGB curve, with YM +3.6 and XM +0.9 at typing (quoting the Dec '21 contracts). The comments also allowed the IR strip to flatten. Elsewhere, Lowe pointed to the potential for a cessation of bond purchases in '22. He also outlined the reasoning behind moving ahead with tapering at the Bank's September decision, in addition to adjusting the meeting where the RBA will reconsider its bond purchase rate to Feb '22. The thoughts were largely in line with the broader groupthink expressed in the wake of the decision i.e. gives the time bank to assess the economic impact of re-opening, addresses any COVID-related delay of reaching RBA goals and provides some insurance against downside risks. The uptick in the Nikkei 225 and syndication of a new 30-Year NZGB across the Tasman had applied some pressure to the space earlier in the day.

JGBS AUCTION: Japanese MOF sells Y497.2bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y497.2bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.002% (prev. -0.003%)

- High Spread: -0.001% (prev. -0.001%)

- % Allotted At High Spread: 7.8033% (prev. 42.2043%)

- Bid/Cover: 4.242x (prev. 3.104x)

AUSSIE BONDS: The AOFM sells A$100mn of the 2.50% 20 Sep ‘30 I/L Bond, issue #CAIN408:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 2.50% 20 September 2030 I/L Bond, issue #CAIN408:

- Average Yield: -0.8400% (prev. -0.9102%)

- High Yield: -0.8350% (prev. -0.9050%)

- Bid/Cover: 4.0400x (prev. 4.2700x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 38.5% (prev. 66.7%)

- Bidders 32 (prev. 35), successful 5 (prev. 13), allocated in full 2 (prev. 10)

EQUITIES: Mixed Overnight

The Nikkei 225 tagged fresh multi-decade highs on Tuesday, benefitting from positive reports surrounding the domestic COVID vaccine drive in Japan and expectations surrounding post-election stimulus. Elsewhere, it was China Evergrande that continued to steal the headlines, with the giant property developer flagging further risks and headwinds to company operations, while it confirmed that it has hired restructuring advisors to explore avenues out of its multitude of problems. The CSI 300 and Hang Seng both trade a little below unchanged levels. U.S. e-minis added incrementally to Monday's rally. Participants are zeroed in on Tuesday's U.S. CPI print.

OIL: A Little Firmer

WTI & Brent futures have added ~$0.40 to settlement levels, building on 2 sessions of gains. Monday's rally was aided by the continued issues re: getting U.S. Gulf supply back online in the wake of hurricane Ida, with a bullish sell-side note from Goldman Sachs no doubt helping the bid. The U.S. Gulf dynamic is feeding into the tight supply mantra, and the impact on prices was compounded by the latest OPEC report, released Monday, which revealed an uptick in the cartel's global demand forecasts. The latest round of weekly API crude inventory estimates will headline on Tuesday.

GOLD: U.S. CPI Eyed As Gold Coils

Gold has meandered through the early rounds of trade this week, with spot continuing to print around $1,790/oz. That leaves the technical overlay as it was, with firm support at the Aug 19 low ($1,774.5/oz), while firm resistance is located at the July 15 high ($1,834.1/oz). Tuesday's U.S. CPI print provides the next notable input for participants.

FOREX: Aussie Goes Offered On Lowe's Comments

AUD sold off as RBA Gov Lowe delivered a speech on "Delta, the Economy and Monetary Policy," in which he downplayed market pricing pointing to a rate hike in '22 & '23, reaffirming the Bank's well-trodden guidance. A BBG trader source suggested that short-term accounts initiated AUD/USD shorts in the lead-up to Lowe's address.

- NZD faltered on the back of apparent trans-Tasman spillover. The latest house sales data from REINZ showed that activity in New Zealand's property market took a hit from lockdowns in August, but median prices continued to rise reaching record highs.

- JPY softened into the Tokyo fix and remained on the back foot, as Japanese equity benchmarks traded in the green. Japanese headline flow was dominated by political headlines related to the ongoing LDP leadership race.

- U.S. CPI headlines today's global data docket, with UK labour market report also due. A round of comments from BoE Gov Bailey is eyed.

FOREX OPTIONS: Expiries for Sep14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1745-55(E1.1bln), $1.1835(E1.1bln), $1.1900-25(E1.2bln)

- AUD/USD: $0.7340-45(A$1.0bln)

- USD/CAD: C$1.2600-10($747mln), C$1.2650($661mln)

- USD/CNY: Cny6.4390($600mln), Cny6.5000($532mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.