-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Infrastructure Impasse Remains Evident On The Hill, E-Minis Fall

EXECUTIVE SUMMARY

- INFRASTRUCTURE VOTE DELAYED, DEMOCRATS STRUGGLE TO SAVE BIDEN $3.5T BILL (AP)

- YELLEN HINTS AT A 'FEW DAYS' OF ROOM AFTER DEBT-LIMIT DEADLINE (BBG)

- MANCHIN DEMANDS FED END ASSET PURCHASES (YAHOO FINANCE)

- U.S. CONGRESS AVERTS SHUTDOWN, SENDS 9-WEEK FUNDING PATCH TO BIDEN'S DESK (POLITICO)

- U.S. HOUSE PANEL PLANS OCT. 26 HEARING ON CHINA LISTINGS IN U.S. (BBG)

- OPEC+ CONSIDERS OPTIONS FOR RELEASING MORE OIL TO THE MARKET (RTRS SOURCES)

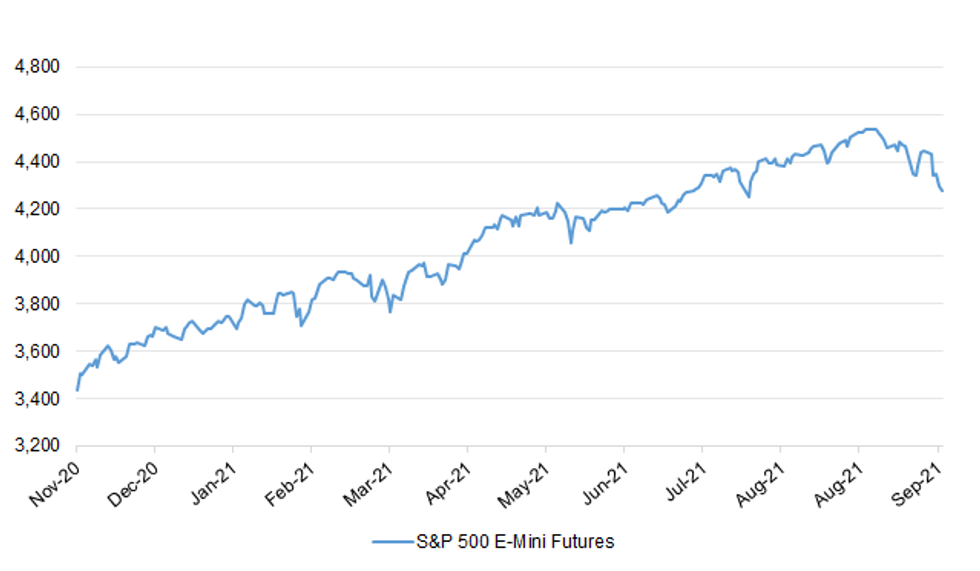

Fig. 1: S&P 500 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: Britain's business minister Kwasi Kwarteng said fuel levels at gas stations across the country were trending up and data suggested that a problem with shortages was stabilising. "Data suggests we are continuing to see signs that the situation at the pumps is stabilising and in all parts of the UK forecourt stock levels are trending up," he wrote on Twitter. (RTRS)

ENERGY: There has been no improvement in petrol supplies at independent petrol stations since Wednesday, according to industry body the Petrol Retailers Association. The PRA, which represents independent fuel retailers, said that more than a quarter (27%) of its members' were still out of fuel on Thursday. That was better than the 37% which were out of fuel on Tuesday, but demand remained higher than usual, it said. However the AA said it saw signs that the pressure was starting to ease. (BBC)

ECONOMY: Retail bosses have accused the government of failing to avert the lorry driver crisis and described its plan for short-term visas as "doomed to fail". They warned of shortages at Halloween and Christmas. One supermarket chief executive said that the government needed to stop "dicking about" and expand its plan to bring in 5,000 drivers from Europe for a three-month period. "The prime minister is being badly advised about drivers. We need many, many more than 5,000 to stem the issues in the short term," the chief executive, who wished to remain anonymous, said. "Three months is ridiculous. Why put a number or a timeframe on it when it's not relevant and by next autumn market forces will have kicked in?" (The Times)

ECONOMY: The government's coronavirus furlough scheme ends today after supporting millions of workers during the pandemic. Ministers say the wages of more than 11 million jobs were subsidised for at least some of the scheme's duration, at a cost of about £70bn. There is now uncertainty over the almost one million people still thought to be on the scheme at the end of September, according to Office for National Statistics (ONS) estimates. Meanwhile, job vacancies in the UK have hit a record of more than a million, according to recent ONS data, with openings in the hospitality and transport sectors up more than 75% in three months. Chancellor Rishi Sunak said the government is "not done supporting people" despite the ending of furlough and the removal of the temporary Universal Credit uplift. Chief Secretary to the Treasury Simon Clarke told Sky News' Kay Burley: "There is a lot of opportunity out there for people now. There's never an easy moment to end these measures. "They've been hugely important but it is also time to recognise that we are now, thankfully, out of the teeth of this pandemic... and we're in a situation where normal opportunity is back out there for people to embrace." However, he added: "There will be some job losses but there are also these one million vacancies in the labour market for people to move towards and a huge range of support to help them do that." Economists say there is likely to be a rise in unemployment due to new redundancies, despite the fact some may be able to find work in recovering sectors such as travel and hospitality. (Sky)

ECONOMY: U.K. directors are the least optimistic about the economy since the height of the winter lockdown after confidence "fell off a cliff" in September, a business lobby warned. With energy and tax bills spiking, a fuel crisis biting and government support for workers being withdrawn, people running small and medium-sized businesses are broadly negative about the economic outlook for the first time since February, according to an Institute of Directors survey released Thursday. That's in contrast to a surge in confidence during the summer. Three-quarters of directors are bracing for higher costs in the next 12 months, little more than half predict higher revenue and firms expecting to increase business investment are in a minority. The responses illustrate the storm clouds gathering over the recovery, with consumers also turning worried in the face of a looming squeeze on living standards. (BBG)

FISCAL: Conservative MPs in "red wall" seats have urged the chancellor to cut business rates, days after Labour announced it would abolish the tax and overhaul the system. Tory MPs who won seats in 2019 in Labour's northern heartlands, including Bishop Auckland's Dehenna Davison, Leigh's James Grundy and Lee Anderson from Ashfield, said high street shops were most at risk of closure in seats that Boris Johnson had promised to prioritise with levelling up. There have long been calls to reform business rates, which raise revenues of about £25bn a year in England. In March 2020 Rishi Sunak promised a review of the tax, which is expected to report this autumn. (Guardian)

FISCAL: Britain is already taxed enough, we can't take any more, says Jacob Rees-Mogg. The comments are seen as a shot across the bows of the PM and Chancellor from one of the most anti-tax Cabinet ministers ahead of the Budget. (Telegraph)

EUROPE

CORONAVIRUS: European countries with lower vaccination rates could see a surge in Covid-19 infections, hospitalizations and deaths over the next two months, according to the European Centre for Disease Prevention and Control. The EU agency, in its latest Rapid Risk Assessment, said the virus's high level of circulation within the population puts poorly inoculated countries in the EU and European Economic Area at risk between now and the end of November. The group also cited the concern that even vaccinated people can experience severe outcomes from infection. (BBG)

FRANCE: France will move to ease the cost of rising prices for consumers by blocking further natural gas price hikes and by preventing a planned increase in electricity tariffs scheduled in February, Prime Minister Jean Castex said on Thursday. "For natural gas and electricity, we'll put in place what I would call a tariffs shield. We're going to shield ourselves against those tariff hikes," Castex told TF1 television. On Monday, France's energy regulator said that Engie's gas prices would increase by 12.6% on Oct. 1. Castex said that rise would go through but that the prices from then on would remain at the same level until world prices go down, something which should occur in March or April. (France 24)

PORTUGAL: Counter-cyclical capital buffer for lenders will remain unchanged in the 4Q, Portuguese central bank says on its website. (BBG)

GREECE: Greece imposed a night time curfew on Thessaloniki, the country's second largest city, as the number of cases rose in the past few days the city and area around it. The curfew will start at 1am to 6am and will apply from Friday, Oct. 1. Bars, restaurants and cafes won't play music. Authorities also ban any event, in the whole country, with more than 20 people.

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- S&P on France (current rating: AA; Outlook Stable) & Poland (current rating: A-; Outlook Stable)

U.S.

FED: MNI BRIEF: Fed's Evans Says Underlying Inflation May Lag 2%

- Chicago Federal Reserve President Charles Evans said Thursday that while supply shocks will contribute to faster inflation well into next year, the underlying trend of prices may hold below 2% and make it difficult for policy makers to achieve their goals. "I still see underlying inflation as below 2% and not enough lift being done with wage and price growth," Evans said during a webinar with Princeton University professor Markus Brunnermeier. Evans reiterated that tapering will be justified around the end of this year and done around the middle of next year, with one rate increase in 2023 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI: St. Louis Fed Model Sees Loss of 818k Jobs in September

- U.S. hiring in September "could be weak or even negative" in September, according to a St. Louis Fed analysis of real-time employment data from the scheduling software company Homebase, showing a seasonally-adjusted decline of 818,000 jobs, a St. Louis Fed economist told MNI. The model forecasts changes in employment as measured by the BLS's household survey, which tracks closely the headline payrolls figures from the BLS's establishment survey. A smaller drop of 500,000 jobs was forecast by the model without seasonal adjustment, the worst since January - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: Despite a long night of frantic negotiations, Democrats were unable late Thursday to reach an immediate deal to salvage President Joe Biden's $3.5 trillion government overhaul, forcing leaders to call off promised votes on a related public works bill. Action is to resume Friday. Speaker Nancy Pelosi had pushed the House into an evening session and top White House advisers huddled for talks at the Capitol as the Democratic leaders worked to negotiate a scaled-back plan that centrist holdouts would accept. Biden had cleared his schedule for calls with lawmakers but it appeared no deal was within reach, particularly with Democratic Sen. Joe Manchin. Manchin refused to budge, the West Virginia centrist holding fast to his earlier declaration that he was willing to meet the president less than halfway — $1.5 trillion. (AP)

FISCAL: Treasury Secretary Janet Yellen suggested Thursday that the U.S. government may have a few days of cash left after the Oct. 18 date she gave earlier this week before a potential default linked to the debt limit. "It will be impossible for Treasury on that day, or a few days thereafter" to pay the nation's bills since cash flow will be "limited" and "will be run down quickly," she said in response to questions during a hearing before the House Financial Services Committee. Yellen also said she would support a permanent repeal of the debt limit -- as opposed to the temporary suspension under consideration now -- and reiterated that a default would be a "catastrophe" for the country. (BBG)

FISCAL: Congress avoided a government shutdown Thursday hours before funding would have lapsed. President Joe Biden signed a short-term appropriations bill that will keep the government running through Dec. 3. Washington had to beat a midnight Thursday deadline to prevent a shutdown of some federal operations. The Senate and House approved the funding legislation earlier Thursday. The Senate passed it in a 65-35 vote as all 50 Democrats backed it and 15 Republicans joined them. The House passed the bill by a 254-175 margin. Every Democratic representative and 34 Republicans supported it. The so-called continuing resolution will set spending at current levels into December while lawmakers hash out a full-year funding plan. The legislation includes money for hurricane relief and the resettlement of Afghan refugees. "This is a good outcome, one I'm happy we are getting done," Schumer said before the Senate vote. (CNBC)

FISCAL/FED: Sen. Joe Manchin says he will make a deal with his own Democratic party on a spending bill, but only if the Federal Reserve begins pulling back on its monetary stimulus to the economy. In a signed agreement with Senate Majority Leader Chuck Schumer (D-N.Y.), Manchin said he would only support a budget resolution with a top-line number of $1.5 trillion, with no funds in the new legislation disbursed until after all COVID-related federal spending is exhausted. Another condition: The "Federal Reserve ends quantitative easing," referring to the central bank's efforts to prop up the economy through asset purchases. Through QE, the Fed is currently buying about $120 billion a month in U.S. Treasuries and agency mortgage-backed securities. (Yahoo Finance)

CORONAVIRUS: New U.S. cases slowed by a third this month, from a seven- day average of more than 161,000 on Sept. 1 to about 107,000 on Tuesday, according to the Centers for Disease Control and Prevention. Daily deaths, which peaked at more than 2,000 in mid- September, have declined 12% since then by the same measure. The number of patients hospitalized with confirmed Covid-19 fell to about 73,000 from a peak in early September, a 22% decline, according to data on the CDC's website. While all U.S. states except California are still listed as "high transmission" areas in a CDC update published Thursday, a majority showed a week-on-week decline in new cases. Alaska, Maine and North Dakota led the nation in the percentage increase in infections. (BBG)

CORONAVIRUS: One in four companies has instituted a vaccine mandate for U.S. workers, a sharp increase from last month, following President Joe Biden's directive ordering large employers to require shots or weekly testing. Another 13% of companies plan to put a mandate in place, Brian Kropp, chief of human-resources research at consultant Gartner, said in a panel discussion Thursday. The firm's findings are based off a survey of roughly 400 organizations. Last month, just 16% of companies had vaccine mandates, Gartner data show, but Biden's Sept. 9 directive has sent employers scrambling to come up with plans to adhere to the new rules. About 20% of the most recent survey's respondents haven't decided what to do yet, Kropp said, indicating that the remaining companies -- about 40% -- might ultimately decide to test their employees instead of enforcing inoculations. (BBG)

CORONAVIRUS: New York state must temporarily allow exemptions from a mandate on Covid-19 vaccinations for health-care workers with religious objections, a judge ruled. A federal appeals court in Manhattan granted a temporary restraining order while the matter is being argued in court. The judge will hear arguments on the vaccine mandate on Oct. 14. (BBG)

RATINGS: S&P Global Ratings on Thursday warned of "severe and extraordinary" consequences for financial markets if the United States defaults on its debt, although it added it expects the U.S. Congress will ultimately address the debt ceiling in a timely manner. (RTRS)

EQUITIES: A trader just established a massive hedging position via options to protect a portfolio of stocks in the event that the S&P 500's losses snowball toward 20% during the fourth quarter. The trader Thursday morning bought 45,300 put-spread collars -- options cocktails that combine various strike prices in a single strategy -- on the S&P 500 for $94 million. The order involved selling calls with a strike price at 4,505 while buying puts exercising at 4,135 and selling puts at 3,480, which all expire on Dec. 31. Behind the wager was likely a belief that the S&P 500's upside would be capped at 4,505, or a 3% gain from the index's Wednesday close of 4,359, while the downside could be a drop of as much as 20%. (BBG)

OTHER

GLOBAL TRADE: The European Union has postponed for a month the next round of negotiations for a free trade agreement with Australia, in a move believed to be retribution for the cancellation of the $90 billion submarine contract with French company Naval Group. (AFR)

GLOBAL TRADE: Micron is facing higher costs along with its competitors, CEO Sanjay Mehrotra says in a message to customers. "We are still experiencing cost increases across our bill of materials and outsourced manufacturing services and do not expect that pressure to ease in the foreseeable future." "We anticipate that these cost increases will be reflected in our pricing, even as we remain committed to a competitive, value-based pricing approach with all our customers." "Lean inventory and industry-wide constraints on assembly and test capacity and components limit our ability to flex to meet changes to your demand profile. (BBG)

GLOBAL TRADE: U.S. government officials won't leak or make public the information they request chipmakers to provide, Taiwan's Minister of Economic Affairs Wang Mei-hua told reporters in Taipei, citing communication with U.S. The U.S. government's main concern is the auto chip shortage, which has lasted several months despite Taiwan cos increasing output. (BBG)

U.S./CHINA: A House subcommittee plans to hold a hearing titled "Taking Stock of 'China, Inc.': Examining Risks to Investors and the U.S. Posed by Foreign Issuers in U.S. Markets." House Financial Services Subcommittee on Investor Protection, Entrepreneurship and Capital Markets hearing planned for Oct. 26 at 10am Washington time. (BBG)

GEOPOLITICS: India should maintain "strategic autonomy" instead of joining any exclusive alliances against its neighbour, Beijing's top envoy in New Delhi said, days after leaders of the Quad gathered in Washington for their first in-person summit, with Beijing a veiled target. Without naming the US-led Quadrilateral Security Dialogue or its members, Sun Weidong said any attempts to "gang up for containing and suppressing China" would "be doomed to fail". "It is worth noting that a few countries are going against the trend," Sun told more than 100 representatives from business, culture and academic communities in India during a virtual meeting on Wednesday. "Out of selfishness, they hold a zero-sum cold war mentality, vigorously seek closed and exclusive ideological 'small cliques' and military alliances targeting a third party, stoke arms races, tension, division and bloc confrontation, turn the Asia-Pacific into an arena of major powers' game and destabilise the world," he said, according to a transcript published on the embassy's website. (SCMP)

JAPAN: Fumio Kishida, the newly elected leader of Japan's ruling Liberal Democratic Party, plans to appoint senior LDP lawmaker Shunichi Suzuki as finance minister and retain Toshimitsu Motegi as foreign minister, party sources said Friday. (Kyodo News)

JAPAN: Kishida May Dissolve House Of Representatives On Oct 14: Mainichi reports that new LDP leader Fumio Kishida is planning to dissolve the House of Representatives on October 14, the last day of the special parliamentary session held to install him as Prime Minister. Once lawmakers formally pick Kishida as new Premier, he will deliver his policy speech on October 8 and is expected to take questions from opposition MPs on October 11 - 13. (MNI)

JAPAN: Japan's financial regulator is keeping a closer watch on the nation's banks and insurers as their drawn out hunt for yield pushes them into riskier non-traditional assets. After years of ultra-low interest rates and record levels of deposits, it's "inevitable" that firms are taking bigger risks, according to Toshinori Yashiki, who's in charge of assessing risk at banks and insurers at the Financial Services Agency. "The situation is getting worse," Yashiki, 56, said in an interview. "There have been moves to pursue yields," and financial firms "have to take risks they haven't taken before." Regulatory officials in Japan are treading a fine line between supporting an environment where financial firms seek out investments that offer higher returns, while guarding against excessive risk taking. Some lenders are turning to riskier offerings to make a return on deposits that ballooned during the pandemic. (BBG)

BOJ: MNI: BOJ September Tankan: Sentiment Improves, Capex Plans Up

- Business sentiment improved among major manufacturing businesses from three months ago, reflecting solid demand for IT-related goods, the Bank of Japan's September Tankan business sentiment survey showed. Major non-manufacturers, mainly the face-to-face services, also showed improved confidence, marking a fifth straight rise for both categories. A stepped-up vaccine rollout has helped with the latest reading on business confidence that comes as Japan is ready to name a new prime minister on Monday and hold elections likely in November - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: MNI INSIGHT: Tankan Supports BOJ Econ Views; High Costs Eyed

- Bank of Japan officials will maintain the outlook for the economy to rebound from pandemic conditions as intact as the September Tankan survey showed that capital investment plans by companies stand solid, MNI understands. The survey showed that capex plans in both smaller and major firms that BOJ officials are focused on indicated that a virtuous cycle from profits to spending will not reverse despite continued high uncertainties - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: MNI BRIEF: Australia Set For November Re-Opening

- Australia on Friday brought forward its plans for international opening by one month and vaccinated Australians will be able to travel overseas from November, when current limits on international arrivals will also be removed - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australian Prime Minister Scott Morrison has announced a reshuffle of his cabinet after his industry minister resigned last month, as he seeks to solidify his conservative government's leadership team ahead of next year's election. Angus Taylor, who will remain in his energy portfolio, will add to his responsibilities by replacing Christian Porter as industry minister. Porter quit after disclosing that he'd accepted an anonymous donation to help cover legal fees in a defamation case. (BBG)

AUSTRALIA: The NSW Premier Gladys Berejiklian has announced her resignation, after the state's corruption watchdog revealed that she was under investigation. (ABC)

AUSTRALIA: Australia's Therapeutics Goods Administration advised that Sinovac and Covishield, the Indian-manufactured version of AstraZeneca's vaccine, should be considered recognized vaccines when determining the vaccination status of incoming international travelers. (BBG)

SOUTH KOREA: South Korea will maintain toughened social distancing rules across the nation for two more weeks, the prime minister said Friday, as the country is bracing for a potential surge in new COVID-19 cases ahead of back-to-back extended weekends. Under the renewed plan that will go into effect Monday, the greater Seoul area will remain under the toughest social distancing of Level 4, while the rest of the country will be under Level 3, Prime Minister Kim Boo-kyum said during an interagency meeting on the government's coronavirus response. Cafes and restaurants in the capital area will be allowed to operate until 10 p.m. and social gatherings of up to six people will be allowed in the capital area after 6 p.m. if four of them are fully vaccinated. (Yonhap)

NORTH KOREA: North Korea said Friday it had test-fired a new type of anti-aircraft missile. "The Academy of Defence Science of the DPRK test-fired an anti-aircraft missile newly developed by it on September 30, aiming at confirming the practicality of operation of the launcher, radar and comprehensive battle command vehicle as well as the comprehensive combat performance of the missile," the official Korean Central News Agency said. DPRK stands for the North's official name, the Democratic People's Republic of Korea. Earlier this week, the North test-launched a new hypersonic missile. (Yonhap)

NORTH KOREA: North Korea remained unresponsive to South Korea's regular calls via military and liaison hotlines Friday morning after leader Kim Jong-un offered to restore severed cross-border communication lines in early October. "North Korea did not answer the opening call through the inter-Korean liaison office at 9 a.m.," a unification ministry official said. The calls through military hotlines also went unanswered, another official said. (Yonhap)

TURKEY: Turkey extends tax advantage on lira deposit accounts until end of year, according to decree in Official Gazette. Decree also extends tax relief on income gained from lira-denominated investment funds, bonds and Islamic debt issued by banks to year-end. (BBG)

MEXICO: The Bank of Mexico raised its benchmark interest rate by 25 basis points to 4.75% on Thursday, as expected, in a four-to-one vote by its governing board, as the central bank expressed concern about above-target inflation. All 22 analysts surveyed in a Reuters poll had expected the bank, known as Banxico, to raise the rate for the third time in a row to 4.75%. "Although the shocks that have increased inflation are expected to be transitory, due to their variety, magnitude, and the extended horizon over which they have affected it, they may pose risks to the price formation process and to inflation expectations," Banxico said in its monetary policy statement. In order to avoid those risks, Banxico said it deemed it necessary to hike the key rate. (RTRS)

RUSSIA: The United States and Russia said in a joint statement on Thursday that they had held "intensive and substantive" talks in their second meeting within a framework that is aimed at easing tensions between the world's largest nuclear weapons powers. The two countries have agreed to set up two working groups, which will convene ahead of a third plenary meeting. A date for the third gathering was not provided. U.S. President Joe Biden and Russian President Vladimir Putin, whose countries hold 90% of the world's nuclear weapons, agreed at a June summit in Geneva to embark on an integrated bilateral 'Strategic Stability Dialogue' to lay the groundwork for future arms control and risk reduction measures. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa relaxed coronavirus restrictions after infections abated and inoculations increased, scrapping almost all curbs on alcohol sales and easing limits on the size of public gatherings. The move to virus alert level 1 from level 2 will help shore up an economy that's grappling with record-high unemployment and bruised investor confidence. It will also make it easier for political parties to campaign for municipal elections scheduled for Nov. 1. (BBG)

SOUTH AFRICA: President Cyril Ramaphosa tried and failed to convince British Prime Minister Boris Johnson to drop the U.K.'s decision to keep South Africa on a list of nations banned because of Covid-19 risks. "I put South Africa's case to him, which he understood very well," Ramaphosa said in a televised address Thursday. "We both agreed that decisions of this nature should be informed by science and are hopeful of a positive outcome when the issue comes up for review in the coming days." South Africa has reacted with fury to its continued inclusion on the U.K.'s so-called red list, which bars foreigners outright and forces British citizens to undergo hotel quarantine on arrival at a cost of 2,285 pounds ($3,070). The U.K. also won't recognize visitors as vaccinated unless they received doses in a select group of countries, regardless of which shot they were given. (BBG)

SOUTH AFRICA: South Africa's energy regulator Nersa has rejected a multi-year revenue application by state-owned power utility Eskom, the regulator said in a statement on Thursday. The National Energy Regulator of South Africa (Nersa) said it will embark on a consultation process to develop a new methodology that will ensure sustainable electricity prices. Eskom is mired in financial crisis and struggles to power Africa's most industrialised economy because of regular faults at ageing coal-fired plants that provide most of the country's electricity. The revenue applications, if approved by the regulator, provide an important mechanism for Eskom to claw back money from customers via tariffs. (RTRS)

OIL: OPEC+ is considering going beyond its existing deal to boost production by 400,000 barrels per day (bpd) when it meets next week, sources said, against a backdrop of oil near a three-year high and pressure from consumers for more supply. (RTRS)

OIL: National security adviser Jake Sullivan planned on discussing high oil prices with Saudi Crown Prince Mohammed bin Salman during a meeting earlier this week, White House press secretary Jen Psaki said on Thursday. "Obviously, the price of oil is of concern. We have been in touch with OPEC, and I believe it was going to be raised but I haven't had a chance to get a readout beyond that," Psaki told reporters. (RTRS)

OIL: The United States will hold an auction for drilling rights in the Gulf of Mexico on Nov. 17 to comply with a court order to resume oil and gas lease sales, the Biden administration said on Thursday. The auction of some 80 million acres offshore will be the first the Interior Department has held under President Joe Biden, who campaigned on a promise to end new federal oil and gas leasing as part of a climate change agenda. The last such sale in the Gulf of Mexico was in November of 2020. (RTRS)

OVERNIGHT DATA

JAPAN Q3 TANKAN LARGE M'FING INDEX 18; MEDIAN 13; Q2 14

JAPAN Q3 TANKAN LARGE M'FING OUTLOOK 14; MEDIAN 14; Q2 13

JAPAN Q3 TANKAN LARGE NON-M'FING INDEX 2; MEDIAN 0; Q2 1

JAPAN Q3 TANKAN LARGE NON-M'FING OUTLOOK 3; MEDIAN 5; Q2 3

JAPAN Q3 TANKAN LARGE ALL INDUSTRY CAPEX +10.1%; MEDIAN +9.3%; Q2 +9.6%

JAPAN Q3 TANKAN SMALL M'FING INDEX -3; MEDIAN -9; Q2 -7

JAPAN Q3 TANKAN SMALL M'FING OUTLOOK -4; MEDIAN -8; Q2 -6

JAPAN Q3 TANKAN SMALL NON-M'FING INDEX -10; MEDIAN -11; Q2 -9

JAPAN Q3 TANKAN SMALL NON-M'FING OUTLOOK -13; MEDIAN -9; Q2 -12

JAPAN AUG UNEMPLOYMENT 2.8%; MEDIAN 2.9%; JUL 2.8%

JAPAN AUG JOB-TO-APPLICANT RATIO 1.14; MEDIAN 1.14; JUL 1.15

JAPAN SEP, F JIBUN BANK M'FING PMI 51.5; FLASH 51.2

September data indicated a softer improvement in the health of the Japanese manufacturing sector, as the latest Manufacturing PMI signalled that firms began to feel the impacts of the resurgence in COVID-19 cases related to the Delta variant and ongoing supply chain disruption. Japanese firms recorded renewed declines in both output and new orders, as businesses succumbed to disruption caused by strict pandemic restrictions and raw material shortages. Positively, external markets reversed the decline seen in August to return to expansion territory, although the rate of growth was only mild. Supply chain disruption continued to dampen activity and demand during September. Firms noted a sharp deterioration in vendor performance as supplier delivery times lengthened to the greatest extent since April 2011. Yet, Japanese goods producers were confident that these challenges would lift in the near term and noted stronger optimism regarding the year ahead outlook. Confidence was underpinned by hopes that the end of the pandemic would trigger a broad recovery in demand, and encourage a number of new product launches. IHS Markit estimates that industrial production will rise by 8.2% in 2021, though this will not fully recover the output lost to the pandemic last year. (IHS Markit)

AUSTRALIA AUG HOME LOANS VALUE -4.3% M/M; MEDIAN -0.5%; JUL +0.2%

AUSTRALIA AUG OWNER-OCCUPIER LOAN VALUE -6.6% M/M; MEDIAN -0.9%; JUL -0.4%

AUSTRALIA AUG INVESTOR LOAN VALUE +1.5% M/M; JUL +1.8%

AUSTRALIA SEP, F MARKIT M'FING PM 56.8; FLASH 57.3

Australia's manufacturing sector showed better performance in September according to the latest IHS Markit Australia Manufacturing PMI. This was despite COVID-19 cases staying elevated in the month with anecdotal evidence suggesting that manufacturers were able to better adapt to ongoing virus disruptions. Improved demand conditions alongside ongoing COVID-19 restrictions however contributed to worsening supply constraints in September as lead times and price pressures both built situations that will be worth monitoring going forward. Broadly, better business confidence was seen by the Future Output sub-index indication, the only sentiment gauge, and through better employment and purchasing activity recorded. Hopefully this momentum will carry through to the fourth quarter with the virus situation appearing to have turned a corner in September. (IHS Markit)

AUSTRALIA SEP CORELOGIC HOUSE PRICE INDEX +1.5% M/M; AUG +1.5%

NEW ZEALAND SEP ANZ CONSUMER CONFIDENCE INDEX 104.5; AUG 109.6

NEW ZEALAND SEP ANZ CONSUMER CONFIDENCE -4.7% M/M; AUG -3.1%

Households' response to whether it was a good time to buy a major household item dropped sharply in September. Some of this may reflect temporary lockdown impacts, rather than a rethink of spend or save decisions, but many regions that are back in Level 2dropped sharply as well. It's a shot across the bow for a retail sector that has been enjoying extremely strong demand. However, some of it may also reflect supply problems –for many durables supply is limited and delays common. And prices are rising. The fall has been particularly pronounced amongst younger adults, who have lower job security generally (and less housing wealth). But some of it may also reflect rising mortgage rates. This series will be key to watch for gauging momentum in the economy as the year progresses. (ANZ)

NEW ZEALAND SEP CORELOGIC HOUSE PRICE INDEX +27.8% Y/Y; AUG +27.0%

SOUTH KOREA SEP TRADE BALANCE +$4.203BN; MEDIAN +$5.061BN; AUG +$1.646BN

SOUTH KOREA SEP EXPORTS +16.7% Y/Y; MEDIAN +16.0% AUG +34.8%

SOUTH KOREA SEP IMPORTS +31.0% Y/Y; MEDIAN +28.0%; AUG +44.0%

SOUTH KOREA SEP MARKIT M'FING PMI 52.4; AUG 51.2

South Korean manufacturers reported a stronger improvement in the health of the sector for the first time in three months in September, with the latest Manufacturing PMI signalling a modest improvement in business conditions. This came as manufacturers reported a renewed rise in output and a further pick-up in new order inflows. Moreover, firms noted that demand had risen notably among international clients, with growth in new export sales accelerating. That said, supply chain disruption continued to hinder overall activity and demand in the manufacturing sector. Material shortages and rising input costs were exacerbated by ongoing delays in sourcing and receiving inputs, as evidenced by the strongest lengthening in supplier delivery times since the COVID-19 pandemic first hit in April last year. Goods producers remained confident that output would rise over the coming 12 months, however some firms voiced concerns that sustained disruption to supply chains, particularly in the key semiconductor industry and in the wider manufacturing sector would act as a drag on the recovery if issues remain unresolved until 2022. As a result, business confidence eased to the softest level reported since October 2020. (IHS Markit)

MARKETS

SNAPSHOT: Infrastructure Impasse Remains Evident On The Hill, E-Minis Fall

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 702.44 points at 28751.32

- ASX 200 down 139.659 points at 7193.2

- Shanghai Comp. is closed

- JGB 10-Yr future up 26 ticks at 151.63, yield down 2.6bp at 0.046%

- Aussie 10-Yr future up 1.0 tick at 98.495, yield down 1bp at 1.480%

- U.S. 10-Yr future +0-12+ at 132-00, yield down 1.36bp at 1.474%

- WTI crude down $0.2 at $74.83, Gold down $4.68 at $1752.21

- USD/JPY down 14 pips at Y111.15

- INFRASTRUCTURE VOTE DELAYED, DEMOCRATS STRUGGLE TO SAVE BIDEN $3.5T BILL (AP)

- YELLEN HINTS AT A 'FEW DAYS' OF ROOM AFTER DEBT-LIMIT DEADLINE (BBG)

- MANCHIN DEMANDS FED END ASSET PURCHASES (YAHOO FINANCE)

- U.S. CONGRESS AVERTS SHUTDOWN, SENDS 9-WEEK FUNDING PATCH TO BIDEN'S DESK (POLITICO)

- U.S. HOUSE PANEL PLANS OCT. 26 HEARING ON CHINA LISTINGS IN U.S. (BBG)

- OPEC+ CONSIDERS OPTIONS FOR RELEASING MORE OIL TO THE MARKET (RTRS SOURCES)

BOND SUMMARY: Technical Break In E-minis Lends Support To Core FI Overnight

The late NY month-/quarter-end bid faded a little in early Asia-Pac trade, with a lack of tier 1 headline flow evident as e-minis initially nudged away from their late NY lows. The space then turned bid as initial key support in e-mini S&P 500 futures was breached, weighing on broader risk appetite. T-Notes last +0-12+ at 132-00, through Thursday's late high. The early bear steepening witnessed on the cash Tsy curve has now been unwound and more, with the major benchmarks sitting little changed to 1.0bp richer. Holidays in China (which will last a week) and Hong Kong (which will return on Monday) thinned out liquidity during Asia-Pac trade, but the aforementioned gyrations in e-minis resulted in volume of ~140K for T-Notes. Final manufacturing PMI readings from across the globe will be observed on Friday, with the latest ISM m'fing survey and PCE data set to headline in U.S. hours. We will also get Fedspeak from Harker & Mester.

- JGB futures surged during the Tokyo morning, last +26 on the day. Participants played catch up to the late NY richening in the U.S. Tsy space & no changes to the BoJ's Q4 Rinban plan, published late on Thursday (there was speculation that the BoJ may cut its purchases out to 10s, with domestic participants likely reacting in early Tokyo trade, building on the overnight bid). The broader risk-off flows that we outlined earlier then provided a further source of support. 10s lead the rally in cash trade, firming by ~2.5bp. Elsewhere, it would seem that the shape of PM-in-waiting Kishida's cabinet is being leaked to the press.

- Aussie bonds followed the broader ebbs and flows. In terms of idiosyncratic matters, local data (headlined by a softer round of housing finance readings) has provided little impetus for the space, while speculation & subsequent news of advances when it comes to Australia's international reopening schedule may have allowed Aussie 10s to underperform their U.S. counterparts since yesterday's Sydney close. We saw another firm round of ACGB supply, this time in the form of an auction of A$1.0bn of ACGB Nov '31. The auction saw the cover ratio print comfortably above 5.00x, while the weighted average yield printed 0.75bp through prevailing mids at the time of supply (per Yieldbroker). The recent cheapening, coupled with the well-defined, supportive factors when it comes to ACGB demand (RBA purchase-adjusted negative net supply, record liquidity in the domestic banking system and international appeal) and reduced free float of the line driven by RBA ACGB purchases outweighed any worries re: the prospect for deeper cheapening and lack of hedging capability when it comes to futures.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 2.75% 21 Nov ‘28 Bond, issue #TB152:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 2.75% 21 November 2028 Bond, issue #TB152:

- Average Yield: 1.1425% (prev. 0.6280%)

- High Yield: 1.1475% (prev. 0.6300%)

- Bid/Cover: 5.2980x (prev. 4.6107x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 10.1% (prev. 68.9%)

- Bidders 53 (prev. 40), successful 22 (prev. 14), allocated in full 11 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 6 October it plans to sell A$1.0bn of the 1.75% 21 November 2032 Bond.

- On Thursday 7 October it plans to sell A$1.0bn of the 21 January 2022 Note & A$1.0bn of the 22 April 2022 Note.

- On Friday 8 October it plans to sell A$1.0bn of the 4.75% 21 April 2027 Bond.

JGBS AUCTION: Japanese MOF sells Y4.0614tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0614tn 3-Month Bills:

- Average Yield -0.1330% (prev. -0.1202%)

- Average Price 100.0361 (prev. 100.0300)

- High Yield: -0.1271% (prev. -0.1162%)

- Low Price 100.0345 (prev. 100.0290)

- % Allotted At High Yield: 94.6548% (prev. 92.6187%)

- Bid/Cover: 3.817x (prev. 4.566x)

EQUITIES: Equities Start October On the Backfoot

Some were worried that the holidays in play in both China & Hong Kong would limit activity in Asia-Pac trading, but that hasn't been the case. A negative lead from Wall St., a subsequent technical break lower in the S&P 500 e-mini contract and uncertainty surrounding U.S. infrastructure spending matters have weighed on regional equities during Friday's Asia-Pac session. The Nikkei 225 & the ASX 200 both trade ~2% softer on the day, while the major U.S. e-mini futures are ~0.5% worse off following the previously flagged technical break of short-term support. Note that September saw Wall St. lodge its worst month since the COVID-driven malaise of March '20.

OIL: Crude On Track For 6th Straight Weekly Gain

Crude's early Asia-Pac rally faltered as broader risk appetite took a hit, leaving WTI & Brent futures at virtually unchanged levels as we move into European dealing.

- This comes after the major metrics added ~$0.20 come Thursday's settlement. Thursday's initial defensive tone was set by talks pointing to a resumption of talks between Iran & Europe at some point "soon," before the pressure from a move lower in U.S. equity futures added further weight. Reports that China has instructed energy firms to secure supplies for winter "at all costs" then put a bid into the space during NY hours, with the aforementioned losses quickly reversed. New session highs were registered in the wake of the aforementioned headlines surrounding China before RTRS source report suggested that "OPEC+ is considering going beyond its existing deal to boost production by 400,000 barrels per day (bpd) when it meets next week, sources said, against a backdrop of oil near a three-year high and pressure from consumers for more supply."

GOLD: Spot Little Changed Overnight After Thursday's Recovery

Thursday saw the DXY & our weighted U.S. real yield monitor pull back from their respective recent highs, which allowed gold to form a base just above initial technical support at Wednesday's low ($1,721.7/oz). Spot then edged away from its NY highs as we moved through Thursday's session, to last deal little changed, just shy of $1,755/oz, as a modest uptick in the DXY competes with a modest downtick in the aforementioned real yield monitor. The technical overlay remains consistent with the pattern outlined yesterday. U.S. PCE & m'fing ISM data provide the points of interest on Friday.

FOREX: Mild Risk Aversion To End The Week

Oscillations in broader risk sentiment drove G10 price action, with major currency pairs holding tight ranges amid the absence of market-moving headline flow. A dip in U.S. e-mini futures seemed to spill over into the FX space, inspiring the dissipation of earlier modest risk-on tone.

- Oil-tied CAD and NOK are the worst performers in the G10 basket as we type, with crude oil edging lower. GDP joined them near the bottom of the G10 scoreboard amid lingering concerns over the UK's fuel crisis.

- Safe haven currencies are heading toward the London session on a slightly firmer footing. JPY outperformer, with headlines surrounding the shape of PM-in-waiting Kishida's cabinet trickling through.

- Mainland China began its week-long holiday, while markets in Hong Kong were also shut, which limited activity in Asia.

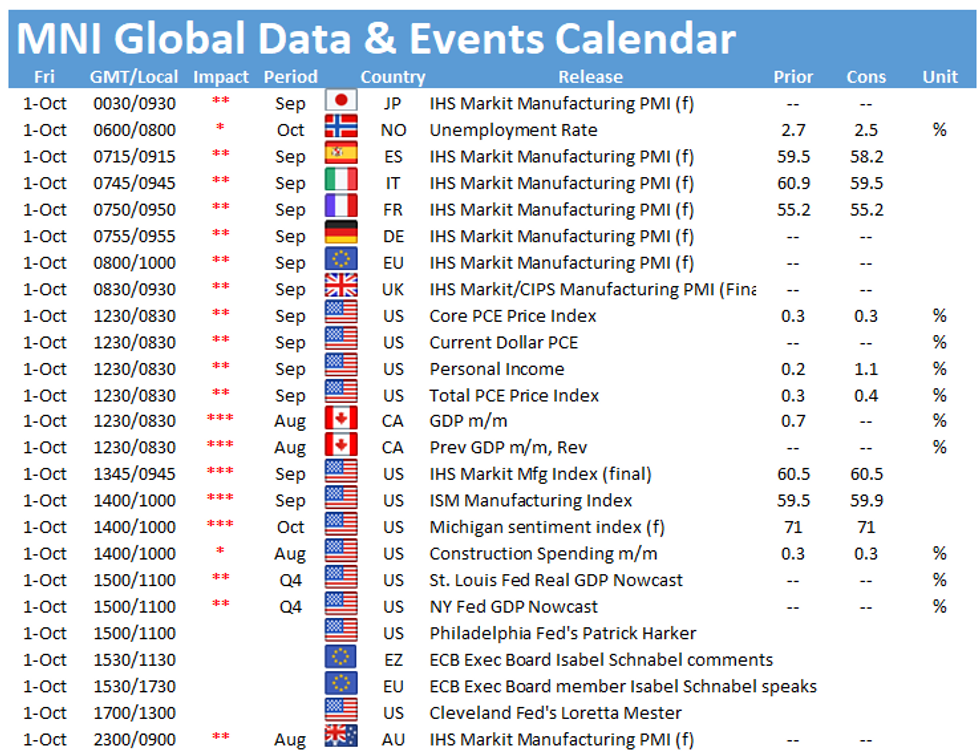

- U.S. personal income/spending & Canadian GDP will take focus on the data front today, along a number of PMI readings from across the globe. Comments are due from Fed's Harker & Mester as well as ECB's Schnabel.

FOREX OPTIONS: Expiries for Oct01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E886mln)

- USD/JPY: Y110.50-70($1.6bln)

- AUD/USD: $0.7200(A$1.4bln)

- USD/CAD: C$1.2400-15($1.3bln); C$1.2600($1.8bln), C$1.2670-90($620mln), C$1.2700-20($1.3bln), C$1.2800($1.4bln), C$1.2850($2.0bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.