-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: E-Minis Break Support Overnight, Risk Trades On The Backfoot

- Chinese & Hong Kong holidays resulted in thinner markets during Asia-Pac hours, although it was a busy enough session with broader market flow in the driving seat.

- E-minis broke through technical support overnight, weighing on broader risk appetite.

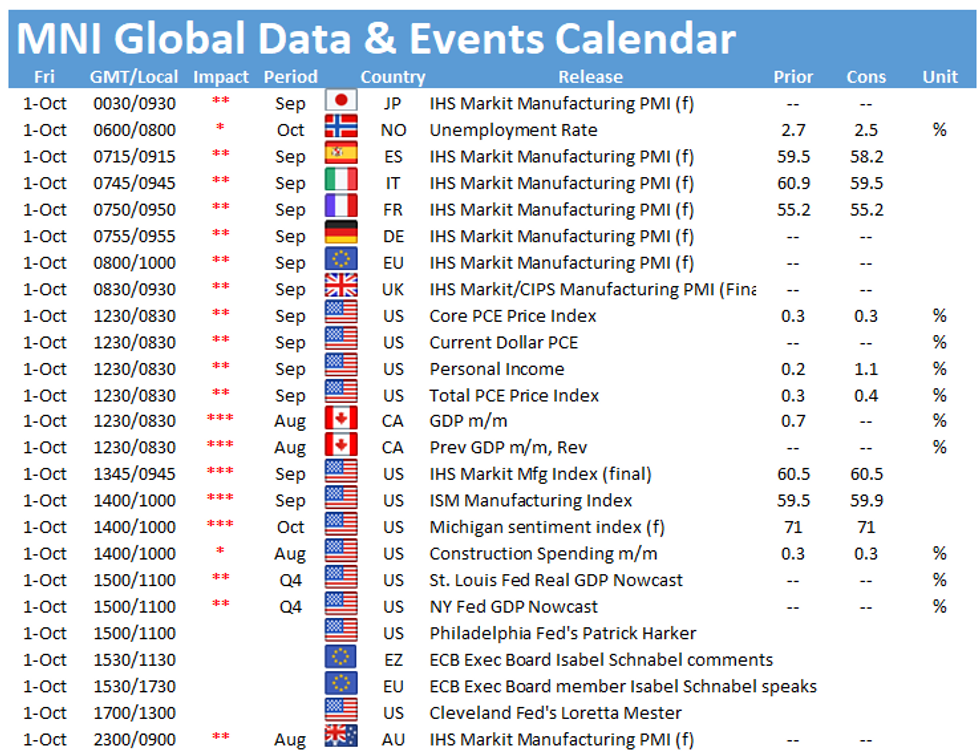

- Final m'fing PMIs, U.S. M'fing ISM & PCE data, Canadian GDP, Fedspeak & comments from ECB's Schnabel headline on Friday.

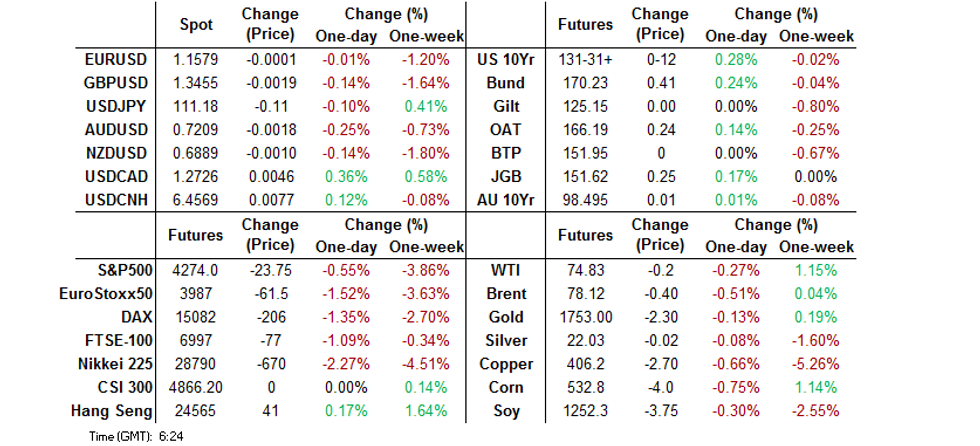

BOND SUMMARY: Technical Break In E-minis Lends Support To Core FI Overnight

The late NY month-/quarter-end bid faded a little in early Asia-Pac trade, with a lack of tier 1 headline flow evident as e-minis initially nudged away from their late NY lows. The space then turned bid as initial key support in e-mini S&P 500 futures was breached, weighing on broader risk appetite. T-Notes last +0-12+ at 132-00, through Thursday's late high. The early bear steepening witnessed on the cash Tsy curve has now been unwound and more, with the major benchmarks sitting little changed to 1.0bp richer. Holidays in China (which will last a week) and Hong Kong (which will return on Monday) thinned out liquidity during Asia-Pac trade, but the aforementioned gyrations in e-minis resulted in volume of ~140K for T-Notes. Final manufacturing PMI readings from across the globe will be observed on Friday, with the latest ISM m'fing survey and PCE data set to headline in U.S. hours. We will also get Fedspeak from Harker & Mester.

- JGB futures surged during the Tokyo morning, last +26 on the day. Participants played catch up to the late NY richening in the U.S. Tsy space & no changes to the BoJ's Q4 Rinban plan, published late on Thursday (there was speculation that the BoJ may cut its purchases out to 10s, with domestic participants likely reacting in early Tokyo trade, building on the overnight bid). The broader risk-off flows that we outlined earlier then provided a further source of support. 10s lead the rally in cash trade, firming by ~2.5bp. Elsewhere, it would seem that the shape of PM-in-waiting Kishida's cabinet is being leaked to the press.

- Aussie bonds followed the broader ebbs and flows. In terms of idiosyncratic matters, local data (headlined by a softer round of housing finance readings) has provided little impetus for the space, while speculation & subsequent news of advances when it comes to Australia's international reopening schedule may have allowed Aussie 10s to underperform their U.S. counterparts since yesterday's Sydney close. We saw another firm round of ACGB supply, this time in the form of an auction of A$1.0bn of ACGB Nov '31. The auction saw the cover ratio print comfortably above 5.00x, while the weighted average yield printed 0.75bp through prevailing mids at the time of supply (per Yieldbroker). The recent cheapening, coupled with the well-defined, supportive factors when it comes to ACGB demand (RBA purchase-adjusted negative net supply, record liquidity in the domestic banking system and international appeal) and reduced free float of the line driven by RBA ACGB purchases outweighed any worries re: the prospect for deeper cheapening and lack of hedging capability when it comes to futures.

FOREX: Mild Risk Aversion To End The Week

Oscillations in broader risk sentiment drove G10 price action, with major currency pairs holding tight ranges amid the absence of market-moving headline flow. A dip in U.S. e-mini futures seemed to spill over into the FX space, inspiring the dissipation of earlier modest risk-on tone.

- Oil-tied CAD and NOK are the worst performers in the G10 basket as we type, with crude oil edging lower. GDP joined them near the bottom of the G10 scoreboard amid lingering concerns over the UK's fuel crisis.

- Safe haven currencies are heading toward the London session on a slightly firmer footing. JPY outperformer, with headlines surrounding the shape of PM-in-waiting Kishida's cabinet trickling through.

- Mainland China began its week-long holiday, while markets in Hong Kong were also shut, which limited activity in Asia.

- U.S. personal income/spending & Canadian GDP will take focus on the data front today, along a number of PMI readings from across the globe. Comments are due from Fed's Harker & Mester as well as ECB's Schnabel.

FOREX OPTIONS: Expiries for Oct01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E886mln)

- USD/JPY: Y110.50-70($1.6bln)

- AUD/USD: $0.7200(A$1.4bln)

- USD/CAD: C$1.2400-15($1.3bln); C$1.2600($1.8bln), C$1.2670-90($620mln), C$1.2700-20($1.3bln), C$1.2800($1.4bln), C$1.2850($2.0bln)

ASIA FX: Central Bank Speak, M'fing PMIs Take Focus Amid Holiday-Thinned Liquidity

The condition of the manufacturing sector across Asia improved in September, according to the latest survey results published by IHS Markit. Central bank rhetoric supported THB and PHP, while markets in China and Hong Kong were closed in observance of public holidays.

- CNH: USD/CNH crept higher on the back of broader market impetus, with onshore Chinese markets shut and no PBOC fix.

- KRW: The won went offered and underperformed all of its regional peers, weighed on by a combination of geopolitical angst and Covid-19 worry. The DPRK test-launched a new anti-aircraft missile. Meanwhile, South Korea extended current social distancing measures ahead of two back-to-back long weekends. The decision came after a flare-up in Covid-19 infections observed in the wake of the recent Chuseok holiday.

- PHP: The peso led gains in the Asia EM basket, with spot USD/PHP moving away from the psychological PHP51 barrier, which provided formidable resistance over the last few sessions. BSP Diokno said Thursday that the central bank stands ready to "provide dollar liquidity" if they see legitimate demand or excessive volatility.

- THB: USD/THB reopened on a softer footing and remained in negative territory despite trimming some of its initial losses. A senior BoT official said Thursday that the central bank will monitor the baht's movement after USD/THB printed a fresh four-year low on the last day of its worst month in more than 20 years.

- IDR: The rupiah ignored the release of local CPI figures, which fell more or less in line with expectations.

- MYR: USD/MYR recouped its initial losses but seems poised to finish the week on a softer footing.

EQUITIES: Equities Start October On the Backfoot

Some were worried that the holidays in play in both China & Hong Kong would limit activity in Asia-Pac trading, but that hasn't been the case. A negative lead from Wall St., a subsequent technical break lower in the S&P 500 e-mini contract and uncertainty surrounding U.S. infrastructure spending matters have weighed on regional equities during Friday's Asia-Pac session. The Nikkei 225 & the ASX 200 both trade ~2% softer on the day, while the major U.S. e-mini futures are ~0.5% worse off following the previously flagged technical break of short-term support. Note that September saw Wall St. lodge its worst month since the COVID-driven malaise of March '20.

GOLD: Spot Little Changed Overnight After Thursday's Recovery

Thursday saw the DXY & our weighted U.S. real yield monitor pull back from their respective recent highs, which allowed gold to form a base just above initial technical support at Wednesday's low ($1,721.7/oz). Spot then edged away from its NY highs as we moved through Thursday's session, to last deal little changed, just shy of $1,755/oz, as a modest uptick in the DXY competes with a modest downtick in the aforementioned real yield monitor. The technical overlay remains consistent with the pattern outlined yesterday. U.S. PCE & m'fing ISM data provide the points of interest on Friday.

OIL: Crude On Track For 6th Straight Weekly Gain

Crude's early Asia-Pac rally faltered as broader risk appetite took a hit, leaving WTI & Brent futures at virtually unchanged levels as we move into European dealing.

- This comes after the major metrics added ~$0.20 come Thursday's settlement. Thursday's initial defensive tone was set by talks pointing to a resumption of talks between Iran & Europe at some point "soon," before the pressure from a move lower in U.S. equity futures added further weight. Reports that China has instructed energy firms to secure supplies for winter "at all costs" then put a bid into the space during NY hours, with the aforementioned losses quickly reversed. New session highs were registered in the wake of the aforementioned headlines surrounding China before RTRS source report suggested that "OPEC+ is considering going beyond its existing deal to boost production by 400,000 barrels per day (bpd) when it meets next week, sources said, against a backdrop of oil near a three-year high and pressure from consumers for more supply."

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.