-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ Hikes, Taiwan Geopolitical Matters Eyed

EXECUTIVE SUMMARY

- WHITE HOUSE: BIDEN HAS CONFIDENCE IN FED'S POWELL `AT THIS TIME' (POLITICO)

- ECB'S LAGARDE: ECB TO ZOOM IN ON INFLATION EXPECTATIONS, WAGES (RTRS)

- BIDEN SAYS HE & CHINA'S XI HAVE AGREED TO ABIDE BY TAIWAN AGREEMENT (RTRS)

- XI WON'T GO TO ROME SUMMIT, CHINESE ENVOYS TELL G-20 SHERPAS (BBG)

- RBNZ HIKES RATES, SIGNALS MORE TO COME (MNI)

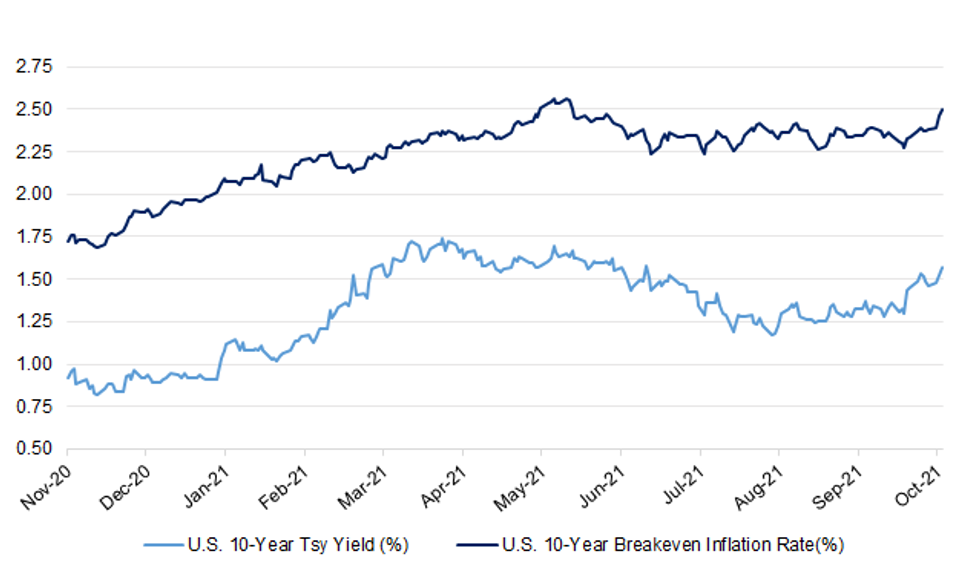

Fig. 1: U.S. 10-Year Yield vs. U.S. 10-Year Breakeven Inflation Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ENERGY: Gasoline and diesel shortages have eased in London and southeast England and the situation in the rest of Britain has improved further, according to an industry group representing independent fuel vendors. The Petrol Retailers Association said 15% of forecourts in and around the capital were dry, down from 22% on Sunday, but 21% still had only one grade of fuel. Britain deployed military tanker drivers on Monday to help deliver fuel after a chaotic week of panic-buying. (RTRS)

ECONOMY: Boris Johnson will announce a significant rise in the minimum wage within weeks as he pledges to end the "broken" model of a low-wage, low-growth economy. The Times has been told that the prime minister will accept the recommendations of independent advisers that are likely to boost the pay of the lowest earners to about £9.42 an hour. The announcement will mean the annual earnings of someone on the "national living wage" — the minimum wage paid to people over the age of 23 — increasing by 5.7 per cent. To someone working 35 hours per week, the increase would be worth an extra £928 a year before tax. (The Times)

ECONOMY: Boris Johnson clashed publicly with business leaders yesterday as each side blamed the other for the recent economic upheaval. In a series of interviews the prime minister insisted that it was not his job to "fix every problem in business", dismissing claims of labour shortages and supply chain problems that are fuelling inflation. He told the BBC that the disruption had been caused "very largely by the strength of the economic recovery" and that industry was "getting to grips with it, finding the staff that they need". (The Times)

ECONOMY: Nearly two-thirds of UK manufacturers expect to raise their prices in the run-up to Christmas after being hit by mounting cost pressures, a leading employers' group has said. The British Chambers of Commerce said inflation expectations had risen to their highest since its records began at the end of the 1980s, with 62% of industrial firms planning price hikes over the next three months. The BCC's warning came as the UK's biggest bakery chain Greggs and the upmarket confectioner Hotel Chocolat both reported evidence of growing price pressures. (Guardian)

BREXIT: The U.K. hit back at France over its threat to Britain's electricity supplies in a dispute over fishing, escalating post-Brexit tensions between the two countries. France is "unreasonable" to suggest Britain is not respecting their post-Brexit accord on fish, Brexit minister David Frost said Tuesday. Earlier, a French minister highlighted the U.K.'s reliance on France for its energy supply, suggesting it could be leveraged as a means of retaliation in their dispute over access to British fishing waters. "We do not accept that we are not abiding by that agreement," Frost said at the Conservative Party conference in Manchester. "It's not really a fair reflection of the efforts we've made." (BBG)

AUTOS: The UK's new car market has recorded its weakest September in 23 years, according to figures from the industry's trade body. The Society of Motor Manufacturers and Traders said the figure of 215,312 cars registered last month was more than a third down on September last year, when pandemic restrictions were curtailing economic activity. September is typically the second busiest month of the year for the industry, but a global shortage of computer chips has limited availability. Last month's "desperately disappointing" figures were 44.7 per cent down on the pre-pandemic ten-year average for the month and the lowest number since September 1998, the organisation said. Overall registrations in 2021 so far are only 6 per cent ahead of last year. (The Times)

EUROPE

ECB: The European Central Bank is closely watching inflation expectations and wage developments as predicting the length of disruptions caused the economy's post-pandemic reopening is difficult, ECB President Christine Lagarde said. "We should not overreact to supply shortages or rising energy prices, as our monetary policy cannot directly affect those phenomena," Lagarde said in a speech. "But we will pay close attention to wage developments and inflation expectations to ensure that inflation expectations are anchored at 2%," she said. (RTRS)

IRELAND: Irish domestic economic activity will reach its pre-coronavirus pandemic level by the end of this year thanks to a stronger than expected surge in consumption that will add to inflationary pressure, the country's central bank said on Wednesday. However, local price pressures are expected to ease towards the latter half of next year, the Irish authority said, echoing the European Central Bank's view that many of the drivers of a recent spike in euro zone inflation are temporary. Ireland's central bank expects modified domestic demand, its preferred measure for the health of the economy, to increase by 5.5% this year, up from the 3.4% it forecast three months ago, and by 7.1% next year versus 5.6% previously. (RTRS)

ENERGY: France, Spain and three other European countries called on the bloc to take urgent action to cushion the blow of skyrocketing gas prices -- and investigate their cause. Finance ministers of France, Spain, Greece, Czech Republic and Romania issued a joint statement asking the European Union to develop a toolkit to "immediately react to dramatic price surges." They called for an investigation into the gas market, said the bloc should coordinate purchases to "increase our bargaining power," and urged an overhaul of power markets. (BBG)

U.S.

FED: The White House on Tuesday said President Joe Biden has confidence in Federal Reserve Chair Jerome Powell, hours after Sen. Elizabeth Warren (D-Mass.) said the central bank chief had "failed as a leader" amid fallout from financial trades made by top Fed officials last year. "He does have confidence in Powell at this time," White House spokesperson Karine Jean-Pierre told reporters aboard Air Force One. (POLITICO)

FED: Senator Elizabeth Warren said revelations about investment transactions last year by Federal Reserve officials call into question Jerome Powell's leadership of the U.S. central bank. "For Fed officials to actively trade in the market raises legitimate questions about conflicts of interest and insider trading," the Massachusetts Democrat said Tuesday during a Senate speech. "These Fed officials actually show, at a minimum, really bad judgment." (BBG)

FED: Federal Reserve Chairman Jay Powell has the backing of more than half the Republicans who sit on the Senate Banking Committee, support that could help him earn a second term to lead the central bank, despite sharp criticism from Senator Elizabeth Warren, a Democrat. (BBG)

ECONOMY: MNI INTERVIEW: Services Prices Seen Up Through Most of '22 -ISM

- The cost of services jumped again in September and isn't likely to slow anytime soon, though consumers aren't pulling back on their spending just yet, ISM services chair Anthony Nieves told MNI Tuesday.

FISCAL: A CNN reporter tweeted the following on Tuesday: "Senate vote set for 215pm tomorrow to break a filibuster on bill to suspend debt limit. It will fail amid GOP opposition." (MNI)

FISCAL: To get around Republican obstruction, President Joe Biden said Tuesday that Democrats are considering a change to the Senate's filibuster rules in order to quickly approve lifting the nation's debt limit and avoid what would be a devastating credit default. The president's surprise remarks come as the Senate is tangled in a fiscally dangerous standoff over a vote that's needed to suspend the nation's debt limit and allow the federal government to continue borrowing to pay down its balances. Congress has just days to act before the Oct. 18 deadline when the Treasury Department has warned it will run short of funds to handle the nation's already accrued debt load. Biden has resisted any filibuster rule changes over other issues, but his off-the-cuff comments Tuesday night interjected a new urgency to an increasingly uncertain situation. "It's a real possibility," Biden told reporters outside the White House. (AP)

FISCAL: The White House is asking business leaders to meet with President Joe Biden on Wednesday about the need to raise the U.S. debt ceiling, according to a person familiar with the plans. (RTRS)

FISCAL: Before leaving Washington, Biden met virtually with moderate Democratic members of the House of Representatives about the infrastructure bill and his Build Back Better agenda. "It was a constructive meeting," Jean-Pierre said. Biden held a similar meeting with progressives on Monday. (RTRS)

OTHER

GLOBAL TRADE: The U.S. Trade Representative's office said on Tuesday it is seeking public comments on plans to revive a targeted tariff exclusion process for imports from China, specifically whether to reinstate previously extended exclusions on 549 import product categories. USTR said it would accept public comments from Oct. 12 through Dec. 1 on possible exclusions for a list of products that includes industrial components, thermostats, medical supplies, bicycles and textiles. (RTRS)

GLOBAL TRADE: South Korea's trade ministry on Wednesday expressed concerns over Washington's latest request to local chipmakers to share information on their supply chains amid growing concerns over the leak of major trade secrets. Trade Minister Yeo Han-koo met his U.S. counterpart, Katherine Tai, in Paris on the sidelines of the council meeting of the Organization for Economic Co-operation and Development (OECD), sharing opinions on various bilateral trade issues, according to the Ministry of Trade, Industry and Energy. During the meeting, Yeo said there has been growing concerns in South Korea that the information requested by Washington was too vast and may include trade secrets of related businesses. (Yonhap)

U.S./CHINA: U.S. President Joe Biden's national security adviser will hold talks with China's top diplomat Yang Jiechi in Switzerland on Wednesday, upholding a pledge by both countries to boost communication amid a deepening strategic rivalry. (RTRS)

U.S./CHINA/TAIWAN: U.S. President Joe Biden said on Tuesday that he has spoken to Chinese President Xi Jinping about Taiwan and they agreed to abide by the Taiwan agreement. "I've spoken with Xi about Taiwan. We agree ... we'll abide by the Taiwan agreement," he said. "We made it clear that I don't think he should be doing anything other than abiding by the agreement." (RTRS)

CHINA/TAIWAN: Taiwan Defence Minister Chiu Kuo-cheng said on Wednesday China will be capable of mounting a full scale invasion of the democratic island by 2025. Over a four day period beginning last Friday, Taiwan reported close to 150 Chinese air force aircraft entered its air defence zone, part of a pattern of what Taipei calls Beijing's continued harassment of the Chinese-claimed island. (RTRS)

GEOPOLITICS: Chinese diplomats have informed officials from the Group of 20 nations that President Xi Jinping does not currently plan to attend a summit in Italy this month in person, according to four people familiar with the matter. The message was conveyed at a meeting of G-20 envoys known as sherpas in Florence last month. Chinese envoys cited China's Covid protocols, which can include quarantine mandates for returning travelers, as a reason Xi did not intend to go to Rome, three of the people said. The people said there had been no communications on the matter since, and Italy, which is hosting the G-20 this year, has yet to receive an official response either way. Beijing often announces the president's travel plans at the last minute, and any final decision may not be sent to Prime Minister Mario Draghi's government until closer to the summit, which starts Oct. 30. (BBG)

CORONAVIRUS: World Health Organization officials said Tuesday that the unvaccinated are "dying unnecessarily" from Covid-19, citing global vaccine inequities as one of the main obstacles to immunizing more people against the virus. Some 56 countries fell short of the WHO's goal of getting 10% of their populations immunized against the virus by the end of September, officials said in a Q&A live streamed on the organization's social media channels. Increasing access to vaccines would help reduce Covid deaths and hospitalizations as the world approaches 5 million coronavirus fatalities, said Maria Van Kerkhove, the WHO's technical lead for Covid-19. (CNBC)

CORONAVIRUS: Merck's announcement that its experimental antiviral pill is effective against the most severe outcomes of Covid-19 is "certainly good news," a World Health Organization official said Tuesday, as the international agency awaits clinical trial data on the drug. "We're looking forward to receiving the data from them," Maria Van Kerkhove, the WHO's technical lead for Covid, said during a virtual Q&A. "I think everybody wants earlier treatment so that we prevent people from actually, you know, getting to that severe state and actually dying from the disease." (CNBC)

JAPAN: Asahi reports that some people within the ruling Liberal Democratic Party have expressed a sense of concern ahead of the looming general election following the release of initial approval ratings for the freshly inaugurated Kishida Cabinet. Asahi cited an unnamed former LDP minister suggesting that "low" ratings have caused anxiety among party officials. Opinion poll results conducted immediately after the inauguration of the Kishida Cabinet showed that the new administration is starting off from a relatively low base. The rate of public support for Kishida's government is considerably lower than those recorded for most freshly inaugurated administrations in recent years. Japanese voters will head to the polls for a general election on October 31 after a 12-day campaigning period. (MNI)

BOJ: Japanese firms have no pressing need to raise wages because they retained jobs during last year's pandemic-induced economic slump, and thus do not need to fill job vacancies as quickly as U.S. companies, Bank of Japan Governor Haruhiko Kuroda said. (RTRS)

AUSTRALIA: The banking regulator has announced tougher serviceability tests for home loans, which will make it harder for some borrowers to get a mortgage. In a letter to banks today, the Australian Prudential Regulation Authority (APRA) has increased the minimum interest rate buffer on home loan applications from 2.5 to 3 percentage points. "All ADIs [authorised deposit taking institutions] should be operating with a buffer of at least 3 percentage points over the loan interest rate," the regulator warned. "The buffer provides an important contingency for rises in interest rates over the life of the loan, as well as for any unforeseen changes in a borrower's income or expenses. "Where ADIs continue to approve loans using a lower buffer rate beyond the end of October 2021, APRA will adjust individual prudential capital requirements to reflect higher credit risk inherent in new lending." This means that, from the end of October, banks will have to test whether new borrowers can still afford their mortgage repayments if home loan interest rates rose to be 3 percentage points above their current rate. (ABC)

RBNZ: MNI STATE OF PLAY: RBNZ Hikes Rates, Signals More To Come

- An expected rate hike by the Reserve Bank of New Zealand on Wednesday is expected to be followed by one more this year as the central bank moves to cool an overheating economy - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

RBNZ: Assistant Reserve Bank of New Zealand Governor Christian Hawkesby has been appointed as Deputy Governor following the departure of Geoff Bascand, the RBNZ said on Wednesday. Hawkesby will take up the role in January next year when Bascand leaves the bank. He will also take over Bascand's role leading the RBNZ's financial stability functions. (MNI)

NEW ZEALAND: The Government will keep vaccination clinics open all day and into the evening next Saturday in a nationwide push to get more people vaccinated by October 16. Covid-19 Response Minister Chris Hipkins said the next week and a half would be "critical" to boosting vaccination rates ahead of a National Day of Action for vaccination planned for October 16. He has asked business leaders, media, and community groups to take part in the vaccine drive. "We need to pull out all the stops to increase our vaccination rates. It has never been more urgent," he said on Wednesday. (Stuff NZ)

NORTH KOREA: Japan's coast guard spotted a N. Korean ship with a portable missile system in late June off the coast of Ishikawa prefecture, central Japan, public broadcaster NHK reports, citing an unidentified person. (BBG)

RUSSIA: 17 senators, including the top Democrats and Republicans on the Senate Intelligence and Foreign Relations committees, are calling on President Biden to expel 300 Russian diplomats if Moscow does not issue more diplomatic visas to make up for its ban on the U.S. Embassy hiring local Russian staff. It would be the largest expulsion of Russian diplomats in U.S. history and would mark a major escalation in tensions between the two countries. (Axios)

RUSSIA: The European Commission is looking into complaints by some EU countries that Russia is using its position as a major supplier to propel the soaring price of gas in Europe, the bloc's energy policy chief said on Tuesday. (RTRS)

IRAN: President Joe Biden's national security adviser told his Israeli counterpart on Tuesday that diplomacy is the best way to rein in Iran's nuclear program even as he reaffirmed Biden's warning to Tehran that Washington could turn to other options if negotiations fail. (RTRS)

METALS: State prosecutors in the state of Minas Gerais have filed a lawsuit seeking 2.5 billion reais from miners Vale, Samarco and BHP related to a tailings dam disaster in 2015, according to a statement on Tuesday. (RTRS)

COPPER: Peru's government said on Tuesday it had reached an agreement with MMG Ltd's Las Bambas mine and the local Chumbivilcas community to avoid road blockades that have threatened production at the huge copper mine. (RTRS)

OIL: Top oil exporter Saudi Arabia cut the November official selling price (OSP) to Asia for its flagship Arab Light crude to $1.30 a barrel above the Oman/Dubai average, the country's state oil producer Aramco said on Tuesday. Saudi Arabia set its Arab Light OSP to northwest Europe at a discount of $2.40 a barrel against ICE Brent for November and its OSP to the United States was at a premium of $1.25 a barrel over Argus Sour Crude Index (ASCI). (RTRS)

OVERNIGHT DATA

SOUTH KOREA SEP CPI +2.5% Y/Y; MEDIAN +2.4%; AUG +2.6%

SOUTH KOREA SEP CPI +0.5% M/M; MEDIAN +0.4%; AUG +0.6%

SOUTH KOREA SEP CORE CPI +1.9% Y/Y; MEDIAN +1.8%; AUG +1.8%

SOUTH KOREA SEP FOREIGN RESERVES $463.97BN; AUG $463.93BN

MARKETS

SNAPSHOT: RBNZ Hikes, Taiwan Geopolitical Matters Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 456.41 points at 27365.43

- ASX 200 down 47.657 points at 7200.7

- Shanghai Comp. is closed

- JGB 10-Yr future down 16 ticks at 151.35, yield up 2bp at 0.080%

- Aussie 10-Yr future down 7.5 ticks at 98.385, yield up 7.5bp at 1.590%

- US 10-Yr future -0-08+ at 131-15, yield up 4bp at 1.566%

- WTI crude down $0.06 at $78.87, Gold down $7.70 at $1752.51

- USD/JPY up 29 pips at Y111.75

- WHITE HOUSE: BIDEN HAS CONFIDENCE IN FED'S POWELL `AT THIS TIME' (POLITICO)

- ECB'S LAGARDE: ECB TO ZOOM IN ON INFLATION EXPECTATIONS, WAGES (RTRS)

- BIDEN SAYS HE & CHINA'S XI HAVE AGREED TO ABIDE BY TAIWAN AGREEMENT (RTRS)

- XI WON'T GO TO ROME SUMMIT, CHINESE ENVOYS TELL G-20 SHERPAS (BBG)

- RBNZ HIKES RATES, SIGNALS MORE TO COME (MNI)

BOND SUMMARY: More Weakness For Core FI In Asia

Broader flows were at the fore overnight, with little in the way of meaningful headline flow observed. Core fixed income markets initially showed lower on spill over from the weakness in U.S. Tsys during Tuesday's session, before stabilising as the Nikkei 225 and e-mini moved into negative territory, reversing early gains. The space then moved lower again as U.S. 10-Year yields registered a fresh multi-month high.

- That leaves T-Notes -0-09 at 131-14+, with the cash Tsy curve bear steepening as 30s cheapen by the best part of 5bp on the day. A 5K block buyer of USX1 157.50 puts headlined during Asia-Pac hours. Wednesday's U.S. docket is dominated by the latest ADP employment report.

- JGB futures followed the broader gyrations, with the contract last -16 on the day. 20s provided the weakest point on the cash JGB curve, softening by a little over 1bp on the day as of typing. 5+-Year swap spreads have seen some widening, pointed to pay-side flows as one of the drivers as the move. Recent comments from BoJ Governor Kuroda haven't offered anything new, as he pointed to well-documented headwinds for inflation

- ACGBs marched to the beat of the broader drum, leaving YM -4.0 and XM -8.0 at typing. A$1.0bn of ACGB Nov '32 supply was easily digested, with the weighted average yield printing 0.43bp through prevailing mids at the time of the auction (per Yieldbroker pricing). The cover ratio was closer to 6.00x than it was 5.00x, with the well-trodden supportive factors and recent cheapening supporting demand (amongst other factors, which were outlined in our preview). Elsewhere, the APRA introduced slightly tighter mortgage lending restrictions, with deeper macroprudential measures expected further down the track.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 1.6137% (prev. 1.3220%)

- High Yield: 1.6150% (prev. 1.3225%)

- Bid/Cover: 5.8850x (prev. 3.5200x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 24.9% (prev. 66.5%)

- Bidders 52 (prev. 42), successful 23 (prev. 18), allocated in full 8 (prev. 7)

EQUITIES: Early Gains Reversed

After an initially positive start equity markets in Asia reversed early gains and languish in negative territory, the ongoing Chinese market holiday kept liquidity thin. Japanese bourses led the way lower again, the Nikkei 225 down for the eighth straight session. The initial round of approval ratings for the Kishida Cabinet proved disappointing for LDP officials. In New Zealand the RBNZ raised interest rates for the first time in seven years, the NZX 50 gave back early gains and sits ~0.3% lower on the day. Similar price action in the US, early gains for e-minis reversed as yields continued to rise, markets look ahead to the ADP employment report ahead of NFP figures later this week.

OIL: Rally Paused As Stocks Build

After rallying again on Tuesday WTI and Brent crude futures have softened slightly in Asia amid broadly negative risk sentiment in the region. US stockpile data from API after market yesterday also weighed on oil, headline inventories rose 951k bbls while downstream stocks also rose, if US DoE numbers confirm the build it will be the second straight weekly gain. Despite the move off highs crude futures are up 4.5% for the week so far. The moves follow OPEC+'s decision to keep output policy unchanged on Monday, signalling to markets that the group will tolerate restricted output in return for higher prices. The break higher this week confirms an extension of the current bullish price sequence of higher highs and higher lows and attention turns to $79.53 for WTI, a Fibonacci projection and the $80.00 psychological hurdle.

GOLD: A Touch Softer, Eyes On ADP

An uptick in U.S. Tsy yields and the DXY applied some pressure to bullion in overnight trade, with spot last dealing a little over $5/oz softer on the session, just above $1,750/oz. This comes after the breakeven-led dip in our weighted U.S. real yield monitor, alongside a downtick in the DXY, supported bullion in the latter rounds of NY dealing on Tuesday. The technical picture remains little changed for gold. Today's U.S. ADP employment report will set the scene ahead of Friday's NFP release, although we should expect the former to generate the usual conversations/debate surrounding the short-term correlation between the two releases.

FOREX: Antipodeans Grind Lower, RBNZ Stoke Some NZD Volatility

The RBNZ triggered some NZD volatility as policymakers raised the OCR by 25bp (in line with expectations), pointed to elevated capacity pressures and reaffirmed their view that further withdrawal of stimulus is in sight. The kiwi blipped higher in the initial reaction but promptly shed gains and retreated towards fresh session lows.

- NZD/USD topped out at $0.6979 before staging a pullback, but the $0.6928/27 area, which limited losses earlier this week, proved resilient. Looking ahead, as much as NZ$2.2bn worth of NZD/USD options with strikes at $0.7000 will roll off at today's NY cut.

- Post-RBNZ volatility briefly interrupted the Antipodeans' general depreciation driven by broader risk-off feel. Equity benchmarks across the Asia-Pac region reversed early gains and retreated alongside U.S. e-mini futures.

- The greenback firmed against G10 currencies and the DXY crossed above yesterday's highs amid an uptick in U.S. Tsy yields.

- Onshore Chinese markets remained closed in observance of a week-long national holiday.

- Today's data highlights include German factory orders, EZ retail sales & U.S. ADP employment change. Speeches are due from ECB's Centeno & Riksbank's Skingsley.

FOREX OPTIONS: Expiries for Oct06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1615-25(E622mln)

- GBP/USD: $1.3835-55(Gbp663mln)

- AUD/USD: $0.7300(A$671mln)

- NZD/USD: $0.7000(N$2.2bln)

- USD/CAD: C$1.2550-60(C$1.6bln), C$1.2600($868mln), C$1.2720-30($1.2bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.