-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoE Dial Up Tightening Talk

EXECUTIVE SUMMARY

- BOE'S BAILEY: INFLATION GOING TO GO HIGHER, WOULD PREFER IT NOT THERE

- BOE'S SAUNDERS: BRACE FOR INTEREST RATE RISES (Telegraph)

- ECB'S VILLEROY: INFLATION TO FALL BELOW 2% BY END-2022 (BBG)

- AUSTRIAN CLL'R KURZ STEPS DOWN, CZECH PM BABIS LOSES RE-ELECTION BID

- JAPAN PM KISHIDA: NO PLAN TO ALTER CAPITAL-GAINS, DIVIDEND TAXES (RTRS)

- CHINA COAL FUTURES SURGE TO RECORD AS FLOOD SWAMPS MINE HUB (BBG)

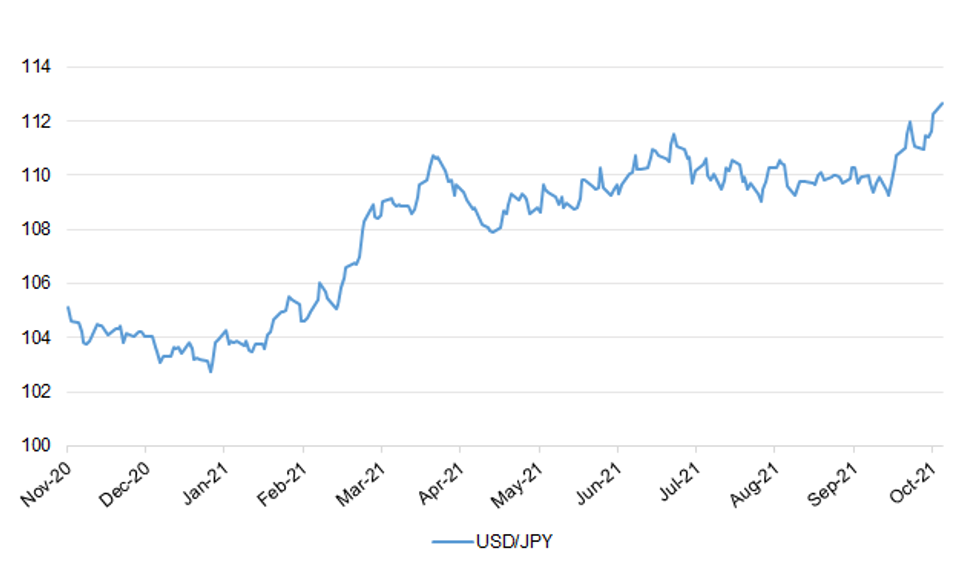

Fig. 1: USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Andrew Bailey told The Yorkshire Post that investment into the nation's infrastructure in recent years had been weak and said supporting digital, transport and climate infrastructure would help the economy grow, provide certainty for the economy and increase capacity for business. Mr Bailey said that economic recovery from the pandemic still had some distance to being fully realised but said that he did not anticipate any further increases in unemployment. However the governor warned that inflation was likely to increase and said he had a "very delicate and challenging job" when it came to managing its longer-term impact on the economy. With inflation currently running above the Bank of England's target of two per cent, Mr Bailey said a huge amount of focus was currently being directed to bring it under control. "Obviously I am concerned with inflation above target," he said. "Unfortunately, if you look at our last forecast, it is going to go higher I am afraid. As the Bank of England governor I would prefer it not be there. But we are in very unusual times and what I would say is we have to manage our way through these times." He added: "We are going to have a very delicate and challenging job on our hands so we have got to in a sense prevent the thing becoming permanently embedded because that would obviously be very damaging." (Yorkshire Post)

BOE: Households must brace for "significantly earlier" interest rate rises as the Bank of England prepares to head off soaring inflation, one of its key policymakers has said. Michael Saunders, who sits on the Bank's monetary policy committee (MPC), said financial markets were right to bet on faster increases as the Consumer Prices Index heads above 4pc - and even hinted rates could rise before the end of this year. Mr Saunders said: "You can be aggressive in providing stimulus when it's needed. But the flip side of that is to be willing to take away some of that stimulus when inflation risks are no longer to the downside but more to the upside." Financial markets are now on alert for the Bank to raise rates at a much faster pace than expected in the summer. Investors are pricing in an increase to 0.75pc by the end of next year. Mr Saunders said: "I'm not in favour of using code words or stating our intentions in advance of the meeting too precisely, the decisions get taken at the proper time. But markets have priced in over the last few months an earlier rise in Bank rate than previously and I think that's appropriate. "The February one is fully priced in and for December, it's half priced in. I'm not trying to give a commentary on exactly which one, but I think it is appropriate that the markets have moved to pricing a significantly earlier path of tightening than they did previously." Despite surging gas prices, Mr Saunders said widespread labour shortages pose a bigger risk of inflation by feeding into higher pay demands. (Telegraph)

ECONOMY: The Treasury has played down hopes that major factories and chemical plants could receive support packages to help them cope with the energy crisis this winter. There were warnings on Sunday that some factories are "days away" from having to stop production because energy bills have quadrupled this year. Kwasi Kwarteng, the Business Secretary, appeared to offer some hope when he suggested a financial package might be forthcoming. Mr Kwarteng acknowledged that it was a "critical situation" but denied he had requested billions of pounds of support when asked whether he was considering a price cap or winter package for businesses. Hinting at a new financial package, the Business Secretary added: "I think he showed a great deal of flexibility when he allowed £500 million to be dispersed by local authorities for vulnerable consumers, and we're working to see what we can do in terms of protecting industry." But a senior Treasury source said no talks about a financial package have taken place, despite firms pleading for help to prevent further collapses as wholesale gas prices spiral. The source told Sky News: "This is not the first time the BEIS Secretary has made things up in interviews. To be crystal clear, the Treasury is not involved in any talks." Another source told The Telegraph: "The Treasury has not been involved in talks." (Telegraph)

ECONOMY: Rishi Sunak is to save billions of pounds by counting as aid financial assistance to poor countries being provided as a result of a windfall Britain has received from the International Monetary Fund (IMF). In a move that has been condemned by former Conservative international development secretaries, the chancellor has chosen not to use the UK's share of a new $650bn IMF global fighting fund to increase the share of national output spent on aid. Britain received $27.4bn (£20bn) as its share of an allocation of IMF special drawing rights (SDRs) – financial assets designed to help poor countries struggling during the pandemic – months after the government decided to cut aid spending from 0.7% to 0.5% of national income. Other rich countries are making help provided as a result of the SDRs additional to existing budgets, but the UK will stick to internationally agreed rules that allow 30% of any concessional lending through the IMF to count as aid. (Guardian)

POLITICS: Health secretary Sajid Javid has expressed alarm at the rising numbers of people suffering long Covid symptoms, telling a private meeting of health officials that the problem was "huge" and "getting bigger". The meeting was given an update on long Covid treatment, with NHS England bosses revealing 10 per cent of all clinic appointments were being taken up by NHS staff in a sign of the potential longer term impact of coronavirus and the risk it could undermine already depleted staffing levels. NHS staff are most likely to be affected by long Covid, followed by staff in social care and teachers. As many as 125,000 NHS staff may be affected by persistent symptoms. (Independent)

POLITICS: A cabinet minister has been accused of making misleading claims about a £1.2bn cable project linked to a Conservative donor. Almost one in 10 Conservative MPs had taken money from firms linked to Viktor Fedotov, revealed in the Pandora papers to have secretly co-owned a company once accused of participating in a massive corruption scheme. One of those firms included Aquind. Labour highlighted that the business secretary, Kwasi Kwarteng, had said he was supportive of the project in a 2019 letter released under freedom of information, despite Kwarteng saying on Sunday he had never voiced support. A source at the Department for Business, Energy & Industrial Strategy said the letter was part of a proposal for cross-border infrastructure schemes to the "EU Projects of Common Interest" (PCI) register, which included Aquind as one of four interconnector projects. The source said the planning decision was separate and quasi-judicial and proposing the project to the PCI did not mean it would be approved. (Guardian)

ENERGY: Ministers will announce plans for levies on gas bills to fund low-carbon heating within the next fortnight despite rising prices, The Times has been told. The government will publish a new strategy with a carbon pricing scheme that could push gas bills significantly higher. The strategy, which will be published before the Cop26 climate conference in Glasgow next month, commits the government to cutting the price of electricity, which is significantly higher than gas. It will seek to end "price distortions" by removing green levies from electricity bills over the next decade and imposing new charges on gas bills. Ministers have been warned that average annual energy bills could reach £2,000 next year if wholesale prices continue to rise. (Times)

NORTHERN IRELAND: Britain's Brexit chief has accused the EU of not listening to his demands on Northern Ireland in a heated series of late-night posts on Twitter. Lord Frost's comments came after Ireland's foreign minister Simon Coveney accused him of laying out red lines he knew the EU could not accept, to deliberately engineer a breakdown in relations. The UK's Brexit minister said he preferred "not to do negotiations by twitter" but would proceed since Mr Coveney had "begun the process". The Brexit minister wants to change the part of the deal relating to Northern Ireland but the EU says the UK must stand by what it has signed. But Lord Frost specifically wants to dump jurisdiction of the European Court of Justice over the Northern Ireland deal, which he signed up to during talks but now is having second thoughts about. (Independent)

UK/FRANCE: Priti Patel has been urged to "come clean" over her strategy to curb Channel crossings after more than 1,100 migrants tried to make the journey over two days. The figures emerged as Patel, the home secretary, faced criticism from a French minister who said the UK had not paid the £54 million it had promised to France to help tackle the crossings. Patel recently said the government would withhold the funds unless French authorities stopped more migrants from reaching the UK. (Times)

EUROPE

ECB: Bank of France Governor Francois Villeroy de Galhau said he expects inflation in the euro area to peak in coming months and for price increases to fall below 2% by the end of 2022. Villeory, who is also a member of the European Central Bank's governing council, said the jump in inflation was a temporary bump linked to the rise in energy prices and a few other areas, and that business leaders were already telling him of declines prices in some commodities. "A bump, even if it's high, doesn't make for a long term trend," Villeroy said in an interview on France Inter radio. "I don't think it's start of a spiral, even if we need to remain very vigilant." Villeroy also dismissed a question about whether the ECB should consider raising rates, saying that the first error one can make in monetary policy would be to overreact to a temporary variation in prices. (BBG)

EU: Brussels is preparing a sweeping overhaul of the regime that allows foreign banks to use lightly regulated branches to operate across the EU, in a move that could push up costs for the industry. The European Commission is working on proposals to empower financial regulators to force banks to turn some of their European branches into subsidiaries, if the branches' activities are deemed sufficiently large and risky, according to people familiar with the plans. The rules aim to crack down on thinly supervised non-EU banks that are expanding rapidly in Europe — a trend accelerated by Brexit as financial institutions from Asia, the US and other markets broaden their activities in the single market. The European Central Bank, which has been supervising Europe's biggest banks since 2014, has grown increasingly concerned that the branches system allows some foreign banks to continue escaping ECB oversight by doing much of their business in the bloc via lightly supervised branches. However, the proposals could cost the industry billions of euros since capital and liquidity requirements for branches are largely far lower than those imposed on subsidiaries, which typically have to meet the same rules as standalone banks. (FT)

EU/UK: French Interior Minister Gerald Darmanin on Saturday called for the start of negotiations for a migration treaty between the European Union and Britain. Darmanin also urged the British government to "uphold its promise" to finance the fight against the illegal immigrants who gather on the northern French coast seeking to cross into England. "We need to negotiate a treaty, since Mr (Michel) Barnier did not do so when he negotiated Brexit, which binds us on migration issues," the interior minister said, adding that France will champion the project when it takes over the EU's rotating presidency in January. (France24)

GERMANY: Talks to form a three-way coalition government in Germany risk getting bogged down over finance and budget matters, based on divergent policy objectives outlined by leaders of the two junior parties over the weekend. Volker Wissing, secretary-general of the business-friendly FDP, said his party won't accept tax increases or a loosening of the so-called debt brake, according to a report in the tabloid Bild on Sunday. Less than 24 hours earlier, the Green Party co-leader, Robert Habeck, called for more investment in climate protection and also urged debt relief for southern European countries worst-hit by the Covid-19 pandemic. The different viewpoints of the two likeliest junior partners in a Social Democratic Party-led coalition suggest talks due to resume Monday may be more complicated than anticipated. Party leaders after the first day praised the good atmosphere between the negotiators. "Debt doesn't create a future," Wissing told Bild on Sunday, insisting that his party would "stick to this position." Habeck had warned Saturday in an interview with the public broadcaster Deutschlandfunk that withholding debt relief from cash-strapped European nations would encourage extremism. There are a lot of deep-seated policy conflicts between the three parties, Habeck said, adding, "This is not a done deal yet." FDP leader Christian Lindner declined to comment on Habeck's interview. (BBG)

AUSTRIA: Austrian Chancellor Sebastian Kurz on Saturday announced that he would step down amid allegations of financial impropriety against his office. Kurz said he would move to parliament as leader of the Austrian People's Party (ÖVP). Foreign Minister Alexander Schallenberg will replace him as chancellor, he said. "My country is more important to me than myself," Kurz said in a televised statement. "What we need now are stable conditions,'' he told reporters in Vienna. "So, in order to resolve the stalemate, I want to make way to prevent chaos and ensure stability." (Deutsche Welle)

CZECHIA: Czech Prime Minister Andrej Babis lost his re-election bid on Saturday, a major upset against a billionaire businessman who had personified the rise of populist nationalism in Central Europe. With 99.9% of ballots counted, Mr. Babis's Yes party held 27.2% of the vote, trailing less than a percentage point behind a coalition of right-leaning parties called Together. Along with a separate, liberal alliance of parties called Pirates and Mayors, the two coalitions appeared to hold 108 of parliament's 200 seats, according to Czech Television, the national public broadcaster. On Saturday, leaders of each said they would form a government together. "Both democratic coalitions have a chance to build a government," Together leader Petr Fiala told supporters Saturday night. "Change is here. We promised it. We will do it." (WSJ)

CZECHIA: Czech President Milos Zeman was receiving treatment in an intensive care unit on Sunday, creating uncertainty at a time when he is due to lead political talks about forming a new government after a parliamentary election. Director Miroslav Zavoral of the Central Military Hospital in Prague said Zeman, 77, was admitted due to complications related to an undisclosed chronic condition. (RTRS)

POLAND/BELARUS: A record number of people attempted to cross the border between Poland and Belarus Saturday, amid accusations that Belarus is facilitating migration to the European Union's eastern border. The Polish Border Guard told CNN that Saturday's figure of of 739 attempted crossings was the most so far for a single day. They're the latest in a weeks-long migration crisis at the border, for which Poland imposed a state of emergency last month. (CNN)

POLAND: More than 100,000 Poles demonstrated on Sunday in support of European Union membership after a court ruling that parts of EU law are incompatible with the constitution raised concerns the country could eventually leave the bloc. According to the organisers, protests took place in over 100 towns and cities across Poland and several cities abroad, with 80,000-100,000 people gathering in the capital Warsaw alone, waving Polish and EU flags and shouting "We are staying". (RTRS)

ENERGY: The Kremlin's ambassador to the EU has called on Europe to mend ties with Moscow in order to avoid future gas shortages, but insisted that Russia had nothing to do with the recent jump in prices. Vladimir Chizov, Russia's permanent representative to the EU, said he expected Gazprom, the state-controlled exporter that supplies 35 per cent of European gas needs, to respond swiftly to instructions from president Vladimir Putin to adjust output. Action, which would help curb skyrocketing wholesale prices, was likely to come "sooner rather than later," he said. Putin "gave some advice to Gazprom, to be more flexible. And something makes me think that Gazprom will listen," Chizov told the Financial Times. (FT)

US

FED: The U.S. labor market will see "ups and downs" as the pandemic lingers but it's premature to judge that the recovery is in peril, said San Francisco Federal Reserve President Mary Daly. "It's too soon to say it's stalling, but certainly we're seeing the pain of Covid, and the pain of the delta variant," Daly told CBS's "Face the Nation" on Sunday. "Covid is not behind us, so I don't expect the job market to just be continuous. It is going to have these ups and downs." (BBG)

FISCAL: U.S. Treasury Secretary Janet Yellen warned on ABC's "This Week" that Sen. Minority Leader Mitch McConnell and Republicans are playing with "catastrophe" over a pending fight to raise the debt ceiling. While the Senate reached a deal on Thursday for an emergency hike of the debt ceiling by $480 billion to pay the nation's bills through Dec. 3, McConnell has warned of a battle brewing over raising it further. Pressed by "This Week" anchor George Stephanopoulos about what would happen if McConnell keeps his word that Republicans won't help the Democrats next time, Yellen painted a picture with drastic consequences. "Fifty million Americans wouldn't receive Social Security payments. Our troops won't know when or if they would be paid. The 30 million families that receive a child tax credit, those payments would be in jeopardy," Yellen said. She said such a scenario "could result in catastrophe." Yellen has previously expressed support for eliminating the debt limit and was asked by Stephanopoulos if she has been able to convince President Joe Biden to get on board with that position. "Yes, I support [it]. But it's up to Congress," Yellen said. Yellen also expressed confidence that Congress will approve legislation to include the 15% global corporate minimum tax agreed to by 136 countries in Biden's spending package. She said the tax would "reassure the world that the U.S. will do its part." "This is a very historic agreement," Yellen said. "We should be competing on the basis of our strengths, on our institutions, not a race to the bottom that deprives countries of the resources we need to invest in our people." (ABC)

POLITICS/ECONOMY: The Justice Department has been quietly ramping up antitrust enforcement under the Biden administration, despite not having a politically confirmed official to serve as antitrust chief. The department shares antitrust authority with the Federal Trade Commission, whose new liberal leadership has drawn much of the early spotlight. Yet in recent months the DOJ has blocked a major insurance-industry merger between Aon PLC and rival Willis Towers Watson PLC; filed an aggressive challenge to a partnership between American Airlines Group Inc. and JetBlue Airways Corp.; and withdrawn from a real-estate industry settlement in order to take a deeper look at whether industry practices keep some broker commissions artificially high. Antitrust staffers are advancing investigations of business practices at Apple Inc., Alphabet Inc.'s Google (which already is facing one Justice Department antitrust lawsuit) and Visa Inc. The department's antitrust division also is deep into scrutinizing some high-profile pending mergers. Those include a publishing industry deal in which Penguin Random House's parent company is seeking to buy Simon & Schuster, and UnitedHealth Group Inc.'s planned acquisition of health-care technology company Change Healthcare. (WSJ)

POLITICS: The House panel investigating the Jan. 6 insurrection is prepared to seek criminal prosecutions for aides to former President Trump who refuse to comply with subpoenas, member Rep. Adam Schiff (D-Calif.) told CBS's "Face the Nation" Sunday. Driving the news: The former president has told former aides and associates to invoke executive privilege and not comply with Congressional requests, according to reports. (Axios)

POLITICS: A federal appeals court panel reinstated Texas' restrictive abortion law late Friday, temporarily restoring a ban on virtually all procedures that had been blocked by a lower court two days earlier in a case brought by the Biden administration. The decision by three judges on the U.S. Court of Appeals for the Fifth Circuit, in a terse two-page ruling granting a stay as it considers an appeal by the state of Texas, had been expected by many abortion providers. While at least six clinics in Texas had begun conducting abortions beyond the limits of the new law this week, most of the state's roughly two dozen providers had opted not to take that step as the case moved through the courts. (NYT)

POLITICS: Senate Republicans, with a few exceptions, are hoping that former President Trump does not announce his intention to run again for president. These GOP senators definitely don't want to see Trump announce a bid before the 2022 midterm elections, fearing that could sink their hopes of winning back the Senate. More broadly, they're generally reluctant to see him on the ballot in 2024 at all because of his track record with independent and swing voters. Several Republican senators, who requested anonymity to discuss Trump frankly, said they don't want to see Trump return as the party's standard bearer. "I think we're better off when he's not part of any story," said a Republican senator, who said his view is widely shared in the GOP conference. (Hill)

OTHER

GLOBAL TRADE: U.S. Trade Representative Katherine Tai today held a virtual meeting with Vice Premier of the People's Republic of China Liu He to discuss the U.S.-China trade relationship, according to a readout. Ambassador Tai and Vice Premier Liu reviewed implementation of the U.S.-China Economic and Trade Agreement and agreed that the two sides would consult on certain outstanding issues. They acknowledged the importance of the bilateral trade relationship and the impact that it has not only on the U.S. and China but also the global economy. Ambassador Tai said she looks forward to following up with Vice Premier Liu in the near future. (BBG)

IMF: The International Monetary Fund's executive board plans to deliberate Monday over the fate of the lender's chief, Kristalina Georgieva, after discussions Sunday with her and the law firm that alleged improper actions in her previous job at the World Bank, according to a person familiar with the talks. The board, with 24 directors representing the fund's 190 member nations, is trying to complete its review as the IMF and World Bank start their annual meetings -- where finance ministers and central bankers from across the world will gather in Washington starting on Monday, with dozens of events planned. The board meeting on Sunday with law firm WilmerHale ran for several hours in the afternoon, the person said on condition of anonymity because the talks were private. "The board made further significant progress today in its assessment with a view to very soon concluding its consideration of the matter," fund spokesman Gerry Rice said in a statement Sunday, confirming that the board had met with both the firm and Georgieva. (BBG)

GEOPOLITICS: The Pentagon's first chief software officer said he resigned in protest at the slow pace of technological transformation in the US military, and because he could not stand to watch China overtake America. In his first interview since leaving the post at the Department of Defense a week ago, Nicolas Chaillan told the Financial Times that the failure of the US to respond to Chinese cyber and other threats was putting his children's future at risk. "We have no competing fighting chance against China in 15 to 20 years. Right now, it's already a done deal; it is already over in my opinion," he said, adding there was "good reason to be angry". (FT)

CHINA/TAIWAN: Chinese President Xi Jinping vowed on Saturday to achieve "peaceful reunification" with Taiwan, and did not directly mention the use of force after a week of tensions with the Chinese-claimed island that sparked international concern. Speaking at Beijing's Great Hall of the People, Xi said the Chinese people have a "glorious tradition" of opposing separatism. "Taiwan independence separatism is the biggest obstacle to achieving the reunification of the motherland, and the most serious hidden danger to national rejuvenation," he said on the anniversary of the revolution that overthrew the last imperial dynasty in 1911. (RTRS)

CHINA/TAIWAN: Taiwan will never "bow" to China the island's president said in a defiant statement as she vowed to strengthen the country's armed forces to defend its democratic way of life in the face of increasing military pressure from Beijing. Speaking on Taiwan's national day, Tsai Ing-wen ruled out the idea that the island would agree to be "subordinate" to Beijing, the day after President Xi of China insisted that the "historical task" of reunifying China must take place. "There should be absolutely no illusions that the Taiwanese people will bow to pressure," Tsai told troops, politicians and foreign diplomats gathered in front of the presidential office. "We will continue to bolster our national defence and demonstrate our determination to defend ourselves in order to ensure that nobody can force Taiwan to take the path China has laid out for us." (Times)

CHINA/INDIA: The 13th round of military talks between India and China did not produce any resolution of the remaining issues in eastern Ladakh, the Indian Army said on Monday a day after the dialogue. It said the Indian side made "constructive suggestions" for resolving the remaining areas but the Chinese side was not agreeable to them and also could not provide any forward-looking proposals. "The meeting thus did not result in resolution of the remaining areas," the Army said in a statement. (Economic Times)

CHINA/INDIA: China has accused India of making unreasonable demands in their latest round of talks as the two neighbours continued to blame each other for the latest flashpoints on their disputed border. "During the talks, the Chinese side has made great efforts and fully demonstrated its sincerity to promote the de-escalation of the border situation," Long said in a statement. "But the Indian side still insists on unreasonable and unrealistic demands, making the negotiations more difficult. (SCMP)

CHINA/INDIA: Chinese state media has denied reports that border troops had been detained by the Indian army but said a routine patrol had been "unreasonably obstructed" late last month. The two sides are separated by the Line of Actual Control (LAC) but they have been unable to agree its exact boundaries. China Daily said the troops were operating in a place called Dongzhang on the Chinese side of the de facto border. (SCMP)

U.S./RUSSIA: Russia will allow U.S. Under Secretary of State Victoria Nuland to visit for talks despite having previously blacklisted her, after Washington agreed to lift a similar restriction placed on a Russian citizen, Moscow said on Sunday. The U.S. official, who is expected in Moscow from Oct. 11 to 13, visits at a time when political ties between the countries are badly strained. She will meet senior officials to discuss bilateral, regional and global issues, the State Department has said. (RTRS)

JAPAN: Japan's new Prime Minister, Fumio Kishida, said on Sunday he won't seek to change the country's taxes on capital gains and dividends for now as he intends to pursue other steps for better wealth distribution, such as raising wages of medical workers. Kishida, who has vowed to rectify wealth disparities, had previously said reviewing those taxes would be an option in addressing income gaps. The premier's new stance indicates his concern about jitters in the stock market caused by the prospects of higher tax levies. (RTRS)

JAPAN: Japan's new prime minister, Fumio Kishida, makes his debut in parliamentary questioning on Monday, the first chance for the opposition to probe Kishida's promises and plans since he took office last week. With the general election scheduled to take place in three weeks' time, tackling the next wave of the coronavirus pandemic and rebuilding a weak economy are set to become key issues of debate. (RTRS)

JAPAN: The Japanese government aims to reduce the country's use of nuclear energy as much as possible, new Environment Minister Tsuyoshi Yamaguchi said in a recent interview with Jiji Press and other media outlets. "We would like to reduce our reliance on nuclear power as much as possible and as early as possible," said Yamaguchi, who assumed the post in the cabinet of Prime Minister Fumio Kishida, who took office last week. "The answer is that we should introduce renewable energy sources as much as possible," Yamaguchi said. (Jiji)

NEW ZEALAND: New Zealand will require teachers and workers in the health and disability sectors to be fully vaccinated against COVID-19, Prime Minister Jacinda Ardern said on Monday, as she extended restrictions in Auckland, its largest city, for another week. (RTRS)

SOUTH KOREA: The chief of the ruling Democratic Party (DP) said Monday the nomination of Gyeonggi Gov. Lee Jae-myung as its presidential candidate was confirmed and decided in accordance with the party rules after runner-up ex-Prime Minister Lee Nak-yon appealed the results. Lee Jae-myung won 50.29 percent of all votes cast in the course of the party's 11-round primary since last month, followed by Lee Nak-yon with 39.14 percent. The governor needed a majority of the votes to avoid a runoff. (Yonhap)

HONG KONG: Hong Kong Chief Executive Carrie Lam acknowledged travel restrictions could harm the city's reputation as a global financial hub, but stressed that even a single fatality from Covid-19 would be a major cause for concern, underscoring the ultra-strict "Covid Zero" approach that has frustrated global businesses. In an interview with Bloomberg Television on Monday, Lam said she was "duty bound to protect my people" with travel restrictions even as other finance centers such as Singapore open up and shift to a strategy of living with the virus. (BBG)

HONG KONG: Hong Kong and mainland Chinese authorities need to agree on the specific circumstances that will trigger the suspension of quarantine-free travel in the negotiations for reopening the border, the city's leader has said. Chief Executive Carrie Lam Cheng Yuet-ngor also insisted on Sunday that a health code app being designed for quarantine-free travel to the mainland would not be compulsory for all Hong Kong residents. "Our system can only apply to those who wish to cross the border, and it must be voluntary because we do not have a system for registering names and with a tracking function," she said. (SCMP)

CANADA: Vehicle production is plunging across the world as automakers struggle to get their hands on vital computer chips, leading to lengthy downtime at assembly plants and posing a challenge to the economic recovery. Even so, the Canadian slowdown is especially severe. In August, light-vehicle production in Canada tumbled 38 per cent from a year earlier, according to data from research firm Wards Intelligence. Production in the U.S. fell 16 per cent over the same span and in Mexico by 20 per cent. (Globe & Mail)

SINGAPORE: Singapore announced Saturday it will be opening new travel lanes for vaccinated visitors from 8 more countries. It came as its Prime Minister Lee Hsien Loong predicted it will take between three to six months to get to a "new normal" of living with Covid. The Southeast Asian country will be launching more vaccinated travel lanes (VTL) — with Canada, Denmark, France, Italy, Netherlands, Spain, the U.K. and the U.S., the transport ministry announced. Applications will open on Tuesday, and travelers from those countries who meet the conditions will be able to enter Singapore from Oct. 19, the minister said. (CNBC)

MALAYSIA: Malaysia will allow interstate and overseas travel from Monday (Oct 11) for the 90 per cent of its adult population that have been fully vaccinated against Covid-19. In a national broadcast on Sunday to mark the achievement of the immunisation target, Prime Minister Ismail Sabri Yaakob also vowed that the progressive relaxation of pandemic curbs will not be reversed even if there are spikes in infections. (Straits Times)

INDIA: India has ample coal stocks to meet power sector demand, a coal ministry statement said on Sunday, a day after the Delhi Chief Minister said a shortage of the fuel meant the Indian capital could face a power crisis. State-run Coal India Ltd is using its 40 million tonne stocks to replenish utilities, which together have 7.2 million tonnes of inventory, equivalent to four days' requirements, the ministry statement said. A lack of coal has caused a supply shortage in some eastern and northern states, with residents in the regions experiencing power cuts stretching to up to 14 hours a day. (RTRS)

INDIA: India is racing to wrap up a clutch of quick-fire bilateral trade pacts by the end of March, officials said, as economic necessity spurs a shift from New Delhi's usual go-slow approach on trade deals. The shift also means that Prime Minister Narendra Modi's government is prioritizing "early harvest" pacts over comprehensive free trade agreements with partners, a move that's leaving some countries perplexed, officials said, asking not to be identified as the talks are private. Modi's office is pushing ministries, particularly foreign and commerce, to deliver on initial deals with countries including Australia and the U.K., several officials said. That's even as India walked away from Asia's biggest multilateral agreement in 2019 and has shown little interest so far in a Trans-Pacific pact. (BBG)

MIDDLE EAST: Secretary of State Antony Blinken will hold a trilateral meeting at the State Department on Wednesday with the foreign ministers of Israel and the United Arab Emirates. Why it matters: This is the first such meeting since the signing in 2020 of the "Abraham Accords," normalization agreements Israel struck with Bahrain and the UAE. It is a substantial step by the Biden administration to strengthen the treaty between the countries. (Axios)

ISRAEL/GERMANY: Outgoing German Chancellor Angela Merkel stood on Sunday in Jerusalem with her head bowed over the buried ashes of Jews killed in Nazi death camps, and pledged Germany would preserve a post-Holocaust commitment to Israel's security. Merkel, on her eighth and final visit to Israel as she concludes her 16-year term, earlier held talks with Prime Minister Naftali Bennett, whose opposition to Palestinian statehood is at odds with Western powers including Germany. Commenting on what Israel sees as an issue crucial to its security, Merkel said the coming weeks would be decisive for the future of a nuclear deal with Iran. (RTRS)

AFGHANISTAN: Senior Taliban representatives have said they had "positive" discussions with a delegation from the United States in the Qatari capital Doha, and have begun a meeting with the European Union representatives. It was the first face-to-face meeting between the two sides since the Taliban took over Afghanistan on August 15 after the West-backed government of President Ashraf Ghani collapsed as the US forces started to withdraw from the country. Al Jazeera's Natasha Ghoneim, reporting from Doha, said the Americans "aren't offering any details as the talks conclude", but the Afghan delegation has said the two-day talks were "positive". "They hope it paves the way for recognition of the Afghan government – not only by the United States, but the international community," Ghoneim said. (Al Jazeera)

AFGHANISTAN: The Taliban on Saturday ruled out cooperation with the United States to contain extremist groups in Afghanistan, staking out an uncompromising position on a key issue ahead of the first direct talks between the former foes since America withdrew from the country in August. Senior Taliban officials and U.S. representatives are meeting this weekend in Doha, the capital of Qatar. Officials from both sides have said issues include reining in extremist groups and the evacuation of foreign citizens and Afghans from the country. The Taliban have signaled flexibility on evacuations. However, Taliban political spokesman Suhail Shaheen told The Associated Press there would be no cooperation with Washington on containing the increasingly active Islamic State group in Afghanistan. IS has taken responsibility for a number of recent attacks, including a suicide bombing Friday that killed 46 minority Shiite Muslims and wounded dozens as they prayed in a mosque in the northern city of Kunduz. (AP)

AFGHANISTAN: The U.S. has agreed to provide humanitarian aid to a desperately poor Afghanistan on the brink of an economic disaster, while refusing to give political recognition to the country's new Taliban rulers, the Taliban said Sunday. (NPR)

IRAQ: Polls have closed in Iraq's parliamentary election with one of the lowest turnouts in years amid waning support for the democratic system brought in following the United States-led invasion of 2003. Some 41 percent of eligible voters cast their ballots in Sunday's election, according to the Iraqi election commission. (Al Jazeera)

CHINA

SECURITY: China's drive for web security has entered a "fast lane," with positive progress made in many cases, the Xinhua News Agency said in a commentary. The cybersecurity agency has effectively prevented risks to national security resulting from the procurement, data treatment and overseas listings by investigating online platforms including ride-hailing Didi Chuxing Technology, logistics firms Yunmanman and online recruiter Boss Zhipin, the official news carrier said. (MNI)

HOUSING: China's northeast city Harbin, the capital of Heilongjiang province, is giving fresh graduates and new residents as much as CNY100,000 incentives and other favorable terms to courage them to buy homes and settle in the city, Yicai.com reported citing the local government. Harbin is joining many other Chinese cities seeking to arrest the falling markets, which reflects a growing divergence in China' regional housing markets, said Yicai.com. Some have published price floors to prevent developers from selling for too cheap and disrupting the markets, said the newspaper. Many Chinese cities now face the challenge of overly bearish housing markets, which cause financial difficulties for developers and impact financial stability, the newspaper said citing analysts. Harbin average new home price slid 0.3% in August from July, or 0.6% lower than a year ago, said Yicai. (MNI)

BONDS: Modern Land (China) Co. is asking holders for a three-month extension on $250 million dollar bond due to mature Oct. 25 while also announcing two top executives plan to loan the builder about $125 million. The company is asking for the maturity extension to "improve our liquidity and cash flow management and to avoid any potential payment default," it said in a Monday morning filing with the Hong Kong stock exchange. Modern Land is also asking for consent to redeem 35% of the bond's principal on Oct. 25. Modern Land said in a separate filing that Chairman Zhang Lei and President Zhang Peng intend to loan the company about 800 million yuan, a move expected to be completed in two to three months. (BBG)

COMMODITIES: China's authorities should keep commodity prices stable by strictly preventing speculators from misusing bank loans and trust funds to bet on products such as coal, steel and non-ferrous metals, the government-run Economic Daily said in an editorial. The producer prices index is expected to remain high as domestic commodities demand outstrips supply while high prices persist on the international markets, said the daily. The authorities should ensure prioritized funding to companies engaged in supplying thermal coal and heating, and they should support importers to ensure adequate imports to supplement domestic supply, the newspaper said. China's electricity usage boosted by heating usage is expected to surge this winter, outstripping demand peaks in the summer and last winter, said the newspaper citing the National Development and Reform Commission. (MNI)

COMMODITIES: Heavy rains and flooding expanded mine shutdowns in China's biggest coal producing region, sending prices to a record and hindering efforts by Beijing to boost energy supplies for winter. Floods have closed 60 of the 682 coal mines in Shanxi province, a region that has produced 30% of the China's supply of the fuel this year, adding to a worsening energy crisis that threatens the country's economic growth. Thermal coal futures surged to a new intraday record after trading opened Monday. (BBG)

CHINA MARKETS

PBOC DRAINS NET CNY190BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operations lead to a net drain of CNY190 billion after offsetting the maturity of CNY200 billion reverse repos today, according to Wind Information.

- The operation aims to keep the liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1923% at 09:26 am local time from the close of 1.8266% on Friday.

- The CFETS-NEX money-market sentiment index closed at 34 on Saturday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4479 MON VS 6.4604

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4479 on Monday, compared with the 6.4604 set on Friday.

MARKETS

SNAPSHOT: BoE Dial Up Tightening Talk

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 453.13 points at 28503.87

- ASX 200 down 28.193 points at 7291.9

- Shanghai Comp. up 13.595 points at 3605.762

- JGB 10-Yr future down 10 ticks at 151.23, yield up 0.3bp at 0.091%

- Aussie 10-Yr future down 7 ticks at 98.265, yield up 7.2bp at 1.710%

- U.S. 10-Yr future -0-09 at 130-27+, cash Tsys are closed

- WTI crude up $1.48 at $80.83, Gold down $1.11 at $1756.09

- USD/JPY up 40 pips at Y112.64

- BOE'S BAILEY: INFLATION GOING TO GO HIGHER, WOULD PREFER IT NOT THERE

- BOE'S SAUNDERS: BRACE FOR INTEREST RATE RISES (Telegraph)

- ECB'S VILLEROY: INFLATION TO FALL BELOW 2% BY END-2022 (BBG)

- AUSTRIAN CLL'R KURZ STEPS DOWN, CZECH PM BABIS LOSES RE-ELECTION BID

- JAPAN PM KISHIDA: NO PLAN TO ALTER CAPITAL-GAINS, DIVIDEND TAXES (RTRS)

- CHINA COAL FUTURES SURGE TO RECORD AS FLOOD SWAMPS MINE HUB (BBG)

BOND SUMMARY: Inflation Worry, Post-NFP Impetus Keep Core FI Heavy

Participants looked through tensions across tensions across the Taiwan Strait as the new week got under way, focusing on the global economic outlook instead. T-Notes remained heavy and extended post-NFP losses, as the latest U.S. jobs report showed that wages rose faster than expected despite a considerable miss in headline NFP growth. The report was assessed amid the ongoing energy crunch, which adds fuel to inflation expectations.

- T-Notes pierced the 131-00 figure and retreated to a fresh four-month low of 130-25+. The contract last sits -0-10 at 130-26+, hovering just above session lows. Eurodollars last seen unch. to -4.5 ticks through the reds. Cash Tsys are closed owing to a market holiday in the U.S. but local CPI data & FOMC minutes are eyed later this week.

- JGB futures ebbed lower to fresh cycle lows, last trade at 151.23, 9 ticks shy of the previous settlement. The contract slipped amid an upswing in the Nikkei 225, which was bolstered by PM Kishida's comment that he was not planning a capital-gains hike, even as one of his allies recently advocated raising the levy. The Premier will take questions from lawmakers re: his first policy speech today. Cash JGB yields are little changed as we type.

- Australia's 3-Year yield topped 0.500% for the first time since March 2020. Cash ACGB curve bear steepened, with yields last seen -0.3bp to +7.2bp (10s underperform). YM reopened on a softer footing and held below neutral levels, it last sits -4.5; XM lost ground and trades -7.5 at typing. Bills trade 2-5 ticks lower through the reds. Local headline flow lacked notable catalysts, with the expected Sydney reopening coming to fruition. The RBA offered to buy A$1.6bn of ACGBs with maturities of Nov '24 to Nov '28, but excluding ACGB Apr '26.

EQUITIES: In The Green

Equity markets in the Asia-Pac region mostly higher on Monday, liquidity in the region is thin with markets in South Korea and Taiwan observing holiday', while Columbus Day in the US is also serving to keep things quiet. Markets in Hong Kong lead the way higher with gains of over 2% as tech shares continue their recent rally, helped by receding concerns over China's regulatory crackdown. Bourses in Japan seeing gains of over 1.5% as JPY weakens to the lowest levels since 2018. Elsewhere US futures are flat to slightly lower, clawing back early losses as markets shake off a downgrade in US growth forecasts by Goldman Sachs over the weekend.

OIL: Commodities Bid

Crude futures continued to climb in Asia-Pac trade on Monday, a rising tide lifts all boats and crude saw gains alongside coal and iron ore. WTI and Brent crude futures traded positively into the Friday close, extending the recovery off the Wednesday low to touch the best levels in around seven years. The moves follow reports throughout the week that two major sources of supply - OPEC+ and the US Strategic Petroleum Reserve – will not release stockpiles to settle market prices. This keeps the outlook for WTI and Brent crude bullish, with $81.60 - 1.618 proj of the Aug 23 - Sep 2 - Sep 9 price swing marking the next upside level.

GOLD: Creeps Higher

Gold squeezed out some gains after initially dipping, but the yellow metal is still well below the Friday high after its initial knee jerk jump was post-NFP was quickly reversed. Columbus Day in the US is likely to keep things quiet today, immediate resistance levels seen at the 50-day EMA at $1778.8 and potentially $1787.4, Sep 22 as a key resistance.

FOREX: Hawkish BoE Speak Supports Sterling, Yen Turns Its Tail

The yen tumbled in Asia amid a strong showing from the Nikkei 225, as PM Kishida brushed away earlier speculation that he might raise capital-gains and dividend taxes. The broader inflationary concerns helped sap strength from JPY, as Japan's consumer prices are struggling to return to growth, inspiring a growing divergence in the outlook for the BoJ's policy action versus its major peers.

- USD/JPY punched through resistance from Apr 24, 2019 and rallied to its highest point since Dec 18, 2018 as the yen landed at the bottom of the G10 pile.

- Sterling received a boost from hawkish BoE rhetoric, as Gov Bailey expressed a sense of discomfort with accelerating inflation, while MPC member Saunders warned that UK households should prepare for "significantly earlier" rate hikes.

- GBP/JPY went bid and printed its best levels since Jul 6, after breaching its 100-DMA and forming a double bottom pattern into the back end of last week.

- Commodity-tied AUD, NOK and CAD were in demand amid a relentless rise in commodity prices. The NZD lagged behind its high-beta peers, AUD/NZD resumed attacks at its 100-DMA.

- South Korean and Taiwanese markets were shut in observance of public holidays in those countries.

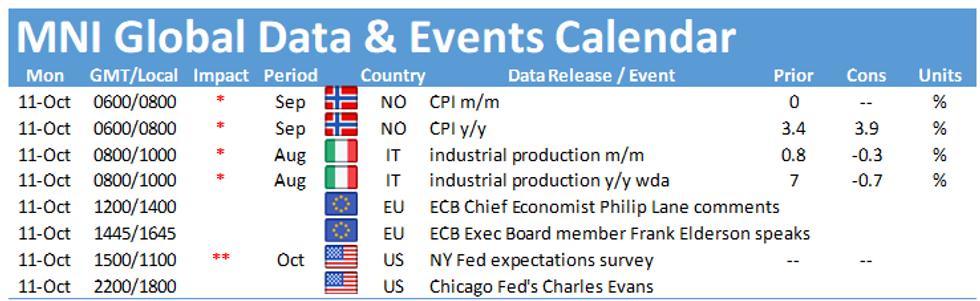

- Italian industrial output, Norwegian CPI and plenty of ECB speak take focus from here, with little of note slated for NY hours owing to market holidays in the U.S. and Canada.

FOREX OPTIONS: Expiries for Oct11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550(E502mln), $1.1590-00(E1.1bln), $1.1900-20(E1.1bln)

- USD/JPY: Y111.00-05($671mln)

- USD/CNY: Cny6.4200($592mln), Cny6.4300($760mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.